EX-99.2

Published on May 9, 2023

Quarterly Earnings Presentation Q1 2023 May 9, 2023

2Earnings Presentation Q1 2023 PresBuilder Placeholder - Delete this box if you see it on a slide, but DO NOT REMOVE this box from the slide layout All statements made in this presentation that are consider to be forward-looking are made in good faith by the Company and are intended to qualify for the safe harbor from liability established by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. You should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," “target”, “goal”, "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) unfavorable economic conditions that may affect operations, financial condition and cash flows including spending on home renovation or construction projects, inflation, recessions, instability in the financial markets or credit markets; (2) increased supply chain costs, including raw materials, sourcing, transportation and energy; (3) the highly competitive nature of the markets that we serve; (4) the ability to continue to innovate with new products and services; (5) seasonality; (6) large customer concentration; (7) the ability to recruit and retain qualified employees; (8) the outcome of any legal proceedings that may be instituted against the Company; (9) adverse changes in currency exchange rates; (10) the impact of COVID-19 on the Company’s business; or (11) regulatory changes and potential legislation that could adversely impact financial results. The foregoing list of factors is not exclusive, and readers should also refer to those risks that are included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including the Annual Report on Form 10-K filed February 27, 2023. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward looking statements. Except as required by applicable law, the Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this communication to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Presentation of Non-GAAP Financial Measures In addition to the results provided in accordance with U.S. generally accepted accounting principles (“GAAP”) throughout this presentation the company has provided non-GAAP financial measures, which present results on a basis adjusted for certain items. The company uses these non-GAAP financial measures for business planning purposes and in measuring its performance relative to that of its competitors. The company believes that these non- GAAP financial measures are useful financial metrics to assess its operating performance from period-to-period by excluding certain items that the company believes are not representative of its core business. These non-GAAP financial measures are not intended to replace, and should not be considered superior to, the presentation of the company’s financial results in accordance with GAAP. The use of the non-GAAP financial measures terms may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures. These non-GAAP financial measures are reconciled from the respective measures under GAAP in the appendix below. The company is not able to provide a reconciliation of the company’s non-GAAP financial guidance to the corresponding GAAP measures without unreasonable effort because of the inherent difficulty in forecasting and quantifying certain amounts necessary for such a reconciliation such as certain non-cash, nonrecurring or other items that are included in net income and EBITDA as well as the related tax impacts of these items and asset dispositions / acquisitions and changes in foreign currency exchange rates that are included in cash flow, due to the uncertainty and variability of the nature and amount of these future charges and costs. Forward Looking Statements

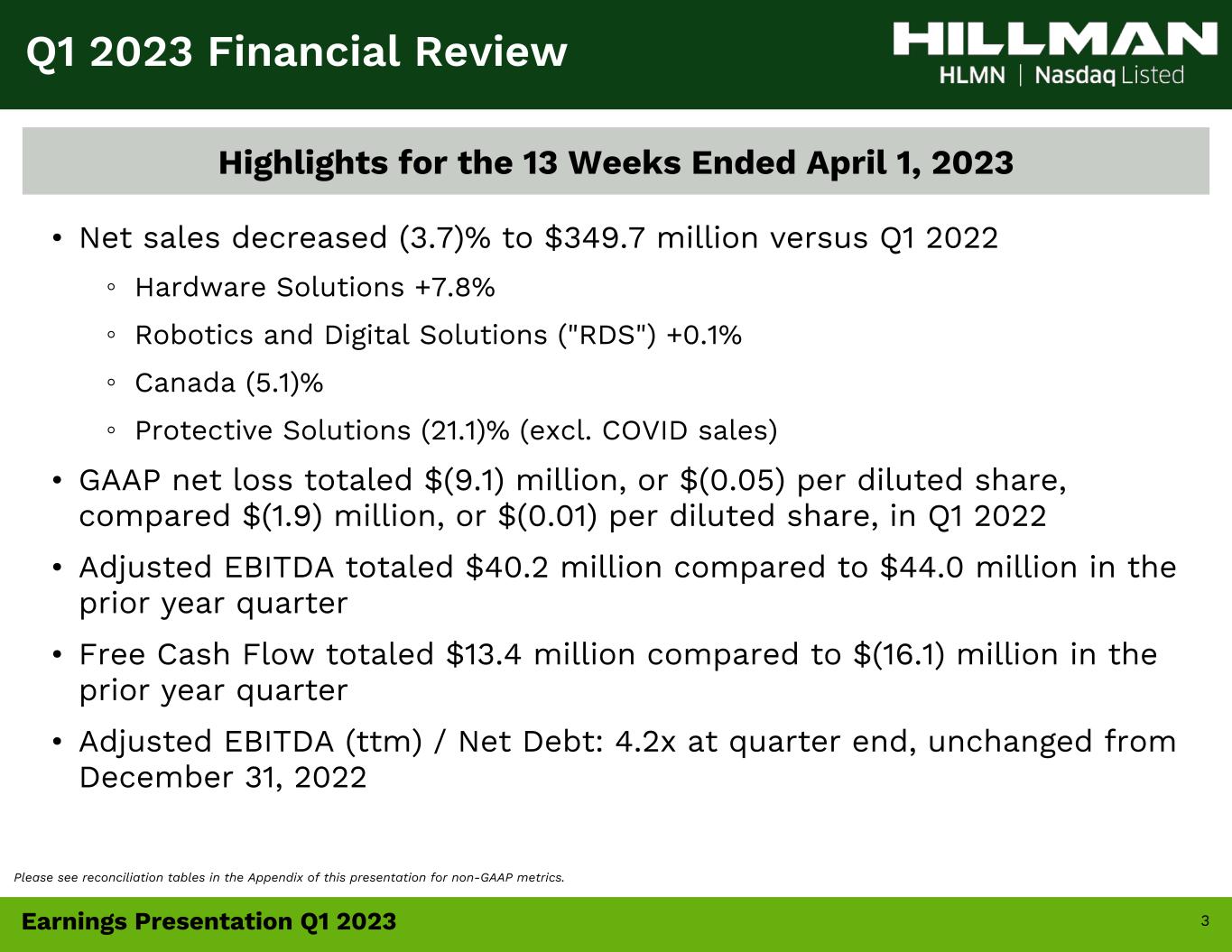

3Earnings Presentation Q1 2023 • Net sales decreased (3.7)% to $349.7 million versus Q1 2022 ◦ Hardware Solutions +7.8% ◦ Robotics and Digital Solutions ("RDS") +0.1% ◦ Canada (5.1)% ◦ Protective Solutions (21.1)% (excl. COVID sales) • GAAP net loss totaled $(9.1) million, or $(0.05) per diluted share, compared $(1.9) million, or $(0.01) per diluted share, in Q1 2022 • Adjusted EBITDA totaled $40.2 million compared to $44.0 million in the prior year quarter • Free Cash Flow totaled $13.4 million compared to $(16.1) million in the prior year quarter • Adjusted EBITDA (ttm) / Net Debt: 4.2x at quarter end, unchanged from December 31, 2022 Q1 2023 Financial Review Please see reconciliation tables in the Appendix of this presentation for non-GAAP metrics. Highlights for the 13 Weeks Ended April 1, 2023

4Earnings Presentation Q1 2023 Q1 2023 Operational Review Highlights for the 13 Weeks Ended April 1, 2023 • Reiterated guidance • Inventory reduced by $38 million during the quarter; reduced by a total of $124 million from the peak during June of 2022 • Fill rates averaged approximately 97% year to date • New business (with existing and new customers) secured across multiple business segments • Strong performance and customer service positions Hillman for continued new business wins and momentum

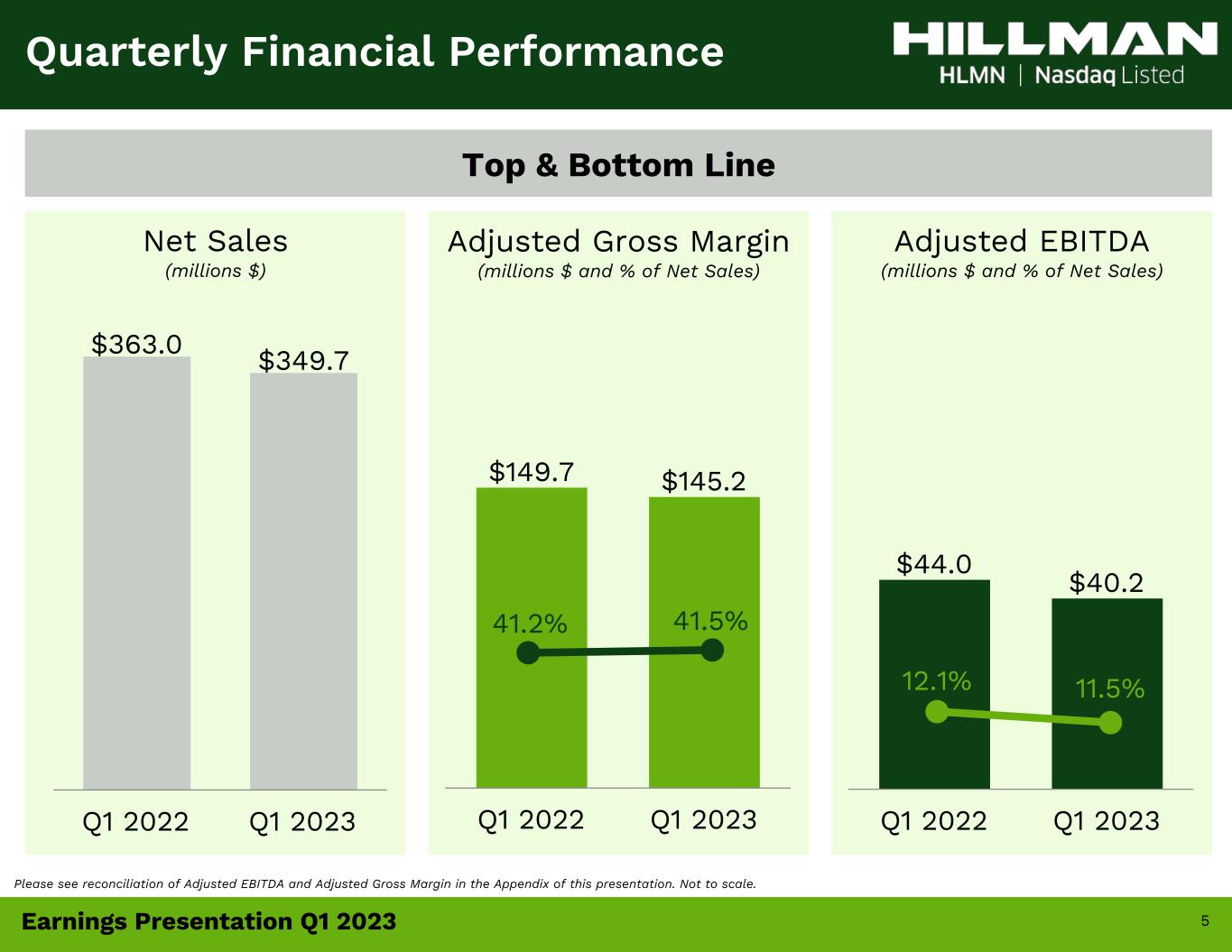

5Earnings Presentation Q1 2023 Quarterly Financial Performance Adjusted EBITDA (millions $ and % of Net Sales) Please see reconciliation of Adjusted EBITDA and Adjusted Gross Margin in the Appendix of this presentation. Not to scale. Top & Bottom Line Net Sales (millions $) Adjusted Gross Margin (millions $ and % of Net Sales) $44.0 $40.2 Q1 2022 Q1 2023 11.5%12.1% $149.7 $145.2 Q1 2022 Q1 2023 $363.0 $349.7 Q1 2022 Q1 2023 41.5%41.2%

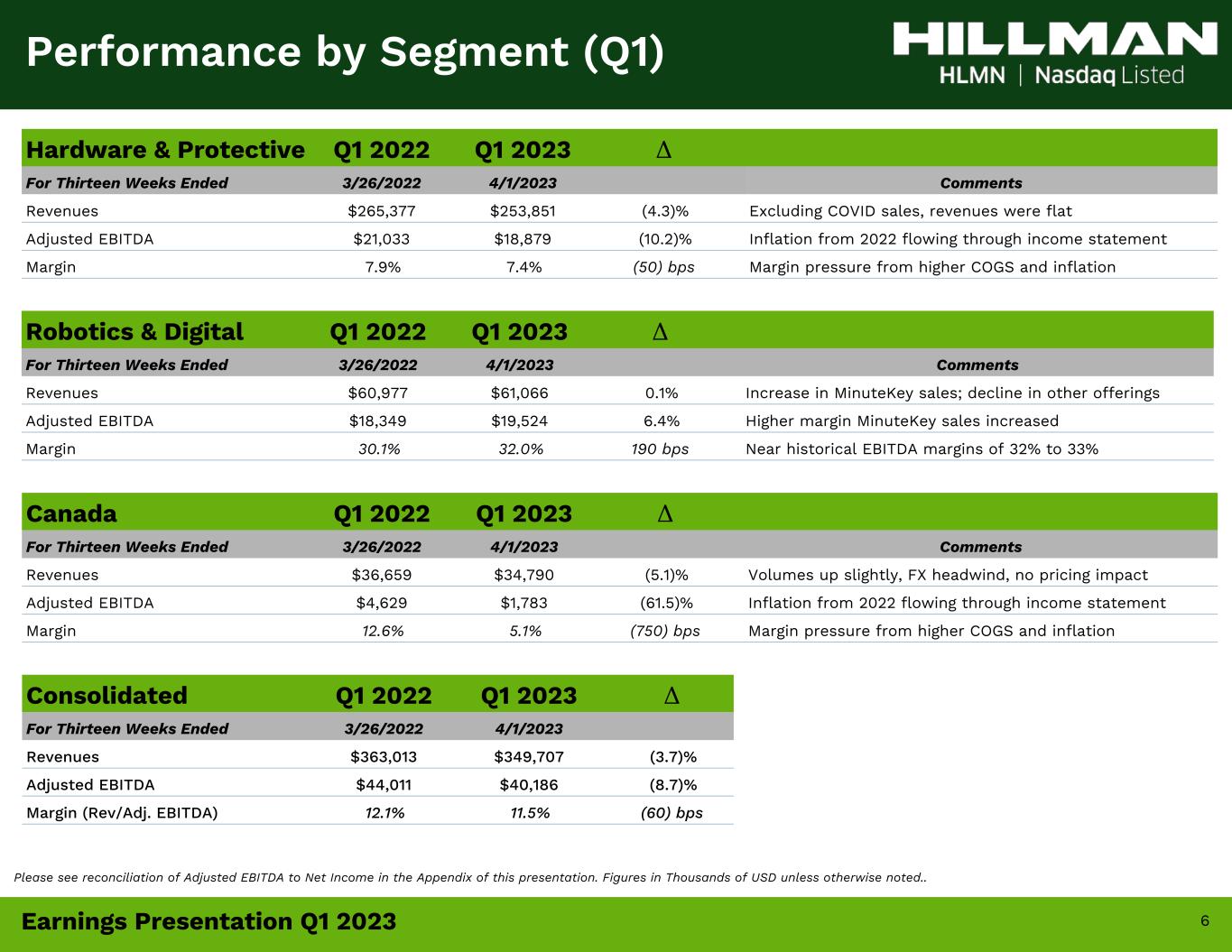

6Earnings Presentation Q1 2023 Hardware & Protective Q1 2022 Q1 2023 Δ For Thirteen Weeks Ended 3/26/2022 4/1/2023 Comments Revenues $265,377 $253,851 (4.3)% Excluding COVID sales, revenues were flat Adjusted EBITDA $21,033 $18,879 (10.2)% Inflation from 2022 flowing through income statement Margin 7.9% 7.4% (50) bps Margin pressure from higher COGS and inflation Robotics & Digital Q1 2022 Q1 2023 Δ For Thirteen Weeks Ended 3/26/2022 4/1/2023 Comments Revenues $60,977 $61,066 0.1% Increase in MinuteKey sales; decline in other offerings Adjusted EBITDA $18,349 $19,524 6.4% Higher margin MinuteKey sales increased Margin 30.1% 32.0% 190 bps Near historical EBITDA margins of 32% to 33% Canada Q1 2022 Q1 2023 Δ For Thirteen Weeks Ended 3/26/2022 4/1/2023 Comments Revenues $36,659 $34,790 (5.1)% Volumes up slightly, FX headwind, no pricing impact Adjusted EBITDA $4,629 $1,783 (61.5)% Inflation from 2022 flowing through income statement Margin 12.6% 5.1% (750) bps Margin pressure from higher COGS and inflation Consolidated Q1 2022 Q1 2023 Δ For Thirteen Weeks Ended 3/26/2022 4/1/2023 Revenues $363,013 $349,707 (3.7)% Adjusted EBITDA $44,011 $40,186 (8.7)% Margin (Rev/Adj. EBITDA) 12.1% 11.5% (60) bps Performance by Segment (Q1) Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted..

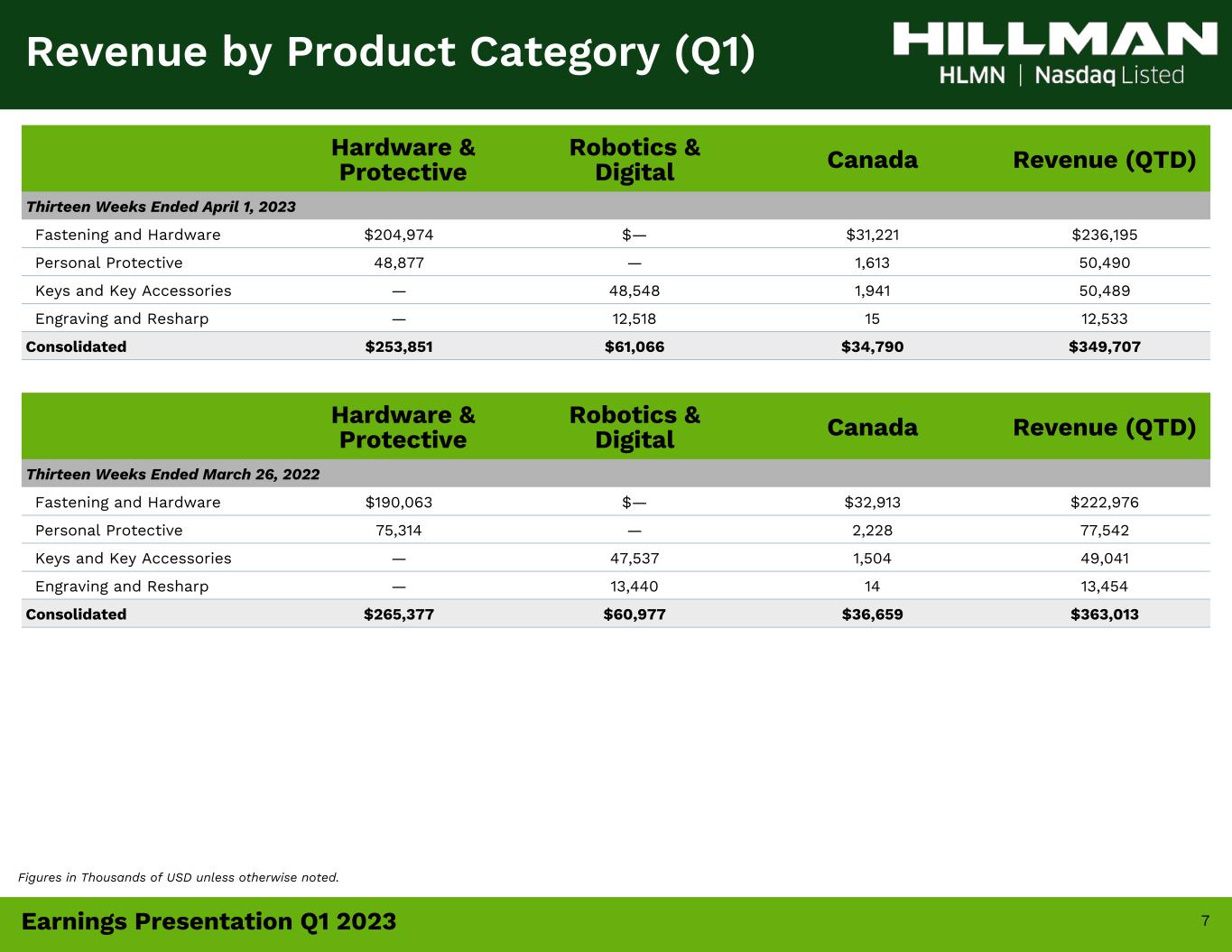

7Earnings Presentation Q1 2023 Hardware & Protective Robotics & Digital Canada Revenue (QTD) Thirteen Weeks Ended April 1, 2023 Fastening and Hardware $204,974 $— $31,221 $236,195 Personal Protective 48,877 — 1,613 50,490 Keys and Key Accessories — 48,548 1,941 50,489 Engraving and Resharp — 12,518 15 12,533 Consolidated $253,851 $61,066 $34,790 $349,707 Revenue by Product Category (Q1) Hardware & Protective Robotics & Digital Canada Revenue (QTD) Thirteen Weeks Ended March 26, 2022 Fastening and Hardware $190,063 $— $32,913 $222,976 Personal Protective 75,314 — 2,228 77,542 Keys and Key Accessories — 47,537 1,504 49,041 Engraving and Resharp — 13,440 14 13,454 Consolidated $265,377 $60,977 $36,659 $363,013 Figures in Thousands of USD unless otherwise noted.

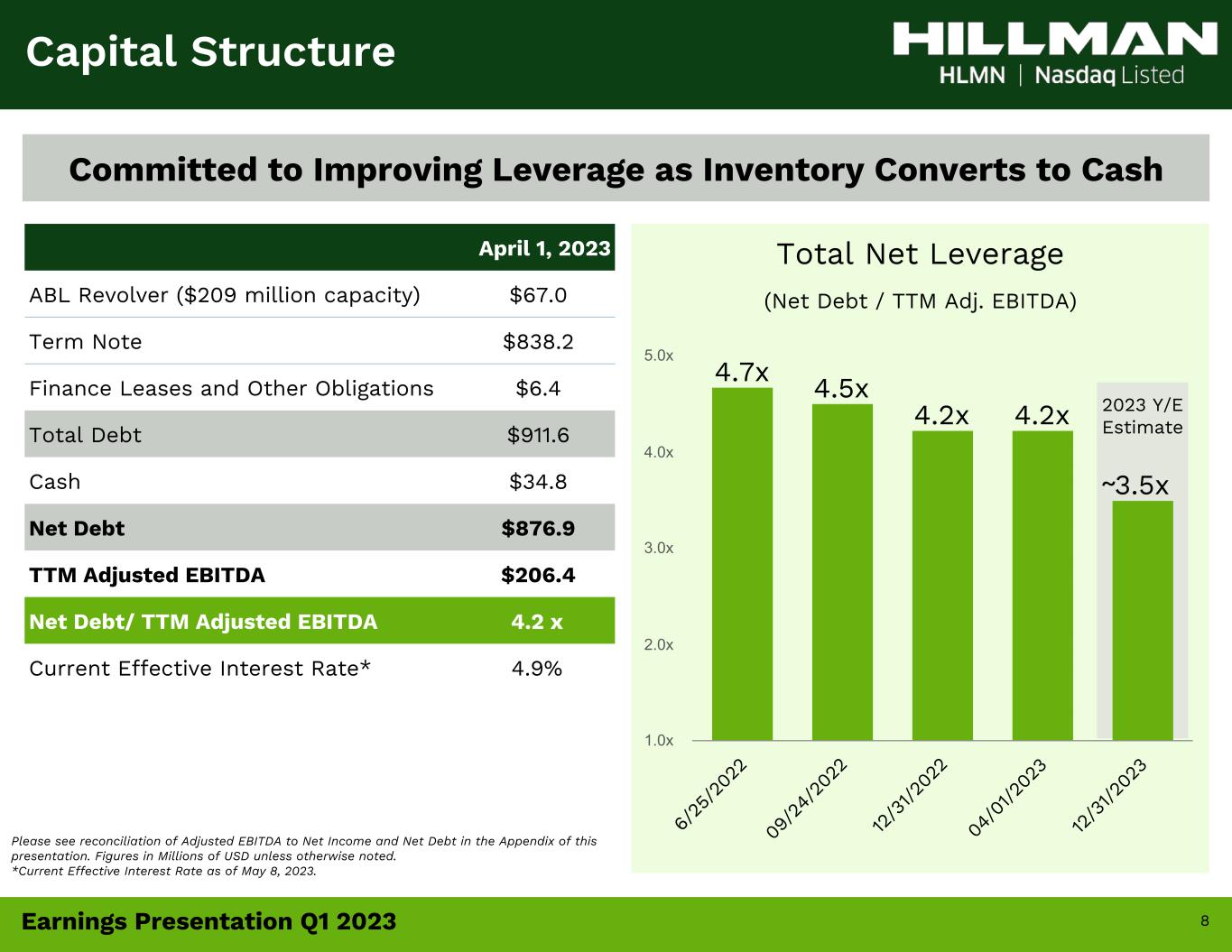

8Earnings Presentation Q1 2023 Capital Structure April 1, 2023 ABL Revolver ($209 million capacity) $67.0 Term Note $838.2 Finance Leases and Other Obligations $6.4 Total Debt $911.6 Cash $34.8 Net Debt $876.9 TTM Adjusted EBITDA $206.4 Net Debt/ TTM Adjusted EBITDA 4.2 x Current Effective Interest Rate* 4.9% Committed to Improving Leverage as Inventory Converts to Cash Total Net Leverage (Net Debt / TTM Adj. EBITDA) 2023 Y/E Estimate 4.7x 4.5x 4.2x 4.2x 3.5x 6/ 25 /2 02 2 09 /2 4/ 20 22 12 /3 1/2 02 2 04 /0 1/2 02 3 12 /3 1/2 02 3 1.0x 2.0x 3.0x 4.0x 5.0x Please see reconciliation of Adjusted EBITDA to Net Income and Net Debt in the Appendix of this presentation. Figures in Millions of USD unless otherwise noted. *Current Effective Interest Rate as of May 8, 2023. ~

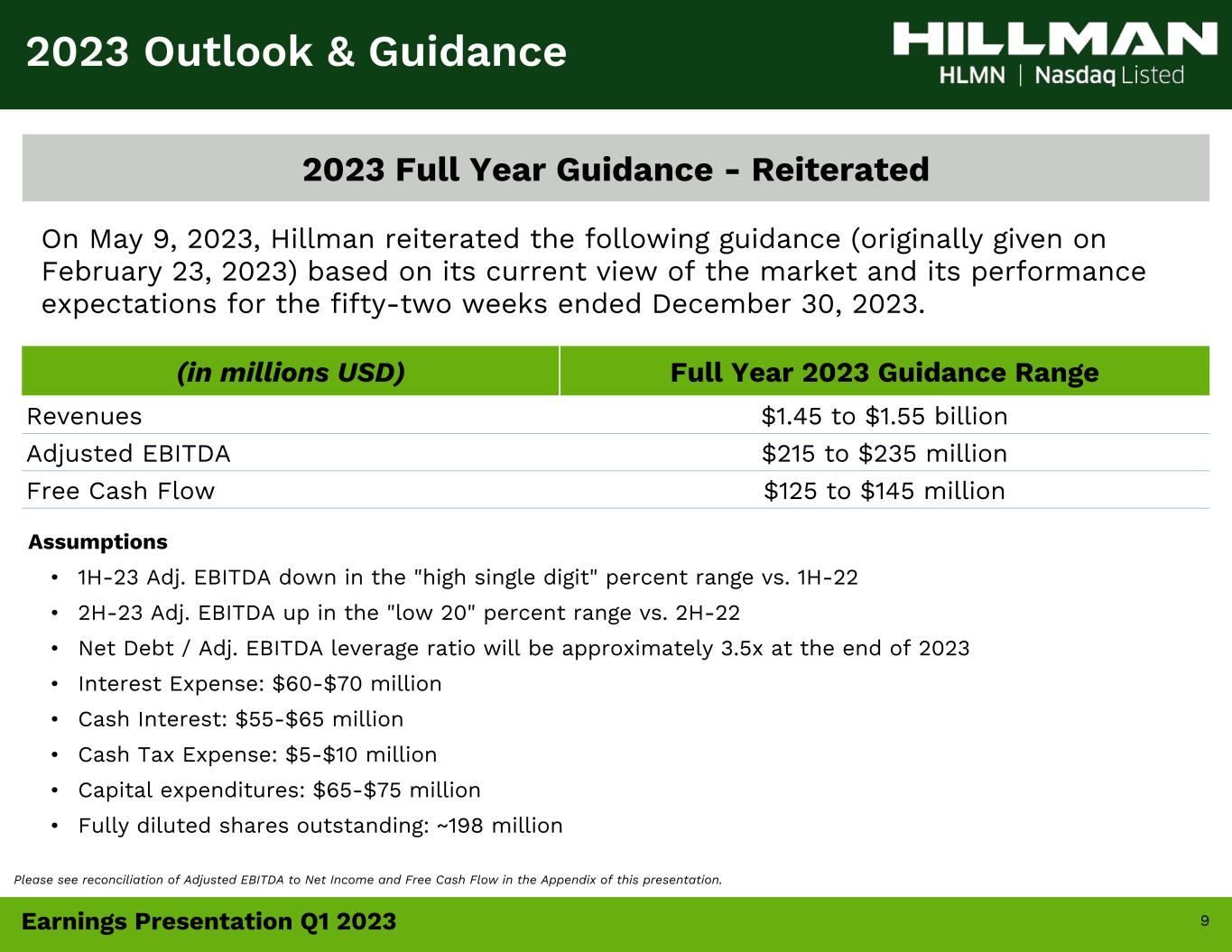

9Earnings Presentation Q1 2023 2023 Outlook & Guidance (in millions USD) Full Year 2023 Guidance Range Revenues $1.45 to $1.55 billion Adjusted EBITDA $215 to $235 million Free Cash Flow $125 to $145 million Assumptions • 1H-23 Adj. EBITDA down in the "high single digit" percent range vs. 1H-22 • 2H-23 Adj. EBITDA up in the "low 20" percent range vs. 2H-22 • Net Debt / Adj. EBITDA leverage ratio will be approximately 3.5x at the end of 2023 • Interest Expense: $60-$70 million • Cash Interest: $55-$65 million • Cash Tax Expense: $5-$10 million • Capital expenditures: $65-$75 million • Fully diluted shares outstanding: ~198 million On May 9, 2023, Hillman reiterated the following guidance (originally given on February 23, 2023) based on its current view of the market and its performance expectations for the fifty-two weeks ended December 30, 2023. 2023 Full Year Guidance - Reiterated Please see reconciliation of Adjusted EBITDA to Net Income and Free Cash Flow in the Appendix of this presentation.

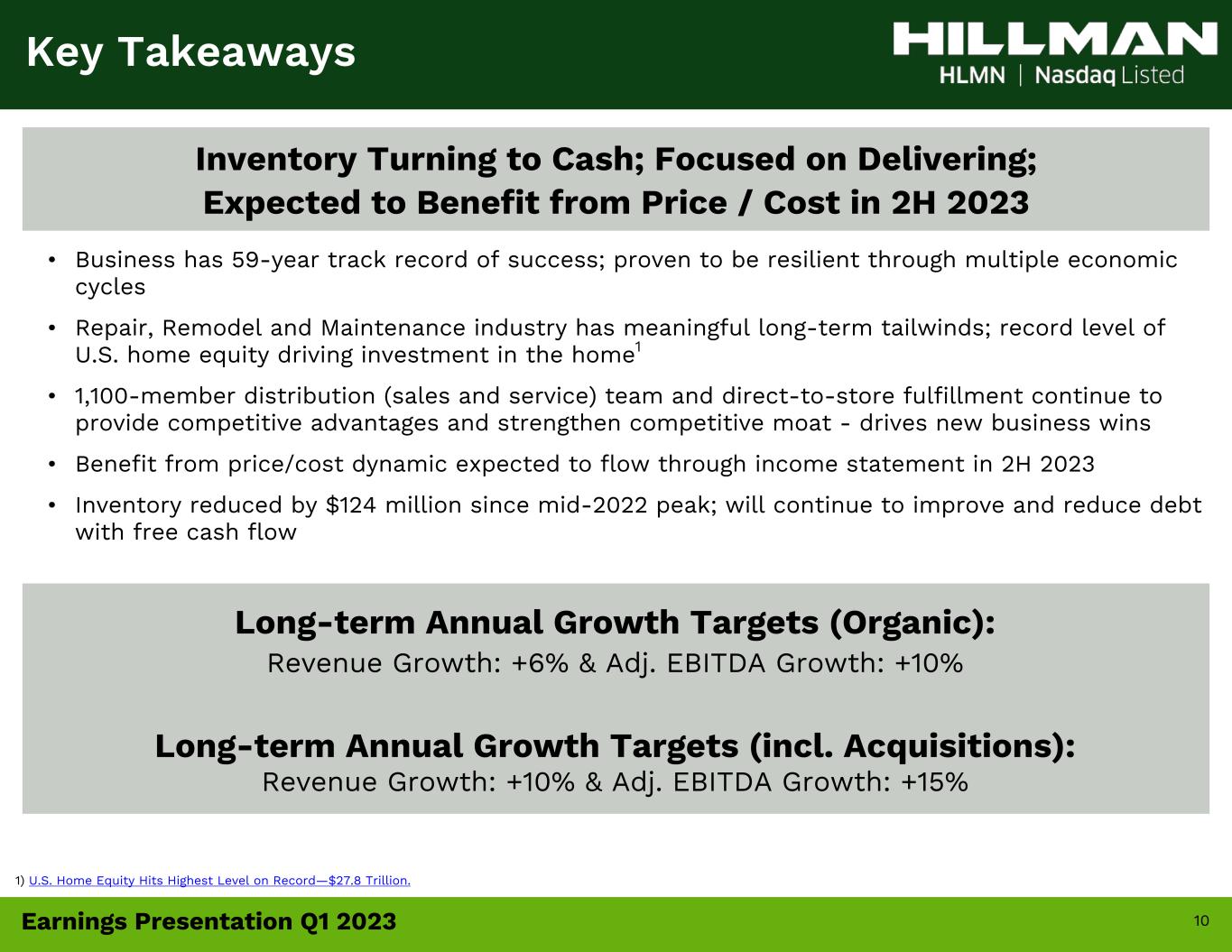

10Earnings Presentation Q1 2023 Key Takeaways Inventory Turning to Cash; Focused on Delivering; Expected to Benefit from Price / Cost in 2H 2023 Long-term Annual Growth Targets (Organic): Revenue Growth: +6% & Adj. EBITDA Growth: +10% Long-term Annual Growth Targets (incl. Acquisitions): Revenue Growth: +10% & Adj. EBITDA Growth: +15% • Business has 59-year track record of success; proven to be resilient through multiple economic cycles • Repair, Remodel and Maintenance industry has meaningful long-term tailwinds; record level of U.S. home equity driving investment in the home1 • 1,100-member distribution (sales and service) team and direct-to-store fulfillment continue to provide competitive advantages and strengthen competitive moat - drives new business wins • Benefit from price/cost dynamic expected to flow through income statement in 2H 2023 • Inventory reduced by $124 million since mid-2022 peak; will continue to improve and reduce debt with free cash flow 1) U.S. Home Equity Hits Highest Level on Record—$27.8 Trillion.

11 Appendix

12Earnings Presentation Q1 2023 Investment Highlights Significant runway for incremental growth: Organic + M&A Management team with proven operational and M&A expertise Strong financial profile with 59-year track record Market and innovation leader across multiple categories Indispensable partner embedded with winning retailers Customers love us, trust us and rely on us Large, predictable, growing and resilient end markets

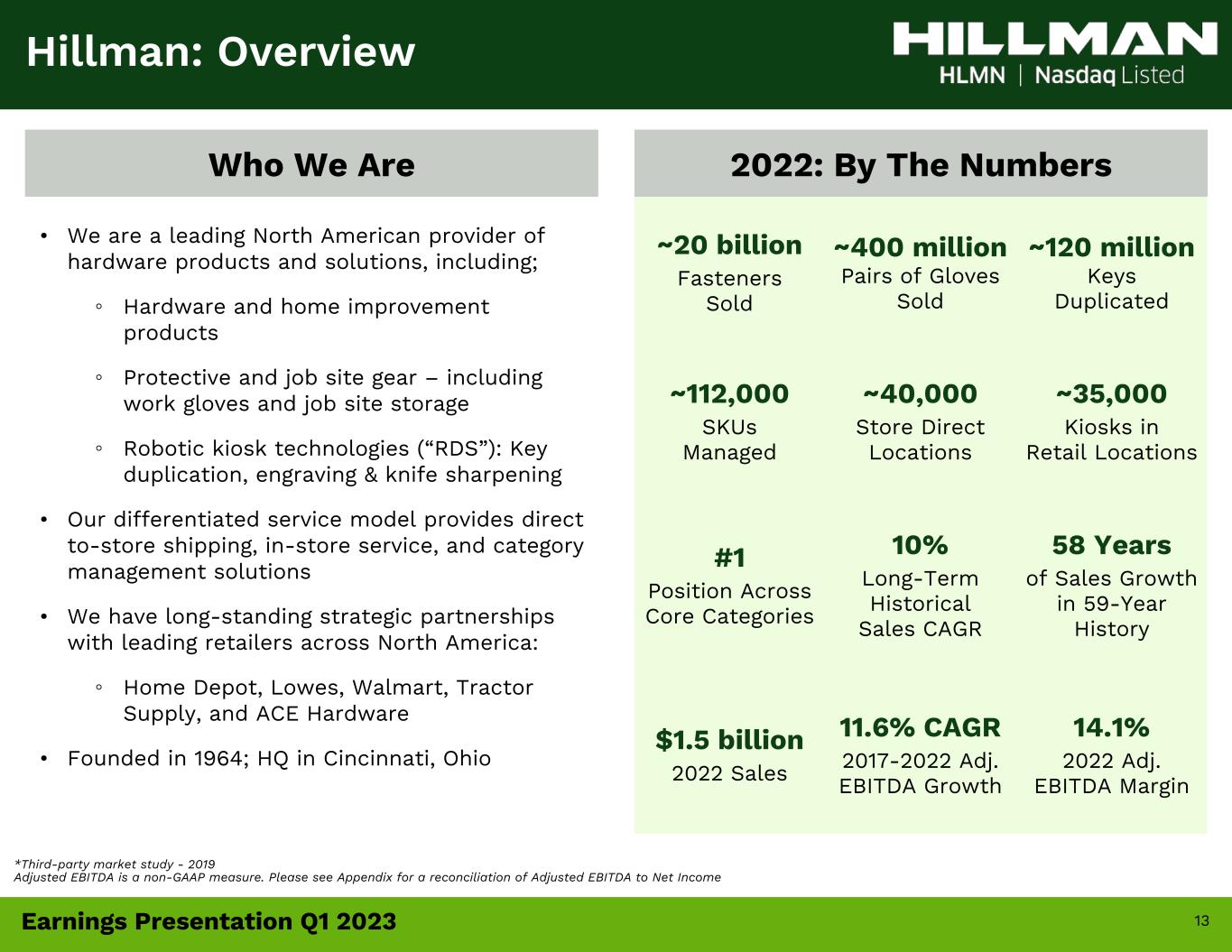

13Earnings Presentation Q1 2023 Hillman: Overview Who We Are *Third-party market study - 2019 Adjusted EBITDA is a non-GAAP measure. Please see Appendix for a reconciliation of Adjusted EBITDA to Net Income ~20 billion Fasteners Sold ~400 million Pairs of Gloves Sold ~120 million Keys Duplicated ~112,000 SKUs Managed ~40,000 Store Direct Locations ~35,000 Kiosks in Retail Locations #1 Position Across Core Categories 10% Long-Term Historical Sales CAGR 58 Years of Sales Growth in 59-Year History $1.5 billion 2022 Sales 11.6% CAGR 2017-2022 Adj. EBITDA Growth 14.1% 2022 Adj. EBITDA Margin 2022: By The Numbers • We are a leading North American provider of hardware products and solutions, including; ◦ Hardware and home improvement products ◦ Protective and job site gear – including work gloves and job site storage ◦ Robotic kiosk technologies (“RDS”): Key duplication, engraving & knife sharpening • Our differentiated service model provides direct to-store shipping, in-store service, and category management solutions • We have long-standing strategic partnerships with leading retailers across North America: ◦ Home Depot, Lowes, Walmart, Tractor Supply, and ACE Hardware • Founded in 1964; HQ in Cincinnati, Ohio

14Earnings Presentation Q1 2023 Primary Product Categories #1 in Segment Representative Top Customers #1 in Segment #1 in Segment Key and Fob Duplication Personalized Tags Knife Sharpening Fasteners & Specialty Gloves Builders Hardware & Metal Shapes Safety / PPE Construction Fasteners Work Gear Picture Hanging Source: Third party industry report. Hardware Solutions Protective Solutions Robotics & Digital Solutions

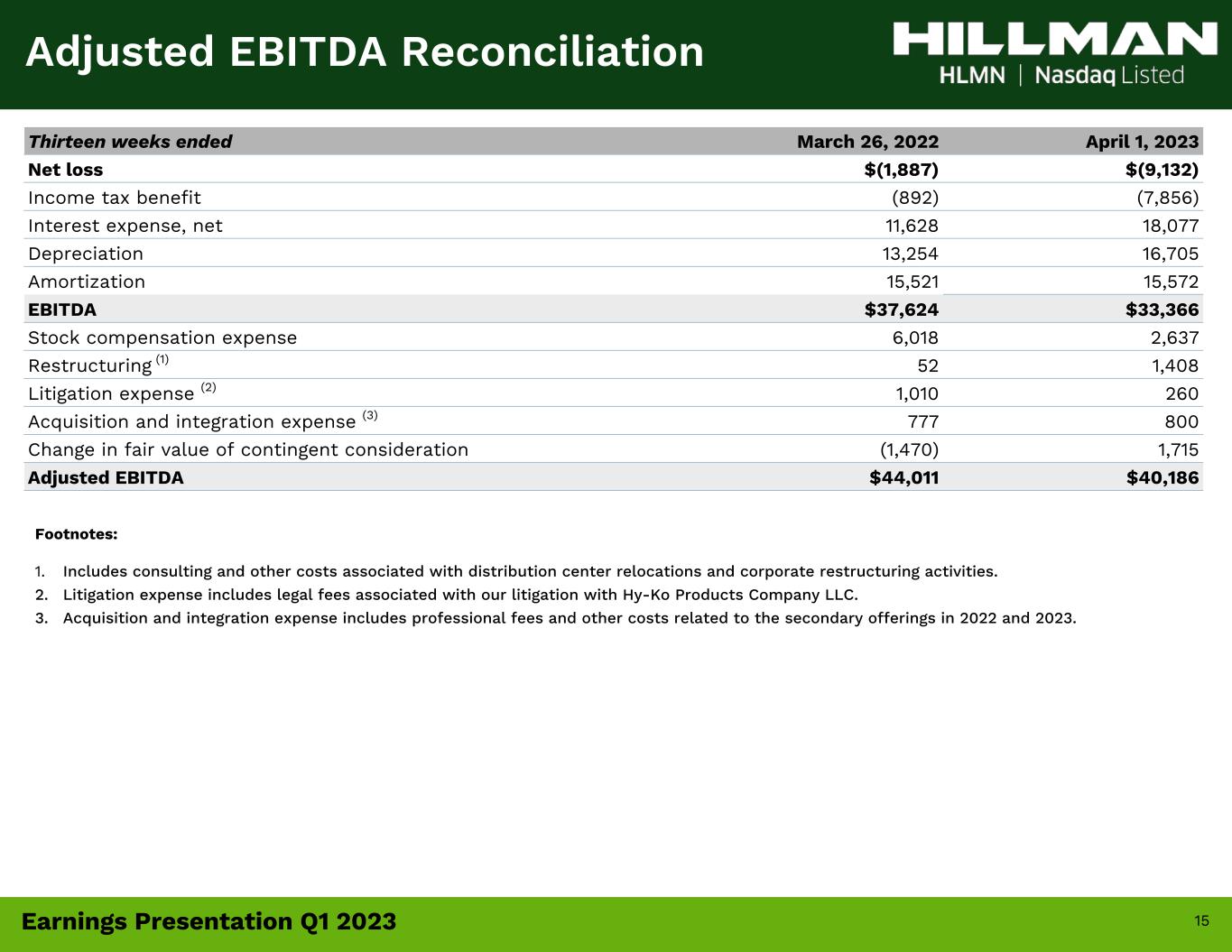

15Earnings Presentation Q1 2023 Thirteen weeks ended March 26, 2022 April 1, 2023 Net loss $(1,887) $(9,132) Income tax benefit (892) (7,856) Interest expense, net 11,628 18,077 Depreciation 13,254 16,705 Amortization 15,521 15,572 EBITDA $37,624 $33,366 Stock compensation expense 6,018 2,637 Restructuring (1) 52 1,408 Litigation expense (2) 1,010 260 Acquisition and integration expense (3) 777 800 Change in fair value of contingent consideration (1,470) 1,715 Adjusted EBITDA $44,011 $40,186 Adjusted EBITDA Reconciliation Footnotes: 1. Includes consulting and other costs associated with distribution center relocations and corporate restructuring activities. 2. Litigation expense includes legal fees associated with our litigation with Hy-Ko Products Company LLC. 3. Acquisition and integration expense includes professional fees and other costs related to the secondary offerings in 2022 and 2023.

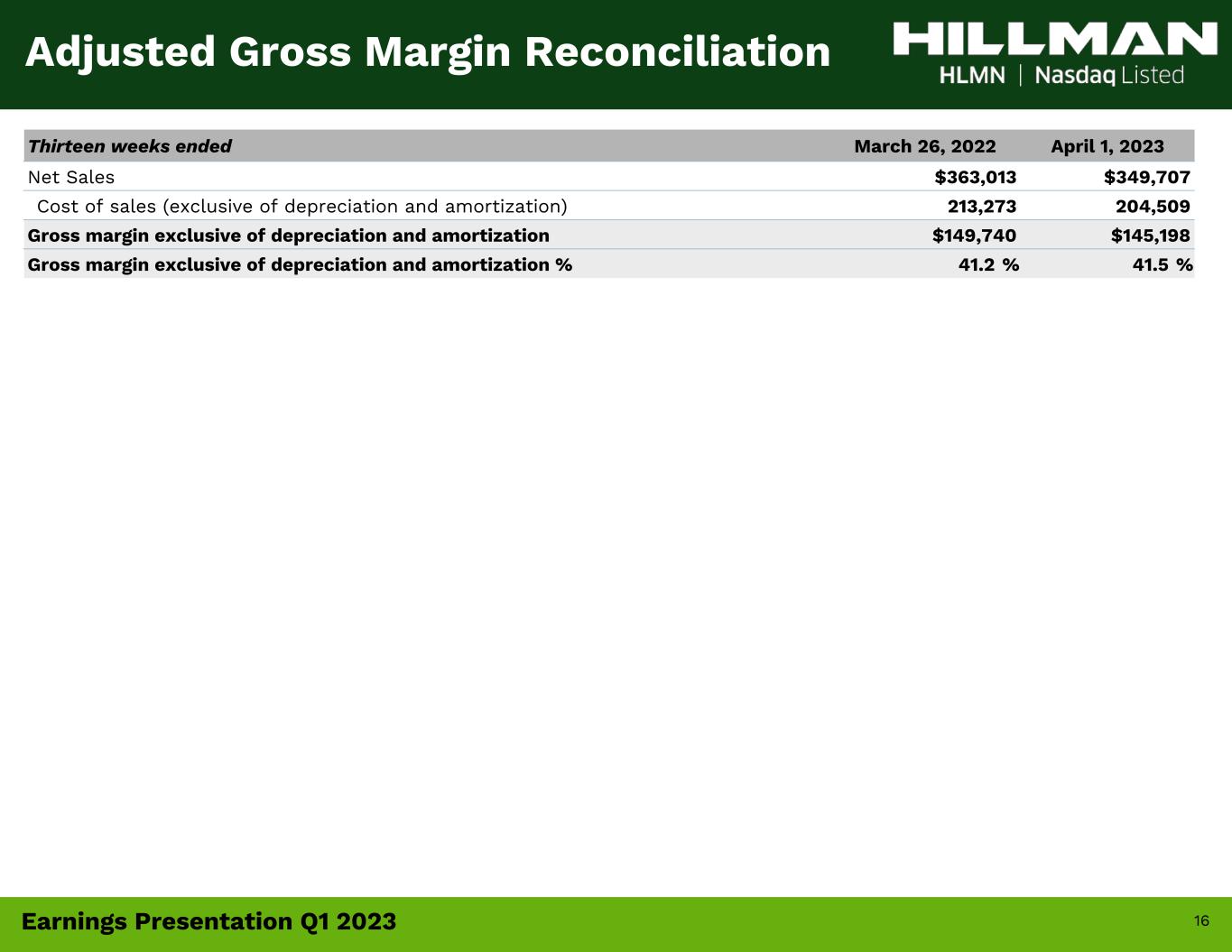

16Earnings Presentation Q1 2023 Thirteen weeks ended March 26, 2022 April 1, 2023 Net Sales $363,013 $349,707 Cost of sales (exclusive of depreciation and amortization) 213,273 204,509 Gross margin exclusive of depreciation and amortization $149,740 $145,198 Gross margin exclusive of depreciation and amortization % 41.2 % 41.5 % Adjusted Gross Margin Reconciliation

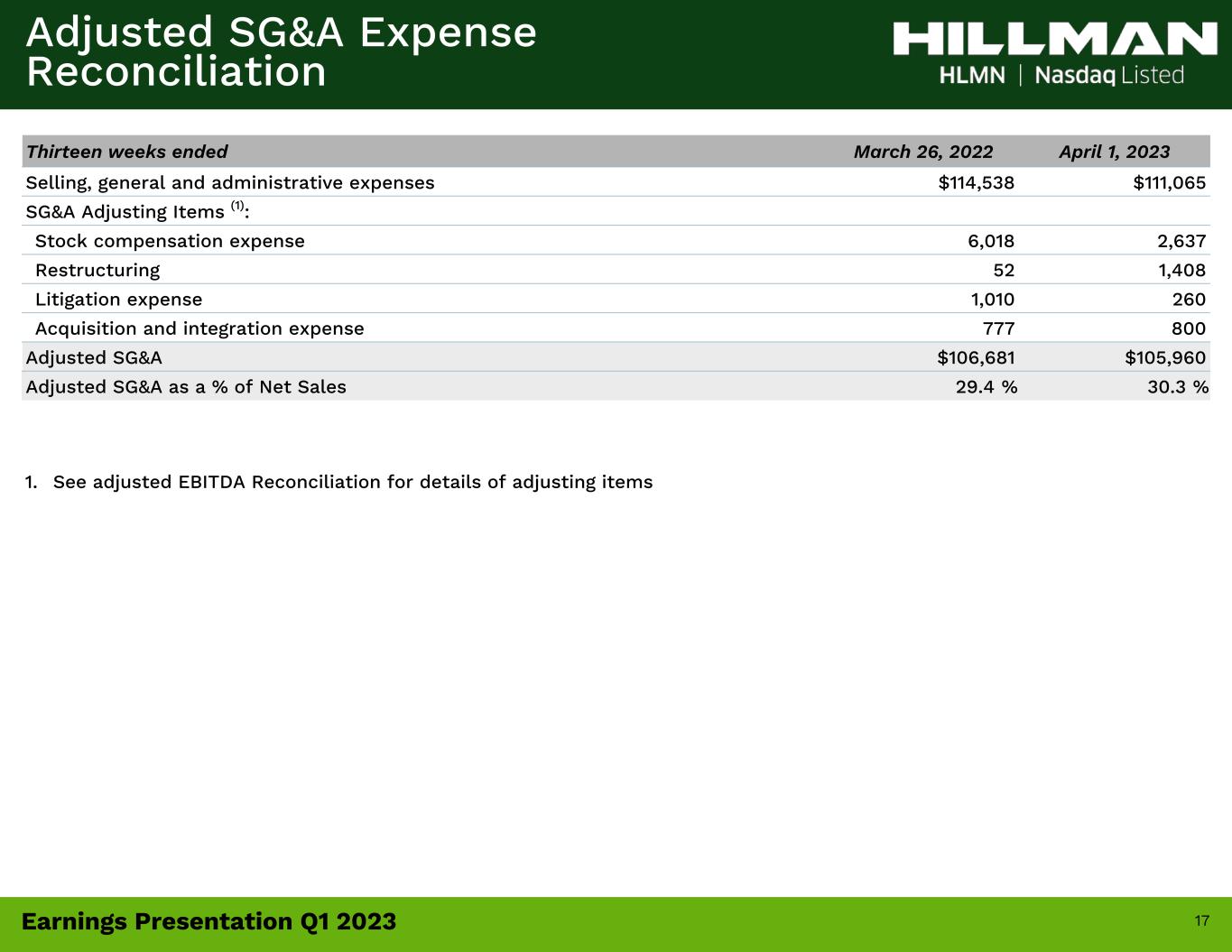

17Earnings Presentation Q1 2023 Thirteen weeks ended March 26, 2022 April 1, 2023 Selling, general and administrative expenses $114,538 $111,065 SG&A Adjusting Items (1): Stock compensation expense 6,018 2,637 Restructuring 52 1,408 Litigation expense 1,010 260 Acquisition and integration expense 777 800 Adjusted SG&A $106,681 $105,960 Adjusted SG&A as a % of Net Sales 29.4 % 30.3 % Adjusted SG&A Expense Reconciliation 1. See adjusted EBITDA Reconciliation for details of adjusting items

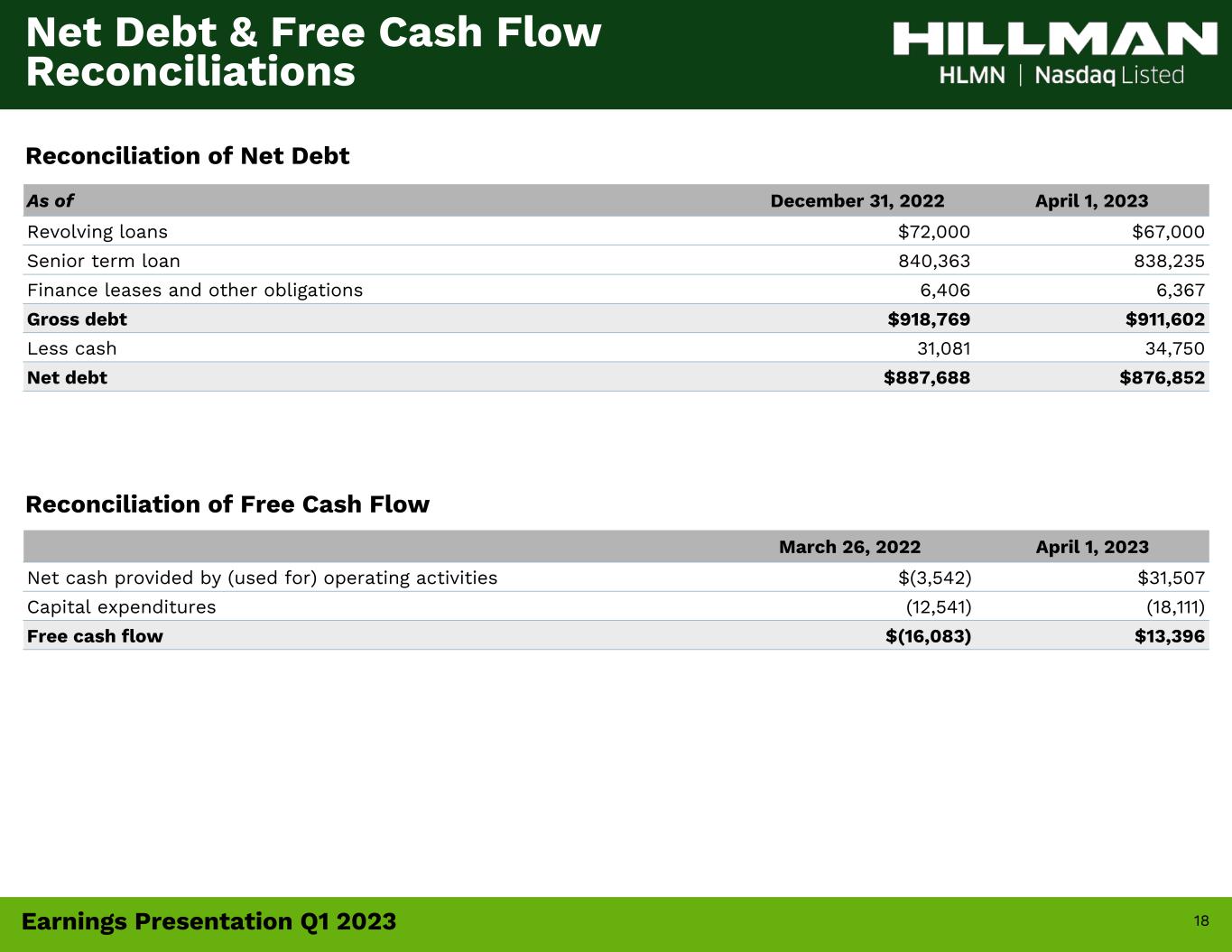

18Earnings Presentation Q1 2023 As of December 31, 2022 April 1, 2023 Revolving loans $72,000 $67,000 Senior term loan 840,363 838,235 Finance leases and other obligations 6,406 6,367 Gross debt $918,769 $911,602 Less cash 31,081 34,750 Net debt $887,688 $876,852 Net Debt & Free Cash Flow Reconciliations March 26, 2022 April 1, 2023 Net cash provided by (used for) operating activities $(3,542) $31,507 Capital expenditures (12,541) (18,111) Free cash flow $(16,083) $13,396 Reconciliation of Net Debt Reconciliation of Free Cash Flow

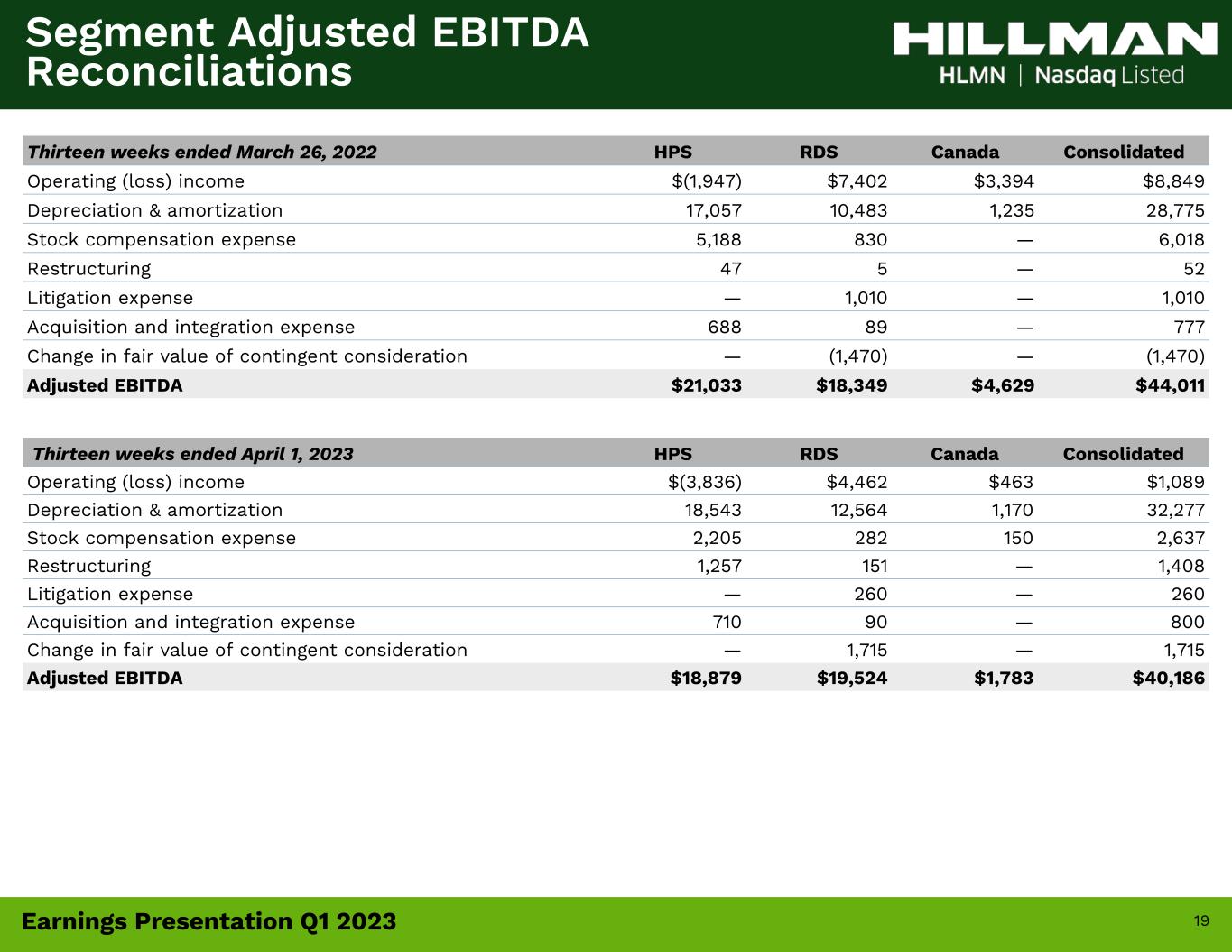

19Earnings Presentation Q1 2023 Thirteen weeks ended April 1, 2023 HPS RDS Canada Consolidated Operating (loss) income $(3,836) $4,462 $463 $1,089 Depreciation & amortization 18,543 12,564 1,170 32,277 Stock compensation expense 2,205 282 150 2,637 Restructuring 1,257 151 — 1,408 Litigation expense — 260 — 260 Acquisition and integration expense 710 90 — 800 Change in fair value of contingent consideration — 1,715 — 1,715 Adjusted EBITDA $18,879 $19,524 $1,783 $40,186 Thirteen weeks ended March 26, 2022 HPS RDS Canada Consolidated Operating (loss) income $(1,947) $7,402 $3,394 $8,849 Depreciation & amortization 17,057 10,483 1,235 28,775 Stock compensation expense 5,188 830 — 6,018 Restructuring 47 5 — 52 Litigation expense — 1,010 — 1,010 Acquisition and integration expense 688 89 — 777 Change in fair value of contingent consideration — (1,470) — (1,470) Adjusted EBITDA $21,033 $18,349 $4,629 $44,011 Segment Adjusted EBITDA Reconciliations