EX-10.2

Published on November 5, 2024

Exhibit 10.2 - Randall Fagundo Consulting Agreement

CONSULTING AGREEMENT

THIS CONSULTING AGREEMENT (“Agreement”) is entered into as of September 1, 2024, between The Hillman Group, Inc., a Delaware corporation (the “Company”), and Randall Fagundo (“Consultant”).

RECITALS

WHEREAS, the Company desires to retain Consultant to provide to the Company certain consulting services as described herein; and

WHEREAS, Consultant desires to render such consulting services.

NOW, THEREFORE, in consideration of the payment of the Consulting Fees (as defined in Section 4 below) and of the foregoing promises, and the mutual agreements and covenants set forth herein, and other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties, intending to be legally bound, agree as follows:

1. Consulting Period; Termination.

(a) Subject to Section 1

(b) hereof, this Agreement shall continue for a period of three (3) years from the date hereof, unless further extended pursuant to mutual written agreement between the Company and Consultant (the “Consulting Period”). (b) This Agreement shall terminate automatically upon the death or incapacitation of Consultant.

2. Consulting Services. During the Consulting Period, Consultant shall provide consulting services to the Company (collectively, the “Consulting Services”) as reasonably requested by the Company, which may include without limitation, those Consulting Services set forth on Exhibit A hereto. Consultant shall provide such Consulting Services at such times and at such locations as the Company may reasonably request, which shall not exceed ten hours per month.

3. Independent Contractor. Consultant acknowledges and agrees that Consultant’s status at all times shall be that of an independent contractor, and that Consultant may not, at any time, act as an employee, agent or representative for or on behalf of the Company, for any purpose or transaction, and may not bind or otherwise obligate the Company in any manner whatsoever. Consultant acknowledges that Consultant shall have no authority to terminate the employment of any employee of the Company. In recognition of Consultant’s status as an independent contractor, Consultant hereby waives any rights as an employee or deemed employee of the Company or any of its affiliates. In furtherance of the foregoing, in the course of performing the Consulting Services, Consultant shall disclose that Consultant (and any persons acting on behalf of Consultant) is acting as an independent contractor, not as an agent of the Company, and that Consultant has no authority to bind the Company to any contractual agreement. In addition, while performing the Consulting Services pursuant to this Agreement, Consultant shall be responsible for complying with all applicable federal, state, and local laws, ordinances and regulations related to such services performed hereunder.

US-DOCS\151264017.7

4. Consulting Fees; Expenses.

(a) Consulting Fees. In consideration of Consultant’s retention hereunder to perform the Consulting Services, the Company will pay Consultant the consideration set forth on Exhibit B during the Consulting Period (collectively, the “Consulting Fees”).

(b) Expenses. Consultant shall receive reimbursement for business expenses incurred by Consultant during the Consulting Period in the performance of the Consulting Services hereunder and consistent with the Company’s travel and reimbursement policies; provided, that (i) all such expenses are approved in advance and in writing by the Company; (ii) Consultant furnishes appropriate documentation as required by the Internal Revenue Code of 1986, as amended (and such other documentation concerning such expenses as the Company may, from time to time, reasonably request) no later than thirty (30) days following the date the expense was incurred; and (iii) all such expenses shall be set forth on a single monthly invoice along with the Consulting Fees for the month that the expenses were incurred.

5. Taxes. Consultant shall pay directly all taxes associated with the compensation Consultant receives under this Agreement. With respect to any payments to Consultant pursuant to this Agreement, the Company shall not withhold or pay any FICA or other federal, state or local income or other taxes, or comply with or contribute to state workers’ compensation, unemployment or other funds or programs. Consultant acknowledges the separate responsibility for the payment of all such taxes, and agrees to indemnify the Company and hold the Company and its respective officers, employees, directors, managers, shareholders and affiliated entities harmless from and against any and all liability, claims, costs and expenses which any of them may suffer or incur arising out of any failure by Consultant to pay promptly any such tax as required by any applicable law.

6. Return of Materials. Upon the termination of Consultant’s engagement hereunder, Consultant will surrender immediately to the Company in good condition, any merchandise, books, accounts, memoranda, records, keys and other property of whatsoever nature, whether tangible or intangible, which are in Consultant’s possession and which belong to the Company or which reasonably may be considered to be related to or, in any way, be connected with the business of the Company. In the event that such items are not so returned, the Company shall have the right to recover such property and to deduct from any earned but unpaid Consulting Fees or expense reimbursement payable to Consultant the reasonable value of such items plus all reasonable costs, attorneys’ fees and expenses incurred in searching for, taking, removing and recovering said property.

7. Confidential Information. Consultant acknowledges and agrees that in providing the Consulting Services, Consultant may acquire Confidential Information (as defined below) and that such Confidential Information constitutes valuable property of the Company. Accordingly, Consultant shall not at any time during the term of this Agreement or following its expiration or termination, disclose to anyone outside the Company or use in any manner, other than in performing the Consulting Services to the Company hereunder, any Confidential Information of the Company or its affiliates. Notwithstanding the foregoing, Consultant shall not be liable for the disclosure of information which may otherwise be deemed Confidential Information hereunder, if (i) the information is in, or becomes part of, the public domain, other than by

Consultant’s unauthorized disclosure of the information; (ii) the information is disclosed with the Company’s prior written approval; or (iii) the information is required to be disclosed by law pursuant to a subpoena, interrogatory, civil investigative demand or similar process (provided that Consultant shall provide the Company with as much notice of such required disclosure as is reasonably possible). For purposes of this Agreement, “Confidential Information” shall include all information of the Company which is not readily available to the public, including, but not limited to, information relating to customers, processes, products, formulae, data, business and contracting plans, business procedures, finances, prices and all related information, and any of the foregoing received by the Company from any other person or entity.

8. Ownership of Work Product.

(a) Consultant acknowledges that any work created by Consultant in connection with the performance of the Consulting Services (“Work Product”) is being created at the request of the Company. Consultant agrees to grant, assign and convey and hereby grants, assigns and conveys to the Company all right, title and interest in and to all Work Product, including, without limitation, all inventions, works of authorship, trade secrets and other proprietary data, programs, specifications, documentation, technical information, and all other materials (as well as the copyrights, patents, trade secrets and similar rights attendant hereto), including any improvements made to any intellectual property or technology of the Company or any derivative work based upon any work or material of the Company, conceived, reduced to practice, authored or developed by Consultant, either solely or jointly with others, including employees of the Company, during and in connection with the performance of the Consulting Services. To the fullest extent permissible under applicable law, any work of authorship included in the Work Product shall be deemed a "work made for hire" as defined under the United States copyright laws. To the extent any work of authorship is not a work for hire, Consultant agrees to grant, assign and convey and hereby grants, assigns and conveys to the Company all right, title and interest in and to any such work of authorship. The Company shall have the right to use the whole of any Work Product, any part or parts thereof, or none of the Work Product, as it sees fit. The Company may alter the Work Product, add to it, or combine it with any other work or works, at its sole discretion. Notwithstanding the foregoing, all material submitted by Consultant as part of the Work Product or as part of the process of creating the Work Product, including but not limited to programs, listings, printouts, documentation, notes, flow charts, and programming aids, shall be the property of the Company whether or not the Company uses such material. No rights are reserved by Consultant. Whenever an invention or discovery is made by the Consultant either solely or in collaboration with others, including employees of the Company, under or relating to this Agreement, Consultant shall promptly give the Company written notice thereof and shall furnish the Company with complete information thereon including, as a minimum, (1) a complete written disclosure of each such invention and (2) information concerning the date and identity of any public use, sale or publication of such invention made by or known to Consultant or of any contemplated publication by Consultant. As used herein, the terms (1) "invention" or "invention or discovery" includes any art, machine, manufacture, design or composition of matter or any new and useful improvement thereof where it is or may be patentable under the patent laws of the United States or of any foreign country; and (2) "made," when used in relation to any invention or discovery, means the conception of the first actual or constructive reduction

to practice of such invention. Consultant agrees that it will not seek patent, copyright, trademark, registered design or other protection for any rights in any Work Product. Consultant shall not have the right to disclose or use any Work Product for any purpose whatsoever and shall not communicate to any third party the nature of or details relating to any Work Product.

(b) Consultant agrees that, at the Company’s expense, but without any additional consideration, Consultant shall do all things and execute all documents as the Company may reasonably require, to vest in the Company or its nominees the rights referred to herein and to secure for the Company or its nominees all patent, trademark, copyright and trade secret protection or to otherwise evidence, perfect, or protect any of the Company’s ownership rights pursuant to this Agreement. If Consultant does not execute such documents or do such other things, Consultant hereby appoints the Company as its attorney-in-fact to do so on its behalf. The power granted to the Company in the preceding sentence is acknowledged by Consultant to be coupled with an interest and shall be irrevocable and perpetual. The obligations under this Section 8 shall survive expiration or termination of this Agreement and any amendments thereto. Furthermore, Consultant hereby irrevocably waives all rights in and to all works created or developed hereunder.

9. Noncompetition and No Solicitation

(a) For the term of this Agreement and a period of one (1) year following the termination hereof, Consultant shall not directly or indirectly, individually or for any person, firm or employee solicit, divert, interfere with, disturb or take away, or attempt to solicit, divert, interfere with, disturb or take away the patronage of (i) any customer or prospective customer of Company, (ii) any entity that was a customer of Company at any time within one (1) year prior to the termination (collectively, “Customers”). Consultant further acknowledges that to the extent Consultant engages in sales and/or dealings with Customers, Consultant developed substantial good will on behalf of Company by dealing with customers. Such customer good will is, in all instances, the property of Company. Consultant further acknowledges that any solicitation of Customers in violation of this agreement would be a misappropriation of customer good will to the substantial detriment of Company.

(b)For the term of this Agreement and a period of one (1) year following the termination, Consultant shall not engage in or provide any services that are substantially similar to the business of Company on behalf of any individual, business, practice, service or enterprise by directly or indirectly providing such services to any third party that has been a Customer at any time within the one (1) year period immediately preceding the termination.

(c)For the term of this Agreement and a period of one (1) year following the termination, Consultant shall not solicit any individual that has been an employee or consultant for the Company in the year prior to the termination for any employment opportunity.

(d)Consultant shall seek approval from the General Counsel of Company before accepting any employment or contractual arrangement for my services from any other

entity prior to accepting said employment or contract for services, and Company shall not deny said approval for any cause other than that Company has a reasonable belief that said employment or contract violates said Non-Competition and No Solicitation prohibition herein.

(e)For the sake of clarity, the consideration paid under this Agreement is consideration for this Non-Competition and No Solicitation laid forth herein, in addition to the Consulting Services, and all continued payments and vesting shall immediately cease in the event that Consultant violates said Non-Competition and Solicitation provisions.

10.Miscellaneous.

(a) Governing Law. This Agreement shall be construed in accordance with and governed by the laws of the State of Ohio, without regard to conflict of laws principles. Each party hereto agrees that any claim relating to this Agreement shall be brought solely in the state or federal courts of the State of Ohio located in Hamilton County, Ohio, and all objections to personal jurisdiction and venue in any action, suit or proceeding so commenced are hereby expressly waived by all parties hereto. The parties waive personal service of any and all process on each of them and consent that all such service of process shall be made in the manner, to the party and at the address set forth in Section 10(d) of this Agreement, and service so made shall be complete as stated in such section.

(b) Assignment; Binding Effect. This Agreement and the obligations of Consultant hereunder may not be assigned or delegated by Consultant to any third party without the prior written consent of the Company, and any attempted assignment or delegation shall be void and of no force or effect. Consultant shall not subcontract any part of the Consulting Services hereunder. This Agreement shall inure to the benefit of, and shall be binding upon, the parties and their respective successors, permitted assigns, affiliates, heirs and legal representatives, as applicable.

(c) Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original, but all of which shall constitute one and the same instrument.

(d) Notices. All notices, consents, waivers, and other communications under this Agreement must be in writing and will be deemed to have been duly given when (a) delivered by hand to the address(es) below, (b) sent by facsimile or electronic mail, if electronically confirmed, or (c) one business day after deposit with a nationally recognized overnight delivery service (receipt and next day delivery requested), in each case to the appropriate addresses and facsimile numbers set forth below (or to such other addresses and facsimile numbers as a party may designate by notice to the other parties):

If to the Company: The Hillman Group, Inc.

1280 Kemper Meadow Dr.

Forest Park, OH 45240

Attn: Daniel M. Bauer, Asst. General Counsel

E-mail: Daniel.bauer@hillmangroup.com

If to Consultant: Randy Fagundo

____________________________ (address)

____________________________ (email)

____________________________ (phone)

(e) Headings. The headings in this Agreement are used for the convenience of reference only and shall not be used in the construction of, or otherwise impart meaning to, this Agreement.

(f) Entire Agreement; Amendments. This Agreement supersedes all previous agreements concerning the subject matter hereof, if any, among the parties and is the entire agreement between the Company and Consultant concerning the subject matter hereof. No waiver, amendment or modification hereof shall be valid unless in writing and signed by all parties.

[Signature page follows]

IN WITNESS WHEREOF, the parties have caused this Consulting Agreement to be duly executed as of the day and year first written above.

THE HILLMAN GROUP, INC.

By:__/s/_Aaron Parker_________________

Name: Aaron Parker

Title: Chief People Officer

(“Company”)

___/s/ Randall Fagundo___________

RANDALL FAGUNDO

(“Consultant”)

EXHIBIT A

Consulting Services

•Assistance and support pertaining to any pertinent legal or administrative proceedings involving the RDS Business, or the Company.

•Transition support and services relating to the business and leadership of the RDS Business.

•Advising on industry and market trends as pertinent.

•Other services as mutually agreed by Consultant and Company.

EXHIBIT B

Consulting Fees

In consideration for the Consulting Services provided under this Agreement, and upon the terms and subject to the conditions set forth in this Consulting Agreement and the applicable equity award agreements, the Company will modify certain equity awards currently held by Mr. Fagundo as described below. Failure to provide the Consulting Services or to comply with the terms of this Consulting Agreement will result in the forfeiture of any outstanding equity awards.

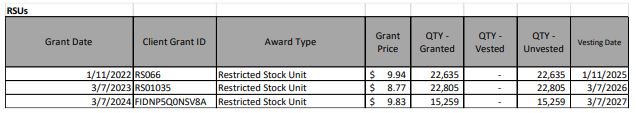

•RSUs - Modification of Mr. Fagundo’s unvested restricted stock units listed below to allow for continued vesting of the same, notwithstanding the cessation of employment, through the duration of the Consulting Agreement:

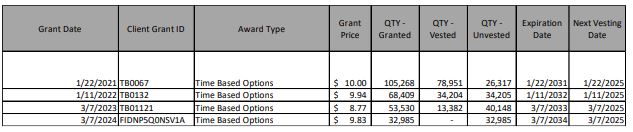

•Time Based Options - Modification of Mr. Fagundo’s unvested time based stock options listed below to allow for continued vesting of the same, notwithstanding the cessation of employment, through the duration of the Consulting Agreement; provided that such options must be exercised within a time period following their applicable vesting dates that is (i) twelve months in the case of the stock options issued under the 2014 Equity Incentive Plan; and (ii) three months in the case of the stock options issued under the 2021 Equity Incentive Plan:

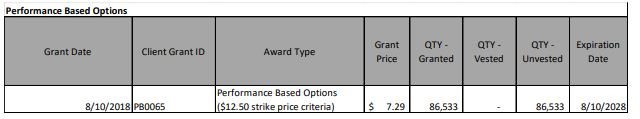

•Performance Based Options - Modification of Mr. Fagundo’s unvested performance-based stock options listed below to allow for the same to remain outstanding and eligible to vest through the expiration of each such option notwithstanding the cessation of employment; provided that such options must be exercised within twelve months of the vesting date should the options vest: