EX-99.2

Published on August 5, 2025

Quarterly Earnings Results Presentation Q2 2025 - August 5, 2025

2 PresBuilder Placeholder - Delete this box if you see it on a slide, but DO NOT REMOVE this box from the slide layout Forward Looking Statements This presentation contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. All forward-looking statements are made in good faith by the company and are intended to qualify for the safe harbor from liability established by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995.You should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," “target”, “goal”, "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) unfavorable economic conditions that may affect operations, financial condition and cash flows including spending on home renovation or construction projects, inflation, recessions, instability in the financial markets or credit markets; (2) increased supply chain costs, including tariffs, raw materials, sourcing, transportation and energy; (3) the highly competitive nature of the markets that we serve; (4) the ability to continue to innovate with new products and services; (5) seasonality; (6) large customer concentration; (7) the ability to recruit and retain qualified employees; (8) the outcome of any legal proceedings that may be instituted against the Company; (9) adverse changes in currency exchange rates; or (10) regulatory changes and potential legislation that could adversely impact financial results. The foregoing list of factors is not exclusive, and readers should also refer to those risks that are included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K for the fiscal year ended December 28, 2024. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward looking statements. Except as required by applicable law, the Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this communication to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Presentation of Non-GAAP Financial Measures In addition to the results provided in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”) throughout this presentation the company has provided non-GAAP financial measures, which present results on a basis adjusted for certain items. The company uses these non-GAAP financial measures for business planning purposes and in measuring its performance relative to that of its competitors. The company believes that these non-GAAP financial measures are useful financial metrics to assess its operating performance from period-to-period by excluding certain items that the company believes are not representative of its core business. These non-GAAP financial measures are not intended to replace, and should not be considered superior to, the presentation of the company’s financial results in accordance with GAAP. The use of the non-GAAP financial measures terms may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures. These non-GAAP financial measures are reconciled from the respective measures under GAAP in the appendix below. The company is not able to provide a reconciliation of the company’s non-GAAP financial guidance to the corresponding GAAP measures without unreasonable effort because of the inherent difficulty in forecasting and quantifying certain amounts necessary for such a reconciliation such as certain non-cash, nonrecurring or other items that are included in net income and EBITDA as well as the related tax impacts of these items and asset dispositions / acquisitions and changes in foreign currency exchange rates that are included in cash flow, due to the uncertainty and variability of the nature and amount of these future charges and costs.

3 • Net sales increased 6.2% to $402.8 million versus Q2 2024 ◦ Hardware and Protective Solutions ("HPS") increased +8.7% ◦ Robotics and Digital Solutions ("RDS") increased +2.3% ◦ Canada decreased (5.6)% • GAAP net income totaled $15.8 million, or $0.08 per diluted share, compared to $12.5 million, or $0.06 per diluted share, in Q2 2024 • Adjusted Gross Margins totaled 48.3% compared to 48.7% in Q2 2024 • Adjusted EBITDA increased to $75.2 million compared to $68.4 million in Q2 2024 • Adjusted EBITDA margins were 18.7% compared to 18.0% in Q2 2024 • Net Debt / Adjusted EBITDA (ttm): 2.7x at quarter end, compared to 2.8x on December 28, 2024 Q2 2025 Financial Review Please see reconciliation tables in the Appendix of this presentation for non-GAAP metrics. Highlights for the 13 Weeks Ended June 28, 2025

4 Q2 2025 Operational Review Highlights for the 13 Weeks Ended June 28, 2025 • Continued taking great care of customers: ◦ YTD fill rates averaged 95% • Continue to pursue accretive, tuck-in M&A opportunities that leverage the Hillman moat • During the quarter, Hillman continued to optimize its supply chain and diversify the country of origin and believe it has the ability to reduce China exposure to 20% by year end • Increased the midpoint of FY 2025 Net Sales and Adj. EBITDA guidance ◦ Expects to end 2025 with 2.4x Net Sales / TTM Adj. EBITDA • Hillman's Board of Directors approved a $100 million share repurchase program

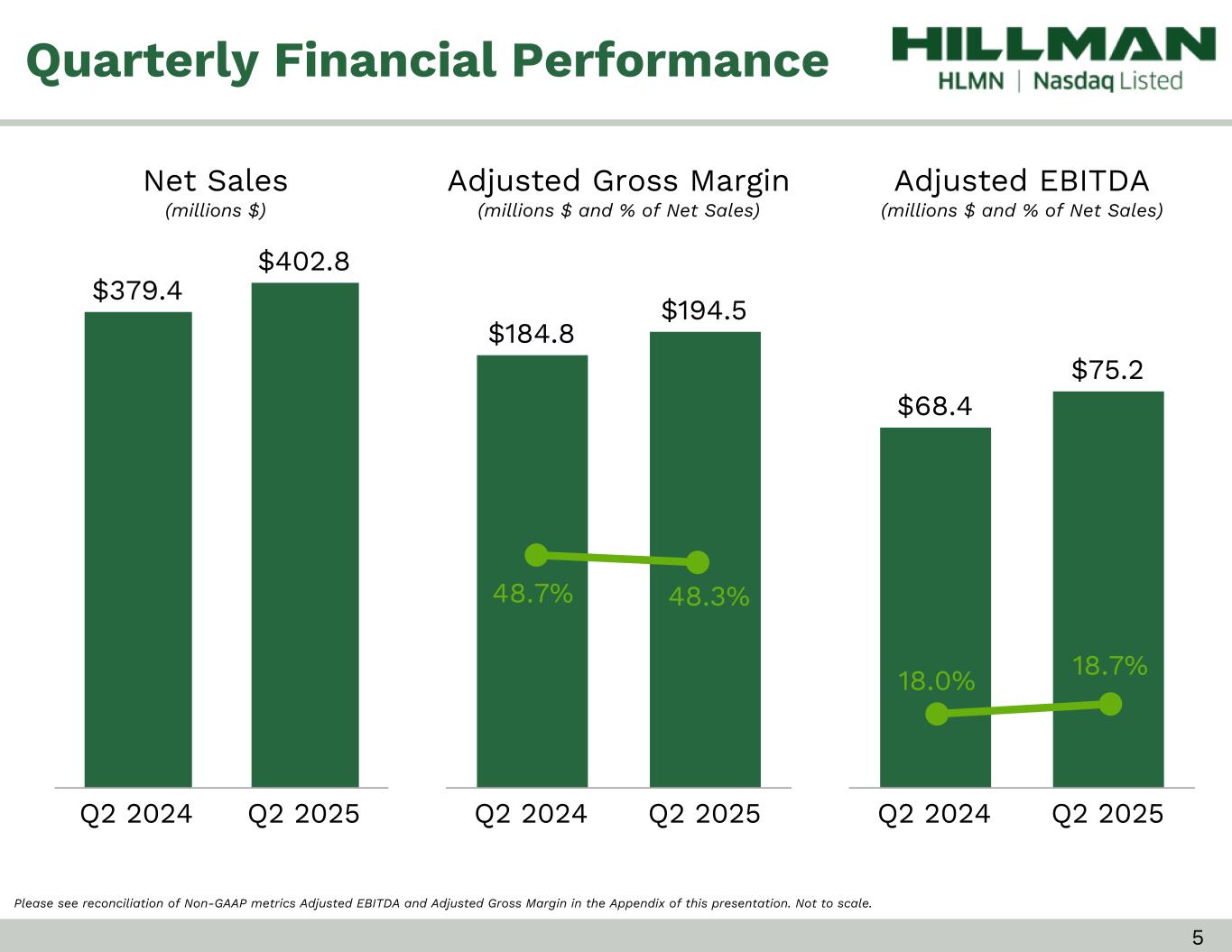

5 Quarterly Financial Performance Adjusted EBITDA (millions $ and % of Net Sales) Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Adjusted Gross Margin in the Appendix of this presentation. Not to scale. Net Sales (millions $) Adjusted Gross Margin (millions $ and % of Net Sales) $68.4 $75.2 Q2 2024 Q2 2025 18.7%18.0% $184.8 $194.5 Q2 2024 Q2 2025 $379.4 $402.8 Q2 2024 Q2 2025 48.3%48.7%

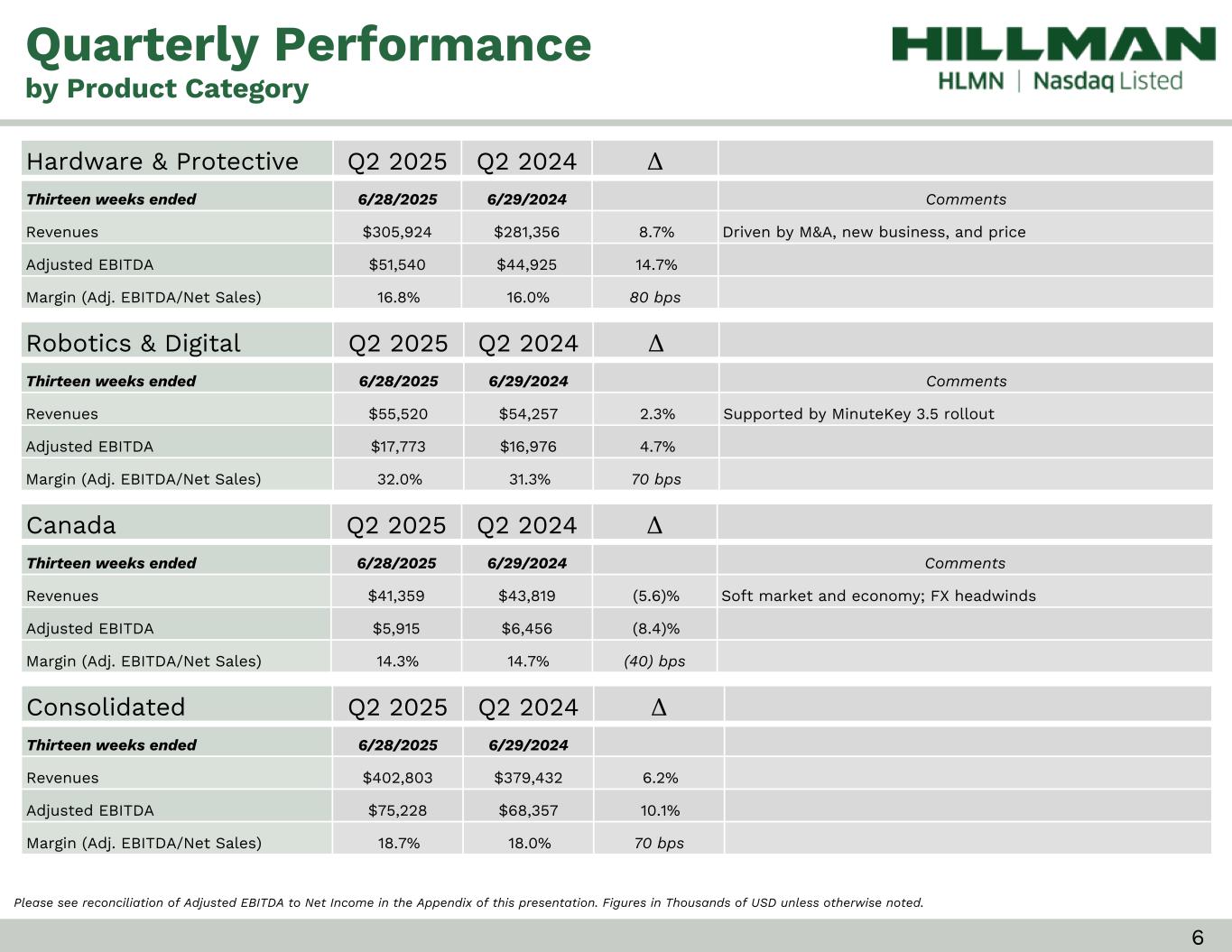

6 Hardware & Protective Q2 2025 Q2 2024 Δ Thirteen weeks ended 6/28/2025 6/29/2024 Comments Revenues $305,924 $281,356 8.7% Driven by M&A, new business, and price Adjusted EBITDA $51,540 $44,925 14.7% Margin (Adj. EBITDA/Net Sales) 16.8% 16.0% 80 bps Robotics & Digital Q2 2025 Q2 2024 Δ Thirteen weeks ended 6/28/2025 6/29/2024 Comments Revenues $55,520 $54,257 2.3% Supported by MinuteKey 3.5 rollout Adjusted EBITDA $17,773 $16,976 4.7% Margin (Adj. EBITDA/Net Sales) 32.0% 31.3% 70 bps Canada Q2 2025 Q2 2024 Δ Thirteen weeks ended 6/28/2025 6/29/2024 Comments Revenues $41,359 $43,819 (5.6)% Soft market and economy; FX headwinds Adjusted EBITDA $5,915 $6,456 (8.4)% Margin (Adj. EBITDA/Net Sales) 14.3% 14.7% (40) bps Consolidated Q2 2025 Q2 2024 Δ Thirteen weeks ended 6/28/2025 6/29/2024 Revenues $402,803 $379,432 6.2% Adjusted EBITDA $75,228 $68,357 10.1% Margin (Adj. EBITDA/Net Sales) 18.7% 18.0% 70 bps Quarterly Performance by Product Category Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted. • Top Row: ◦ 27 point height ◦ 16 font (work sans) ◦ 4 point white bottom line • First Column green ◦ Dark: CFD9D1 ◦ Light: D9E1DA • Other Columns gray ◦ Dark: D9D9D9 ◦ Light E0E0E0 ◦ 1 point white bottom and inside lines

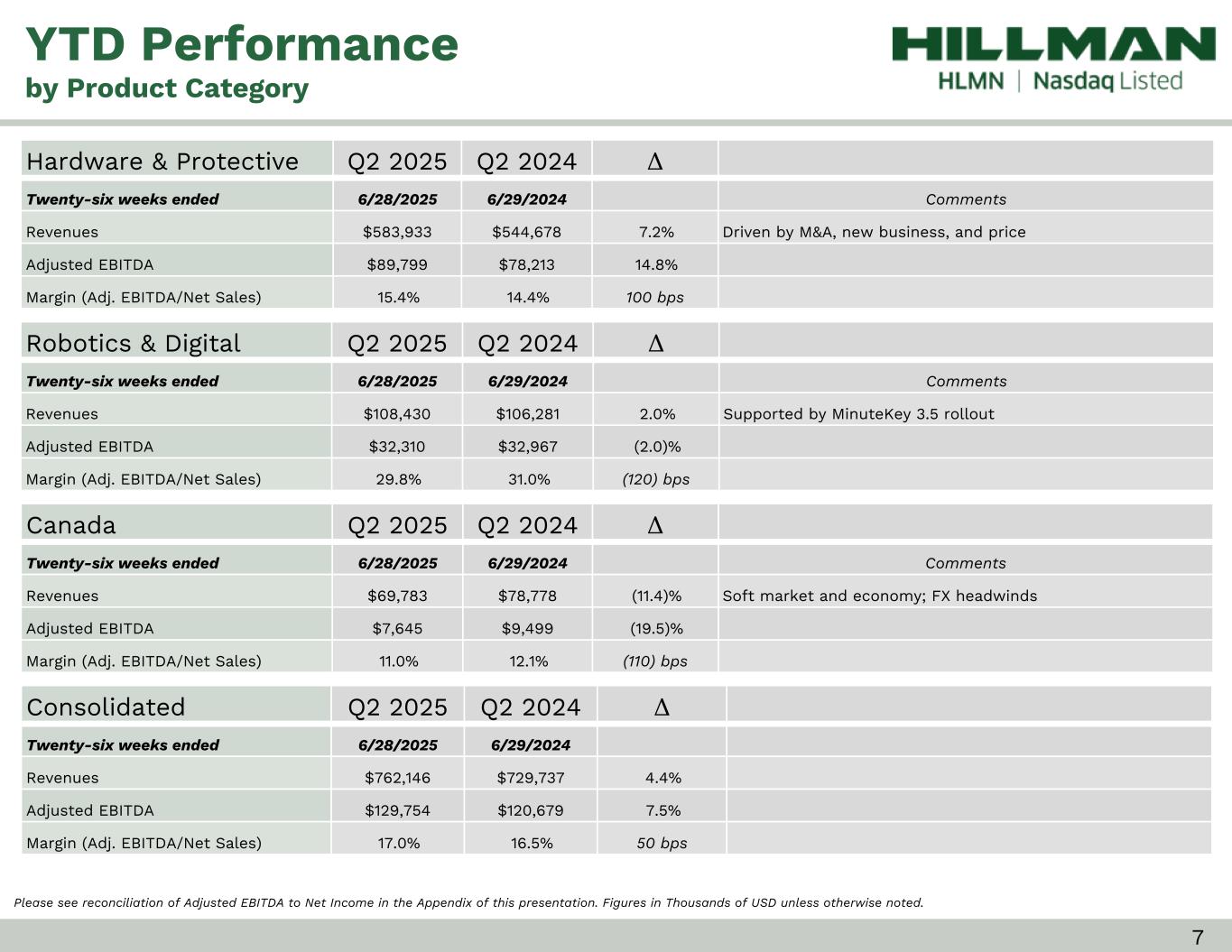

7 Hardware & Protective Q2 2025 Q2 2024 Δ Twenty-six weeks ended 6/28/2025 6/29/2024 Comments Revenues $583,933 $544,678 7.2% Driven by M&A, new business, and price Adjusted EBITDA $89,799 $78,213 14.8% Margin (Adj. EBITDA/Net Sales) 15.4% 14.4% 100 bps Robotics & Digital Q2 2025 Q2 2024 Δ Twenty-six weeks ended 6/28/2025 6/29/2024 Comments Revenues $108,430 $106,281 2.0% Supported by MinuteKey 3.5 rollout Adjusted EBITDA $32,310 $32,967 (2.0)% Margin (Adj. EBITDA/Net Sales) 29.8% 31.0% (120) bps Canada Q2 2025 Q2 2024 Δ Twenty-six weeks ended 6/28/2025 6/29/2024 Comments Revenues $69,783 $78,778 (11.4)% Soft market and economy; FX headwinds Adjusted EBITDA $7,645 $9,499 (19.5)% Margin (Adj. EBITDA/Net Sales) 11.0% 12.1% (110) bps Consolidated Q2 2025 Q2 2024 Δ Twenty-six weeks ended 6/28/2025 6/29/2024 Revenues $762,146 $729,737 4.4% Adjusted EBITDA $129,754 $120,679 7.5% Margin (Adj. EBITDA/Net Sales) 17.0% 16.5% 50 bps YTD Performance by Product Category Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted.

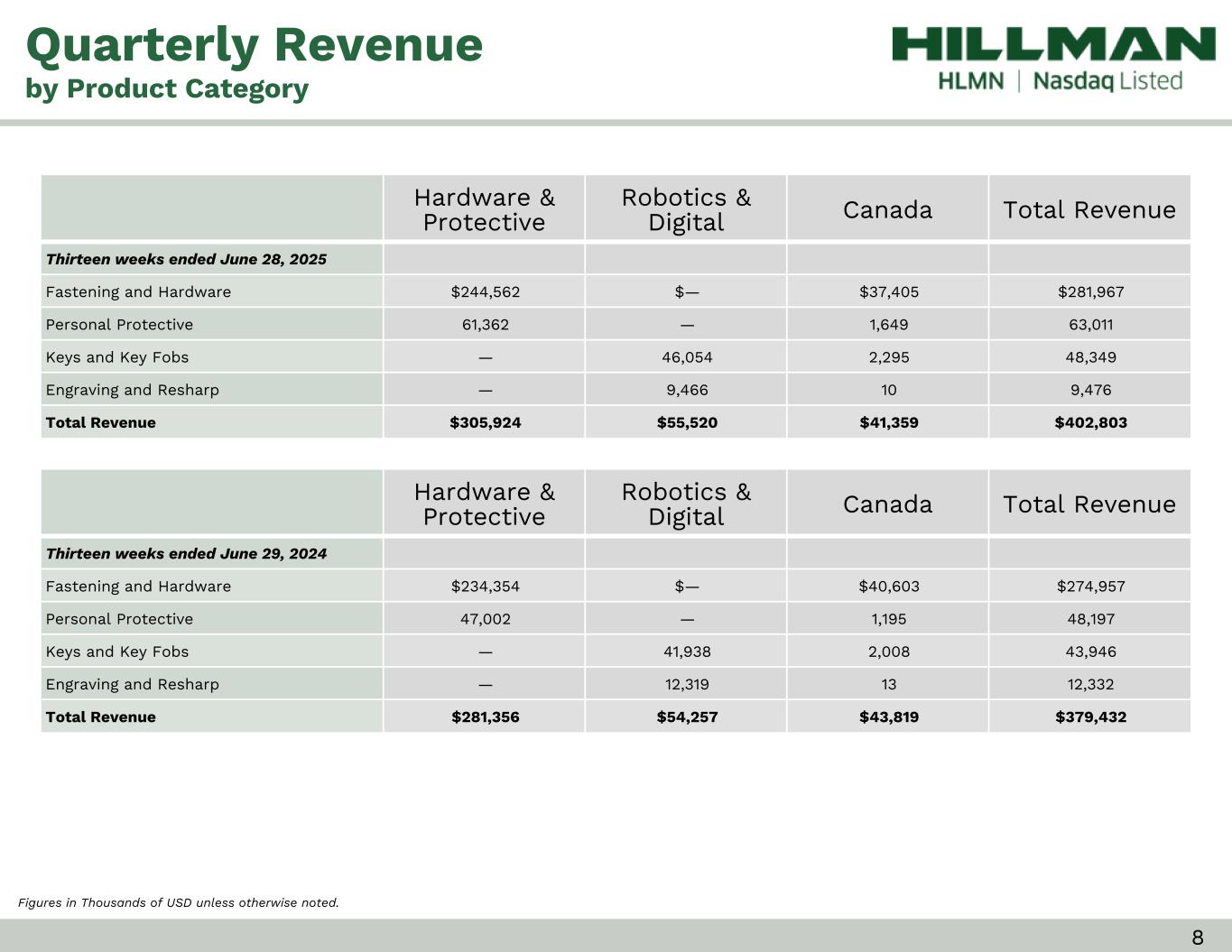

8 Hardware & Protective Robotics & Digital Canada Total Revenue Thirteen weeks ended June 28, 2025 Fastening and Hardware $244,562 $— $37,405 $281,967 Personal Protective 61,362 — 1,649 63,011 Keys and Key Fobs — 46,054 2,295 48,349 Engraving and Resharp — 9,466 10 9,476 Total Revenue $305,924 $55,520 $41,359 $402,803 Quarterly Revenue by Product Category Hardware & Protective Robotics & Digital Canada Total Revenue Thirteen weeks ended June 29, 2024 Fastening and Hardware $234,354 $— $40,603 $274,957 Personal Protective 47,002 — 1,195 48,197 Keys and Key Fobs — 41,938 2,008 43,946 Engraving and Resharp — 12,319 13 12,332 Total Revenue $281,356 $54,257 $43,819 $379,432 Figures in Thousands of USD unless otherwise noted.

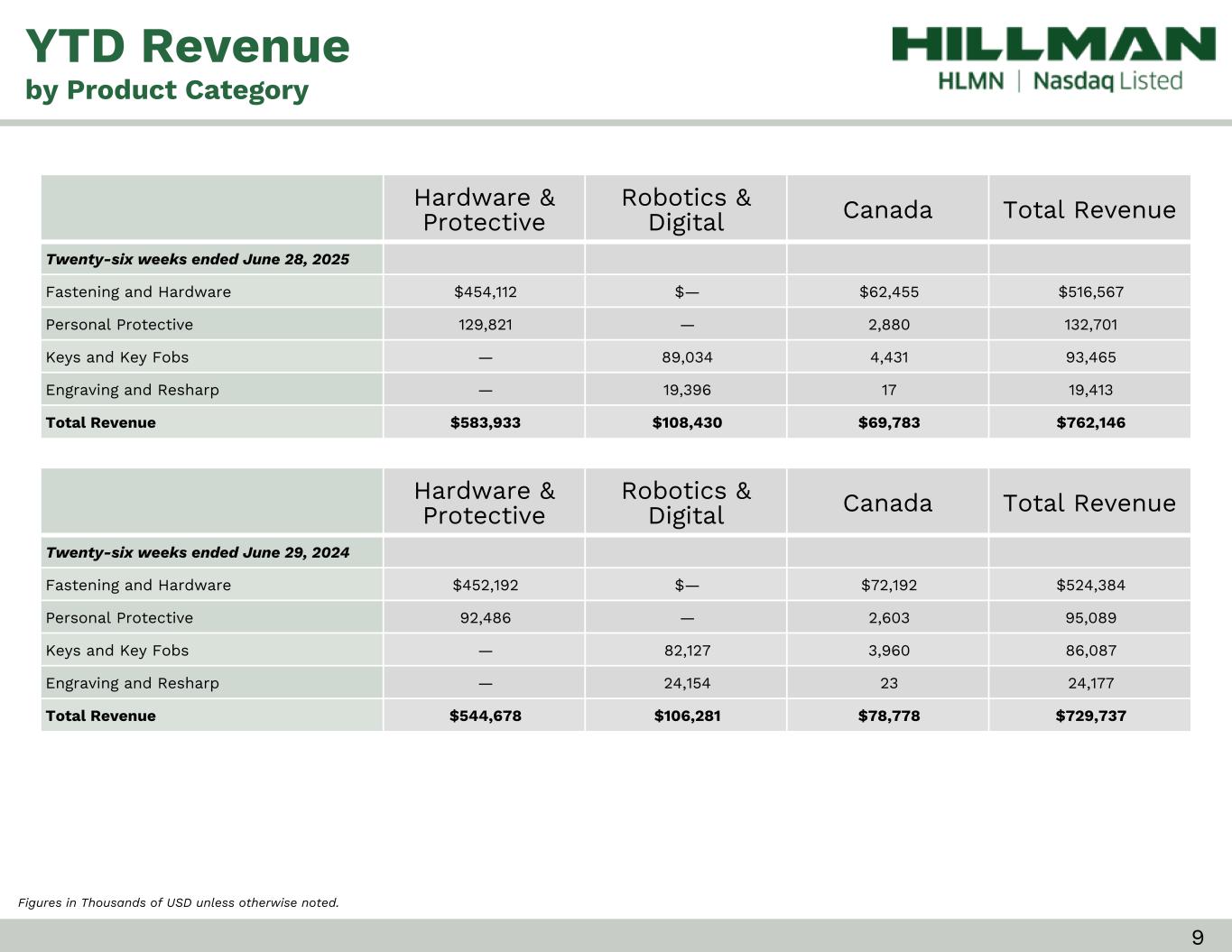

9 Hardware & Protective Robotics & Digital Canada Total Revenue Twenty-six weeks ended June 28, 2025 Fastening and Hardware $454,112 $— $62,455 $516,567 Personal Protective 129,821 — 2,880 132,701 Keys and Key Fobs — 89,034 4,431 93,465 Engraving and Resharp — 19,396 17 19,413 Total Revenue $583,933 $108,430 $69,783 $762,146 YTD Revenue by Product Category Hardware & Protective Robotics & Digital Canada Total Revenue Twenty-six weeks ended June 29, 2024 Fastening and Hardware $452,192 $— $72,192 $524,384 Personal Protective 92,486 — 2,603 95,089 Keys and Key Fobs — 82,127 3,960 86,087 Engraving and Resharp — 24,154 23 24,177 Total Revenue $544,678 $106,281 $78,778 $729,737 Figures in Thousands of USD unless otherwise noted.

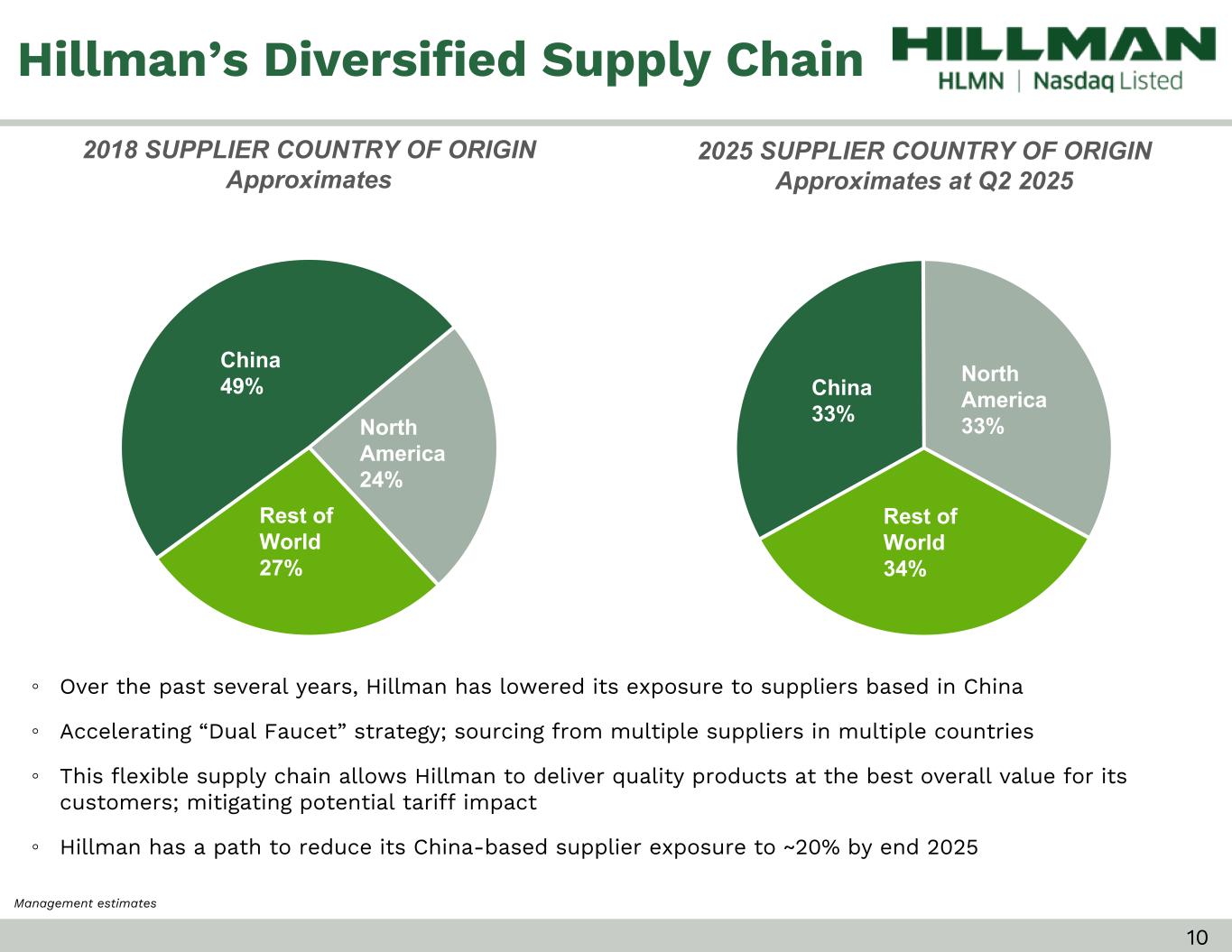

10 Hillman’s Diversified Supply Chain ◦ Over the past several years, Hillman has lowered its exposure to suppliers based in China ◦ Accelerating “Dual Faucet” strategy; sourcing from multiple suppliers in multiple countries ◦ This flexible supply chain allows Hillman to deliver quality products at the best overall value for its customers; mitigating potential tariff impact ◦ Hillman has a path to reduce its China-based supplier exposure to ~20% by end 2025 2018 SUPPLIER COUNTRY OF ORIGIN Approximates China 49% North America 24% Rest of World 27% 2025 SUPPLIER COUNTRY OF ORIGIN Approximates at Q2 2025 China 33% North America 33% Rest of World 34% Management estimates

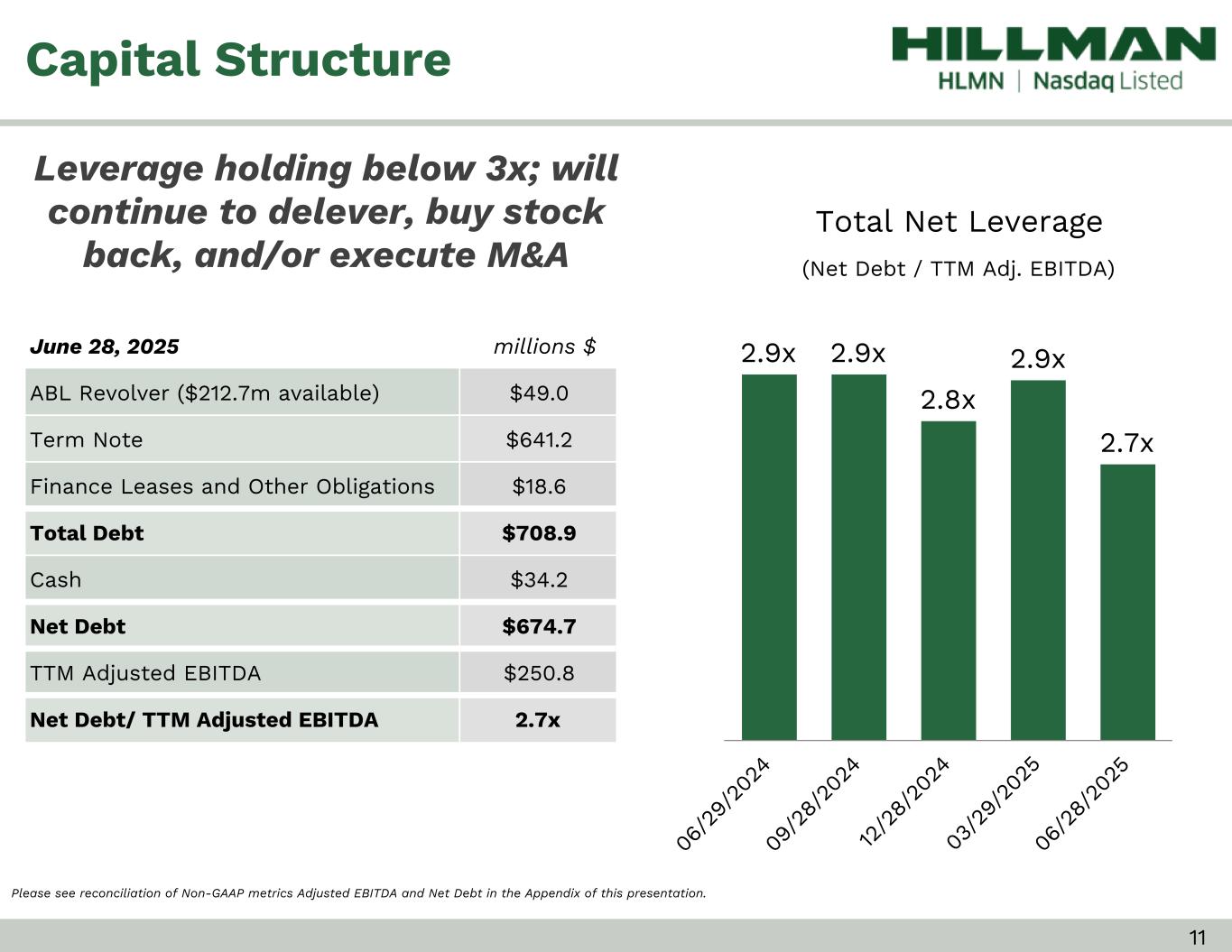

11 Total Net Leverage (Net Debt / TTM Adj. EBITDA) Capital Structure June 28, 2025 millions $ ABL Revolver ($212.7m available) $49.0 Term Note $641.2 Finance Leases and Other Obligations $18.6 Total Debt $708.9 Cash $34.2 Net Debt $674.7 TTM Adjusted EBITDA $250.8 Net Debt/ TTM Adjusted EBITDA 2.7x Leverage holding below 3x; will continue to delever, buy stock back, and/or execute M&A Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Net Debt in the Appendix of this presentation. 2.9x 2.9x 2.8x 2.9x 2.7x 06 /2 9/ 20 24 09 /2 8/ 20 24 12 /2 8/ 20 24 03 /2 9/ 20 25 06 /2 8/ 20 25

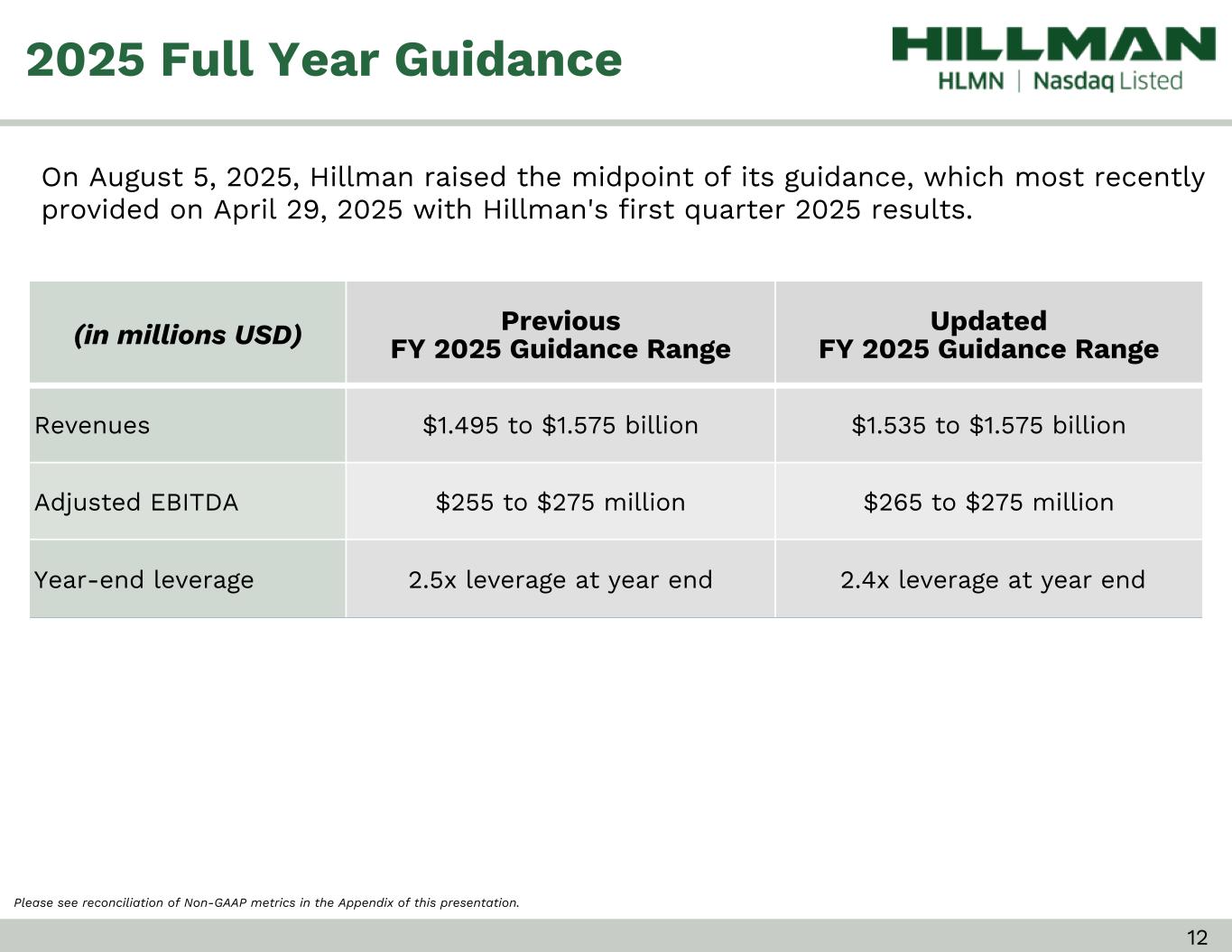

12 2025 Full Year Guidance (in millions USD) Previous FY 2025 Guidance Range Updated FY 2025 Guidance Range Revenues $1.495 to $1.575 billion $1.535 to $1.575 billion Adjusted EBITDA $255 to $275 million $265 to $275 million Year-end leverage 2.5x leverage at year end 2.4x leverage at year end On August 5, 2025, Hillman raised the midpoint of its guidance, which most recently provided on April 29, 2025 with Hillman's first quarter 2025 results. Please see reconciliation of Non-GAAP metrics in the Appendix of this presentation.

13 Key Takeaways Resilient Business; Focused on Diversifying Supply Chain Historical Long-term Annual Growth Targets (Organic): Revenue Growth: +6% & Adj. EBITDA Growth: +10% Historical Long-term Annual Growth Targets (incl. Acquisitions): Revenue Growth: +10% & Adj. EBITDA Growth: +15% • Business has 60+ year track record of success; proven to be resilient through multiple economic cycles with great long-term partnerships with customers • Hillman products are utilized for repair, maintenance and remodel projects; products are generally low-cost and a very small percentage of a given project • 1,200-member sales and service team and direct-to-store fulfillment continue to provide competitive advantages and strengthen competitive moat - drives new business wins • Given the tariff environment, Hillman working to diversify its supply chain to optimize costs and value; working to mitigate higher costs

Appendix

15 Investment Highlights Significant runway for incremental growth: Organic + M&A Management team with proven operational and M&A expertise Strong financial profile with 60+ year track record Market and innovation leader across multiple categories Indispensable partner embedded with winning retailers Customers love us, trust us and rely on us Large, predictable, growing and resilient end markets

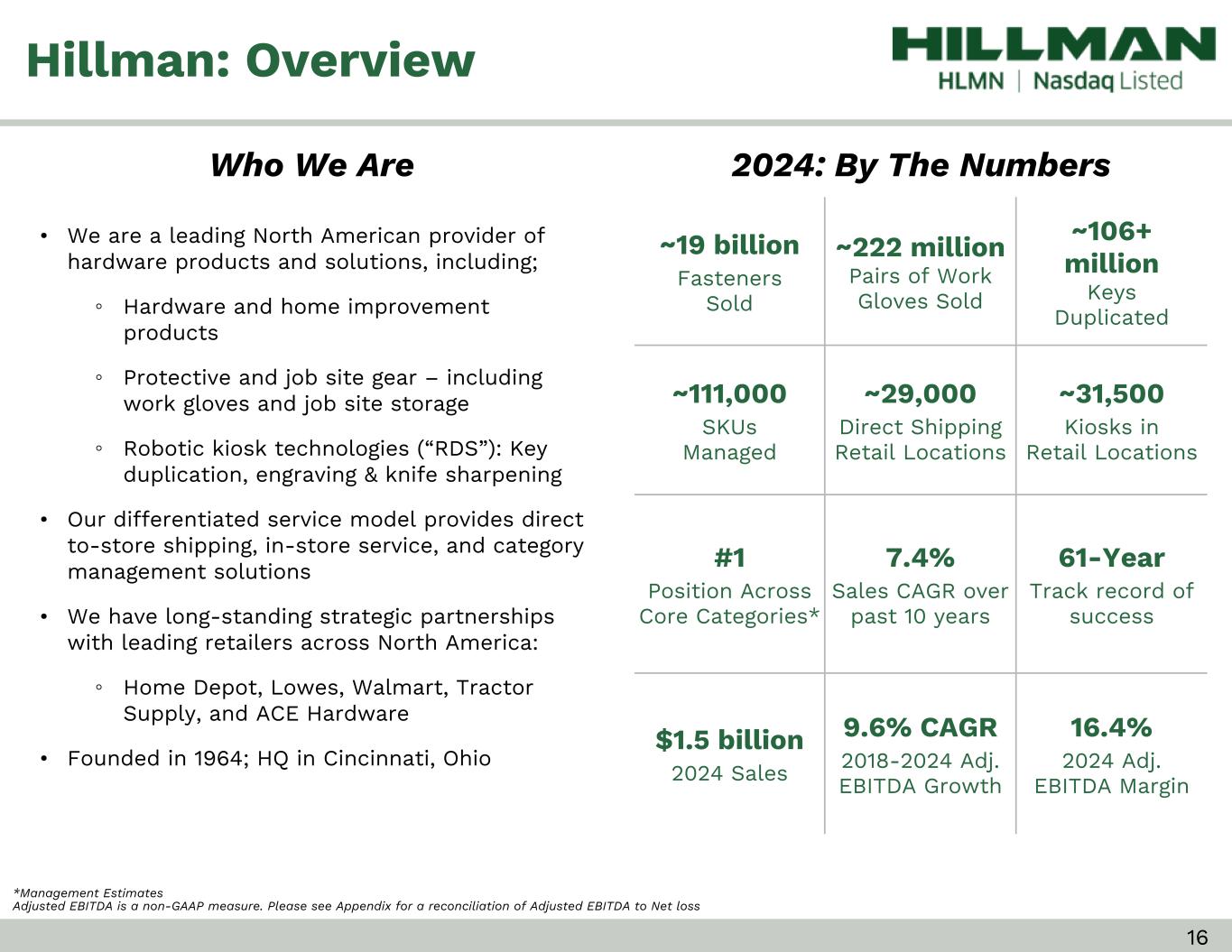

16 Hillman: Overview Who We Are *Management Estimates Adjusted EBITDA is a non-GAAP measure. Please see Appendix for a reconciliation of Adjusted EBITDA to Net loss ~19 billion Fasteners Sold ~222 million Pairs of Work Gloves Sold ~106+ million Keys Duplicated ~111,000 SKUs Managed ~29,000 Direct Shipping Retail Locations ~31,500 Kiosks in Retail Locations #1 Position Across Core Categories* 7.4% Sales CAGR over past 10 years 61-Year Track record of success $1.5 billion 2024 Sales 9.6% CAGR 2018-2024 Adj. EBITDA Growth 16.4% 2024 Adj. EBITDA Margin 2024: By The Numbers • We are a leading North American provider of hardware products and solutions, including; ◦ Hardware and home improvement products ◦ Protective and job site gear – including work gloves and job site storage ◦ Robotic kiosk technologies (“RDS”): Key duplication, engraving & knife sharpening • Our differentiated service model provides direct to-store shipping, in-store service, and category management solutions • We have long-standing strategic partnerships with leading retailers across North America: ◦ Home Depot, Lowes, Walmart, Tractor Supply, and ACE Hardware • Founded in 1964; HQ in Cincinnati, Ohio

17 #1 in Segment Representative Top Customers #1 in Segment #1 in Segment Key and Fob Duplication Personalized Tags Knife Sharpening Fasteners & Specialty Gloves Builders Hardware & Metal Shapes Safety / PPE Construction Fasteners Work Gear Picture Hanging Source: Third party industry report and management estimates. Primary Product Categories Hardware Solutions Robotics & Digital SolutionsProtective Solutions Rope & Chain

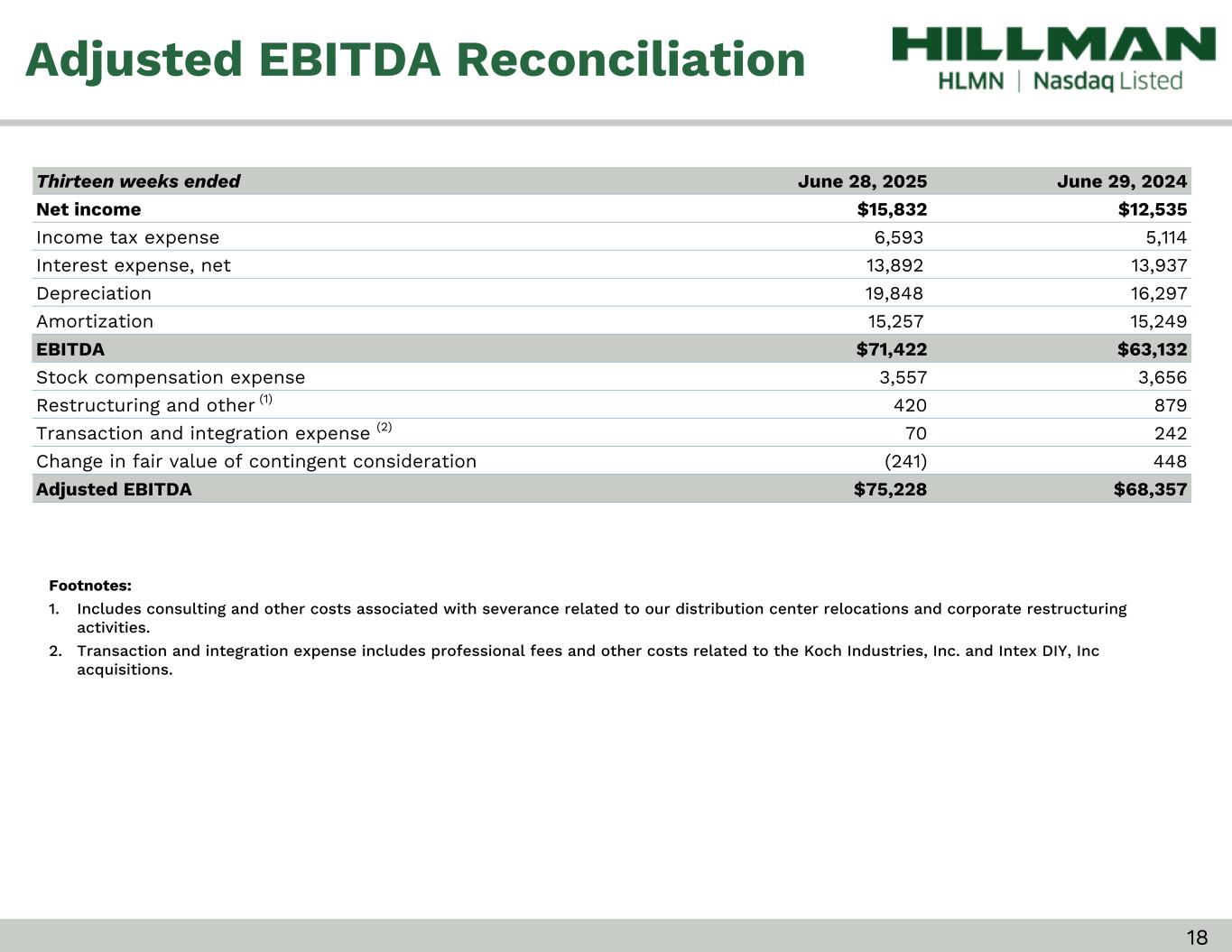

18 Thirteen weeks ended June 28, 2025 June 29, 2024 Net income $15,832 $12,535 Income tax expense 6,593 5,114 Interest expense, net 13,892 13,937 Depreciation 19,848 16,297 Amortization 15,257 15,249 EBITDA $71,422 $63,132 Stock compensation expense 3,557 3,656 Restructuring and other (1) 420 879 Transaction and integration expense (2) 70 242 Change in fair value of contingent consideration (241) 448 Adjusted EBITDA $75,228 $68,357 Adjusted EBITDA Reconciliation Footnotes: 1. Includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities. 2. Transaction and integration expense includes professional fees and other costs related to the Koch Industries, Inc. and Intex DIY, Inc acquisitions.

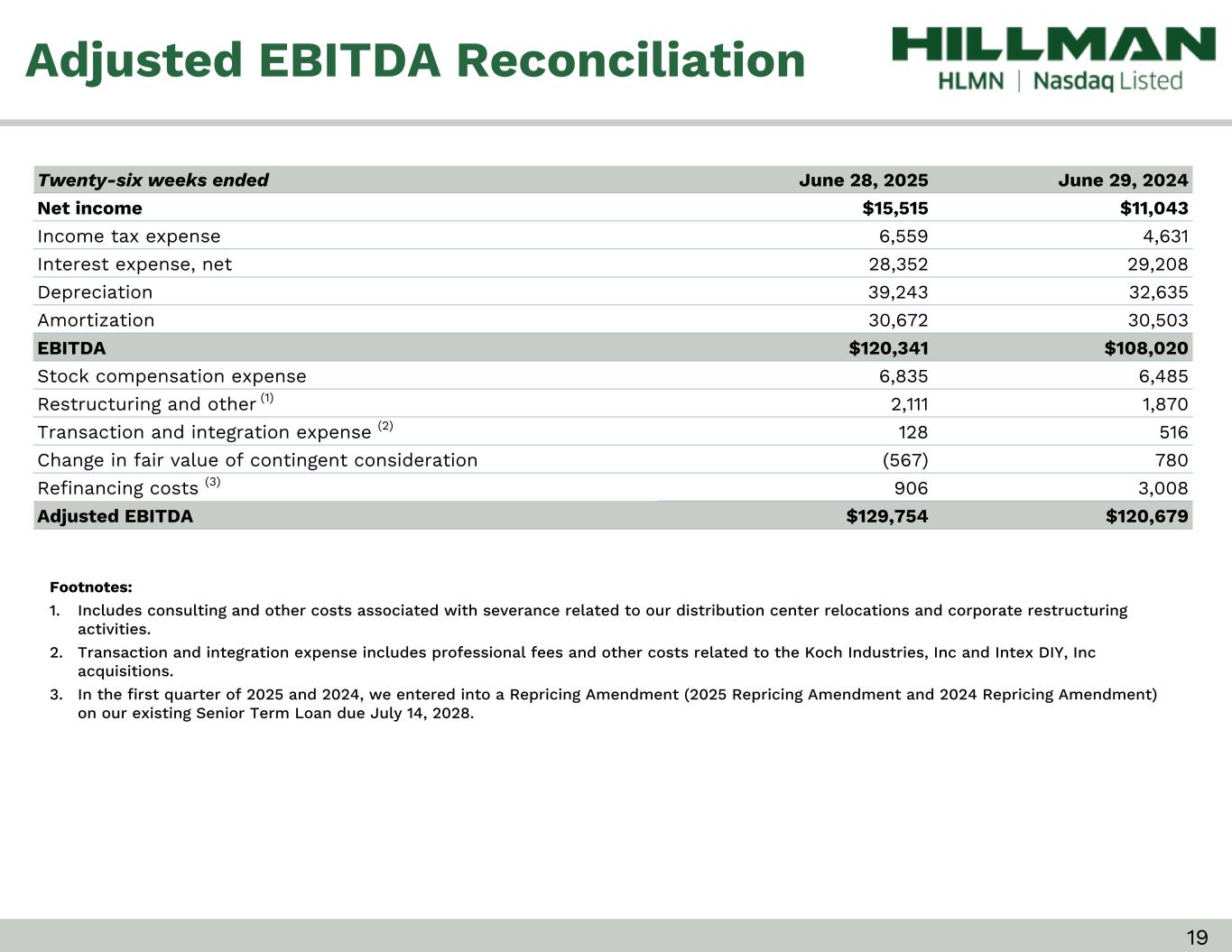

19 Twenty-six weeks ended June 28, 2025 June 29, 2024 Net income $15,515 $11,043 Income tax expense 6,559 4,631 Interest expense, net 28,352 29,208 Depreciation 39,243 32,635 Amortization 30,672 30,503 EBITDA $120,341 $108,020 Stock compensation expense 6,835 6,485 Restructuring and other (1) 2,111 1,870 Transaction and integration expense (2) 128 516 Change in fair value of contingent consideration (567) 780 Refinancing costs (3) 906 3,008 Adjusted EBITDA $129,754 $120,679 Adjusted EBITDA Reconciliation Footnotes: 1. Includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities. 2. Transaction and integration expense includes professional fees and other costs related to the Koch Industries, Inc and Intex DIY, Inc acquisitions. 3. In the first quarter of 2025 and 2024, we entered into a Repricing Amendment (2025 Repricing Amendment and 2024 Repricing Amendment) on our existing Senior Term Loan due July 14, 2028.

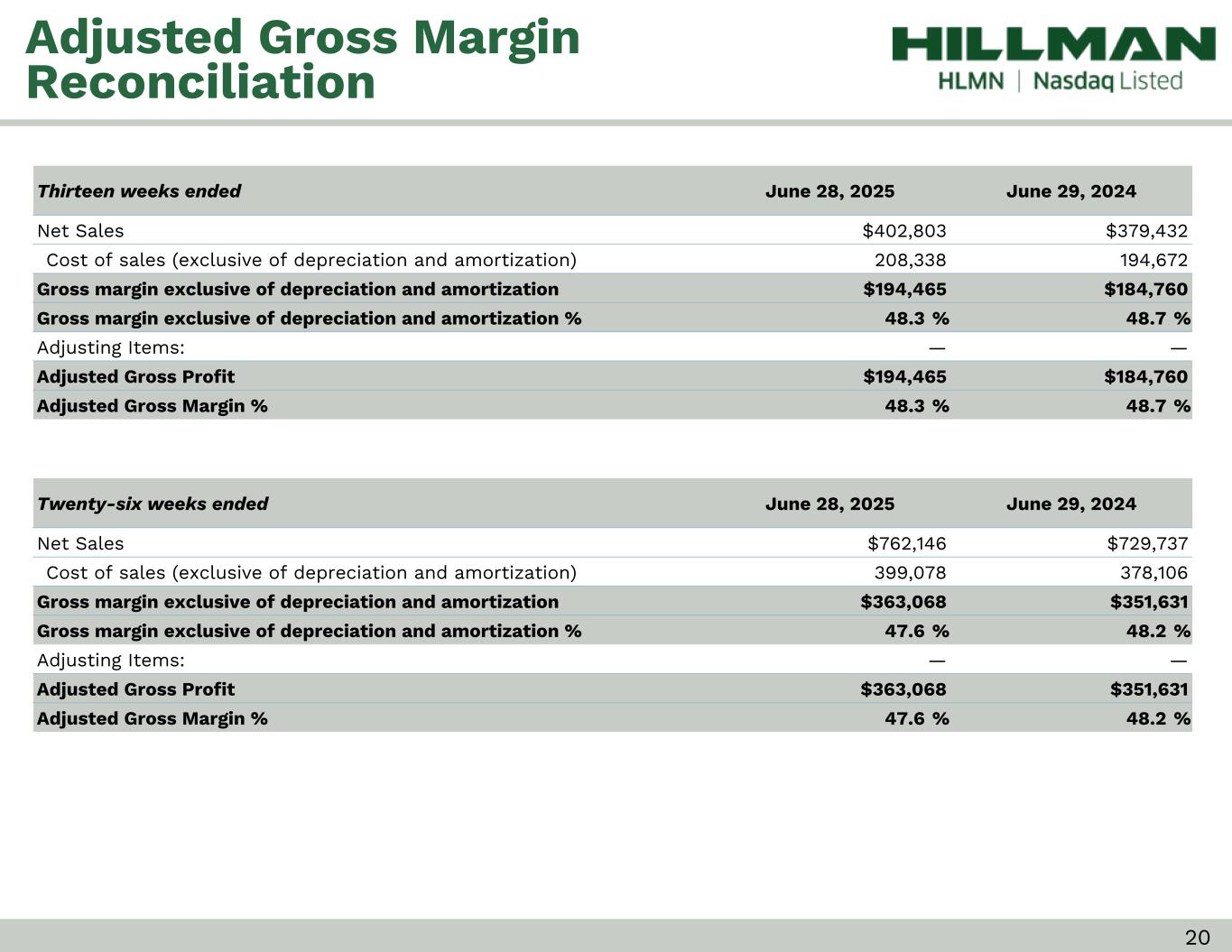

20 Thirteen weeks ended June 28, 2025 June 29, 2024 Net Sales $402,803 $379,432 Cost of sales (exclusive of depreciation and amortization) 208,338 194,672 Gross margin exclusive of depreciation and amortization $194,465 $184,760 Gross margin exclusive of depreciation and amortization % 48.3 % 48.7 % Adjusting Items: — — Adjusted Gross Profit $194,465 $184,760 Adjusted Gross Margin % 48.3 % 48.7 % Twenty-six weeks ended June 28, 2025 June 29, 2024 Net Sales $762,146 $729,737 Cost of sales (exclusive of depreciation and amortization) 399,078 378,106 Gross margin exclusive of depreciation and amortization $363,068 $351,631 Gross margin exclusive of depreciation and amortization % 47.6 % 48.2 % Adjusting Items: — — Adjusted Gross Profit $363,068 $351,631 Adjusted Gross Margin % 47.6 % 48.2 % Adjusted Gross Margin Reconciliation

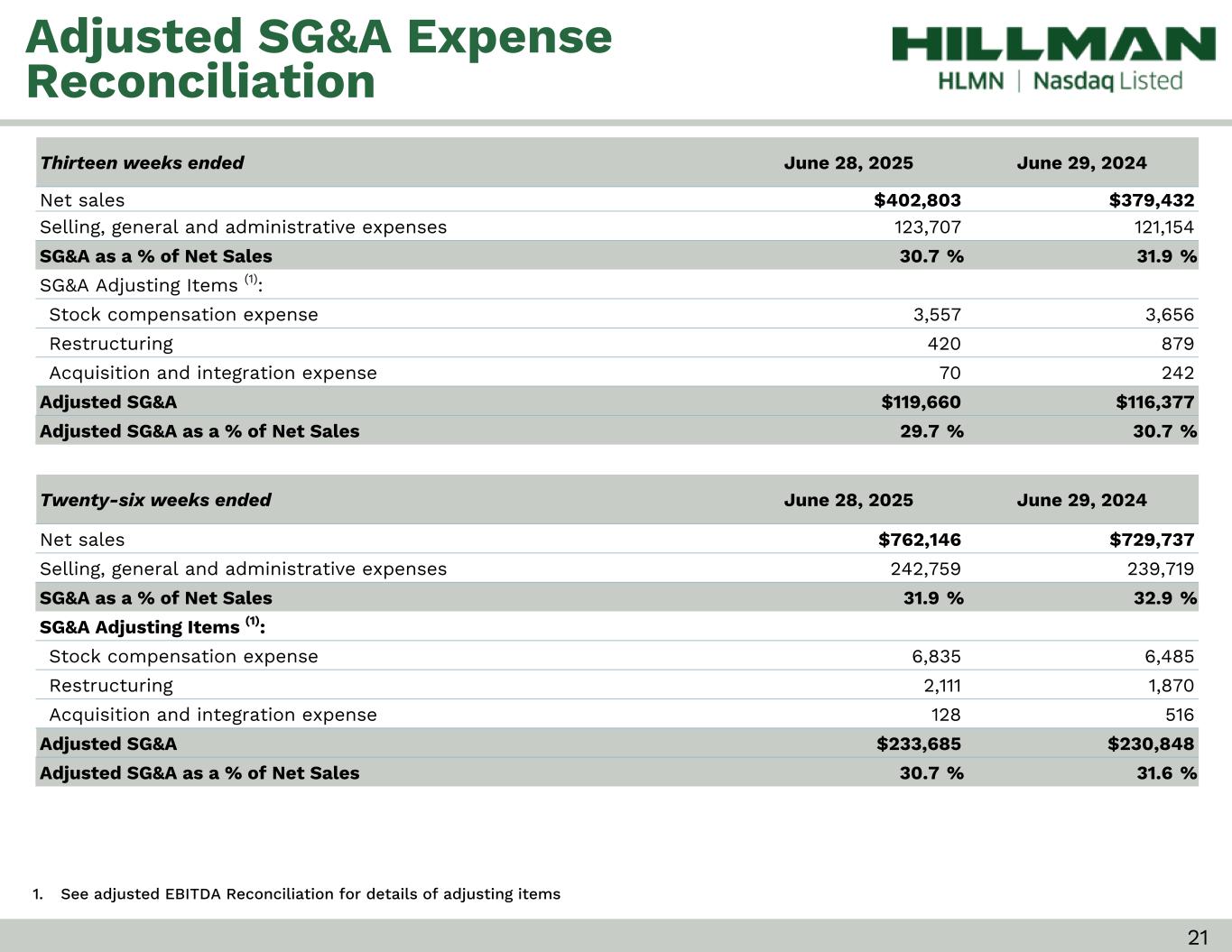

21 Thirteen weeks ended June 28, 2025 June 29, 2024 Net sales $402,803 $379,432 Selling, general and administrative expenses 123,707 121,154 SG&A as a % of Net Sales 30.7 % 31.9 % SG&A Adjusting Items (1): Stock compensation expense 3,557 3,656 Restructuring 420 879 Acquisition and integration expense 70 242 Adjusted SG&A $119,660 $116,377 Adjusted SG&A as a % of Net Sales 29.7 % 30.7 % Twenty-six weeks ended June 28, 2025 June 29, 2024 Net sales $762,146 $729,737 Selling, general and administrative expenses 242,759 239,719 SG&A as a % of Net Sales 31.9 % 32.9 % SG&A Adjusting Items (1): Stock compensation expense 6,835 6,485 Restructuring 2,111 1,870 Acquisition and integration expense 128 516 Adjusted SG&A $233,685 $230,848 Adjusted SG&A as a % of Net Sales 30.7 % 31.6 % Adjusted SG&A Expense Reconciliation 1. See adjusted EBITDA Reconciliation for details of adjusting items

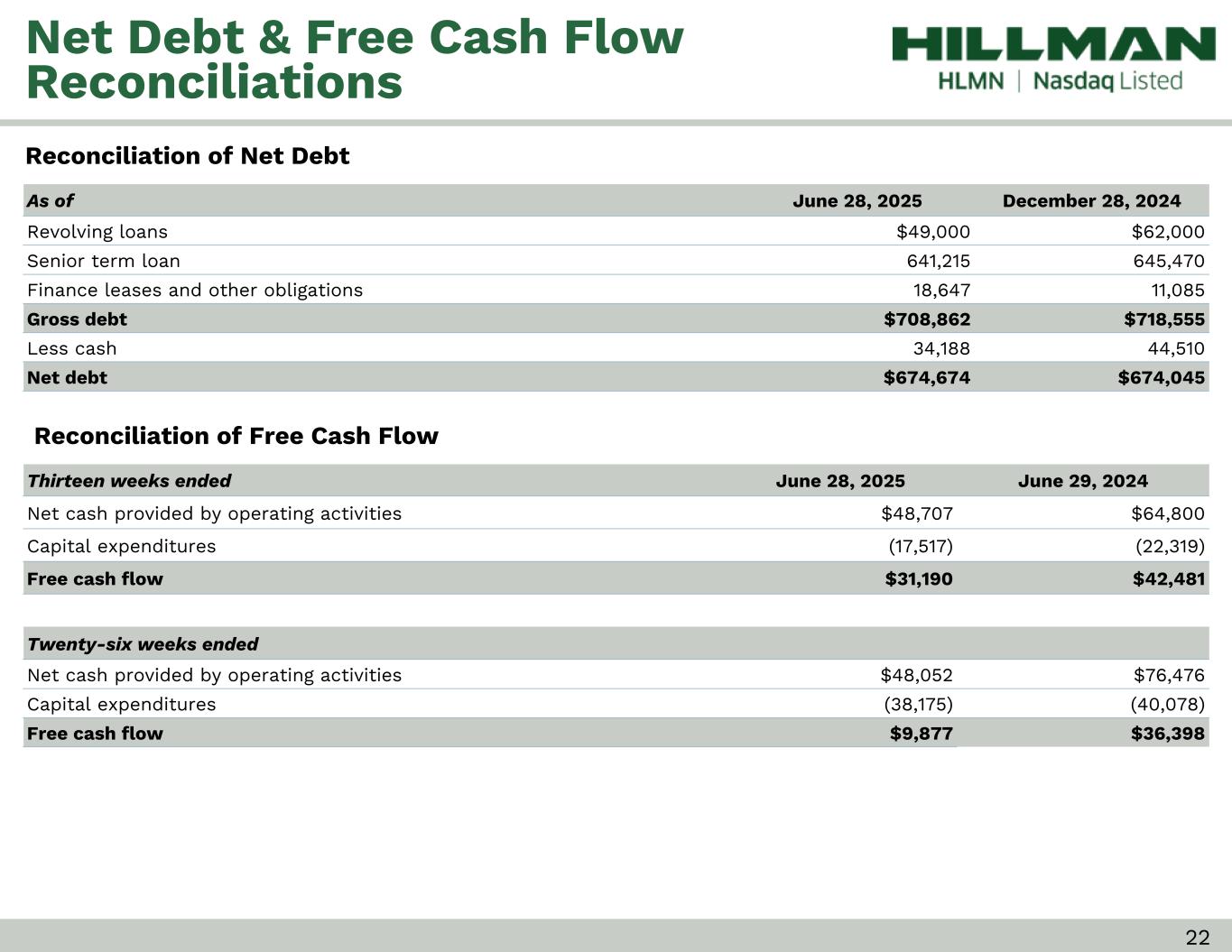

22 As of June 28, 2025 December 28, 2024 Revolving loans $49,000 $62,000 Senior term loan 641,215 645,470 Finance leases and other obligations 18,647 11,085 Gross debt $708,862 $718,555 Less cash 34,188 44,510 Net debt $674,674 $674,045 Net Debt & Free Cash Flow Reconciliations Thirteen weeks ended June 28, 2025 June 29, 2024 Net cash provided by operating activities $48,707 $64,800 Capital expenditures (17,517) (22,319) Free cash flow $31,190 $42,481 Twenty-six weeks ended Net cash provided by operating activities $48,052 $76,476 Capital expenditures (38,175) (40,078) Free cash flow $9,877 $36,398 Reconciliation of Net Debt Reconciliation of Free Cash Flow

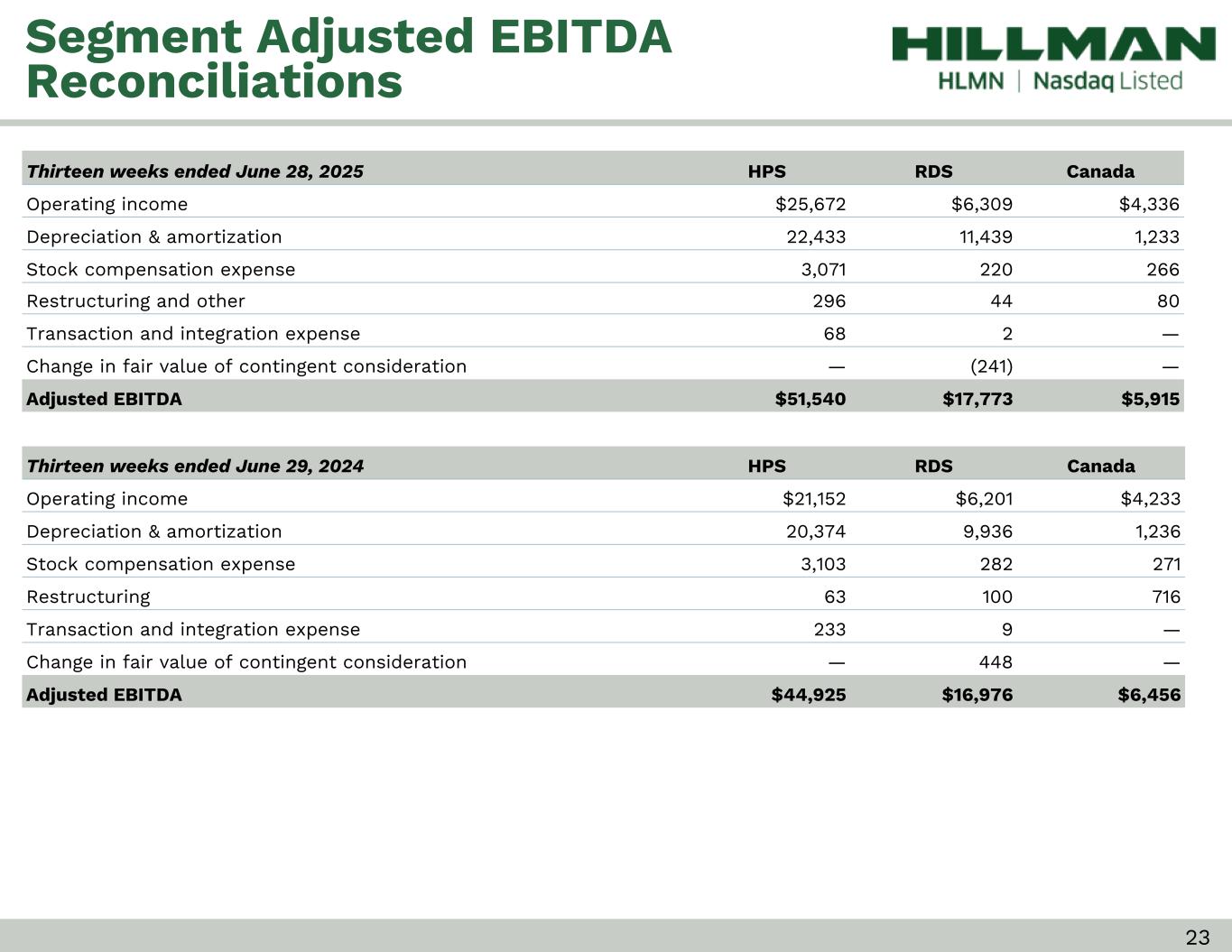

23 Thirteen weeks ended June 28, 2025 HPS RDS Canada Operating income $25,672 $6,309 $4,336 Depreciation & amortization 22,433 11,439 1,233 Stock compensation expense 3,071 220 266 Restructuring and other 296 44 80 Transaction and integration expense 68 2 — Change in fair value of contingent consideration — (241) — Adjusted EBITDA $51,540 $17,773 $5,915 Thirteen weeks ended June 29, 2024 HPS RDS Canada Operating income $21,152 $6,201 $4,233 Depreciation & amortization 20,374 9,936 1,236 Stock compensation expense 3,103 282 271 Restructuring 63 100 716 Transaction and integration expense 233 9 — Change in fair value of contingent consideration — 448 — Adjusted EBITDA $44,925 $16,976 $6,456 Segment Adjusted EBITDA Reconciliations

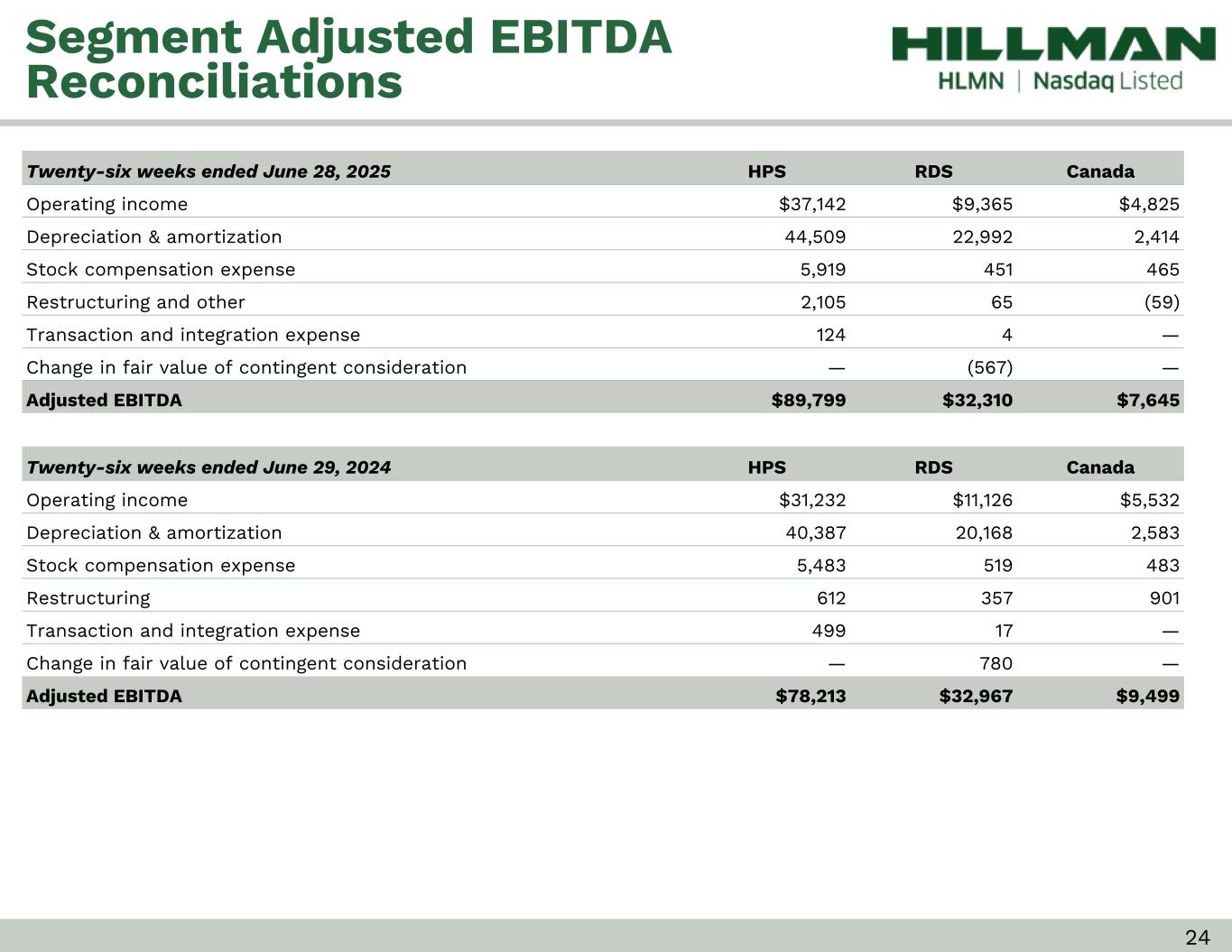

24 Twenty-six weeks ended June 28, 2025 HPS RDS Canada Operating income $37,142 $9,365 $4,825 Depreciation & amortization 44,509 22,992 2,414 Stock compensation expense 5,919 451 465 Restructuring and other 2,105 65 (59) Transaction and integration expense 124 4 — Change in fair value of contingent consideration — (567) — Adjusted EBITDA $89,799 $32,310 $7,645 Twenty-six weeks ended June 29, 2024 HPS RDS Canada Operating income $31,232 $11,126 $5,532 Depreciation & amortization 40,387 20,168 2,583 Stock compensation expense 5,483 519 483 Restructuring 612 357 901 Transaction and integration expense 499 17 — Change in fair value of contingent consideration — 780 — Adjusted EBITDA $78,213 $32,967 $9,499 Segment Adjusted EBITDA Reconciliations