EX-99.2

Published on November 3, 2022

235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Quarterly Earnings Presentation Q3 2022

2 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 PresBuilder Placeholder - Delete this box if you see it on a slide, but DO NOT REMOVE this box from the slide layout This presentation contains certain forward-looking statements, including, but not limited to, certain plans, expectations, goals, projections, and statements, which are not historical facts and are subject to numerous assumptions, risks, and uncertainties. Statements that do not describe historical or current facts, including statements about beliefs and expectations, are forward-looking statements. All forward-looking statements are made in good faith by the company and are intended to qualify for the safe harbor from liability established by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995.You should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," “target”, “goal”, "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) unfavorable economic conditions that may affect operations, financial condition and cash flows including spending on home renovation or construction projects, inflation, recessions, instability in the financial markets or credit markets; (2) increased supply chain costs, including raw materials, sourcing, transportation and energy; (3) the highly competitive nature of the markets that we serve (4) ability to continue to innovate with new products and services; (5) seasonality; (6) large customer concentration; (7) ability to recruit and retain qualified employees; (8) the outcome of any legal proceedings that may be instituted against the Company (9) adverse changes in currency exchange rates; (10) the impact of COVID-19 on the Company’s business; or (11) regulatory changes and potential legislation that could adversely impact financial results. The foregoing list of factors is not exclusive, and readers should also refer to those risks that are included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including the Annual Report on Form 10-K filed on March 16, 2022. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward looking statements. Except as required by applicable law, the Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this communication to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based. Presentation of Non-GAAP Financial Measures In addition to the results provided in accordance with U.S. generally accepted accounting principles (“GAAP”) throughout this presentation the company has provided non-GAAP financial measures, which present results on a basis adjusted for certain items. The company uses these non-GAAP financial measures for business planning purposes and in measuring its performance relative to that of its competitors. The company believes that these non-GAAP financial measures are useful financial metrics to assess its operating performance from period-to-period by excluding certain items that the company believes are not representative of its core business. These non-GAAP financial measures are not intended to replace, and should not be considered superior to, the presentation of the company’s financial results in accordance with GAAP. The use of the non-GAAP financial measures terms may differ from similar measures reported by other companies and may not be comparable to other similarly titled measures. These non-GAAP financial measures are reconciled from the respective measures under GAAP in the appendix below. The company is not able to provide a reconciliation of the company’s non-GAAP financial guidance to the corresponding GAAP measures without unreasonable effort because of the inherent difficulty in forecasting and quantifying certain amounts necessary for such a reconciliation such as certain non-cash, nonrecurring or other items that are included in net income and EBITDA as well as the related tax impacts of these items and asset dispositions / acquisitions and changes in foreign currency exchange rates that are included in cash flow, due to the uncertainty and variability of the nature and amount of these future charges and costs. Forward Looking Statements

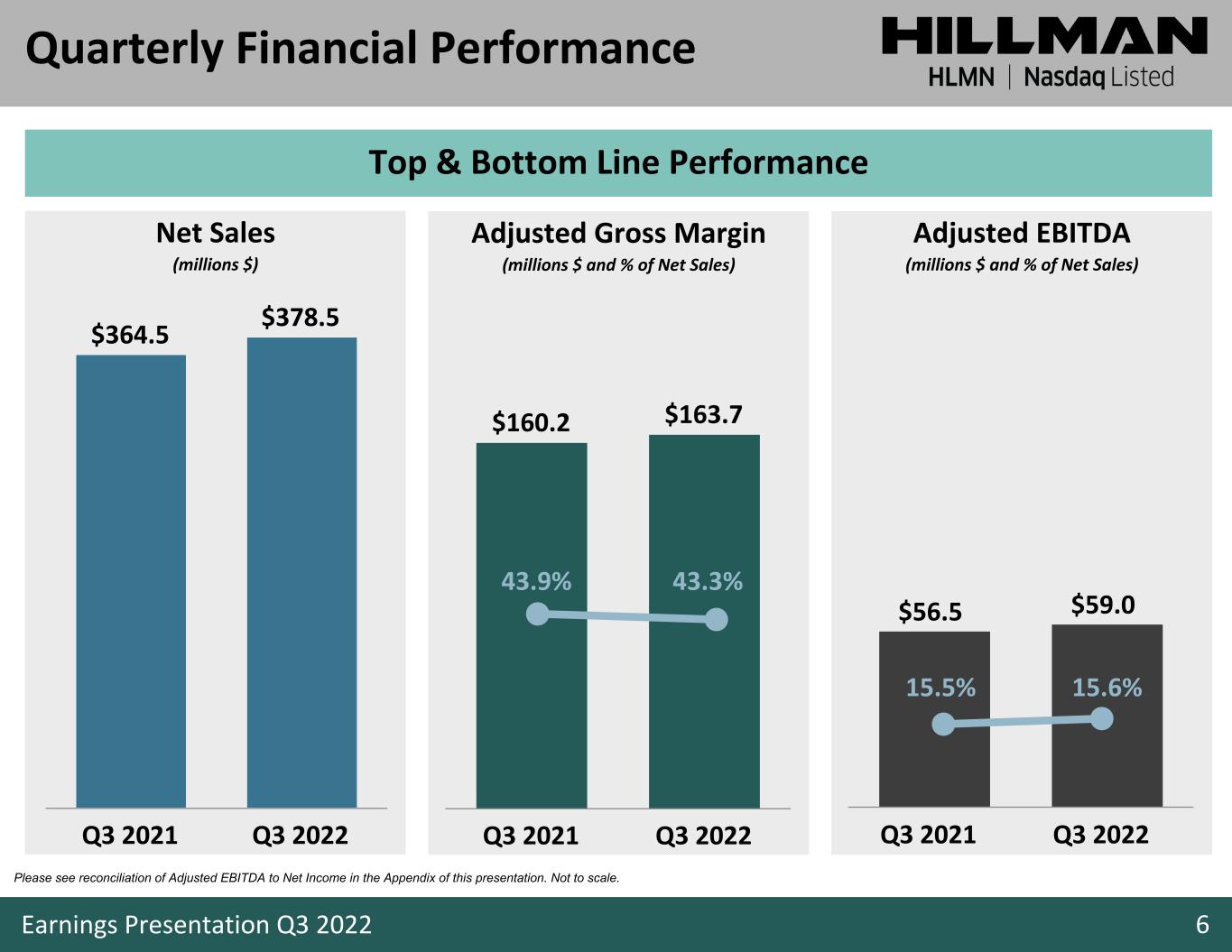

3 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 • Net sales increased 3.9% to $378.5 million versus Q3 2021 ◦ Hardware Solutions +11.0% ◦ Robotics and Digital Solutions ("RDS") (2.8)% ◦ Canada +15.6% ◦ Protective Solutions +5.7% (excl. COVID-related PPE sales) • GAAP net loss improved to $(9.5) million, or $(0.05) per diluted share, compared to a net loss of $(32.5) million, or $(0.19) per diluted share, in Q3 2021 • Adjusted EBITDA increased to $59.0 million from $56.5 million in Q3 2021 • Adjusted EBITDA (ttm) / Net Debt: 4.5x at quarter end • Compared to Pre-COVID (Q3 2022 vs Q3 2019): ◦ Net sales increased +19.3% ◦ Adjusted EBITDA +16.1% Q3 2022 Highlights Please see reconciliation of Adjusted EBITDA to Net Income and Net Debt in the Appendix of this presentation. Financial Highlights for the 13 Weeks Ended September 24, 2022

4 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Q3 2022 Highlights • Successfully implemented price increase (fourth increase in past 18 months) • Maintained average fill rates of nearly 96% for the year • Positioned for continued new business momentum ◦ Examples of quarterly wins: ▪ Picture hanging, builders’ hardware, deck screws, solid wall anchors (including new concrete screws) • Expects to see inventory to continue to come down and cash flows increase in the fourth quarter of 2022 and into 2023 Operational Highlights for the 13 Weeks Ended September 24, 2022

5 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 • Net sales increased 5.0% to $1.14 billion versus the 39 weeks ended September 25, 2021 ◦ Hardware Solutions +12.2% ◦ Robotics and Digital Solutions ("RDS") +1.3% ◦ Canada +7.8% ◦ Protective Solutions +1.5% (excl. COVID-related PPE sales) • GAAP net loss improved to $(2.5) million, or $(0.01) per diluted share, compared to a net loss of $(44.9) million, or $(0.38) per diluted share, versus the 39 weeks ended September 25, 2021 • Adjusted EBITDA totaled $165.3 million versus $168.8 million in the 39 weeks ended September 25, 2021 YTD 2022 Highlights Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Financial Highlights for the 39 Weeks Ended September 24, 2022

6 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Adjusted EBITDA (millions $ and % of Net Sales) Top & Bottom Line Performance Net Sales (millions $) Adjusted Gross Margin (millions $ and % of Net Sales) Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Not to scale. Quarterly Financial Performance $56.5 $59.0 Q3 2021 Q3 2022 15.5% 15.6%Q3 2022 vs Q3 2019 (Pre-COVID) • Net sales increased +19.3% ◦ Adjusted EBITDA +16.1% $364.5 $378.5 Q3 2021 Q3 2022 $160.2 $163.7 Q3 2021 Q3 2022 43.3%43.9%

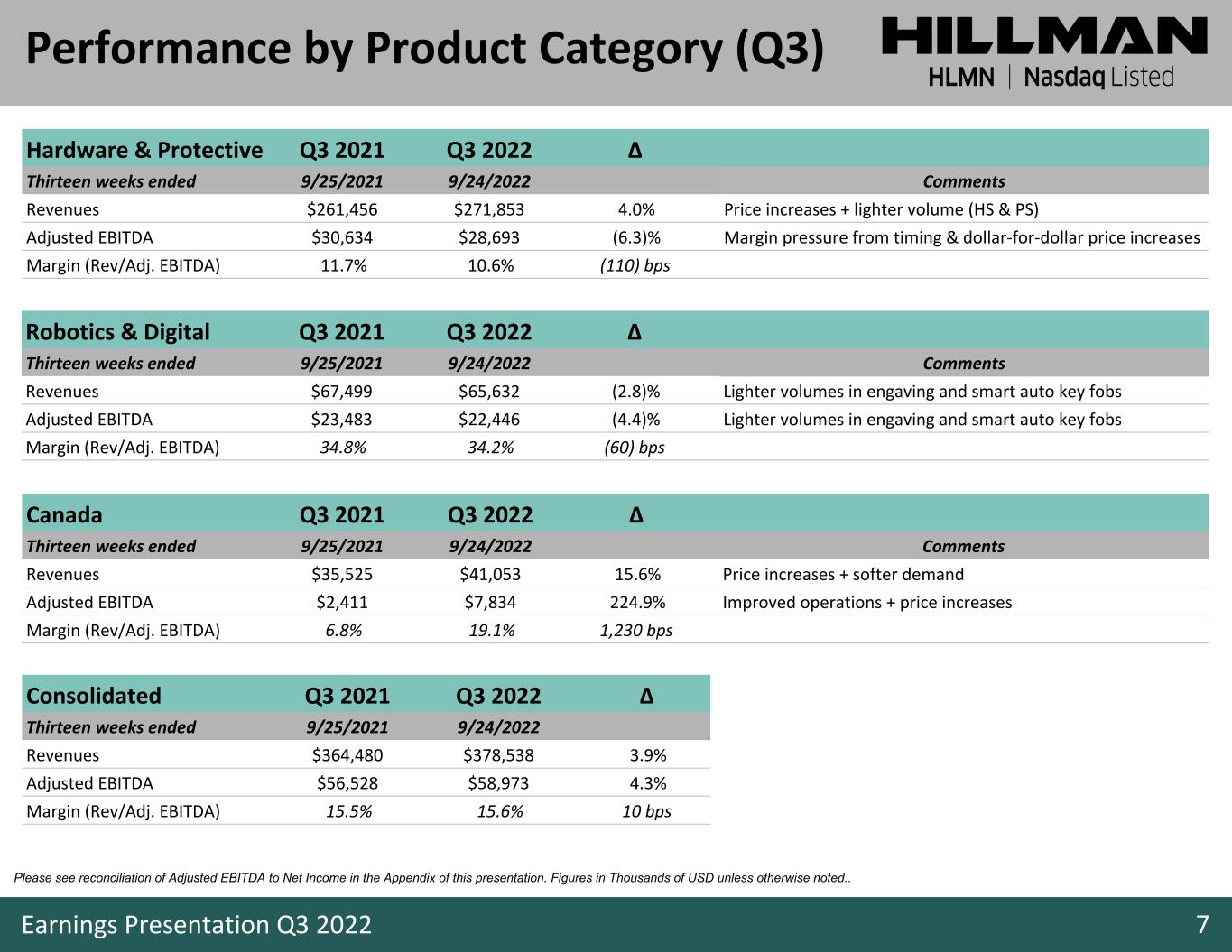

7 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Hardware & Protective Q3 2021 Q3 2022 Δ Thirteen weeks ended 9/25/2021 9/24/2022 Comments Revenues $261,456 $271,853 4.0% Price increases + lighter volume (HS & PS) Adjusted EBITDA $30,634 $28,693 (6.3)% Margin pressure from timing & dollar-for-dollar price increases Margin (Rev/Adj. EBITDA) 11.7% 10.6% (110) bps Robotics & Digital Q3 2021 Q3 2022 Δ Thirteen weeks ended 9/25/2021 9/24/2022 Comments Revenues $67,499 $65,632 (2.8)% Lighter volumes in engaving and smart auto key fobs Adjusted EBITDA $23,483 $22,446 (4.4)% Lighter volumes in engaving and smart auto key fobs Margin (Rev/Adj. EBITDA) 34.8% 34.2% (60) bps Canada Q3 2021 Q3 2022 Δ Thirteen weeks ended 9/25/2021 9/24/2022 Comments Revenues $35,525 $41,053 15.6% Price increases + softer demand Adjusted EBITDA $2,411 $7,834 224.9% Improved operations + price increases Margin (Rev/Adj. EBITDA) 6.8% 19.1% 1,230 bps Consolidated Q3 2021 Q3 2022 Δ Thirteen weeks ended 9/25/2021 9/24/2022 Revenues $364,480 $378,538 3.9% Adjusted EBITDA $56,528 $58,973 4.3% Margin (Rev/Adj. EBITDA) 15.5% 15.6% 10 bps Performance by Product Category (Q3) Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted..

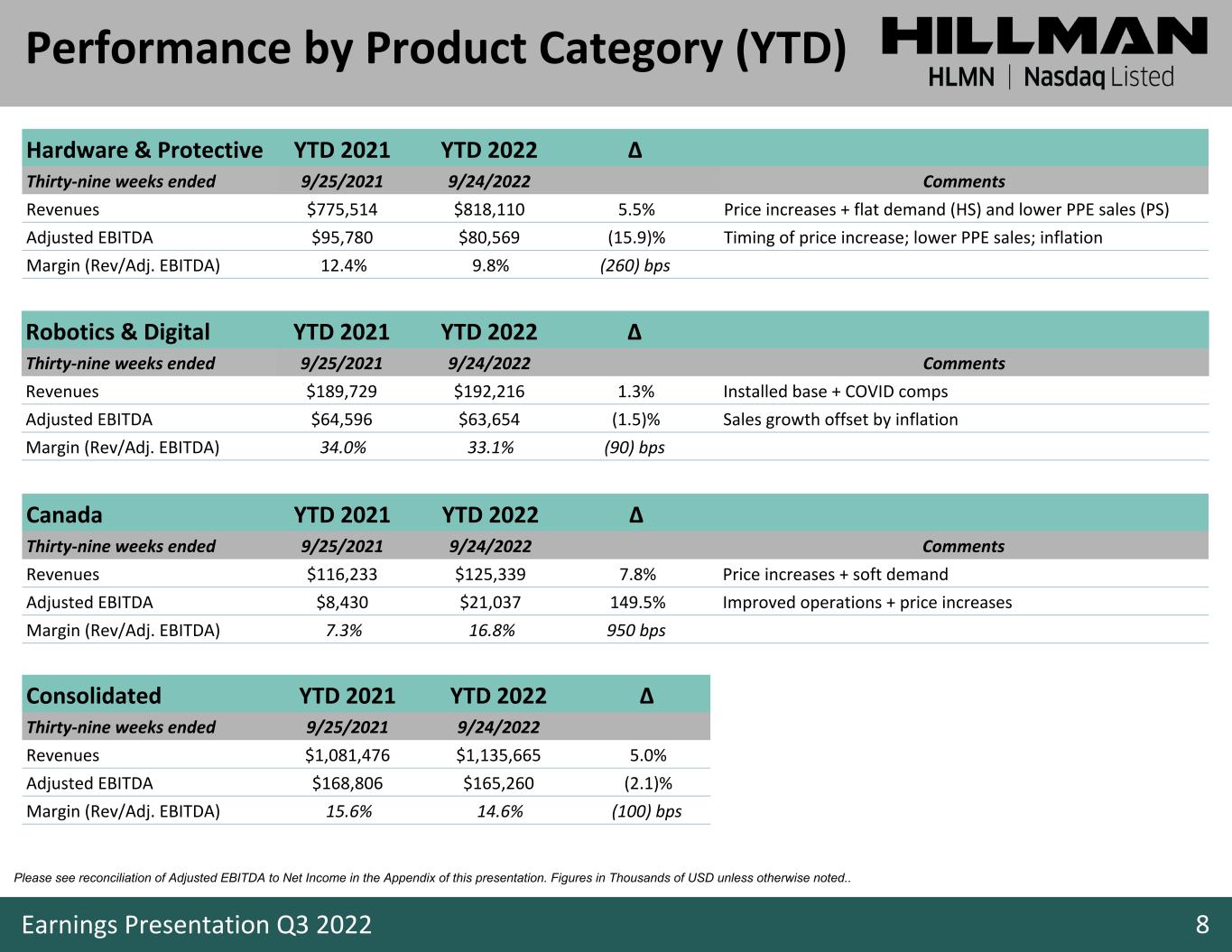

8 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Hardware & Protective YTD 2021 YTD 2022 Δ Thirty-nine weeks ended 9/25/2021 9/24/2022 Comments Revenues $775,514 $818,110 5.5% Price increases + flat demand (HS) and lower PPE sales (PS) Adjusted EBITDA $95,780 $80,569 (15.9)% Timing of price increase; lower PPE sales; inflation Margin (Rev/Adj. EBITDA) 12.4% 9.8% (260) bps Robotics & Digital YTD 2021 YTD 2022 Δ Thirty-nine weeks ended 9/25/2021 9/24/2022 Comments Revenues $189,729 $192,216 1.3% Installed base + COVID comps Adjusted EBITDA $64,596 $63,654 (1.5)% Sales growth offset by inflation Margin (Rev/Adj. EBITDA) 34.0% 33.1% (90) bps Canada YTD 2021 YTD 2022 Δ Thirty-nine weeks ended 9/25/2021 9/24/2022 Comments Revenues $116,233 $125,339 7.8% Price increases + soft demand Adjusted EBITDA $8,430 $21,037 149.5% Improved operations + price increases Margin (Rev/Adj. EBITDA) 7.3% 16.8% 950 bps Consolidated YTD 2021 YTD 2022 Δ Thirty-nine weeks ended 9/25/2021 9/24/2022 Revenues $1,081,476 $1,135,665 5.0% Adjusted EBITDA $168,806 $165,260 (2.1)% Margin (Rev/Adj. EBITDA) 15.6% 14.6% (100) bps Performance by Product Category (YTD) Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Thousands of USD unless otherwise noted..

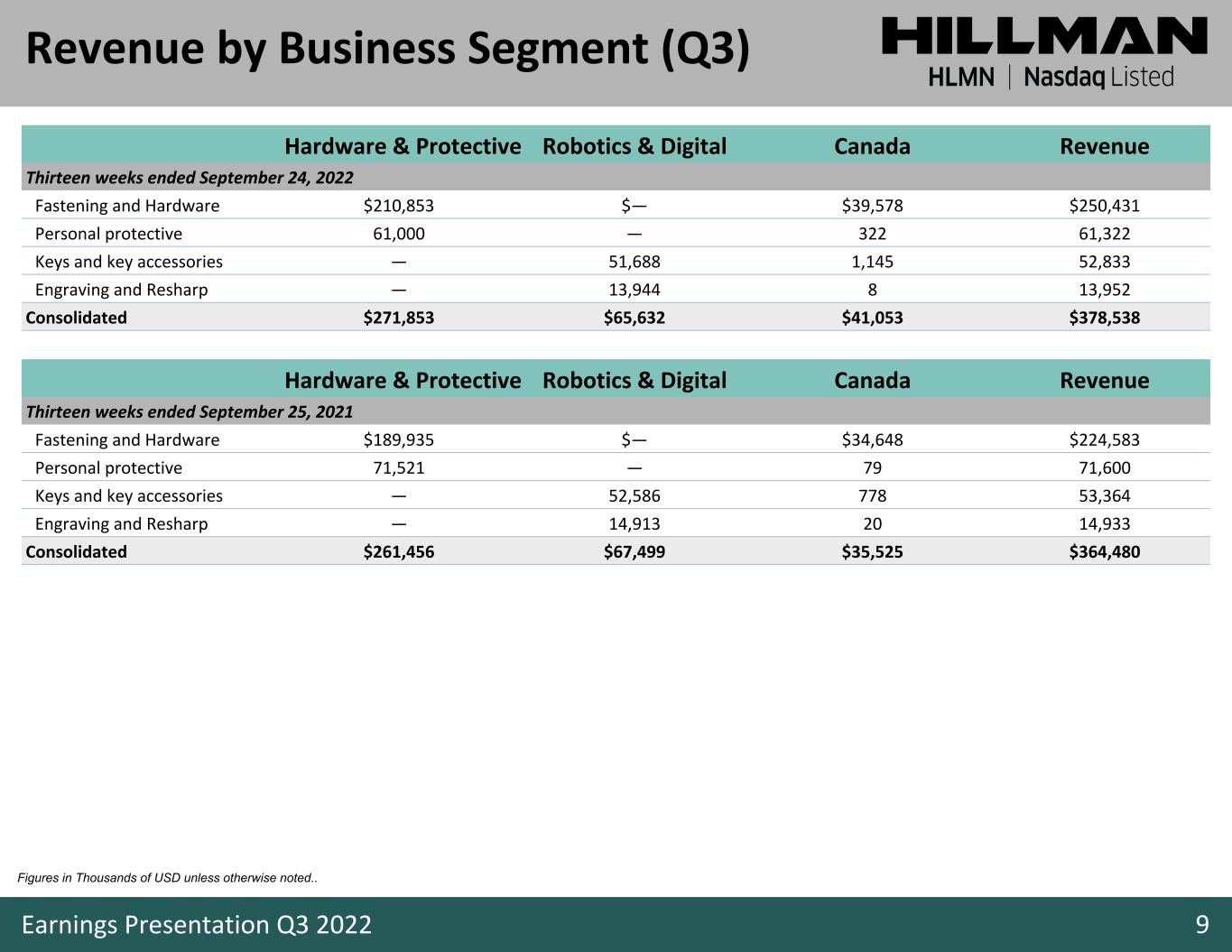

9 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Hardware & Protective Robotics & Digital Canada Revenue Thirteen weeks ended September 24, 2022 Fastening and Hardware $210,853 $— $39,578 $250,431 Personal protective 61,000 — 322 61,322 Keys and key accessories — 51,688 1,145 52,833 Engraving and Resharp — 13,944 8 13,952 Consolidated $271,853 $65,632 $41,053 $378,538 Revenue by Business Segment (Q3) Hardware & Protective Robotics & Digital Canada Revenue Thirteen weeks ended September 25, 2021 Fastening and Hardware $189,935 $— $34,648 $224,583 Personal protective 71,521 — 79 71,600 Keys and key accessories — 52,586 778 53,364 Engraving and Resharp — 14,913 20 14,933 Consolidated $261,456 $67,499 $35,525 $364,480 Figures in Thousands of USD unless otherwise noted..

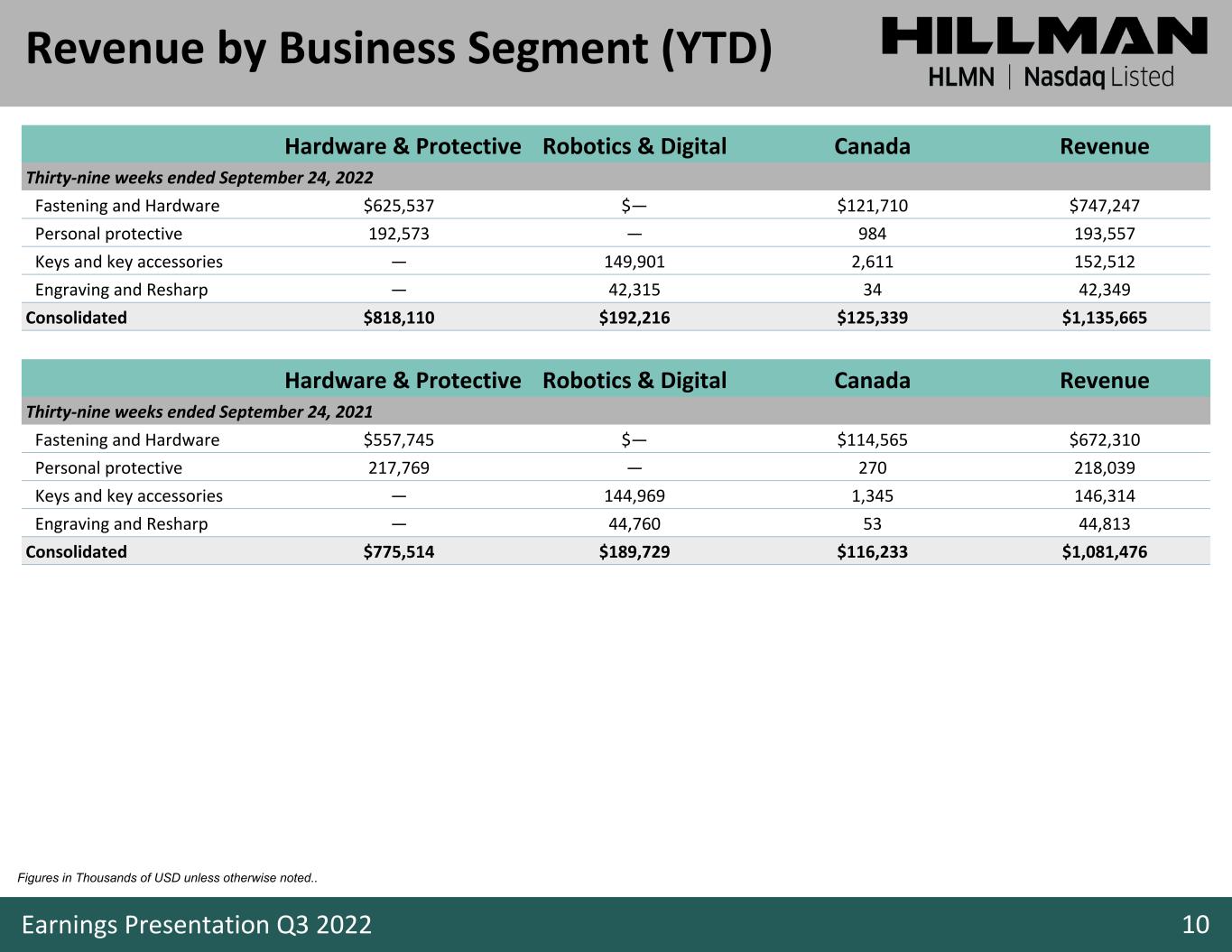

10 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Hardware & Protective Robotics & Digital Canada Revenue Thirty-nine weeks ended September 24, 2022 Fastening and Hardware $625,537 $— $121,710 $747,247 Personal protective 192,573 — 984 193,557 Keys and key accessories — 149,901 2,611 152,512 Engraving and Resharp — 42,315 34 42,349 Consolidated $818,110 $192,216 $125,339 $1,135,665 Revenue by Business Segment (YTD) Hardware & Protective Robotics & Digital Canada Revenue Thirty-nine weeks ended September 24, 2021 Fastening and Hardware $557,745 $— $114,565 $672,310 Personal protective 217,769 — 270 218,039 Keys and key accessories — 144,969 1,345 146,314 Engraving and Resharp — 44,760 53 44,813 Consolidated $775,514 $189,729 $116,233 $1,081,476 Figures in Thousands of USD unless otherwise noted..

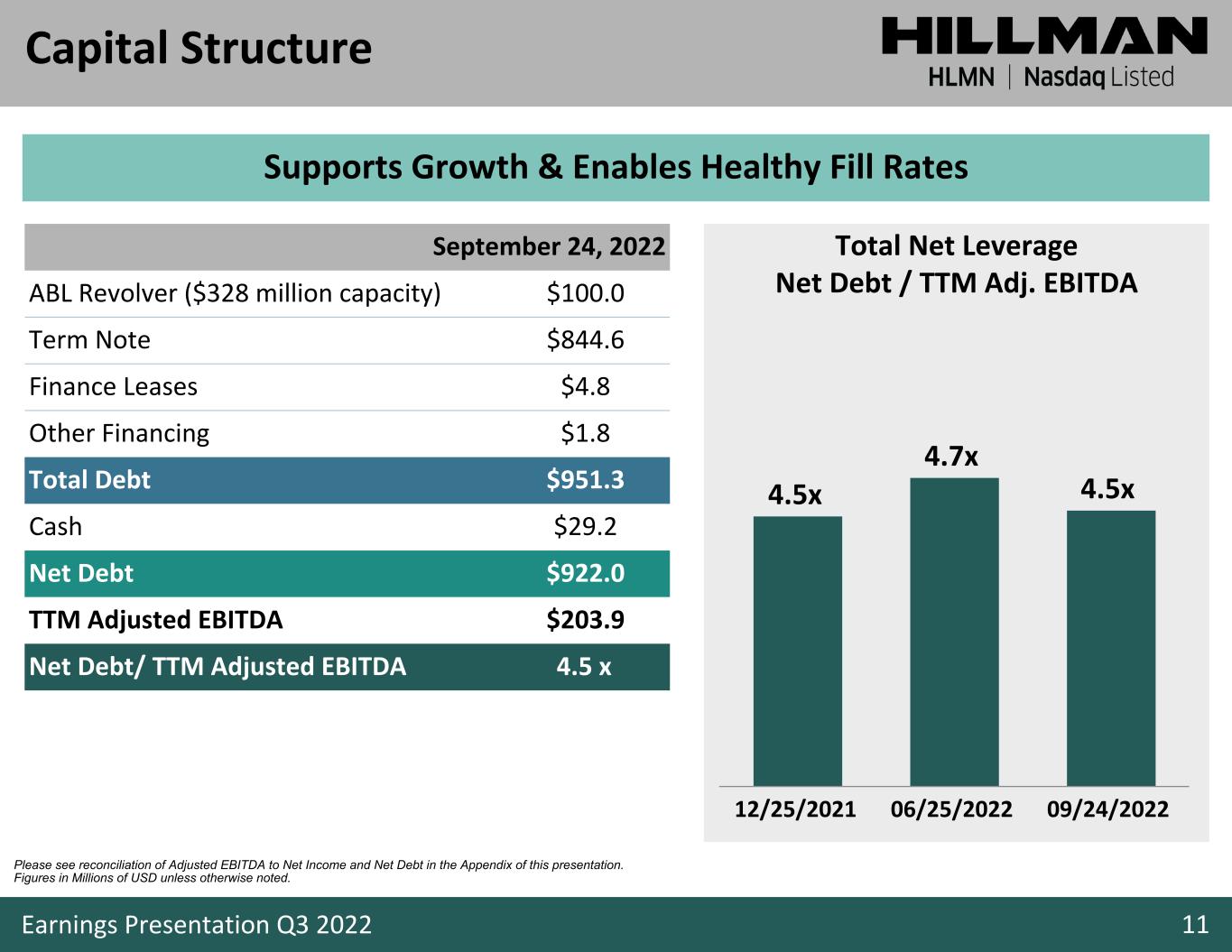

11 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Capital Structure Supports Growth & Enables Healthy Fill Rates Total Net Leverage Net Debt / TTM Adj. EBITDA Please see reconciliation of Adjusted EBITDA to Net Income and Net Debt in the Appendix of this presentation. Figures in Millions of USD unless otherwise noted. 4.5x 4.7x 4.5x 12/25/2021 06/25/2022 09/24/2022 September 24, 2022 ABL Revolver ($328 million capacity) $100.0 Term Note $844.6 Finance Leases $4.8 Other Financing $1.8 Total Debt $951.3 Cash $29.2 Net Debt $922.0 TTM Adjusted EBITDA $203.9 Net Debt/ TTM Adjusted EBITDA 4.5 x

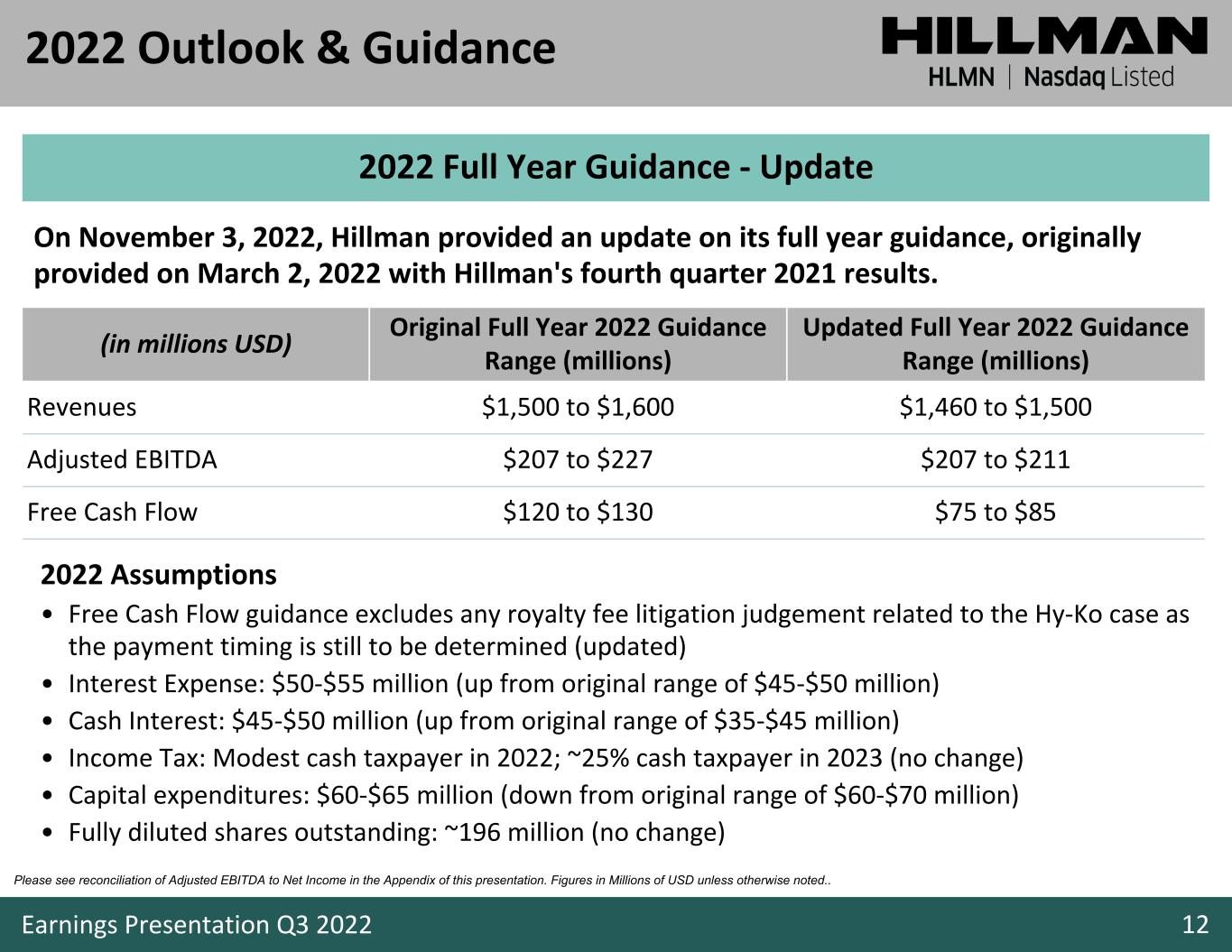

12 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 (in millions USD) Original Full Year 2022 Guidance Range (millions) Updated Full Year 2022 Guidance Range (millions) Revenues $1,500 to $1,600 $1,460 to $1,500 Adjusted EBITDA $207 to $227 $207 to $211 Free Cash Flow $120 to $130 $75 to $85 2022 Assumptions • Free Cash Flow guidance excludes any royalty fee litigation judgement related to the Hy-Ko case as the payment timing is still to be determined (updated) • Interest Expense: $50-$55 million (up from original range of $45-$50 million) • Cash Interest: $45-$50 million (up from original range of $35-$45 million) • Income Tax: Modest cash taxpayer in 2022; ~25% cash taxpayer in 2023 (no change) • Capital expenditures: $60-$65 million (down from original range of $60-$70 million) • Fully diluted shares outstanding: ~196 million (no change) 2022 Outlook & Guidance On November 3, 2022, Hillman provided an update on its full year guidance, originally provided on March 2, 2022 with Hillman's fourth quarter 2021 results. 2022 Full Year Guidance - Update Please see reconciliation of Adjusted EBITDA to Net Income in the Appendix of this presentation. Figures in Millions of USD unless otherwise noted..

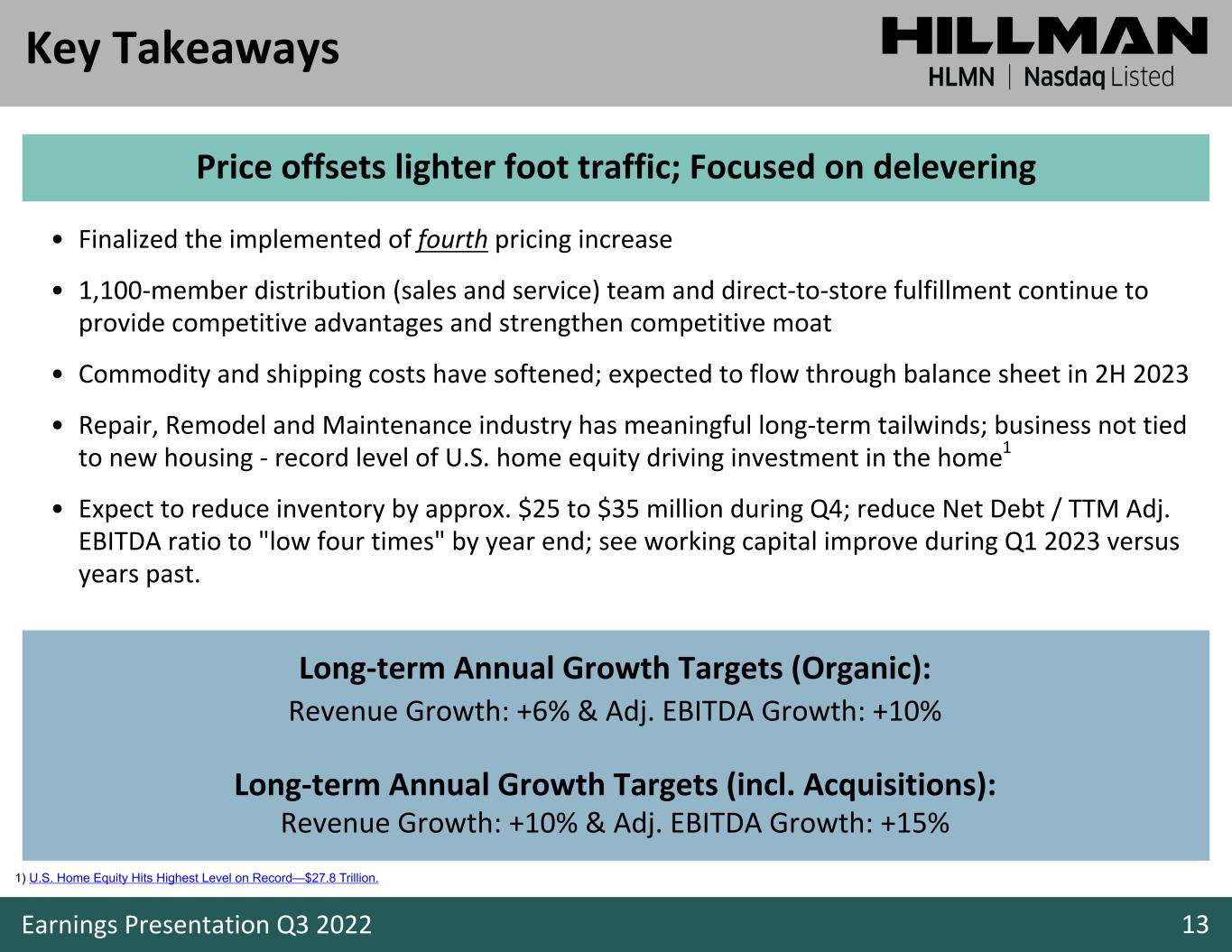

13 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Key Takeaways Price offsets lighter foot traffic; Focused on delevering Long-term Annual Growth Targets (Organic): Revenue Growth: +6% & Adj. EBITDA Growth: +10% Long-term Annual Growth Targets (incl. Acquisitions): Revenue Growth: +10% & Adj. EBITDA Growth: +15% • Finalized the implemented of fourth pricing increase • 1,100-member distribution (sales and service) team and direct-to-store fulfillment continue to provide competitive advantages and strengthen competitive moat • Commodity and shipping costs have softened; expected to flow through balance sheet in 2H 2023 • Repair, Remodel and Maintenance industry has meaningful long-term tailwinds; business not tied to new housing - record level of U.S. home equity driving investment in the home1 • Expect to reduce inventory by approx. $25 to $35 million during Q4; reduce Net Debt / TTM Adj. EBITDA ratio to "low four times" by year end; see working capital improve during Q1 2023 versus years past. 1) U.S. Home Equity Hits Highest Level on Record—$27.8 Trillion.

14 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Appendix

15 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Significant runway for incremental growth: Organic + M&A Management team with proven operational and M&A expertise Strong financial profile with 57-year track record Market and innovation leader across multiple categories Indispensable partner embedded with winning retailers Customers love us, trust us and rely on us Large, predictable, growing and resilient end markets #1 Investment Highlights

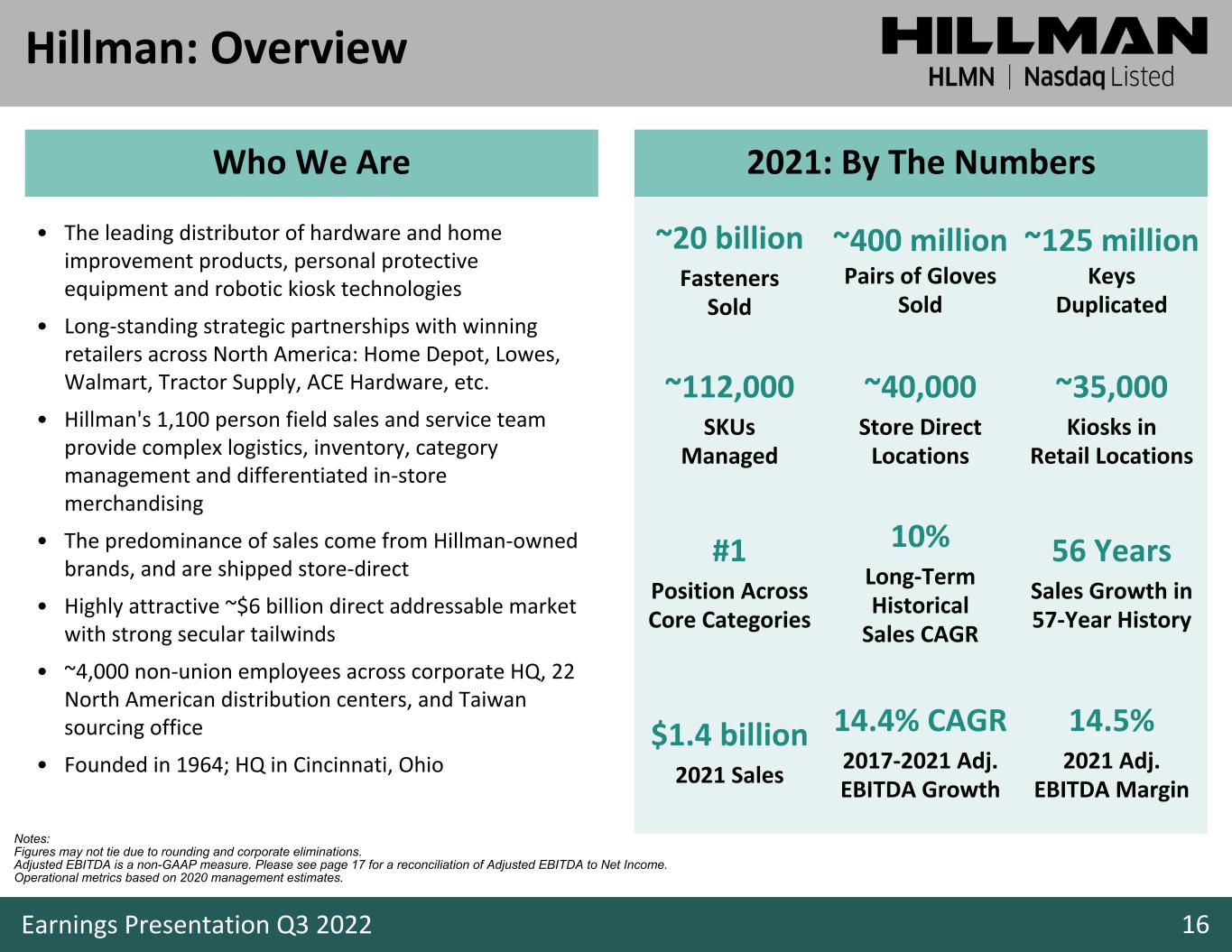

16 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Who We Are Notes: Figures may not tie due to rounding and corporate eliminations. Adjusted EBITDA is a non-GAAP measure. Please see page 17 for a reconciliation of Adjusted EBITDA to Net Income. Operational metrics based on 2020 management estimates. ~20 billion Fasteners Sold ~400 million Pairs of Gloves Sold ~125 million Keys Duplicated ~112,000 SKUs Managed ~40,000 Store Direct Locations ~35,000 Kiosks in Retail Locations #1 Position Across Core Categories 10% Long-Term Historical Sales CAGR 56 Years Sales Growth in 57-Year History $1.4 billion 2021 Sales 14.4% CAGR 2017-2021 Adj. EBITDA Growth 14.5% 2021 Adj. EBITDA Margin Hillman: Overview 2021: By The Numbers • The leading distributor of hardware and home improvement products, personal protective equipment and robotic kiosk technologies • Long-standing strategic partnerships with winning retailers across North America: Home Depot, Lowes, Walmart, Tractor Supply, ACE Hardware, etc. • Hillman's 1,100 person field sales and service team provide complex logistics, inventory, category management and differentiated in-store merchandising • The predominance of sales come from Hillman-owned brands, and are shipped store-direct • Highly attractive ~$6 billion direct addressable market with strong secular tailwinds • ~4,000 non-union employees across corporate HQ, 22 North American distribution centers, and Taiwan sourcing office • Founded in 1964; HQ in Cincinnati, Ohio

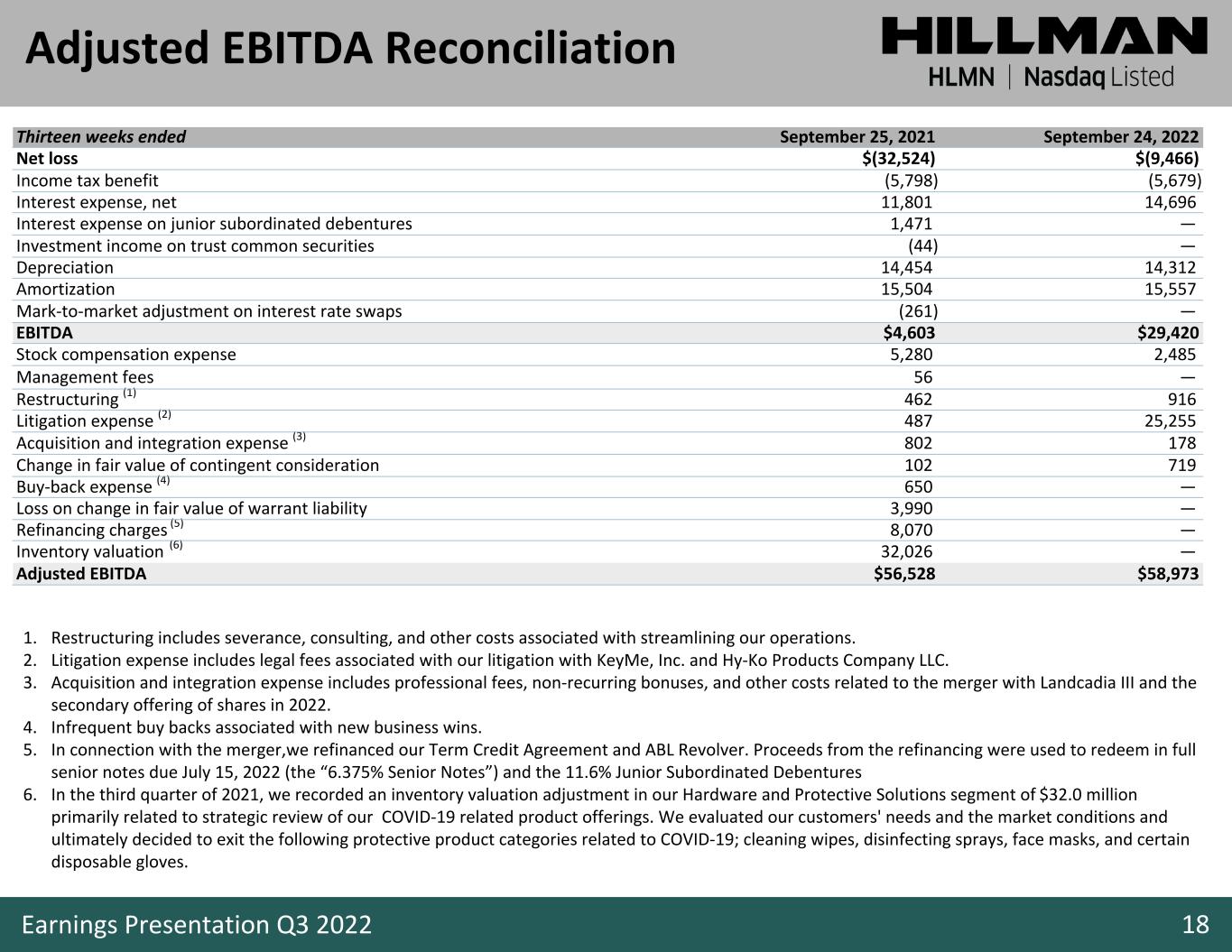

17 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 #1 in Segment Representative Top Customers #1 in Segment #1 in Segment Key and Fob Duplication Personalized Tags Knife Sharpening Fasteners & Specialty Gloves Builders Hardware & Metal Shapes Safety / PPE Construction Fasteners Work Gear Picture Hanging Source: Third party industry report. Primary Product Categories Hardware Solutions Protective Solutions Robotics & Digital Solutions

18 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Thirteen weeks ended September 25, 2021 September 24, 2022 Net loss $(32,524) $(9,466) Income tax benefit (5,798) (5,679) Interest expense, net 11,801 14,696 Interest expense on junior subordinated debentures 1,471 — Investment income on trust common securities (44) — Depreciation 14,454 14,312 Amortization 15,504 15,557 Mark-to-market adjustment on interest rate swaps (261) — EBITDA $4,603 $29,420 Stock compensation expense 5,280 2,485 Management fees 56 — Restructuring (1) 462 916 Litigation expense (2) 487 25,255 Acquisition and integration expense (3) 802 178 Change in fair value of contingent consideration 102 719 Buy-back expense (4) 650 — Loss on change in fair value of warrant liability 3,990 — Refinancing charges (5) 8,070 — Inventory valuation (6) 32,026 — Adjusted EBITDA $56,528 $58,973 1. Restructuring includes severance, consulting, and other costs associated with streamlining our operations. 2. Litigation expense includes legal fees associated with our litigation with KeyMe, Inc. and Hy-Ko Products Company LLC. 3. Acquisition and integration expense includes professional fees, non-recurring bonuses, and other costs related to the merger with Landcadia III and the secondary offering of shares in 2022. 4. Infrequent buy backs associated with new business wins. 5. In connection with the merger,we refinanced our Term Credit Agreement and ABL Revolver. Proceeds from the refinancing were used to redeem in full senior notes due July 15, 2022 (the “6.375% Senior Notes”) and the 11.6% Junior Subordinated Debentures 6. In the third quarter of 2021, we recorded an inventory valuation adjustment in our Hardware and Protective Solutions segment of $32.0 million primarily related to strategic review of our COVID-19 related product offerings. We evaluated our customers' needs and the market conditions and ultimately decided to exit the following protective product categories related to COVID-19; cleaning wipes, disinfecting sprays, face masks, and certain disposable gloves. Adjusted EBITDA Reconciliation

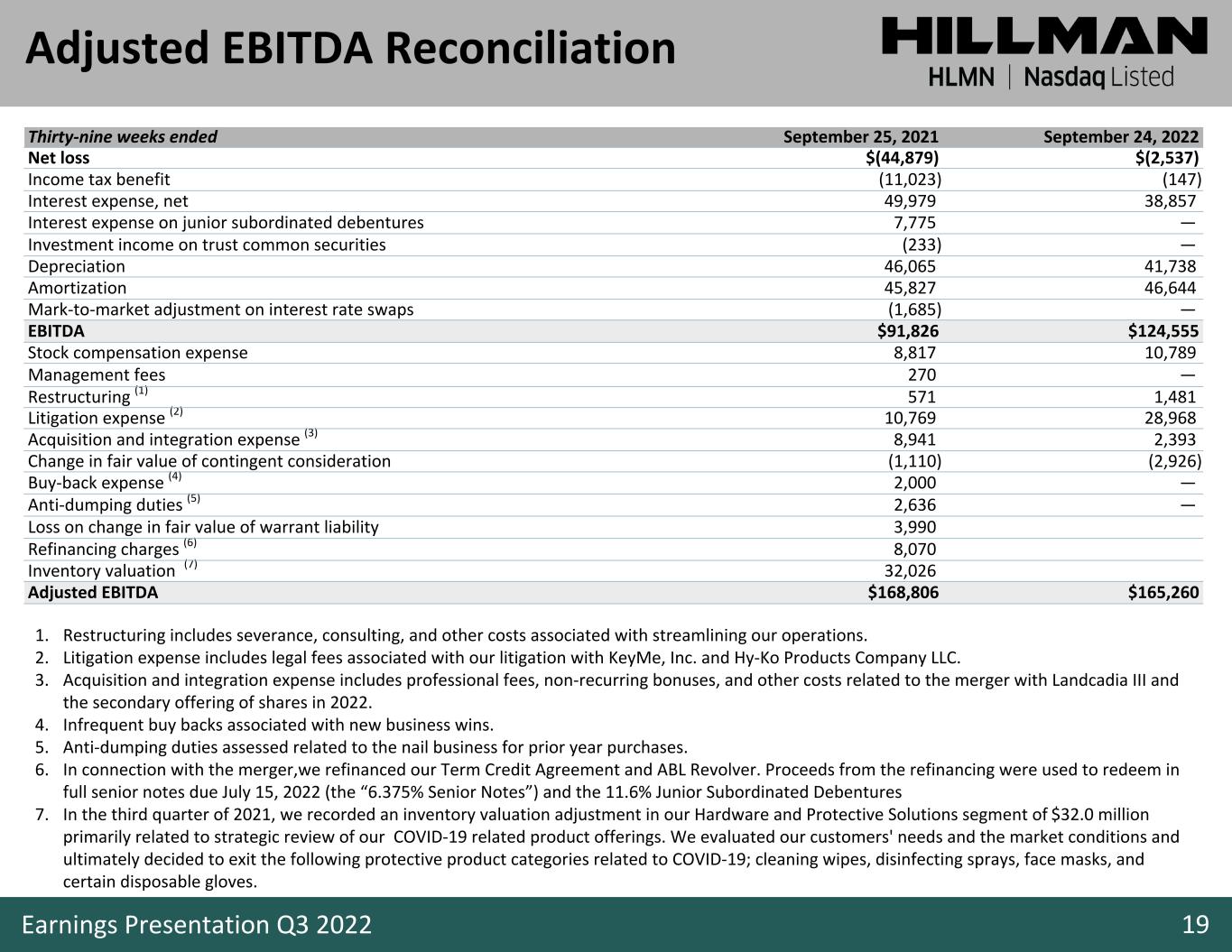

19 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Thirty-nine weeks ended September 25, 2021 September 24, 2022 Net loss $(44,879) $(2,537) Income tax benefit (11,023) (147) Interest expense, net 49,979 38,857 Interest expense on junior subordinated debentures 7,775 — Investment income on trust common securities (233) — Depreciation 46,065 41,738 Amortization 45,827 46,644 Mark-to-market adjustment on interest rate swaps (1,685) — EBITDA $91,826 $124,555 Stock compensation expense 8,817 10,789 Management fees 270 — Restructuring (1) 571 1,481 Litigation expense (2) 10,769 28,968 Acquisition and integration expense (3) 8,941 2,393 Change in fair value of contingent consideration (1,110) (2,926) Buy-back expense (4) 2,000 — Anti-dumping duties (5) 2,636 — Loss on change in fair value of warrant liability 3,990 Refinancing charges (6) 8,070 Inventory valuation (7) 32,026 Adjusted EBITDA $168,806 $165,260 1. Restructuring includes severance, consulting, and other costs associated with streamlining our operations. 2. Litigation expense includes legal fees associated with our litigation with KeyMe, Inc. and Hy-Ko Products Company LLC. 3. Acquisition and integration expense includes professional fees, non-recurring bonuses, and other costs related to the merger with Landcadia III and the secondary offering of shares in 2022. 4. Infrequent buy backs associated with new business wins. 5. Anti-dumping duties assessed related to the nail business for prior year purchases. 6. In connection with the merger,we refinanced our Term Credit Agreement and ABL Revolver. Proceeds from the refinancing were used to redeem in full senior notes due July 15, 2022 (the “6.375% Senior Notes”) and the 11.6% Junior Subordinated Debentures 7. In the third quarter of 2021, we recorded an inventory valuation adjustment in our Hardware and Protective Solutions segment of $32.0 million primarily related to strategic review of our COVID-19 related product offerings. We evaluated our customers' needs and the market conditions and ultimately decided to exit the following protective product categories related to COVID-19; cleaning wipes, disinfecting sprays, face masks, and certain disposable gloves. Adjusted EBITDA Reconciliation

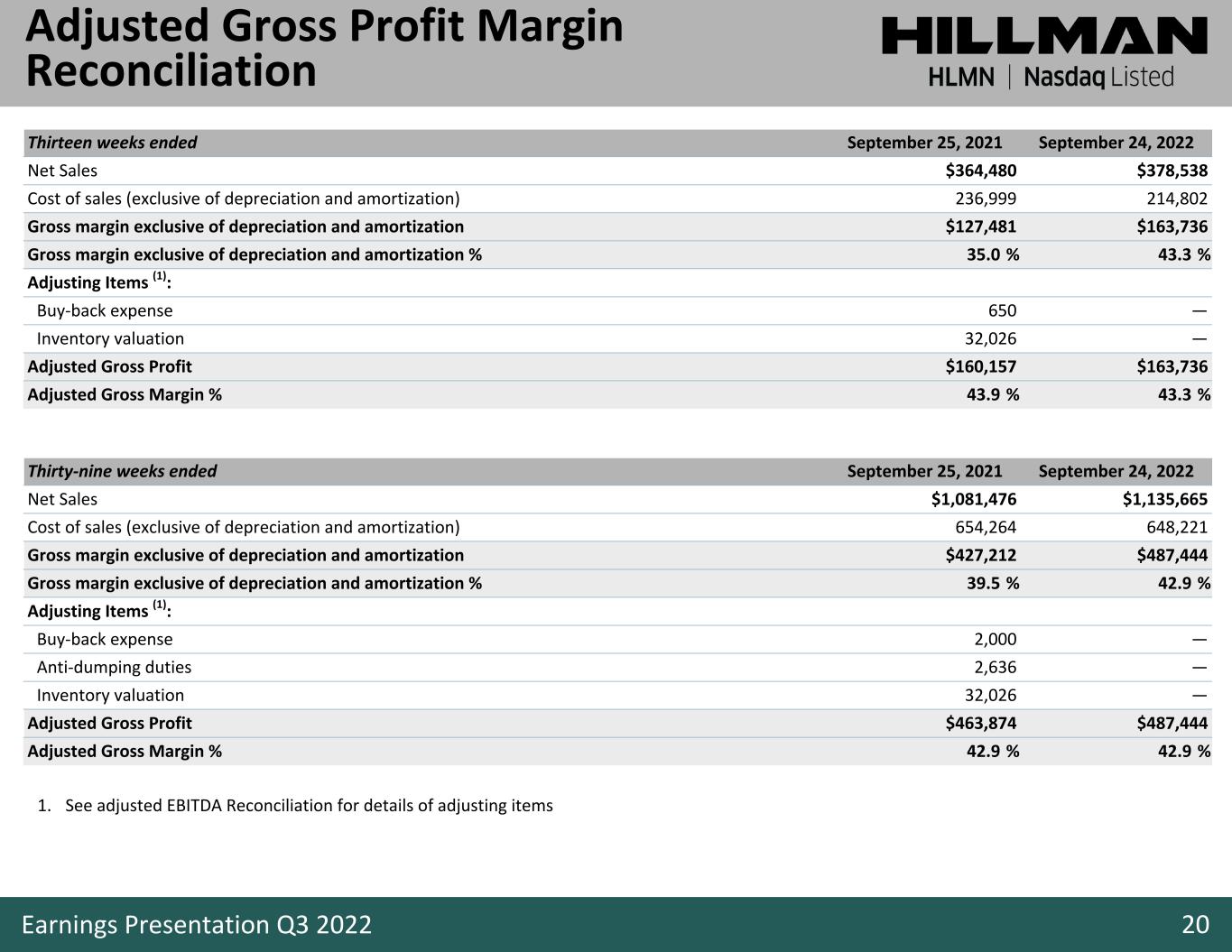

20 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Thirteen weeks ended September 25, 2021 September 24, 2022 Net Sales $364,480 $378,538 Cost of sales (exclusive of depreciation and amortization) 236,999 214,802 Gross margin exclusive of depreciation and amortization $127,481 $163,736 Gross margin exclusive of depreciation and amortization % 35.0 % 43.3 % Adjusting Items (1): Buy-back expense 650 — Inventory valuation 32,026 — Adjusted Gross Profit $160,157 $163,736 Adjusted Gross Margin % 43.9 % 43.3 % Adjusted Gross Profit Margin Reconciliation 1. See adjusted EBITDA Reconciliation for details of adjusting items Thirty-nine weeks ended September 25, 2021 September 24, 2022 Net Sales $1,081,476 $1,135,665 Cost of sales (exclusive of depreciation and amortization) 654,264 648,221 Gross margin exclusive of depreciation and amortization $427,212 $487,444 Gross margin exclusive of depreciation and amortization % 39.5 % 42.9 % Adjusting Items (1): Buy-back expense 2,000 — Anti-dumping duties 2,636 — Inventory valuation 32,026 — Adjusted Gross Profit $463,874 $487,444 Adjusted Gross Margin % 42.9 % 42.9 %

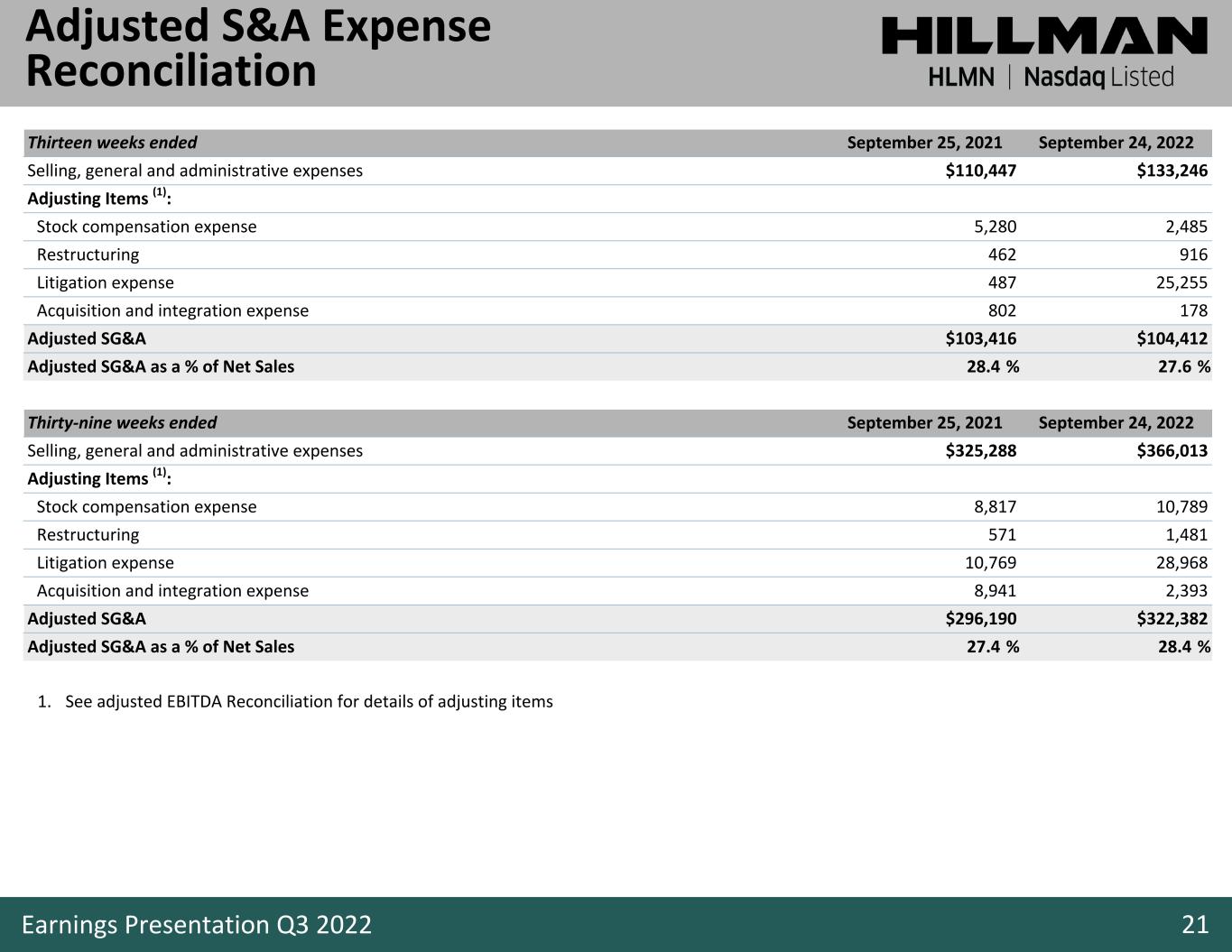

21 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Thirteen weeks ended September 25, 2021 September 24, 2022 Selling, general and administrative expenses $110,447 $133,246 Adjusting Items (1): Stock compensation expense 5,280 2,485 Restructuring 462 916 Litigation expense 487 25,255 Acquisition and integration expense 802 178 Adjusted SG&A $103,416 $104,412 Adjusted SG&A as a % of Net Sales 28.4 % 27.6 % Adjusted S&A Expense Reconciliation 1. See adjusted EBITDA Reconciliation for details of adjusting items Thirty-nine weeks ended September 25, 2021 September 24, 2022 Selling, general and administrative expenses $325,288 $366,013 Adjusting Items (1): Stock compensation expense 8,817 10,789 Restructuring 571 1,481 Litigation expense 10,769 28,968 Acquisition and integration expense 8,941 2,393 Adjusted SG&A $296,190 $322,382 Adjusted SG&A as a % of Net Sales 27.4 % 28.4 %

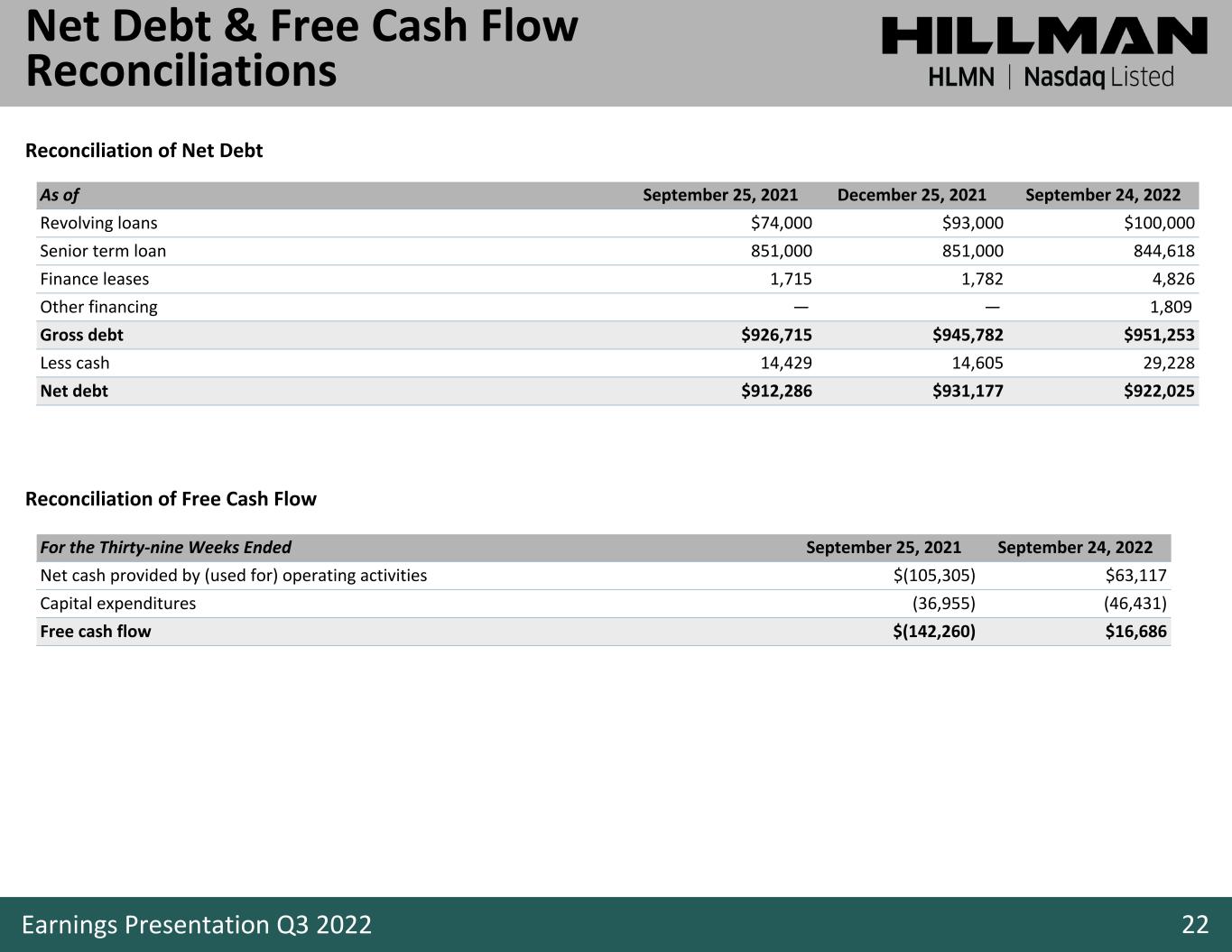

22 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 As of September 25, 2021 December 25, 2021 September 24, 2022 Revolving loans $74,000 $93,000 $100,000 Senior term loan 851,000 851,000 844,618 Finance leases 1,715 1,782 4,826 Other financing — — 1,809 Gross debt $926,715 $945,782 $951,253 Less cash 14,429 14,605 29,228 Net debt $912,286 $931,177 $922,025 Net Debt & Free Cash Flow Reconciliations For the Thirty-nine Weeks Ended September 25, 2021 September 24, 2022 Net cash provided by (used for) operating activities $(105,305) $63,117 Capital expenditures (36,955) (46,431) Free cash flow $(142,260) $16,686 Reconciliation of Net Debt Reconciliation of Free Cash Flow

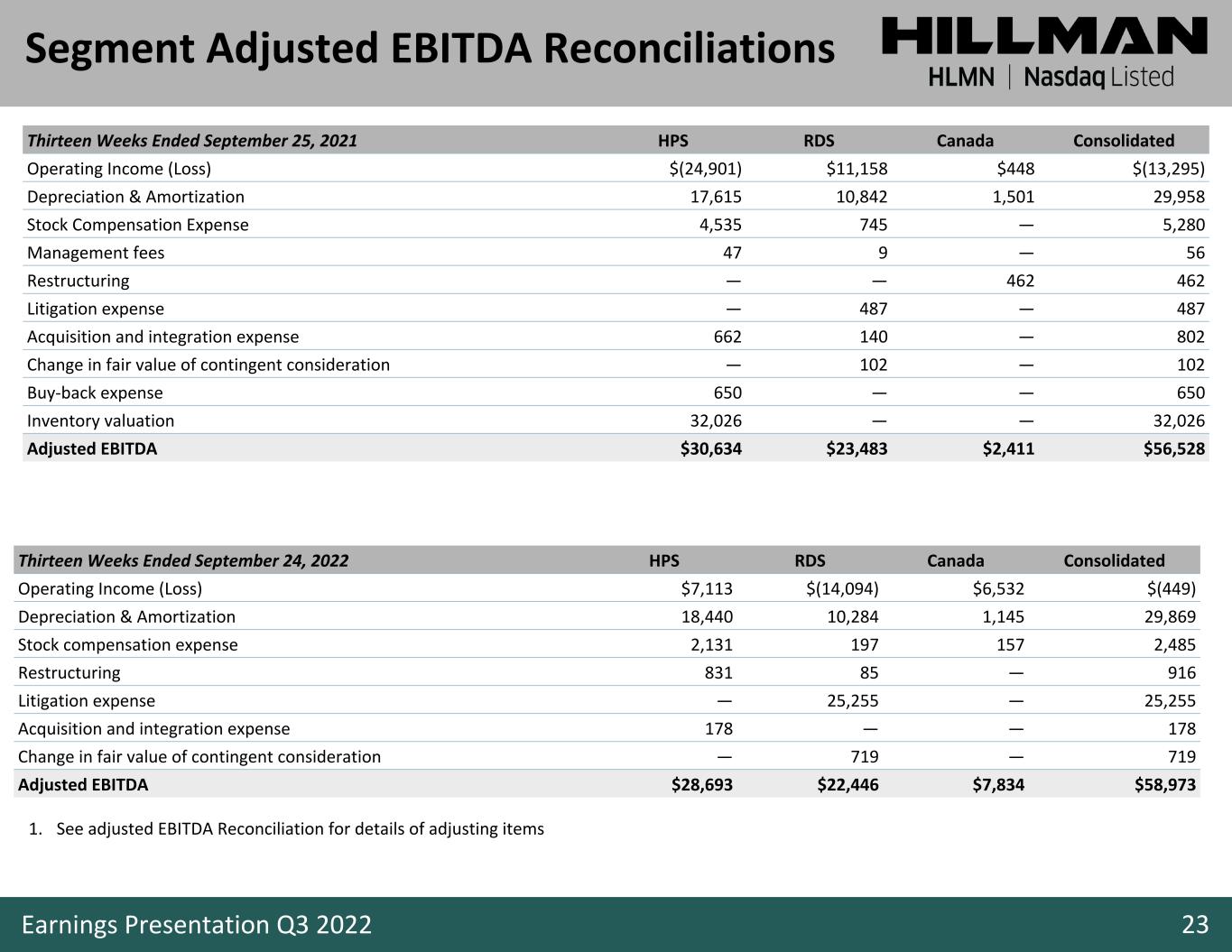

23 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Thirteen Weeks Ended September 24, 2022 HPS RDS Canada Consolidated Operating Income (Loss) $7,113 $(14,094) $6,532 $(449) Depreciation & Amortization 18,440 10,284 1,145 29,869 Stock compensation expense 2,131 197 157 2,485 Restructuring 831 85 — 916 Litigation expense — 25,255 — 25,255 Acquisition and integration expense 178 — — 178 Change in fair value of contingent consideration — 719 — 719 Adjusted EBITDA $28,693 $22,446 $7,834 $58,973 Thirteen Weeks Ended September 25, 2021 HPS RDS Canada Consolidated Operating Income (Loss) $(24,901) $11,158 $448 $(13,295) Depreciation & Amortization 17,615 10,842 1,501 29,958 Stock Compensation Expense 4,535 745 — 5,280 Management fees 47 9 — 56 Restructuring — — 462 462 Litigation expense — 487 — 487 Acquisition and integration expense 662 140 — 802 Change in fair value of contingent consideration — 102 — 102 Buy-back expense 650 — — 650 Inventory valuation 32,026 — — 32,026 Adjusted EBITDA $30,634 $23,483 $2,411 $56,528 Segment Adjusted EBITDA Reconciliations 1. See adjusted EBITDA Reconciliation for details of adjusting items

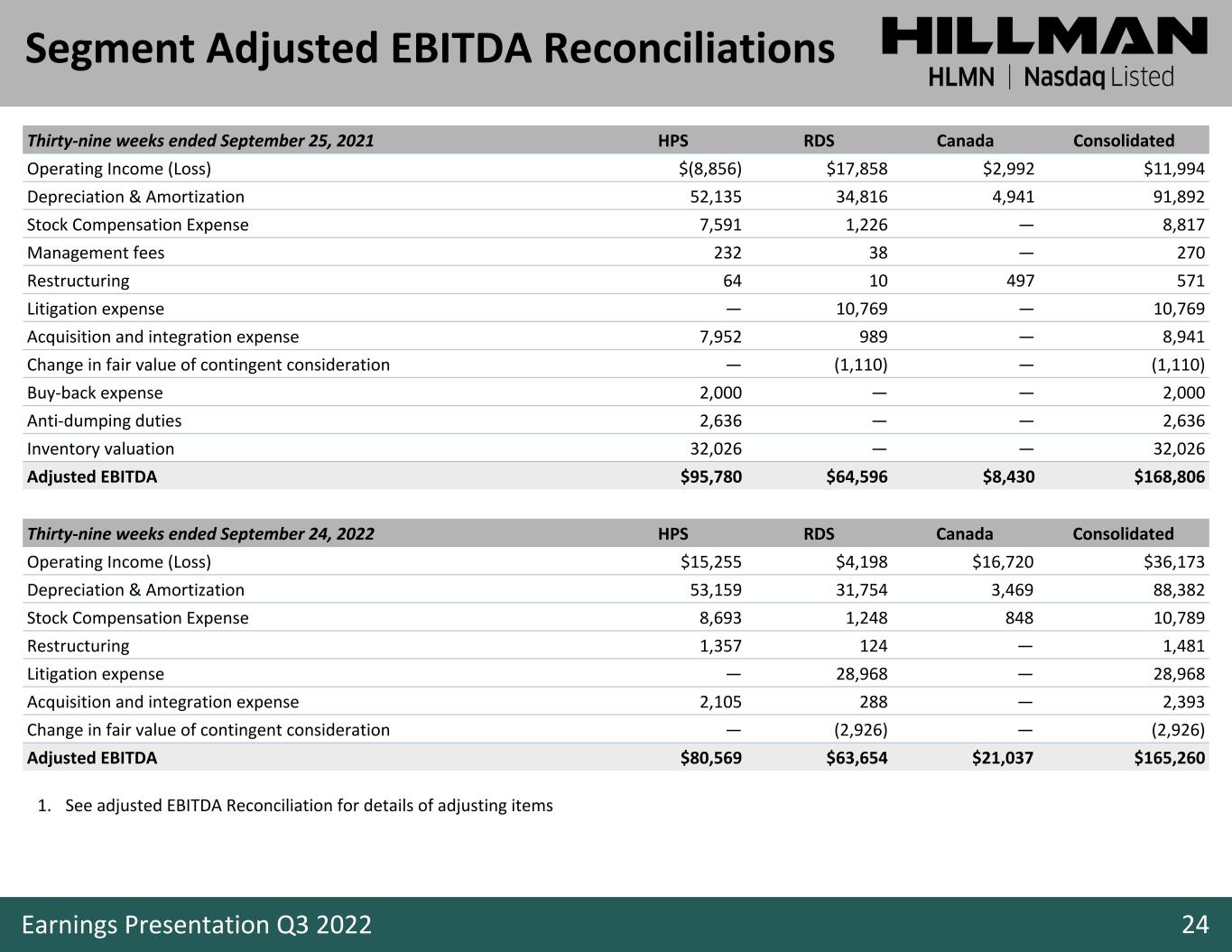

24 235 235 235 56 115 144 36 90 87 61 61 61 180 180 180 147 183 201 30 140 130 Earnings Presentation Q3 2022 Thirty-nine weeks ended September 24, 2022 HPS RDS Canada Consolidated Operating Income (Loss) $15,255 $4,198 $16,720 $36,173 Depreciation & Amortization 53,159 31,754 3,469 88,382 Stock Compensation Expense 8,693 1,248 848 10,789 Restructuring 1,357 124 — 1,481 Litigation expense — 28,968 — 28,968 Acquisition and integration expense 2,105 288 — 2,393 Change in fair value of contingent consideration — (2,926) — (2,926) Adjusted EBITDA $80,569 $63,654 $21,037 $165,260 Thirty-nine weeks ended September 25, 2021 HPS RDS Canada Consolidated Operating Income (Loss) $(8,856) $17,858 $2,992 $11,994 Depreciation & Amortization 52,135 34,816 4,941 91,892 Stock Compensation Expense 7,591 1,226 — 8,817 Management fees 232 38 — 270 Restructuring 64 10 497 571 Litigation expense — 10,769 — 10,769 Acquisition and integration expense 7,952 989 — 8,941 Change in fair value of contingent consideration — (1,110) — (1,110) Buy-back expense 2,000 — — 2,000 Anti-dumping duties 2,636 — — 2,636 Inventory valuation 32,026 — — 32,026 Adjusted EBITDA $95,780 $64,596 $8,430 $168,806 Segment Adjusted EBITDA Reconciliations 1. See adjusted EBITDA Reconciliation for details of adjusting items