10-K: Annual report pursuant to Section 13 and 15(d)

Published on February 22, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

For the fiscal year ended December 30 , 2023

FOR THE TRANSITION PERIOD FROM _____ TO _____

Commission file number 001-39609

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

||||

| , | ||||||||||||||||||||

| (Address of principal executive offices) | (Zip Code) | |||||||||||||||||||

Registrant's telephone number, including area code: (513 ) 851-4900

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

| Common Stock, par value $0.0001 per share | HLMN | The Nasdaq Stock Market LLC | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b‑2 of the Exchange Act. (Check one):

| ☒ | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ (Do not check if a smaller reporting company) | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b) ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting stock held by non-affiliates of the registrant as of July 1, 2023, the last business day of the registrant's most recently completed second fiscal quarter, was $1,741 million based upon the closing price reported for such date on the Nasdaq Global Select Market.

On February 20, 2024, 195,181,953 shares of common stock, par value $0.0001 per share, were issued and outstanding.

Documents Incorporated by Reference: Part III of this 10-K incorporates by reference certain information from the registrants definitive Proxy Statement for the 2024 Annual Meeting of Stockholders.

| TABLE OF CONTENTS | ||||||||

| PART I | ||||||||||||||

| FORWARD-LOOKING STATEMENTS | ||

This annual report contains certain forward-looking statements, including, but not limited to, certain disclosures related to acquisitions, refinancing, capital expenditures, resolution of pending litigation, and realization of deferred tax assets, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements.

All forward-looking statements are made in good faith by the Company and are intended to qualify for the safe harbor from liability established by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. You should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," “target”, “goal”, "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) unfavorable economic conditions that may affect operations, financial condition and cash flows including spending on home renovation or construction projects, inflation, recessions, instability in the financial markets or credit markets; (2) increased supply chain costs, including raw materials, sourcing, transportation and energy; (3) the highly competitive nature of the markets that we serve; (4) the ability to continue to innovate with new products and services; (5) direct and indirect costs associated with the May 2023 ransomware attack, and our receipt of expected insurance receivables associated with that cyber security incident; (6) seasonality; (7) large customer concentration; (8) the ability to recruit and retain qualified employees; (9) the outcome of any legal proceedings that may be instituted against the Company; (10) adverse changes in currency exchange rates; or (11) regulatory changes and potential legislation that could adversely impact financial results. The foregoing list of factors is not exclusive, and readers should also refer to those risks that are included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including this Annual Report on Form 10-K. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward looking statements.

Except as required by applicable law, the Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this communication to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

| ITEM 1 - BUSINESS. | ||

General

Hillman Solutions Corp. and its wholly-owned subsidiaries (collectively, “Hillman” or “Company”) are one of the largest providers of hardware-related products and related merchandising services to retail markets in North America. Our principal business is operated through our wholly-owned subsidiary, Hillman, which had net sales of approximately $1,476.5 million in 2023. Hillman sells its products to hardware stores, home centers, mass merchants, pet supply stores, and other retail outlets principally in the United States, Canada, Mexico, Latin America, and the Caribbean. Product lines include thousands of small parts such as fasteners and related hardware items; threaded rod and metal shapes; keys and accessories; builder's hardware; personal protective equipment, such as gloves and eye-wear; and identification items, such as tags and letters, numbers, and signs. We support product sales with services that include design and installation of merchandising systems, maintenance of appropriate in-store inventory levels, and break-fix for our robotics kiosks.

2| December 30, 2023 Form 10-K

|

||||||||

Hillman's corporate headquarters is located at 1280 Kemper Meadow Drive, Cincinnati, Ohio. We maintain a website at www.hillmangroup.com. Information contained or linked on our website is not incorporated by reference into this annual report and should not be considered a part of this annual report.

History

In 1964, Max Hillman established Hillman Bolt & Screw Corporation in Cincinnati, Ohio when he purchased a franchise operation from Sharon Bolt & Screw, a hardware fastener company. Max began distributing fasteners to independent hardware stores in southern Ohio and northern Kentucky, with a relentless commitment to service.

Max’s two sons, Mick Hillman and Rick Hillman, joined their father’s company in 1969, as Hillman’s customer base and distribution network continued to grow. In 1982, Hillman Bolt & Screw was purchased by Sun Distributors followed by Max’s retirement shortly thereafter. Mick and Rick took over the day-to-day operations of the business in 1984.

During the early 1990s, the Company developed its National Field Service Group, which today includes 1,100 field service and sales representatives, to manage the complex assortment of Hillman products on its customers’ shelves. Over the next three decades Hillman continued to win new business, expanding from traditional hardware stores to big box and home improvement retailers, and into adjacent product categories through multiple strategic acquisitions.

During the 2000s, Hillman was purchased three separate times by private equity firms (2001, 2004 and 2010). During 2012 and 2013, Rick and Mick Hillman retired, respectively, after more than 40 years of actively managing the Company. Thereafter in 2014, CCMP Capital Advisors acquired the majority interest in Hillman. In 2021, Hillman became a publicly traded company, listing its shares on the Nasdaq stock exchange under the ticker symbol “HLMN” by virtue of a merger with a Special Purpose Acquisition Company ("SPAC"). See Note 3 - Merger Agreement of the Notes to Consolidated Financial Statements for additional information.

Hillman’s legacy of service has remained unchanged throughout its history, and it continues to take care of its customers first.

Nasdaq listing - 2021

During 2021, the Company began exploring ways to further expand is access to the capital markets by becoming a publicly traded entity. On July 14, 2021, privately held HMAN Group Holdings Inc. ("Old Hillman"), and Landcadia Holdings III, Inc. (“Landcadia” and after the Business Combination described herein, “New Hillman”), a SPAC, consummated the previously announced business combination (the “Closing”) pursuant to the terms of the Agreement and Plan of Merger, dated as of January 24, 2021 (as amended on March 12, 2021, the "Merger Agreement”). Unless the context indicates otherwise, the discussion of the Company and its financial condition and results of operations is with respect to New Hillman following the closing date and Old Hillman prior to the closing date. See Note 3 - Merger Agreement of the Notes to Consolidated Financial Statements for additional information.

In connection with the Closing, the Company entered into a new credit agreement (the “Term Credit Agreement”), which provided for a new funded term loan facility of $835.0 million and a delayed draw term loan facility of $200.0 million (of which $16.0 million was drawn). As of July 2023, the delayed draw term loan facility expired. The Company also entered into an amendment to their existing asset-based revolving credit agreement, extending the maturity and conformed certain provisions to the Term Credit Agreement. The proceeds of the funded term loans under the Term Credit Agreement and revolving credit loans under the ABL Credit Agreement were used, together with other available cash, to (1) refinance in full all outstanding term loans and to terminate all outstanding commitments under the credit agreement, dated as of May 31, 2018, (2) refinance outstanding revolving credit loans, and (3) redeem in full senior notes due July 15, 2022 (the “6.375% Senior Notes”). Additionally, we fully redeemed the 11.6% Junior Subordinated Debentures. In connection with the refinancing, we incurred a loss of $8.1 million and paid $38.7 million in financing fees, of which $21.0 million were recorded as a financing activity. See Note 9 - Long-Term Debt of the Notes to Consolidated Financial Statements for additional information.

Hillman Group

We are comprised of three separate operating business segments: (1) Hardware and Protective Solutions, (2) Robotics and Digital Solutions, and (3) Canada.

We provide products such as fasteners and related hardware items; threaded rod and metal shapes; keys, key duplication systems, and accessories; builder's hardware; personal protective equipment, such as gloves and eye-wear; and identification items, such as tags and letters, numbers, and signs to retail outlets, primarily hardware stores, home centers and mass merchants, pet supply stores, grocery stores, and drug stores. We complement our extensive product selection with regular retailer visits by our field sales and service organization.

3| December 30, 2023 Form 10-K

|

||||||||

We market and distribute a wide variety of Stock Keeping Units (“SKUs”) of small, hard-to-find and hard-to-manage hardware items. We function as a category manager for retailers and support these products with in-store service, high order fill rates, and rapid delivery of products sold. Sales and service representatives regularly visit retail outlets to review stock levels, reorder items in need of replacement, and interact with the store management to offer new product and merchandising ideas. Thousands of items can be actively managed with the retailer experiencing a substantial reduction of in-store labor costs and replenishment paperwork. Service representatives also assist in organizing the products in a consumer-friendly manner. We complement our broad range of products with merchandising services such as displays, product identification stickers, retail price labels, store rack and drawer systems, assistance in rack positioning and store layout, and inventory restocking services. We regularly refresh retailers' displays with new products and package designs utilizing color-coding to simplify the shopping experience for consumers and improve the attractiveness of individual store displays.

We operate from 22 strategically located distribution centers in North America and supplement our operations with third-party logistics providers to warehouse and ship customer orders in the certain areas.

Products and Suppliers

Our product strategy concentrates on providing total project solutions using the latest technology for common and unique home improvement projects. Our portfolio provides retailers the assurance that their shoppers can find the right product at the right price within an 'easy to shop' environment.

We currently manage a worldwide supply chain comprised of a large number of vendors, the largest of which accounted for approximately 8.3% of the Company's annual purchases and the top five of which accounted for approximately 17.9% of our annual purchases. Our vendor quality control procedures include on-site evaluations and frequent product testing. Vendors are also evaluated based on delivery performance and the accuracy of their shipments.

Hardware and Protective Solutions

Our Hardware and Protective Solutions segment includes a variety of product categories including: Fasteners; Builders Hardware; Wall Hanging, Threaded Rod and Metal Shapes; Letters, Numbers, and Signs ("LNS"); and Personal Protective Equipment.

Our Fastener business consists of three categories: core fasteners, construction fasteners, and anchors sold under a variety of brands including Hillman, Fas-n-Tite, Deck-Plus, and Power-Pro. Core fasteners include nuts, bolts, screws, washers, and specialty items. Construction fasteners include deck, drywall, metal screws, and both hand driven and collated nails. Anchors include hollow wall and solid wall items such as plastic anchors, toggle bolts, concrete screws, and wedge anchors.

Builders Hardware includes a variety of common household items such as coat hooks, door stops, hinges, gate latches, and decorative hardware. We market the builder's hardware products under the Hardware Essentials® brand and provide the retailer with innovation in both product and merchandising solutions. The Hardware Essentials® program utilizes modular packaging, color coding, and integrated merchandising to simplify the shopping experience for consumers. Colorful signs, packaging, and installation instructions guide the consumer quickly and easily to the correct product location in store, while digital content including pictures and videos assist the online journey. Hardware Essentials® provides retailers and consumers decorative upgrade opportunities through contemporary finishes and designs.

The Wall Hanging category includes traditional picture hanging hardware, primarily marketed under the OOK® and Hillman brands, and the High & Mighty® series of tool-free wall hangers, decorative hooks and floating shelves that was launched in 2017.

We are the leading supplier of Threaded Rod and Metal Shapes in the retail market. The SteelWorks® threaded rod product includes hot and cold rolled rod, both weldable and plated, as well as a complete offering of All-Thread rod in galvanized steel, stainless steel, and brass. The SteelWorks® program is carried by many top retailers, including Lowe's and Menard's, and through cooperatives such as Ace Hardware. In addition, we are the primary supplier of Metal Shapes to many wholesalers throughout the country.

LNS includes product lines that target both the homeowner and commercial user. Product lines within this category include individual and/or packaged letters, numbers, signs, safety related products (e.g. 911 signs), driveway markers, and a variety of sign accessories, such as sign frames.

Our expansive Personal Protective Equipment category covers many uses for DIYer ("Do It Yourself") around the house and for the professional at the job site. Our products can be found at leading retailers across North America.

We distribute a full assortment of work gloves under the Firm Grip®, True Grip®, and Gorilla Grip brands; automotive gloves including Grease Monkey®; Digz® gardening gloves and more; as well as cleaning and all-

4| December 30, 2023 Form 10-K

|

||||||||

purpose gloves. As a category leader in work gloves, our portfolio is founded on design and consumer driven innovation.

Our work-gear products consist of tool storage, knee pads, clothing, and other accessories sold under variety of brands including AWP®, McGuire Nicholas®, and Firm Grip®. The portfolio offers a “one stop shop” for leading retailers with an expansive assortment to meet the needs of both the pro and DIYer.

Our safety products include face masks and safety vests sold under a variety of brands including Firm Grip®, AWP®, and Premium Defense®. Focusing on innovative materials, intuitive design, and industry trends, we expect growth in the Hardware and Protective Solutions segment.

Hardware and Protective Solutions generated approximately $1,074.6 million, $1,068.7 million and $1,017.6 million of revenues in the years ended December 30, 2023, December 31, 2022, and December 25, 2021, respectively.

Robotics and Digital Solutions

Our Robotics and Digital Solutions segment consists primarily of software-enabled robotic key duplication and engraving solutions that are tailored to the unique needs of the consumer. Robotics and Digital Solutions products are located in high-traffic environments where retailers can provide consumers with on-the-spot, customized licensed and unlicensed key and engraving options. Our offerings include store associate assisted key duplication and self-service robotic engraving and key duplication kiosks; together with related software, systems, keys, and key accessories sold in proximity to the kiosks. Our services include product and category management, merchandising services, and access to our proprietary robotic key duplicating and engraving software platforms and equipment.

We design and manufacture proprietary software and equipment in our Boulder, Colorado and Tempe, Arizona facilities; housing the cornerstone for our key duplication business. Our key duplication system is offered in various retail channels including mass merchants, home centers, automotive parts retailers, franchise and independent hardware stores, and grocery/drug chains. We believe we provide the most diverse key duplication systems in the industry, through our unique combination of self-service kiosk technology and store associate assisted duplication systems. Equipment diversity allows us to meet the individual needs of retailers. Our self-service solutions are driven by our MinuteKey technology, while store associate assisted duplication currently uses the state-of-the-art KeyKrafter® equipment and other legacy duplication machines.

Our MinuteKey self-service kiosk uses robotics technology in an innovative way that is accurate, easy to use, convenient, fast and highly reliable. We utilize a proprietary network integration software within our MinuteKey kiosks to maintain high levels of machine up-time and ensure machines have the optimal mix of key types available for duplication. The kiosk is completely self-service and has a 100% customer satisfaction guarantee. We manufacture and support the MinuteKey kiosk out of our Boulder, Colorado and Tempe, Arizona facilities.

Hillman KeyKrafter® is our most popular, innovative, and effective store associate assisted key duplication kiosk. It provides significant reduction in duplication time while increasing accuracy and ease of use for unskilled store associates. Additionally, with the KeyKrafter® solution, the capability exists for consumers to securely store and retrieve digital back-ups of their key without the original through the revolutionary Hillman KeyHero® Technology. Our Precision Laser Key System™ uses a digital optical camera, lasers, and proprietary software to scan a customer’s key. The system identifies the key and retrieves the key’s specifications, including the appropriate blank and cutting pattern, from a comprehensive database. This technology automates nearly every aspect of key duplication and provides the ability for every store associate to cut a key accurately. In the automotive key space, we offer the SmartBox Automotive Key Programmer which is a tool to quickly and easily pair transponder keys, remotes, and smart keys.

We retain ownership of the key duplicating equipment and market and sell keys and key accessories. Our proprietary key offering features the universal blank which uses a “universal” keyway to replace up to five original equipment keys. We continually refresh the retailer’s key offerings by introducing decorated and licensed keys and accessories. Our key offering features decorative themes of art and popular licenses such as NFL, Disney, Breast Cancer Awareness, and Marvel to increase personalization, purchase frequency and average transaction value per key. We also market a successful line of decorative and licensed lanyards and other key accessories.

All of our key duplication systems are supported by a dedicated in store kiosk sales and service team.

In our engraving business, we supply a variety of innovative options of consumer-operated robotic kiosks such as Quick-Tag®, TagWorks®, and FIDO® for engraving specialty items such as pet identification tags, luggage tags, and other engraved identification tags. We have developed unique engraving systems leveraging state-of-the-art technologies to provide a customized solution for mass merchant, pet supply retailers, and other high traffic areas such as theme parks, all supported by our in store kiosk field service technicians. We design, engineer, manufacture, and assemble the engraving kiosks in our Boulder, Colorado and Tempe, Arizona facilities.

Our engraving business focuses on the growing consumer spending trends surrounding personalized and pet identification. Innovation has played a major role in the development of our engraving business unit. From the

5| December 30, 2023 Form 10-K

|

||||||||

original Quick-Tag® consumer-operated kiosk system to the proprietary laser system of TagWorks®, we continue to lead the industry with consumer-friendly engraving solutions. As in our key business, we retain ownership of the key engraving equipment and market and sell blank tags.

Robotics and Digital Solutions generated approximately $245.4 million, $245.6 million, and $246.5 million of revenues in the years ended December 30, 2023, December 31, 2022, and December 25, 2021, respectively.

Canada

Our Canada segment distributes fasteners and related hardware items, threaded rod, keys, key duplicating systems, accessories, and identification items, such as tags and letters, numbers, and signs to hardware stores, home centers, mass merchants, industrial distributors, automotive aftermarket distributors, and other retail outlets and industrial Original Equipment Manufacturers (“OEMs”) in Canada. The product lines offered in our Canada segment are consistent with the product offerings detailed in our other segments. The Canada segment also produces made to order screws and self-locking fasteners for automotive suppliers, OEMs, and industrial distributors.

In the first quarter of 2023, the Company realigned its Canada segment to include the Canada portions of the Protective Solutions and MinuteKey businesses, which are now operating under the Canada segment leadership team. Previously, the results of the Canada portion of the Protective Solutions business were reported in the Hardware and Protective Solutions segment and the Canada portion of the MinuteKey business was reported in the Robotics and Digital Solutions segment and were operating under those respective segment leadership teams.

Our Canada segment generated approximately $156.5 million, $172.0 million and $161.9 million of revenues in the years ended December 30, 2023, December 31, 2022, and December 25, 2021, respectively.

Markets and Customers

We sell our products to national accounts such as Home Depot, Lowe’s, Menard’s, PETCO, PetSmart, Tractor Supply, and Walmart. Our status as a national supplier of proprietary products to big box retailers allows us to develop a strong market position and high barriers to entry within our product categories.

We service a wide variety of franchise and independent retail outlets. These individual dealers are typically members of the larger cooperatives, such as Ace Hardware, True Value, and Do-It-Best. We ship directly to the cooperative's retail locations and also supply many items to the cooperative's central warehouses. These central warehouses distribute to their members that do not have a requirement for Hillman's in-store service. These arrangements reduce credit risk and logistic expenses for us while also reducing central warehouse inventory and delivery costs for the cooperatives.

A typical hardware store maintains thousands of different items in inventory, many of which generate small dollar sales but large profits. It is difficult for a retailer to economically monitor all stock levels and to reorder the products from multiple vendors. This problem is compounded by the necessity of receiving small shipments of inventory at different times and stocking the goods. The failure to have these small items available will have an adverse effect on store traffic, thereby possibly denying the retailer the opportunity to sell items that generate higher dollar profits.

We sell our products to a large volume of customers, the top two of which accounted for approximately $640.4 million, or approximately 43% of our total revenues in 2023. For the year ended December 30, 2023, Home Depot was the single largest customer, representing approximately $344.1 million or 23.3% of our total revenues. Lowe's was the second largest at approximately $296.3 million or 20.1%. No other customer accounted for more than 10% of total revenue in 2023. In each of the years ended December 30, 2023, December 31, 2022, and December 25, 2021, we derived over 10% of our total revenues from Lowe's and Home Depot which operated in each of our operating segments. See Note 20 - Concentration of Credit Risks of the Notes to Consolidated Financial Statements for additional information.

Hillman continues to expand its B2B eCommerce platform allowing certain customers to order online through the Company’s website, www.hillmangroup.com. The B2B eCommerce platform features many of our items available for sale online and over thousands of customers are enrolled with the online ordering platform. We continue to support direct-to-store and direct-to-consumer fulfillment for consumers who choose to order fasteners directly from retailers' websites.

Sales and Marketing

We believe that our primary competitive advantage is rooted in our ability to provide a greater level of customer service than our competitors. We partner with our customers to understand the unmet needs of consumers, design creative solutions, and commercialize those solutions, bringing them to life in both physical and digital channels through a tight alignment between the product management, marketing communications, and channel

6| December 30, 2023 Form 10-K

|

||||||||

marketing functions. We provide best in class support and customer service at every touch point for our retail partners. Service is the hallmark of Hillman company-wide, employing 1,102 full-time and 124 part-time people on our sales and service team. The national accounts field service organization consists of approximately 742 employees and 73 field managers focusing on big box retailers, pet super stores, large national discount chains, and grocery stores. This organization reorders products, details store shelves, and sets up in-store promotions. Many of our largest customers use Electronic Data Interchange (“EDI”) for processing of orders and invoices.

We employ what we believe to be the largest direct sales force in the industry. The sales force, which consists of approximately 254 employees and is managed by 33 field managers, focuses on the franchise and independent customers. The depth of the sales and service team enables us to maintain consistent call cycles ensuring that all customers experience proper stock levels and inventory turns. This team also prepares custom plan-o-grams of displays to fit the needs of any store and establishes programs that meet customers' requirements for pricing, invoicing, and other needs. This group also benefits from daily internal support from our inside sales and customer service teams. On average, each sales representative is responsible for approximately 61 full service accounts that the sales representative calls on approximately every two weeks. These efforts allow the sales force to sell and support our product lines.

Competition

Our primary competitors in the national accounts marketplace for fasteners are Primesource Building Products, Inc., Midwest Fastener Corporation, Illinois Tool Works Inc., Spectrum Brands, and competition from direct import by our customers. Our national competitors for gloves and personal protective equipment include Techtronic Industries, West Chester Protective Gear, PIP, Iron Clad, and MidWest Quality Gloves, Inc. Competition is primarily based on sourcing and price. We believe our product innovation and in store merchandising service create a more compelling and unique experience for both the consumer and our customers. Other competitors are local and regional distributors. Competitors in the pet tag market are specialty retailers, direct mail order, and retailers with in-store mail order capability. The Quick-Tag®, FIDO®, and TagWorks® systems have patent protected technology that is a major barrier to entry and helps to preserve this market segment.

The principal competitor for our franchise and independent hardware store customers is Midwest Fastener Corporation. The hardware outlets that purchase our products without regularly scheduled sales representative visits may also purchase products from local and regional distributors and cooperatives. We compete primarily on field service, merchandising, as well as product availability and price, and depth of product line.

Insurance Arrangements

Under our current large deductible insurance programs, we retain the exposure on certain expected losses related to workers' compensation, general liability, and automobile claims up to the applicable deductibles. Our primary and umbrella policies provide coverage for catastrophic exposure and aggregate losses in excess of applicable deductibles. We also retain the exposure on expected losses related to health benefits of certain employees. We believe that our present insurance is adequate for our businesses. See Note 18 - Commitments and Contingencies, of the Notes to Consolidated Financial Statements.

Human Capital Resources

Employees

As of December 30, 2023, we had 3,801 full time and part time employees, none of which were covered by a collective bargaining agreement. In our opinion, employee relations are good.

Health and Safety

Employee health and safety is a top priority in all aspects of our business. We are committed to providing a healthy environment and safe workplace at all our facilities and in the field. Our dedicated Safety Team oversees our health & safety program and procedures. We implement robust safety protocols across all operations, maintain a Safety Compliance Program, and regularly conduct self-assessments to examine our safety culture and processes.

| SAFETY MEASURE | HILLMAN | |||||||

Total Recordable Incident Rate (TRIR) |

2.21 | |||||||

Lost-Time Incident Rate (LTIR)1

|

0.45 | |||||||

1 Data spans 12 months between January 2023 and December 2023.

7| December 30, 2023 Form 10-K

|

||||||||

Attraction, Development, and Retention

The success of our efforts to grow our business depends on the contributions and abilities of key executives, our sales force, and other personnel. Our Human Resources department leads the search to reach a diverse talent pool. We have a standard framework for posting jobs, interviewing for open positions, and onboarding new employees. We offer employees resources to continuously improve their skills and performance with the goal of further cultivating the diverse talent on our team. We seek people who are demonstrate our core values: absolute integrity, accountability to our team and customers, the ability to build on difference, trust and respect.

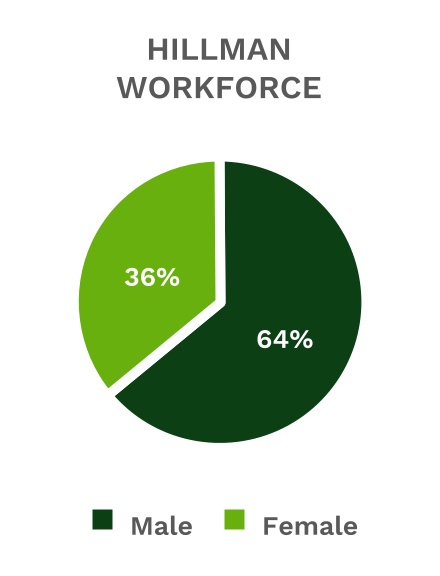

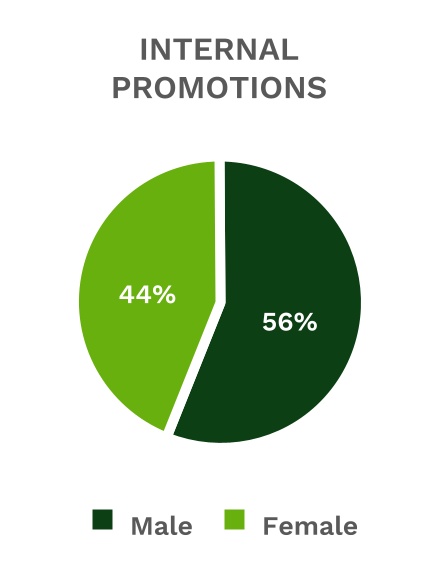

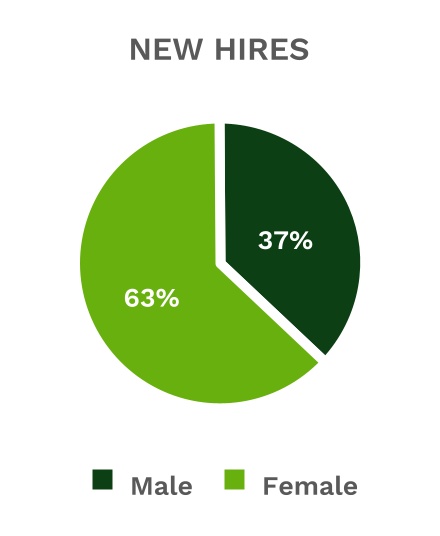

Diversity and Inclusion

We are committed to actions that build an inclusive and equitable workplace where diversity is valued and leveraged. We ask our employees to bring their authentic selves to work every day and this shows in both our products and our services. We are committed to creating equal opportunities for employment, and creating inclusive and diverse workplaces that allow our team to perform to their fullest potential.

Backlog

We do not consider the sales backlog to be a significant indicator of future performance due to the short order cycle of our business. Our sales backlog from ongoing operations was approximately $19.9 million as of December 30, 2023 and approximately $24.6 million as of December 31, 2022. We expect to realize the entire December 30, 2023 backlog during fiscal 2024.

Where You Can Find More Information

We file quarterly reports on Form 10-Q and annual reports on Form 10-K and furnish current reports on Form 8-K and other information with the Securities and Exchange Commission (the “Commission”). The Commission also maintains an Internet site at www.sec.gov that contains quarterly, annual, and current reports, proxy and information statements, and other information regarding issuers, like Hillman, that file electronically with the Commission.

In addition, our quarterly reports on Form 10-Q, annual reports on Form 10-K, current reports on Form 8-K, and all amendments to those reports, are available free of charge on our website at www.hillmangroup.com as soon as reasonably practicable after such reports are electronically filed with the Commission. We are providing the address to our website solely for the information of investors. We do not intend the address to be an active link or to incorporate the contents of the website into this report.

8| December 30, 2023 Form 10-K

|

||||||||

| ITEM 1A - RISK FACTORS. | ||

You should carefully consider the following risks. However, the risks set forth below are not the only risks that we face, and we face other risks which have not yet been identified or which are not yet otherwise predictable. If any of the following risks occur or are otherwise realized, our business, financial condition, and results of operations could be materially adversely affected. You should carefully consider the risks described below and all other information in this Annual Report on Form 10-K, including our Consolidated Financial Statements and the related Notes to Consolidated Financial Statements and schedules thereto.

Risks Relating to Our Products and Demand for our Products:

Our sales are dependent upon the health and stability of the general economy. Adverse changes in economic factors specific to the home improvement industry may adversely affect our sales and financial performance.

Many North American and global economic factors may adversely affect our financial performance. These include, but are not limited to, periods of slow economic growth or recession, home price appreciation or decreasing housing turnover, volatility and/or lack of liquidity from time to time in U.S. and world financial markets and the consequent reduced availability and/or higher cost of borrowing to Hillman, its customers, and consumers, slower rates of growth in real disposable personal income that could affect the rate of growth in consumer spending, inflation and its impacts on discretionary spending and on our costs, shortages, and other disruptions in the labor supply, consumer debt levels, changes in tax rates and policy, outbreak of pandemics, fluctuations in fuel and energy costs, inflation or deflation of commodity prices, natural disasters, armed conflicts, and acts of both domestic and international terrorism.

Sales of many of our products are driven by the activity level of home repair and remodel projects. Our customers, suppliers, and other parties with whom we do business are also impacted by the foregoing conditions and adverse changes may result in financial difficulties leading to restructurings, bankruptcies, liquidations, and other unfavorable events for our customers, consumers, suppliers, and other service providers. Adverse trends in any of the foregoing factors could reduce our sales, adversely impact the mix of our sales, or increase our costs, which could have a material adverse effect on our business, financial condition and results of operations.

Large customer concentration and the inability to penetrate new channels of distribution could adversely affect our business.

Our two largest customers constituted approximately $640.4 million of net sales and $35.3 million of the year-end accounts receivable balance for 2023. Both of these customers are big box chain stores. Our results of operations depend greatly on our ability to maintain existing relationships and arrangements with these big box chain stores. To the extent that the big box chain stores are materially adversely impacted by the changing retail landscape, this could have a negative effect on our results of operations. These two customers have been key components of our growth and failure to maintain fulfillment and service levels or relationships with these customers could result in a material loss of business. Our inability to penetrate new channels of distribution, including ecommerce, may also have a negative impact on our future sales and business. (See Note 20 - Concentration of Credit Risks of the Notes to Consolidated Financial Statements for additional information).

To compete successfully, we must develop and commercialize a continuing stream of innovative new products that create consumer demand.

Our long-term success in the current competitive environment depends on our ability to develop and commercialize a continuing stream of innovative new products, including those in our new mass merchant fastener program, which create and maintain consumer demand. We also face the risk that our competitors will introduce innovative new products that compete with our products. Our strategy includes increased investment in new product development and continued focus on innovation. There are, nevertheless, numerous uncertainties inherent in successfully developing and commercializing innovative new products on a continuing basis, and new product launches may not provide expected growth results.

9| December 30, 2023 Form 10-K

|

||||||||

Acquisitions have formed a significant part of our growth strategy in the past and may continue to do so. If we are unable to identify suitable acquisition candidates, successfully integrate an acquired business, or obtain financing needed to complete an acquisition, our growth strategy may not succeed.

Historically, our growth strategy has relied in part on acquisitions that either expand or complement our businesses and/or product offerings in new or existing markets. However, there can be no assurance that we will be able to identify or acquire acceptable acquisition candidates on terms favorable to us and in a timely manner.

The process of integrating acquired businesses into our operations may result in unforeseen difficulties and may require a disproportionate amount of resources and management attention, and there can be no assurance that we will be able to successfully integrate acquired businesses into our operations. Additionally, we may not achieve the anticipated benefits from any acquisition.

Unfavorable changes in the current economic environment may make it difficult to acquire businesses in order to further our growth strategy. We will continue to seek acquisition opportunities both to expand into new markets and to enhance our position in our existing markets. However, our ability to do so will depend on a number of factors, including our ability to obtain financing that we may need to complete a proposed acquisition opportunity which may be unavailable or available on terms that are not advantageous to us. If financing is unavailable or on unfavorable terms, we may be forced to forego otherwise attractive acquisition opportunities which may have a negative effect on our ability to grow.

Risks Related to our Operations:

Our results of operations could be negatively impacted by inflation or deflation in supply chain costs, including raw materials, sourcing, transportation and energy.

Many of our products are manufactured out of metals, including but not limited to steel, aluminum, zinc, and copper. Additionally, we use other commodity-based materials in the manufacture of Letters, Numbers, and Signs (“LNS”) that are resin-based and subject to fluctuations in the price of oil. We source the majority of our products from third parties and are subject to changes in their underlying manufacturing costs. We also use third parties for transportation and are exposed to fluctuations in freight costs to transport goods from our suppliers to our distribution facilities and to our customers, as well as the price of diesel fuel in the form of freight surcharges on customer shipments and the cost of gasoline used by the field sales and service force. Inflation in these costs could result in significant cost increases. If we are unable to mitigate any cost increases from the foregoing factors through various customer pricing actions and cost reduction initiatives, our financial condition may be adversely affected. Conversely, in the event that there is deflation, we may experience, and in fact have experienced, pressure from our customers to reduce prices. There can be no assurance that we would be able to reduce our cost base (through negotiations with suppliers or other measures) to offset any such price concessions which could adversely impact our results of operations and cash flows.

Our business is subject to risks associated with sourcing product from overseas.

We import a majority of our products and rely on foreign sources, primarily China and Taiwan, to meet our supply demands at prices that support our current operating margins. Substantially all of our import operations are subject to customs requirements, tariffs, and quotas set by governments through mutual agreements or unilateral actions. The U.S. tariffs on steel, aluminum, and other imported goods have materially increased the costs of many of our foreign sourced products, and any escalation in the tariffs will increase the impact. In order to sustain current operating margins while the tariffs are in effect, we must be able to increase prices with our customers and find alternative, similarly priced sources that are not subject to the tariffs. If we are unable to effectively implement these countermeasures, our operating margins will be impacted.

In addition, the countries from which our products and materials are manufactured or imported may, from time to time, impose additional quotas, duties, tariffs, or other restrictions on their imports or adversely modify existing restrictions. Adverse changes in these import costs and restrictions, or our suppliers' failure to comply with customs regulations or similar laws, could harm our business.

If any of our existing vendors fail to meet our needs, we believe that sufficient capacity exists in the open market to supply any shortfall that may result. However, it is not always possible to replace a vendor on short notice without disruption in our operations, which may require more costly expedited transportation expense and replacement of a major vendor is often at higher prices.

Our ability to import products in a timely and cost-effective manner may also be affected by conditions at ports or issues that otherwise affect transportation and warehousing providers, such as port and shipping capacity, high demand for ocean freight, labor disputes, severe weather, or increased homeland security requirements in the U.S. and other countries. These issues could delay importation of products, increase our transit costs, or require us to

10| December 30, 2023 Form 10-K

|

||||||||

locate alternative ports or warehousing providers to avoid disruption to customers. These alternatives may not be available on short notice or could result in higher transit costs, which could have an adverse impact on our business and financial condition.

Further, COVID-19 outbreaks could cause temporary closures or labor shortages at our facilities, the facilities of our suppliers, or other disruptions throughout our supply chain. This may adversely affect our results of operations, financial position, and cash flows.

Additionally, in recent years, tensions between mainland China and Taiwan have further escalated. Conflict between China and Taiwan could disrupt our supply chain, including limiting access to key ports, disrupting the operations of our suppliers, or resulting in potential international sanctions, all of which could adversely affect our results of operations or increase our costs.

We are subject to inventory management risks: insufficient inventory may result in increased costs, lost sales and lost customers, while excess inventory may increase our costs.

We balance the need to maintain inventory levels that are sufficient to maintain superior customer fulfillment levels against the risk and financial costs of carrying excess inventory levels. In order to successfully manage our inventories, we must estimate demand from our customers at the product level and timely purchase products in quantities that substantially correspond to that demand. If we overestimate demand and purchase too much of a particular product, we could have excess inventory handling costs, distribution center capacity constraints and inventory that we cannot sell profitably.

In addition, we may have to write down such inventory if we are unable to sell it for its recorded value. In fact, In the fourth quarter of 2023, we recorded inventory revaluation charges of $5.0 million in connection with exiting certain retail locations and markets for a product line. By contrast, if we underestimate demand and purchase insufficient quantities of a product, and/or do not maintain enough inventory of a product, we may not be able to fulfill customer orders on a timely basis which could result in fines, the loss of sales and ultimately loss of customers for those products as they turn to our competitors. Our business, financial condition and results of operations could suffer a material adverse effect if either or both of these situations occur frequently or in large volumes.

Because our business is working capital intensive, we rely on our ability to manage our product purchasing and customer credit policies.

Our operations are working capital intensive, and our inventories, accounts receivable, and accounts payable are significant components of our net asset base. We manage our inventories and accounts payable through our purchasing policies and our accounts receivable through our customer credit policies. In recent years, our lead times extended due to disruptions in the global supply chain. During 2021 and 2022, we saw increased lead times for ocean freight from Asia, and we had to increase our inventory levels to maintain our high fill rates with our customers, which has increased our inventory costs and reduced our profitability. Our lead times and inventory levels normalized in 2023. However, there are no assurances that lead times will not increase in the future, and in such event our working capital and financial condition may be adversely affected. If we fail to adequately manage our product purchasing or customer credit policies, our working capital and financial condition may be adversely affected.

We are subject to the risks of doing business internationally.

A portion of our revenue is generated outside the United States, primarily from customers located in Canada, Mexico, Latin America, and the Caribbean. Because we sell our products and services outside the United States, our business is subject to risks associated with doing business internationally, which include:

•changes in a specific country's or region's political and cultural climate or economic condition;

•unexpected or unfavorable changes in foreign laws and regulatory requirements;

•difficulty of effective enforcement of contractual provisions in local jurisdictions;

•inadequate intellectual property protection in foreign countries;

•the imposition of duties and tariffs and other trade barriers;

•trade-protection measures, import or export licensing requirements such as Export Administration Regulations promulgated by the U.S. Department of Commerce, Economic Sanctions Laws and Regulations administered by the Office of Foreign Assets Control, and fines, penalties, or suspension or revocation of export privileges;

•violations of the United States Foreign Corrupt Practices Act;

11| December 30, 2023 Form 10-K

|

||||||||

•the effects of applicable and potentially adverse foreign tax law changes;

•significant adverse changes in foreign currency exchange rates; and

•difficulties associated with repatriating cash in a tax-efficient manner.

Any failure to adapt to these or other changing conditions in foreign countries in which we do business could have an adverse effect on our business and financial results.

Risks Related to our Workforce:

Successful sales and marketing efforts depend on our ability to recruit and retain qualified employees.

The success of our efforts to grow our business depends on the contributions and abilities of key executives, our sales force, and other personnel, including the ability of our sales force to achieve adequate customer coverage. We must therefore continue to recruit, retain, and motivate management, sales, and other personnel to maintain our current business and to support our projected growth. A shortage of these key employees might jeopardize our ability to implement our growth strategy.

Increases in labor costs, potential labor disputes and work stoppages or an inability to hire skilled distribution, sales and other personnel could adversely affect our business.

An increase in labor costs, work stoppages or disruptions at our facilities or those of our suppliers or transportation service providers, or other labor disruptions, could decrease our sales and increase our expenses. In addition, although our employees are not represented by a union, our labor force may become subject to labor union organizing efforts, which could cause us to incur additional labor costs and increase the related risks that we now face.

A significant increase in the salaries and wages paid by competing employers could result in a reduction of our labor force, increases in the salaries and wages that we must pay, or both. If we are unable to hire warehouse, distribution, sales and other personnel, our ability to execute our business plan and our results of operations would suffer.

Risks Related to our Technology and Cybersecurity:

Our success is highly dependent on information and our technology systems, as well as those of our third party vendors and business partners.

We depend on our information systems, and those of our third party vendors and business partners, to process orders, to manage inventory and accounts receivable collections, to purchase, sell, and ship products efficiently and on a timely basis, to maintain cost-effective operations, and to provide superior service to our customers. If these systems are damaged, intruded upon, shutdown, or cease to function properly (whether by planned upgrades, force majeure, telecommunications failures, hardware or software break-ins or viruses, other cyber-security incidents, or otherwise), we may suffer disruption in our ability to manage and operate our business.

In late May 2023, we experienced a ransomware attack relating to certain systems on our network (the “Cybersecurity Incident”). The Cybersecurity Incident affected certain of our information technology systems, and as part of the containment effort, we suspended affected systems and elected to temporarily suspend additional systems in an abundance of caution. We reactivated and restored our operational systems over the course of the week following the Cybersecurity Incident. The Cybersecurity Incident related costs net of an expected insurance receivable totaled $1.0 million.

While we have taken measures designed to protect the security of our information and technology systems, and any information handled by these systems, including personal, sensitive, confidential, and proprietary information, there can be no assurance that the measures which we have adopted to protect against certain events that could disrupt the operations of our information systems will prevent the occurrence of such a disruption. Any such disruption could have a material adverse effect on our business and results of operations.

In addition, we plan to upgrade our existing information technology systems or choose to incorporate new technology systems from time to time in order for such systems to support our business. Costs and potential problems and interruptions associated with the implementation of new or upgraded systems and technology or with maintenance or adequate support of existing systems could disrupt or reduce the efficiency of our operations. Any such reduction in efficiency or disruption could have a material adverse effect on our business and results of operations.

12| December 30, 2023 Form 10-K

|

||||||||

Unauthorized disclosure of personal, sensitive or confidential customer, employee, supplier, or Company information, whether through a breach of our computer systems, or those of our third party vendors and business partners, including cyber-attacks or otherwise, could severely harm our business.

As part of our business, we collect, process, and retain personal, sensitive and confidential personal information about our customers, employees, and suppliers. Despite the security measures we have in place, our facilities and systems, and those of the retailers and other third party distributors with which we do business, may be vulnerable to security breaches, cyber-attacks, acts of vandalism, computer viruses, misplaced or lost data, programming and/or human errors, or other similar events. In fact, in late May 2023, we experienced a ransomware attack relating to certain systems on our network, as is more fully described on the preceding page, and some confidential personal information of our employees and selected dependents was accessed by the threat actor.

In addition, employees may intentionally or inadvertently cause the unauthorized access to or release of personal, sensitive, or confidential customer, employee, supplier or Company information. Because the techniques used to circumvent security systems can be highly sophisticated, change frequently, are often not recognized until launched against a target, and may originate from less regulated and remote areas around the world, we may be unable to proactively anticipate or address all possible techniques or implement adequate preventive measures for all situations.

Any security breach involving the misappropriation, loss, or other unauthorized disclosure of confidential customer, employee, supplier, or Company information, whether by us or by the retailers and other third party distributors and business partners with which we do business, could result in losses, severely damage our reputation, expose us to the risks of litigation and liability, disrupt our operations, and have a material adverse effect on our business, results of operations, and financial condition.

We anticipate that these threats will continue to grow in scope and complexity over time. Cybercrime and attacking techniques are constantly evolving, and we or our third party vendors and business partners may be unable to anticipate attempted security breaches, react in a timely manner, or implement adequate preventative measures, particularly given the increasing use of hacking techniques designed to circumvent controls, avoid detection, and remove or obfuscate forensic artifacts.

The regulatory environment related to information security, data collection, and privacy is increasingly rigorous, with new and constantly changing requirements applicable to our business, and compliance with those requirements could result in additional costs. As a result, our practices may not have complied in the past or may not comply now or in the future with all such laws, regulations, requirements and obligations. Our failure to take any steps perceived by the a regulatory body as appropriate to protect certain information may result in claims under various data privacy and security laws, which could severely impact our business.

Risks Related to Intellectual Property:

Failure to adequately protect intellectual property could adversely affect our business.

Intellectual property rights are an important and integral component of our business. We attempt to protect our intellectual property rights through a combination of patent, trademark, copyright, and trade secret laws, as well as licensing agreements and third-party nondisclosure and assignment agreements.

In the event that our trademarks or patents are successfully challenged and we lose the rights to use those trademarks or patents, or if we fail to prevent others from using them, we could experience reduced sales or be forced to redesign or rebrand our products, requiring us to devote resources to product development, advertising, and marketing new products and brands. In addition, we cannot be sure that any pending trademark or patent applications will be granted or will not be challenged or opposed by third parties or that we will be able to enforce our trademark rights against counterfeiters.

Failure to obtain or maintain adequate protection of our intellectual property rights for any reason could have a material adverse effect on our business, results of operations, and financial condition.

Our success depends in part on our ability to operate without infringing on or misappropriating the proprietary rights of others, and if we are unable to do so we may be liable for damages.

We cannot be certain that United States or foreign patents or patent applications of other companies do not exist or will not be issued that would prevent us from commercializing our products. Third parties may sue us, and in fact have sued us (see Item 3 - Legal Proceedings of this Annual Report and Note 18 - Commitments and Contingencies of the Notes to Consolidated Financial Statements for additional information), for infringing or misappropriating their patent or other intellectual property rights. Intellectual property litigation is costly. If we do

13| December 30, 2023 Form 10-K

|

||||||||

not prevail in litigation, in addition to any damages we might have to pay, we could be required to cease the infringing activity, obtain a license requiring us to make royalty payments, and/or enter into other settlement arrangements that temporarily preclude us from liability. It is possible that a required license may not be available to us on commercially acceptable terms, if at all. In addition, a required license may be non-exclusive, and therefore our competitors may have access to the same technology licensed to us. If we fail to obtain a required license or are unable to design around another company’s patent, we may be unable to make use of some of the affected products, which would reduce our revenue.

The defense costs and settlements for patent infringement lawsuits are not covered by insurance. Patent infringement lawsuits can take years to settle. If we are not successful in our defenses or are not successful in obtaining dismissals of any such lawsuit, legal fees or settlement costs could have a material adverse effect on our results of operations and financial position.

Recent changes in United States patent laws may limit our ability to obtain, defend, and/or enforce our patents.

The United States has recently enacted and implemented wide ranging patent reform legislation. The United States Supreme Court has ruled on several patent cases in recent years, either narrowing the scope of patent protection available in certain circumstances or weakening the rights of patent owners in certain situations. In addition to increasing uncertainty with regard to our ability to obtain patents in the future, this combination of events has created uncertainty with respect to the value of patents, once obtained. Depending on actions by the United States Congress, the United States federal courts, and the United States Patent and Trademark Office, the laws and regulations governing patents could change in unpredictable ways that could weaken our ability to obtain new patents or to enforce patents that we have licensed or that we might obtain in the future. Similarly, changes in patent law and regulations in other countries or jurisdictions, changes in the governmental bodies that enforce them or changes in how the relevant governmental authority enforces patent laws or regulations may weaken our ability to obtain new patents or to enforce patents that we have licensed or that we may obtain in the future.

Risks Relating to Our Indebtedness:

We have significant indebtedness that could affect operations and financial condition and prevent us from successfully executing our strategy.

We have a significant amount of indebtedness. On December 30, 2023, our total indebtedness was $760.9 million, of which, $751.9 million is indebtedness issued under the term loan facility, and $9.1 million is indebtedness under finance lease and other obligations. The Company also has an asset-based revolving credit facility with aggregate commitments of up to $375.0 million that does not have an outstanding balance, and aggregate availability of $246.8 million as of December 30, 2023, subject to customary asset-backed loan borrowing base and availability provisions.

Our substantial indebtedness could have important consequences. For example, it could:

•make it more difficult for us to satisfy obligations to holders of our indebtedness;

•increase our vulnerability to increases in interest rates;

•increase our vulnerability to general adverse economic and industry conditions;

•require the dedication of a substantial portion of cash flow from operations to payments on indebtedness, thereby reducing the availability of cash flow to fund working capital, capital expenditures, research and development efforts, and other general corporate purposes;

•limit flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

•place us at a competitive disadvantage compared to competitors that have less debt; and

•limit our ability to borrow additional funds.

In addition, the agreement governing our senior secured credit facilities contain financial and other restrictive covenants that limit our ability to engage in activities that may be in our long-term best interests. The failure to comply with those covenants could result in an event of default which, if not cured or waived, could result in the acceleration of all outstanding indebtedness.

Despite current indebtedness levels, we may still be able to incur substantially more debt. This could further exacerbate the risks associated with our substantial leverage.

We may be able to incur substantial additional indebtedness in the future. The terms of our senior secured credit facilities do not fully prohibit us from doing so. The senior secured credit facilities permit additional borrowing of

14| December 30, 2023 Form 10-K

|

||||||||

up to $246.8 million as of December 30, 2023, subject to customary asset-backed loan borrowing base and availability provisions. If new debt is added to our current debt levels, the related risks that we now face could intensify.

We rely on available borrowings under the Asset-Based Revolving credit facility (“ABL Revolver”) for cash to operate our business, and the availability of credit under the ABL Revolver may be subject to significant fluctuation.

In addition to cash we generate from our business, our principal existing source of cash is borrowings available under the ABL Revolver. Aggregate availability will be limited to the lesser of a borrowing base and $375.0 million. The borrowing base is calculated on a monthly (or more frequent under certain circumstances) valuation of our inventory, accounts receivable and certain cash balances. As a result, our access to credit under the ABL Revolver is potentially subject to significant fluctuation, depending on the value of the borrowing base-eligible assets as of any measurement date. The inability to borrow under the ABL Revolver may adversely affect our liquidity, financial position and results of operations. As of December 30, 2023, the ABL Revolver did not have an outstanding balance and had outstanding letters of credit of $40.9 million, with $246.8 million of available borrowings as a source of liquidity based on the customary asset-backed loan borrowing base and availability provisions.

We are subject to fluctuations in interest rates.

All of our indebtedness incurred under our senior secured credit facilities have variable interest rates. Increases in borrowing rates will increase our cost of borrowing, which may adversely affect our results of operations and financial condition. Our term loan and interest rate derivatives generally bear interest at a rate per annum equal to Daily Simple Secured Overnight Financing Rate (SOFR). We may, and have in the past, enter into interest rate derivatives that hedge risks related to floating for fixed rate interest payments in order to reduce interest rate volatility, however there are no assurances that we will do so, or that we will be able to do so on terms favorable to us. Further, we may choose not to maintain interest rate swaps with any of our variable rate indebtedness, or may only choose to maintain interest rate swaps with some, but not all, of our variable rate indebtedness.

The failure to meet certain financial covenants required by our credit agreements may materially and adversely affect assets, financial position, and cash flows.

Certain aspects of our credit agreements require the maintenance of a leverage ratio and limit our ability to incur debt, make investments, or undertake certain other business activities. In particular, our minimum allowed fixed charge coverage ratio requirement is 1.0x as of December 30, 2023. A breach of the covenant, or any other covenants, could result in an event of default under the credit agreements. Upon the occurrence of an event of default under the credit agreements, all amounts outstanding, together with accrued interest, could be declared immediately due and payable by our lenders. If this happens, our assets may not be sufficient to repay in full the payments due under the credit agreements. The current credit market environment and other macro-economic challenges affecting the global economy may adversely impact our ability to borrow sufficient funds or sell assets or equity in order to pay existing debt.

Volatility and weakness in bank and capital markets may adversely affect credit availability and related financing costs for us.

Bank and capital markets can experience periods of volatility and disruption. If the disruption in these markets is prolonged, our ability to refinance, and the related cost of refinancing, some or all of our debt could be adversely affected. Additionally, during periods of volatile credit markets, there is a risk that lenders, even those with strong balance sheets and sound lending practices, could fail or refuse to honor their legal commitments and obligations under existing credit commitments. Although we currently can access the bank and capital markets, there is no assurance that such markets will continue to be a reliable source of financing for us. These factors, including the tightening of credit markets, could adversely affect our ability to obtain cost-effective financing.

Increased volatility and disruptions in the financial markets also could make it more difficult and more expensive for us to refinance outstanding indebtedness and obtain financing. In addition, the adoption of new statutes and regulations, the implementation of recently enacted laws or new interpretations or the enforcement of older laws and regulations applicable to the financial markets or the financial services industry could result in a reduction in the amount of available credit or an increase in the cost of credit. Disruptions in the financial markets can also adversely affect our lenders, insurers, customers, and other counterparties. Any of these results could cause a material adverse effect to our business, financial condition, and results of operations.

Legal, Regulatory, and Other External Risks:

15| December 30, 2023 Form 10-K

|

||||||||

We are exposed to adverse changes in currency exchange rates.

Exposure to foreign currency risk exists because we, through our global operations, enter into transactions and make investments denominated in multiple currencies. Our predominant exposures are in Canadian, Mexican, and Asian currencies, including the Chinese Yuan (“CNY”). In preparing our Consolidated Financial Statements for foreign operations with functional currencies other than the U.S. dollar, asset and liability accounts are translated at current exchange rates and income and expenses are translated using weighted-average exchange rates. With respect to the effects on translated earnings, if the U.S. dollar strengthens relative to local currencies, our earnings could be negatively impacted. We do not make a practice of hedging our non-U.S. dollar earnings.

We source many products from China and other Asian countries for resale in other regions. To the extent that the U.S. dollar declines relative to the CNY or other currencies, we may experience cost increases on such purchases. The U.S. dollar increased in value relative to the CNY by 2.9% in 2023, increased by 8.3% in 2022 and decreased by 2.6% in 2021. Significant appreciation of the CNY or other currencies in countries where we source our products could adversely impact our profitability. In addition, our foreign subsidiaries in Canada and Mexico may purchase certain products from their vendors denominated in U.S. dollars. If the U.S. dollar strengthens compared to the local currencies, it may result in margin erosion. We have a practice of hedging some of our Canadian subsidiary's purchases denominated in U.S. dollars. We may not be successful at implementing customer pricing or other actions in an effort to mitigate the related cost increases which may adversely impact our results of operations.

If we were required to write down all or part of our goodwill or indefinite-lived trade names, our financial condition and results of operations could be materially adversely affected.

We have $825.0 million of goodwill and $85.5 million of indefinite-lived trademarks recorded on our accompanying Consolidated Balance Sheets at December 30, 2023. We are required to periodically determine if our goodwill or indefinite-lived trademarks have become impaired, in which case we would write down the impaired portion.

While our fourth quarter 2023 impairment test determined the fair value of the Hardware Solutions and Protective Solutions reporting units exceeded their respective carrying by 4% and 6%, respectively, certain changes in the assumptions used for discount rate, projected revenue growth, and projected EBITDA growth could result in the fair value of either of these reporting units being less than its carrying value, in which case we would be required to write down goodwill to its fair value (see Management's Discussion & Analysis - Critical Accounting Policies and Estimates - Goodwill for additional information). Additionally, a continued decline in our stock price may trigger an evaluation of the recoverability of the recorded goodwill and other long-lived assets.

If we were required to record additional write downs of all or part of our goodwill or indefinite-lived trademarks, our financial condition and net income could be materially adversely affected.

We are subject to legal proceedings and legal compliance risks.

We are involved in various legal proceedings, which from time to time may involve lawsuits, state and federal governmental inquiries, audits and investigations, environmental matters, employment, tort, state false claims act, consumer litigation, and intellectual property litigation. At times, such matters may involve executive officers and other management. Certain of these legal proceedings may be a significant distraction to management and could expose us to significant liability, including settlement expenses, damages, fines, penalties, attorneys' fees and costs, and non-monetary sanctions, any of which could have a material adverse effect on our business and results of operations.

Our business may be adversely affected by seasonality.

In general, we have experienced seasonal fluctuations in sales and operating results from quarter to quarter. Typically, the first calendar quarter is the weakest due to the effect of weather on home projects and the construction industry. If adverse weather conditions persist on a regional or national basis into the second or other calendar quarters, our business, financial condition, and results of operations may be materially adversely affected.

Future tax law changes may materially increase our prospective income tax expense.

We are subject to income taxation in many jurisdictions in the U.S., as well as foreign jurisdictions. Judgment is required in determining our worldwide income tax provision and, accordingly, there are many transactions and computations for which our final income tax determination is uncertain. We are occasionally audited by income tax authorities in various tax jurisdictions. Although we believe our recorded tax estimates are reasonable, the ultimate outcome from any audit (or related litigation) could be materially different from the amounts reflected in our income tax provisions and accruals. Future settlements of income tax audits may have a material effect on

16| December 30, 2023 Form 10-K

|

||||||||

earnings between the period of initial recognition of tax estimates in the financial statements and the point of ultimate tax audit settlement.

Additionally, it is possible that future income tax legislation and regulations or interpretations thereof in any jurisdiction to which we are subject to taxation may be enacted and such changes could have a material impact on our worldwide income tax provision beginning with the period during which such changes become effective. In addition, our future effective tax rates could be subject to volatility or adversely affected by a number of factors, including: