EX-99.2

Published on November 5, 2024

Quarterly Earnings Presentation Q3 2024 November 5, 2024

2Earnings Presentation Q3 2024 PresBuilder Placeholder - Delete this box if you see it on a slide, but DO NOT REMOVE this box from the slide layout All statements made in this presentation that are consider to be forward-looking are made in good faith by the Company and are intended to qualify for the safe harbor from liability established by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. You should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," “target”, “goal”, "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) unfavorable economic conditions that may affect our and our customers’, suppliers’ and other business partners’ operations, financial condition and cash flows including spending on home renovation or construction projects, inflation, recessions, instability in the financial markets or credit markets; (2) increased supply chain costs, including raw materials, sourcing, transportation and energy; (3) the highly competitive nature of the markets that we serve; (4) the ability to continue to innovate with new products and services; (5) direct and indirect costs associated with the May 2023 ransomware attack, and our receipt of expected insurance receivables associated with that cyber security incident; (6) seasonality; (7) large customer concentration; (8) the ability to recruit and retain qualified employees; (9) the outcome of any legal proceedings that may be instituted against the Company; (10) adverse changes in currency exchange rates; or (11) regulatory changes and potential legislation that could adversely impact financial results. The foregoing list of factors is not exclusive, and readers should also refer to those risks that are included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including the Annual Report on Form 10-K filed on February 22, 2024. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward looking statements. Except as required by applicable law, the Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this communication to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Presentation of Non-GAAP Financial Measures In addition to the results provided in accordance with U.S. generally accepted accounting principles (“GAAP”) throughout this presentation the company has provided non-GAAP financial measures, which present results on a basis adjusted for certain items. The company uses these non-GAAP financial measures for business planning purposes and in measuring its performance relative to that of its competitors. The company believes that these non- GAAP financial measures are useful financial metrics to assess its operating performance from period-to-period by excluding certain items that the company believes are not representative of its core business. These non-GAAP financial measures are not intended to replace, and should not be considered superior to, the presentation of the company’s financial results in accordance with GAAP. The use of the non-GAAP financial measures terms may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures. These non-GAAP financial measures are reconciled from the respective measures under GAAP in the appendix below. The company is not able to provide a reconciliation of the company’s non-GAAP financial guidance to the corresponding GAAP measures without unreasonable effort because of the inherent difficulty in forecasting and quantifying certain amounts necessary for such a reconciliation such as certain non-cash, nonrecurring or other items that are included in net income and EBITDA as well as the related tax impacts of these items and asset dispositions / acquisitions and changes in foreign currency exchange rates that are included in cash flow, due to the uncertainty and variability of the nature and amount of these future charges and costs. Forward Looking Statements

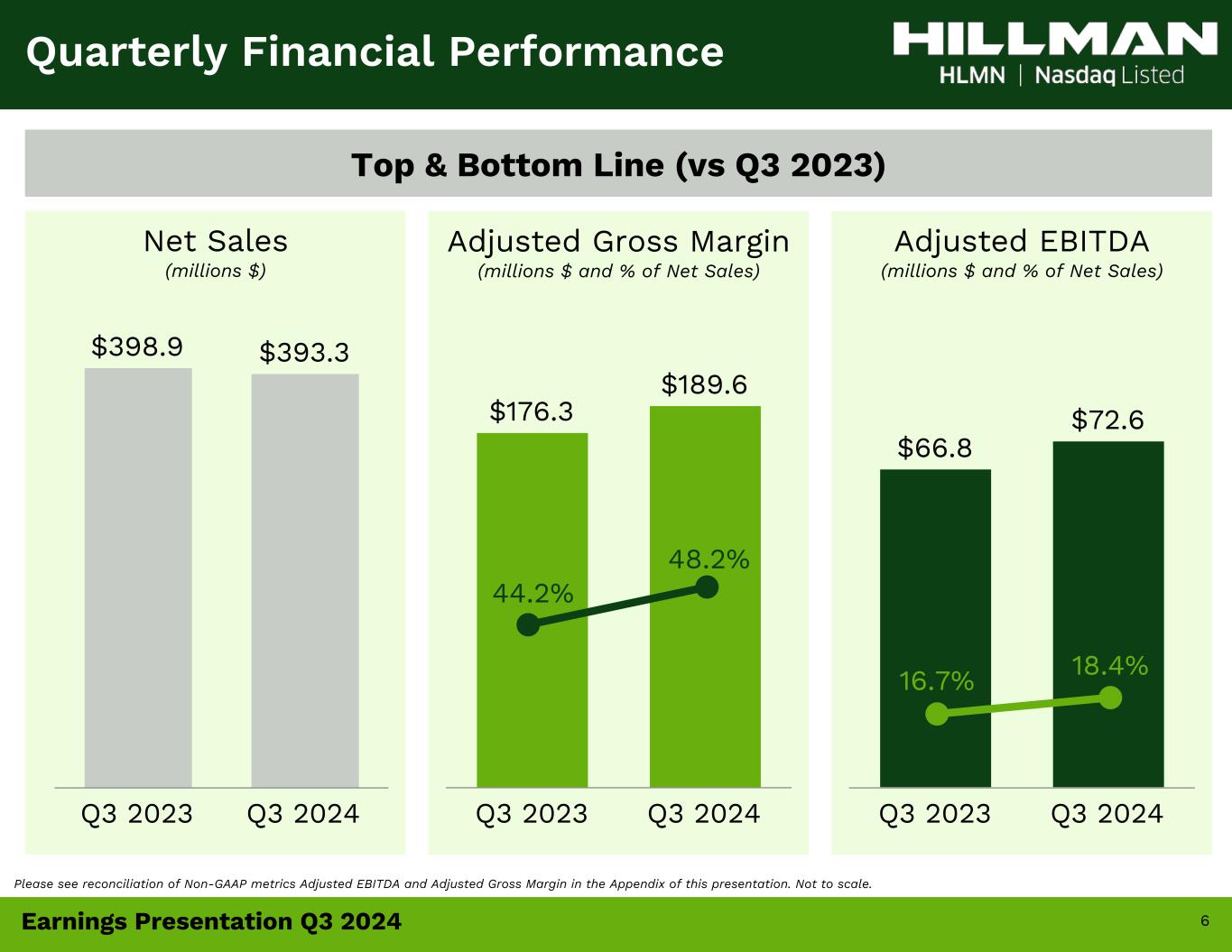

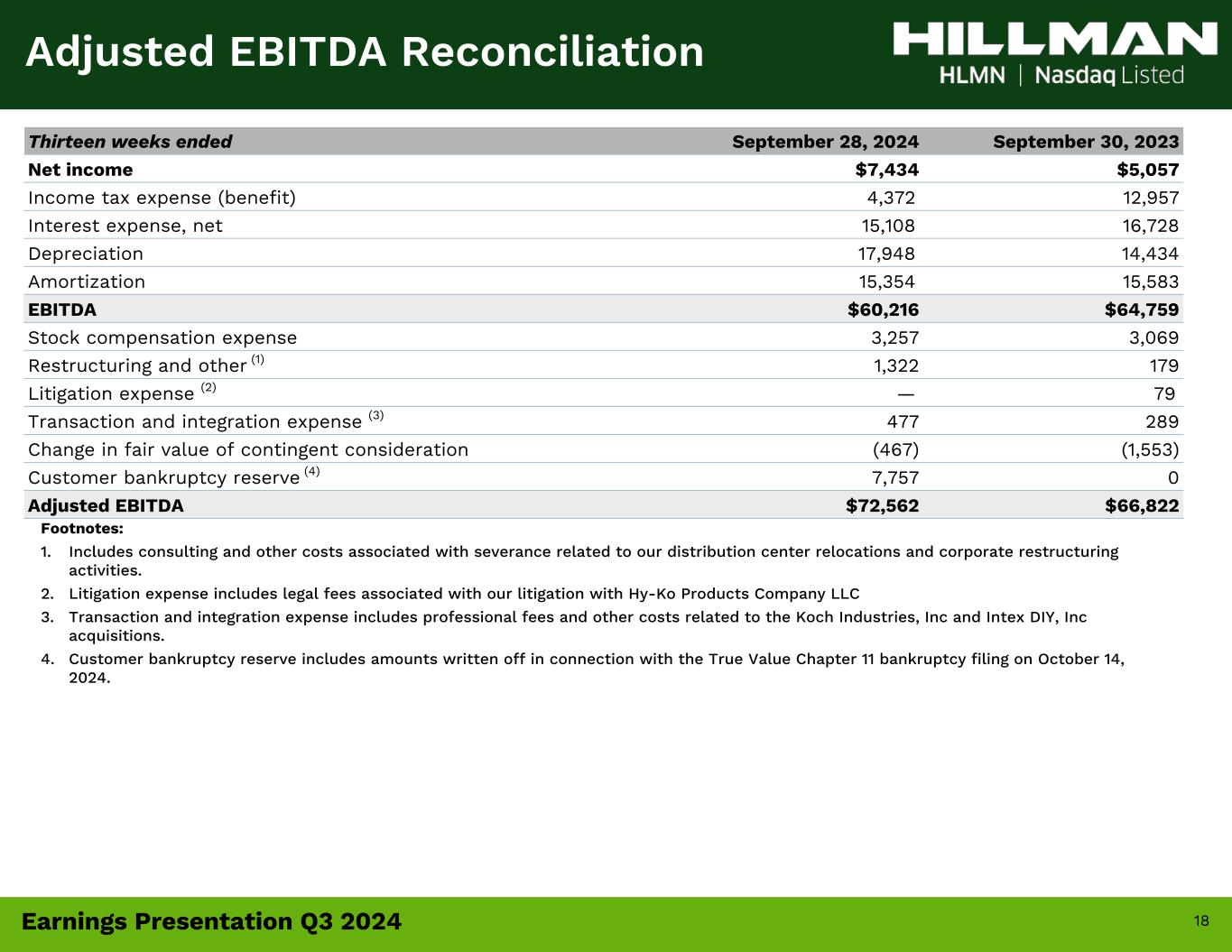

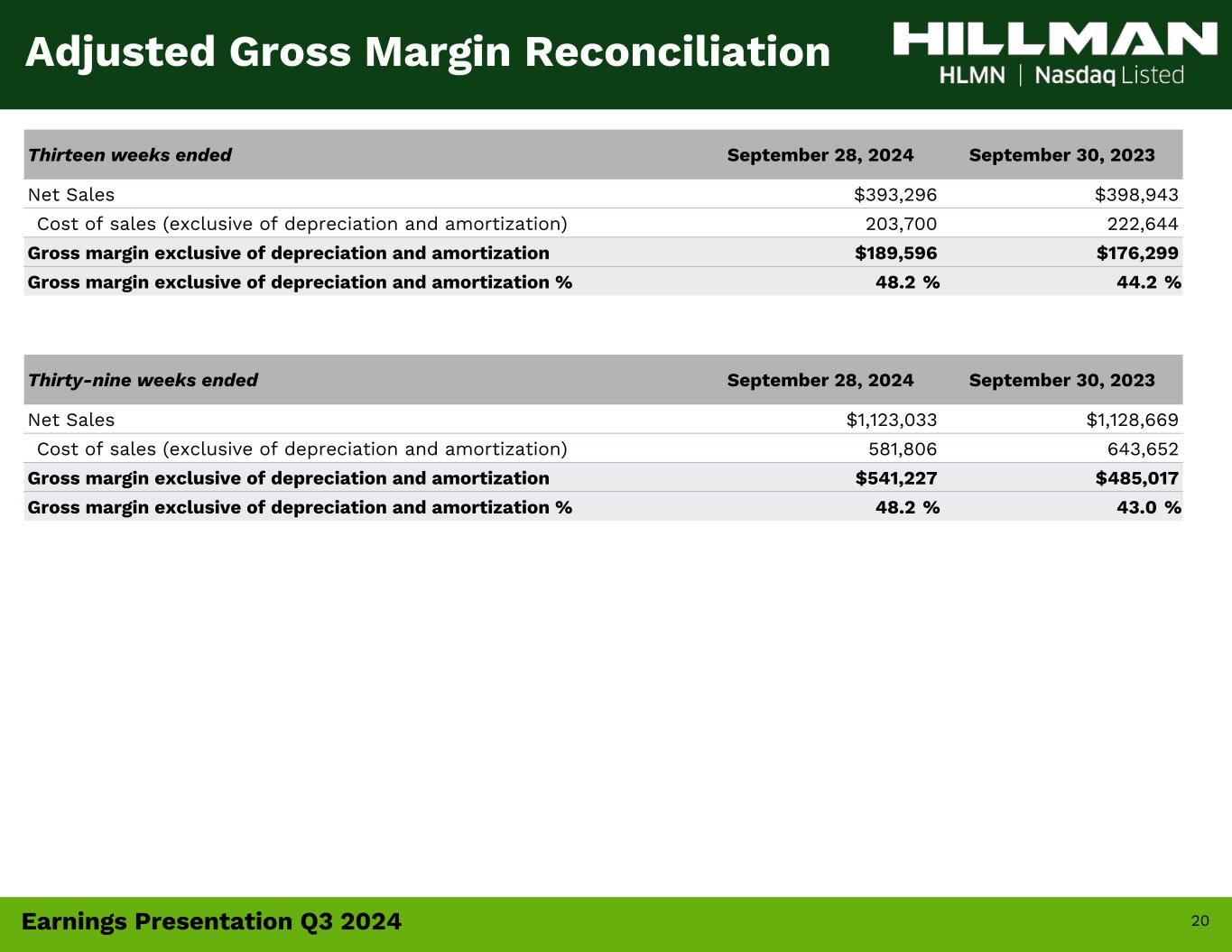

3Earnings Presentation Q3 2024 • Net sales decreased (1.4)% to $393.3 million versus Q3 2023 ◦ Hardware and Protective Solutions ("HPS") increased 0.1% – Hardware Solutions decreased (1.6)% – Protective Solutions increased +5.9% ◦ Robotics and Digital Solutions ("RDS") decreased (5.3)% ◦ Canada decreased (6.5)% • GAAP net income totaled $7.4 million, or $0.04 per diluted share, compared to $5.1 million, or $0.03 per diluted share, in Q3 2023 • Adjusted Gross Margins improved to 48.2% compared to 44.2% in Q3 2023 • Adjusted EBITDA totaled $72.6 million compared to $66.8 million in Q3 2023 • Adjusted EBITDA margins were 18.4% compared to 16.7% in Q3 2023 • Net Debt / Adjusted EBITDA (ttm): 2.8x at quarter end, improved from 3.3x on December 30, 2023, and 3.7x on September 30, 2023 Q3 2024 Financial Review Please see reconciliation tables in the Appendix of this presentation for non-GAAP metrics. Highlights for the 13 Weeks Ended September 28, 2024

4Earnings Presentation Q3 2024 Q3 2024 Operational Review Highlights for the 13 Weeks Ended September 28, 2024 • Continued taking great care of customers: ◦ YTD fill rates averaged 95% • Acquired Intex DIY, a leading supplier of cleaning rags, cloths, and textiles • Subsequent to quarter end, Hillman won: ◦ 2024 Divisional Vendor Partner of the Year in Hardlines at Lowe's ◦ 2024 Partner of the Year in Hardware at Home Depot • Continue to pursue accretive, tuck-in M&A opportunities that leverage the Hillman moat • Increased FY 2024 top and bottom line guidance and refined free cash flow guide

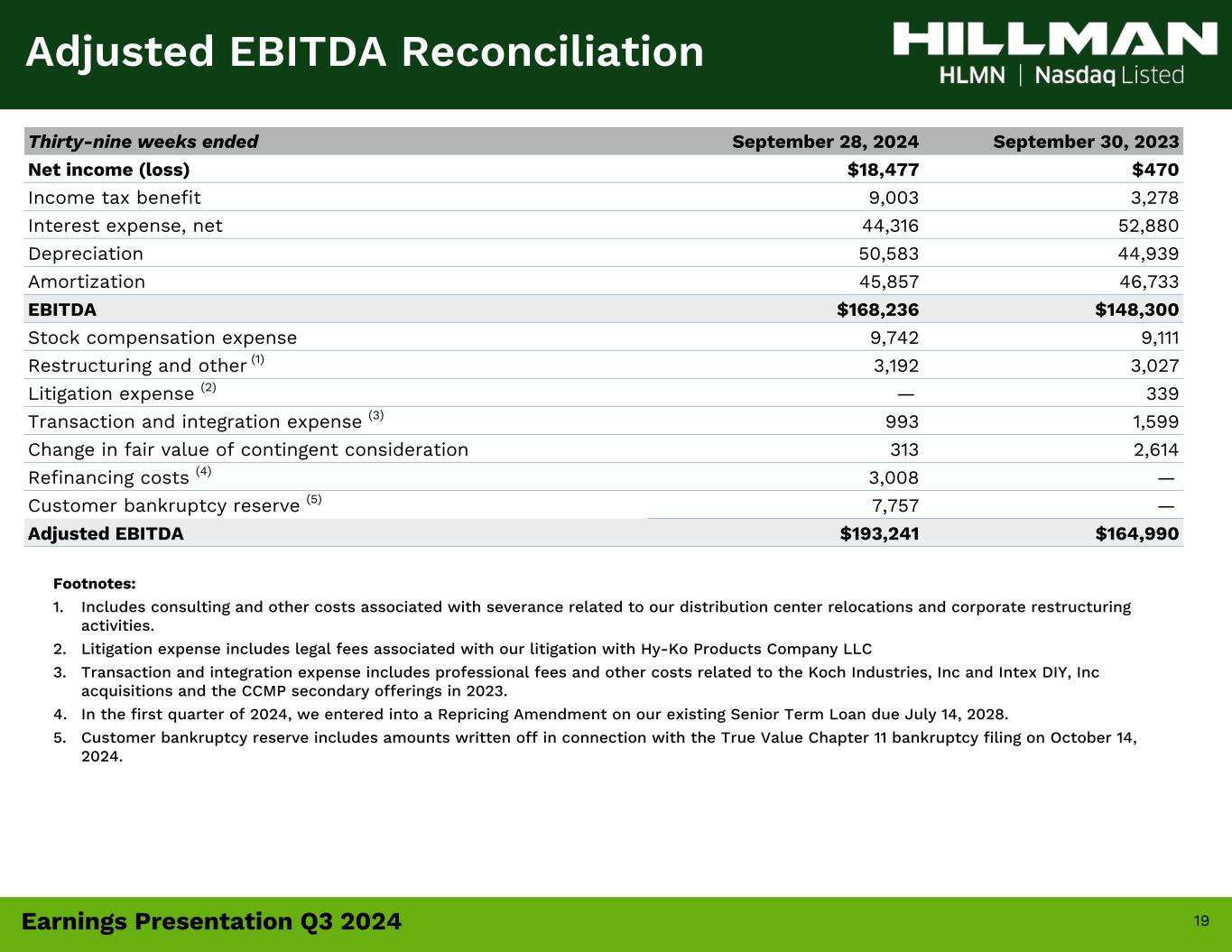

5Earnings Presentation Q3 2024 • Net sales decreased (0.5)% to $1,123.0 million versus the thirty-nine weeks ended September 30, 2023 ◦ Hardware and Protective Solutions ("HPS") increased 1.9% – Hardware Solutions increased +1.8% – Protective Solutions increased +2.5% ◦ Robotics and Digital Solutions ("RDS") decreased (7.4)% ◦ Canada decreased (6.0)% • GAAP net income totaled $18.5 million, or $0.09 per diluted share, compared to GAAP net income of $0.5 million, or $0.00 per diluted share during the thirty-nine weeks ended September 30, 2023. • Adjusted Gross Margins were 48.2% compared to 43.0% in Q3 2023 • Adjusted EBITDA totaled $193.2 million compared to $165.0 million in Q3 2023 • Adjusted EBITDA margins were 17.2% compared to 14.6% in Q3 2023 • Free Cash Flow totaled $76.0 million compared to $119.3 million in Q3 2023 Q3 2024 YTD Financial Review Please see reconciliation tables in the Appendix of this presentation for non-GAAP metrics. Highlights for the 39 Weeks Ended September 28, 2024

6Earnings Presentation Q3 2024 Quarterly Financial Performance Adjusted EBITDA (millions $ and % of Net Sales) Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Adjusted Gross Margin in the Appendix of this presentation. Not to scale. Top & Bottom Line (vs Q3 2023) Net Sales (millions $) Adjusted Gross Margin (millions $ and % of Net Sales) $66.8 $72.6 Q3 2023 Q3 2024 18.4%16.7% $176.3 $189.6 Q3 2023 Q3 2024 $398.9 $393.3 Q3 2023 Q3 2024 48.2% 44.2%

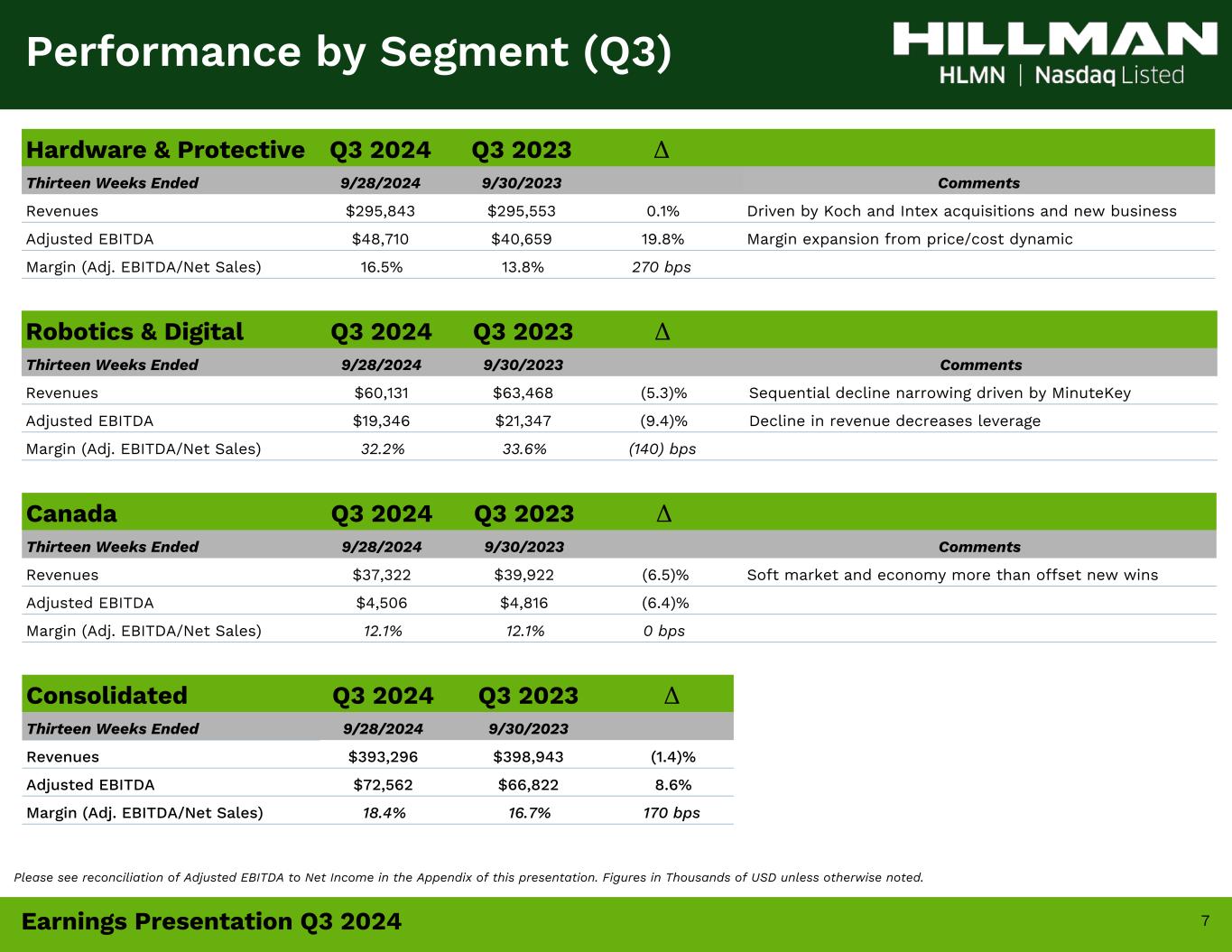

7Earnings Presentation Q3 2024 Hardware & Protective Q3 2024 Q3 2023 Δ Thirteen Weeks Ended 9/28/2024 9/30/2023 Comments Revenues $295,843 $295,553 0.1% Driven by Koch and Intex acquisitions and new business Adjusted EBITDA $48,710 $40,659 19.8% Margin expansion from price/cost dynamic Margin (Adj. EBITDA/Net Sales) 16.5% 13.8% 270 bps Robotics & Digital Q3 2024 Q3 2023 Δ Thirteen Weeks Ended 9/28/2024 9/30/2023 Comments Revenues $60,131 $63,468 (5.3)% Sequential decline narrowing driven by MinuteKey Adjusted EBITDA $19,346 $21,347 (9.4)% Decline in revenue decreases leverage Margin (Adj. EBITDA/Net Sales) 32.2% 33.6% (140) bps Canada Q3 2024 Q3 2023 Δ Thirteen Weeks Ended 9/28/2024 9/30/2023 Comments Revenues $37,322 $39,922 (6.5)% Soft market and economy more than offset new wins Adjusted EBITDA $4,506 $4,816 (6.4)% Margin (Adj. EBITDA/Net Sales) 12.1% 12.1% 0 bps Consolidated Q3 2024 Q3 2023 Δ Thirteen Weeks Ended 9/28/2024 9/30/2023 Revenues $393,296 $398,943 (1.4)% Adjusted EBITDA $72,562 $66,822 8.6% Margin (Adj. EBITDA/Net Sales) 18.4% 16.7% 170 bps Performance by Segment (Q3) Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted.

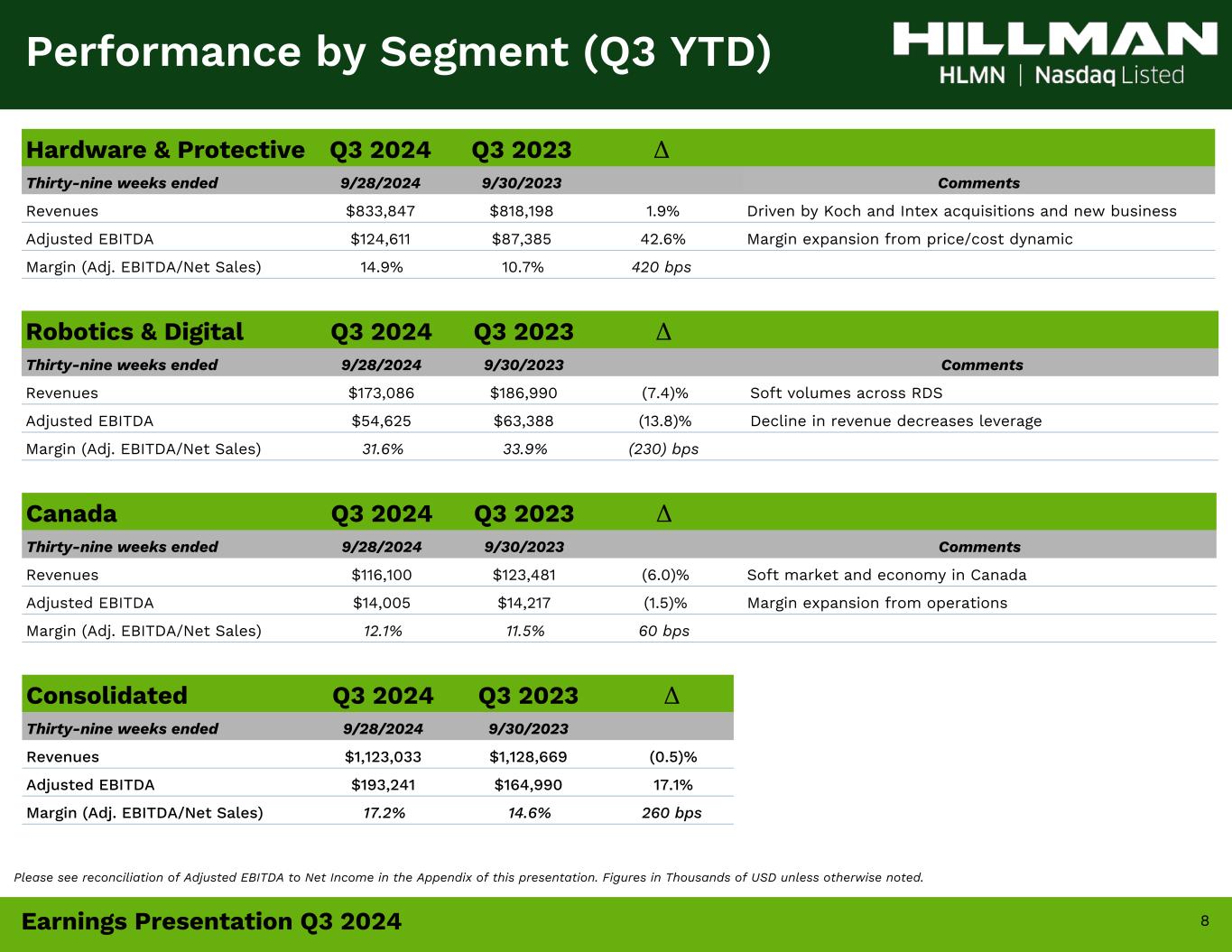

8Earnings Presentation Q3 2024 Hardware & Protective Q3 2024 Q3 2023 Δ Thirty-nine weeks ended 9/28/2024 9/30/2023 Comments Revenues $833,847 $818,198 1.9% Driven by Koch and Intex acquisitions and new business Adjusted EBITDA $124,611 $87,385 42.6% Margin expansion from price/cost dynamic Margin (Adj. EBITDA/Net Sales) 14.9% 10.7% 420 bps Robotics & Digital Q3 2024 Q3 2023 Δ Thirty-nine weeks ended 9/28/2024 9/30/2023 Comments Revenues $173,086 $186,990 (7.4)% Soft volumes across RDS Adjusted EBITDA $54,625 $63,388 (13.8)% Decline in revenue decreases leverage Margin (Adj. EBITDA/Net Sales) 31.6% 33.9% (230) bps Canada Q3 2024 Q3 2023 Δ Thirty-nine weeks ended 9/28/2024 9/30/2023 Comments Revenues $116,100 $123,481 (6.0)% Soft market and economy in Canada Adjusted EBITDA $14,005 $14,217 (1.5)% Margin expansion from operations Margin (Adj. EBITDA/Net Sales) 12.1% 11.5% 60 bps Consolidated Q3 2024 Q3 2023 Δ Thirty-nine weeks ended 9/28/2024 9/30/2023 Revenues $1,123,033 $1,128,669 (0.5)% Adjusted EBITDA $193,241 $164,990 17.1% Margin (Adj. EBITDA/Net Sales) 17.2% 14.6% 260 bps Performance by Segment (Q3 YTD) Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted.

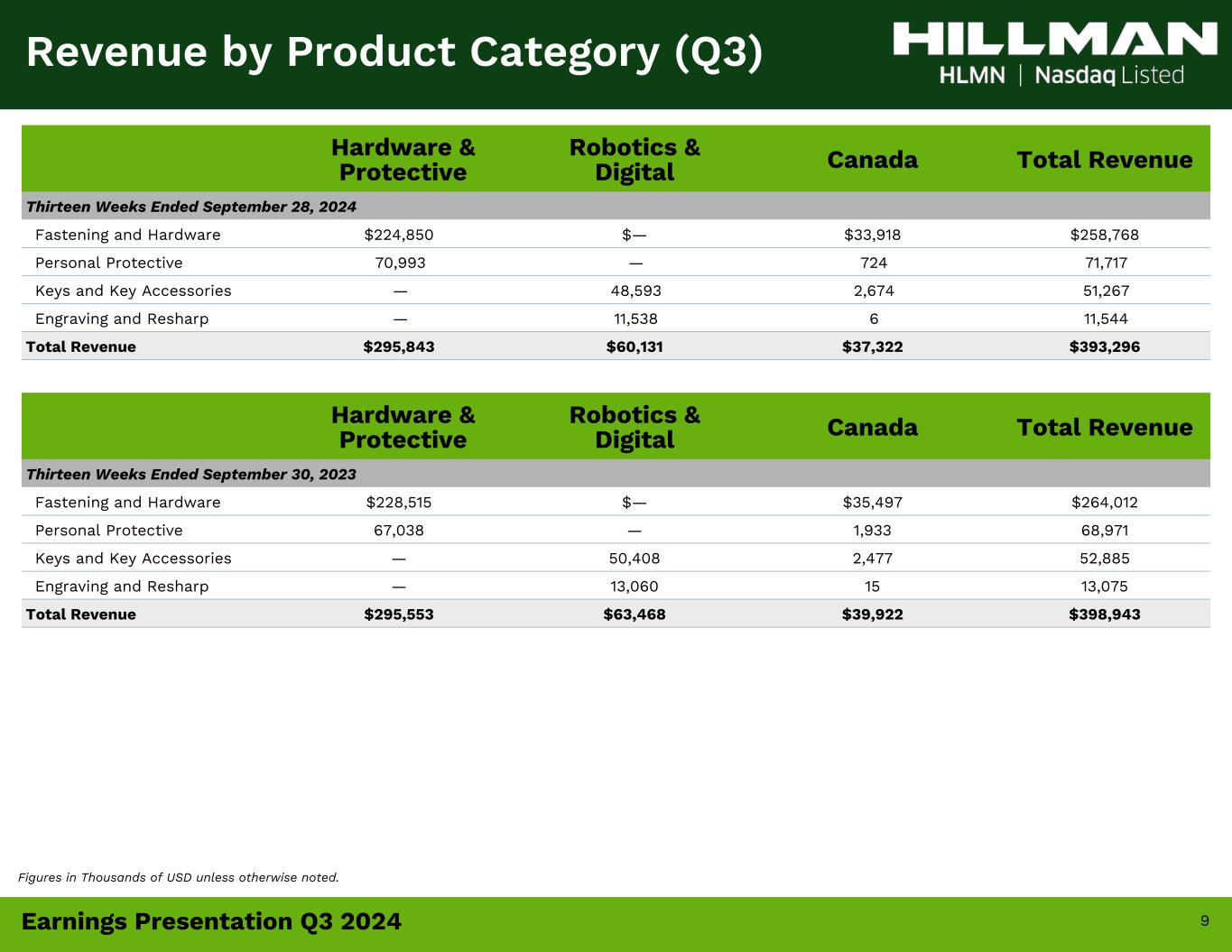

9Earnings Presentation Q3 2024 Hardware & Protective Robotics & Digital Canada Total Revenue Thirteen Weeks Ended September 28, 2024 Fastening and Hardware $224,850 $— $33,918 $258,768 Personal Protective 70,993 — 724 71,717 Keys and Key Accessories — 48,593 2,674 51,267 Engraving and Resharp — 11,538 6 11,544 Total Revenue $295,843 $60,131 $37,322 $393,296 Revenue by Product Category (Q3) Hardware & Protective Robotics & Digital Canada Total Revenue Thirteen Weeks Ended September 30, 2023 Fastening and Hardware $228,515 $— $35,497 $264,012 Personal Protective 67,038 — 1,933 68,971 Keys and Key Accessories — 50,408 2,477 52,885 Engraving and Resharp — 13,060 15 13,075 Total Revenue $295,553 $63,468 $39,922 $398,943 Figures in Thousands of USD unless otherwise noted.

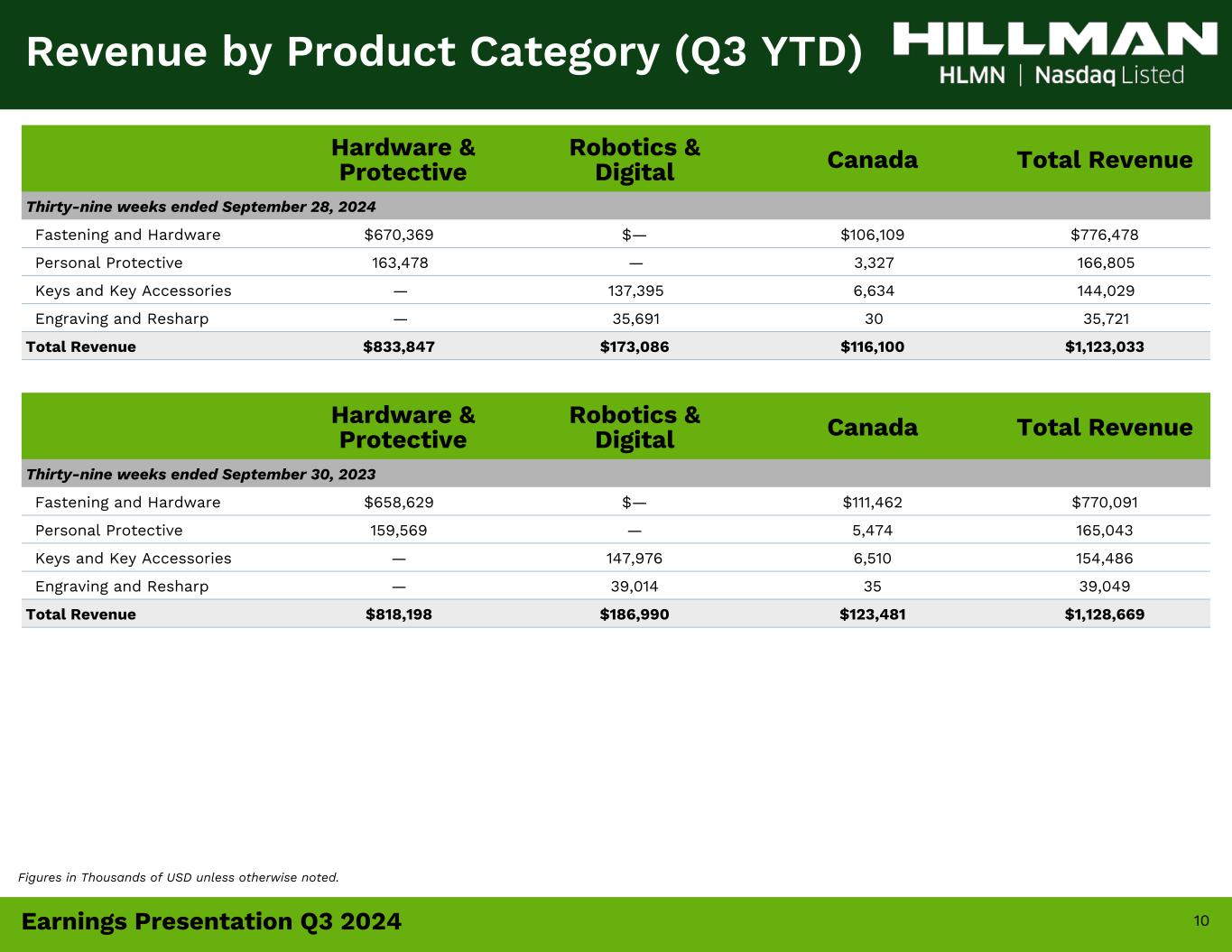

10Earnings Presentation Q3 2024 Hardware & Protective Robotics & Digital Canada Total Revenue Thirty-nine weeks ended September 28, 2024 Fastening and Hardware $670,369 $— $106,109 $776,478 Personal Protective 163,478 — 3,327 166,805 Keys and Key Accessories — 137,395 6,634 144,029 Engraving and Resharp — 35,691 30 35,721 Total Revenue $833,847 $173,086 $116,100 $1,123,033 Revenue by Product Category (Q3 YTD) Hardware & Protective Robotics & Digital Canada Total Revenue Thirty-nine weeks ended September 30, 2023 Fastening and Hardware $658,629 $— $111,462 $770,091 Personal Protective 159,569 — 5,474 165,043 Keys and Key Accessories — 147,976 6,510 154,486 Engraving and Resharp — 39,014 35 39,049 Total Revenue $818,198 $186,990 $123,481 $1,128,669 Figures in Thousands of USD unless otherwise noted.

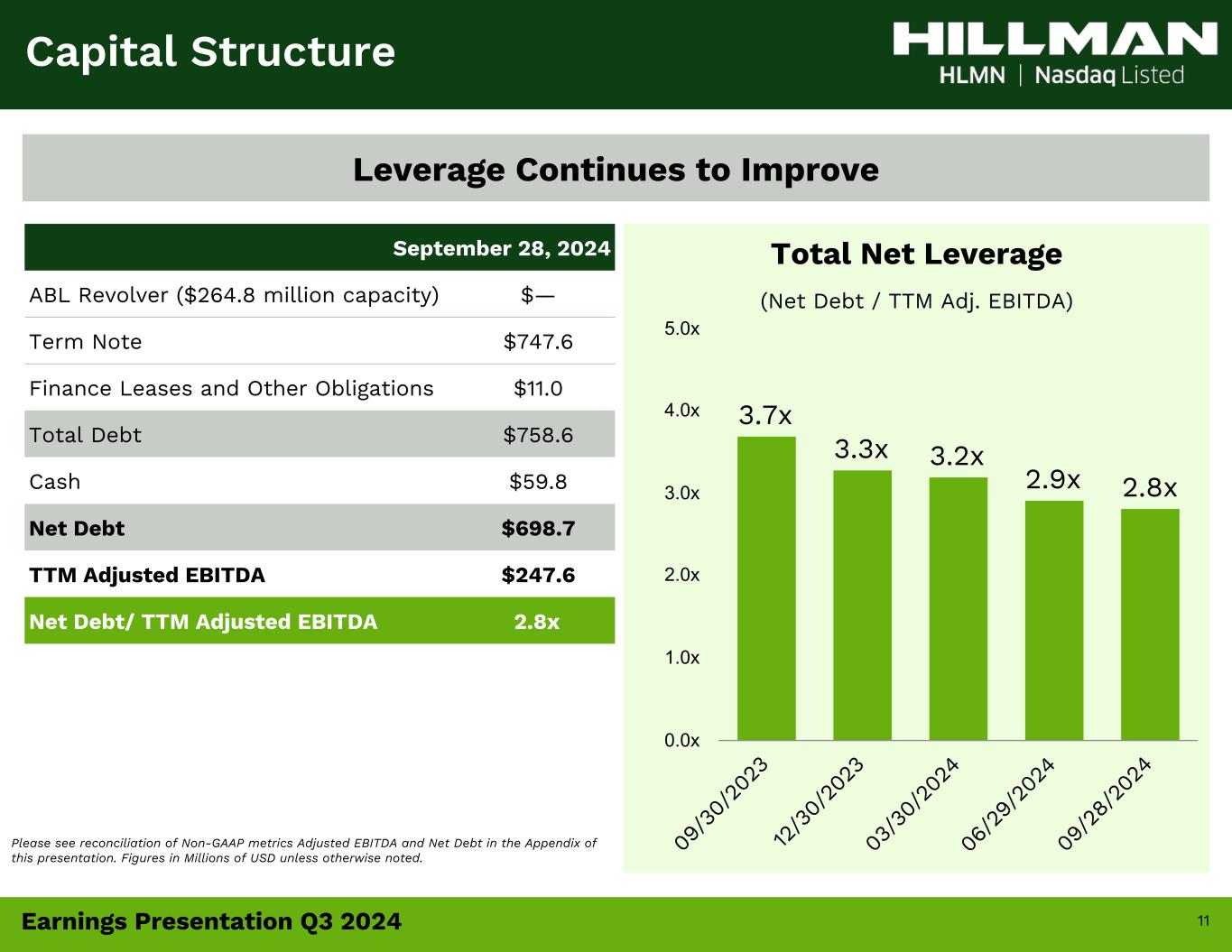

11Earnings Presentation Q3 2024 Total Net Leverage (Net Debt / TTM Adj. EBITDA) Capital Structure September 28, 2024 ABL Revolver ($264.8 million capacity) $— Term Note $747.6 Finance Leases and Other Obligations $11.0 Total Debt $758.6 Cash $59.8 Net Debt $698.7 TTM Adjusted EBITDA $247.6 Net Debt/ TTM Adjusted EBITDA 2.8x Leverage Continues to Improve Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Net Debt in the Appendix of this presentation. Figures in Millions of USD unless otherwise noted. 3.7x 3.3x 3.2x 2.9x 2.8x 09 /3 0/ 20 23 12 /3 0/ 20 23 03 /3 0/ 20 24 06 /2 9/ 20 24 09 /2 8/ 20 24 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x

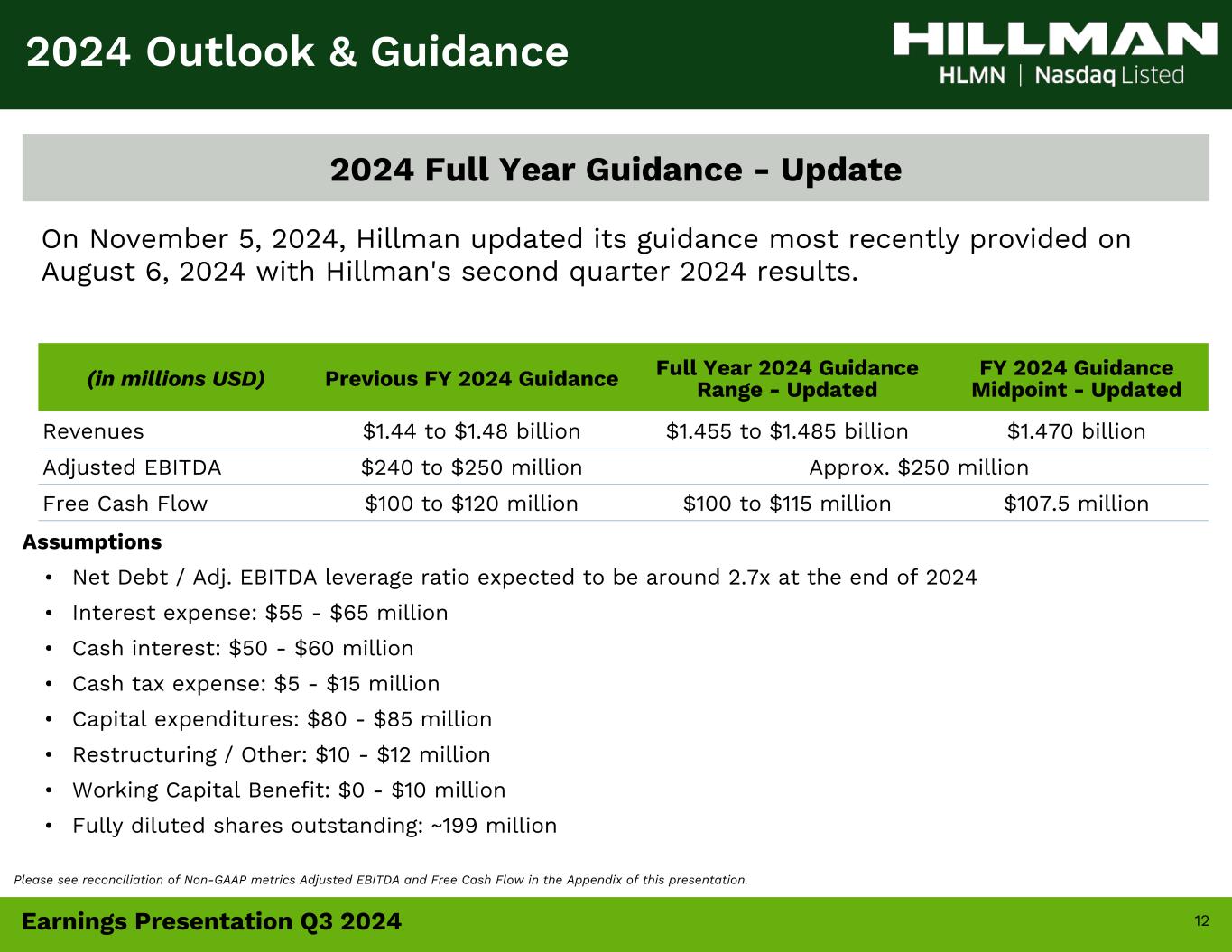

12Earnings Presentation Q3 2024 2024 Outlook & Guidance (in millions USD) Previous FY 2024 Guidance Full Year 2024 Guidance Range - Updated FY 2024 Guidance Midpoint - Updated Revenues $1.44 to $1.48 billion $1.455 to $1.485 billion $1.470 billion Adjusted EBITDA $240 to $250 million Approx. $250 million Free Cash Flow $100 to $120 million $100 to $115 million $107.5 million Assumptions • Net Debt / Adj. EBITDA leverage ratio expected to be around 2.7x at the end of 2024 • Interest expense: $55 - $65 million • Cash interest: $50 - $60 million • Cash tax expense: $5 - $15 million • Capital expenditures: $80 - $85 million • Restructuring / Other: $10 - $12 million • Working Capital Benefit: $0 - $10 million • Fully diluted shares outstanding: ~199 million On November 5, 2024, Hillman updated its guidance most recently provided on August 6, 2024 with Hillman's second quarter 2024 results. 2024 Full Year Guidance - Update Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Free Cash Flow in the Appendix of this presentation.

13Earnings Presentation Q3 2024 Key Takeaways Executing M&A; Winning New Business; Strong Margin Profile Historical Long-term Annual Growth Targets (Organic): Revenue Growth: +6% & Adj. EBITDA Growth: +10% Historical Long-term Annual Growth Targets (incl. Acquisitions): Revenue Growth: +10% & Adj. EBITDA Growth: +15% • Business has 60-year track record of success; proven to be resilient through multiple economic cycles • Repair, Remodel and Maintenance industry has meaningful long-term tailwinds; expected increase in future home spending as 24 million homes in the U.S. will reach "prime remodeling" years (between 20-39 years old) by 20271 • 1,100-member distribution (sales and service) team and direct-to-store fulfillment continue to provide competitive advantages and strengthen competitive moat - drives new business wins • Cost of goods peaked in May 2023, margins have since expanded and are expected to remain strong • Executing tuck-in M&A that leverage the Hillman moat in order to fuel long-term growth 1) John Burns Research and Consulting

14 Appendix

15Earnings Presentation Q3 2024 Investment Highlights Significant runway for incremental growth: Organic + M&A Management team with proven operational and M&A expertise Strong financial profile with 60-year track record Market and innovation leader across multiple categories Indispensable partner embedded with winning retailers Customers love us, trust us and rely on us Large, predictable, growing and resilient end markets

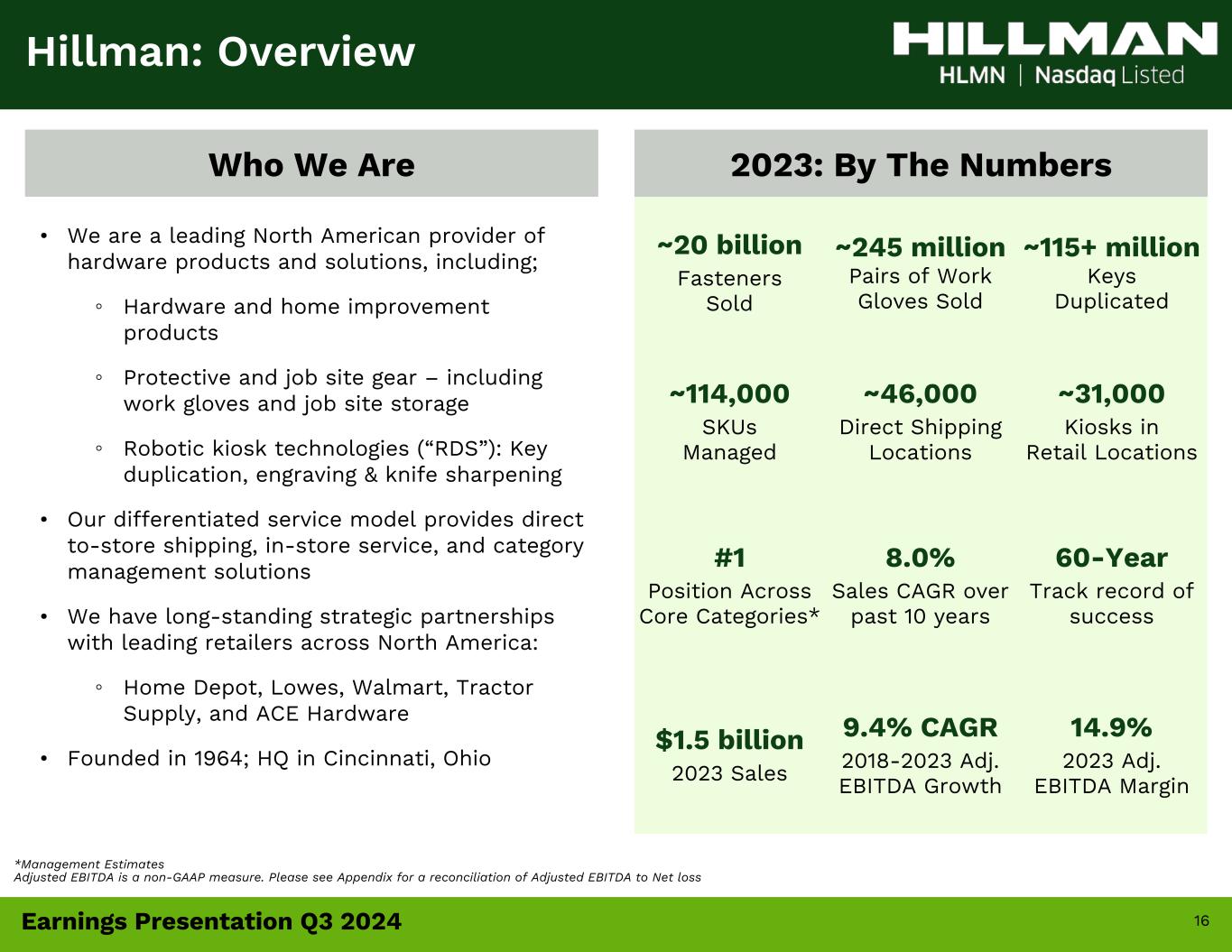

16Earnings Presentation Q3 2024 Hillman: Overview Who We Are *Management Estimates Adjusted EBITDA is a non-GAAP measure. Please see Appendix for a reconciliation of Adjusted EBITDA to Net loss ~20 billion Fasteners Sold ~245 million Pairs of Work Gloves Sold ~115+ million Keys Duplicated ~114,000 SKUs Managed ~46,000 Direct Shipping Locations ~31,000 Kiosks in Retail Locations #1 Position Across Core Categories* 8.0% Sales CAGR over past 10 years 60-Year Track record of success $1.5 billion 2023 Sales 9.4% CAGR 2018-2023 Adj. EBITDA Growth 14.9% 2023 Adj. EBITDA Margin 2023: By The Numbers • We are a leading North American provider of hardware products and solutions, including; ◦ Hardware and home improvement products ◦ Protective and job site gear – including work gloves and job site storage ◦ Robotic kiosk technologies (“RDS”): Key duplication, engraving & knife sharpening • Our differentiated service model provides direct to-store shipping, in-store service, and category management solutions • We have long-standing strategic partnerships with leading retailers across North America: ◦ Home Depot, Lowes, Walmart, Tractor Supply, and ACE Hardware • Founded in 1964; HQ in Cincinnati, Ohio

17Earnings Presentation Q3 2024 Primary Product Categories #1 in Segment#1 in Segment #1 in Segment Key and Fob Duplication Personalized Tags Knife Sharpening Fasteners & Specialty Gloves Builders Hardware & Metal Shapes Safety / PPE / Cleaning Construction Fasteners Work Gear Picture Hanging Source: Third party industry report. Hardware Solutions Protective Solutions Robotics & Digital Solutions Hillman has been selling its top customers for 25 years on average

18Earnings Presentation Q3 2024 Thirteen weeks ended September 28, 2024 September 30, 2023 Net income $7,434 $5,057 Income tax expense (benefit) 4,372 12,957 Interest expense, net 15,108 16,728 Depreciation 17,948 14,434 Amortization 15,354 15,583 EBITDA $60,216 $64,759 Stock compensation expense 3,257 3,069 Restructuring and other (1) 1,322 179 Litigation expense (2) — 79 Transaction and integration expense (3) 477 289 Change in fair value of contingent consideration (467) (1,553) Customer bankruptcy reserve (4) 7,757 0 Adjusted EBITDA $72,562 $66,822 Adjusted EBITDA Reconciliation Footnotes: 1. Includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities. 2. Litigation expense includes legal fees associated with our litigation with Hy-Ko Products Company LLC 3. Transaction and integration expense includes professional fees and other costs related to the Koch Industries, Inc and Intex DIY, Inc acquisitions. 4. Customer bankruptcy reserve includes amounts written off in connection with the True Value Chapter 11 bankruptcy filing on October 14, 2024.

19Earnings Presentation Q3 2024 Thirty-nine weeks ended September 28, 2024 September 30, 2023 Net income (loss) $18,477 $470 Income tax benefit 9,003 3,278 Interest expense, net 44,316 52,880 Depreciation 50,583 44,939 Amortization 45,857 46,733 EBITDA $168,236 $148,300 Stock compensation expense 9,742 9,111 Restructuring and other (1) 3,192 3,027 Litigation expense (2) — 339 Transaction and integration expense (3) 993 1,599 Change in fair value of contingent consideration 313 2,614 Refinancing costs (4) 3,008 — Customer bankruptcy reserve (5) 7,757 — Adjusted EBITDA $193,241 $164,990 Adjusted EBITDA Reconciliation Footnotes: 1. Includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities. 2. Litigation expense includes legal fees associated with our litigation with Hy-Ko Products Company LLC 3. Transaction and integration expense includes professional fees and other costs related to the Koch Industries, Inc and Intex DIY, Inc acquisitions and the CCMP secondary offerings in 2023. 4. In the first quarter of 2024, we entered into a Repricing Amendment on our existing Senior Term Loan due July 14, 2028. 5. Customer bankruptcy reserve includes amounts written off in connection with the True Value Chapter 11 bankruptcy filing on October 14, 2024.

20Earnings Presentation Q3 2024 Thirteen weeks ended September 28, 2024 September 30, 2023 Net Sales $393,296 $398,943 Cost of sales (exclusive of depreciation and amortization) 203,700 222,644 Gross margin exclusive of depreciation and amortization $189,596 $176,299 Gross margin exclusive of depreciation and amortization % 48.2 % 44.2 % Thirty-nine weeks ended September 28, 2024 September 30, 2023 Net Sales $1,123,033 $1,128,669 Cost of sales (exclusive of depreciation and amortization) 581,806 643,652 Gross margin exclusive of depreciation and amortization $541,227 $485,017 Gross margin exclusive of depreciation and amortization % 48.2 % 43.0 % Adjusted Gross Margin Reconciliation

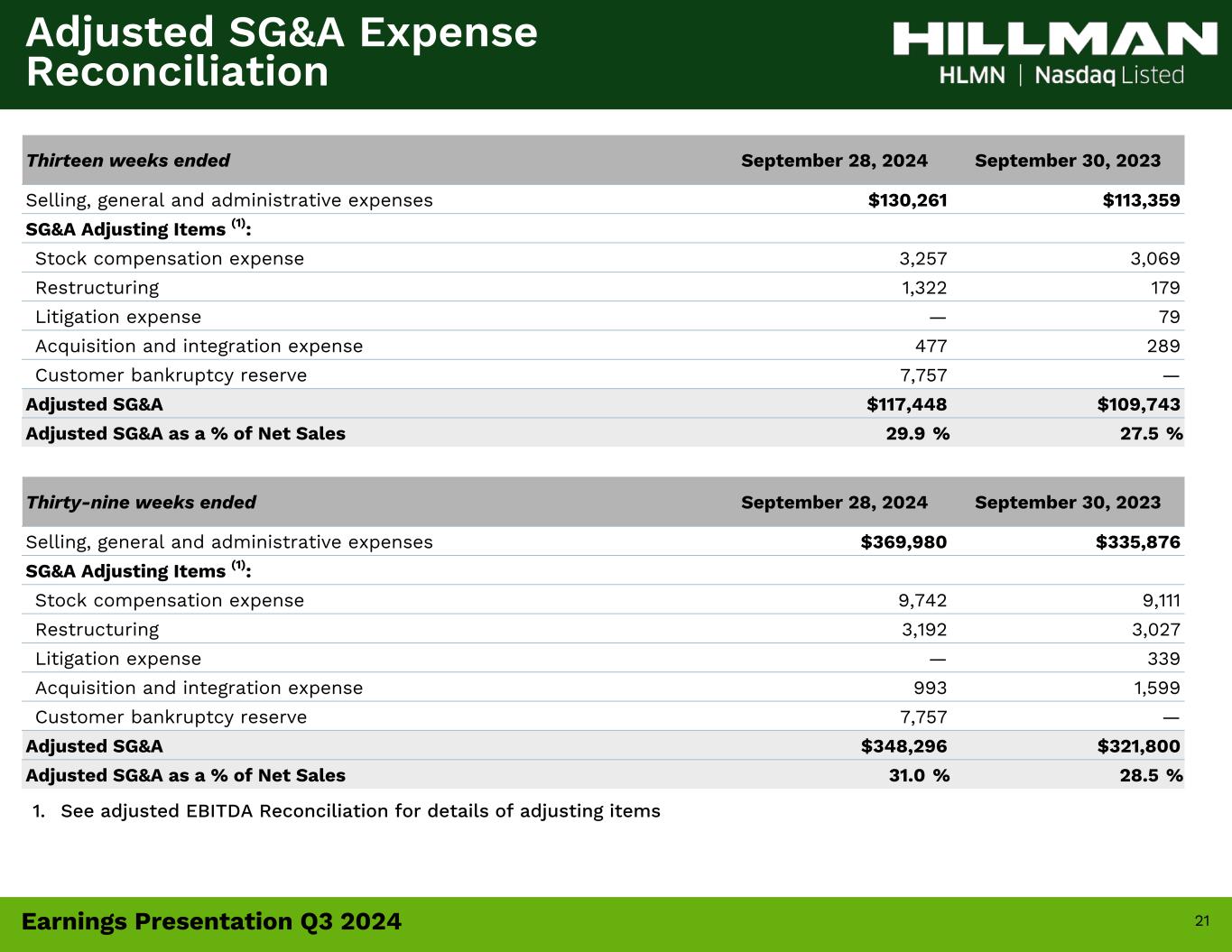

21Earnings Presentation Q3 2024 Thirteen weeks ended September 28, 2024 September 30, 2023 Selling, general and administrative expenses $130,261 $113,359 SG&A Adjusting Items (1): Stock compensation expense 3,257 3,069 Restructuring 1,322 179 Litigation expense — 79 Acquisition and integration expense 477 289 Customer bankruptcy reserve 7,757 — Adjusted SG&A $117,448 $109,743 Adjusted SG&A as a % of Net Sales 29.9 % 27.5 % Thirty-nine weeks ended September 28, 2024 September 30, 2023 Selling, general and administrative expenses $369,980 $335,876 SG&A Adjusting Items (1): Stock compensation expense 9,742 9,111 Restructuring 3,192 3,027 Litigation expense — 339 Acquisition and integration expense 993 1,599 Customer bankruptcy reserve 7,757 — Adjusted SG&A $348,296 $321,800 Adjusted SG&A as a % of Net Sales 31.0 % 28.5 % Adjusted SG&A Expense Reconciliation 1. See adjusted EBITDA Reconciliation for details of adjusting items

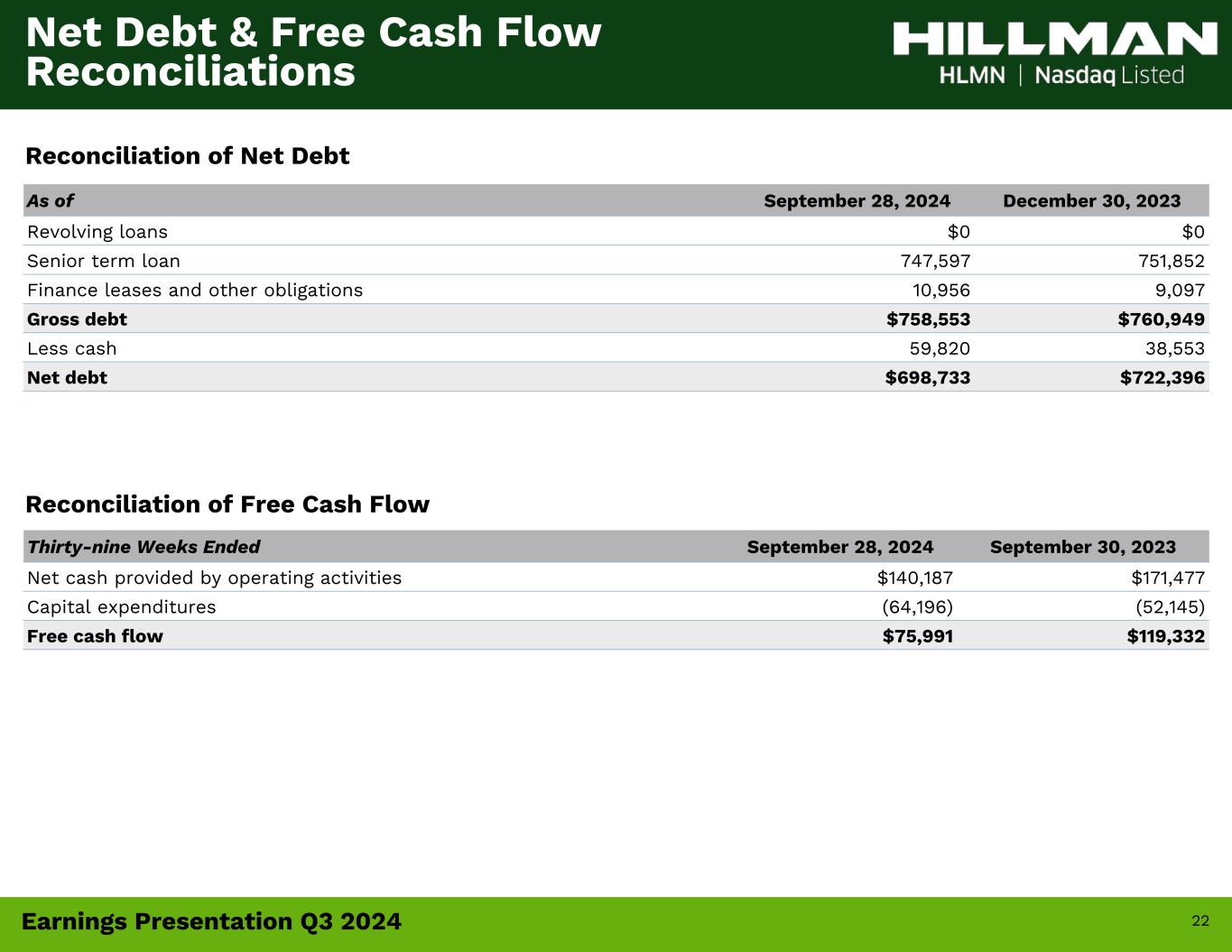

22Earnings Presentation Q3 2024 As of September 28, 2024 December 30, 2023 Revolving loans $0 $0 Senior term loan 747,597 751,852 Finance leases and other obligations 10,956 9,097 Gross debt $758,553 $760,949 Less cash 59,820 38,553 Net debt $698,733 $722,396 Net Debt & Free Cash Flow Reconciliations Thirty-nine Weeks Ended September 28, 2024 September 30, 2023 Net cash provided by operating activities $140,187 $171,477 Capital expenditures (64,196) (52,145) Free cash flow $75,991 $119,332 Reconciliation of Net Debt Reconciliation of Free Cash Flow

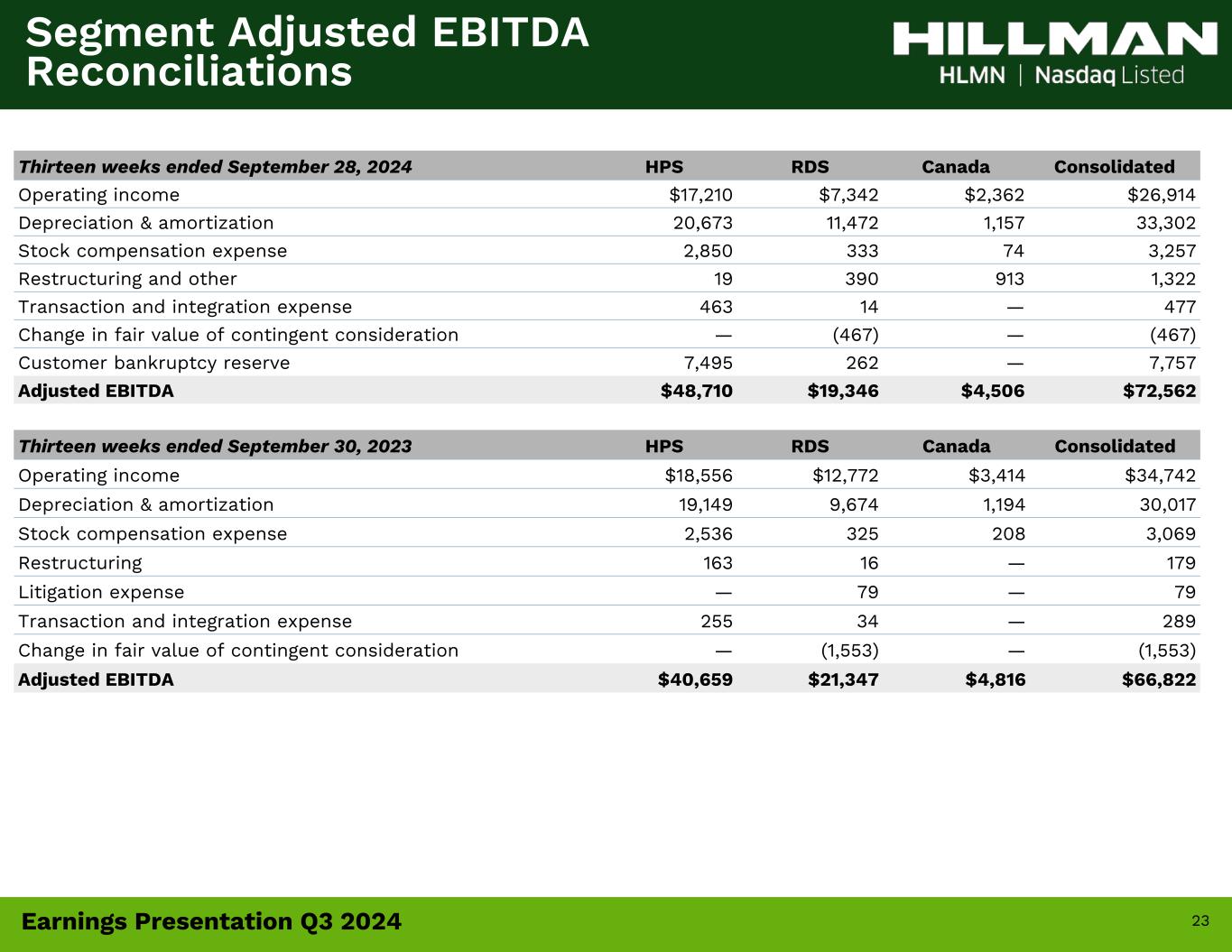

23Earnings Presentation Q3 2024 Thirteen weeks ended September 28, 2024 HPS RDS Canada Consolidated Operating income $17,210 $7,342 $2,362 $26,914 Depreciation & amortization 20,673 11,472 1,157 33,302 Stock compensation expense 2,850 333 74 3,257 Restructuring and other 19 390 913 1,322 Transaction and integration expense 463 14 — 477 Change in fair value of contingent consideration — (467) — (467) Customer bankruptcy reserve 7,495 262 — 7,757 Adjusted EBITDA $48,710 $19,346 $4,506 $72,562 Thirteen weeks ended September 30, 2023 HPS RDS Canada Consolidated Operating income $18,556 $12,772 $3,414 $34,742 Depreciation & amortization 19,149 9,674 1,194 30,017 Stock compensation expense 2,536 325 208 3,069 Restructuring 163 16 — 179 Litigation expense — 79 — 79 Transaction and integration expense 255 34 — 289 Change in fair value of contingent consideration — (1,553) — (1,553) Adjusted EBITDA $40,659 $21,347 $4,816 $66,822 Segment Adjusted EBITDA Reconciliations

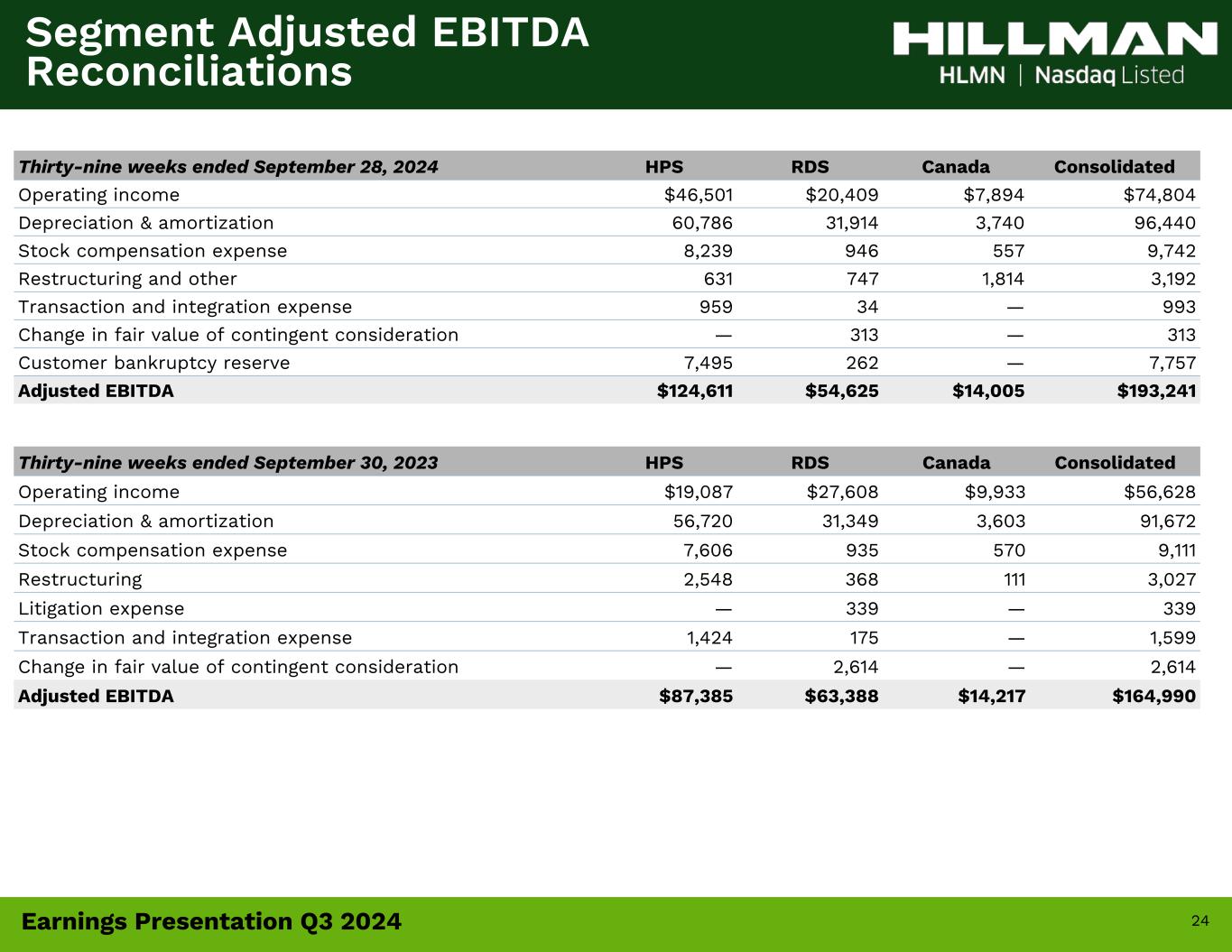

24Earnings Presentation Q3 2024 Thirty-nine weeks ended September 28, 2024 HPS RDS Canada Consolidated Operating income $46,501 $20,409 $7,894 $74,804 Depreciation & amortization 60,786 31,914 3,740 96,440 Stock compensation expense 8,239 946 557 9,742 Restructuring and other 631 747 1,814 3,192 Transaction and integration expense 959 34 — 993 Change in fair value of contingent consideration — 313 — 313 Customer bankruptcy reserve 7,495 262 — 7,757 Adjusted EBITDA $124,611 $54,625 $14,005 $193,241 Thirty-nine weeks ended September 30, 2023 HPS RDS Canada Consolidated Operating income $19,087 $27,608 $9,933 $56,628 Depreciation & amortization 56,720 31,349 3,603 91,672 Stock compensation expense 7,606 935 570 9,111 Restructuring 2,548 368 111 3,027 Litigation expense — 339 — 339 Transaction and integration expense 1,424 175 — 1,599 Change in fair value of contingent consideration — 2,614 — 2,614 Adjusted EBITDA $87,385 $63,388 $14,217 $164,990 Segment Adjusted EBITDA Reconciliations