EX-99.2

Published on November 8, 2023

Quarterly Earnings Presentation Q3 2023 November 8, 2023

2Earnings Presentation Q3 2023 PresBuilder Placeholder - Delete this box if you see it on a slide, but DO NOT REMOVE this box from the slide layout All statements made in this presentation that are consider to be forward-looking are made in good faith by the Company and are intended to qualify for the safe harbor from liability established by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. You should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," “target”, “goal”, "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) unfavorable economic conditions that may affect operations, financial condition and cash flows including spending on home renovation or construction projects, inflation, recessions, instability in the financial markets or credit markets; (2) increased supply chain costs, including raw materials, sourcing, transportation and energy; (3) the highly competitive nature of the markets that we serve; (4) the ability to continue to innovate with new products and services; (5) direct and indirect costs associated with the May 2023 ransomware attack, and our receipt of expected insurance receivables associated with that cybersecurity incident; (6) seasonality; (7) large customer concentration; (8) the ability to recruit and retain qualified employees; (9) the outcome of any legal proceedings that may be instituted against the Company; (10) adverse changes in currency exchange rates; (11) the impact of COVID-19 on the Company’s business; or (12) regulatory changes and potential legislation that could adversely impact financial results. The foregoing list of factors is not exclusive, and readers should also refer to those risks that are included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including the Annual Report on Form 10-K filed February 27, 2023. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward looking statements. Except as required by applicable law, the Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this communication to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Presentation of Non-GAAP Financial Measures In addition to the results provided in accordance with U.S. generally accepted accounting principles (“GAAP”) throughout this presentation the company has provided non-GAAP financial measures, which present results on a basis adjusted for certain items. The company uses these non-GAAP financial measures for business planning purposes and in measuring its performance relative to that of its competitors. The company believes that these non- GAAP financial measures are useful financial metrics to assess its operating performance from period-to-period by excluding certain items that the company believes are not representative of its core business. These non-GAAP financial measures are not intended to replace, and should not be considered superior to, the presentation of the company’s financial results in accordance with GAAP. The use of the non-GAAP financial measures terms may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures. These non-GAAP financial measures are reconciled from the respective measures under GAAP in the appendix below. The company is not able to provide a reconciliation of the company’s non-GAAP financial guidance to the corresponding GAAP measures without unreasonable effort because of the inherent difficulty in forecasting and quantifying certain amounts necessary for such a reconciliation such as certain non-cash, nonrecurring or other items that are included in net income and EBITDA as well as the related tax impacts of these items and asset dispositions / acquisitions and changes in foreign currency exchange rates that are included in cash flow, due to the uncertainty and variability of the nature and amount of these future charges and costs. Forward Looking Statements

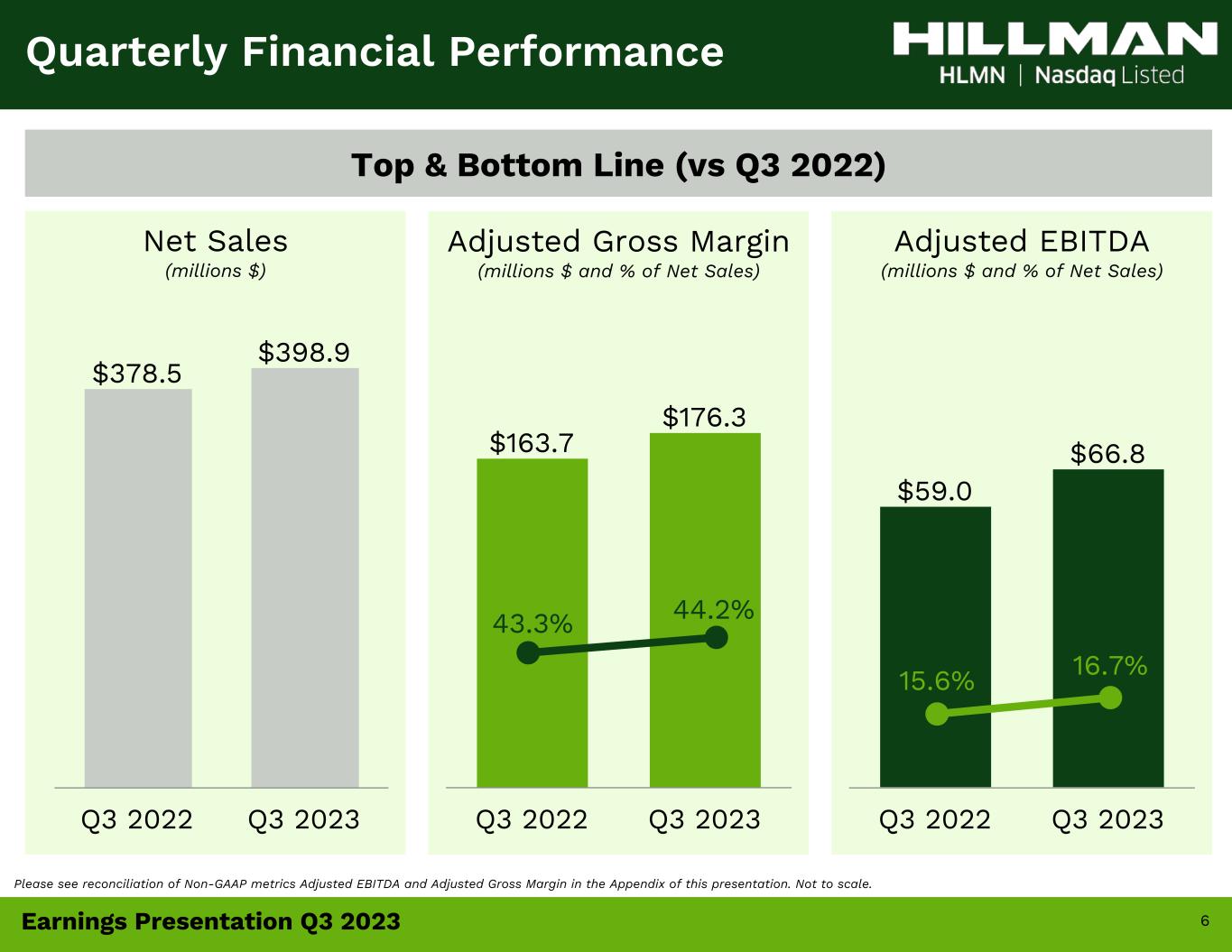

3Earnings Presentation Q3 2023 • Net sales increased 5.4% to $398.9 million versus Q3 2022 ◦ Hardware Solutions increased 8.3% ◦ Robotics and Digital Solutions ("RDS") down (1.4)% ◦ Canada down (9.4)% ◦ Protective Solution increased 13.5% • GAAP net income totaled $5.1 million, or $0.03 per diluted share, compared to net loss of $(9.5) million, or $(0.05) per diluted share, in Q3 2022 • Adjusted EBITDA totaled $66.8 million compared to $59.0 million in Q3 2022 • Adjusted EBITDA (ttm) / Net Debt: 3.7x at quarter end, improved from 4.2x from December 31, 2022 Q3 2023 Financial Review Please see reconciliation tables in the Appendix of this presentation for non-GAAP metrics. Highlights for the 13 Weeks Ended September 30, 2023

4Earnings Presentation Q3 2023 Q3 2023 Operational Review Highlights for the 13 Weeks Ended September 30, 2023 • Updated full year 2023 guidance • Inventory reduced by $33 million during the quarter; bringing year-to-date total to $92 million; expects to reduce by another $5 - $10 million during Q4 2023 • Fill rates averaged approximately 94% year to date • Rolled out new business win in HS and launched nationwide off- shelf promotion in PS - expect to launch PS new business win at top-five customer in Q4 2023 • Cost of goods peaked in May 2023 (driven by high container costs during the Summer of 2022) - resulting margins returned to historical averages during quarter • Named Vendor of the Year by Tractor Supply and Mid-States Distributing

5Earnings Presentation Q3 2023 • Net sales decreased (0.6)% to $1,128.7 million versus the 39 weeks ended September 24, 2022 ◦ Hardware Solutions +5.2% ◦ Robotics and Digital Solutions ("RDS") (1.1)% ◦ Canada (7.6)% ◦ Protective Solutions (6.2)% (excl. COVID sales) • GAAP net income totaled $0.5 million, or $0.00 per diluted share, compared to net loss of $(2.5) million, or $(0.01) per diluted share, during the 39 weeks ended September 24, 2022 • Adjusted EBITDA totaled $165.0 million compared to $165.3 million during the the 39 weeks ended September 24, 2022 • Free Cash Flow totaled $119.3 million compared to $16.8 million during the 39 weeks ended September 24, 2022 Q3 2023 Financial Review Please see reconciliation tables in the Appendix of this presentation for non-GAAP metrics. Highlights for the 39 Weeks Ended September 30, 2023

6Earnings Presentation Q3 2023 Quarterly Financial Performance Adjusted EBITDA (millions $ and % of Net Sales) Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Adjusted Gross Margin in the Appendix of this presentation. Not to scale. Top & Bottom Line (vs Q3 2022) Net Sales (millions $) Adjusted Gross Margin (millions $ and % of Net Sales) $59.0 $66.8 Q3 2022 Q3 2023 16.7%15.6% $163.7 $176.3 Q3 2022 Q3 2023 $378.5 $398.9 Q3 2022 Q3 2023 44.2%43.3%

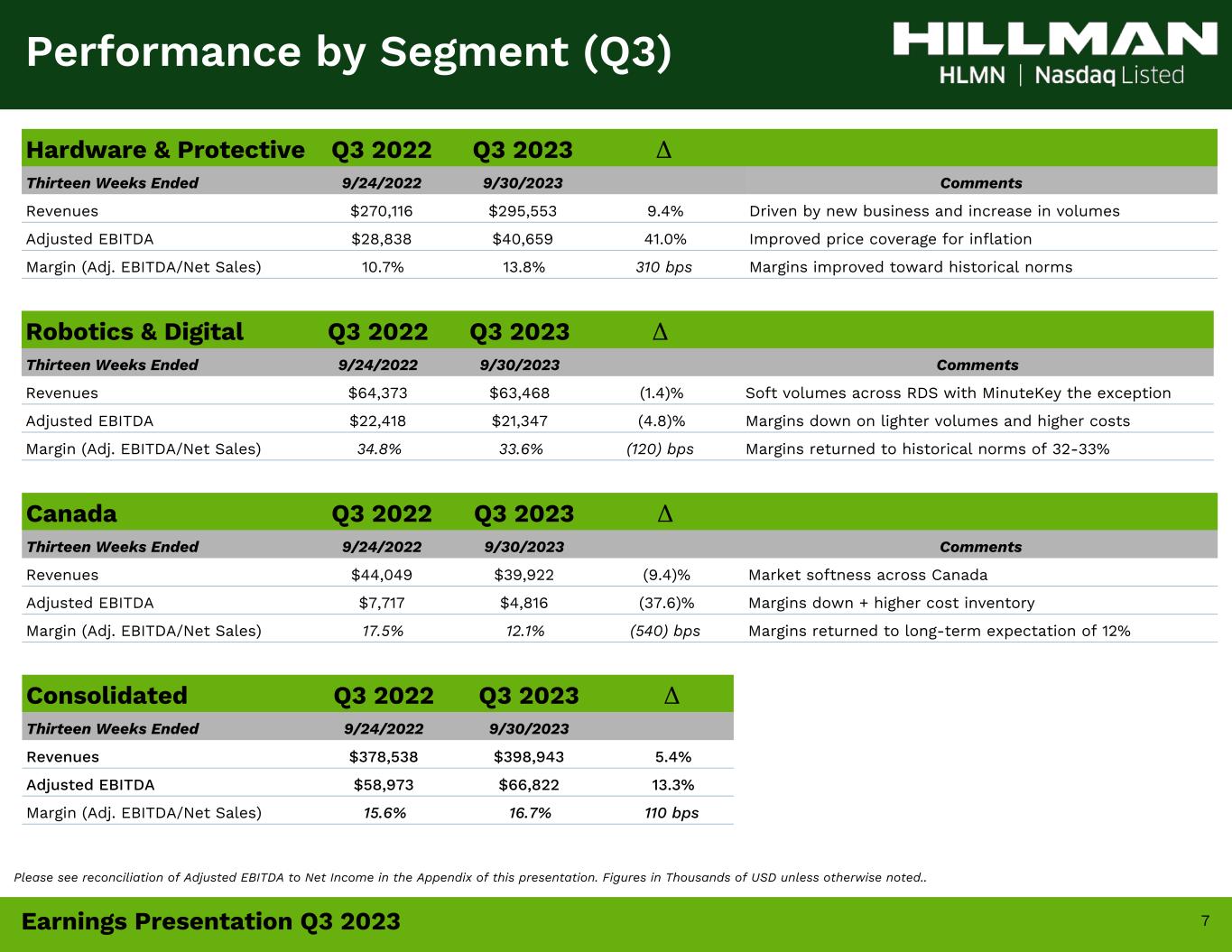

7Earnings Presentation Q3 2023 Hardware & Protective Q3 2022 Q3 2023 Δ Thirteen Weeks Ended 9/24/2022 9/30/2023 Comments Revenues $270,116 $295,553 9.4% Driven by new business and increase in volumes Adjusted EBITDA $28,838 $40,659 41.0% Improved price coverage for inflation Margin (Adj. EBITDA/Net Sales) 10.7% 13.8% 310 bps Margins improved toward historical norms Robotics & Digital Q3 2022 Q3 2023 Δ Thirteen Weeks Ended 9/24/2022 9/30/2023 Comments Revenues $64,373 $63,468 (1.4)% Soft volumes across RDS with MinuteKey the exception Adjusted EBITDA $22,418 $21,347 (4.8)% Margins down on lighter volumes and higher costs Margin (Adj. EBITDA/Net Sales) 34.8% 33.6% (120) bps Margins returned to historical norms of 32-33% Canada Q3 2022 Q3 2023 Δ Thirteen Weeks Ended 9/24/2022 9/30/2023 Comments Revenues $44,049 $39,922 (9.4)% Market softness across Canada Adjusted EBITDA $7,717 $4,816 (37.6)% Margins down + higher cost inventory Margin (Adj. EBITDA/Net Sales) 17.5% 12.1% (540) bps Margins returned to long-term expectation of 12% Consolidated Q3 2022 Q3 2023 Δ Thirteen Weeks Ended 9/24/2022 9/30/2023 Revenues $378,538 $398,943 5.4% Adjusted EBITDA $58,973 $66,822 13.3% Margin (Adj. EBITDA/Net Sales) 15.6% 16.7% 110 bps Performance by Segment (Q3) Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted..

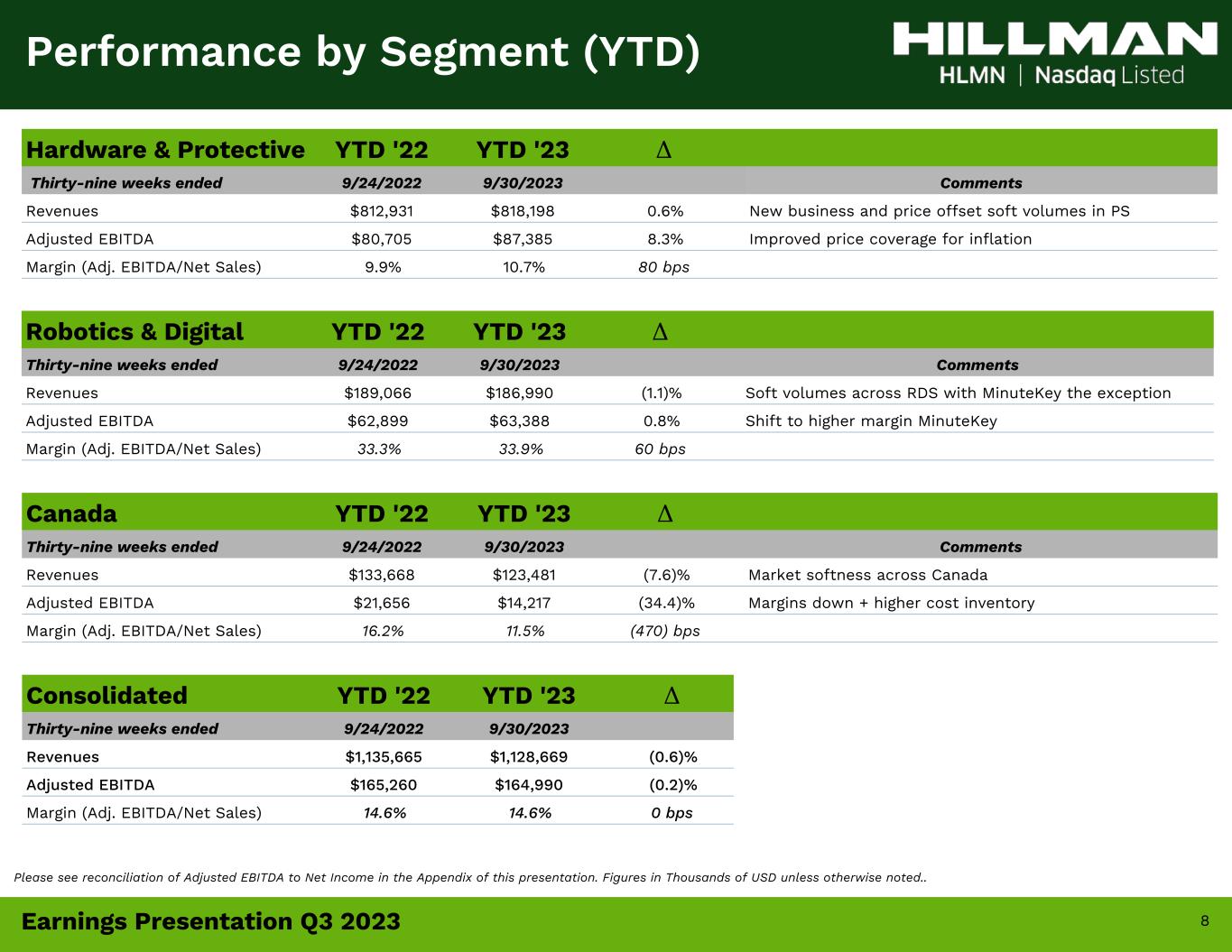

8Earnings Presentation Q3 2023 Hardware & Protective YTD '22 YTD '23 Δ Thirty-nine weeks ended 9/24/2022 9/30/2023 Comments Revenues $812,931 $818,198 0.6% New business and price offset soft volumes in PS Adjusted EBITDA $80,705 $87,385 8.3% Improved price coverage for inflation Margin (Adj. EBITDA/Net Sales) 9.9% 10.7% 80 bps Robotics & Digital YTD '22 YTD '23 Δ Thirty-nine weeks ended 9/24/2022 9/30/2023 Comments Revenues $189,066 $186,990 (1.1)% Soft volumes across RDS with MinuteKey the exception Adjusted EBITDA $62,899 $63,388 0.8% Shift to higher margin MinuteKey Margin (Adj. EBITDA/Net Sales) 33.3% 33.9% 60 bps Canada YTD '22 YTD '23 Δ Thirty-nine weeks ended 9/24/2022 9/30/2023 Comments Revenues $133,668 $123,481 (7.6)% Market softness across Canada Adjusted EBITDA $21,656 $14,217 (34.4)% Margins down + higher cost inventory Margin (Adj. EBITDA/Net Sales) 16.2% 11.5% (470) bps Consolidated YTD '22 YTD '23 Δ Thirty-nine weeks ended 9/24/2022 9/30/2023 Revenues $1,135,665 $1,128,669 (0.6)% Adjusted EBITDA $165,260 $164,990 (0.2)% Margin (Adj. EBITDA/Net Sales) 14.6% 14.6% 0 bps Performance by Segment (YTD) Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted..

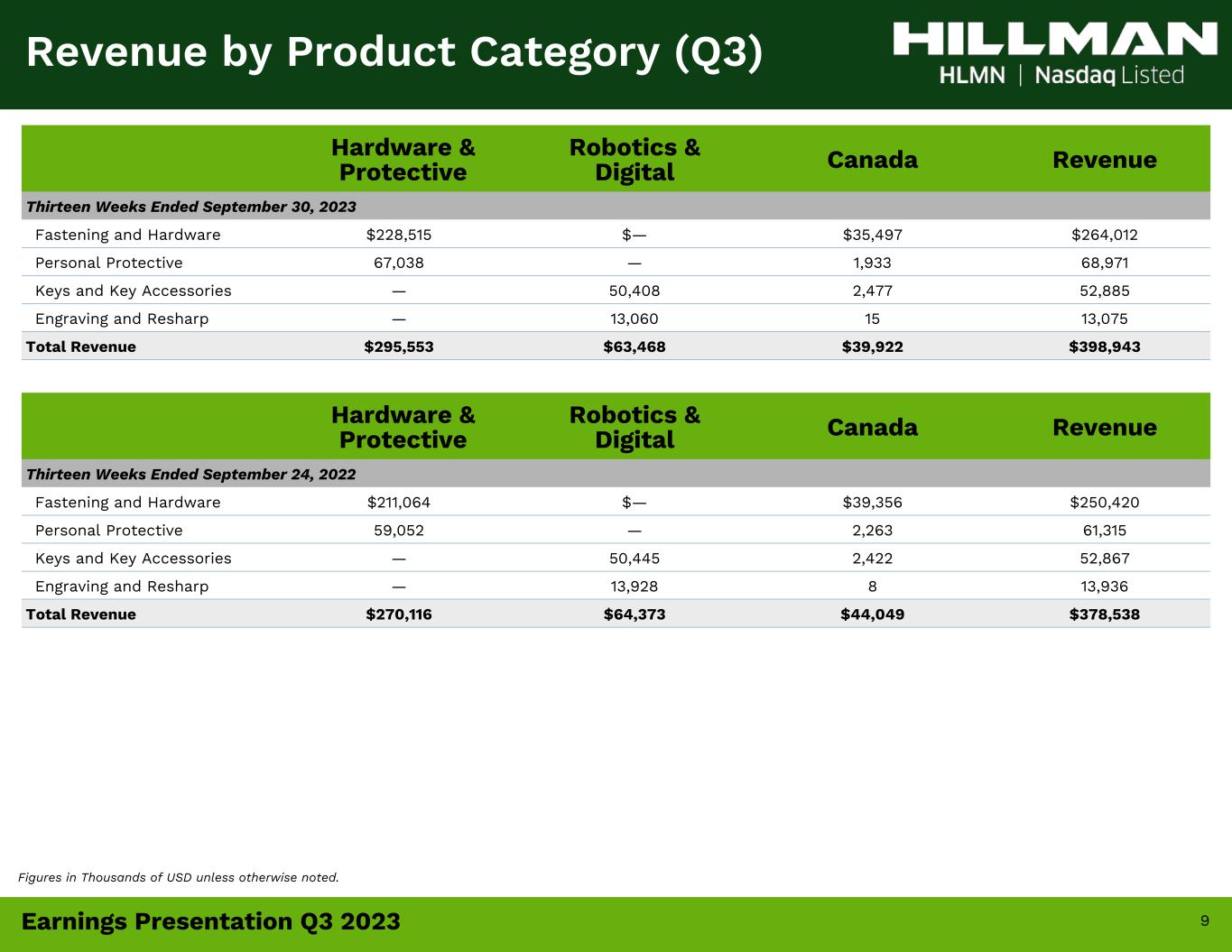

9Earnings Presentation Q3 2023 Hardware & Protective Robotics & Digital Canada Revenue Thirteen Weeks Ended September 30, 2023 Fastening and Hardware $228,515 $— $35,497 $264,012 Personal Protective 67,038 — 1,933 68,971 Keys and Key Accessories — 50,408 2,477 52,885 Engraving and Resharp — 13,060 15 13,075 Total Revenue $295,553 $63,468 $39,922 $398,943 Revenue by Product Category (Q3) Hardware & Protective Robotics & Digital Canada Revenue Thirteen Weeks Ended September 24, 2022 Fastening and Hardware $211,064 $— $39,356 $250,420 Personal Protective 59,052 — 2,263 61,315 Keys and Key Accessories — 50,445 2,422 52,867 Engraving and Resharp — 13,928 8 13,936 Total Revenue $270,116 $64,373 $44,049 $378,538 Figures in Thousands of USD unless otherwise noted.

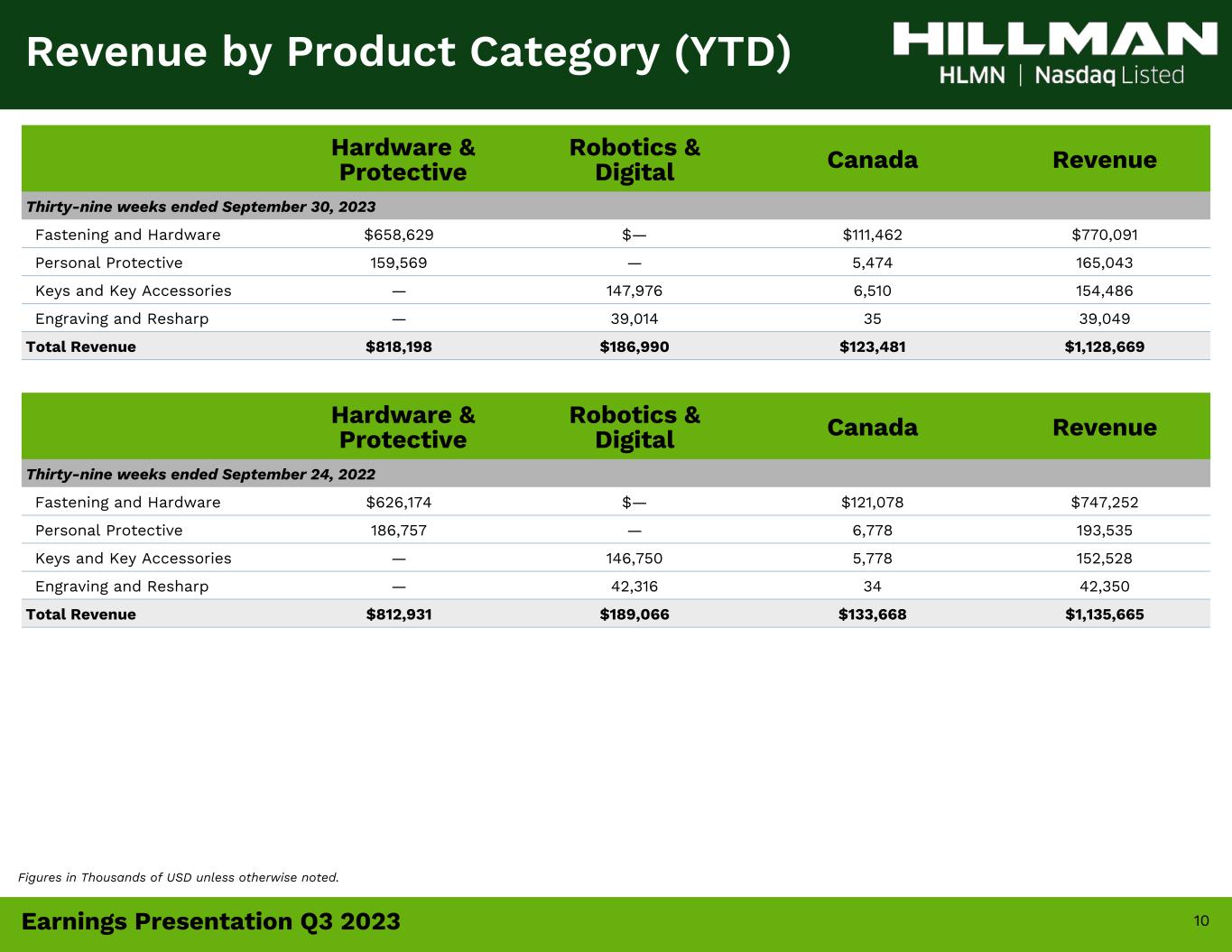

10Earnings Presentation Q3 2023 Hardware & Protective Robotics & Digital Canada Revenue Thirty-nine weeks ended September 30, 2023 Fastening and Hardware $658,629 $— $111,462 $770,091 Personal Protective 159,569 — 5,474 165,043 Keys and Key Accessories — 147,976 6,510 154,486 Engraving and Resharp — 39,014 35 39,049 Total Revenue $818,198 $186,990 $123,481 $1,128,669 Revenue by Product Category (YTD) Hardware & Protective Robotics & Digital Canada Revenue Thirty-nine weeks ended September 24, 2022 Fastening and Hardware $626,174 $— $121,078 $747,252 Personal Protective 186,757 — 6,778 193,535 Keys and Key Accessories — 146,750 5,778 152,528 Engraving and Resharp — 42,316 34 42,350 Total Revenue $812,931 $189,066 $133,668 $1,135,665 Figures in Thousands of USD unless otherwise noted.

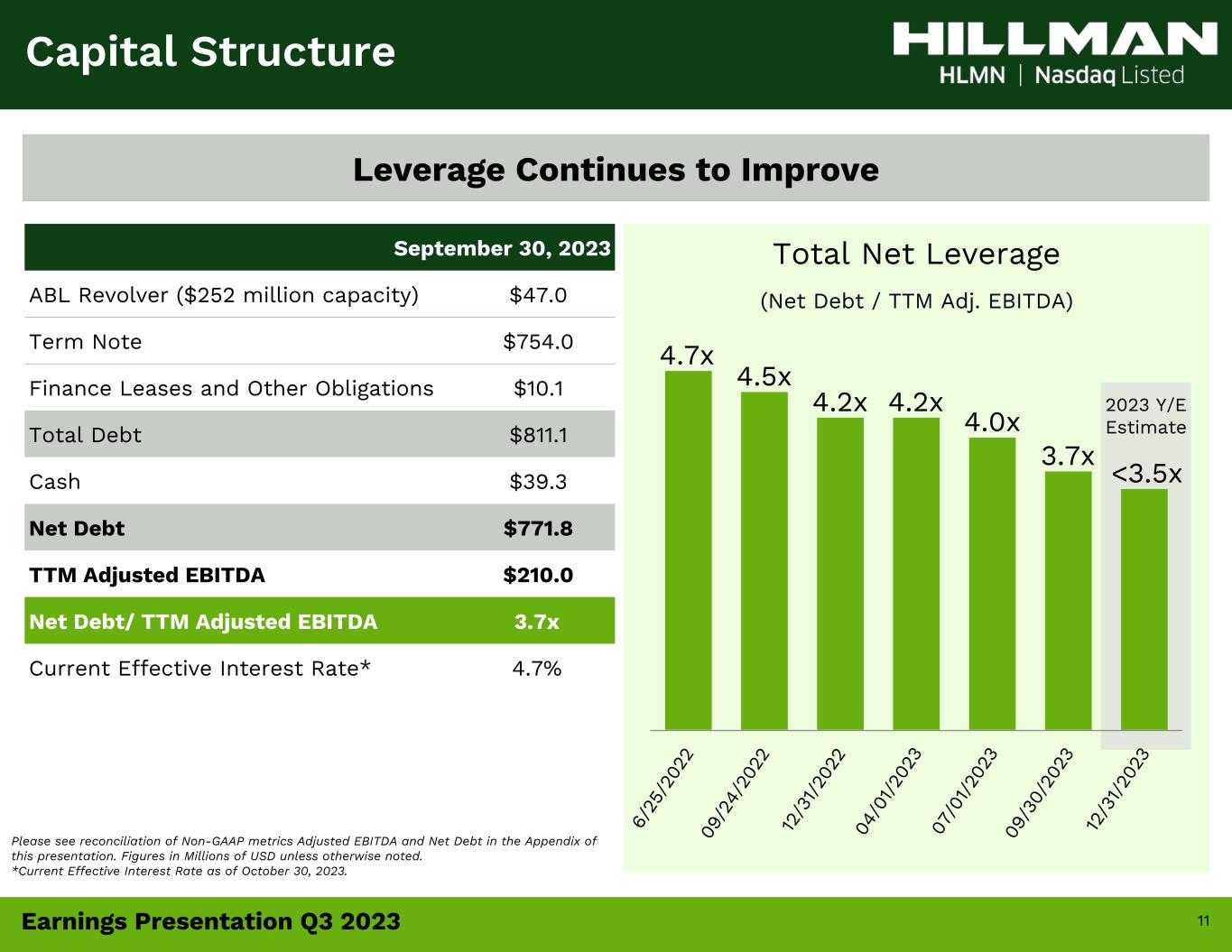

11Earnings Presentation Q3 2023 Total Net Leverage (Net Debt / TTM Adj. EBITDA) Capital Structure September 30, 2023 ABL Revolver ($252 million capacity) $47.0 Term Note $754.0 Finance Leases and Other Obligations $10.1 Total Debt $811.1 Cash $39.3 Net Debt $771.8 TTM Adjusted EBITDA $210.0 Net Debt/ TTM Adjusted EBITDA 3.7x Current Effective Interest Rate* 4.7% Leverage Continues to Improve 2023 Y/E Estimate Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Net Debt in the Appendix of this presentation. Figures in Millions of USD unless otherwise noted. *Current Effective Interest Rate as of October 30, 2023. <3.5x 4.7x 4.5x 4.2x 4.2x 4.0x 3.7x 6/ 25 /2 02 2 09 /2 4/ 20 22 12 /3 1/ 20 22 04 /0 1/ 20 23 07 /0 1/ 20 23 09 /3 0/ 20 23 12 /3 1/ 20 23

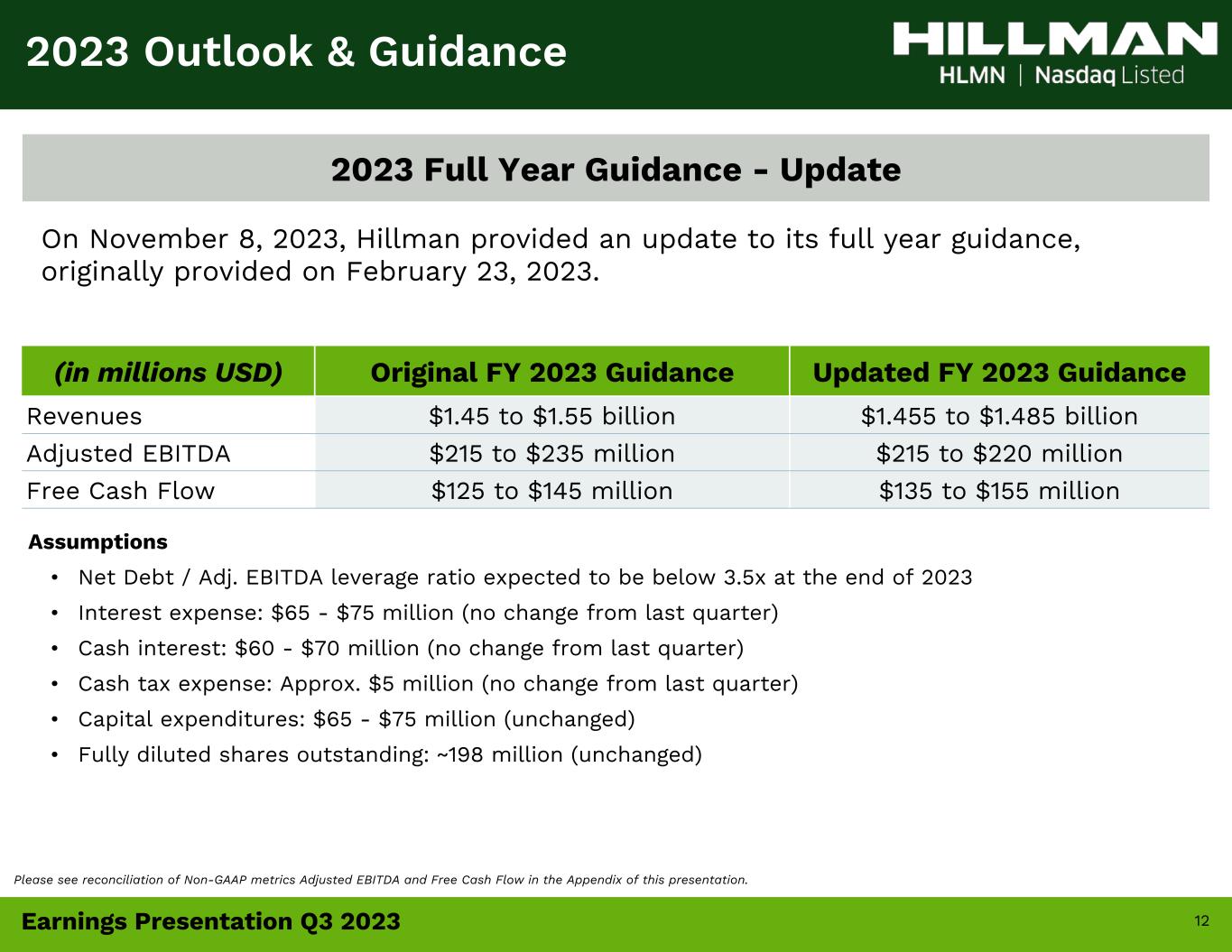

12Earnings Presentation Q3 2023 2023 Outlook & Guidance (in millions USD) Original FY 2023 Guidance Updated FY 2023 Guidance Revenues $1.45 to $1.55 billion $1.455 to $1.485 billion Adjusted EBITDA $215 to $235 million $215 to $220 million Free Cash Flow $125 to $145 million $135 to $155 million Assumptions • Net Debt / Adj. EBITDA leverage ratio expected to be below 3.5x at the end of 2023 • Interest expense: $65 - $75 million (no change from last quarter) • Cash interest: $60 - $70 million (no change from last quarter) • Cash tax expense: Approx. $5 million (no change from last quarter) • Capital expenditures: $65 - $75 million (unchanged) • Fully diluted shares outstanding: ~198 million (unchanged) On November 8, 2023, Hillman provided an update to its full year guidance, originally provided on February 23, 2023. 2023 Full Year Guidance - Update Please see reconciliation of Non-GAAP metrics Adjusted EBITDA and Free Cash Flow in the Appendix of this presentation.

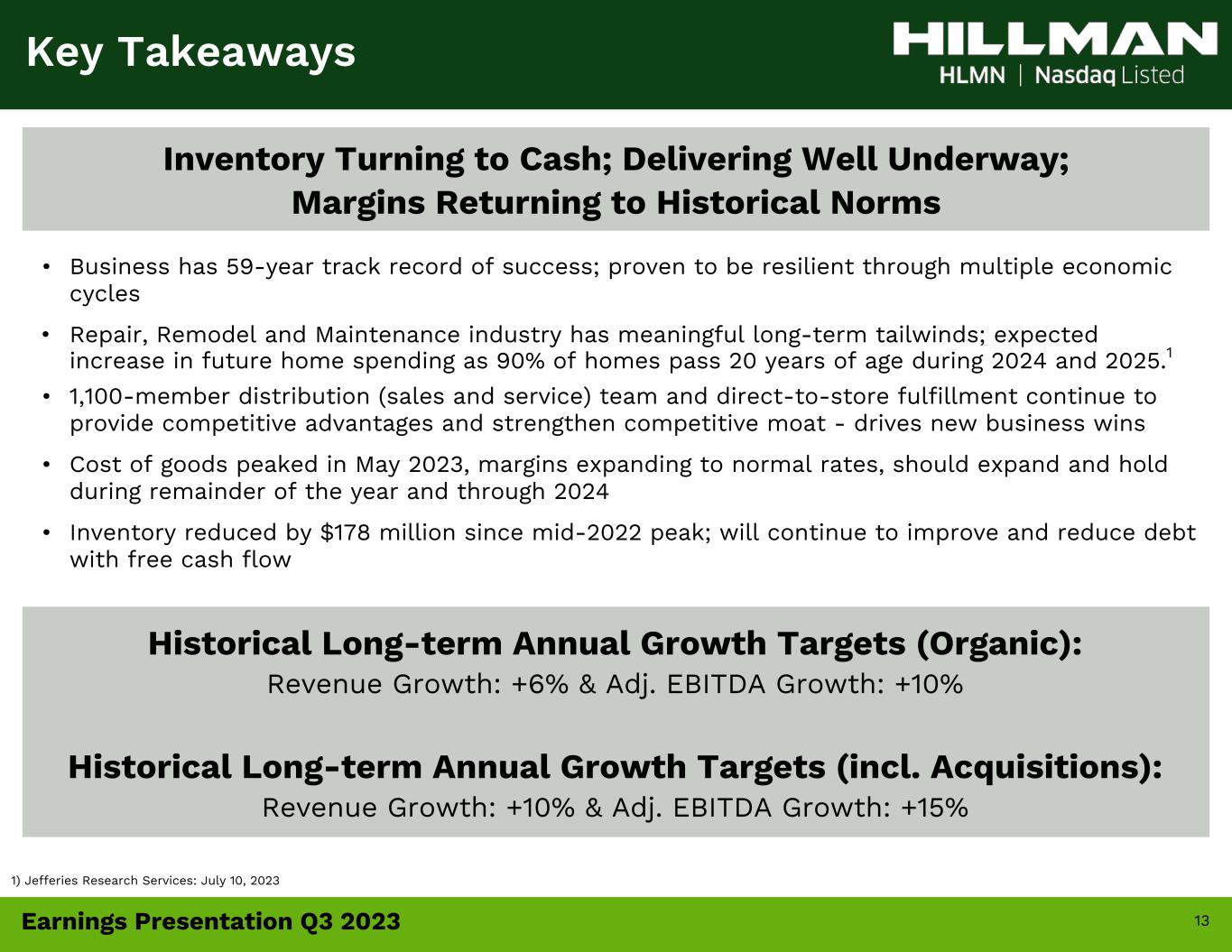

13Earnings Presentation Q3 2023 Key Takeaways Inventory Turning to Cash; Delivering Well Underway; Margins Returning to Historical Norms Historical Long-term Annual Growth Targets (Organic): Revenue Growth: +6% & Adj. EBITDA Growth: +10% Historical Long-term Annual Growth Targets (incl. Acquisitions): Revenue Growth: +10% & Adj. EBITDA Growth: +15% • Business has 59-year track record of success; proven to be resilient through multiple economic cycles • Repair, Remodel and Maintenance industry has meaningful long-term tailwinds; expected increase in future home spending as 90% of homes pass 20 years of age during 2024 and 2025.1 • 1,100-member distribution (sales and service) team and direct-to-store fulfillment continue to provide competitive advantages and strengthen competitive moat - drives new business wins • Cost of goods peaked in May 2023, margins expanding to normal rates, should expand and hold during remainder of the year and through 2024 • Inventory reduced by $178 million since mid-2022 peak; will continue to improve and reduce debt with free cash flow 1) Jefferies Research Services: July 10, 2023

14 Appendix

15Earnings Presentation Q3 2023 Investment Highlights Significant runway for incremental growth: Organic + M&A Management team with proven operational and M&A expertise Strong financial profile with 59-year track record Market and innovation leader across multiple categories Indispensable partner embedded with winning retailers Customers love us, trust us and rely on us Large, predictable, growing and resilient end markets

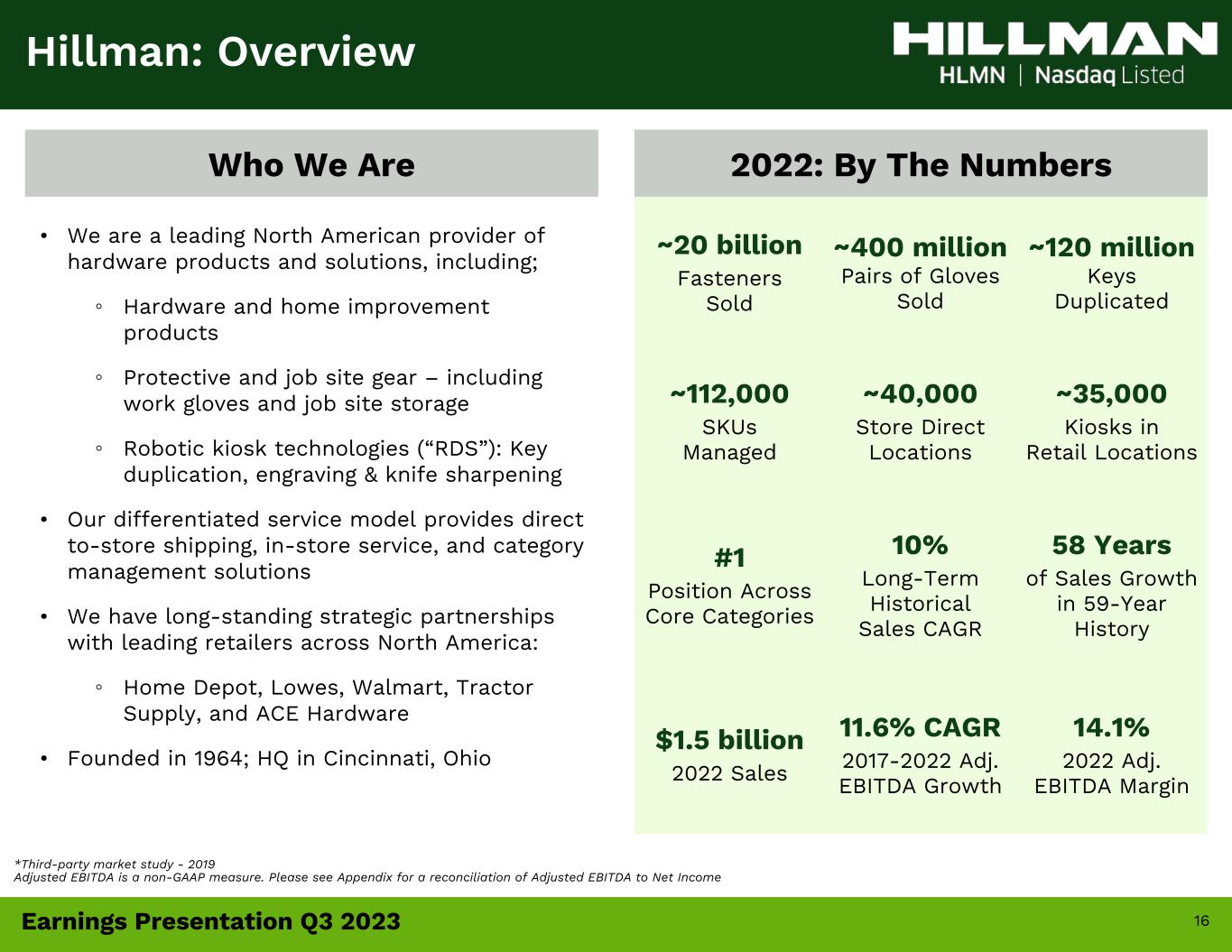

16Earnings Presentation Q3 2023 Hillman: Overview Who We Are *Third-party market study - 2019 Adjusted EBITDA is a non-GAAP measure. Please see Appendix for a reconciliation of Adjusted EBITDA to Net Income ~20 billion Fasteners Sold ~400 million Pairs of Gloves Sold ~120 million Keys Duplicated ~112,000 SKUs Managed ~40,000 Store Direct Locations ~35,000 Kiosks in Retail Locations #1 Position Across Core Categories 10% Long-Term Historical Sales CAGR 58 Years of Sales Growth in 59-Year History $1.5 billion 2022 Sales 11.6% CAGR 2017-2022 Adj. EBITDA Growth 14.1% 2022 Adj. EBITDA Margin 2022: By The Numbers • We are a leading North American provider of hardware products and solutions, including; ◦ Hardware and home improvement products ◦ Protective and job site gear – including work gloves and job site storage ◦ Robotic kiosk technologies (“RDS”): Key duplication, engraving & knife sharpening • Our differentiated service model provides direct to-store shipping, in-store service, and category management solutions • We have long-standing strategic partnerships with leading retailers across North America: ◦ Home Depot, Lowes, Walmart, Tractor Supply, and ACE Hardware • Founded in 1964; HQ in Cincinnati, Ohio

17Earnings Presentation Q3 2023 Primary Product Categories #1 in Segment Representative Top Customers #1 in Segment #1 in Segment Key and Fob Duplication Personalized Tags Knife Sharpening Fasteners & Specialty Gloves Builders Hardware & Metal Shapes Safety / PPE Construction Fasteners Work Gear Picture Hanging Source: Third party industry report. Hardware Solutions Protective Solutions Robotics & Digital Solutions

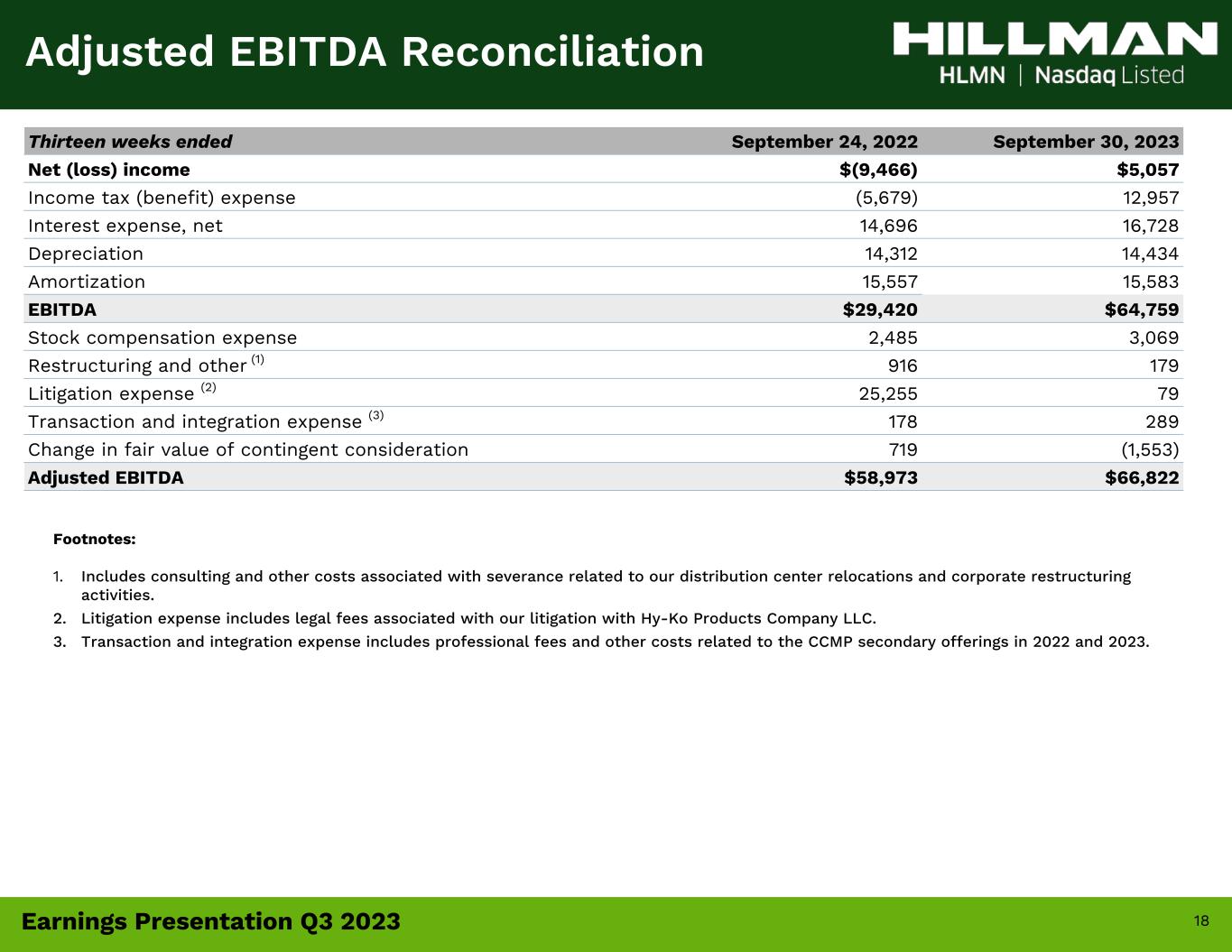

18Earnings Presentation Q3 2023 Thirteen weeks ended September 24, 2022 September 30, 2023 Net (loss) income $(9,466) $5,057 Income tax (benefit) expense (5,679) 12,957 Interest expense, net 14,696 16,728 Depreciation 14,312 14,434 Amortization 15,557 15,583 EBITDA $29,420 $64,759 Stock compensation expense 2,485 3,069 Restructuring and other (1) 916 179 Litigation expense (2) 25,255 79 Transaction and integration expense (3) 178 289 Change in fair value of contingent consideration 719 (1,553) Adjusted EBITDA $58,973 $66,822 Adjusted EBITDA Reconciliation Footnotes: 1. Includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities. 2. Litigation expense includes legal fees associated with our litigation with Hy-Ko Products Company LLC. 3. Transaction and integration expense includes professional fees and other costs related to the CCMP secondary offerings in 2022 and 2023.

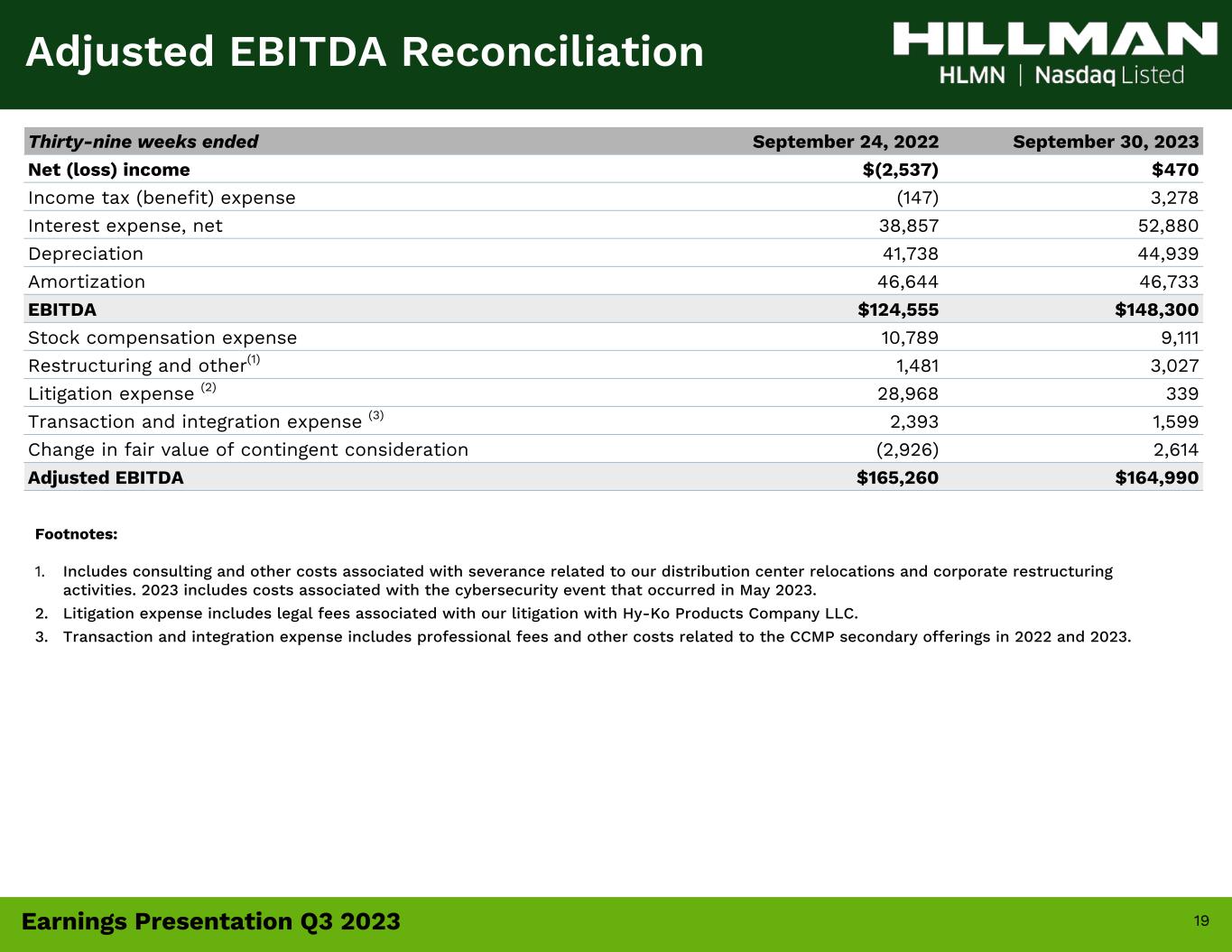

19Earnings Presentation Q3 2023 Thirty-nine weeks ended September 24, 2022 September 30, 2023 Net (loss) income $(2,537) $470 Income tax (benefit) expense (147) 3,278 Interest expense, net 38,857 52,880 Depreciation 41,738 44,939 Amortization 46,644 46,733 EBITDA $124,555 $148,300 Stock compensation expense 10,789 9,111 Restructuring and other(1) 1,481 3,027 Litigation expense (2) 28,968 339 Transaction and integration expense (3) 2,393 1,599 Change in fair value of contingent consideration (2,926) 2,614 Adjusted EBITDA $165,260 $164,990 Adjusted EBITDA Reconciliation Footnotes: 1. Includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities. 2023 includes costs associated with the cybersecurity event that occurred in May 2023. 2. Litigation expense includes legal fees associated with our litigation with Hy-Ko Products Company LLC. 3. Transaction and integration expense includes professional fees and other costs related to the CCMP secondary offerings in 2022 and 2023.

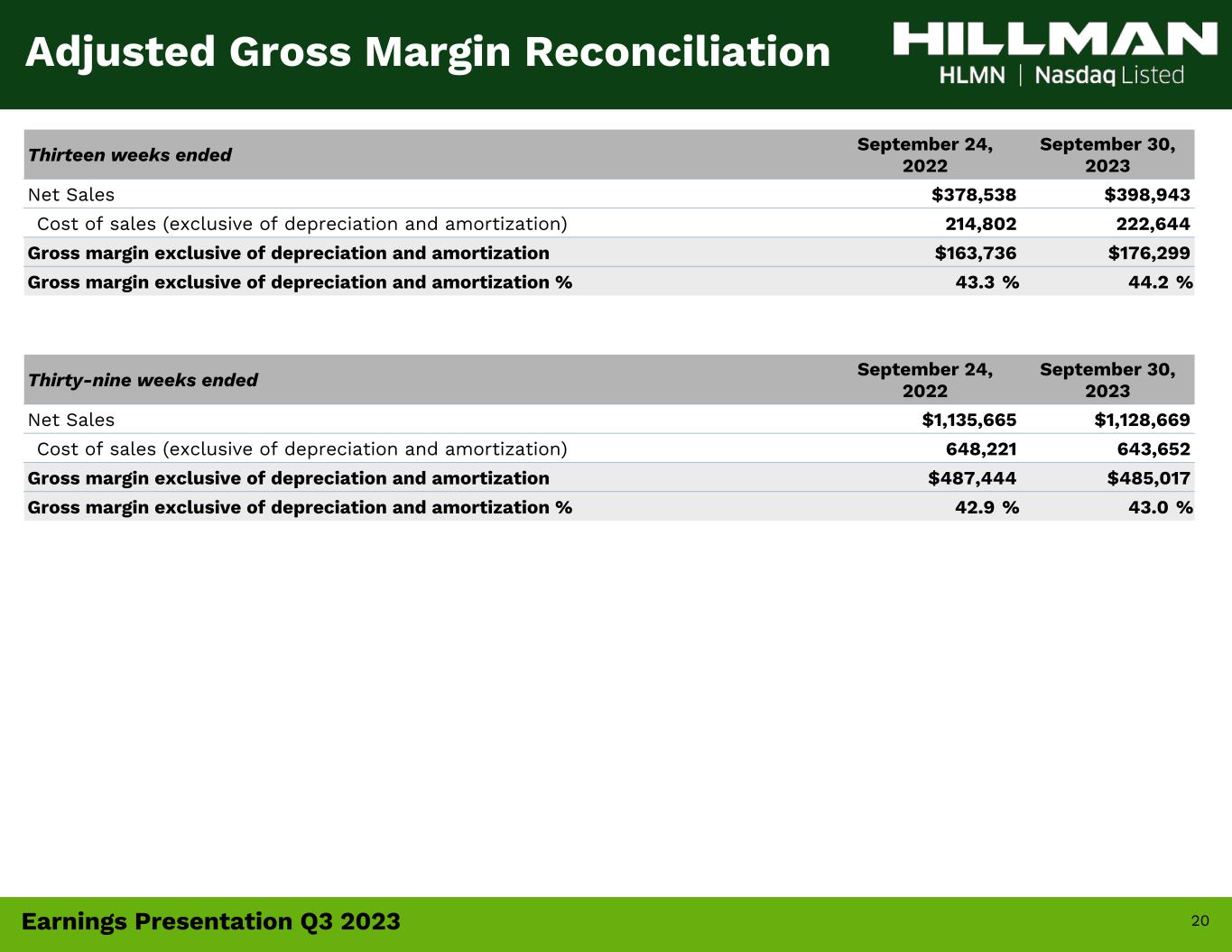

20Earnings Presentation Q3 2023 Thirteen weeks ended September 24, 2022 September 30, 2023 Net Sales $378,538 $398,943 Cost of sales (exclusive of depreciation and amortization) 214,802 222,644 Gross margin exclusive of depreciation and amortization $163,736 $176,299 Gross margin exclusive of depreciation and amortization % 43.3 % 44.2 % Thirty-nine weeks ended September 24, 2022 September 30, 2023 Net Sales $1,135,665 $1,128,669 Cost of sales (exclusive of depreciation and amortization) 648,221 643,652 Gross margin exclusive of depreciation and amortization $487,444 $485,017 Gross margin exclusive of depreciation and amortization % 42.9 % 43.0 % Adjusted Gross Margin Reconciliation

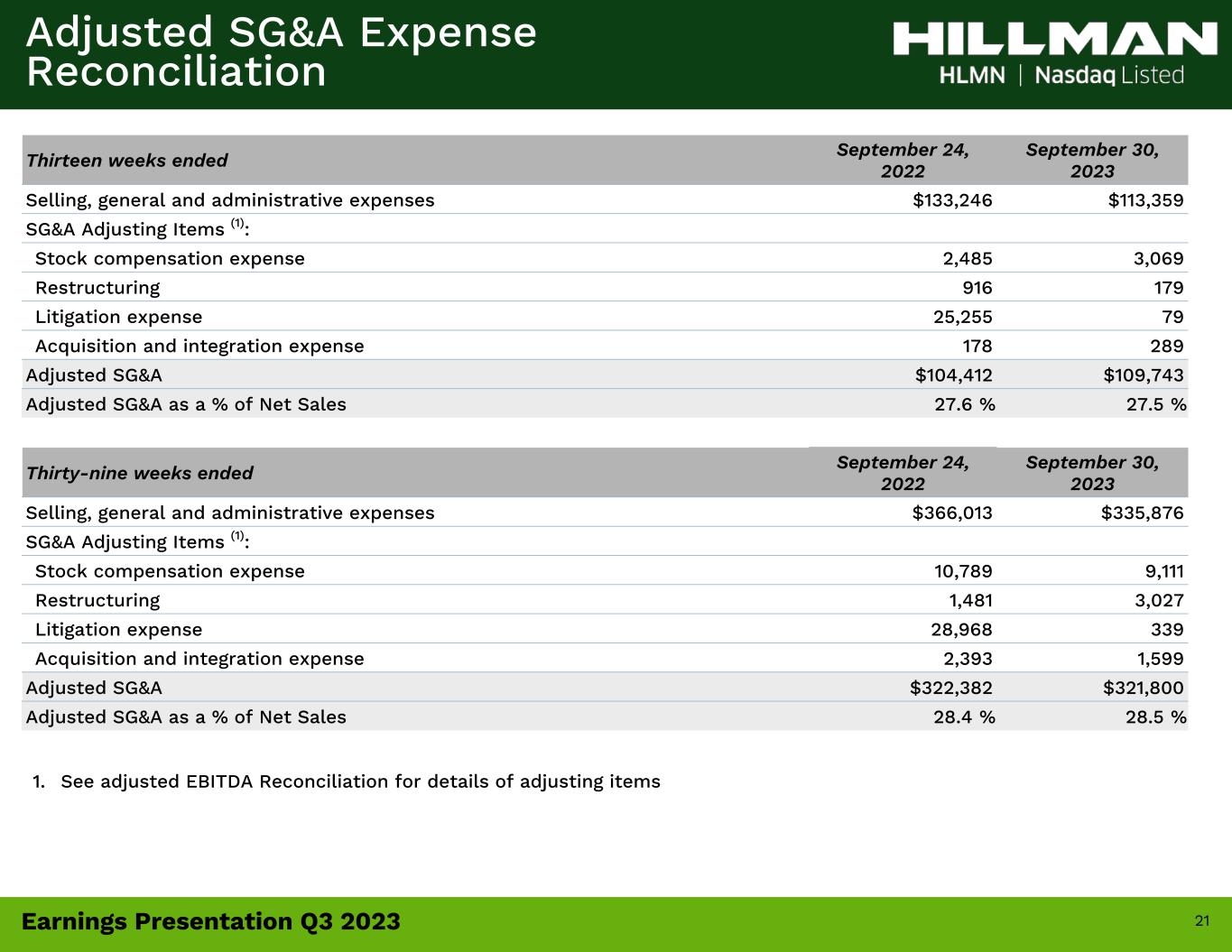

21Earnings Presentation Q3 2023 Thirteen weeks ended September 24, 2022 September 30, 2023 Selling, general and administrative expenses $133,246 $113,359 SG&A Adjusting Items (1): Stock compensation expense 2,485 3,069 Restructuring 916 179 Litigation expense 25,255 79 Acquisition and integration expense 178 289 Adjusted SG&A $104,412 $109,743 Adjusted SG&A as a % of Net Sales 27.6 % 27.5 % Thirty-nine weeks ended September 24, 2022 September 30, 2023 Selling, general and administrative expenses $366,013 $335,876 SG&A Adjusting Items (1): Stock compensation expense 10,789 9,111 Restructuring 1,481 3,027 Litigation expense 28,968 339 Acquisition and integration expense 2,393 1,599 Adjusted SG&A $322,382 $321,800 Adjusted SG&A as a % of Net Sales 28.4 % 28.5 % Adjusted SG&A Expense Reconciliation 1. See adjusted EBITDA Reconciliation for details of adjusting items

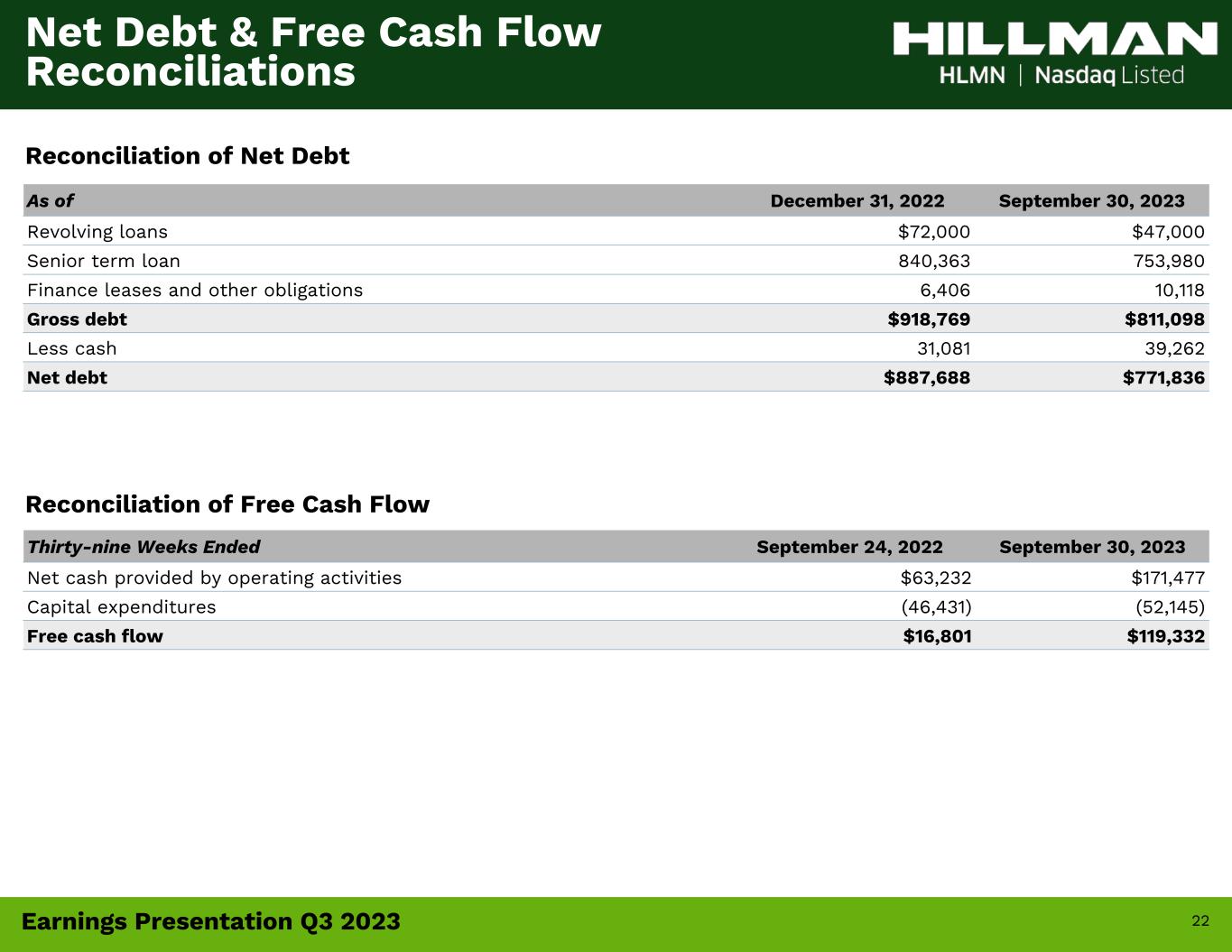

22Earnings Presentation Q3 2023 As of December 31, 2022 September 30, 2023 Revolving loans $72,000 $47,000 Senior term loan 840,363 753,980 Finance leases and other obligations 6,406 10,118 Gross debt $918,769 $811,098 Less cash 31,081 39,262 Net debt $887,688 $771,836 Net Debt & Free Cash Flow Reconciliations Thirty-nine Weeks Ended September 24, 2022 September 30, 2023 Net cash provided by operating activities $63,232 $171,477 Capital expenditures (46,431) (52,145) Free cash flow $16,801 $119,332 Reconciliation of Net Debt Reconciliation of Free Cash Flow

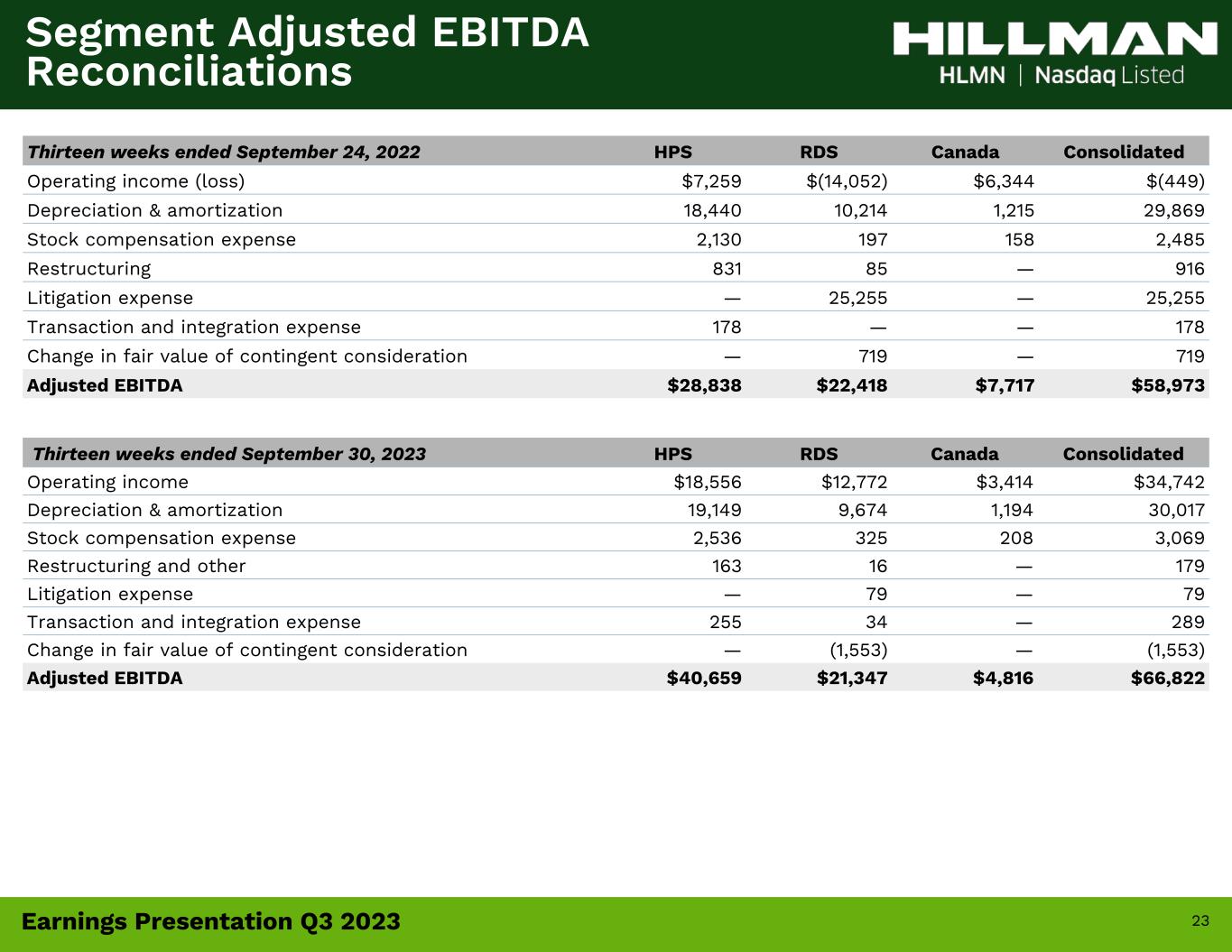

23Earnings Presentation Q3 2023 Thirteen weeks ended September 30, 2023 HPS RDS Canada Consolidated Operating income $18,556 $12,772 $3,414 $34,742 Depreciation & amortization 19,149 9,674 1,194 30,017 Stock compensation expense 2,536 325 208 3,069 Restructuring and other 163 16 — 179 Litigation expense — 79 — 79 Transaction and integration expense 255 34 — 289 Change in fair value of contingent consideration — (1,553) — (1,553) Adjusted EBITDA $40,659 $21,347 $4,816 $66,822 Thirteen weeks ended September 24, 2022 HPS RDS Canada Consolidated Operating income (loss) $7,259 $(14,052) $6,344 $(449) Depreciation & amortization 18,440 10,214 1,215 29,869 Stock compensation expense 2,130 197 158 2,485 Restructuring 831 85 — 916 Litigation expense — 25,255 — 25,255 Transaction and integration expense 178 — — 178 Change in fair value of contingent consideration — 719 — 719 Adjusted EBITDA $28,838 $22,418 $7,717 $58,973 Segment Adjusted EBITDA Reconciliations

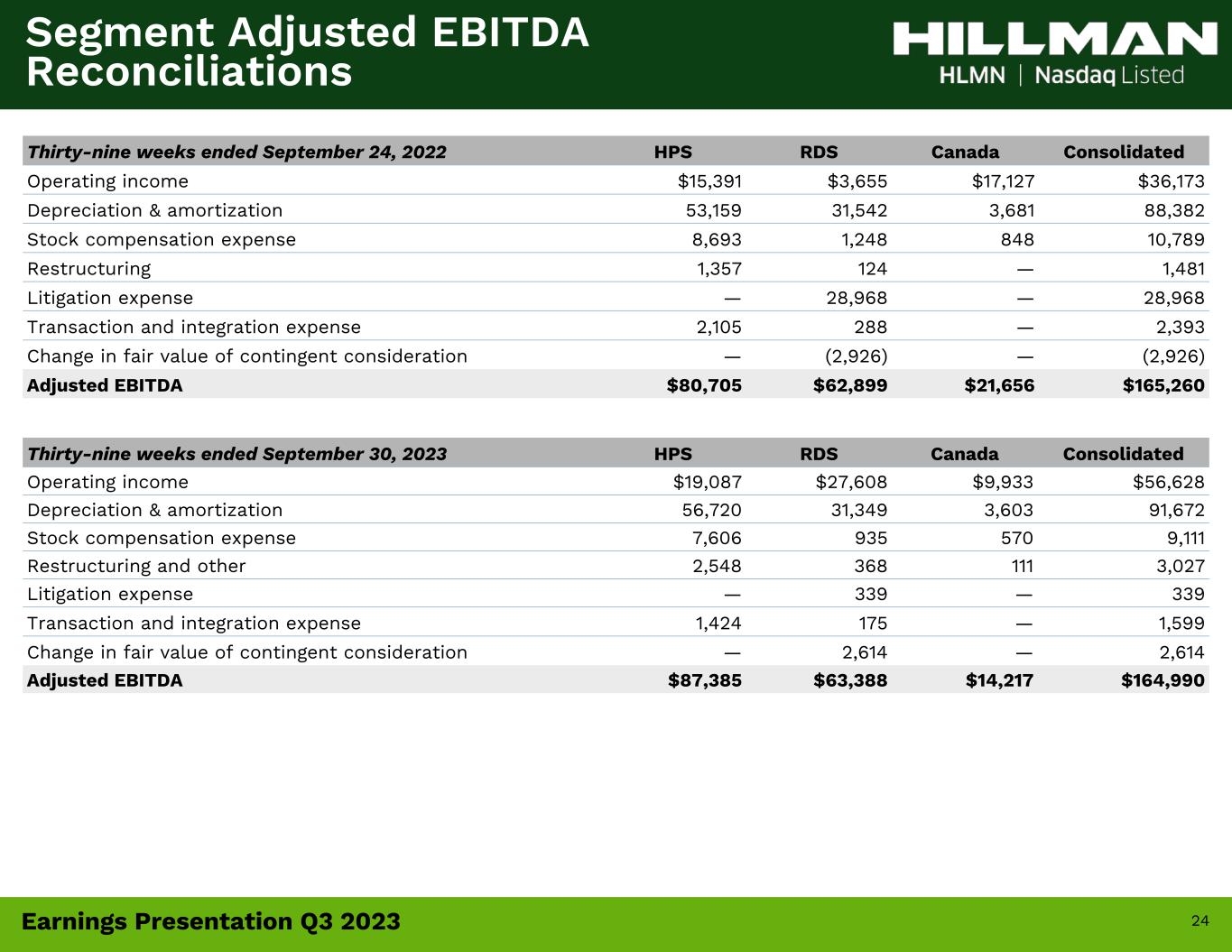

24Earnings Presentation Q3 2023 Thirty-nine weeks ended September 30, 2023 HPS RDS Canada Consolidated Operating income $19,087 $27,608 $9,933 $56,628 Depreciation & amortization 56,720 31,349 3,603 91,672 Stock compensation expense 7,606 935 570 9,111 Restructuring and other 2,548 368 111 3,027 Litigation expense — 339 — 339 Transaction and integration expense 1,424 175 — 1,599 Change in fair value of contingent consideration — 2,614 — 2,614 Adjusted EBITDA $87,385 $63,388 $14,217 $164,990 Thirty-nine weeks ended September 24, 2022 HPS RDS Canada Consolidated Operating income $15,391 $3,655 $17,127 $36,173 Depreciation & amortization 53,159 31,542 3,681 88,382 Stock compensation expense 8,693 1,248 848 10,789 Restructuring 1,357 124 — 1,481 Litigation expense — 28,968 — 28,968 Transaction and integration expense 2,105 288 — 2,393 Change in fair value of contingent consideration — (2,926) — (2,926) Adjusted EBITDA $80,705 $62,899 $21,656 $165,260 Segment Adjusted EBITDA Reconciliations