EX-99.2

Published on February 22, 2024

Quarterly Earnings Presentation Q4 2023 February 22, 2024

2Earnings Presentation Q4 2023 PresBuilder Placeholder - Delete this box if you see it on a slide, but DO NOT REMOVE this box from the slide layout This presentation contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. All forward-looking statements are made in good faith by the company and are intended to qualify for the safe harbor from liability established by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995.You should not rely on these forward- looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," “target”, “goal”, "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) unfavorable economic conditions that may affect operations, financial condition and cash flows including spending on home renovation or construction projects, inflation, recessions, instability in the financial markets or credit markets; (2) increased supply chain costs, including raw materials, sourcing, transportation and energy; (3) the highly competitive nature of the markets that we serve; (4) the ability to continue to innovate with new products and services; (5) direct and indirect costs associated with the May 2023 ransomware attack, and our receipt of expected insurance receivables associated with that cyber security incident; (6) seasonality; (7) large customer concentration; (8) the ability to recruit and retain qualified employees; (9) the outcome of any legal proceedings that may be instituted against the Company; (10) adverse changes in currency exchange rates; or (11) regulatory changes and potential legislation that could adversely impact financial results. The foregoing list of factors is not exclusive, and readers should also refer to those risks that are included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K for the fiscal year ended December 30, 2023. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward looking statements. Except as required by applicable law, the Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this communication to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Presentation of Non-GAAP Financial Measures In addition to the results provided in accordance with U.S. generally accepted accounting principles (“GAAP”) throughout this presentation the company has provided non-GAAP financial measures, which present results on a basis adjusted for certain items. The company uses these non-GAAP financial measures for business planning purposes and in measuring its performance relative to that of its competitors. The company believes that these non- GAAP financial measures are useful financial metrics to assess its operating performance from period-to-period by excluding certain items that the company believes are not representative of its core business. These non-GAAP financial measures are not intended to replace, and should not be considered superior to, the presentation of the company’s financial results in accordance with GAAP. The use of the non-GAAP financial measures terms may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures. These non-GAAP financial measures are reconciled from the respective measures under GAAP in the appendix below. The company is not able to provide a reconciliation of the company’s non-GAAP financial guidance to the corresponding GAAP measures without unreasonable effort because of the inherent difficulty in forecasting and quantifying certain amounts necessary for such a reconciliation such as certain non-cash, nonrecurring or other items that are included in net income and EBITDA as well as the related tax impacts of these items and asset dispositions / acquisitions and changes in foreign currency exchange rates that are included in cash flow, due to the uncertainty and variability of the nature and amount of these future charges and costs. Forward Looking Statements

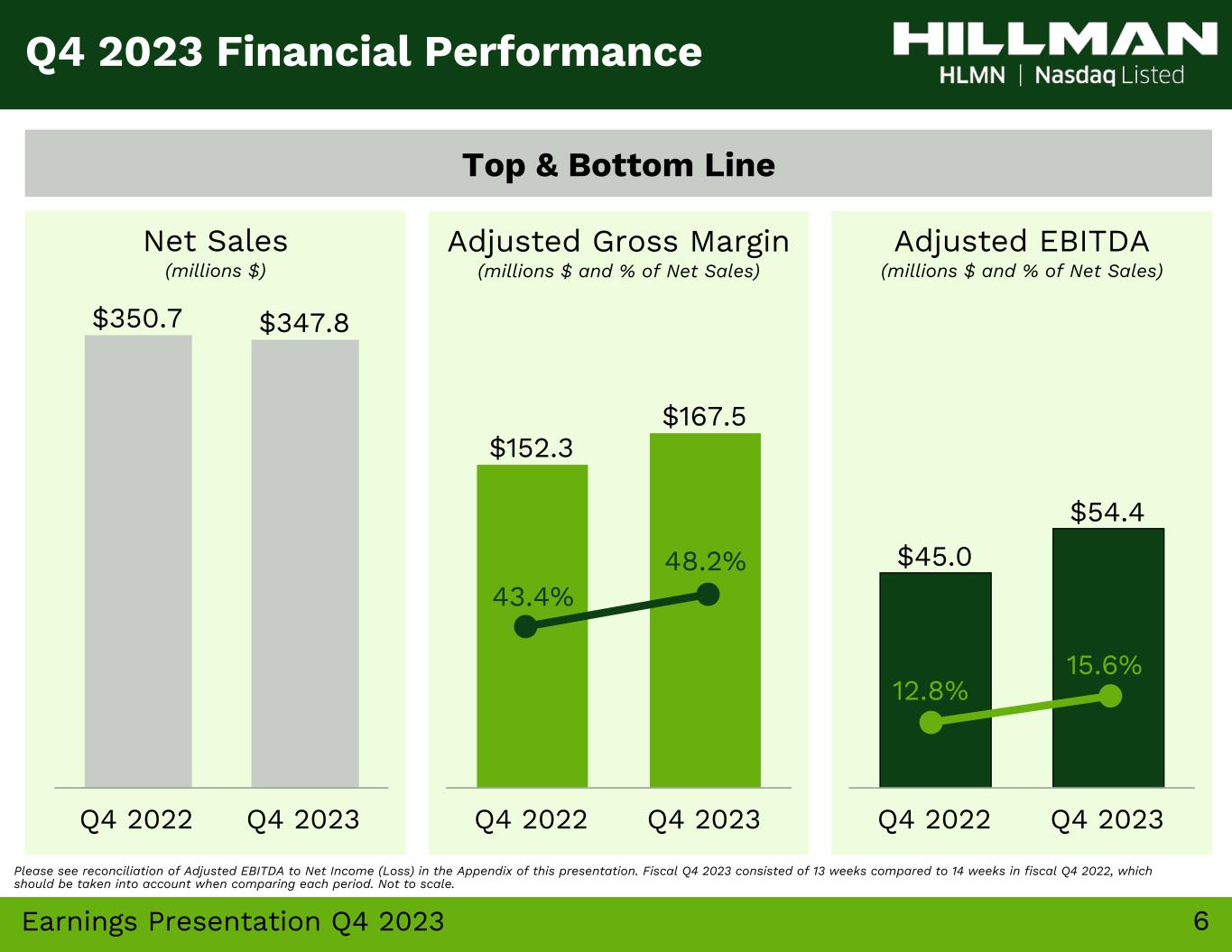

3Earnings Presentation Q4 2023 • Net sales decreased (0.8)% to $348 million versus the 14 weeks ended December 31, 2022; excluding the 14th week during 2022, net sales increased 3.8% from $335 million in 2022 to $348 million in 2023. ◦ Hardware Solutions (1)%; +4% excl. 14th week in 2022 ◦ Protective Solutions +4%; +11% excl. 14th week in 2022 ◦ Robotics and Digital Solutions ("RDS") +3%; +11% excl. 14th week in 2022 ◦ Canada (14)%; (14th week did not impact Canada in 2022) • GAAP net loss totaled $10.1 million, or $(0.05) per diluted share, compared to GAAP net loss of $13.9 million, or $(0.07) per diluted share, in Q4 2022 • Adjusted EBITDA improved to $54.4 million from $45.0 million in Q4 2022 • Adjusted EBITDA (ttm) / Net Debt: 3.3x at December 30, 2023 • Compared to Pre-COVID (Q4 2023 vs Q4 2019): ◦ Net sales increased +22% (+5.1% CAGR) ◦ Adjusted EBITDA +55% (+11.5% CAGR) Q4 2023 Financial Review Please see reconciliation of Adjusted EBITDA to Net Income (Loss) and Net Debt in the Appendix of this presentation. Highlights for the 13 Weeks Ended December 30, 2023

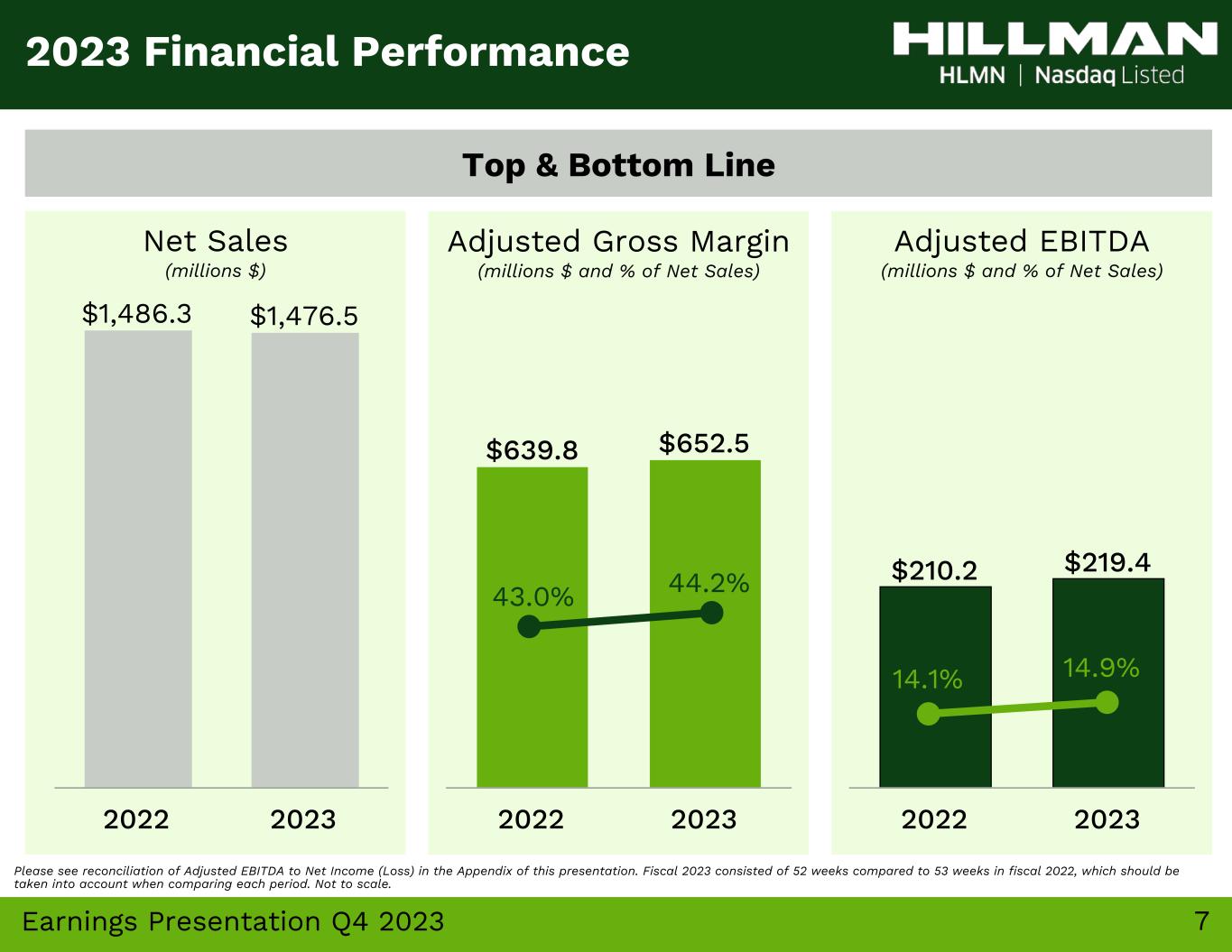

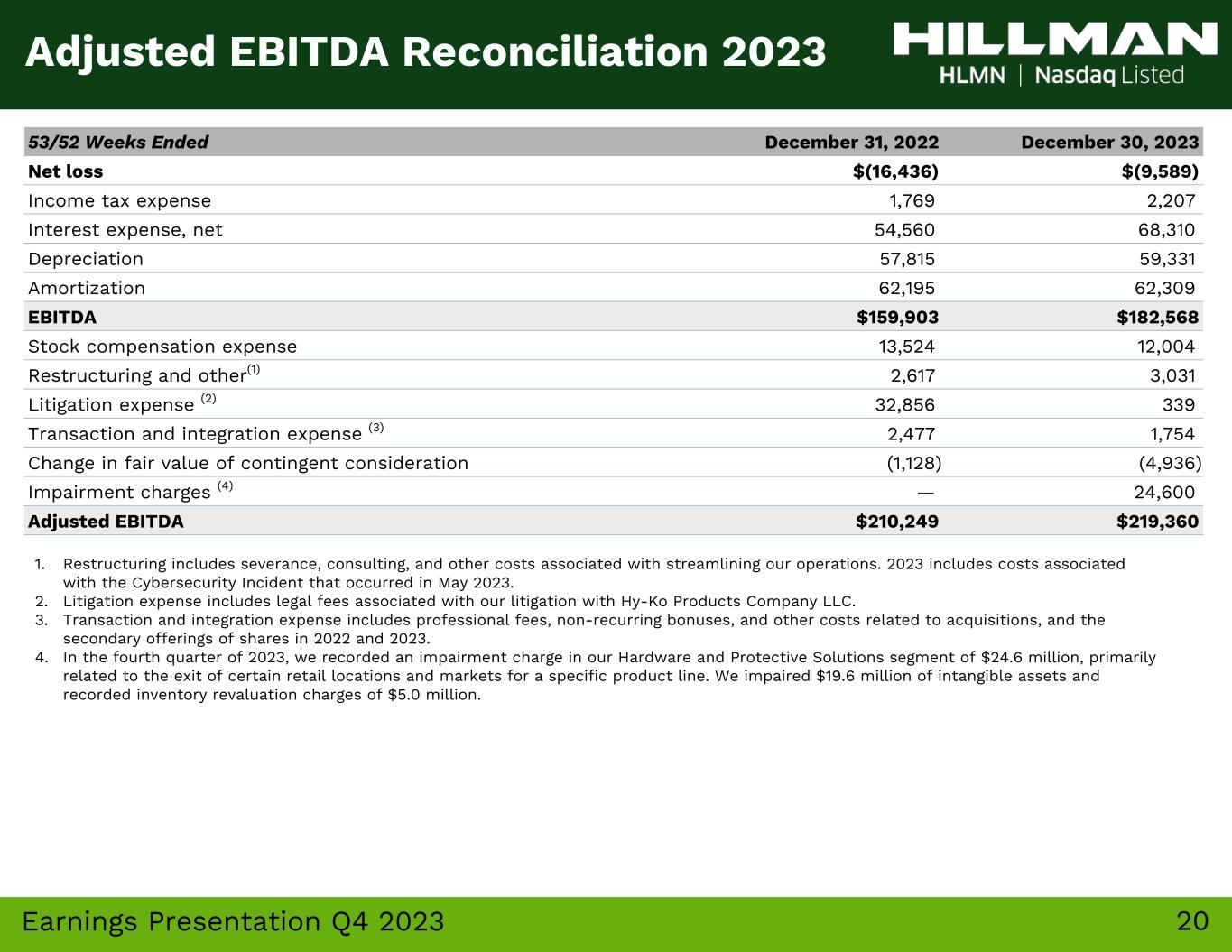

4Earnings Presentation Q4 2023 • Net sales decreased (0.7)% to $1,476 million versus the 53 weeks ended December 31, 2022; excluding the 53rd week during 2022, net sales increased 0.4% from $1,471 million in 2022 to $1,476 million in 2023. ◦ Hardware Solutions +4%; +5% excl. 53rd week ◦ Protective Solutions (11)%; (2.5)% excl. COVID-related PPE sales and 53rd week ◦ Robotics and Digital Solutions ("RDS") (0.1)%; +2% excl. 53rd week ◦ Canada (9)%; (53rd week did not impact Canada in 2022) • GAAP net loss improved to $(9.6) million, or $(0.05) per diluted share, compared to a net loss of $(16.4) million, or $(0.08) per diluted share, in the 53 weeks ended December 31, 2022 • Adjusted EBITDA totaled $219.4 million versus $210.2 million million in the 53 weeks ended December 31, 2022 2023 Financial Review Please see reconciliation of Adjusted EBITDA to Net Income (Loss) in the Appendix of this presentation. Highlights for the 52 Weeks Ended December 30, 2023

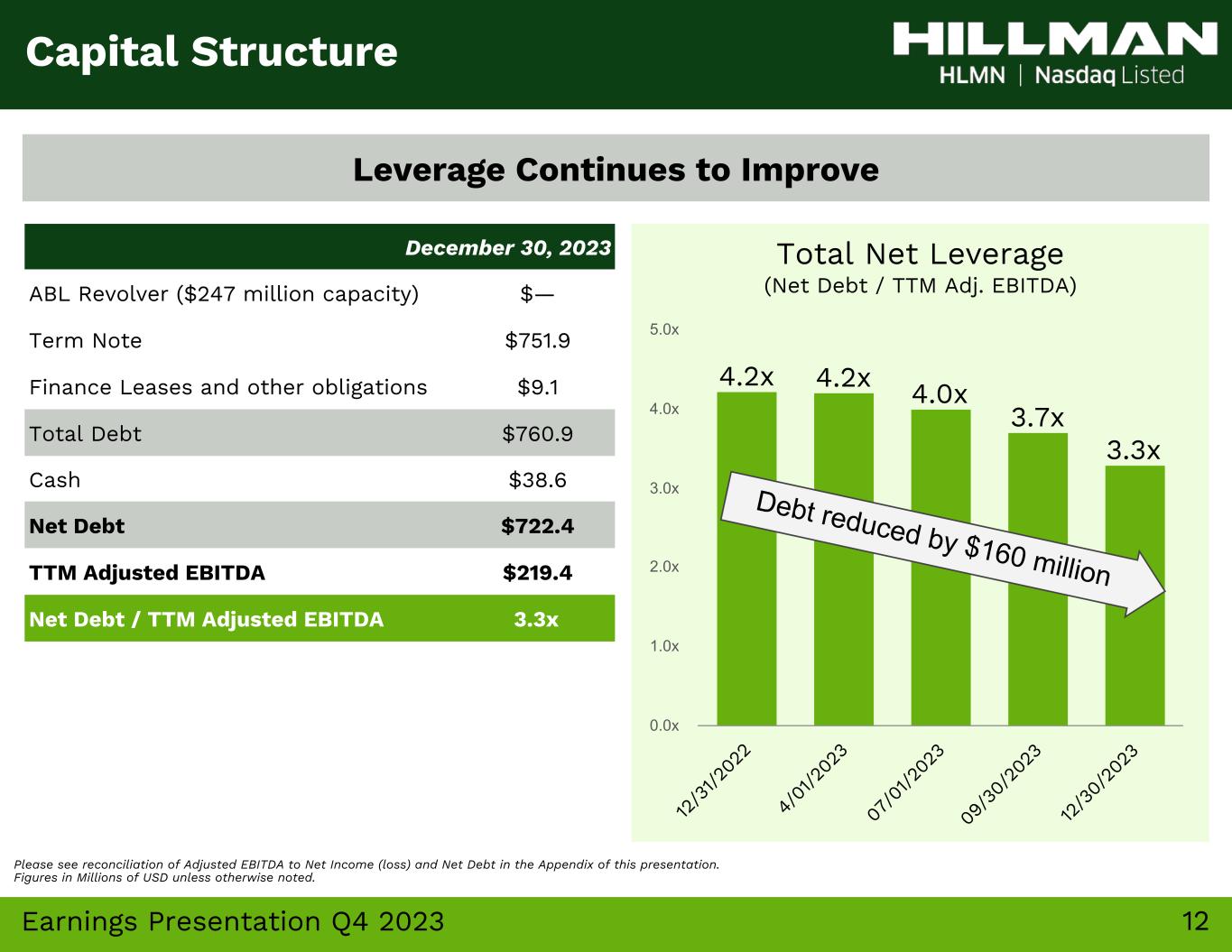

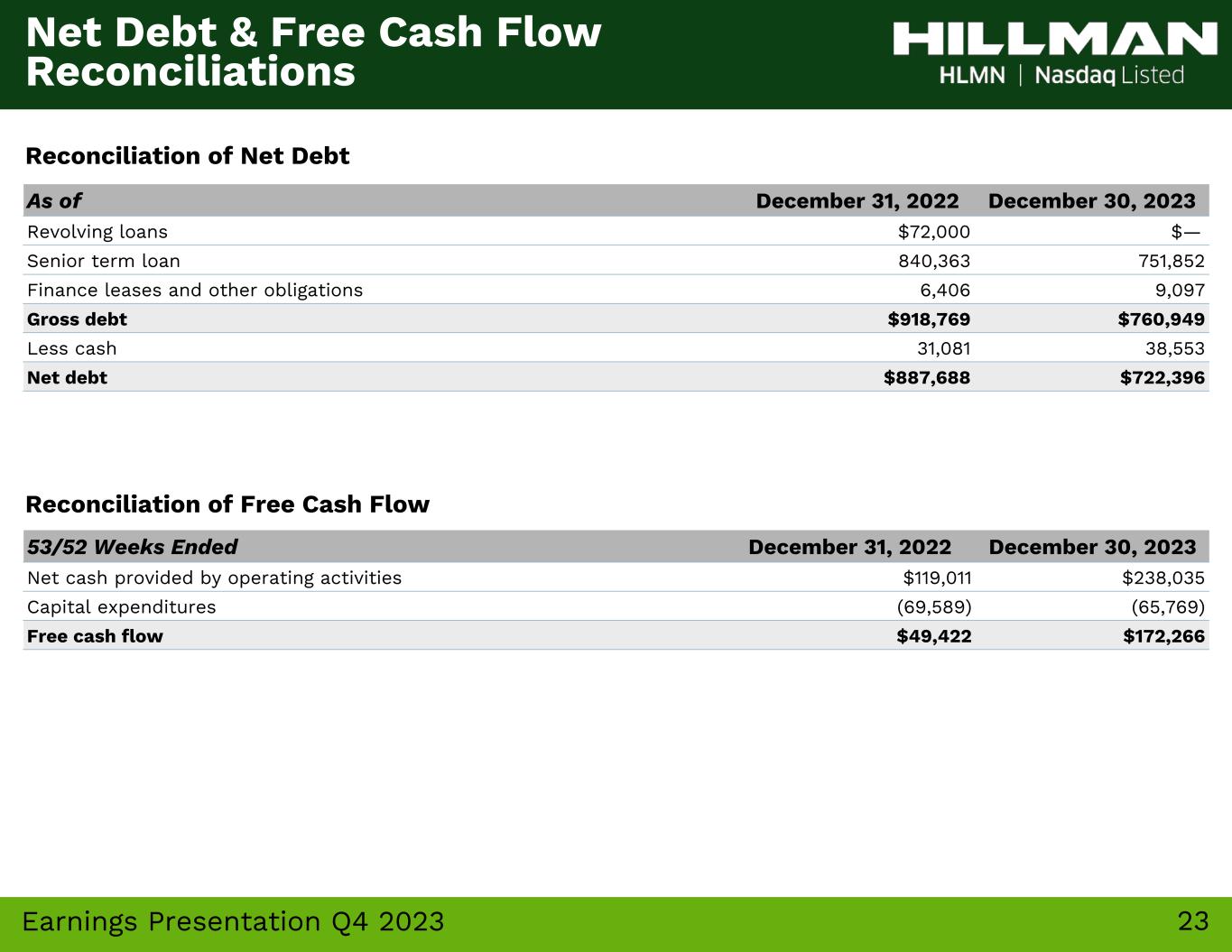

5Earnings Presentation Q4 2023 2023 Operational Review • Successfully rolled out new business wins across product portfolio including a major rollout of rope and chain accessories with a top five customer • Continue to win new business with existing and new customers across business segments • Maintained average fill rates of approximately 94% for the year • Reduced inventory by $104 million during the year • Free Cash Flow totaled $172.3 million • Net Debt / Adj. EBITDA leverage ratio improved to 3.3x from 4.2x a year ago • Awarded 2023 Vendor of the Year by Tractor Supply Co. and Mid-States Distributing • Subsequent to the year end, acquired Koch Industries, marking Hillman's entrance into rope and chain Highlights for the 52 Weeks Ended December 30, 2023 Please see reconciliation of Free Cash Flow in the Appendix of this presentation.

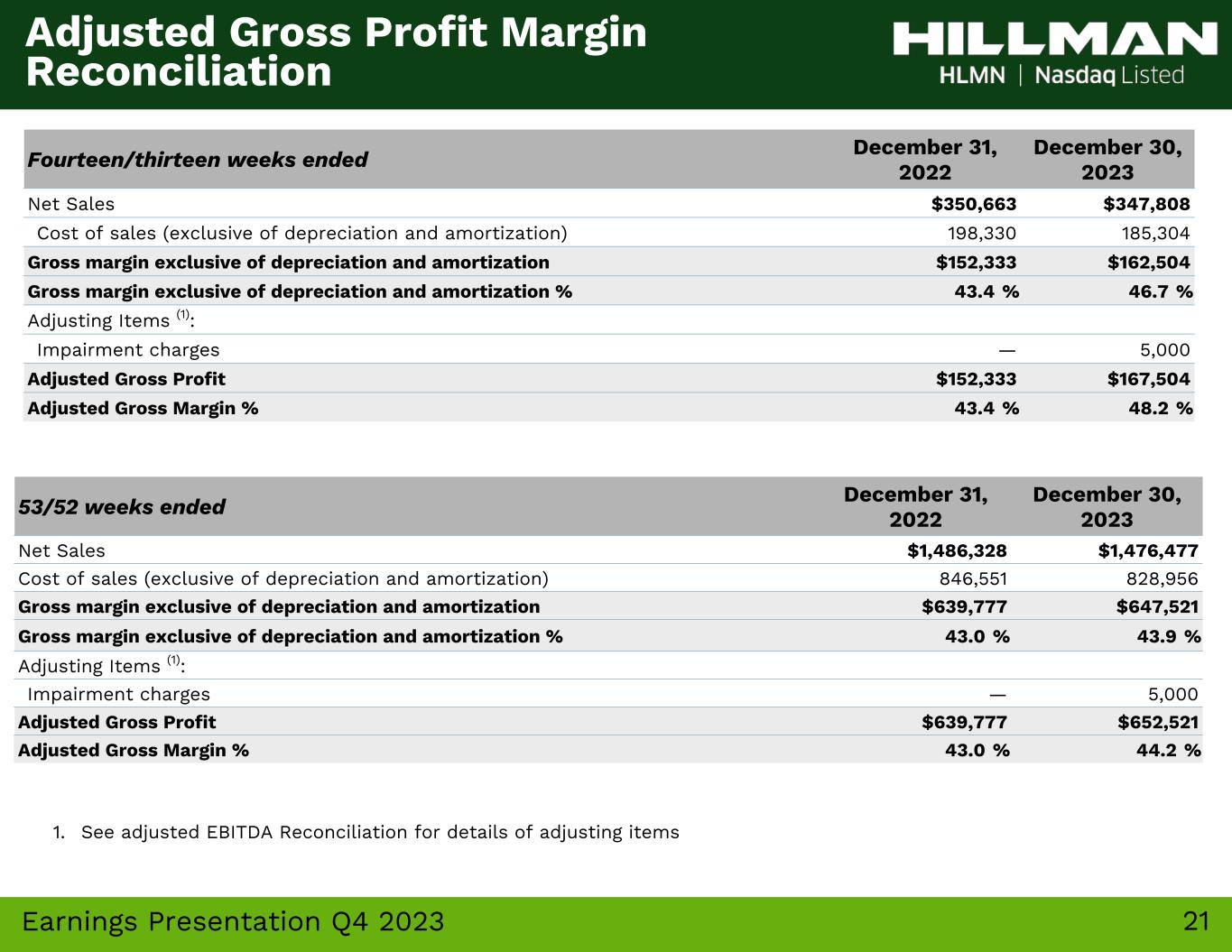

6Earnings Presentation Q4 2023 Adjusted EBITDA (millions $ and % of Net Sales) Please see reconciliation of Adjusted EBITDA to Net Income (Loss) in the Appendix of this presentation. Fiscal Q4 2023 consisted of 13 weeks compared to 14 weeks in fiscal Q4 2022, which should be taken into account when comparing each period. Not to scale. Top & Bottom Line Net Sales (millions $) Adjusted Gross Margin (millions $ and % of Net Sales) Q4 2023 Financial Performance $45.0 $54.4 Q4 2022 Q4 2023 15.6% 12.8% $152.3 $167.5 Q4 2022 Q4 2023 $350.7 $347.8 Q4 2022 Q4 2023 48.2% 43.4%

7Earnings Presentation Q4 2023 Adjusted EBITDA (millions $ and % of Net Sales) Top & Bottom Line Net Sales (millions $) Adjusted Gross Margin (millions $ and % of Net Sales) 2023 Financial Performance $210.2 $219.4 2022 2023 14.9%14.1% $639.8 $652.5 2022 2023 $1,486.3 $1,476.5 2022 2023 44.2%43.0% Please see reconciliation of Adjusted EBITDA to Net Income (Loss) in the Appendix of this presentation. Fiscal 2023 consisted of 52 weeks compared to 53 weeks in fiscal 2022, which should be taken into account when comparing each period. Not to scale.

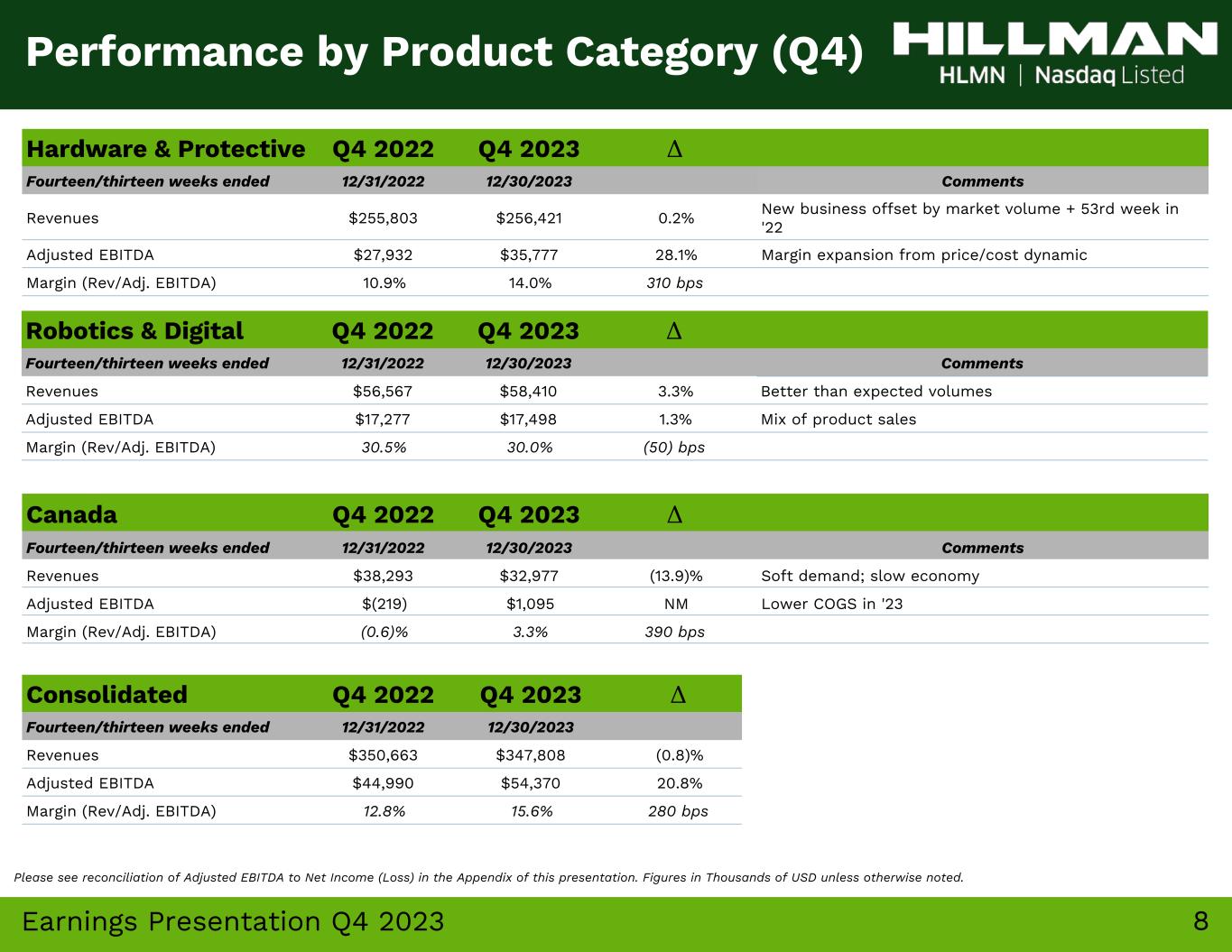

8Earnings Presentation Q4 2023 Hardware & Protective Q4 2022 Q4 2023 Δ Fourteen/thirteen weeks ended 12/31/2022 12/30/2023 Comments Revenues $255,803 $256,421 0.2% New business offset by market volume + 53rd week in '22 Adjusted EBITDA $27,932 $35,777 28.1% Margin expansion from price/cost dynamic Margin (Rev/Adj. EBITDA) 10.9% 14.0% 310 bps Robotics & Digital Q4 2022 Q4 2023 Δ Fourteen/thirteen weeks ended 12/31/2022 12/30/2023 Comments Revenues $56,567 $58,410 3.3% Better than expected volumes Adjusted EBITDA $17,277 $17,498 1.3% Mix of product sales Margin (Rev/Adj. EBITDA) 30.5% 30.0% (50) bps Canada Q4 2022 Q4 2023 Δ Fourteen/thirteen weeks ended 12/31/2022 12/30/2023 Comments Revenues $38,293 $32,977 (13.9)% Soft demand; slow economy Adjusted EBITDA $(219) $1,095 NM Lower COGS in '23 Margin (Rev/Adj. EBITDA) (0.6)% 3.3% 390 bps Consolidated Q4 2022 Q4 2023 Δ Fourteen/thirteen weeks ended 12/31/2022 12/30/2023 Revenues $350,663 $347,808 (0.8)% Adjusted EBITDA $44,990 $54,370 20.8% Margin (Rev/Adj. EBITDA) 12.8% 15.6% 280 bps Performance by Product Category (Q4) Please see reconciliation of Adjusted EBITDA to Net Income (Loss) in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted.

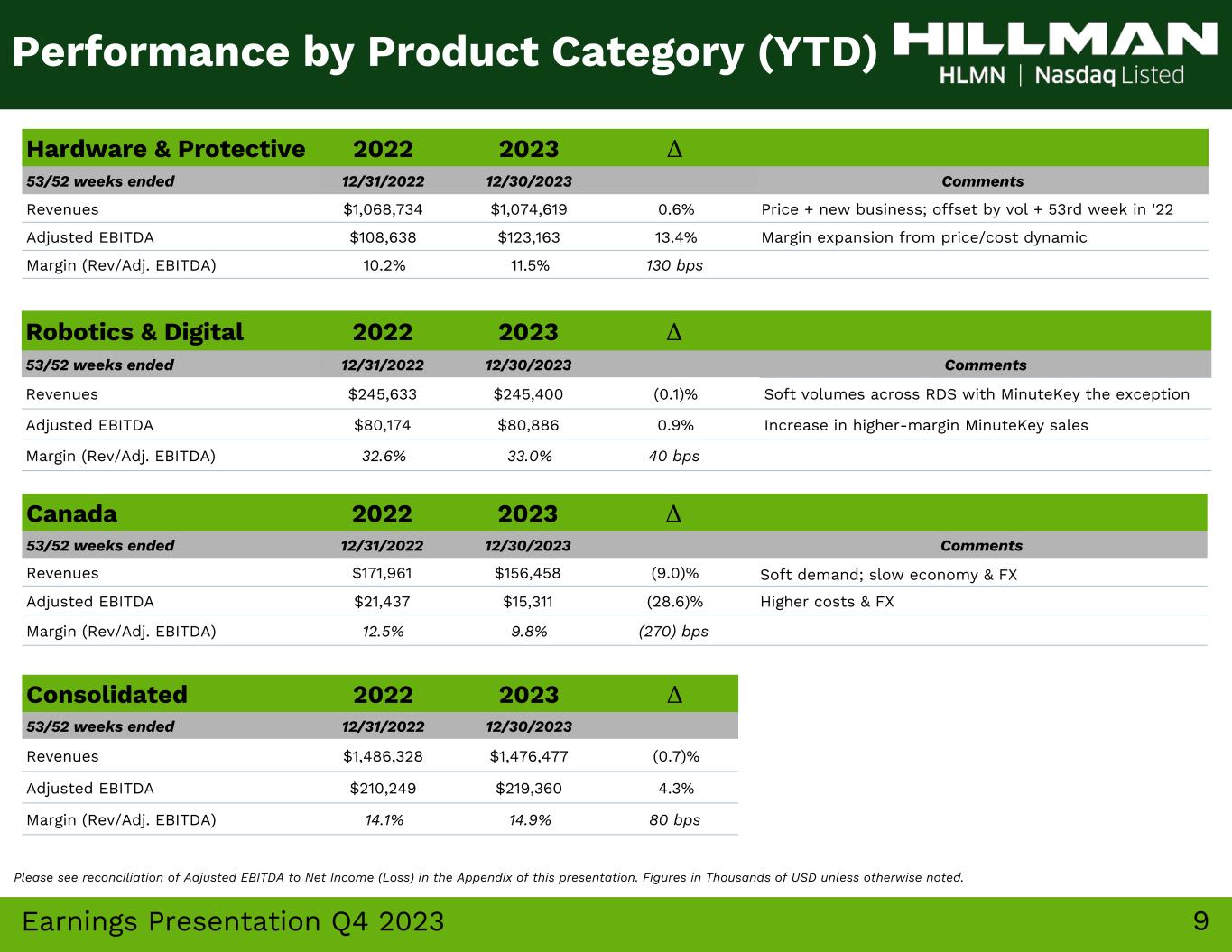

9Earnings Presentation Q4 2023 Hardware & Protective 2022 2023 Δ 53/52 weeks ended 12/31/2022 12/30/2023 Comments Revenues $1,068,734 $1,074,619 0.6% Price + new business; offset by vol + 53rd week in '22 Adjusted EBITDA $108,638 $123,163 13.4% Margin expansion from price/cost dynamic Margin (Rev/Adj. EBITDA) 10.2% 11.5% 130 bps Robotics & Digital 2022 2023 Δ 53/52 weeks ended 12/31/2022 12/30/2023 Comments Revenues $245,633 $245,400 (0.1)% Soft volumes across RDS with MinuteKey the exception Adjusted EBITDA $80,174 $80,886 0.9% Increase in higher-margin MinuteKey sales Margin (Rev/Adj. EBITDA) 32.6% 33.0% 40 bps Canada 2022 2023 Δ 53/52 weeks ended 12/31/2022 12/30/2023 Comments Revenues $171,961 $156,458 (9.0)% Soft demand; slow economy & FX Adjusted EBITDA $21,437 $15,311 (28.6)% Higher costs & FX Margin (Rev/Adj. EBITDA) 12.5% 9.8% (270) bps Consolidated 2022 2023 Δ 53/52 weeks ended 12/31/2022 12/30/2023 Revenues $1,486,328 $1,476,477 (0.7)% Adjusted EBITDA $210,249 $219,360 4.3% Margin (Rev/Adj. EBITDA) 14.1% 14.9% 80 bps Performance by Product Category (YTD) Please see reconciliation of Adjusted EBITDA to Net Income (Loss) in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted.

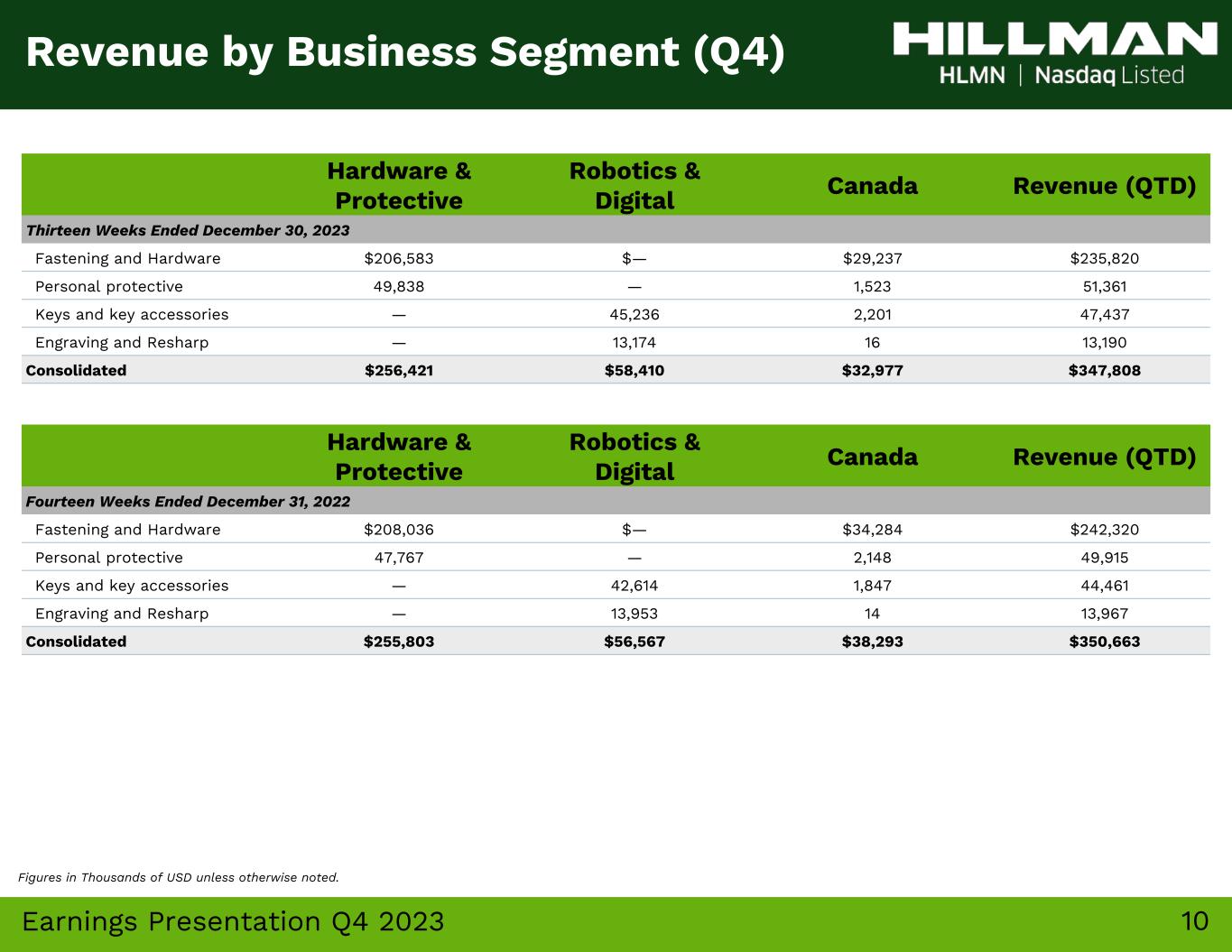

10Earnings Presentation Q4 2023 Hardware & Protective Robotics & Digital Canada Revenue (QTD) Thirteen Weeks Ended December 30, 2023 Fastening and Hardware $206,583 $— $29,237 $235,820 Personal protective 49,838 — 1,523 51,361 Keys and key accessories — 45,236 2,201 47,437 Engraving and Resharp — 13,174 16 13,190 Consolidated $256,421 $58,410 $32,977 $347,808 Revenue by Business Segment (Q4) Hardware & Protective Robotics & Digital Canada Revenue (QTD) Fourteen Weeks Ended December 31, 2022 Fastening and Hardware $208,036 $— $34,284 $242,320 Personal protective 47,767 — 2,148 49,915 Keys and key accessories — 42,614 1,847 44,461 Engraving and Resharp — 13,953 14 13,967 Consolidated $255,803 $56,567 $38,293 $350,663 Figures in Thousands of USD unless otherwise noted.

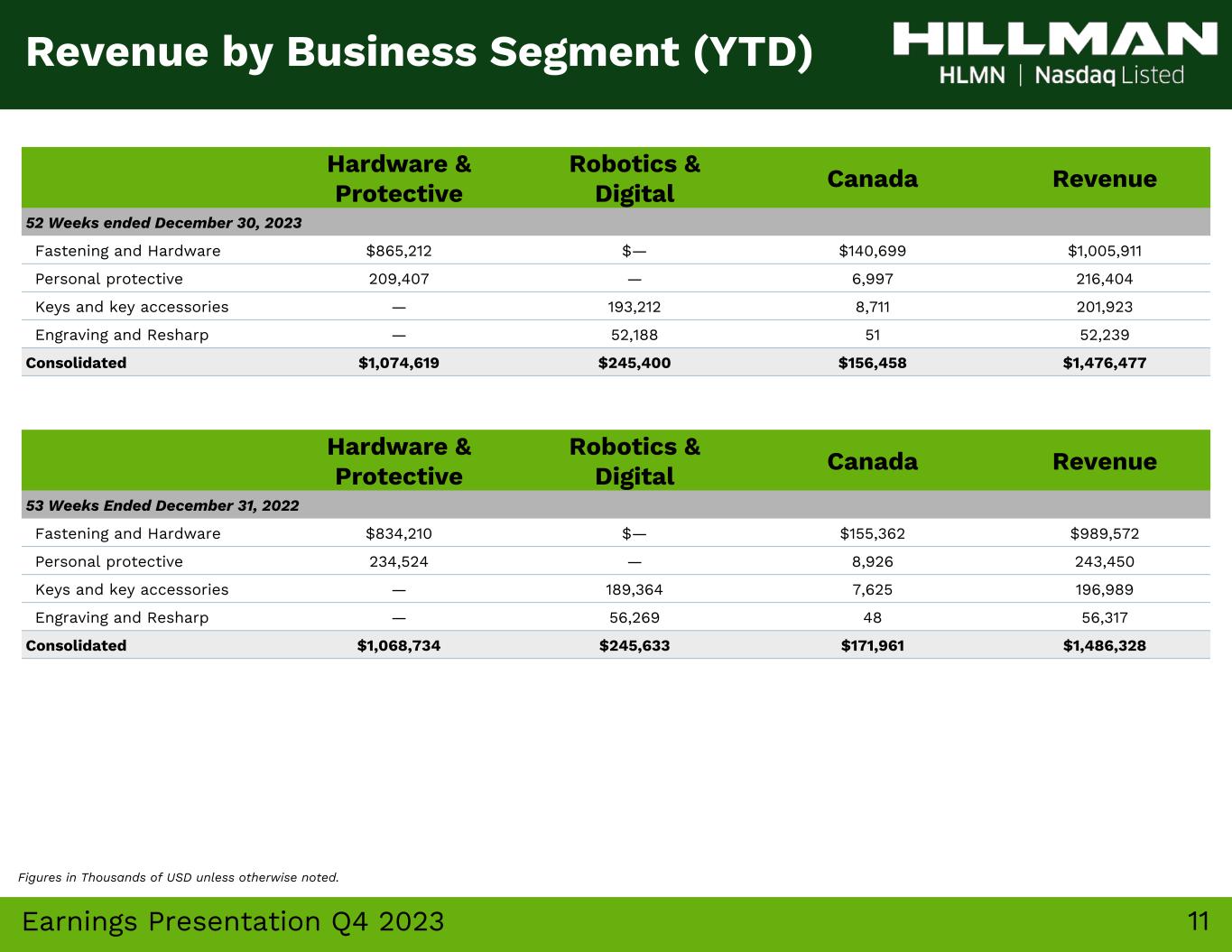

11Earnings Presentation Q4 2023 Hardware & Protective Robotics & Digital Canada Revenue 52 Weeks ended December 30, 2023 Fastening and Hardware $865,212 $— $140,699 $1,005,911 Personal protective 209,407 — 6,997 216,404 Keys and key accessories — 193,212 8,711 201,923 Engraving and Resharp — 52,188 51 52,239 Consolidated $1,074,619 $245,400 $156,458 $1,476,477 Revenue by Business Segment (YTD) Hardware & Protective Robotics & Digital Canada Revenue 53 Weeks Ended December 31, 2022 Fastening and Hardware $834,210 $— $155,362 $989,572 Personal protective 234,524 — 8,926 243,450 Keys and key accessories — 189,364 7,625 196,989 Engraving and Resharp — 56,269 48 56,317 Consolidated $1,068,734 $245,633 $171,961 $1,486,328 Figures in Thousands of USD unless otherwise noted.

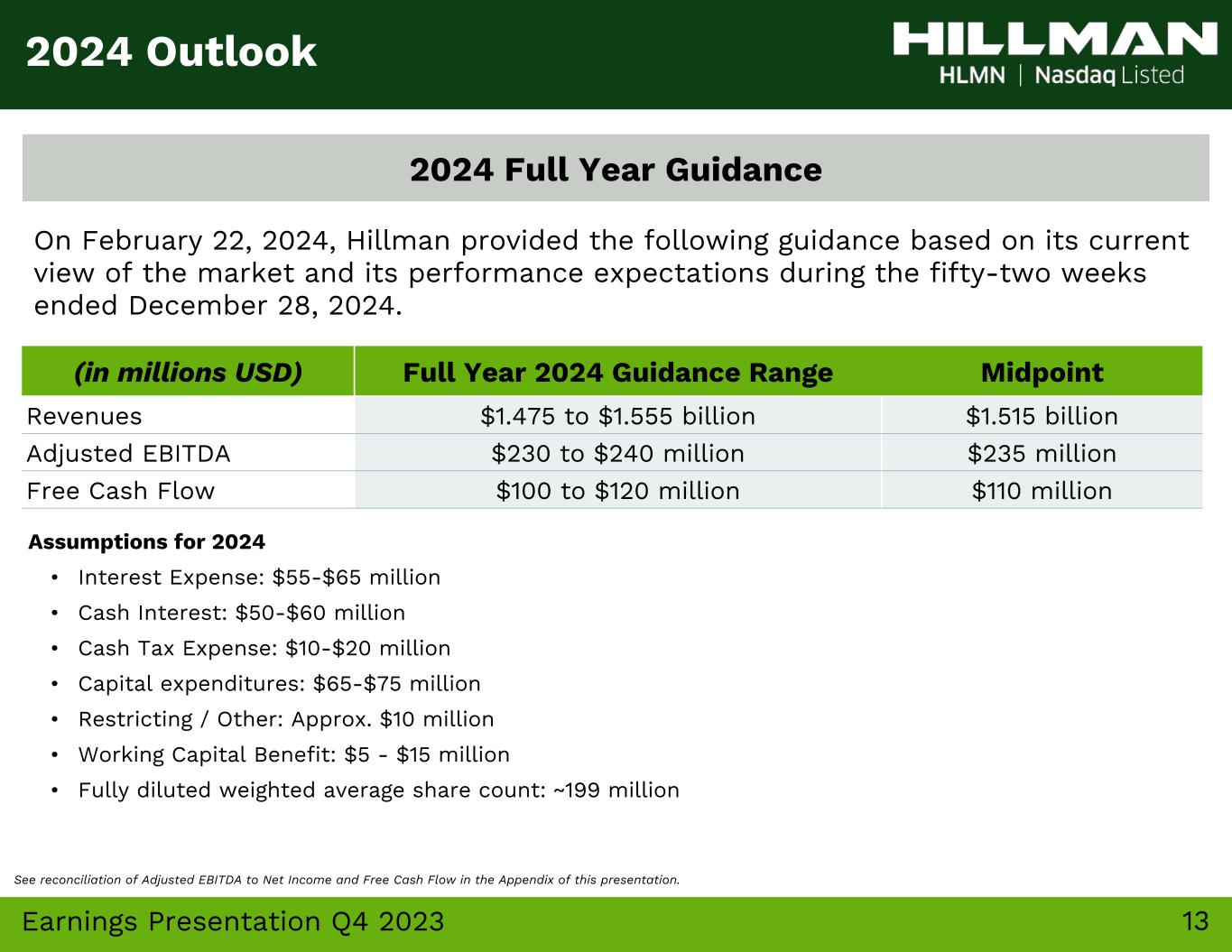

12Earnings Presentation Q4 2023 Total Net Leverage (Net Debt / TTM Adj. EBITDA) Capital Structure Leverage Continues to Improve Please see reconciliation of Adjusted EBITDA to Net Income (loss) and Net Debt in the Appendix of this presentation. Figures in Millions of USD unless otherwise noted. 4.2x 4.2x 4.0x 3.7x 3.3x 12 /3 1/2 02 2 4/ 01 /2 02 3 07 /0 1/2 02 3 09 /3 0/ 20 23 12 /3 0/ 20 23 0.0x 1.0x 2.0x 3.0x 4.0x 5.0x December 30, 2023 ABL Revolver ($247 million capacity) $— Term Note $751.9 Finance Leases and other obligations $9.1 Total Debt $760.9 Cash $38.6 Net Debt $722.4 TTM Adjusted EBITDA $219.4 Net Debt / TTM Adjusted EBITDA 3.3x Debt reduced by $160 million

13Earnings Presentation Q4 2023 (in millions USD) Full Year 2024 Guidance Range Midpoint Revenues $1.475 to $1.555 billion $1.515 billion Adjusted EBITDA $230 to $240 million $235 million Free Cash Flow $100 to $120 million $110 million Assumptions for 2024 • Interest Expense: $55-$65 million • Cash Interest: $50-$60 million • Cash Tax Expense: $10-$20 million • Capital expenditures: $65-$75 million • Restricting / Other: Approx. $10 million • Working Capital Benefit: $5 - $15 million • Fully diluted weighted average share count: ~199 million 2024 Outlook On February 22, 2024, Hillman provided the following guidance based on its current view of the market and its performance expectations during the fifty-two weeks ended December 28, 2024. 2024 Full Year Guidance See reconciliation of Adjusted EBITDA to Net Income and Free Cash Flow in the Appendix of this presentation.

14Earnings Presentation Q4 2023 Key Takeaways Resilient Business; Focused on Delevering & Acquisitions Long-term Annual Growth Targets (Organic): Revenue Growth: +6% & Adj. EBITDA Growth: +10% Long-term Annual Growth Targets (incl. Acquisitions): Revenue Growth: +10% & Adj. EBITDA Growth: +15% • Hillman celebrated its 60th anniversary in 2024, long-term track record of success; proven to be resilient through multiple economic cycles • Repair, Remodel and Maintenance industry has meaningful long-term tailwinds; near-record levels of U.S. home equity driving investment in the home1 • Benefiting from price/cost dynamic which began flowing through income statement in 2H 2023 • Leverage improved to 3.3x (from 4.2x a year ago); will continue to improve and reduce debt with free cash flow • Seeking to execute low-risk, bolt-on acquisitions that leverage Hillman's moat (Acquired Koch Industries in January 2024, entering rope and chain category 1) U.S. Home Equity Hits Highest Level on Record—$27.8 Trillion.

15 Appendix

16Earnings Presentation Q4 2023 Significant runway for incremental growth: Organic + M&A Management team with proven operational and M&A expertise Strong financial profile with 60-year track record Market and innovation leader across multiple categories Indispensable partner embedded with winning retailers Customers love us, trust us and rely on us Large, predictable, growing and resilient end markets Investment Highlights

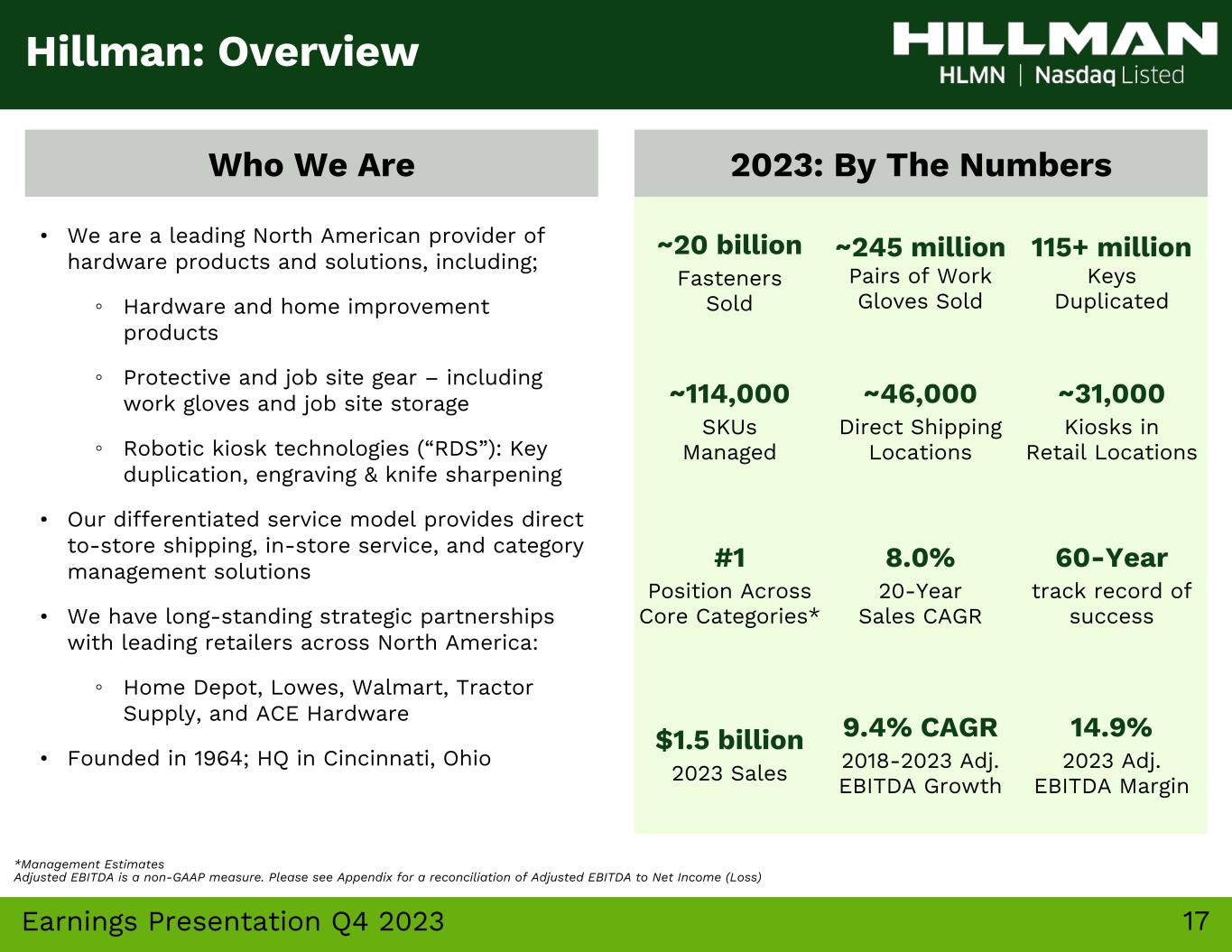

17Earnings Presentation Q4 2023 Who We Are *Management Estimates Adjusted EBITDA is a non-GAAP measure. Please see Appendix for a reconciliation of Adjusted EBITDA to Net Income (Loss) ~20 billion Fasteners Sold ~245 million Pairs of Work Gloves Sold 115+ million Keys Duplicated ~114,000 SKUs Managed ~46,000 Direct Shipping Locations ~31,000 Kiosks in Retail Locations #1 Position Across Core Categories* 8.0% 20-Year Sales CAGR 60-Year track record of success $1.5 billion 2023 Sales 9.4% CAGR 2018-2023 Adj. EBITDA Growth 14.9% 2023 Adj. EBITDA Margin Hillman: Overview 2023: By The Numbers • We are a leading North American provider of hardware products and solutions, including; ◦ Hardware and home improvement products ◦ Protective and job site gear – including work gloves and job site storage ◦ Robotic kiosk technologies (“RDS”): Key duplication, engraving & knife sharpening • Our differentiated service model provides direct to-store shipping, in-store service, and category management solutions • We have long-standing strategic partnerships with leading retailers across North America: ◦ Home Depot, Lowes, Walmart, Tractor Supply, and ACE Hardware • Founded in 1964; HQ in Cincinnati, Ohio

18Earnings Presentation Q4 2023 #1 in Segment Representative Top Customers #1 in Segment #1 in Segment Key and Fob Duplication Personalized Tags Knife Sharpening Fasteners & Specialty Gloves Builders Hardware & Metal Shapes Safety / PPE Construction Fasteners Work Gear Picture Hanging Source: Third party industry report. Primary Product Categories Hardware Solutions Protective Solutions Robotics & Digital Solutions

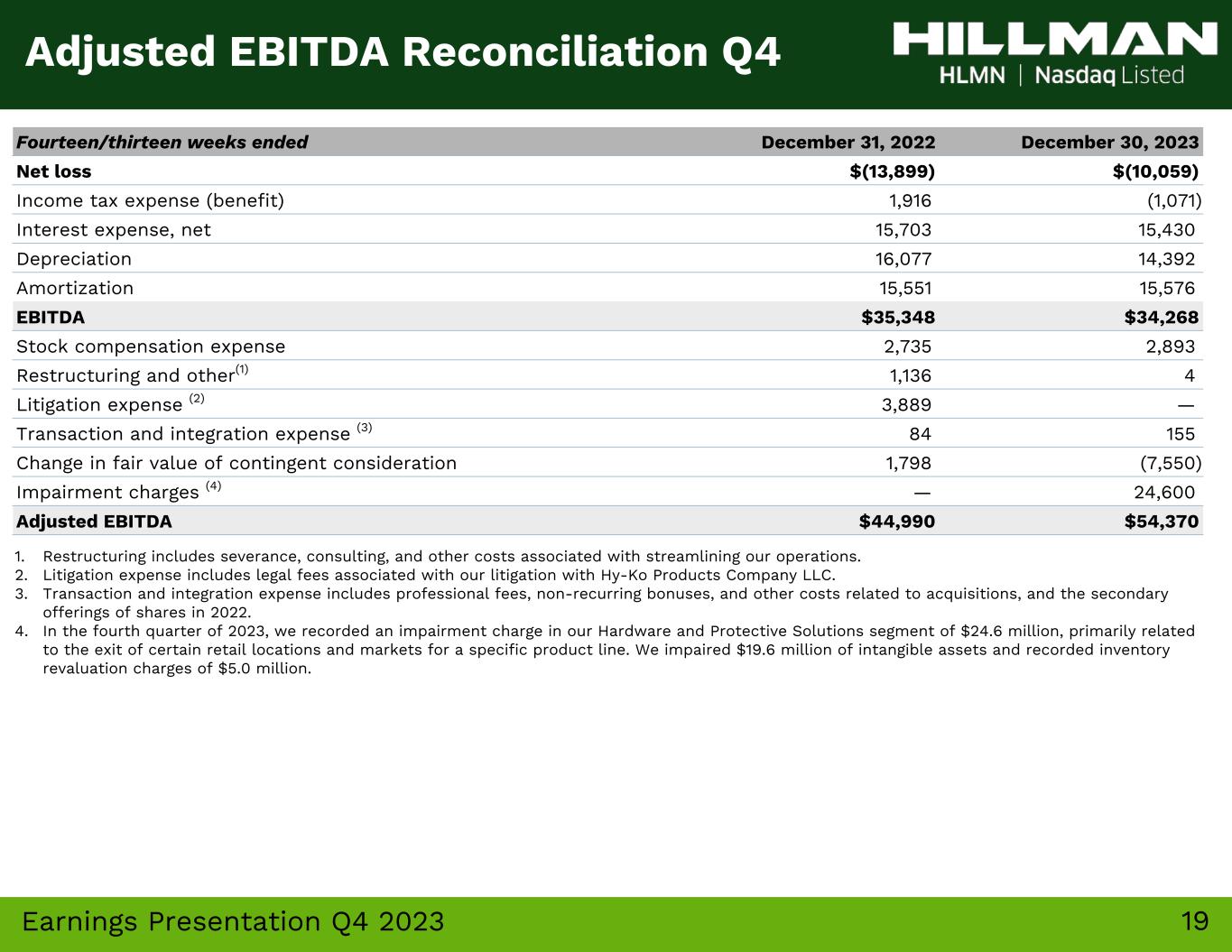

19Earnings Presentation Q4 2023 Fourteen/thirteen weeks ended December 31, 2022 December 30, 2023 Net loss $(13,899) $(10,059) Income tax expense (benefit) 1,916 (1,071) Interest expense, net 15,703 15,430 Depreciation 16,077 14,392 Amortization 15,551 15,576 EBITDA $35,348 $34,268 Stock compensation expense 2,735 2,893 Restructuring and other(1) 1,136 4 Litigation expense (2) 3,889 — Transaction and integration expense (3) 84 155 Change in fair value of contingent consideration 1,798 (7,550) Impairment charges (4) — 24,600 Adjusted EBITDA $44,990 $54,370 1. Restructuring includes severance, consulting, and other costs associated with streamlining our operations. 2. Litigation expense includes legal fees associated with our litigation with Hy-Ko Products Company LLC. 3. Transaction and integration expense includes professional fees, non-recurring bonuses, and other costs related to acquisitions, and the secondary offerings of shares in 2022. 4. In the fourth quarter of 2023, we recorded an impairment charge in our Hardware and Protective Solutions segment of $24.6 million, primarily related to the exit of certain retail locations and markets for a specific product line. We impaired $19.6 million of intangible assets and recorded inventory revaluation charges of $5.0 million. Adjusted EBITDA Reconciliation Q4

20Earnings Presentation Q4 2023 53/52 Weeks Ended December 31, 2022 December 30, 2023 Net loss $(16,436) $(9,589) Income tax expense 1,769 2,207 Interest expense, net 54,560 68,310 Depreciation 57,815 59,331 Amortization 62,195 62,309 EBITDA $159,903 $182,568 Stock compensation expense 13,524 12,004 Restructuring and other(1) 2,617 3,031 Litigation expense (2) 32,856 339 Transaction and integration expense (3) 2,477 1,754 Change in fair value of contingent consideration (1,128) (4,936) Impairment charges (4) — 24,600 Adjusted EBITDA $210,249 $219,360 Adjusted EBITDA Reconciliation 2023 1. Restructuring includes severance, consulting, and other costs associated with streamlining our operations. 2023 includes costs associated with the Cybersecurity Incident that occurred in May 2023. 2. Litigation expense includes legal fees associated with our litigation with Hy-Ko Products Company LLC. 3. Transaction and integration expense includes professional fees, non-recurring bonuses, and other costs related to acquisitions, and the secondary offerings of shares in 2022 and 2023. 4. In the fourth quarter of 2023, we recorded an impairment charge in our Hardware and Protective Solutions segment of $24.6 million, primarily related to the exit of certain retail locations and markets for a specific product line. We impaired $19.6 million of intangible assets and recorded inventory revaluation charges of $5.0 million.

21Earnings Presentation Q4 2023 Fourteen/thirteen weeks ended December 31, 2022 December 30, 2023 Net Sales $350,663 $347,808 Cost of sales (exclusive of depreciation and amortization) 198,330 185,304 Gross margin exclusive of depreciation and amortization $152,333 $162,504 Gross margin exclusive of depreciation and amortization % 43.4 % 46.7 % Adjusting Items (1): Impairment charges — 5,000 Adjusted Gross Profit $152,333 $167,504 Adjusted Gross Margin % 43.4 % 48.2 % Adjusted Gross Profit Margin Reconciliation 53/52 weeks ended December 31, 2022 December 30, 2023 Net Sales $1,486,328 $1,476,477 Cost of sales (exclusive of depreciation and amortization) 846,551 828,956 Gross margin exclusive of depreciation and amortization $639,777 $647,521 Gross margin exclusive of depreciation and amortization % 43.0 % 43.9 % Adjusting Items (1): Impairment charges — 5,000 Adjusted Gross Profit $639,777 $652,521 Adjusted Gross Margin % 43.0 % 44.2 % 1. See adjusted EBITDA Reconciliation for details of adjusting items

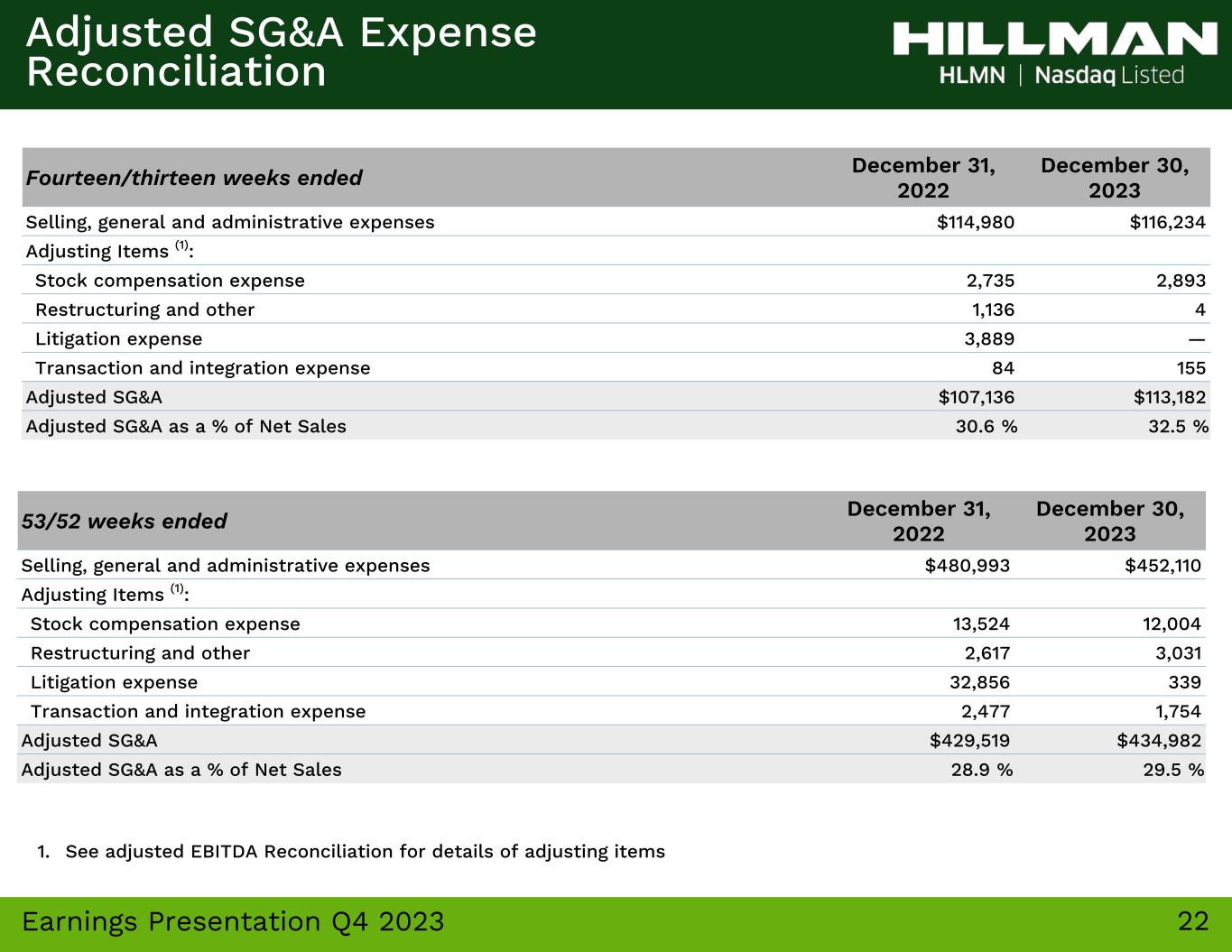

22Earnings Presentation Q4 2023 Fourteen/thirteen weeks ended December 31, 2022 December 30, 2023 Selling, general and administrative expenses $114,980 $116,234 Adjusting Items (1): Stock compensation expense 2,735 2,893 Restructuring and other 1,136 4 Litigation expense 3,889 — Transaction and integration expense 84 155 Adjusted SG&A $107,136 $113,182 Adjusted SG&A as a % of Net Sales 30.6 % 32.5 % Adjusted SG&A Expense Reconciliation 1. See adjusted EBITDA Reconciliation for details of adjusting items 53/52 weeks ended December 31, 2022 December 30, 2023 Selling, general and administrative expenses $480,993 $452,110 Adjusting Items (1): Stock compensation expense 13,524 12,004 Restructuring and other 2,617 3,031 Litigation expense 32,856 339 Transaction and integration expense 2,477 1,754 Adjusted SG&A $429,519 $434,982 Adjusted SG&A as a % of Net Sales 28.9 % 29.5 %

23Earnings Presentation Q4 2023 As of December 31, 2022 December 30, 2023 Revolving loans $72,000 $— Senior term loan 840,363 751,852 Finance leases and other obligations 6,406 9,097 Gross debt $918,769 $760,949 Less cash 31,081 38,553 Net debt $887,688 $722,396 Net Debt & Free Cash Flow Reconciliations 53/52 Weeks Ended December 31, 2022 December 30, 2023 Net cash provided by operating activities $119,011 $238,035 Capital expenditures (69,589) (65,769) Free cash flow $49,422 $172,266 Reconciliation of Net Debt Reconciliation of Free Cash Flow

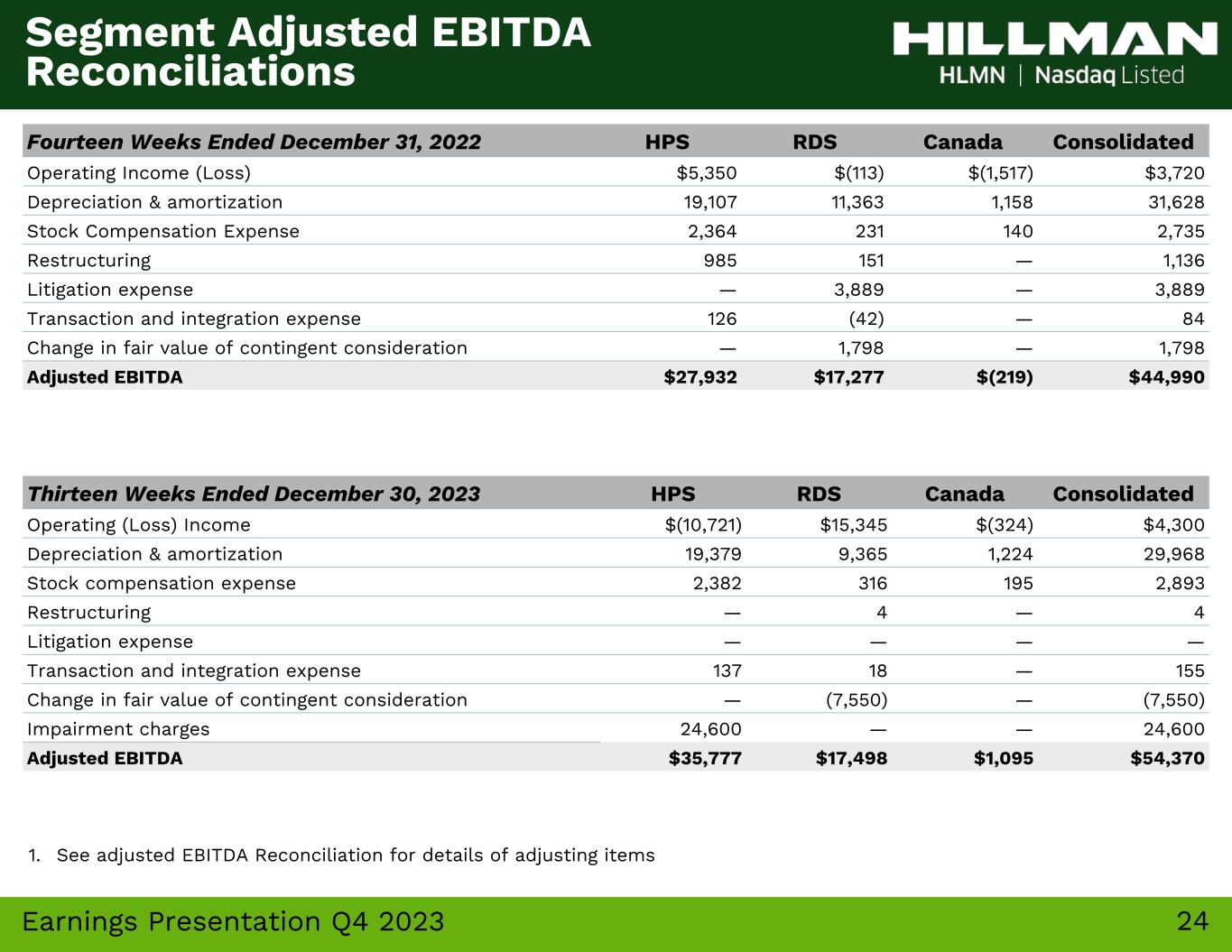

24Earnings Presentation Q4 2023 Thirteen Weeks Ended December 30, 2023 HPS RDS Canada Consolidated Operating (Loss) Income $(10,721) $15,345 $(324) $4,300 Depreciation & amortization 19,379 9,365 1,224 29,968 Stock compensation expense 2,382 316 195 2,893 Restructuring — 4 — 4 Litigation expense — — — — Transaction and integration expense 137 18 — 155 Change in fair value of contingent consideration — (7,550) — (7,550) Impairment charges 24,600 — — 24,600 Adjusted EBITDA $35,777 $17,498 $1,095 $54,370 Fourteen Weeks Ended December 31, 2022 HPS RDS Canada Consolidated Operating Income (Loss) $5,350 $(113) $(1,517) $3,720 Depreciation & amortization 19,107 11,363 1,158 31,628 Stock Compensation Expense 2,364 231 140 2,735 Restructuring 985 151 — 1,136 Litigation expense — 3,889 — 3,889 Transaction and integration expense 126 (42) — 84 Change in fair value of contingent consideration — 1,798 — 1,798 Adjusted EBITDA $27,932 $17,277 $(219) $44,990 Segment Adjusted EBITDA Reconciliations 1. See adjusted EBITDA Reconciliation for details of adjusting items

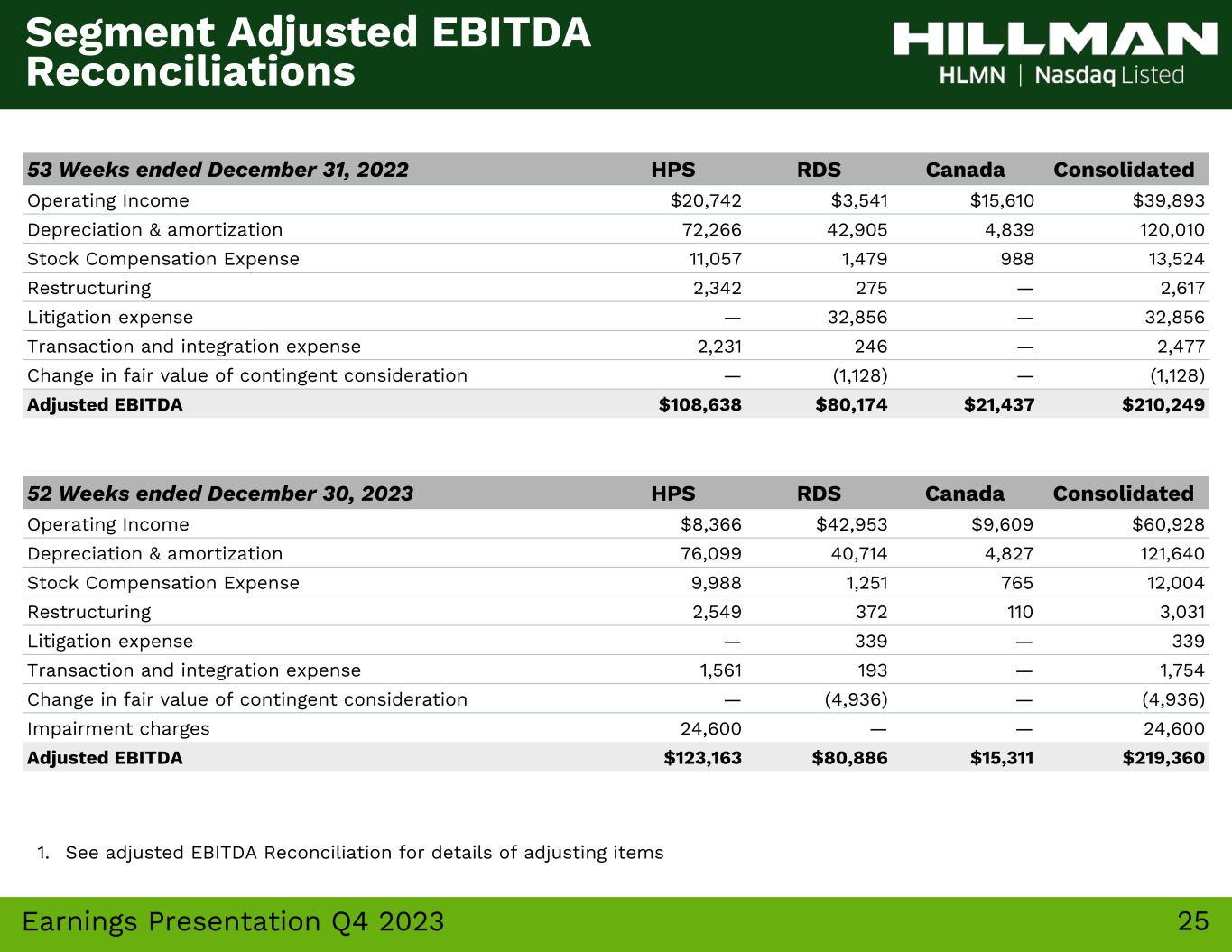

25Earnings Presentation Q4 2023 52 Weeks ended December 30, 2023 HPS RDS Canada Consolidated Operating Income $8,366 $42,953 $9,609 $60,928 Depreciation & amortization 76,099 40,714 4,827 121,640 Stock Compensation Expense 9,988 1,251 765 12,004 Restructuring 2,549 372 110 3,031 Litigation expense — 339 — 339 Transaction and integration expense 1,561 193 — 1,754 Change in fair value of contingent consideration — (4,936) — (4,936) Impairment charges 24,600 — — 24,600 Adjusted EBITDA $123,163 $80,886 $15,311 $219,360 53 Weeks ended December 31, 2022 HPS RDS Canada Consolidated Operating Income $20,742 $3,541 $15,610 $39,893 Depreciation & amortization 72,266 42,905 4,839 120,010 Stock Compensation Expense 11,057 1,479 988 13,524 Restructuring 2,342 275 — 2,617 Litigation expense — 32,856 — 32,856 Transaction and integration expense 2,231 246 — 2,477 Change in fair value of contingent consideration — (1,128) — (1,128) Adjusted EBITDA $108,638 $80,174 $21,437 $210,249 Segment Adjusted EBITDA Reconciliations 1. See adjusted EBITDA Reconciliation for details of adjusting items