EX-99.2

Published on November 4, 2025

Quarterly Earnings Results Presentation Q3 2025 - November 4, 2025

2 PresBuilder Placeholder - Delete this box if you see it on a slide, but DO NOT REMOVE this box from the slide layout Forward Looking Statements This presentation contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. All forward-looking statements are made in good faith by the company and are intended to qualify for the safe harbor from liability established by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995.You should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," “target”, “goal”, "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) unfavorable economic conditions that may affect operations, financial condition and cash flows including spending on home renovation or construction projects, inflation, recessions, instability in the financial markets or credit markets; (2) increased supply chain costs, including tariffs, raw materials, sourcing, transportation and energy; (3) the highly competitive nature of the markets that we serve; (4) the ability to continue to innovate with new products and services; (5) seasonality; (6) large customer concentration; (7) the ability to recruit and retain qualified employees; (8) the outcome of any legal proceedings that may be instituted against the Company; (9) adverse changes in currency exchange rates; or (10) regulatory changes and potential legislation that could adversely impact financial results. The foregoing list of factors is not exclusive, and readers should also refer to those risks that are included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K for the fiscal year ended December 28, 2024. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward looking statements. Except as required by applicable law, the Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this communication to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Presentation of Non-GAAP Financial Measures In addition to the results provided in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”) throughout this presentation the company has provided non-GAAP financial measures, which present results on a basis adjusted for certain items. The company uses these non-GAAP financial measures for business planning purposes and in measuring its performance relative to that of its competitors. The company believes that these non-GAAP financial measures are useful financial metrics to assess its operating performance from period-to-period by excluding certain items that the company believes are not representative of its core business. These non-GAAP financial measures are not intended to replace, and should not be considered superior to, the presentation of the company’s financial results in accordance with GAAP. The use of the non-GAAP financial measures terms may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures. These non-GAAP financial measures are reconciled from the respective measures under GAAP in the appendix below. The company is not able to provide a reconciliation of the company’s non-GAAP financial guidance to the corresponding GAAP measures without unreasonable effort because of the inherent difficulty in forecasting and quantifying certain amounts necessary for such a reconciliation such as certain non-cash, nonrecurring or other items that are included in net income and EBITDA as well as the related tax impacts of these items and asset dispositions / acquisitions and changes in foreign currency exchange rates that are included in cash flow, due to the uncertainty and variability of the nature and amount of these future charges and costs.

3 • Net sales increased 8.0% to $424.9 million versus Q3 2024 ◦ Hardware and Protective Solutions ("HPS") increased +10.0% ◦ Robotics and Digital Solutions ("RDS") increased +3.3% ◦ Canada decreased (0.2)% • GAAP net income totaled $23.2 million, or $0.12 per diluted share, compared to $7.4 million, or $0.04 per diluted share, in Q3 2024 • Adjusted Gross Margins totaled 51.7% compared to 48.2% in Q3 2024 • Adjusted EBITDA increased to $88.0 million compared to $64.8 million in Q3 2024 • Adjusted EBITDA margins were 20.7% compared to 16.5% in Q3 2024 • Net Debt / Adjusted EBITDA (ttm): 2.5x at quarter end, compared to 2.8x on December 28, 2024 Q3 2025 Financial Review Please see reconciliation tables in the Appendix of this presentation for non-GAAP metrics. Highlights for the 13 Weeks Ended September 27, 2025

4 Q3 2025 Operational Review Highlights for the 13 Weeks Ended September 27, 2025 • Continued taking great care of customers: ◦ YTD fill rates averaged 97% • Continue to pursue accretive M&A opportunities that: ◦ Leverage the Hillman moat, and ◦ Expand Hillman's pro, commercial, and industrial businesses • During the quarter, Hillman continued to optimize its "dual faucet" supply chain strategy: ◦ Dual source products in different countries ◦ Diversify the country of origin to have the ability to reduce China exposure • Repurchased $325.6 thousand shares of its common stock at an average price of $9.72 per share, which totaled $3.2 million

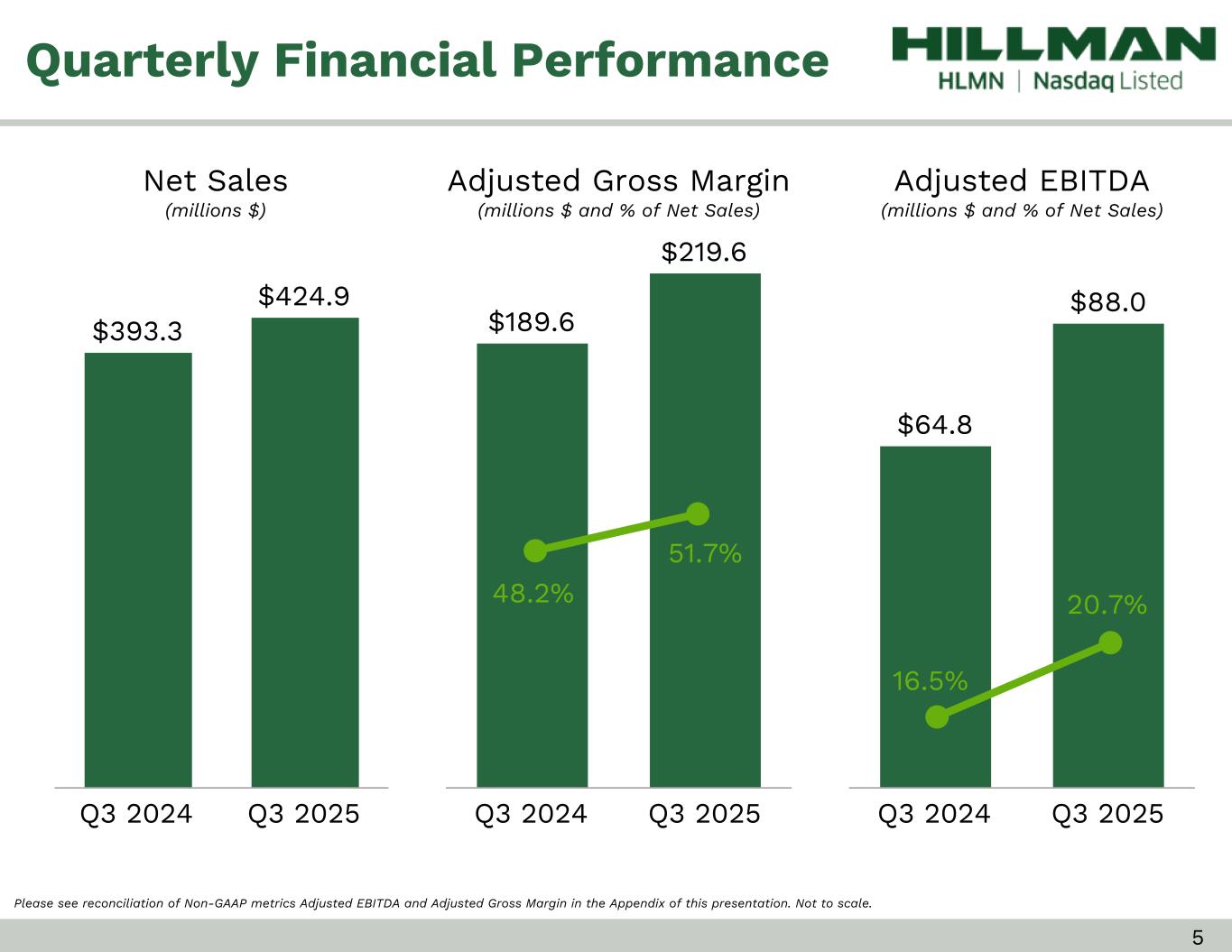

5 Quarterly Financial Performance Adjusted EBITDA (millions $ and % of Net Sales) Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Adjusted Gross Margin in the Appendix of this presentation. Not to scale. Net Sales (millions $) Adjusted Gross Margin (millions $ and % of Net Sales) $64.8 $88.0 Q3 2024 Q3 2025 20.7% 16.5% $189.6 $219.6 Q3 2024 Q3 2025 $393.3 $424.9 Q3 2024 Q3 2025 51.7% 48.2%

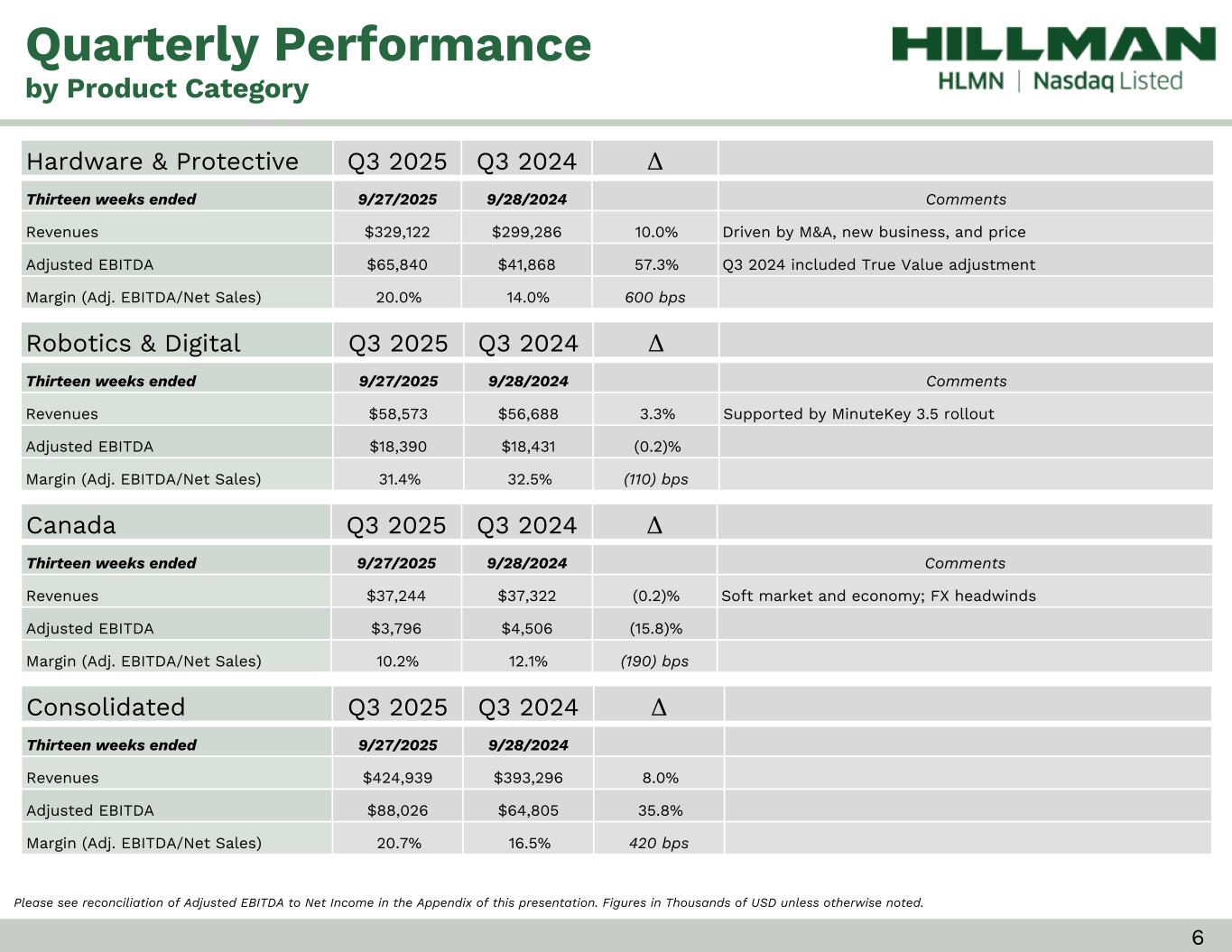

6 Hardware & Protective Q3 2025 Q3 2024 Δ Thirteen weeks ended 9/27/2025 9/28/2024 Comments Revenues $329,122 $299,286 10.0% Driven by M&A, new business, and price Adjusted EBITDA $65,840 $41,868 57.3% Q3 2024 included True Value adjustment Margin (Adj. EBITDA/Net Sales) 20.0% 14.0% 600 bps Robotics & Digital Q3 2025 Q3 2024 Δ Thirteen weeks ended 9/27/2025 9/28/2024 Comments Revenues $58,573 $56,688 3.3% Supported by MinuteKey 3.5 rollout Adjusted EBITDA $18,390 $18,431 (0.2)% Margin (Adj. EBITDA/Net Sales) 31.4% 32.5% (110) bps Canada Q3 2025 Q3 2024 Δ Thirteen weeks ended 9/27/2025 9/28/2024 Comments Revenues $37,244 $37,322 (0.2)% Soft market and economy; FX headwinds Adjusted EBITDA $3,796 $4,506 (15.8)% Margin (Adj. EBITDA/Net Sales) 10.2% 12.1% (190) bps Consolidated Q3 2025 Q3 2024 Δ Thirteen weeks ended 9/27/2025 9/28/2024 Revenues $424,939 $393,296 8.0% Adjusted EBITDA $88,026 $64,805 35.8% Margin (Adj. EBITDA/Net Sales) 20.7% 16.5% 420 bps Quarterly Performance by Product Category Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted. • Top Row: ◦ 27 point height ◦ 16 font (work sans) ◦ 4 point white bottom line • First Column green ◦ Dark: CFD9D1 ◦ Light: D9E1DA • Other Columns gray ◦ Dark: D9D9D9 ◦ Light E0E0E0 ◦ 1 point white bottom and inside lines

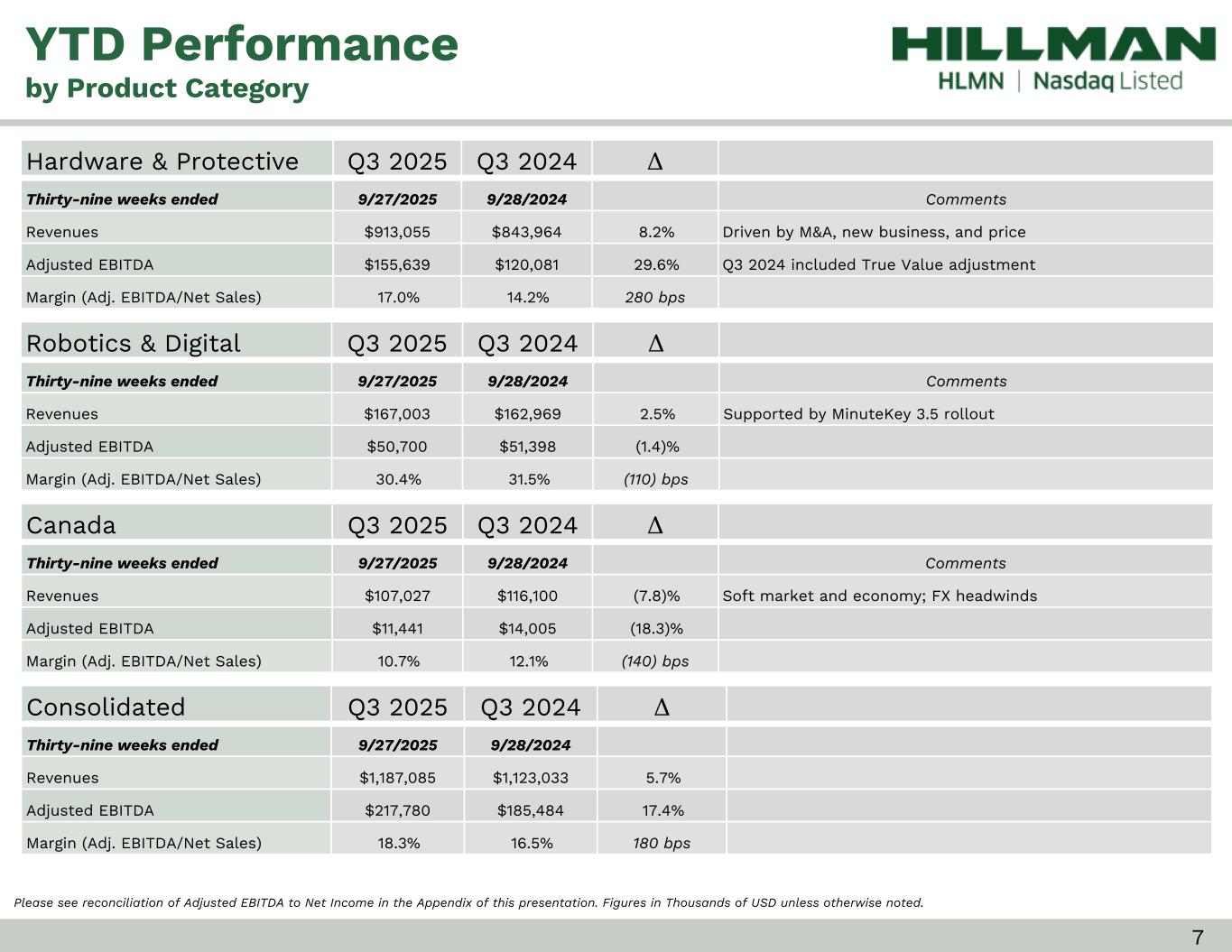

7 Hardware & Protective Q3 2025 Q3 2024 Δ Thirty-nine weeks ended 9/27/2025 9/28/2024 Comments Revenues $913,055 $843,964 8.2% Driven by M&A, new business, and price Adjusted EBITDA $155,639 $120,081 29.6% Q3 2024 included True Value adjustment Margin (Adj. EBITDA/Net Sales) 17.0% 14.2% 280 bps Robotics & Digital Q3 2025 Q3 2024 Δ Thirty-nine weeks ended 9/27/2025 9/28/2024 Comments Revenues $167,003 $162,969 2.5% Supported by MinuteKey 3.5 rollout Adjusted EBITDA $50,700 $51,398 (1.4)% Margin (Adj. EBITDA/Net Sales) 30.4% 31.5% (110) bps Canada Q3 2025 Q3 2024 Δ Thirty-nine weeks ended 9/27/2025 9/28/2024 Comments Revenues $107,027 $116,100 (7.8)% Soft market and economy; FX headwinds Adjusted EBITDA $11,441 $14,005 (18.3)% Margin (Adj. EBITDA/Net Sales) 10.7% 12.1% (140) bps Consolidated Q3 2025 Q3 2024 Δ Thirty-nine weeks ended 9/27/2025 9/28/2024 Revenues $1,187,085 $1,123,033 5.7% Adjusted EBITDA $217,780 $185,484 17.4% Margin (Adj. EBITDA/Net Sales) 18.3% 16.5% 180 bps YTD Performance by Product Category Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted.

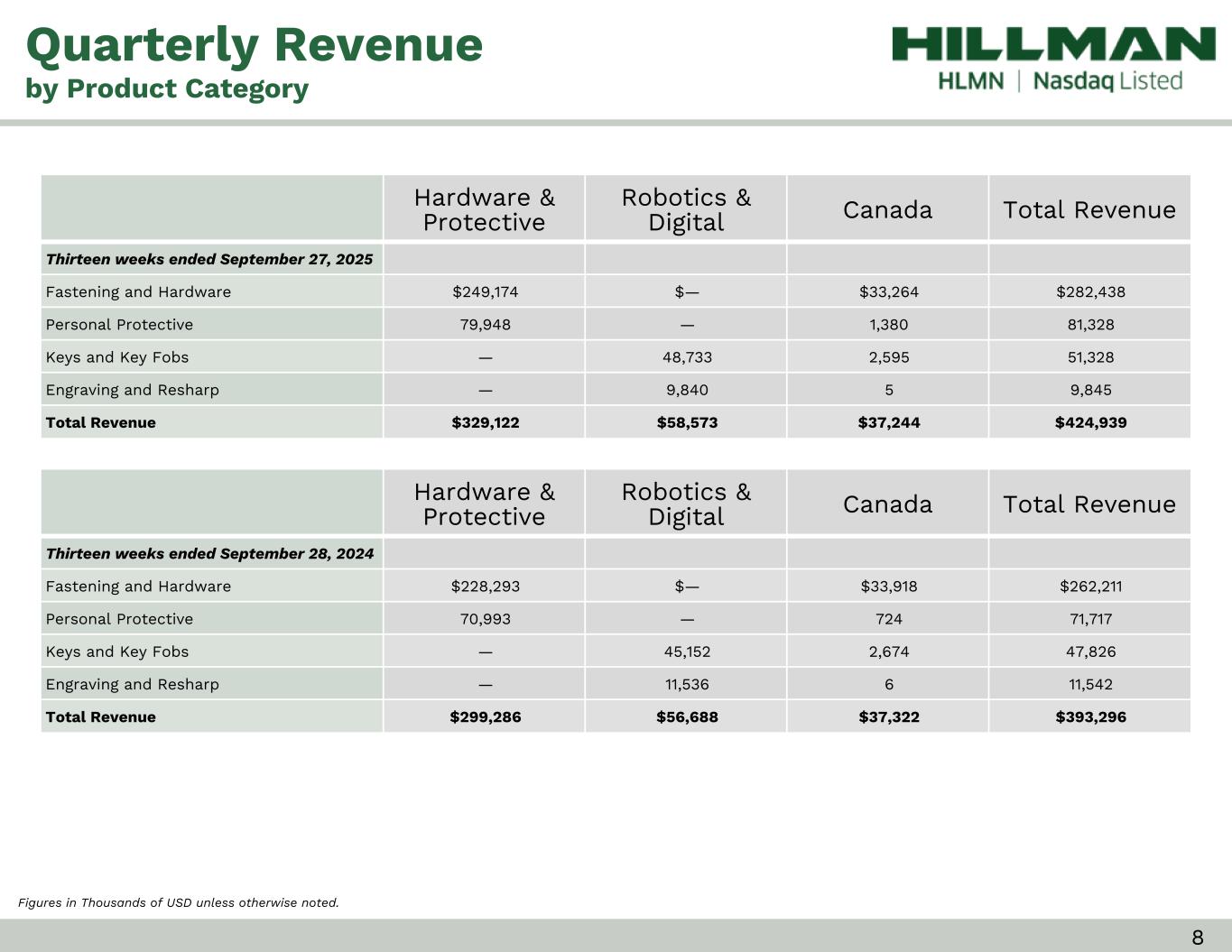

8 Hardware & Protective Robotics & Digital Canada Total Revenue Thirteen weeks ended September 27, 2025 Fastening and Hardware $249,174 $— $33,264 $282,438 Personal Protective 79,948 — 1,380 81,328 Keys and Key Fobs — 48,733 2,595 51,328 Engraving and Resharp — 9,840 5 9,845 Total Revenue $329,122 $58,573 $37,244 $424,939 Quarterly Revenue by Product Category Hardware & Protective Robotics & Digital Canada Total Revenue Thirteen weeks ended September 28, 2024 Fastening and Hardware $228,293 $— $33,918 $262,211 Personal Protective 70,993 — 724 71,717 Keys and Key Fobs — 45,152 2,674 47,826 Engraving and Resharp — 11,536 6 11,542 Total Revenue $299,286 $56,688 $37,322 $393,296 Figures in Thousands of USD unless otherwise noted.

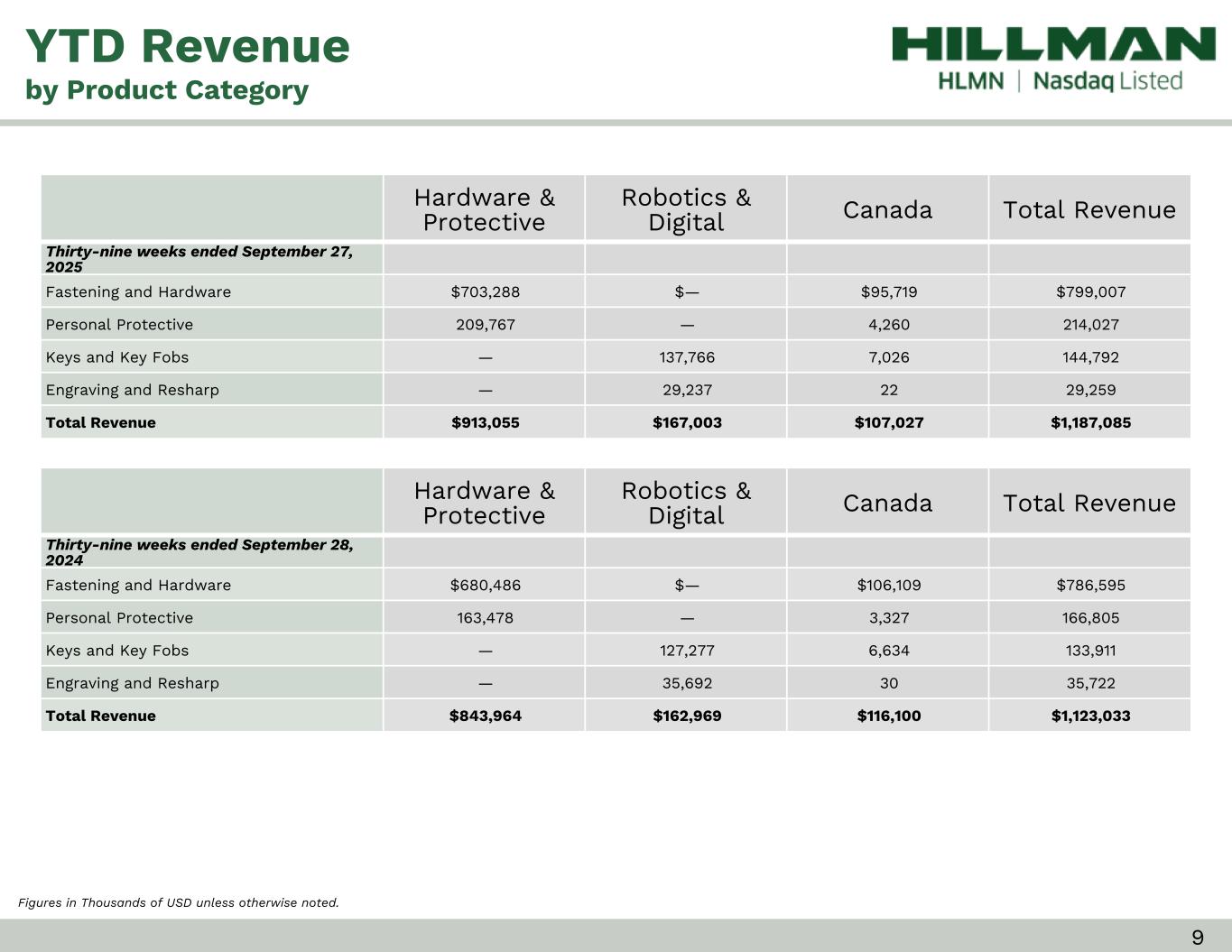

9 Hardware & Protective Robotics & Digital Canada Total Revenue Thirty-nine weeks ended September 27, 2025 Fastening and Hardware $703,288 $— $95,719 $799,007 Personal Protective 209,767 — 4,260 214,027 Keys and Key Fobs — 137,766 7,026 144,792 Engraving and Resharp — 29,237 22 29,259 Total Revenue $913,055 $167,003 $107,027 $1,187,085 YTD Revenue by Product Category Hardware & Protective Robotics & Digital Canada Total Revenue Thirty-nine weeks ended September 28, 2024 Fastening and Hardware $680,486 $— $106,109 $786,595 Personal Protective 163,478 — 3,327 166,805 Keys and Key Fobs — 127,277 6,634 133,911 Engraving and Resharp — 35,692 30 35,722 Total Revenue $843,964 $162,969 $116,100 $1,123,033 Figures in Thousands of USD unless otherwise noted.

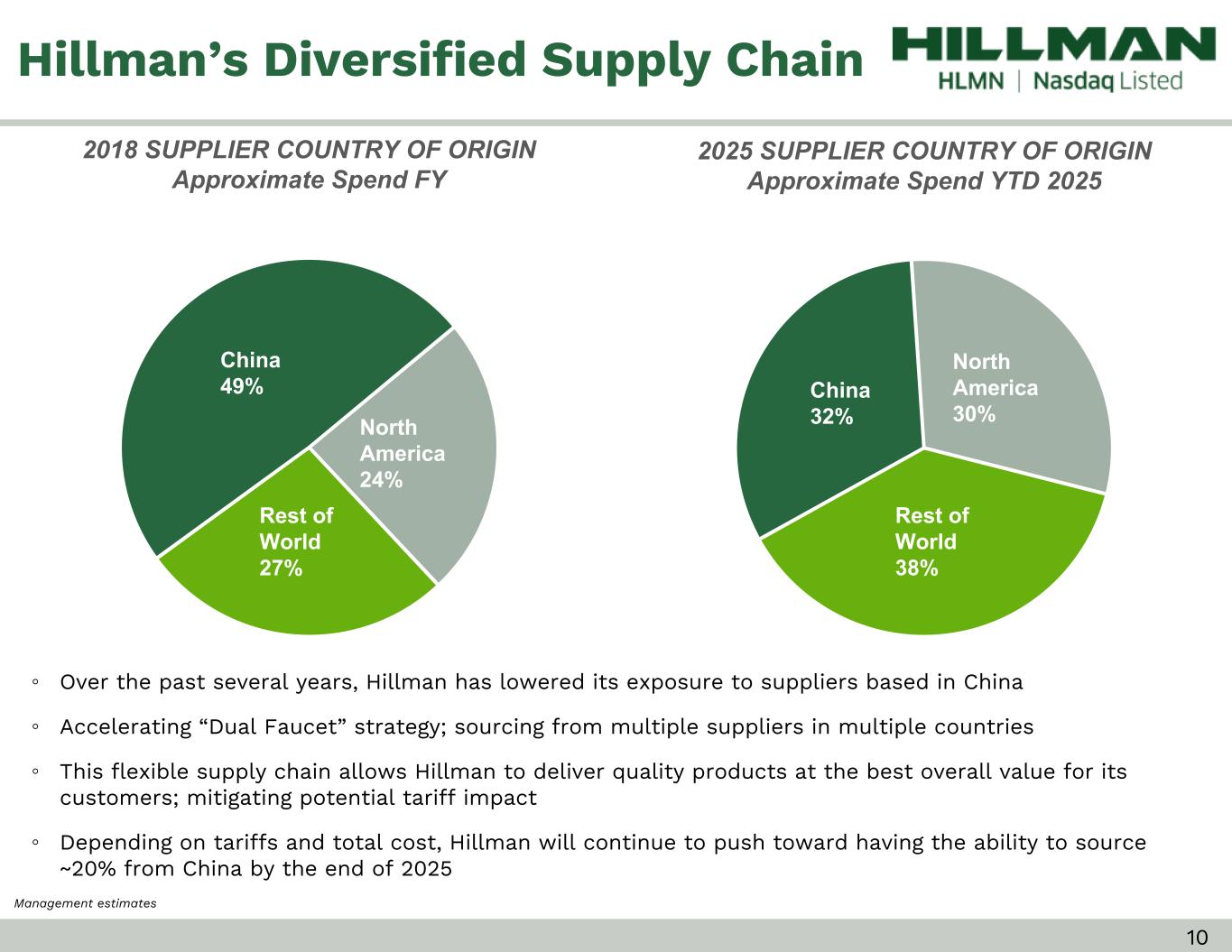

10 Hillman’s Diversified Supply Chain ◦ Over the past several years, Hillman has lowered its exposure to suppliers based in China ◦ Accelerating “Dual Faucet” strategy; sourcing from multiple suppliers in multiple countries ◦ This flexible supply chain allows Hillman to deliver quality products at the best overall value for its customers; mitigating potential tariff impact ◦ Depending on tariffs and total cost, Hillman will continue to push toward having the ability to source ~20% from China by the end of 2025 2018 SUPPLIER COUNTRY OF ORIGIN Approximate Spend FY China 49% North America 24% Rest of World 27% 2025 SUPPLIER COUNTRY OF ORIGIN Approximate Spend YTD 2025 China 32% North America 30% Rest of World 38% Management estimates

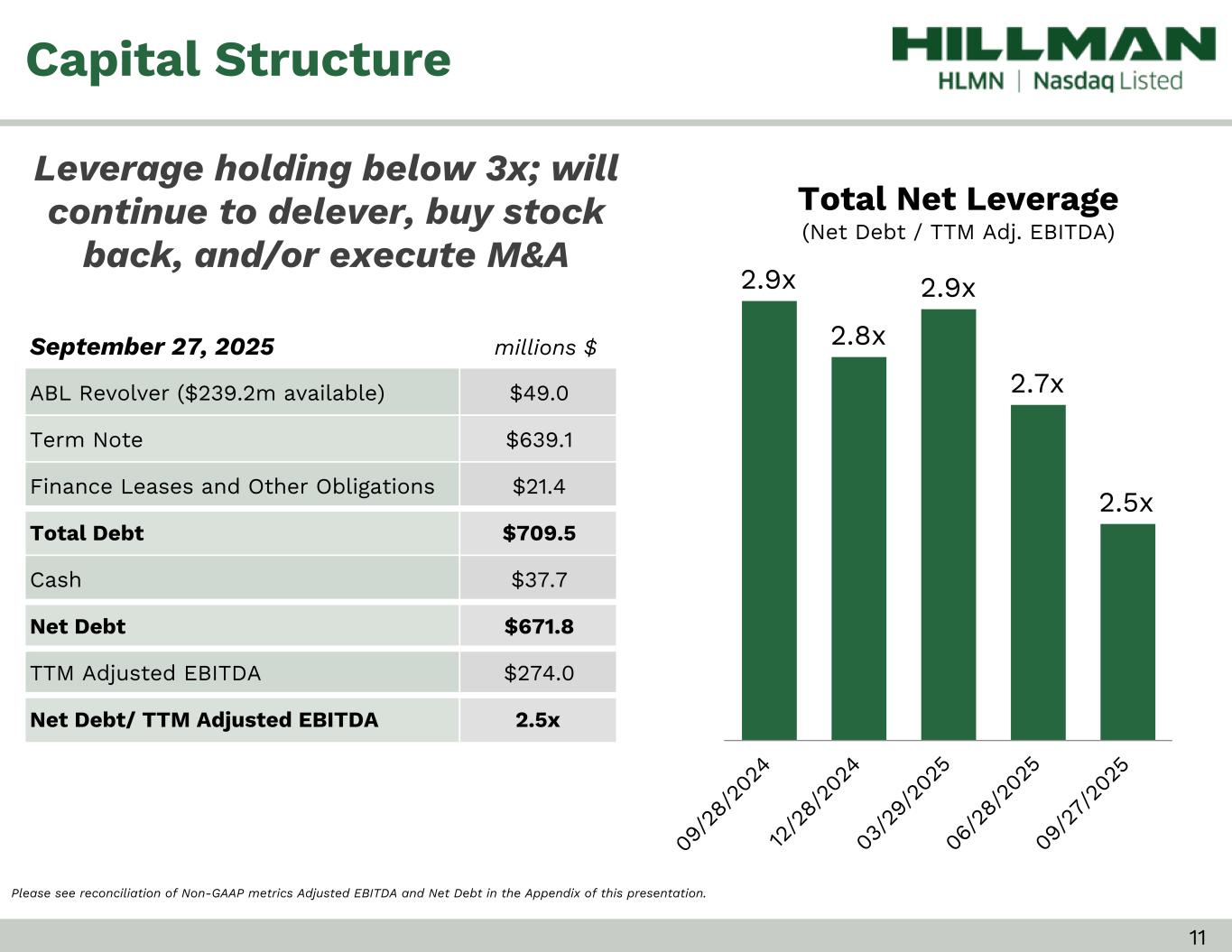

11 Total Net Leverage (Net Debt / TTM Adj. EBITDA) Capital Structure September 27, 2025 millions $ ABL Revolver ($239.2m available) $49.0 Term Note $639.1 Finance Leases and Other Obligations $21.4 Total Debt $709.5 Cash $37.7 Net Debt $671.8 TTM Adjusted EBITDA $274.0 Net Debt/ TTM Adjusted EBITDA 2.5x Leverage holding below 3x; will continue to delever, buy stock back, and/or execute M&A Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Net Debt in the Appendix of this presentation. 2.9x 2.8x 2.9x 2.7x 2.5x 09 /2 8/ 20 24 12 /2 8/ 20 24 03 /2 9/ 20 25 06 /2 8/ 20 25 09 /2 7/ 20 25

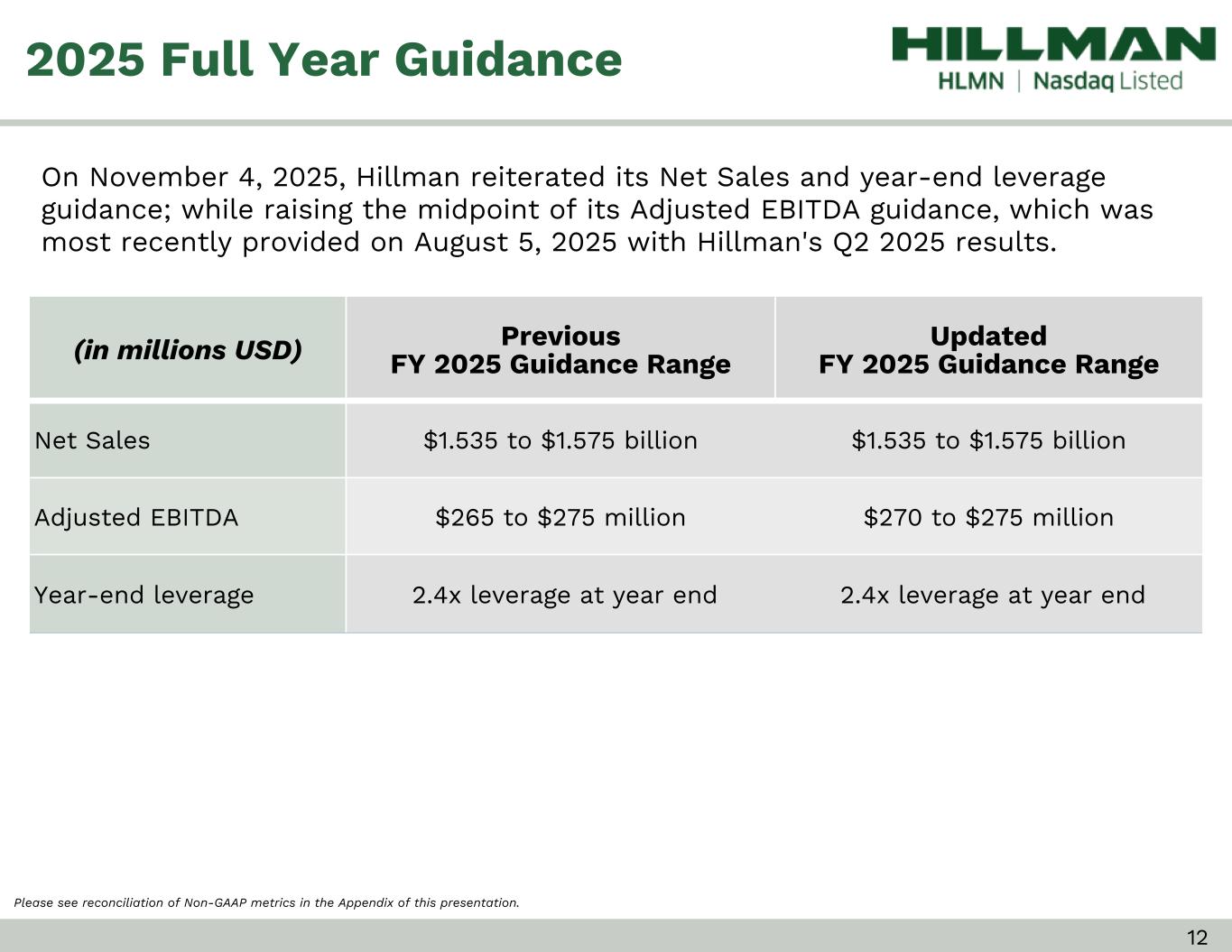

12 2025 Full Year Guidance (in millions USD) Previous FY 2025 Guidance Range Updated FY 2025 Guidance Range Net Sales $1.535 to $1.575 billion $1.535 to $1.575 billion Adjusted EBITDA $265 to $275 million $270 to $275 million Year-end leverage 2.4x leverage at year end 2.4x leverage at year end On November 4, 2025, Hillman reiterated its Net Sales and year-end leverage guidance; while raising the midpoint of its Adjusted EBITDA guidance, which was most recently provided on August 5, 2025 with Hillman's Q2 2025 results. Please see reconciliation of Non-GAAP metrics in the Appendix of this presentation.

13 Key Takeaways Resilient Business; Focused on Diversifying Supply Chain Historical Long-term Annual Growth Targets (Organic): Revenue Growth: +6% & Adj. EBITDA Growth: +10% Historical Long-term Annual Growth Targets (incl. Acquisitions): Revenue Growth: +10% & Adj. EBITDA Growth: +15% • Business has 60+ year track record of success; proven to be resilient through multiple economic cycles with great long-term partnerships with customers • Hillman products are utilized for repair, maintenance and remodel projects; products are generally low-cost and a very small percentage of a given project • 1,200-member sales and service team and direct-to-store fulfillment continue to provide competitive advantages and strengthen competitive moat - drives new business wins • Given the tariff environment, Hillman working to diversify its supply chain to optimize costs and value; working to mitigate higher costs

Appendix

15 Investment Highlights Significant runway for incremental growth: Organic + M&A Management team with proven operational and M&A expertise Strong financial profile with 60+ year track record Market and innovation leader across multiple categories Indispensable partner embedded with winning retailers Customers love us, trust us and rely on us Large, predictable, growing and resilient end markets

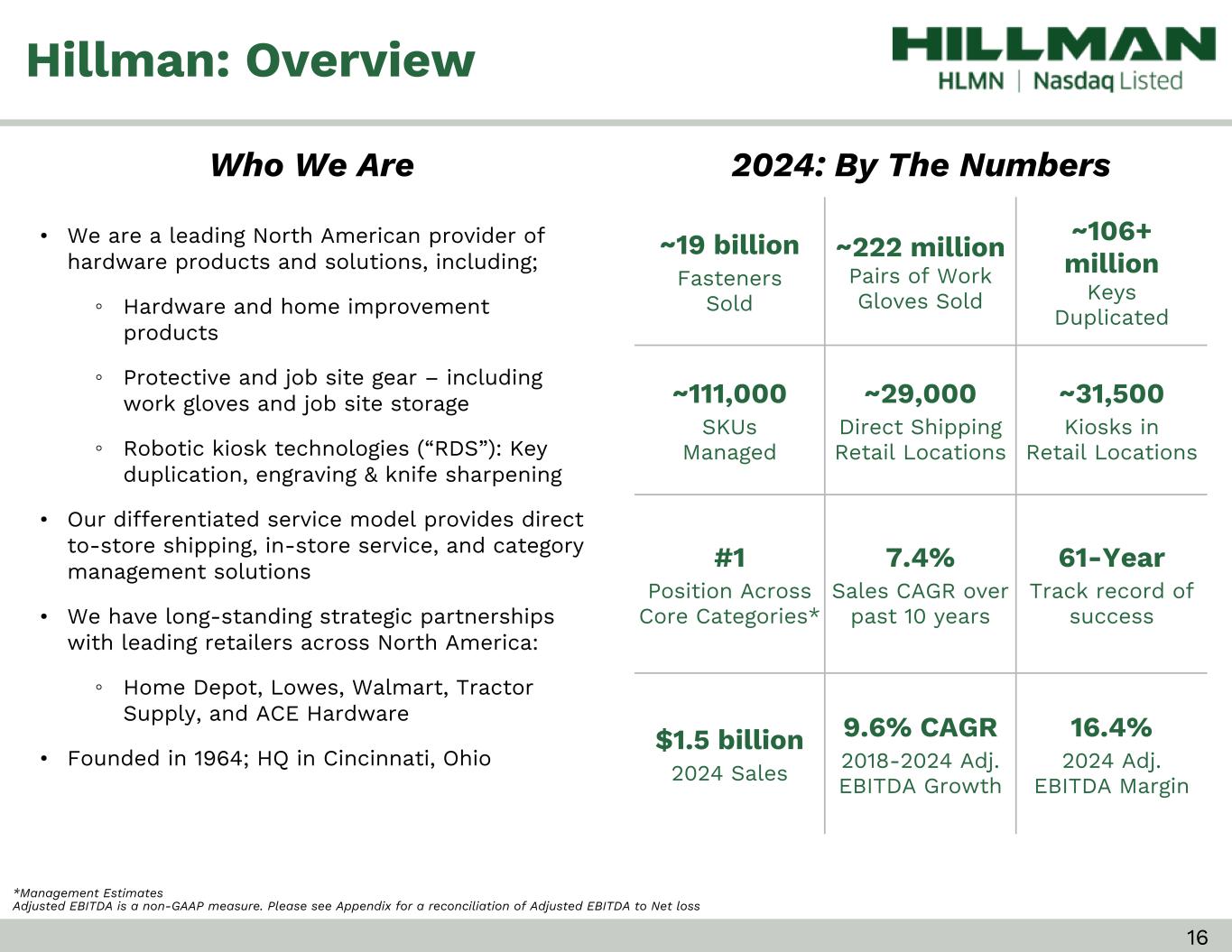

16 Hillman: Overview Who We Are *Management Estimates Adjusted EBITDA is a non-GAAP measure. Please see Appendix for a reconciliation of Adjusted EBITDA to Net loss ~19 billion Fasteners Sold ~222 million Pairs of Work Gloves Sold ~106+ million Keys Duplicated ~111,000 SKUs Managed ~29,000 Direct Shipping Retail Locations ~31,500 Kiosks in Retail Locations #1 Position Across Core Categories* 7.4% Sales CAGR over past 10 years 61-Year Track record of success $1.5 billion 2024 Sales 9.6% CAGR 2018-2024 Adj. EBITDA Growth 16.4% 2024 Adj. EBITDA Margin 2024: By The Numbers • We are a leading North American provider of hardware products and solutions, including; ◦ Hardware and home improvement products ◦ Protective and job site gear – including work gloves and job site storage ◦ Robotic kiosk technologies (“RDS”): Key duplication, engraving & knife sharpening • Our differentiated service model provides direct to-store shipping, in-store service, and category management solutions • We have long-standing strategic partnerships with leading retailers across North America: ◦ Home Depot, Lowes, Walmart, Tractor Supply, and ACE Hardware • Founded in 1964; HQ in Cincinnati, Ohio

17 #1 in Segment Representative Top Customers #1 in Segment #1 in Segment Key and Fob Duplication Personalized Tags Knife Sharpening Fasteners & Specialty Gloves Builders Hardware & Metal Shapes Safety / PPE Construction Fasteners Work Gear Picture Hanging Source: Third party industry report and management estimates. Primary Product Categories Hardware Solutions Robotics & Digital SolutionsProtective Solutions Rope & Chain

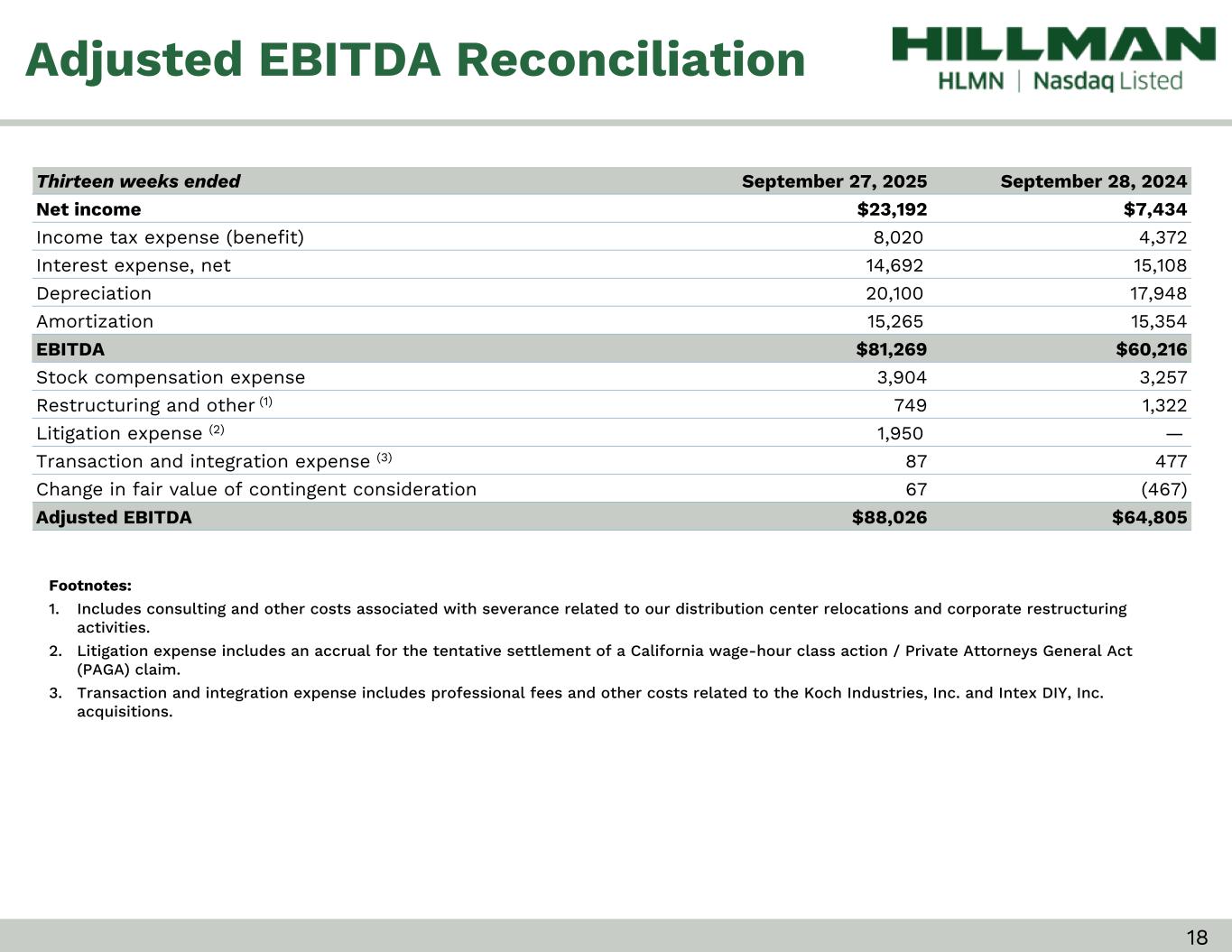

18 Thirteen weeks ended September 27, 2025 September 28, 2024 Net income $23,192 $7,434 Income tax expense (benefit) 8,020 4,372 Interest expense, net 14,692 15,108 Depreciation 20,100 17,948 Amortization 15,265 15,354 EBITDA $81,269 $60,216 Stock compensation expense 3,904 3,257 Restructuring and other (1) 749 1,322 Litigation expense (2) 1,950 — Transaction and integration expense (3) 87 477 Change in fair value of contingent consideration 67 (467) Adjusted EBITDA $88,026 $64,805 Adjusted EBITDA Reconciliation Footnotes: 1. Includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities. 2. Litigation expense includes an accrual for the tentative settlement of a California wage-hour class action / Private Attorneys General Act (PAGA) claim. 3. Transaction and integration expense includes professional fees and other costs related to the Koch Industries, Inc. and Intex DIY, Inc. acquisitions.

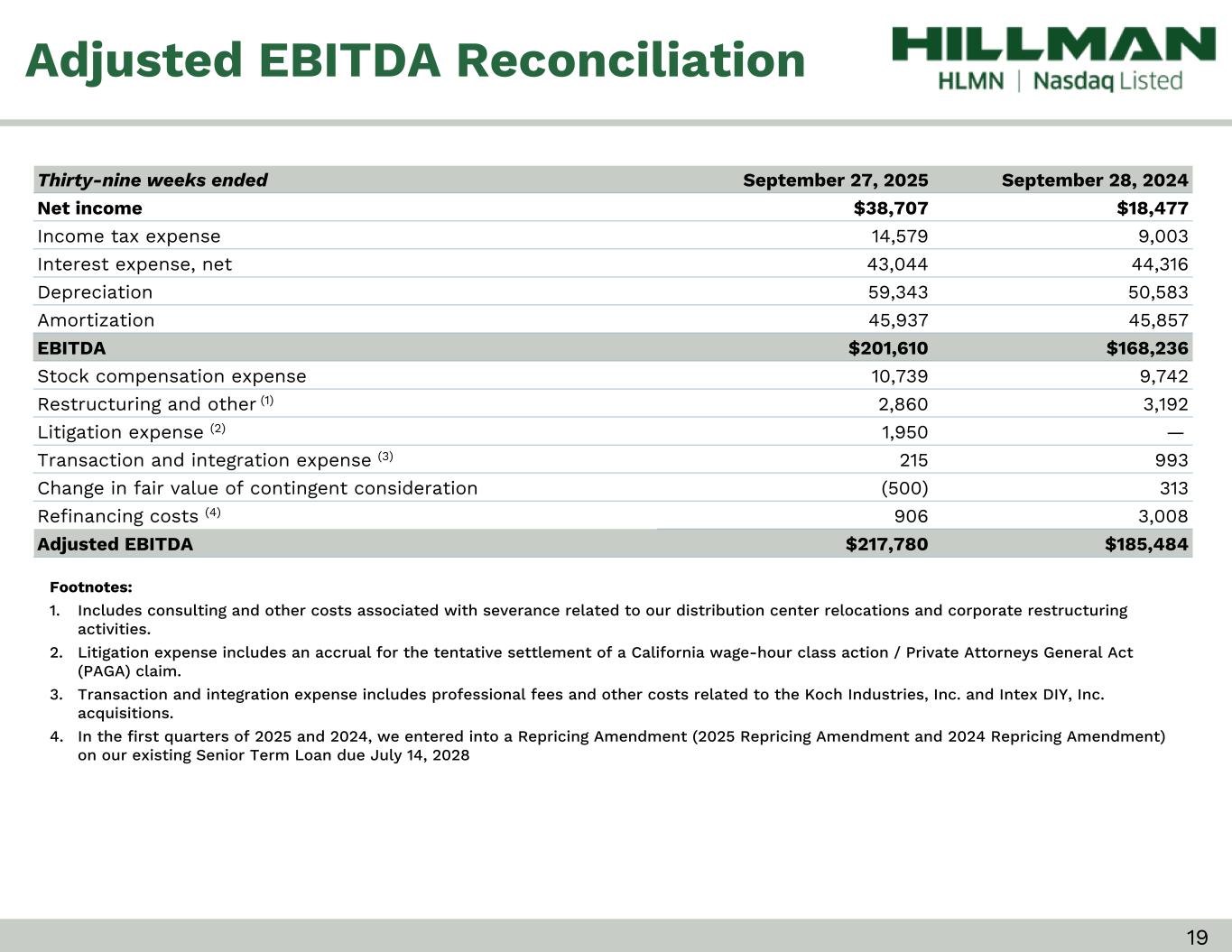

19 Thirty-nine weeks ended September 27, 2025 September 28, 2024 Net income $38,707 $18,477 Income tax expense 14,579 9,003 Interest expense, net 43,044 44,316 Depreciation 59,343 50,583 Amortization 45,937 45,857 EBITDA $201,610 $168,236 Stock compensation expense 10,739 9,742 Restructuring and other (1) 2,860 3,192 Litigation expense (2) 1,950 — Transaction and integration expense (3) 215 993 Change in fair value of contingent consideration (500) 313 Refinancing costs (4) 906 3,008 Adjusted EBITDA $217,780 $185,484 Adjusted EBITDA Reconciliation Footnotes: 1. Includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities. 2. Litigation expense includes an accrual for the tentative settlement of a California wage-hour class action / Private Attorneys General Act (PAGA) claim. 3. Transaction and integration expense includes professional fees and other costs related to the Koch Industries, Inc. and Intex DIY, Inc. acquisitions. 4. In the first quarters of 2025 and 2024, we entered into a Repricing Amendment (2025 Repricing Amendment and 2024 Repricing Amendment) on our existing Senior Term Loan due July 14, 2028

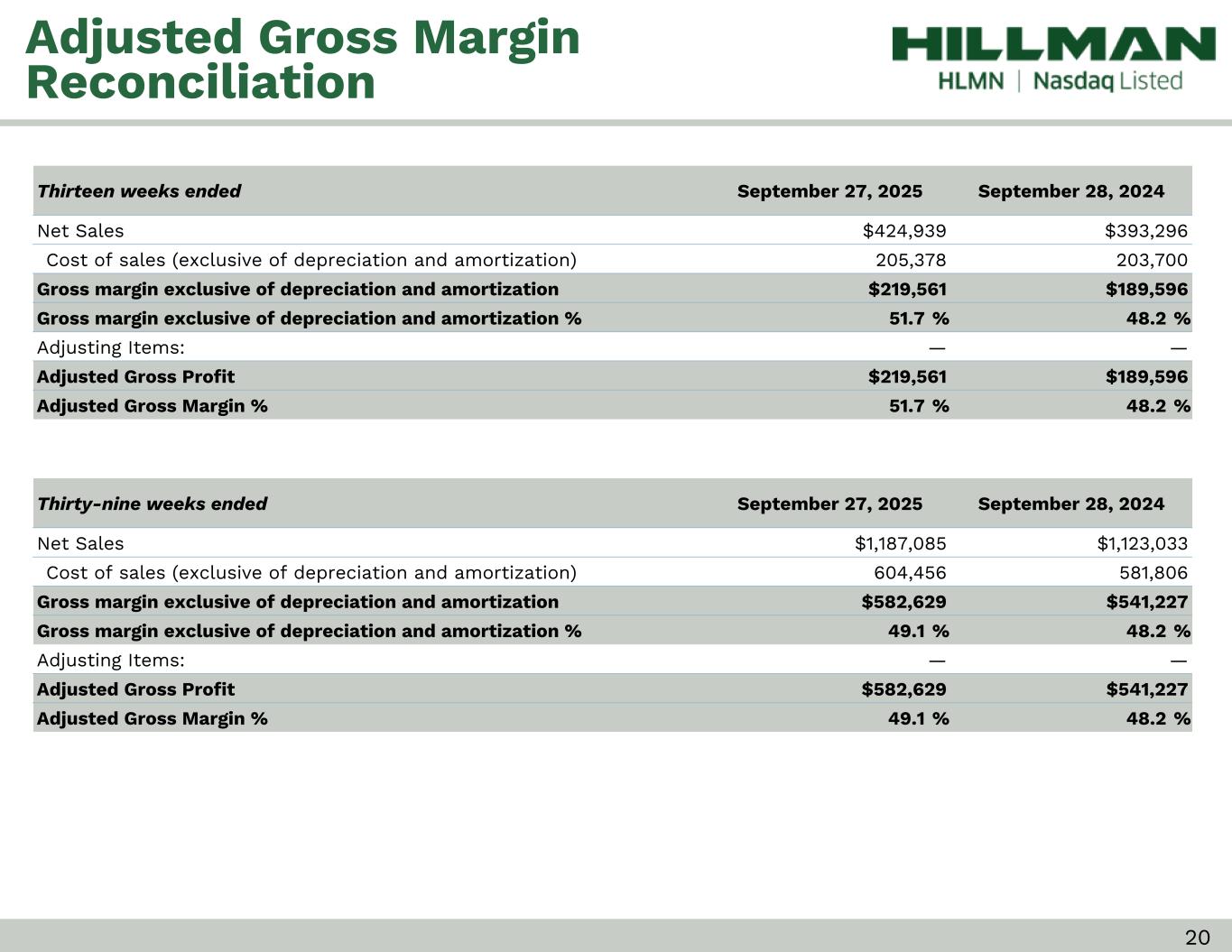

20 Thirteen weeks ended September 27, 2025 September 28, 2024 Net Sales $424,939 $393,296 Cost of sales (exclusive of depreciation and amortization) 205,378 203,700 Gross margin exclusive of depreciation and amortization $219,561 $189,596 Gross margin exclusive of depreciation and amortization % 51.7 % 48.2 % Adjusting Items: — — Adjusted Gross Profit $219,561 $189,596 Adjusted Gross Margin % 51.7 % 48.2 % Thirty-nine weeks ended September 27, 2025 September 28, 2024 Net Sales $1,187,085 $1,123,033 Cost of sales (exclusive of depreciation and amortization) 604,456 581,806 Gross margin exclusive of depreciation and amortization $582,629 $541,227 Gross margin exclusive of depreciation and amortization % 49.1 % 48.2 % Adjusting Items: — — Adjusted Gross Profit $582,629 $541,227 Adjusted Gross Margin % 49.1 % 48.2 % Adjusted Gross Margin Reconciliation

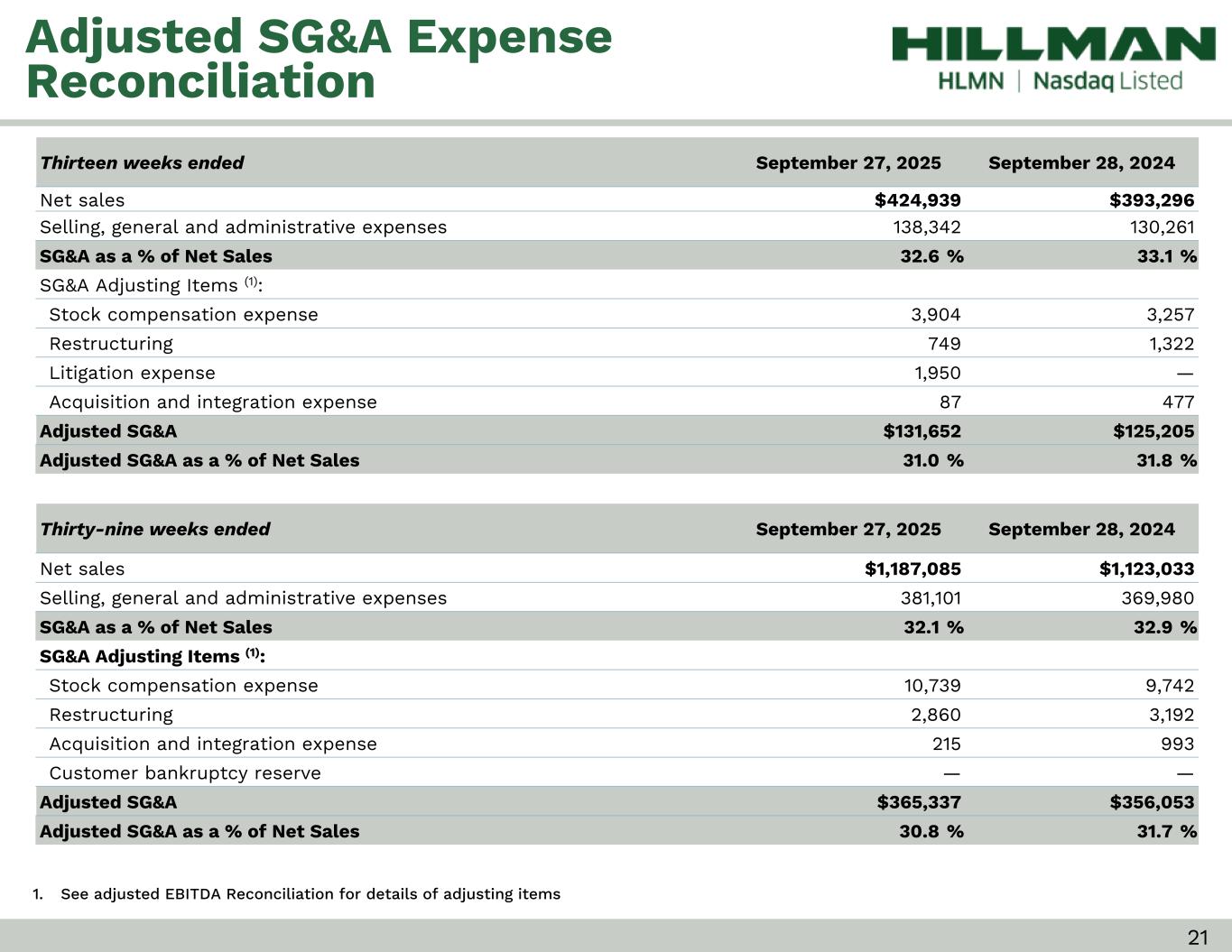

21 Thirteen weeks ended September 27, 2025 September 28, 2024 Net sales $424,939 $393,296 Selling, general and administrative expenses 138,342 130,261 SG&A as a % of Net Sales 32.6 % 33.1 % SG&A Adjusting Items (1): Stock compensation expense 3,904 3,257 Restructuring 749 1,322 Litigation expense 1,950 — Acquisition and integration expense 87 477 Adjusted SG&A $131,652 $125,205 Adjusted SG&A as a % of Net Sales 31.0 % 31.8 % Thirty-nine weeks ended September 27, 2025 September 28, 2024 Net sales $1,187,085 $1,123,033 Selling, general and administrative expenses 381,101 369,980 SG&A as a % of Net Sales 32.1 % 32.9 % SG&A Adjusting Items (1): Stock compensation expense 10,739 9,742 Restructuring 2,860 3,192 Acquisition and integration expense 215 993 Customer bankruptcy reserve — — Adjusted SG&A $365,337 $356,053 Adjusted SG&A as a % of Net Sales 30.8 % 31.7 % Adjusted SG&A Expense Reconciliation 1. See adjusted EBITDA Reconciliation for details of adjusting items

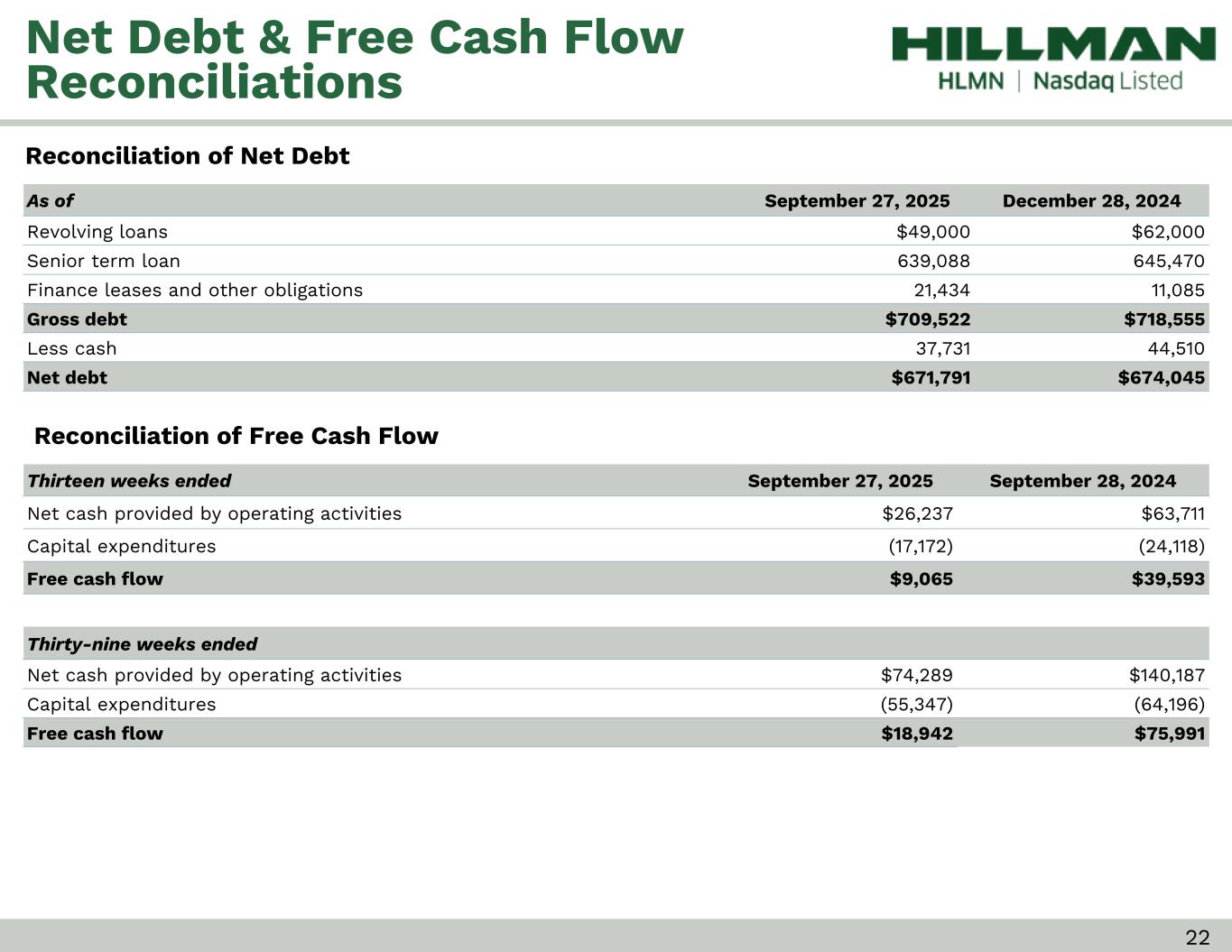

22 As of September 27, 2025 December 28, 2024 Revolving loans $49,000 $62,000 Senior term loan 639,088 645,470 Finance leases and other obligations 21,434 11,085 Gross debt $709,522 $718,555 Less cash 37,731 44,510 Net debt $671,791 $674,045 Net Debt & Free Cash Flow Reconciliations Thirteen weeks ended September 27, 2025 September 28, 2024 Net cash provided by operating activities $26,237 $63,711 Capital expenditures (17,172) (24,118) Free cash flow $9,065 $39,593 Thirty-nine weeks ended Net cash provided by operating activities $74,289 $140,187 Capital expenditures (55,347) (64,196) Free cash flow $18,942 $75,991 Reconciliation of Net Debt Reconciliation of Free Cash Flow

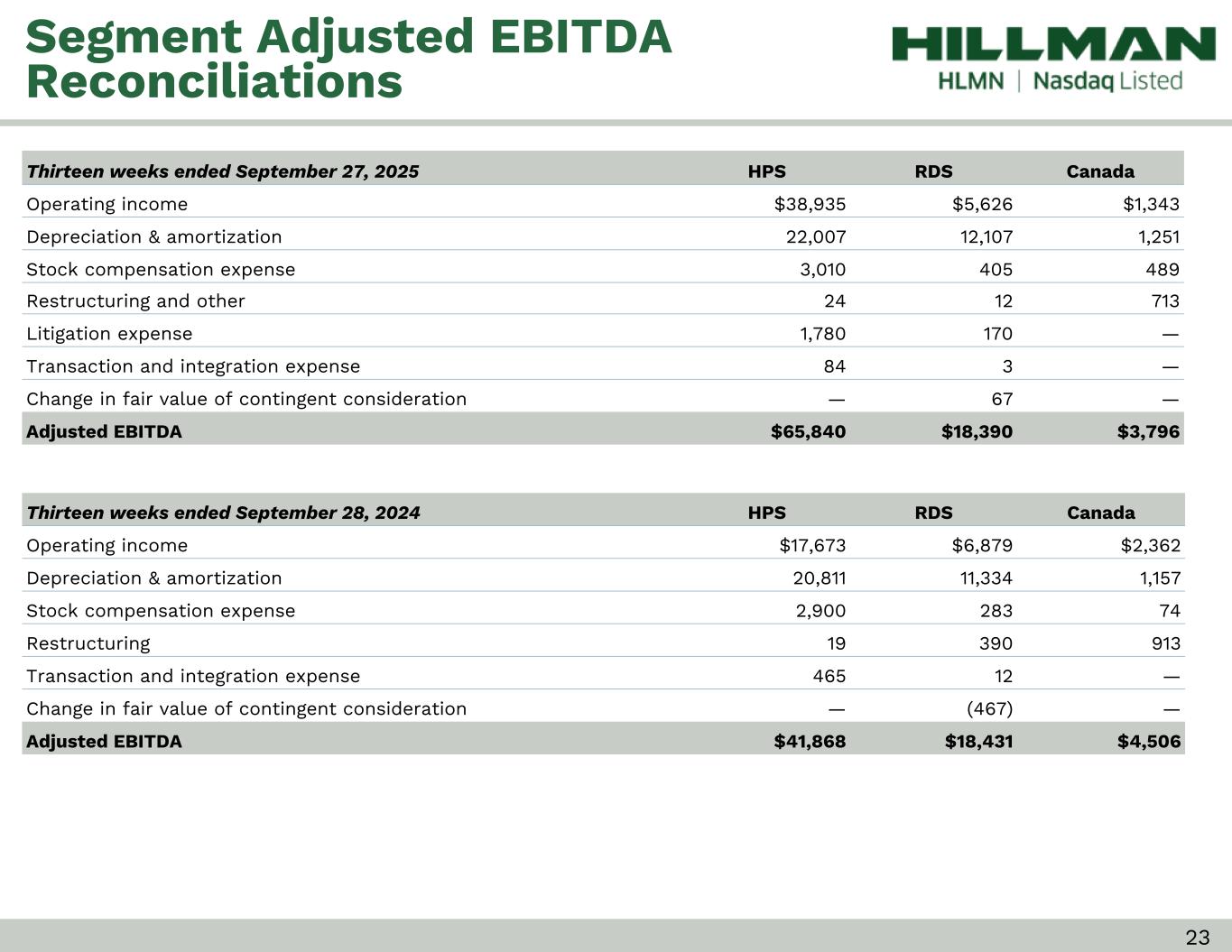

23 Thirteen weeks ended September 27, 2025 HPS RDS Canada Operating income $38,935 $5,626 $1,343 Depreciation & amortization 22,007 12,107 1,251 Stock compensation expense 3,010 405 489 Restructuring and other 24 12 713 Litigation expense 1,780 170 — Transaction and integration expense 84 3 — Change in fair value of contingent consideration — 67 — Adjusted EBITDA $65,840 $18,390 $3,796 Thirteen weeks ended September 28, 2024 HPS RDS Canada Operating income $17,673 $6,879 $2,362 Depreciation & amortization 20,811 11,334 1,157 Stock compensation expense 2,900 283 74 Restructuring 19 390 913 Transaction and integration expense 465 12 — Change in fair value of contingent consideration — (467) — Adjusted EBITDA $41,868 $18,431 $4,506 Segment Adjusted EBITDA Reconciliations

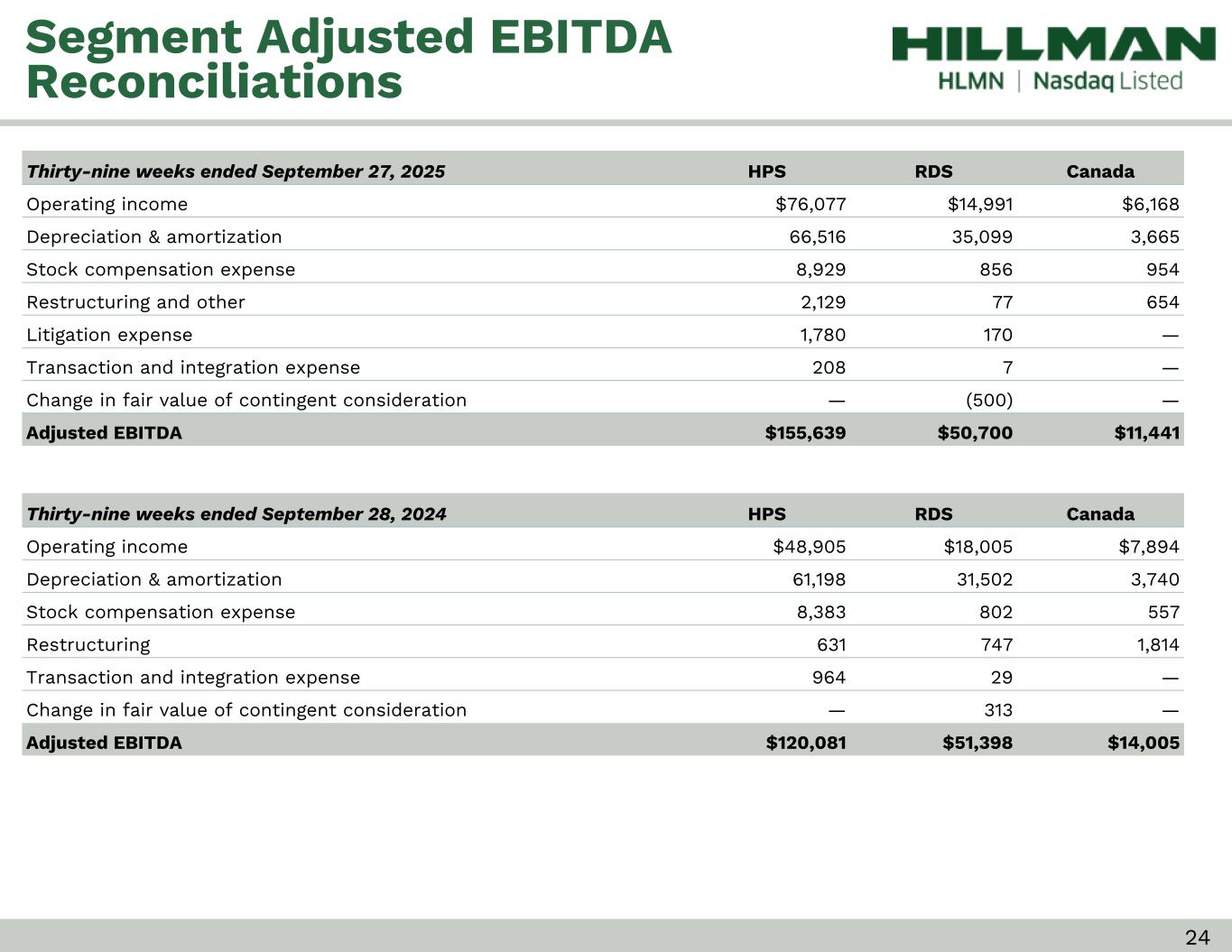

24 Thirty-nine weeks ended September 27, 2025 HPS RDS Canada Operating income $76,077 $14,991 $6,168 Depreciation & amortization 66,516 35,099 3,665 Stock compensation expense 8,929 856 954 Restructuring and other 2,129 77 654 Litigation expense 1,780 170 — Transaction and integration expense 208 7 — Change in fair value of contingent consideration — (500) — Adjusted EBITDA $155,639 $50,700 $11,441 Thirty-nine weeks ended September 28, 2024 HPS RDS Canada Operating income $48,905 $18,005 $7,894 Depreciation & amortization 61,198 31,502 3,740 Stock compensation expense 8,383 802 557 Restructuring 631 747 1,814 Transaction and integration expense 964 29 — Change in fair value of contingent consideration — 313 — Adjusted EBITDA $120,081 $51,398 $14,005 Segment Adjusted EBITDA Reconciliations