EX-99.2

Published on February 17, 2026

Quarterly Earnings Results Presentation Q4 2025 (February 2026)

PresBuilder Placeholder - Delete this box if you see it on a slide, but DO NOT REMOVE this box from the slide layout This presentation contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. All forward-looking statements are made in good faith by the company and are intended to qualify for the safe harbor from liability established by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995.You should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," “target”, “goal”, "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) unfavorable economic conditions that may affect operations, financial condition and cash flows including spending on home renovation or construction projects, inflation, recessions, instability in the financial markets or credit markets; (2) increased supply chain costs, including tariffs, raw materials, sourcing, transportation and energy; (3) the highly competitive nature of the markets that we serve; (4) the ability to continue to innovate with new products and services; (5) seasonality; (6) large customer concentration; (7) the ability to recruit and retain qualified employees; (8) the outcome of any legal proceedings that may be instituted against the Company; (9) adverse changes in currency exchange rates; or (10) regulatory changes and potential legislation that could adversely impact financial results. The foregoing list of factors is not exclusive, and readers should also refer to those risks that are included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K for the fiscal year ended December 27, 2025. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward looking statements. Except as required by applicable law, the Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this communication to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Presentation of Non-GAAP Financial Measures In addition to the results provided in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”) throughout this presentation the company has provided non-GAAP financial measures, which present results on a basis adjusted for certain items. The company uses these non-GAAP financial measures for business planning purposes and in measuring its performance relative to that of its competitors. The company believes that these non-GAAP financial measures are useful financial metrics to assess its operating performance from period-to-period by excluding certain items that the company believes are not representative of its core business. These non-GAAP financial measures are not intended to replace, and should not be considered superior to, the presentation of the company’s financial results in accordance with GAAP. The use of the non-GAAP financial measures terms may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures. These non-GAAP financial measures are reconciled from the respective measures under GAAP in the appendix below. The company is not able to provide a reconciliation of the company’s non-GAAP financial guidance to the corresponding GAAP measures without unreasonable effort because of the inherent difficulty in forecasting and quantifying certain amounts necessary for such a reconciliation such as certain non-cash, nonrecurring or other items that are included in net income and EBITDA as well as the related tax impacts of these items and asset dispositions / acquisitions and changes in foreign currency exchange rates that are included in cash flow, due to the uncertainty and variability of the nature and amount of these future charges and costs. Forward Looking Statements 2

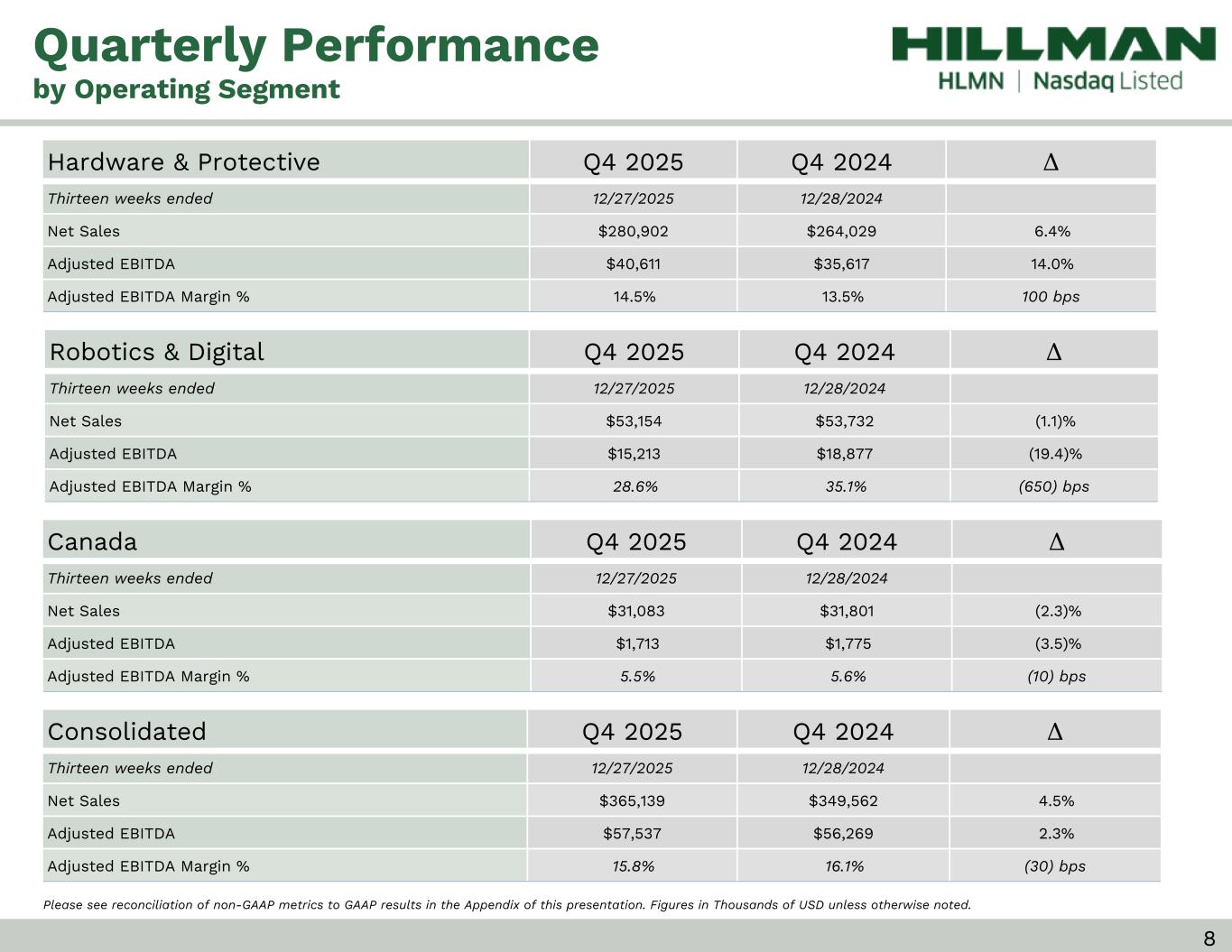

• Net sales increased 4.5% to $365 million versus Q4 2024 ◦ Hardware and Protective Solutions +6% ◦ Robotics and Digital Solutions ("RDS") decreased (1)% ◦ Canada decreased (2)% • GAAP net income totaled $1.6 million, or $0.01 per diluted share, compared to GAAP net loss of $(1.2) million, or $(0.01) per diluted share in Q4 2024 • Adjusted diluted EPS was $0.10 per diluted share compared to $0.10 in Q4 2024 • Adjusted Gross Margins totaled 47.6% • Adjusted EBITDA improved to $57.5 million from $56.3 million in Q4 2024 • Adjusted EBITDA margins were 15.8% Q4 2025 Financial Review Please see reconciliation of Adjusted EBITDA to Net Income (Loss) and Net Debt in the Appendix of this presentation. Highlights for the 13 Weeks Ended December 27, 2025 3

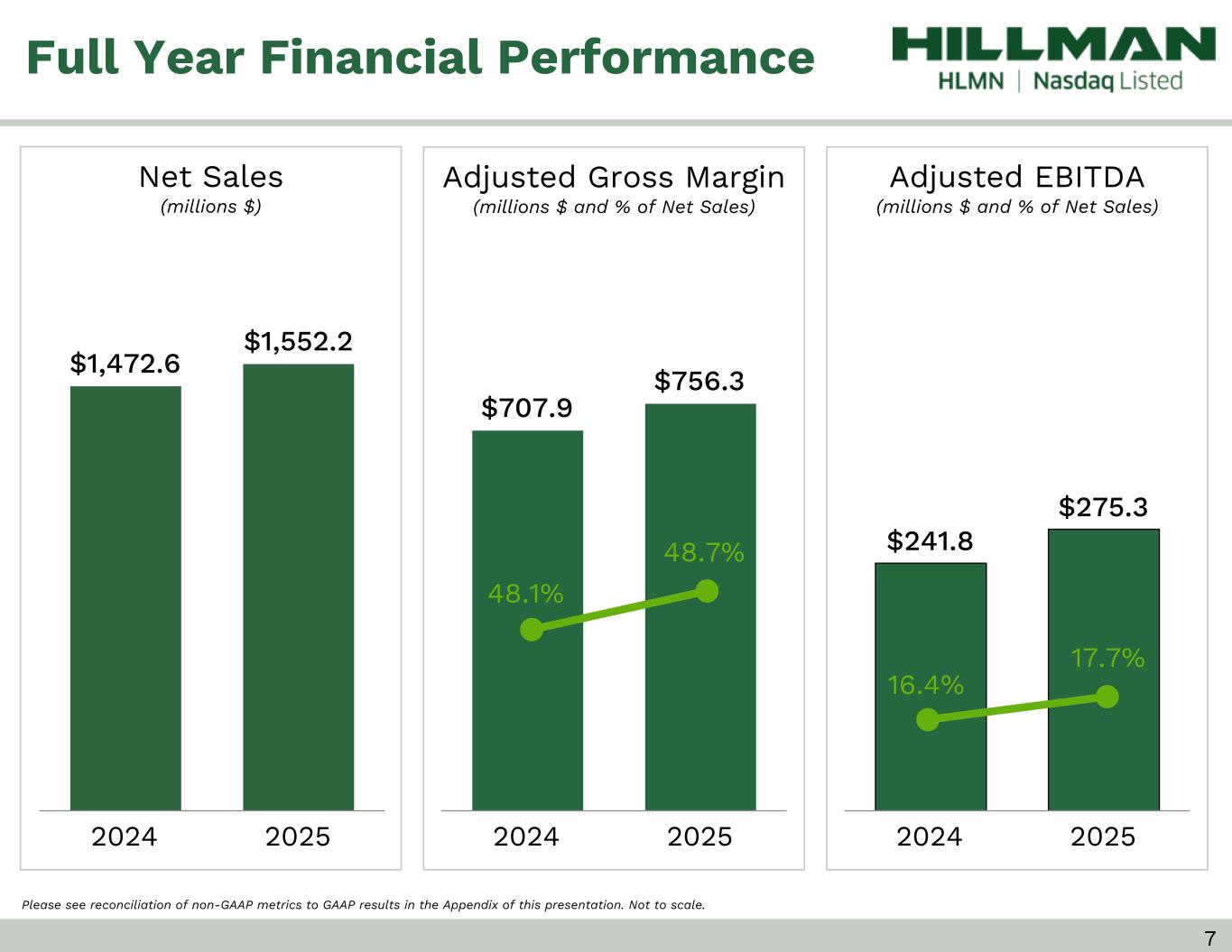

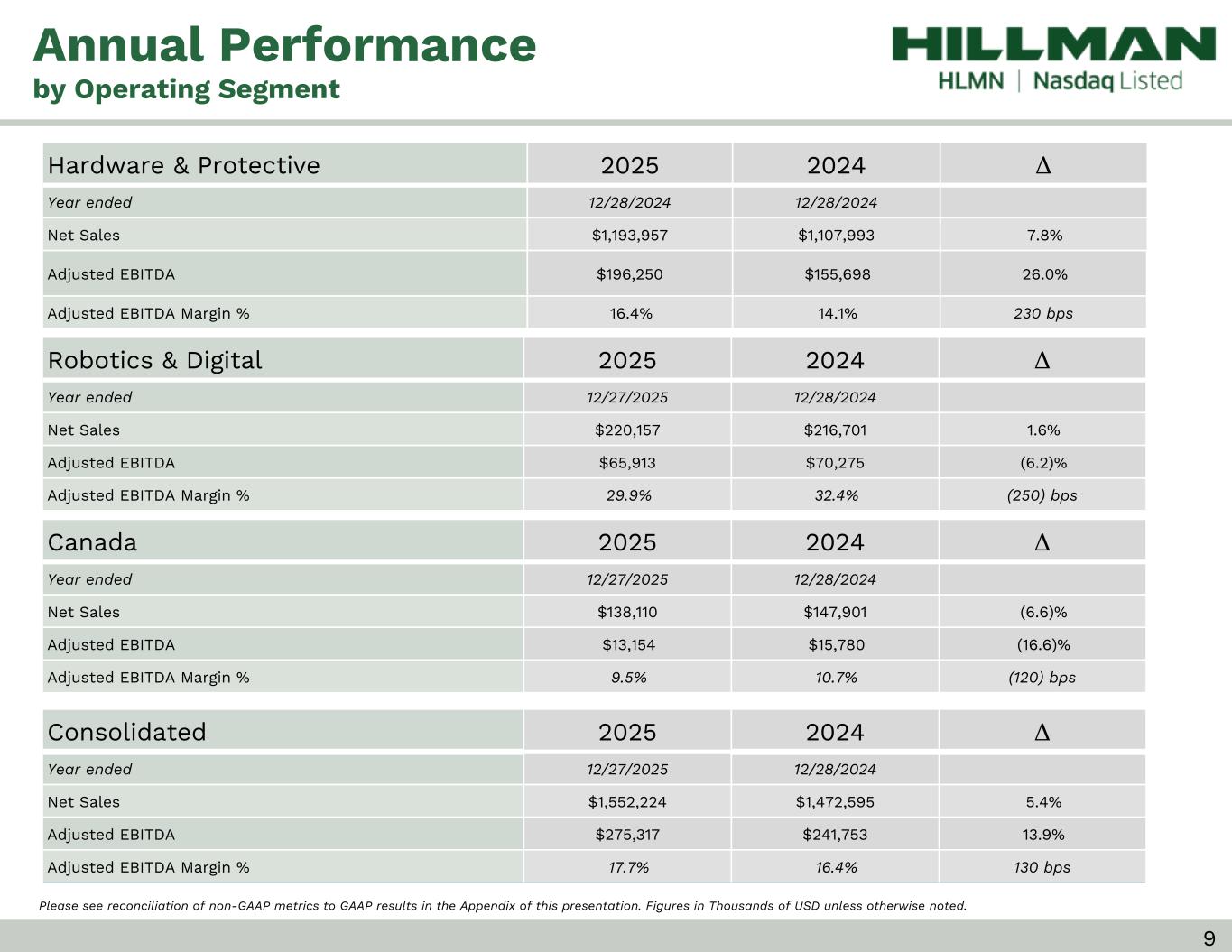

Full Year 2025 Financial Review 4 Highlights for the 52 Weeks Ended December 27, 2025 • Net sales increased 5.4% to $1,552 million versus 2024 ◦ Hardware and Protective Solutions +8% ◦ Robotics and Digital Solutions ("RDS") +2% ◦ Canada decreased (7)% • GAAP net income improved to $40.3 million, or $0.20 per diluted share, compared to net income of $17.3 million, or $0.09 per diluted share in 2024 • Adjusted diluted EPS was $0.58 per diluted share, compared to $0.49 in 2024 • Adjusted Gross Margins totaled 48.7% • Adjusted EBITDA totaled $275.3 million, versus $241.8 million in 2024 • Adjusted EBITDA margins were 17.7% • Free Cash Flow totaled $35.1 million • Net Debt / Adjusted EBITDA (ttm): 2.4x at December 27, 2025, improved from 2.8x on December 28, 2024 Please see reconciliation of non-GAAP metrics to GAAP results in the Appendix of this presentation.

Full Year 2025 Operational Review 5 Highlights for the 52 Weeks Ended December 27, 2025 • Continued taking great care of customers: ◦ Full Year fill rates averaged in the mid-to-high 90% range • Continue to pursue accretive M&A opportunities that: ◦ Leverage the Hillman moat, and ◦ Expand Hillman's pro, commercial, and industrial businesses • Hillman continued to optimize its "dual faucet" supply chain strategy: ◦ Dual source products in different countries ◦ Diversify the country of origin to have the ability to reduce China exposure • Repurchased approximately 1.4 million shares of its common stock at an average price of $9.07 per share, totaling $12.4 million

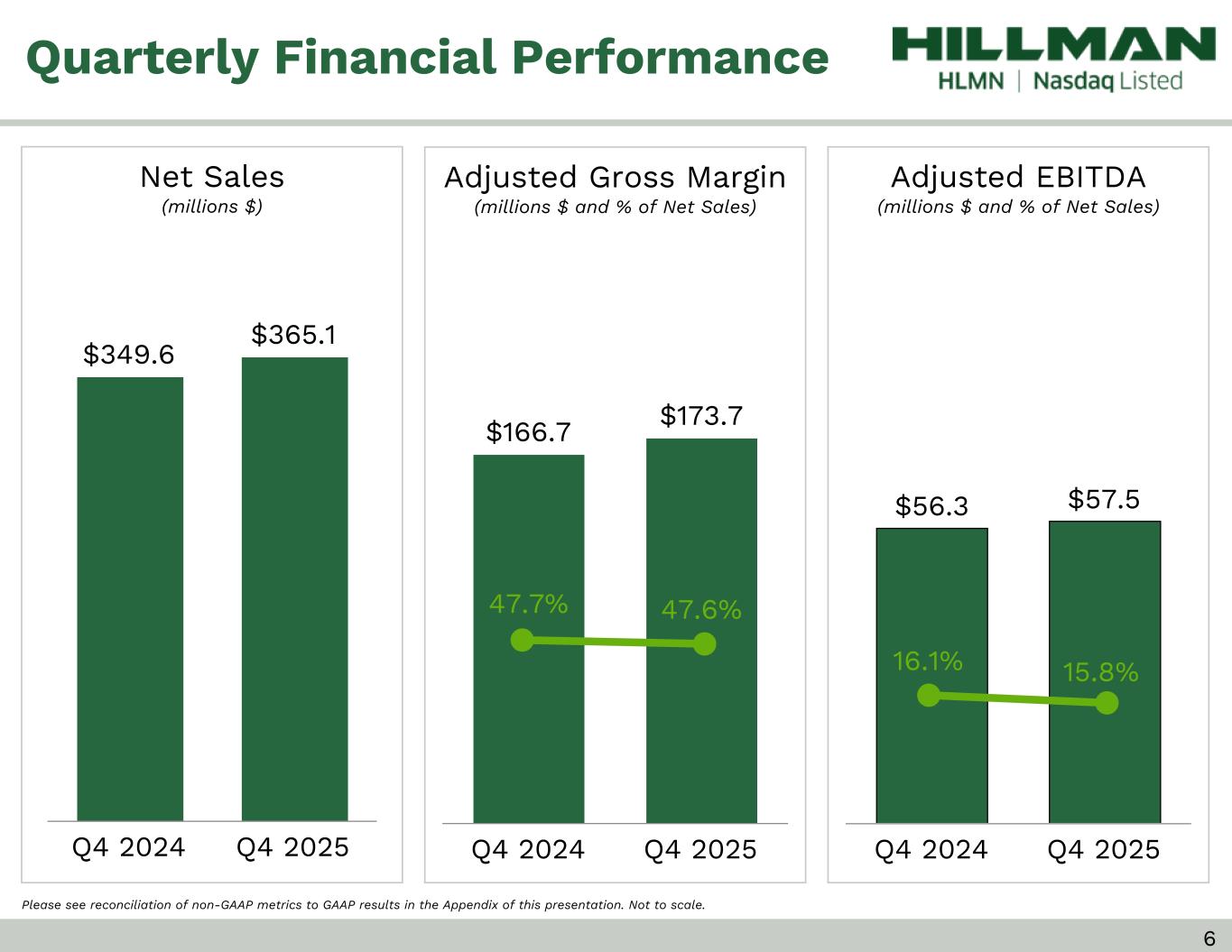

$166.7 $173.7 Q4 2024 Q4 2025 Adjusted EBITDA (millions $ and % of Net Sales) Please see reconciliation of non-GAAP metrics to GAAP results in the Appendix of this presentation. Not to scale. Net Sales (millions $) Adjusted Gross Margin (millions $ and % of Net Sales) Quarterly Financial Performance $56.3 $57.5 Q4 2024 Q4 2025 15.8%16.1% $349.6 $365.1 Q4 2024 Q4 2025 47.6%47.7% 6

Adjusted EBITDA (millions $ and % of Net Sales) Net Sales (millions $) Adjusted Gross Margin (millions $ and % of Net Sales) $241.8 $275.3 2024 2025 17.7% 16.4% $707.9 $756.3 2024 2025 $1,472.6 $1,552.2 2024 2025 48.7% 48.1% 7 Please see reconciliation of non-GAAP metrics to GAAP results in the Appendix of this presentation. Not to scale. Full Year Financial Performance

Hardware & Protective Q4 2025 Q4 2024 Δ Thirteen weeks ended 12/27/2025 12/28/2024 Net Sales $280,902 $264,029 6.4% Adjusted EBITDA $40,611 $35,617 14.0% Adjusted EBITDA Margin % 14.5% 13.5% 100 bps Robotics & Digital Q4 2025 Q4 2024 Δ Thirteen weeks ended 12/27/2025 12/28/2024 Net Sales $53,154 $53,732 (1.1)% Adjusted EBITDA $15,213 $18,877 (19.4)% Adjusted EBITDA Margin % 28.6% 35.1% (650) bps Canada Q4 2025 Q4 2024 Δ Thirteen weeks ended 12/27/2025 12/28/2024 Net Sales $31,083 $31,801 (2.3)% Adjusted EBITDA $1,713 $1,775 (3.5)% Adjusted EBITDA Margin % 5.5% 5.6% (10) bps Consolidated Q4 2025 Q4 2024 Δ Thirteen weeks ended 12/27/2025 12/28/2024 Net Sales $365,139 $349,562 4.5% Adjusted EBITDA $57,537 $56,269 2.3% Adjusted EBITDA Margin % 15.8% 16.1% (30) bps Quarterly Performance by Operating Segment Please see reconciliation of non-GAAP metrics to GAAP results in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted. 8 • Top Row: ◦ 27 point height ◦ 16 font (work sans) ◦ 4 point white bottom line • First Column green ◦ Dark: CFD9D1 ◦ Light: D9E1DA • Other Columns gray ◦ Dark: D9D9D9 ◦ Light E0E0E0 ◦ 1 point white bottom and inside lines

Please see reconciliation of non-GAAP metrics to GAAP results in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted. 9 Hardware & Protective 2025 2024 Δ Year ended 12/28/2024 12/28/2024 Net Sales $1,193,957 $1,107,993 7.8% Adjusted EBITDA $196,250 $155,698 26.0% Adjusted EBITDA Margin % 16.4% 14.1% 230 bps Robotics & Digital 2025 2024 Δ Year ended 12/27/2025 12/28/2024 Net Sales $220,157 $216,701 1.6% Adjusted EBITDA $65,913 $70,275 (6.2)% Adjusted EBITDA Margin % 29.9% 32.4% (250) bps Canada 2025 2024 Δ Year ended 12/27/2025 12/28/2024 Net Sales $138,110 $147,901 (6.6)% Adjusted EBITDA $13,154 $15,780 (16.6)% Adjusted EBITDA Margin % 9.5% 10.7% (120) bps Annual Performance by Operating Segment • Top Row: ◦ 27 point height ◦ 16 font (work sans) ◦ 4 point white bottom line • First Column green ◦ Dark: CFD9D1 ◦ Light: D9E1DA • Other Columns gray ◦ Dark: D9D9D9 ◦ Light E0E0E0 ◦ 1 point white bottom and inside lines Consolidated 2025 2024 Δ Year ended 12/27/2025 12/28/2024 Net Sales $1,552,224 $1,472,595 5.4% Adjusted EBITDA $275,317 $241,753 13.9% Adjusted EBITDA Margin % 17.7% 16.4% 130 bps

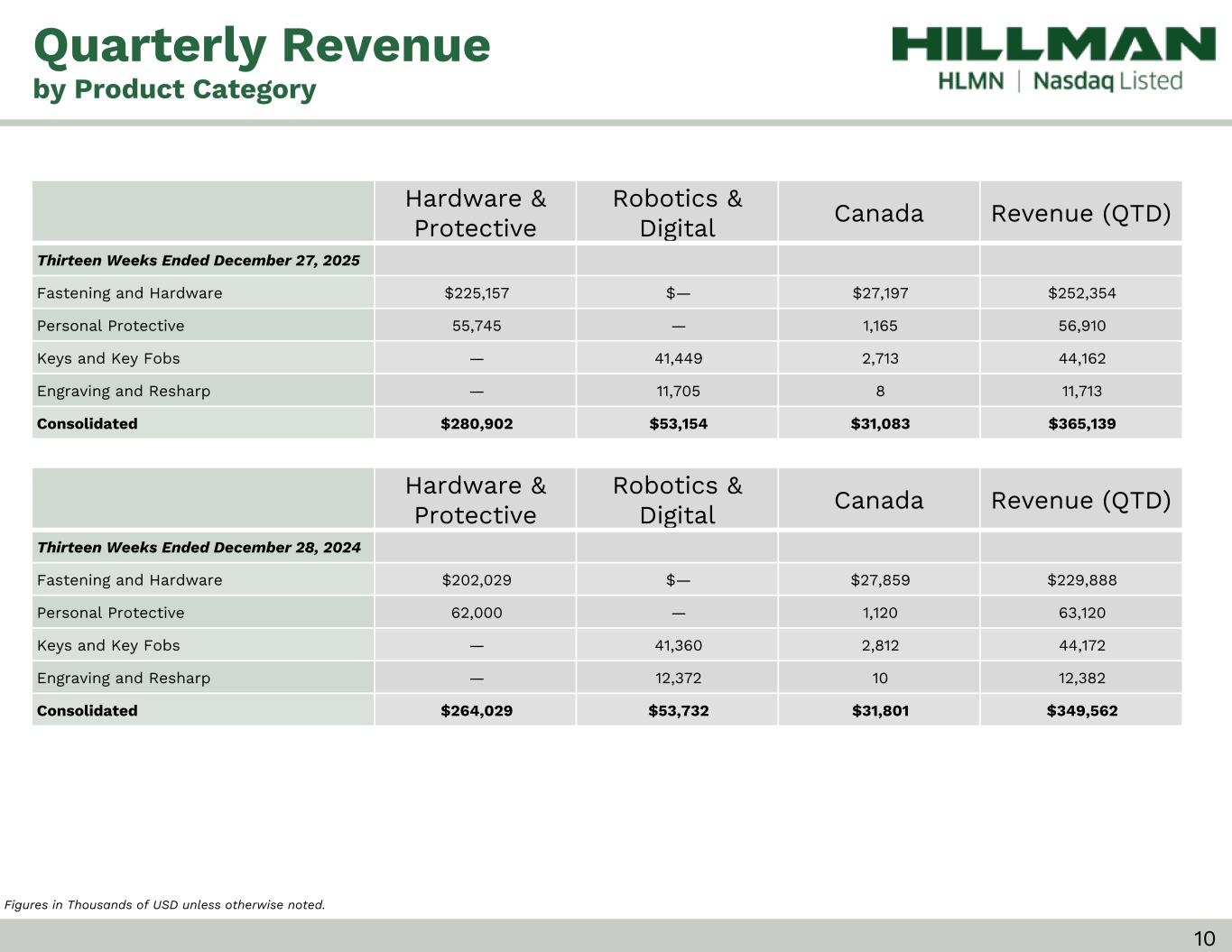

Figures in Thousands of USD unless otherwise noted. Quarterly Revenue by Product Category 10 Hardware & Protective Robotics & Digital Canada Revenue (QTD) Thirteen Weeks Ended December 27, 2025 Fastening and Hardware $225,157 $— $27,197 $252,354 Personal Protective 55,745 — 1,165 56,910 Keys and Key Fobs — 41,449 2,713 44,162 Engraving and Resharp — 11,705 8 11,713 Consolidated $280,902 $53,154 $31,083 $365,139 • Top Row: ◦ 27 point height ◦ 16 font (work sans) ◦ 4 point white bottom line • First Column green ◦ Dark: CFD9D1 ◦ Light: D9E1DA • Other Columns gray ◦ Dark: D9D9D9 ◦ Light E0E0E0 ◦ 1 point white bottom and inside lines Hardware & Protective Robotics & Digital Canada Revenue (QTD) Thirteen Weeks Ended December 28, 2024 Fastening and Hardware $202,029 $— $27,859 $229,888 Personal Protective 62,000 — 1,120 63,120 Keys and Key Fobs — 41,360 2,812 44,172 Engraving and Resharp — 12,372 10 12,382 Consolidated $264,029 $53,732 $31,801 $349,562

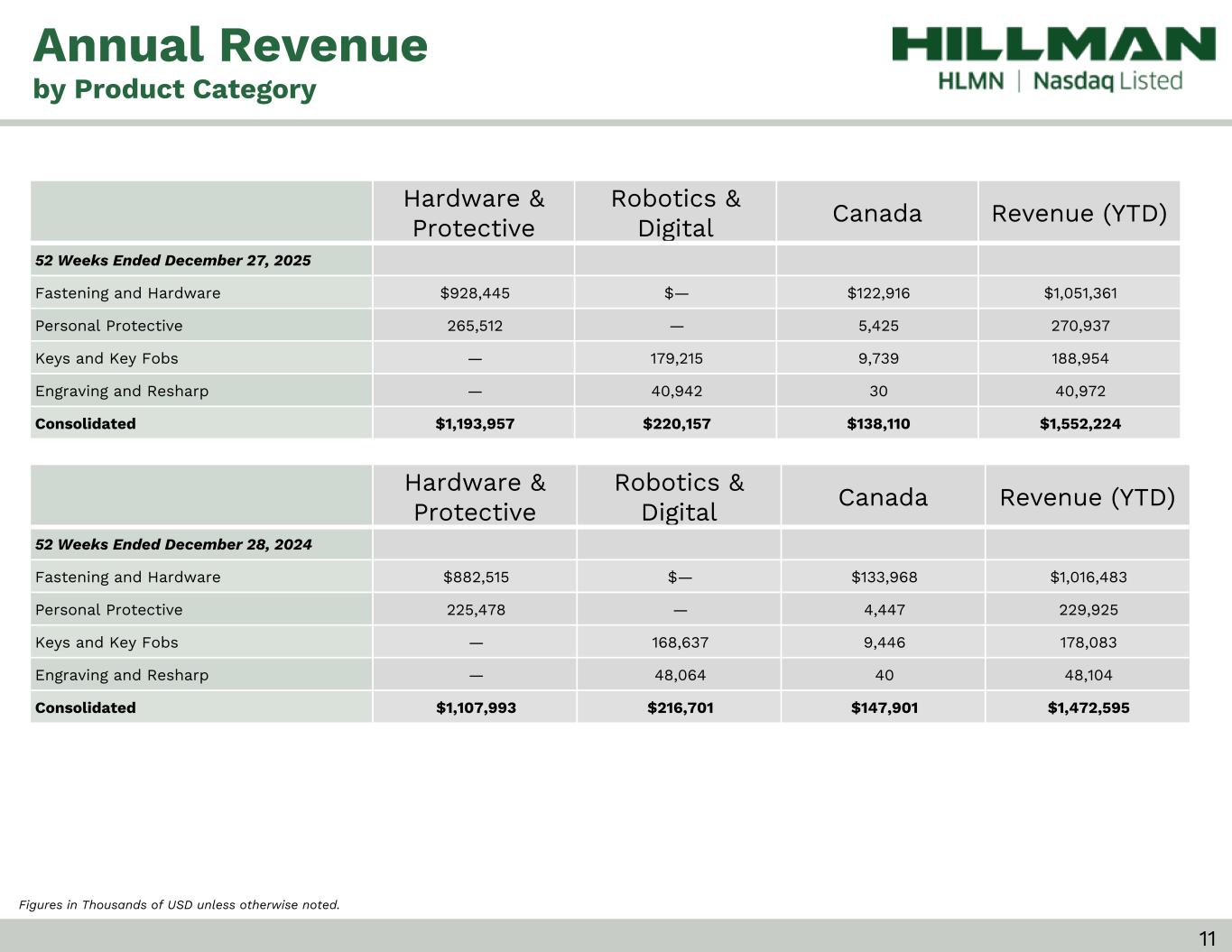

Figures in Thousands of USD unless otherwise noted. Annual Revenue by Product Category 11 Hardware & Protective Robotics & Digital Canada Revenue (YTD) 52 Weeks Ended December 27, 2025 Fastening and Hardware $928,445 $— $122,916 $1,051,361 Personal Protective 265,512 — 5,425 270,937 Keys and Key Fobs — 179,215 9,739 188,954 Engraving and Resharp — 40,942 30 40,972 Consolidated $1,193,957 $220,157 $138,110 $1,552,224 • Top Row: ◦ 27 point height ◦ 16 font (work sans) ◦ 4 point white bottom line • First Column green ◦ Dark: CFD9D1 ◦ Light: D9E1DA • Other Columns gray ◦ Dark: D9D9D9 ◦ Light E0E0E0 ◦ 1 point white bottom and inside lines Hardware & Protective Robotics & Digital Canada Revenue (YTD) 52 Weeks Ended December 28, 2024 Fastening and Hardware $882,515 $— $133,968 $1,016,483 Personal Protective 225,478 — 4,447 229,925 Keys and Key Fobs — 168,637 9,446 178,083 Engraving and Resharp — 48,064 40 48,104 Consolidated $1,107,993 $216,701 $147,901 $1,472,595

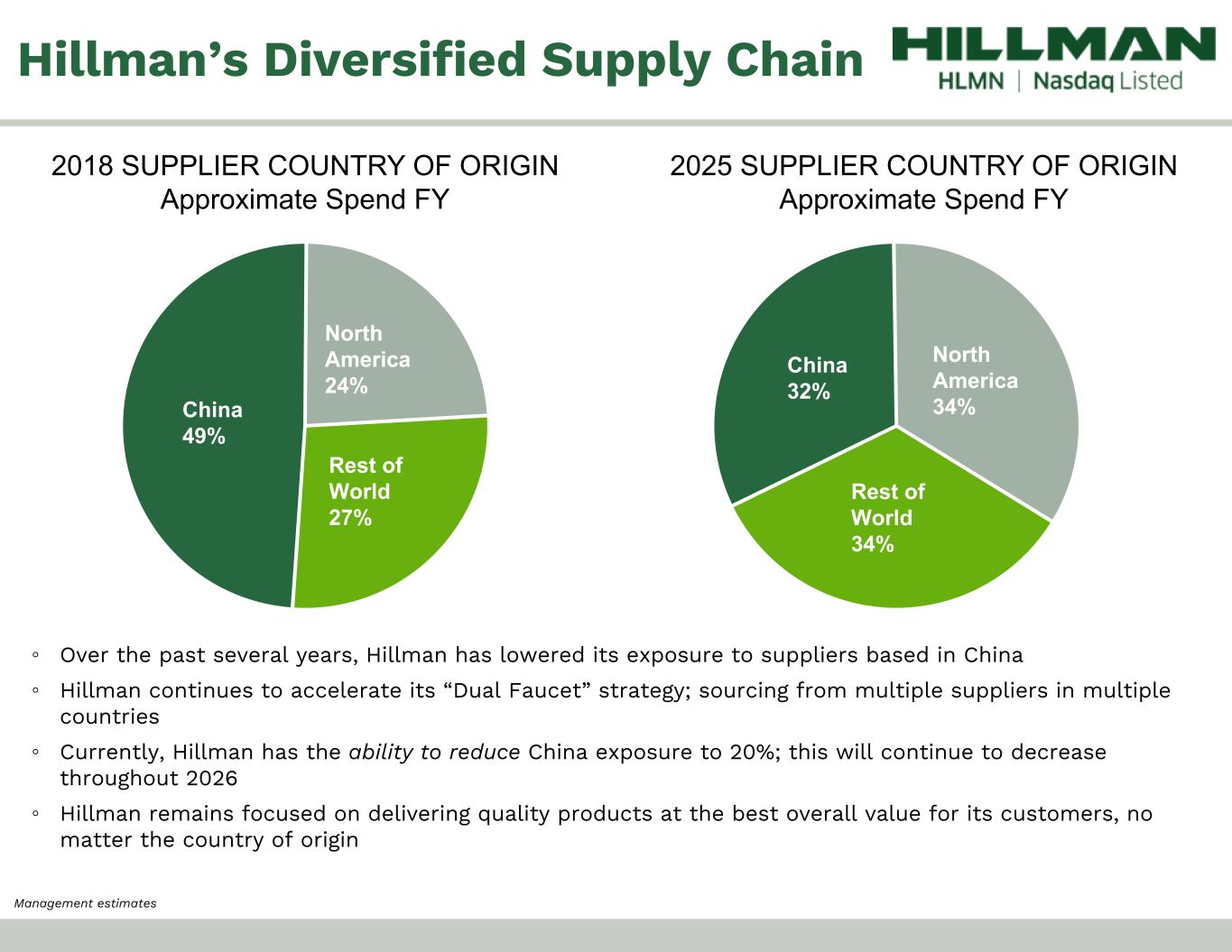

Hillman’s Diversified Supply Chain ◦ Over the past several years, Hillman has lowered its exposure to suppliers based in China ◦ Hillman continues to accelerate its “Dual Faucet” strategy; sourcing from multiple suppliers in multiple countries ◦ Currently, Hillman has the ability to reduce China exposure to 20%; this will continue to decrease throughout 2026 ◦ Hillman remains focused on delivering quality products at the best overall value for its customers, no matter the country of origin China 49% North America 24% Rest of World 27% China 32% North America 34% Rest of World 34% Management estimates 2018 SUPPLIER COUNTRY OF ORIGIN Approximate Spend FY 2025 SUPPLIER COUNTRY OF ORIGIN Approximate Spend FY

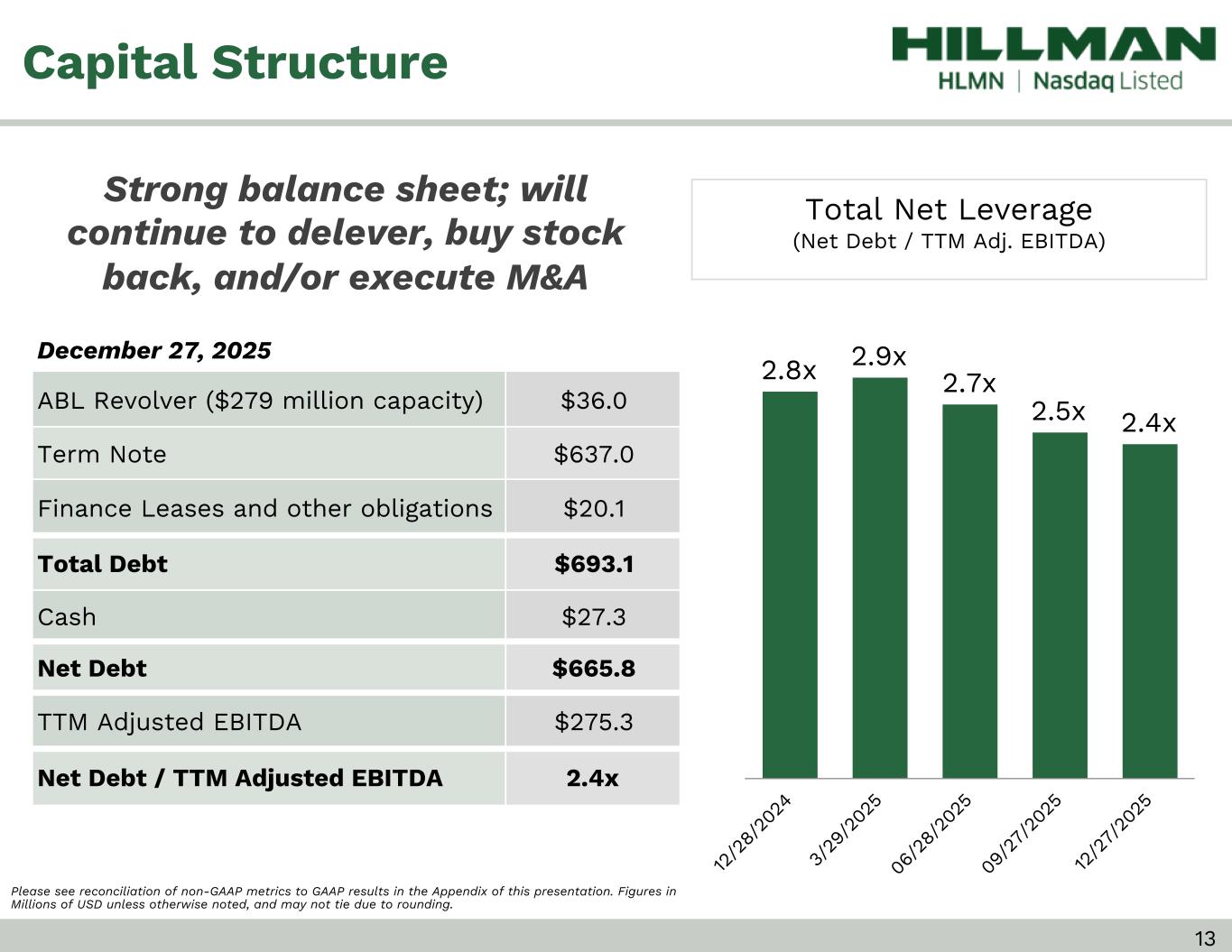

Capital Structure Please see reconciliation of non-GAAP metrics to GAAP results in the Appendix of this presentation. Figures in Millions of USD unless otherwise noted, and may not tie due to rounding. 2.8x 2.9x 2.7x 2.5x 2.4x 12 /2 8/ 20 24 3/ 29 /2 02 5 06 /2 8/ 20 25 09 /2 7/ 20 25 12 /2 7/ 20 25 0.0x 0.5x 1.0x 1.5x 2.0x 2.5x 3.0x 3.5x 4.0x December 27, 2025 ABL Revolver ($279 million capacity) $36.0 Term Note $637.0 Finance Leases and other obligations $20.1 Total Debt $693.1 Cash $27.3 Net Debt $665.8 TTM Adjusted EBITDA $275.3 Net Debt / TTM Adjusted EBITDA 2.4x Strong balance sheet; will continue to delever, buy stock back, and/or execute M&A Total Net Leverage (Net Debt / TTM Adj. EBITDA) 13

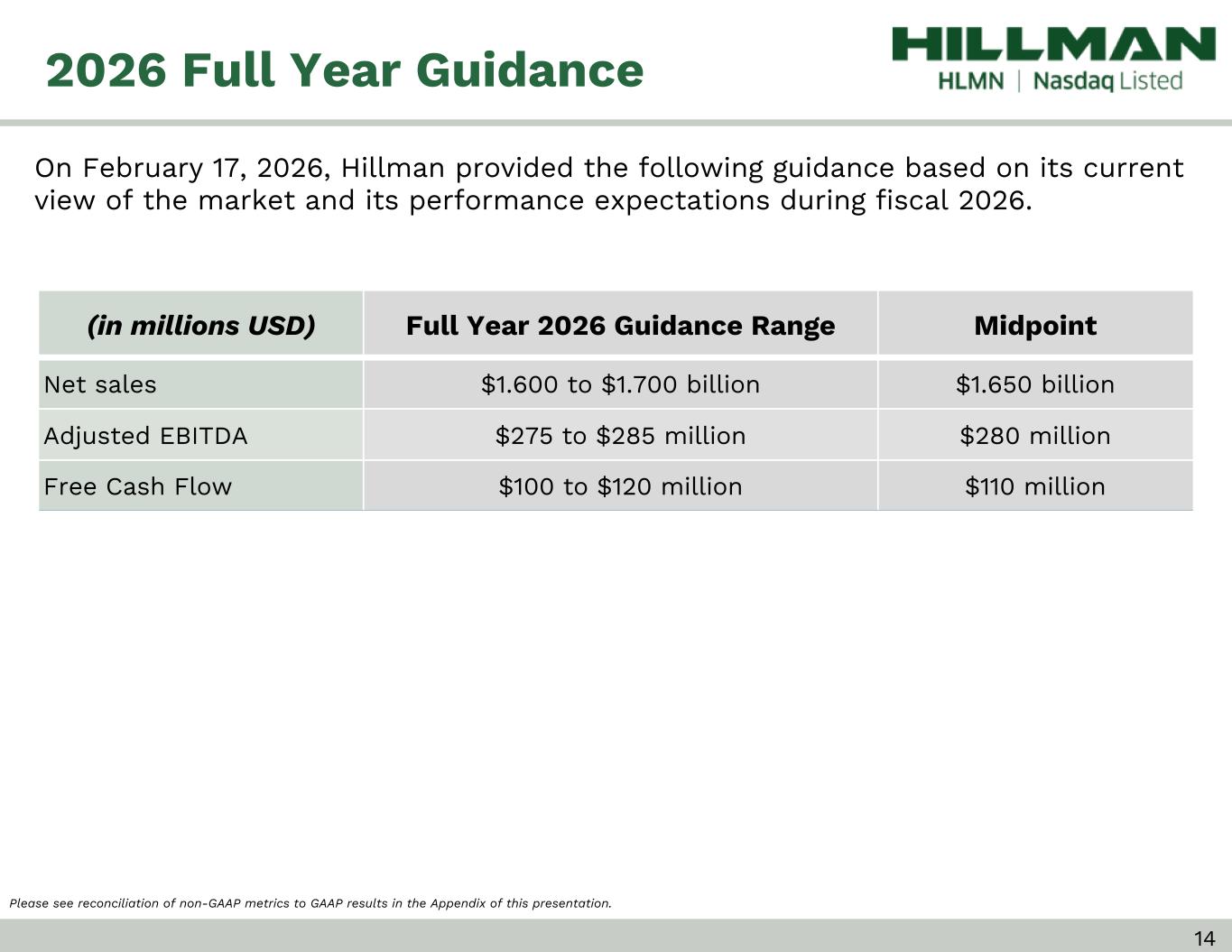

(in millions USD) Full Year 2026 Guidance Range Midpoint Net sales $1.600 to $1.700 billion $1.650 billion Adjusted EBITDA $275 to $285 million $280 million Free Cash Flow $100 to $120 million $110 million 2026 Full Year Guidance On February 17, 2026, Hillman provided the following guidance based on its current view of the market and its performance expectations during fiscal 2026. Please see reconciliation of non-GAAP metrics to GAAP results in the Appendix of this presentation. 14

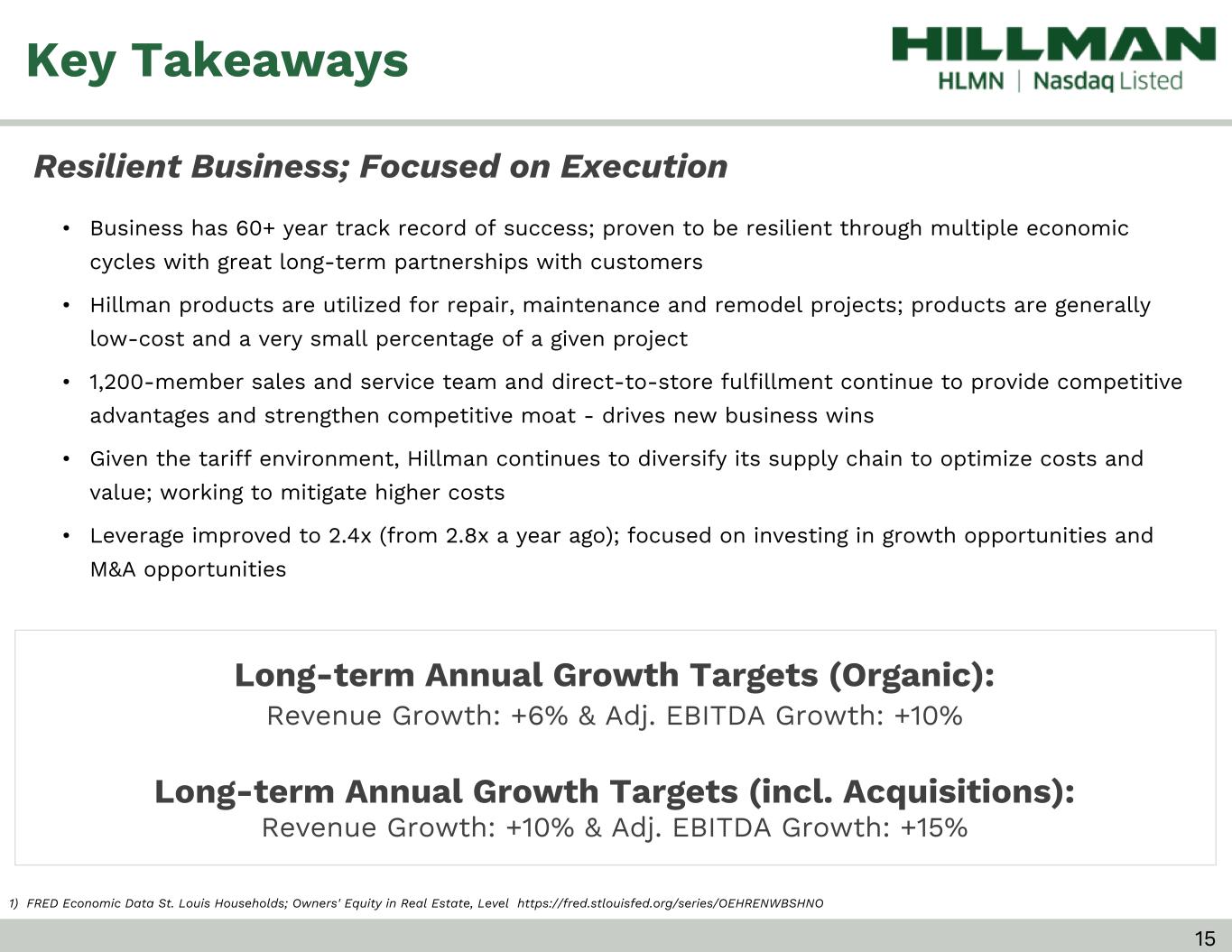

Key Takeaways Long-term Annual Growth Targets (Organic): Revenue Growth: +6% & Adj. EBITDA Growth: +10% Long-term Annual Growth Targets (incl. Acquisitions): Revenue Growth: +10% & Adj. EBITDA Growth: +15% • Business has 60+ year track record of success; proven to be resilient through multiple economic cycles with great long-term partnerships with customers • Hillman products are utilized for repair, maintenance and remodel projects; products are generally low-cost and a very small percentage of a given project • 1,200-member sales and service team and direct-to-store fulfillment continue to provide competitive advantages and strengthen competitive moat - drives new business wins • Given the tariff environment, Hillman continues to diversify its supply chain to optimize costs and value; working to mitigate higher costs • Leverage improved to 2.4x (from 2.8x a year ago); focused on investing in growth opportunities and M&A opportunities Resilient Business; Focused on Execution 15 1) FRED Economic Data St. Louis Households; Owners' Equity in Real Estate, Level https://fred.stlouisfed.org/series/OEHRENWBSHNO

Appendix

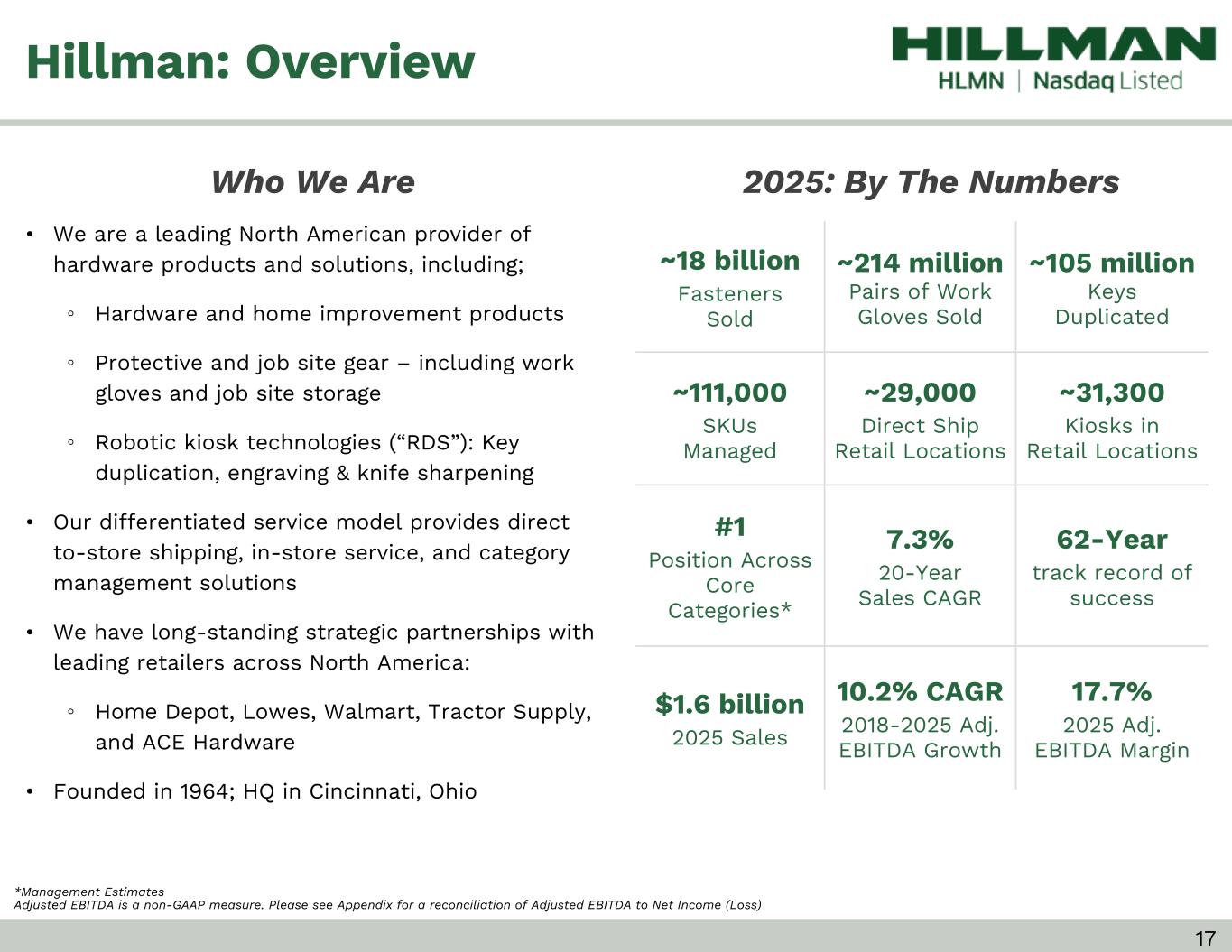

Who We Are *Management Estimates Adjusted EBITDA is a non-GAAP measure. Please see Appendix for a reconciliation of Adjusted EBITDA to Net Income (Loss) ~18 billion Fasteners Sold ~214 million Pairs of Work Gloves Sold ~105 million Keys Duplicated ~111,000 SKUs Managed ~29,000 Direct Ship Retail Locations ~31,300 Kiosks in Retail Locations #1 Position Across Core Categories* 7.3% 20-Year Sales CAGR 62-Year track record of success $1.6 billion 2025 Sales 10.2% CAGR 2018-2025 Adj. EBITDA Growth 17.7% 2025 Adj. EBITDA Margin Hillman: Overview 2025: By The Numbers • We are a leading North American provider of hardware products and solutions, including; ◦ Hardware and home improvement products ◦ Protective and job site gear – including work gloves and job site storage ◦ Robotic kiosk technologies (“RDS”): Key duplication, engraving & knife sharpening • Our differentiated service model provides direct to-store shipping, in-store service, and category management solutions • We have long-standing strategic partnerships with leading retailers across North America: ◦ Home Depot, Lowes, Walmart, Tractor Supply, and ACE Hardware • Founded in 1964; HQ in Cincinnati, Ohio 17

#1 in Segment Representative Top Customers #1 in Segment #1 in Segment Key and Fob Duplication Personalized Tags Knife Sharpening Fasteners & Specialty Gloves Builders Hardware & Metal Shapes Safety / PPE Construction Fasteners Work Gear Picture Hanging Source: Third party industry report. Primary Product Categories Hardware Solutions Robotics & Digital SolutionsProtective Solutions 18

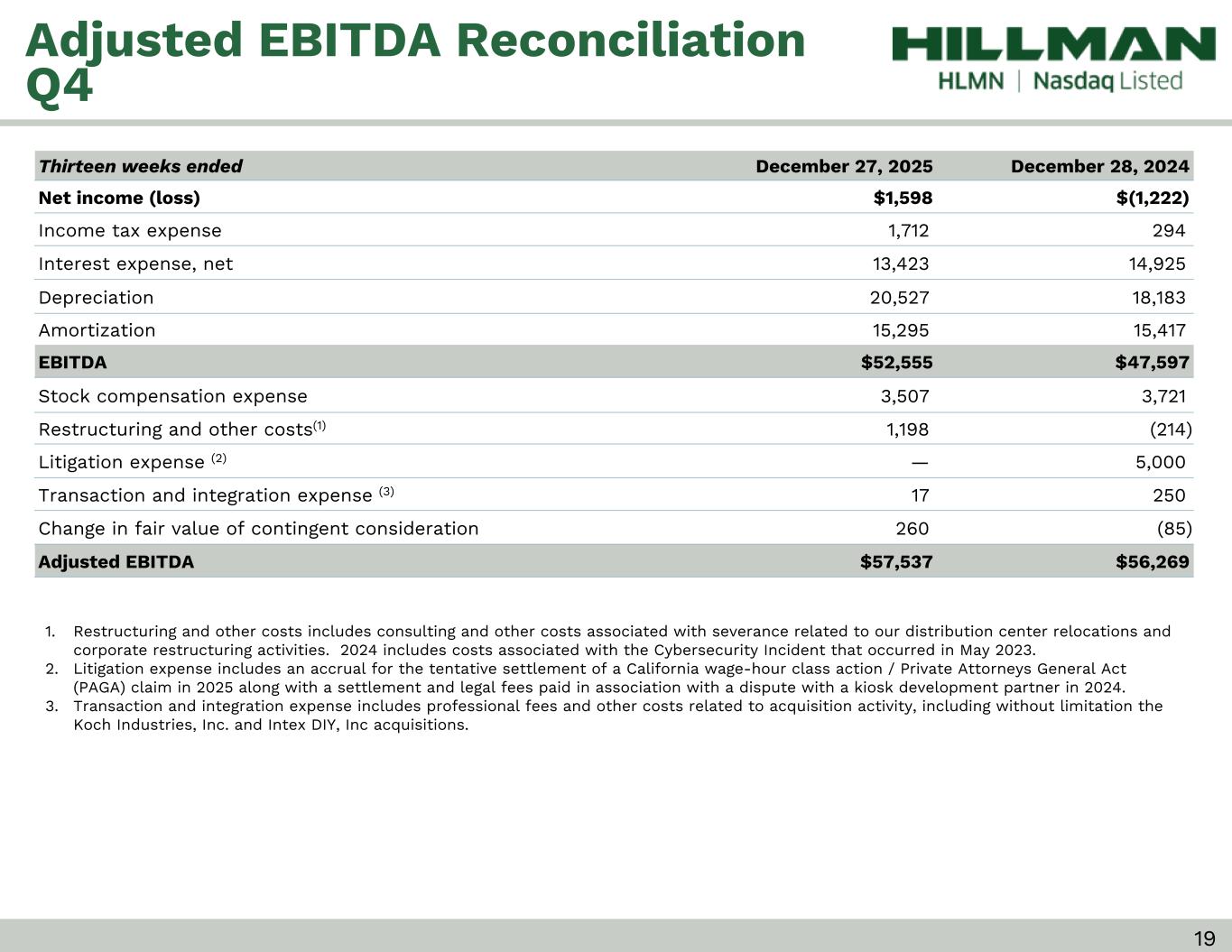

Thirteen weeks ended December 27, 2025 December 28, 2024 Net income (loss) $1,598 $(1,222) Income tax expense 1,712 294 Interest expense, net 13,423 14,925 Depreciation 20,527 18,183 Amortization 15,295 15,417 EBITDA $52,555 $47,597 Stock compensation expense 3,507 3,721 Restructuring and other costs(1) 1,198 (214) Litigation expense (2) — 5,000 Transaction and integration expense (3) 17 250 Change in fair value of contingent consideration 260 (85) Adjusted EBITDA $57,537 $56,269 1. Restructuring and other costs includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities. 2024 includes costs associated with the Cybersecurity Incident that occurred in May 2023. 2. Litigation expense includes an accrual for the tentative settlement of a California wage-hour class action / Private Attorneys General Act (PAGA) claim in 2025 along with a settlement and legal fees paid in association with a dispute with a kiosk development partner in 2024. 3. Transaction and integration expense includes professional fees and other costs related to acquisition activity, including without limitation the Koch Industries, Inc. and Intex DIY, Inc acquisitions. Adjusted EBITDA Reconciliation Q4 19

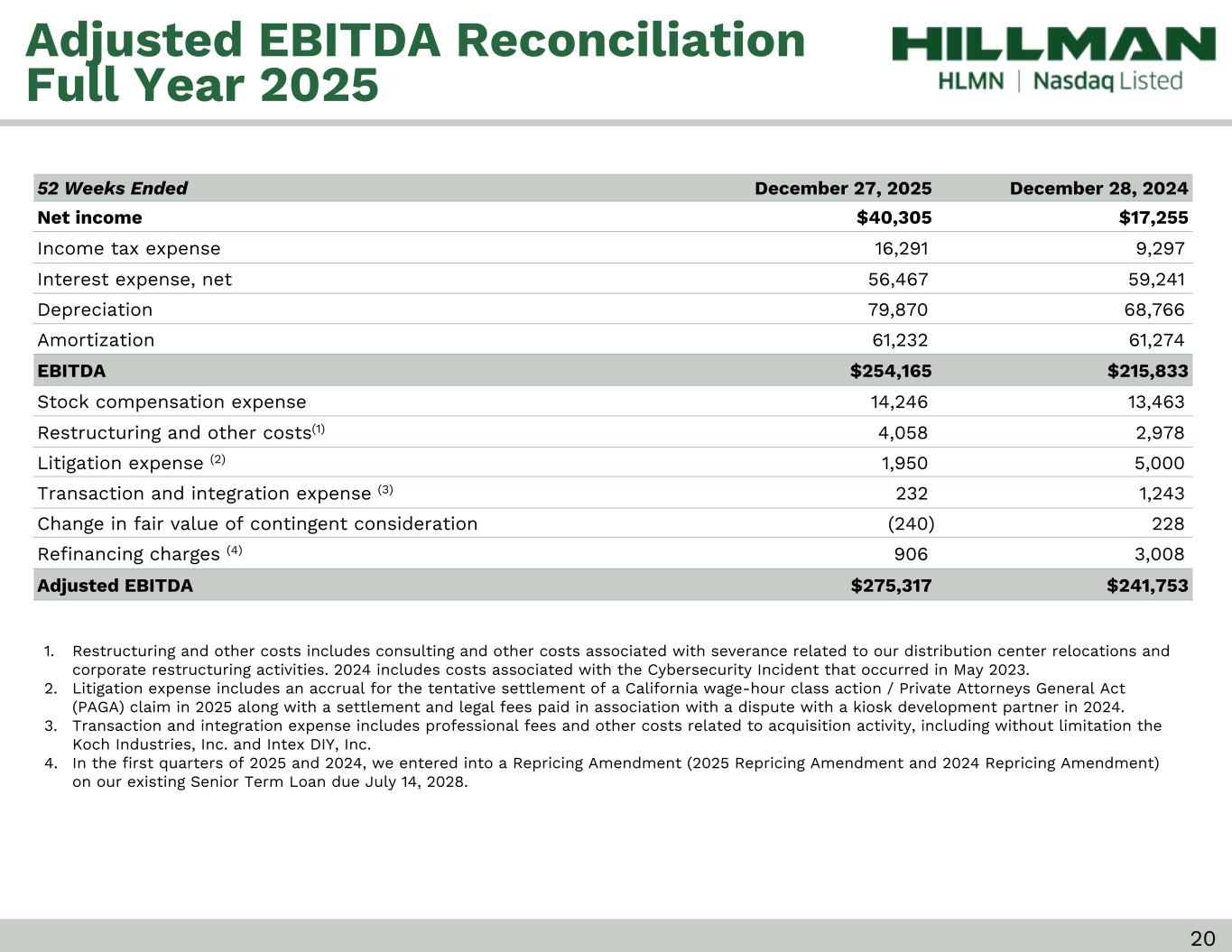

52 Weeks Ended December 27, 2025 December 28, 2024 Net income $40,305 $17,255 Income tax expense 16,291 9,297 Interest expense, net 56,467 59,241 Depreciation 79,870 68,766 Amortization 61,232 61,274 EBITDA $254,165 $215,833 Stock compensation expense 14,246 13,463 Restructuring and other costs(1) 4,058 2,978 Litigation expense (2) 1,950 5,000 Transaction and integration expense (3) 232 1,243 Change in fair value of contingent consideration (240) 228 Refinancing charges (4) 906 3,008 Adjusted EBITDA $275,317 $241,753 Adjusted EBITDA Reconciliation Full Year 2025 1. Restructuring and other costs includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities. 2024 includes costs associated with the Cybersecurity Incident that occurred in May 2023. 2. Litigation expense includes an accrual for the tentative settlement of a California wage-hour class action / Private Attorneys General Act (PAGA) claim in 2025 along with a settlement and legal fees paid in association with a dispute with a kiosk development partner in 2024. 3. Transaction and integration expense includes professional fees and other costs related to acquisition activity, including without limitation the Koch Industries, Inc. and Intex DIY, Inc. 4. In the first quarters of 2025 and 2024, we entered into a Repricing Amendment (2025 Repricing Amendment and 2024 Repricing Amendment) on our existing Senior Term Loan due July 14, 2028. 20

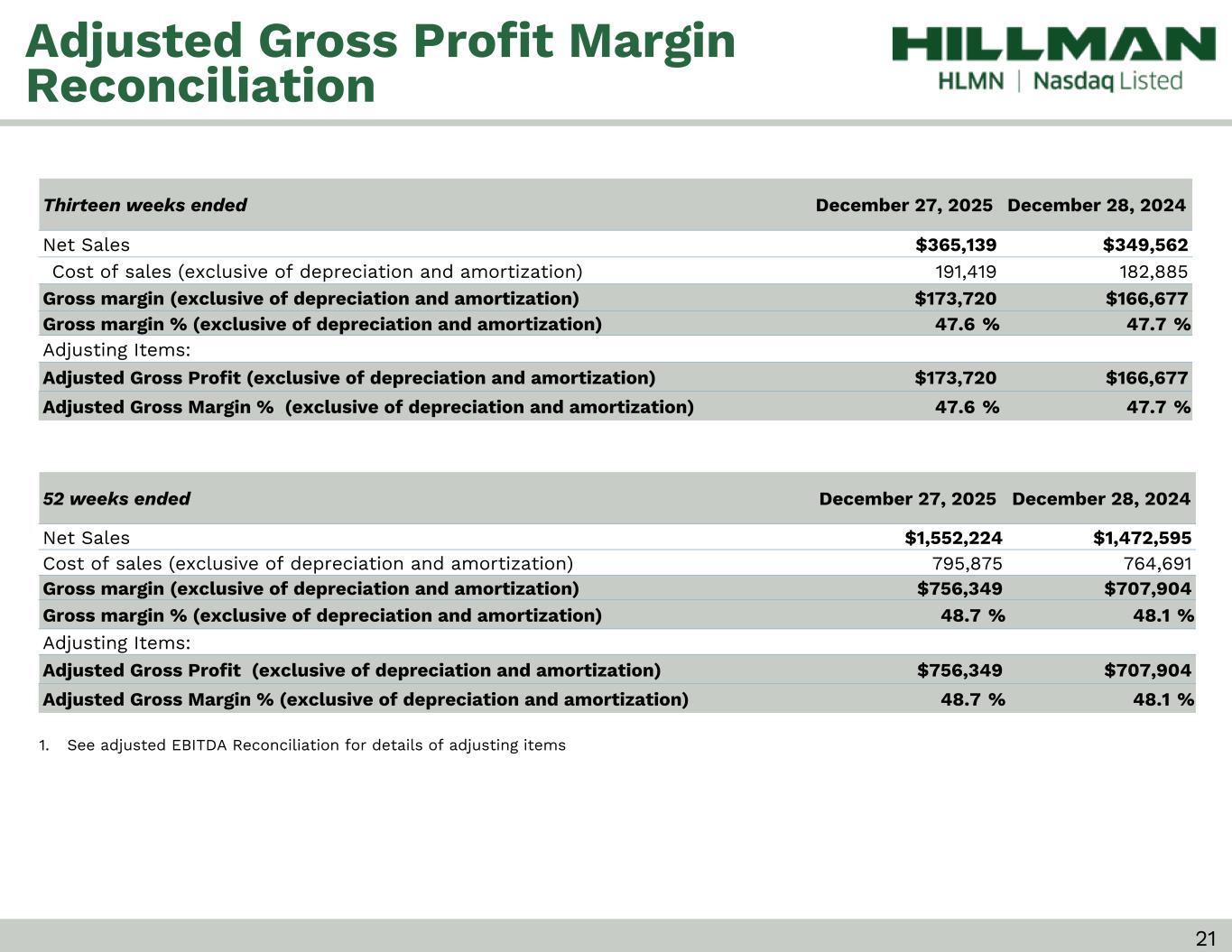

Thirteen weeks ended December 27, 2025 December 28, 2024 Net Sales $365,139 $349,562 Cost of sales (exclusive of depreciation and amortization) 191,419 182,885 Gross margin (exclusive of depreciation and amortization) $173,720 $166,677 Gross margin % (exclusive of depreciation and amortization) 47.6 % 47.7 % Adjusting Items: Adjusted Gross Profit (exclusive of depreciation and amortization) $173,720 $166,677 Adjusted Gross Margin % (exclusive of depreciation and amortization) 47.6 % 47.7 % Adjusted Gross Profit Margin Reconciliation 52 weeks ended December 27, 2025 December 28, 2024 Net Sales $1,552,224 $1,472,595 Cost of sales (exclusive of depreciation and amortization) 795,875 764,691 Gross margin (exclusive of depreciation and amortization) $756,349 $707,904 Gross margin % (exclusive of depreciation and amortization) 48.7 % 48.1 % Adjusting Items: Adjusted Gross Profit (exclusive of depreciation and amortization) $756,349 $707,904 Adjusted Gross Margin % (exclusive of depreciation and amortization) 48.7 % 48.1 % 1. See adjusted EBITDA Reconciliation for details of adjusting items 21

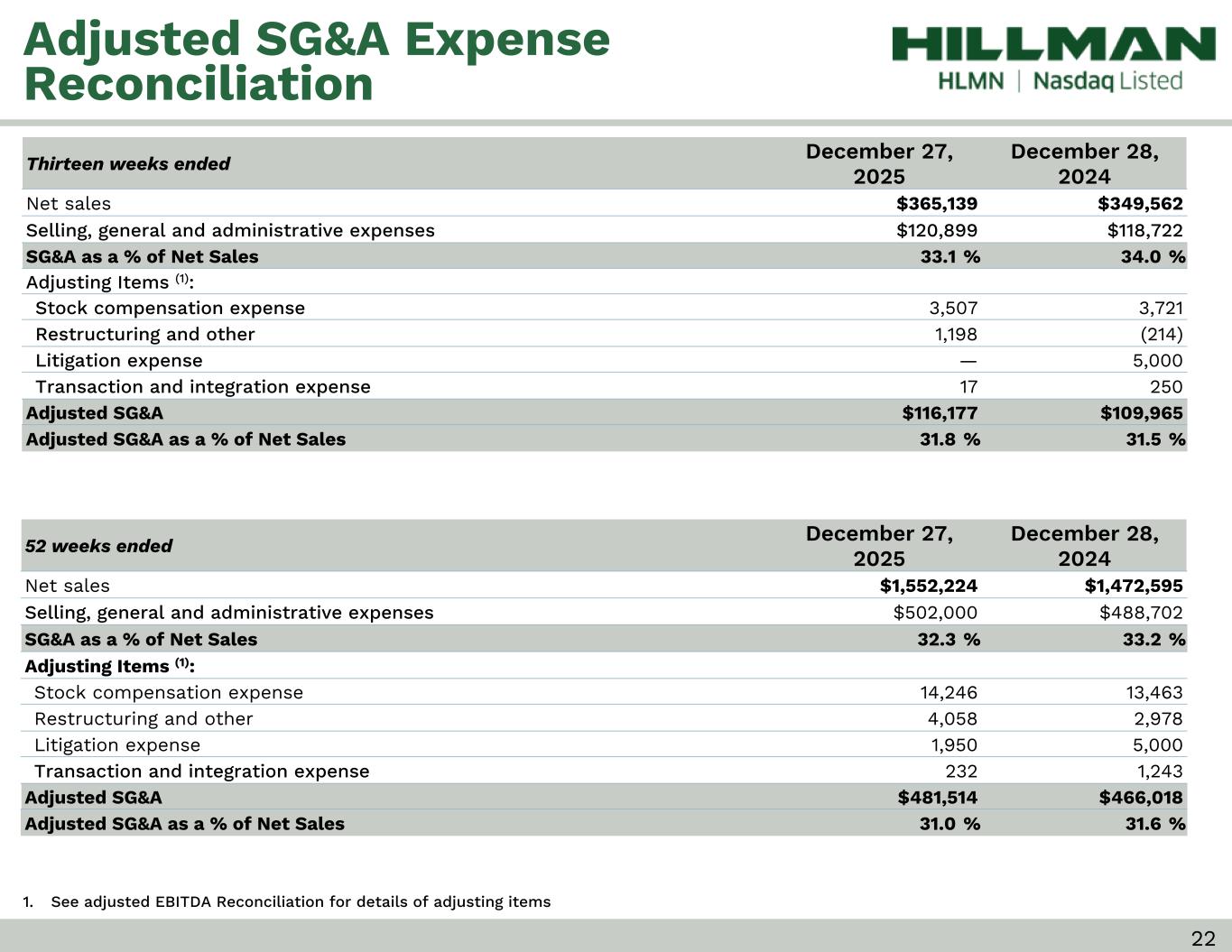

Thirteen weeks ended December 27, 2025 December 28, 2024 Net sales $365,139 $349,562 Selling, general and administrative expenses $120,899 $118,722 SG&A as a % of Net Sales 33.1 % 34.0 % Adjusting Items (1): Stock compensation expense 3,507 3,721 Restructuring and other 1,198 (214) Litigation expense — 5,000 Transaction and integration expense 17 250 Adjusted SG&A $116,177 $109,965 Adjusted SG&A as a % of Net Sales 31.8 % 31.5 % Adjusted SG&A Expense Reconciliation 1. See adjusted EBITDA Reconciliation for details of adjusting items 52 weeks ended December 27, 2025 December 28, 2024 Net sales $1,552,224 $1,472,595 Selling, general and administrative expenses $502,000 $488,702 SG&A as a % of Net Sales 32.3 % 33.2 % Adjusting Items (1): Stock compensation expense 14,246 13,463 Restructuring and other 4,058 2,978 Litigation expense 1,950 5,000 Transaction and integration expense 232 1,243 Adjusted SG&A $481,514 $466,018 Adjusted SG&A as a % of Net Sales 31.0 % 31.6 % 22

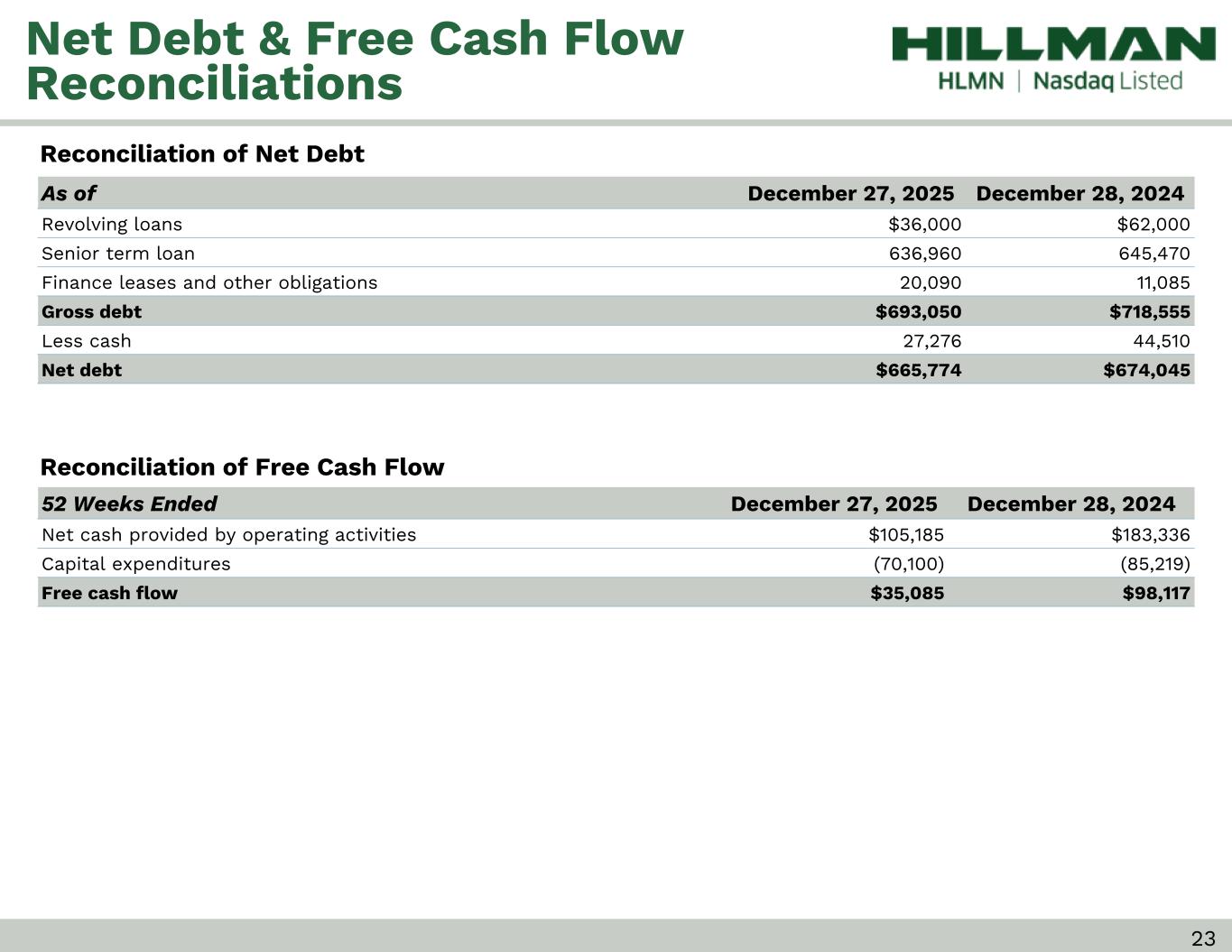

As of December 27, 2025 December 28, 2024 Revolving loans $36,000 $62,000 Senior term loan 636,960 645,470 Finance leases and other obligations 20,090 11,085 Gross debt $693,050 $718,555 Less cash 27,276 44,510 Net debt $665,774 $674,045 Net Debt & Free Cash Flow Reconciliations 52 Weeks Ended December 27, 2025 December 28, 2024 Net cash provided by operating activities $105,185 $183,336 Capital expenditures (70,100) (85,219) Free cash flow $35,085 $98,117 Reconciliation of Net Debt Reconciliation of Free Cash Flow 23

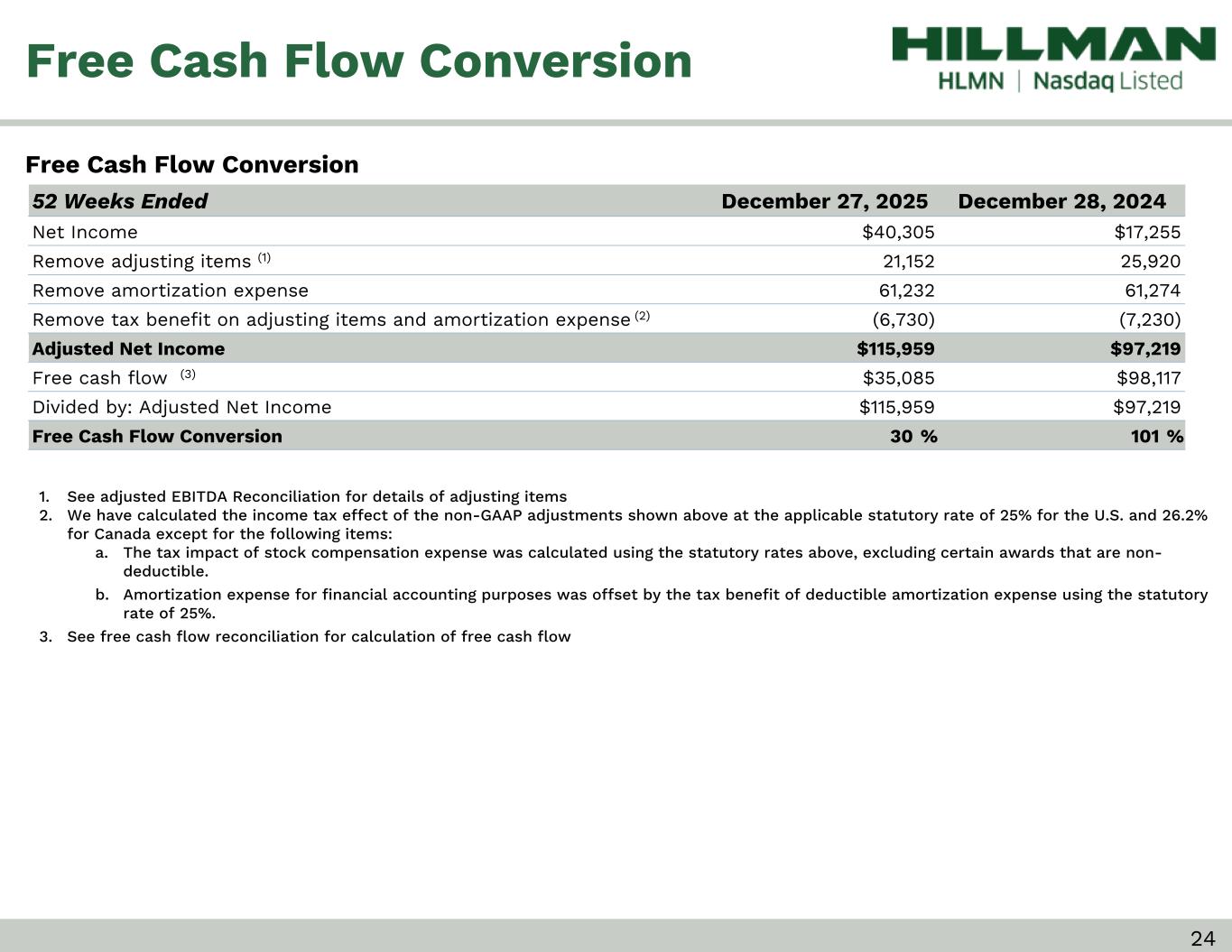

Free Cash Flow Conversion 24 Free Cash Flow Conversion 52 Weeks Ended December 27, 2025 December 28, 2024 Net Income $40,305 $17,255 Remove adjusting items (1) 21,152 25,920 Remove amortization expense 61,232 61,274 Remove tax benefit on adjusting items and amortization expense (2) (6,730) (7,230) Adjusted Net Income $115,959 $97,219 Free cash flow (3) $35,085 $98,117 Divided by: Adjusted Net Income $115,959 $97,219 Free Cash Flow Conversion 30 % 101 % 1. See adjusted EBITDA Reconciliation for details of adjusting items 2. We have calculated the income tax effect of the non-GAAP adjustments shown above at the applicable statutory rate of 25% for the U.S. and 26.2% for Canada except for the following items: a. The tax impact of stock compensation expense was calculated using the statutory rates above, excluding certain awards that are non- deductible. b. Amortization expense for financial accounting purposes was offset by the tax benefit of deductible amortization expense using the statutory rate of 25%. 3. See free cash flow reconciliation for calculation of free cash flow

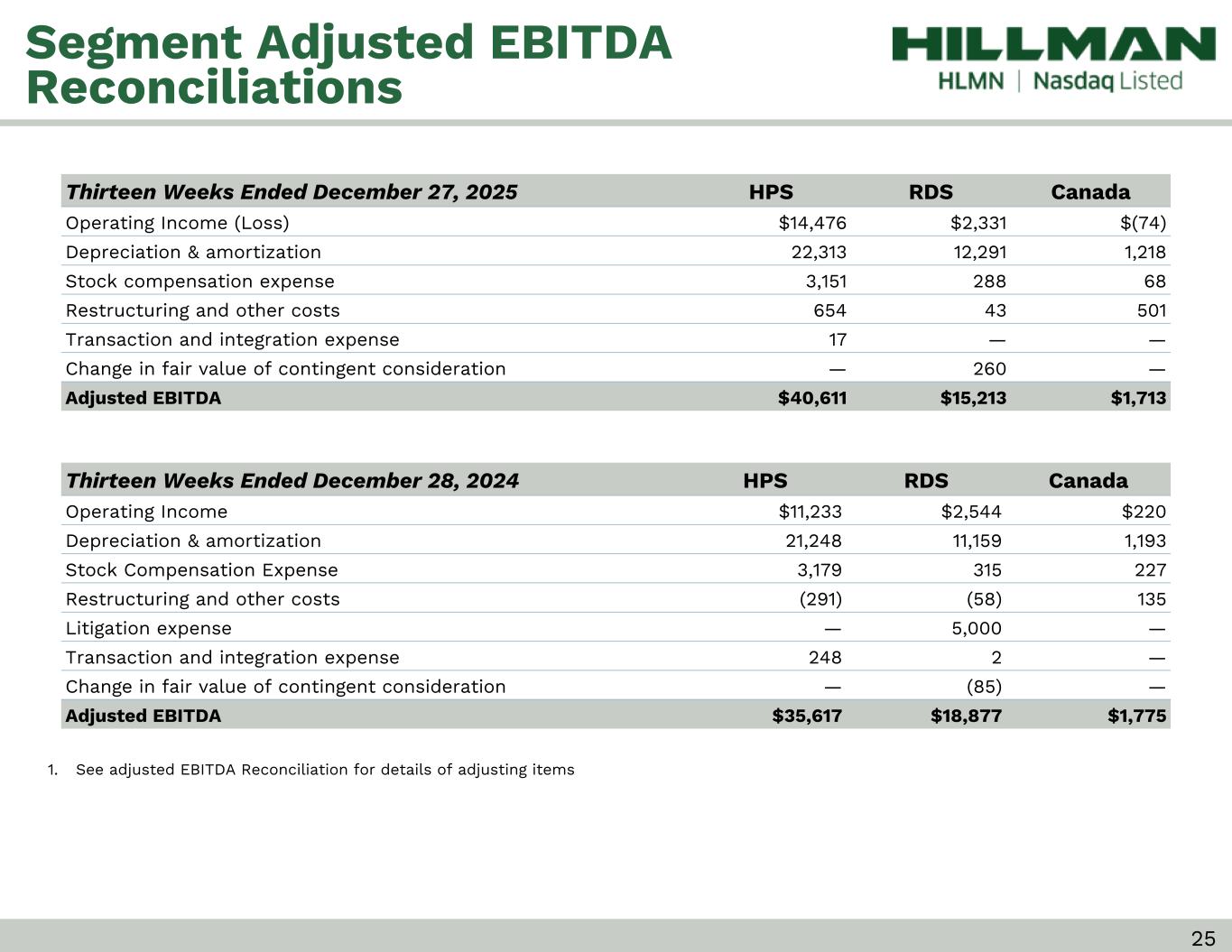

Thirteen Weeks Ended December 27, 2025 HPS RDS Canada Operating Income (Loss) $14,476 $2,331 $(74) Depreciation & amortization 22,313 12,291 1,218 Stock compensation expense 3,151 288 68 Restructuring and other costs 654 43 501 Transaction and integration expense 17 — — Change in fair value of contingent consideration — 260 — Adjusted EBITDA $40,611 $15,213 $1,713 Thirteen Weeks Ended December 28, 2024 HPS RDS Canada Operating Income $11,233 $2,544 $220 Depreciation & amortization 21,248 11,159 1,193 Stock Compensation Expense 3,179 315 227 Restructuring and other costs (291) (58) 135 Litigation expense — 5,000 — Transaction and integration expense 248 2 — Change in fair value of contingent consideration — (85) — Adjusted EBITDA $35,617 $18,877 $1,775 1. See adjusted EBITDA Reconciliation for details of adjusting items 25 Segment Adjusted EBITDA Reconciliations

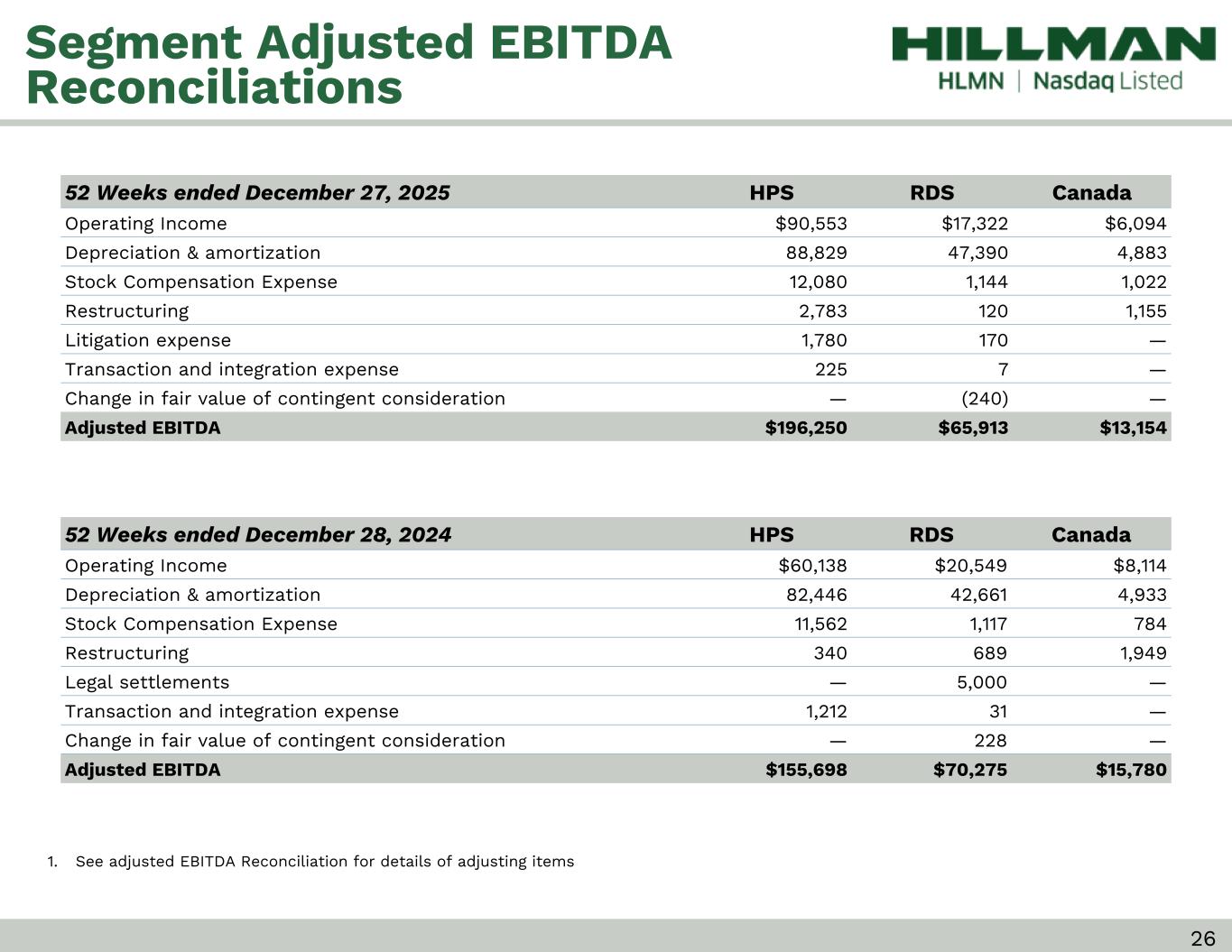

52 Weeks ended December 27, 2025 HPS RDS Canada Operating Income $90,553 $17,322 $6,094 Depreciation & amortization 88,829 47,390 4,883 Stock Compensation Expense 12,080 1,144 1,022 Restructuring 2,783 120 1,155 Litigation expense 1,780 170 — Transaction and integration expense 225 7 — Change in fair value of contingent consideration — (240) — Adjusted EBITDA $196,250 $65,913 $13,154 52 Weeks ended December 28, 2024 HPS RDS Canada Operating Income $60,138 $20,549 $8,114 Depreciation & amortization 82,446 42,661 4,933 Stock Compensation Expense 11,562 1,117 784 Restructuring 340 689 1,949 Legal settlements — 5,000 — Transaction and integration expense 1,212 31 — Change in fair value of contingent consideration — 228 — Adjusted EBITDA $155,698 $70,275 $15,780 Segment Adjusted EBITDA Reconciliations 1. See adjusted EBITDA Reconciliation for details of adjusting items 26