S-4/A: Registration of securities issued in business combination transactions

Published on July 2, 2013

Table of Contents

As filed with the Securities and Exchange Commission on July 1, 2013

Registration No. 333-188869

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

| The Hillman Companies, Inc. | The Hillman Group, Inc. | |

| (Exact name of Registrant as specified in its charter) | (Exact name of Registrant as specified in its charter) | |

| Delaware | Delaware | |

| (State or other jurisdiction of incorporation or organization) | (State or other jurisdiction of incorporation or organization) | |

| 5080 | 5080 | |

| (Primary Standard Industrial Classification Code Number) | (Primary Standard Industrial Classification Code Number) | |

| 23-2874736 | 31-1623179 | |

| (IRS Employer Identification No.) | (IRS Employer Identification No.) |

10590 Hamilton Avenue

Cincinnati, Ohio 45231-1764

(513) 851-4900

(Address, including zip code, and telephone number, including area code, of Registrants principal executive offices)

Douglas D. Roberts

General Counsel and Secretary

The Hillman Companies, Inc.

10590 Hamilton Avenue

Cincinnati, Ohio 45231-1764

(513) 851-4900

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

John C. Kennedy, Esq.

Paul, Weiss, Rifkind, Wharton & Garrison LLP

1285 Avenue of the Americas

New York, New York 10019-6064

(212) 373-3000

Approximate date of commencement of proposed sale to public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of large accelerated filer, accelerated filer and smaller reporting company in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) ¨

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) ¨

CALCULATION OF REGISTRATION FEE

|

|

||||||||

| Title of each Class of Securities to be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Share |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee |

||||

| 10.875% Senior Notes due 2018 |

$65,000,000 | 100% | $65,000,000 (1) | $8,866.00 (2) | ||||

| Guarantees of 10.875% Senior Notes due 2018 |

N/A | N/A | N/A | N/A (3) | ||||

|

|

||||||||

|

|

||||||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(f) of the Securities Act of 1933. |

| (2) | The registration fee has been calculated pursuant to Rule 457(f) under the Securities Act of 1933. The registration fee has been previously paid in connection with the initial filing of this registration statement. |

| (3) | No additional consideration is being received for the guarantees and therefore no additional fee is required. |

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

TABLE OF ADDITIONAL REGISTRANTS

| Name |

State or Other Jurisdiction of Incorporation or Organization |

Primary Standard Industrial Classification Code Number |

IRS Employer Identification Number |

|||||

| Hillman Investment Company |

Delaware | 5080 | 51-0385959 | |||||

| All Points Industries, Inc. |

Florida | 5080 | 65-0683513 | |||||

| SunSub C Inc. |

Delaware | 5080 | 43-1831418 | |||||

| Hillman Group GP1, LLC |

Delaware | 5080 | 46-1806701 | |||||

| Hillman Group GP2, LLC |

Delaware | 5080 | 46-1831510 | |||||

| Paulin Industries Inc. |

Delaware | 5080 | 34-1687883 | |||||

The address of each of the additional registrants is c/o The Hillman Companies, Inc., 10590 Hamilton Avenue, Cincinnati, Ohio 45231-1764.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JULY 1, 2013

PROSPECTUS

The Hillman Group, Inc.

Exchange Offer for $65,000,000

10.875% Senior Notes due 2018 and Related Guarantees

The Notes and the Guarantees

| | We are offering to exchange $65,000,000 of our outstanding 10.875% Senior Notes due 2018 and certain related guarantees, which were issued on February 19, 2013 and which we refer to as the initial notes, for a like aggregate amount of our registered 10.875% Senior Notes due 2018 and certain related guarantees, which we refer to as the exchange notes. The exchange notes will be issued under the indenture dated as of May 28, 2010, as amended and supplemented on December 29, 2010, April 1, 2011, February 5, 2013 and February 19, 2013. |

| | We previously issued $200.0 million in aggregate principal amount of 10.875% Senior Notes due 2018 pursuant to the same indenture as the notes offered for exchange hereby. On December 6, 2010 and December 7, 2011, we completed registered exchange offers with respect to these notes for like principal amounts of registered notes, which we refer to as the existing notes and, together with the exchange notes, the notes. The exchange notes will constitute part of a single class of securities together with the existing notes and have the same terms as the existing notes except as otherwise provided herein. |

| | The notes will mature on June 1, 2018. We will pay interest on the notes on June 1 and December 1 of each year, beginning on December 1, 2013 in the case of the exchange notes, at a rate of 10.875% per annum, to holders of record on the immediately preceding May 15 and November 15, as the case may be. |

The notes are our senior unsecured obligations, rank equally in right of payment with all of our and the guarantors existing and future senior unsecured debt and rank senior in right of payment to all of our and all of the guarantors existing and future subordinated unsecured debt. The notes and the guarantees are effectively subordinated to all of our and the guarantors existing and future secured debt to the extent of the value of the collateral securing such debt. The notes and the guarantees are structurally subordinated to all existing and future liabilities, including trade payables, of each of our subsidiaries that do not guarantee the notes. See Description of NotesBrief Description of the Notes and the Note Guarantees.

Terms of the exchange offer

| | It will expire at 5:00 p.m., New York City time, on , 2013, unless we extend it. |

| | If all the conditions to this exchange offer are satisfied, we will exchange all of our initial notes that are validly tendered and not withdrawn for the exchange notes. |

| | You may withdraw your tender of initial notes at any time before the expiration of this exchange offer. |

| | The exchange notes that we will issue you in exchange for your initial notes will be substantially identical to your initial notes except that, unlike your initial notes, the exchange notes will have no transfer restrictions or registration rights. |

| | The exchange notes that we will issue you in exchange for your initial notes are an addition to a relatively new issue of securities with no established market for trading. |

Before participating in this exchange offer, please refer to the section in this prospectus entitled Risk Factors commencing on page 27.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of those exchange notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an underwriter within the meaning of the Securities Act of 1933, as amended. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for unregistered notes where those unregistered notes were acquired as a result of market-making activities or other trading activities. To the extent any such broker-dealer participates in the exchange offer, we have agreed that for a period of up to 180 days we will use commercially reasonable efforts to make this prospectus, as amended or supplemented, available to such broker-dealer for use in connection with any such resale. See Plan of Distribution.

The date of this prospectus is , 2013.

Table of Contents

| 1 | ||||

| 27 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 43 | ||||

| MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

48 | |||

| 72 | ||||

| 73 | ||||

| 89 | ||||

| 92 | ||||

| 108 | ||||

| 109 | ||||

| 110 | ||||

| 112 | ||||

| 121 | ||||

| 167 | ||||

| 173 | ||||

| 174 | ||||

| 174 | ||||

| 175 | ||||

| F-1 |

MARKET, RANKING AND OTHER DATA

The data included in this prospectus regarding markets and ranking are estimates based on our managements knowledge and experience in the markets in which we operate. We believe these estimates to be accurate as of their respective dates. However, this information may prove to be inaccurate because of the method by which we obtained some of the data for our estimates or because this information cannot always be verified with complete certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties. As a result, you should be aware that market, ranking and other similar data included in this prospectus, and estimates and beliefs based on that data, may not be reliable. Neither we nor the initial purchaser can guarantee the accuracy or completeness of any such information contained in this prospectus.

Table of Contents

This summary may not contain all of the information that may be important to you. Please review this prospectus in its entirety, including the sections entitled Risk Factors, Special Note Regarding Forward Looking Statements, and Where You Can Find More Information, before you decide to invest in the notes.

Unless otherwise specified or the context requires otherwise, (i) the term Hillman Group refers to The Hillman Group, Inc., the principal operating subsidiary of The Hillman Companies, Inc. and the issuer of the notes; (ii) the term Hillman refers to The Hillman Companies, Inc., Hillman Groups indirect parent and a guarantor of the notes; and (iii) the terms we, us, or our and the Company refer collectively to The Hillman Companies, Inc. and its subsidiaries. The term Paulin Acquisition refers to the acquisition of H. Paulin & Co., Limited (Paulin) by Hillman.

The term existing notes refers to the $200.0 million in aggregate principal amount of Hillman Groups 10.875% Senior Notes due 2018 previously issued under the same indenture as the initial notes and the exchange notes offered hereby. The term initial notes refers to the $65.0 million in aggregate principal amount of Hillman Groups 10.875% Senior Notes due 2018 that were issued on February 19, 2013 in exchange for a like principal amount of temporary 10.875% Senior Notes due 2018 issued on December 21, 2012 in a private offering, and the term exchange notes refers to Hillman Groups 10.875% Senior Notes due 2018 to be offered with this prospectus. The term notes refers to the existing notes and the exchange notes, collectively.

Company Overview

We are one of the largest providers of hardware-related products and related merchandising services to retail markets in North America. We had net sales of $555.5 million in 2012. We sell our products to hardware stores, home centers, mass merchants, pet supply stores, and other retail outlets principally in the United States, Canada, Mexico, Australia, Latin America and the Caribbean. Product lines include thousands of small parts such as fasteners and related hardware items; threaded rod and metal shapes; keys, key duplication systems and accessories; builders hardware; and identification items, such as tags and letters, numbers, and signs. We support our product sales with value added services including design and installation of merchandising systems and maintenance of appropriate in-store inventory levels.

We hold a leading position in all of our core product categories and have a strong history of new product introductions and acquisitions of complementary product lines. Our product mix encompasses low price-point consumer products that exhibit recession-resistant characteristics. We sell these products to a diverse customer base comprising hardware stores, home improvement centers, mass merchants, national and regional hardware stores, pet supply stores, and other retail outlets in the United States, Canada, Mexico, Latin America, the Caribbean and Australia. Our wide-ranging service offerings and approximately 850 person full-time sales force makes us a highly effective outsourcing solution for managing stock keeping unit (SKU) intensive, low price-point hardware product categories.

1

Table of Contents

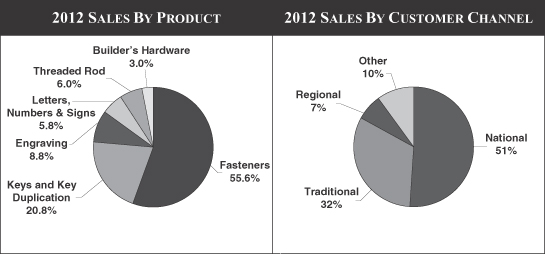

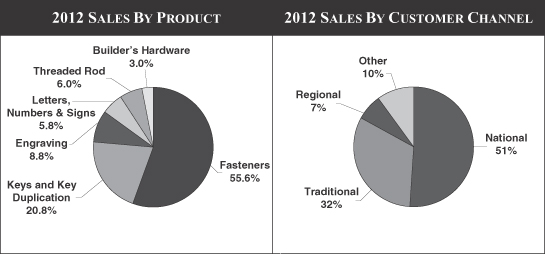

The following charts illustrate the contribution to our net sales by product category and customer type for the year ended December 31, 2012(1):

| (1) | Our net sales by product category and customer type for the year ended December 31, 2012 do not reflect the Paulin Acquisition, which occurred in February 2013. |

We have delivered strong financial results through economic cycles, even in difficult operating environments. For example, during the recessionary periods between 2008 and 2010, we generated significant free cash flow and exhibited relative stability in revenues, profitability and returns. Specifically, while our net sales declined 4.9% between 2008 and 2009 and we experienced a net loss of approximately $1.2 million in each of 2008 and 2009, our earnings before interest, taxes, depreciation and amortization adjusted for management fees, stock compensation, and other acquisition and integration related general and administrative costs (Adjusted EBITDA) grew from $77.4 million to $83.3 million during the same period, representing a compound annual growth rate of 7.6%. Our net sales increased from $506.5 million in 2011 to $555.5 million in 2012. We have grown our Adjusted EBITDA in 14 of the last 15 years. Our strong profitability, combined with the low capital intensity of the business, has resulted in attractive free cash flows and substantial deleveraging. We continue to demonstrate strong operating and financial performance by offering inexpensive consumer products with demand characteristics not significantly affected by macroeconomic uncertainty. Our commitment to value-added merchandising services and category management has also increased our customers reliance on us, thereby creating stability and predictability in our business model.

Products

Fasteners: Fasteners form the core of our product offerings with more than 64,000 SKUs as of December 31, 2012 (prior to the Paulin Acquisition), which we believe represents one of the largest fastener selections among suppliers servicing the hardware retail segment in North America. Our fastener products are sold in numerous packaging configurations, resulting in a very high SKU count, sometimes numbering in the thousands for a single customer. This category includes standard and specialty nuts, bolts, washers, screws, anchors, and picture hanging items in a wide variety of materials and finishes, including steel, brass, chrome, nylon, stainless and galvanized steel for both indoor and outdoor use. We possess the scale and infrastructure to efficiently manage our customers entire supply chain, including sourcing, inventory management and merchandising for these products. In 2013, we completed the Paulin Acquisition in which we acquired a leading Canadian distributor and manufacturer of fasteners, fluid system products, automotive parts, and retail hardware components.

Keys and Key Accessories: Our key duplication business is largely driven by our own proprietary equipment that we design and manufacture in our Tempe, Arizona facility. Our razor / razor blade strategy is

2

Table of Contents

based on providing these Hillman-owned machines to the merchant free of charge and the merchant typically purchases key blanks from us. Key duplication systems are marketed under two brands: Axxess Precision Key Duplication System©, or Axxess, and the Hillman Precision Laser Key Program. We have a large installed base of over 13,900 Axxess+® machines placed in North American retailers including Wal-Mart, Kmart, Sears, The Home Depot, Lowes and Menards. We also have an exclusive strategic partnership with Barnes Distribution for the distribution of the proprietary PC+© Code Cutter to duplicate automobile keys based on a vehicles identification number. This program is marketed to automotive dealerships, auto rental agencies and various companies with truck and vehicle fleets. We have sold over 7,900 PC+ units and 8,500 of the newer Flash Code Cutter units since their introduction. In addition, we also sell key machines to thousands of franchise hardware stores and independent retailers through the Hillman Precision Laser Key Program.

Engraving: Quick-Tag is our patented, consumer-operated vending system that custom engraves specialty products such as pet identification tags, military-style identification tags, holiday ornaments and luggage tags. Using an interactive touch screen, customers input information such as a pet name and telephone number, and the systems proprietary technology engraves the tag in less than two minutes. The Quick-Tag system does not require incremental labor at the point of sale and thus generates high levels of customer satisfaction and attractive margins for the retailer. We have placed over 2,500 Quick-Tag machines in retail outlets throughout the United States and Canada, including at Wal-Mart and PETCO and inside theme parks such as Disney, Sea World and Universal Studios. In 2010, we introduced the new FIDO engraving system to PETCO. FIDO combines an attractive consumer interface and improved engraving capability with an expanded tag offering. We have placed approximately 1,000 FIDO systems in PETCO stores. In 2011, we completed the acquisition of TagWorks. TagWorks provides innovative pet ID tag programs to leading pet products chain retailers using a patented technology, product portfolio, and off-board merchandising display. The TagWorks system utilizes laser printing technology and allows consumers to watch the engraving process. The off-board merchandising allows premium-priced tags to be displayed in store-front locations and is effective at increasing the average price per transaction.

Letters, Numbers and Signs (LNS): Our LNS product category includes individual and/or packaged letters, numbers, signs, safety related products (e.g. 911 signs), driveway markers, and a variety of sign accessories, such as sign frames marketed under the Hillman Sign Center brand. Through a series of strategic acquisitions, exclusive partnerships, and organic product development, we believe we offer retailers a significant offering in the LNS product category. In addition to our core product program, we provide value-added retail support including custom plan-o-grams and merchandising solutions.

Threaded Rod: We are a leading supplier of threaded rod in the retail market in the United States. The SteelWorks threaded rod product includes hot and cold rolled rod, both weld-able and plated, as well as a complete offering of All-Thread rod in galvanized steel, stainless steel, and brass. Selected product applications include metal shelving, racking, grates and enclosures and braces for home improvement and light construction. The SteelWorks program is carried by many top retailers including Lowes, Menards, and Sears, and through cooperatives such as Ace Hardware. We are also the primary supplier of threaded rod to many wholesalers throughout the country.

Builders Hardware: The builders hardware category includes a variety of common household items such as coat hooks, door stops, hinges, gate latches, hasps and decorative hardware. We market the builders hardware products under the Hardware Essentials brand and provide retailers with an innovative merchandising solution. The Hardware Essentials program utilizes modular packaging, color coding and integrated merchandising to simplify the shopping experience for consumers. Colorful signs, packaging and installation instructions guide the consumer quickly and easily to the correct product location. Hardware Essentials provides retailers and consumers decorative upgrade opportunities through the introduction of high-end finishes such as satin nickel, pewter and antique bronze.

3

Table of Contents

Customers

Over the course of our 49-year operating history, we have developed longstanding relationships with over 20,000 active customer accounts as of December 31, 2012 (prior to the Paulin Acquisition), ranging from small local and regional hardware stores to large retail outlets with national footprints and mass merchants. We have a successful track record of generating high levels of customer satisfaction as a result of our uniquely tailored sales and service approach for each of these customer segments. Our customers demand a high level of expertise in managing point of purchase data, item profitability, inventory turns, retail pricing, merchandising capability and display management and we successfully manage these objectives on a daily basis. A measure of our effectiveness in partnering with our customers is the breadth and duration of the relationships we maintain with many of the largest and most respected retailers in North America. These longstanding relationships were developed through considerable sales force effort that we believe cannot be easily replicated. We serve three main customer segments: large retail chains with a national presence, traditional hardware stores and smaller regional retail chains.

National: National accounts include such retailers as Lowes, Home Depot, Wal-Mart, Tractor Supply, Sears, Menards and PETCO. For the year ended December 31, 2012, Lowes was our single largest customer, representing 21.6% of revenue, Home Depot was our second largest at 11.6% of revenue and Wal-Mart was our third largest at 6.9% of revenue. Our sales representatives play critical roles in helping retailers manage store inventory of up to 5,000 SKUs by frequently updating physical inventory availability in their computer systems to ensure optimal SKU replenishment, best-in-class merchandising and display maintenance on all fastener, key, LNS and builders hardware categories, and providing technical service and support for all engraving and key duplicating machines. Our status as a national supplier to major national retailers has allowed us to develop a strong competitive position within our product categories.

Traditional: Our traditional accounts consist of approximately 15,000 franchise and independent (F&I) retail outlets, which are typically members of larger cooperatives such as True Value, Ace Hardware, and Do-It-Best. The segment is divided into two divisions: Store Direct and Warehouse. Through Store Direct, we supply our products directly to independent hardware stores and provide in-store inventory management, product display and price implementation services. Through our Warehouse division, we supply wholesalers, cooperatives and central warehouses such as True Value, Ace Hardware, and Do-It-Best that distribute to their member network and do not require our merchandising services. The Warehouse channel reduces logistics expenses for us while reducing central warehouse inventory and delivery costs for the cooperatives.

Regional: Our regional accounts are comprised of large multi-store chains that operate within regional marketing areas, such as Orchard Supply, 84 Lumber, Westlake Hardware, Orscheln Farm, and Valu Home Center. These customers operate similarly to our national accounts and have centralized purchasing managers. In order to effectively compete against the national retailers, regional chains have been challenged to develop unique niches to maintain and build customer loyalty. We have responded to these challenges by successfully working with regional customers to develop unique merchandising and product assortments that meet targeted customer needs.

Distribution Network and Supply Chain

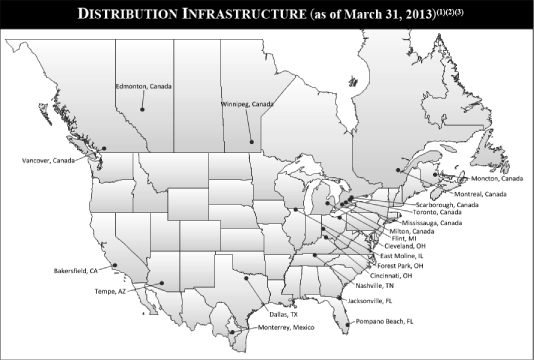

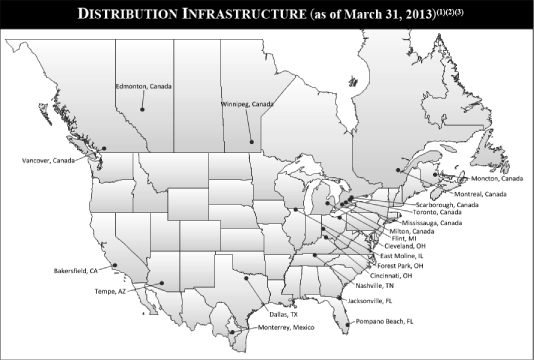

Our customers are generally not equipped to, nor have a desire to handle the sourcing and merchandising of a vast number of low-priced SKUs without the benefit of the economies of scale that we enjoy. We provide a value-added distribution service by providing a wide breadth of products and services to our large-scale national customers on a regional or national basis that smaller competitors are unable to match. Our 335,700-square foot distribution center in Forest Park, Ohio, is the core of our distribution network, augmented by twenty-three additional distribution centers located strategically throughout the United States, Canada, Australia and Mexico as of March 31, 2013. This distribution network provides customers with on-demand supply of approximately

4

Table of Contents

80,000 SKUs (prior to the Paulin Acquisition) and the efficiency of a 97.1% order fill rate. Our focus on service levels has enabled us to reduce our network inbound and outbound cycle times significantly, demonstrating the capability to receive and allocate products within two hours and pick, pack and ship orders within four hours.

As of December 31, 2012, we purchased our products from approximately 427 vendors throughout the world. Our global sourcing strategy is focused on finding the highest quality products from reliable vendors at the lowest prices. This strategy has evolved into a highly efficient system comprised of multiple vendors supplying thousands of low-cost SKUs from multiple countries. Low-cost country sourcing, primarily from Taiwan, China, India and Malaysia, accounted for 43% of our total purchases as of December 31, 2012, the vast majority of which is for the Fastener product category. We continue to evaluate the cost benefits of sourcing from low-cost countries versus sourcing domestically, and expect our sourcing from low-cost countries to increase, creating opportunities for incremental margin improvement. Our vendor quality control procedures include on-site evaluations and frequent product testing, and we evaluate vendors based on delivery performance and the accuracy of their shipments. Our sourcing group is strategically aligned by product category to improve speed to market and to enhance category expertise.

| (1) | There is also a distribution center in Melbourne, Australia, which is not shown on the map. |

| (2) | The Milton, Canada facilities support manufacturing operations exclusively. |

| (3) | The Monterrey, Mexico distribution center is owned and operated by a third party logistics provider. |

Sales and Service Organization

Our established customer relationships are a result of the multiple touch points that our representatives maintain with customers, and extend to purchasing managers, store management and senior executives. With approximately 850 full-time dedicated national and regional sales and service representatives, we maintain close relationships with our customers and provide the highest level of customer service available in the industry. Our representatives regularly visit customer store locations to provide value-added services, such as merchandising

5

Table of Contents

design, in-store service and inventory management. The hands-on support and service offered by our representatives also provide us with multiple opportunities to sell additional products and further enhance existing relationships. As of December 31, 2012 (prior to the Paulin Acquisition), our national and regional sales and service representatives served over 20,000 accounts.

Competitive Strengths

We believe our key competitive strengths include:

Market Leader with Strong Positions in Attractive Growth Markets. We believe we are the market leader in served sales channels for all of our core product categories. Our strong growth over the last 17 years has helped solidify our leading position in each of our business lines. Our leadership position has translated into significant economies of scale that provide a unique competitive advantage in areas such as sourcing, logistics, inventory management, merchandising, customer service and information technology. We are actively expanding our geographic presence with share gains in Canada, Mexico, Australia, Latin American and the Caribbean to complement our strong position in the United States. In 2011, we were awarded the bulk fastener, picture hanging and key business for the Lowes/Woolworths joint venture in Australia. With the Paulin Acquisition in 2013, we acquired a leading Canadian distributor and manufacturer of fasteners, fluid system products, automotive parts, and retail hardware components. We believe we are well-positioned to establish ourselves as a leader in several new product categories due to our relationship with our existing customer base and distribution network.

| Product Line |

Product Category Position |

2012 Revenue ($mm) (1) |

Highlights |

|||||

| Fastener |

#1 | $ | 309 | Distributes approximately 64,000 SKUs (prior to the Paulin Acquisition), which management believes to be one of the largest selections among suppliers servicing the hardware retail segment

Low per unit cost helps insulate end-user demand from economic cyclicality

The Ook and Serv-A-Lite acquisitions expanded our line of picture hanging products, specialty fasteners and electrical parts

Paulin is a leading Canadian distributor and manufacturer of fasteners, fluid system products, automotive parts, and retail hardware components |

||||

| Key Duplication |

#1 | $ | 87 | Patent-protected industry-leading key duplication technologies

Growing installed base of over 13,900 Axxess+ machines in North America

Highly attractive profitability characteristics for both us and customers

New technology and new fashionable products represent significant growth drivers |

||||

6

Table of Contents

| Product Line |

Product Category Position |

2012 Revenue ($mm) (1) |

Highlights |

|||||

| Conventional key cutting systems sold to Traditional hardware stores |

||||||||

| TagWorks/KeyWorks collaboration is expected to provide an opportunity to develop a next generation consumer operated key duplicating system |

||||||||

| Engraving |

#1 | $ | 49 | Installed base of over 2,500 Quick-Tag self-service engraving machines in the United States and Canada

Growing opportunities with continued expansion in high traffic destinationsamusement parks, zoos, movie theaters, sporting venues

TagWorks provides innovative pet ID tag programs to leading pet products chain retailers |

||||

| Letters, Numbers and Signs |

#1 | $ | 32 | Most widely used brand in the United States

Industrys low-cost manufacturer

Capitalizes on existing distribution infrastructure |

||||

| Threaded Rod |

#1 | $ | 33 | Acquired product line in 2006, making us the category leader

Complementary to our other product lines |

||||

| Builders Hardware |

| $ | 16 | Includes a variety of common household items such as coat hooks, door stops, hinges, gate latches, hasps and decorative hardware

Exemplifies our strategy of leveraging core competencies to further penetrate customer accounts with new product offerings |

||||

| Other |

| $ | 29 | Includes key accessories, automotive key duplication revenue, and revenue from Code Cutter |

||||

| (1) | Our 2012 revenue does not reflect the Paulin Acquisition in February 2013. |

Source: Hillman management estimates.

Core Competencies Create Competitive Advantages. The complexity associated with the procurement, distribution, stocking and merchandising of approximately 64,000 SKUs (prior to the Paulin Acquisition) in our fastener category makes direct sourcing by customers a difficult task; one that we believe we deliver with excellence. While the SKU count that we supply is high relative to our customers total SKU count, our customers decision not to source directly is typically influenced by the relatively low percentage of their revenue that our products represent. We also benefit as the exclusive supplier for many product lines across a customers entire store footprint.

Our installed base of more than 13,900 Axxess+ systems and 2,500 Quick-Tag engraving machines in North America creates significant switching costs in our key duplication and engraving product categories. Our

7

Table of Contents

patent-protected equipment would be expensive to replace given the aggregate high value of our current installations. Moreover, high merchandise display costs in each customer store make displacing us time consuming and expensive.

Finally, as evidenced by our 97.1% order fill rate, our ability to consistently meet the highly demanding customer service and procurement requirements of sophisticated national retailers such as Wal-Mart, Kmart, Sears, Lowes, The Home Depot and Menards represents a competitive advantage. We are able to successfully utilize our distribution capabilities to meet such customers just-in-time inventory requirements throughout their entire footprint in the United States, Canada, Mexico, Australia, Latin America and the Caribbean. Such distribution capabilities, coupled with our highly differentiated service oriented business model and long-term customer relationships enhance our competitive position.

Long-Term Customer Relationships. We maintain longstanding relationships, with an average of 14 years for our top eight customers, with many of the largest and most respected retailers in North America. Our long-term customer relationships provide revenue stability and a platform for sustainable growth, and are driven by our unique operating model, unmatched service capabilities and our sales forces desire to be the preferred supplier and valued partner to our customers. We have historically been successful in adding new products to our existing customers by leveraging our supply chain and adopting a focused sales approach. With approximately 850 full-time dedicated national and regional sales and service representatives, we have established strong institutional relationships with our customers while providing superior customer service. As of December 31, 2012 (prior to the Paulin Acquisition), our national and regional sales and services representatives served over 20,000 accounts.

Highly Diversified and Stable Product Categories. We provide a comprehensive selection of fasteners and related hardware products to the retail channel with approximately 80,000 SKUs (prior to the Paulin Acquisition). The items within our product categories possess highly attractive end-user demand attributes, drive traffic through our retail partners and, importantly, generate high margins for both us and our customers. We believe that end-user demand for our products exhibit price inelastic and recession-resistant characteristics: whether a small package of fasteners for a small repair project or a key requiring replacement or a tag for a new pet, macroeconomic conditions do not tend to materially influence the purchasing decision. This is illustrated by our strong operating performance during periods of economic weakness. Lastly, the depth and breadth of our product categories ensure a wide product selection for end-users, which enhances store foot traffic, minimizes lost or missed sales and improves merchant profitability.

Comprehensive Service Offering. Our representatives regularly visit store locations to provide merchandising services, including highly valued in-store inventory management and in-store display and promotion development. The quality of our service force has been instrumental in developing our strong and long standing relationships with customers. Our sales representatives are today one of the only factory service groups providing regular services in many national retailers stores. This hands-on service and support also offers opportunities to sell additional products and further solidify existing relationships. We are often the exclusive supplier of our product categories to the customers entire store footprint, creating additional efficiencies in distribution and management.

Robust Sales and Operations Planning and Reporting. We have developed and implemented an integrated sales and operations planning (S&OP) group through which our leadership team consistently achieves focus, alignment and synchronization among all functions of the organization. The S&OP group is organized by market channel to improve forecasting accuracy and create product level information by customer group. The integration and synchronization of customer purchasing needs to the manufacturing process in Asia provides suppliers with 26 weeks of demand forecasts with weekly shipping schedules. In addition, our dedicated internal monthly reporting packages provide our management with timely reports on key performance indicators,

8

Table of Contents

income and expense items and balance sheet metrics including snapshots of product and customer sales, margins and profits, working capital and detailed MD&A and management briefs on strategic initiatives. The reporting packages also provide information on budgeted financials compared to actual results by customer and product segments, which facilitate executive level monthly meetings to manage operations effectively.

National Distribution Network and Supply Chain Efficiency. Our distribution infrastructure forms the centerpiece of our unique selling proposition and provides us with a significant competitive advantage. Including the Paulin Acquisition, our twenty-four strategically located distribution centers in the United States, Canada, Australia, and Mexico, covering over 2.0 million square feet of space, enable us to maintain a 97.1% order fill rate and ship orders to customers within 48 hours. Our highly efficient and technologically advanced 335,700 square foot distribution center in Forest Park, Ohio, where the majority of our products are received, is the hub of our distribution network. This highly sophisticated network, which utilizes pick-to-light and radio frequency technologies, enables us to effectively manage the vast number of SKUs, a task our customers and competitors are unable to replicate efficiently. We believe we could meaningfully increase our sales within our current facility footprint and have identified potential for further capacity expansion through Lean initiatives. By managing multiple product sources in multiple countries and supplying products and services to thousands of retailers nationwide, we provide a highly differentiated value-added distribution service.

Proven and Economically Aligned Management Team. Our senior management team has a broad range of expertise with an average of approximately 13 years of experience at Hillman. Our senior management team represents a solid mix of tenured employees with long careers at Hillman, augmented by new management talent from large, well-respected organizations. Our current management team has driven our highly effective business strategy over a long period, leading to our strong operating and financial performance over that time period. Furthermore, members of our management team invested an aggregate of $12.5 million in connection with the acquisition of 100% of the capital stock of Hillman by OHCP HM Acquisition Corp. pursuant to equity rollover agreements.

Equity Ownership. Oak Hill Capital Partners (as defined herein) is a private equity firm managing funds with more than $8 billion of initial capital commitments from leading entrepreneurs, endowments, foundations, corporations, pension funds and global financial institutions. Over a period of more than 25 years, the professionals at Oak Hill Capital Partners and its predecessors have invested in more than 70 significant private equity transactions across broad segments of the U.S. and global economies. Oak Hill Capital Partners applies an industry-focused, theme-based approach and engages experienced operating consultants to work directly with management teams to implement strategic and operational initiatives. Oak Hill Capital Partners is one of two independently managed firms (which may work together from time to time) that operate with the Oak Hill name and invest in various asset classes, including equity and debt securities.

Strategy

We intend to continue to expand our business, enhance our market position and increase our revenues and cash flow by focusing on the following:

Focus on Incremental Penetration of Existing Customers: Meaningful opportunity exists for expansion of our current product offerings to our existing customers. Increased penetration of the fastener, key duplication threaded rod and builders hardware product lines to some of our largest customers presents a significant growth opportunity. We plan to increase our product penetration by leveraging our existing supply chain in conjunction with innovative sales and merchandising programs and a focused sales approach with existing customers.

Add New Products to Expand Existing Customer Relationships: We have historically been successful in adding new products to our existing portfolio, both through organic initiatives as well as acquisitions, by seeking product expansion opportunities that are complementary to the existing portfolio and that can be marketed

9

Table of Contents

through our existing sales force. The success of our new product introductions is reflected in the evolution of our diverse product portfolio. For example, the revenue contribution of our non-Fastener product lines has increased from approximately $4.9 million in 1996 to approximately $246.0 million in 2012. We introduced our Threaded Rod product line in 2006 and added the Builders Hardware product line in 2007. In 2013, we added fluid system products, automotive parts, and additional hardware components to our product portfolio with the Paulin Acquisition. Significant additional opportunities exist for further growth through product line expansion.

Enhance Growth Through Footprint Expansion of Major Customers: We believe that we are the exclusive provider of our core products to most customers and we believe we are well positioned to secure aisle space for such products when these customers open new stores. It is anticipated that customers in our National and Regional segment will continue to open new stores in the coming years, providing us with a built-in organic growth opportunity. Store openings by big box chains (defined as mass merchants, home centers, and large-format grocery/drug centers), are expected to gain momentum should the retailing environment improve in step with a general economic recovery.

Continue Our International Growth: We have expanded into Canada, Mexico, Central America, the Caribbean and Australia in recent years, and believe we are well-positioned to expand even further into these and potentially into other international markets. We typically follow the international footprint expansion of our National accounts, including The Home Depot and Lowes. For example, The Home Depots entry into the Mexican market early in the decade and its subsequent expansion to 101 stores currently provides us with a strong built-in growth platform in Mexico. Our distribution centers in Canada and Mexico also provide crucial support to our international customers. We continue to seek international expansion through new customers, increased penetration of existing customers, continued footprint expansion of current customers, and launch of new products. We recently began doing business in Australia and our first sales were reported in the third quarter of 2011.

Focused on Increased Operating Efficiencies: We will continue to focus on enhancing our operating efficiency, including working capital management and effectively managing our cost structure. We intend to expand our implementation of Lean initiatives throughout the organization, providing potential for enhanced profitability and more efficient inventory management. Our focus will include improved sourcing capabilities, potential rationalization of our distribution center network, and greater manufacturing efficiencies in selected facilities.

Pursue Tuck-In Acquisition Opportunities: We have demonstrated a strong track record of successfully acquiring and integrating acquisitions, and plan to continue to selectively pursue tuck-in acquisitions. Over the past 17 years we have completed 15 acquisitions, allowing us to expand our product portfolio with existing customers and enter new markets. Our long-tenured management team, which has participated in the integration of these acquisitions, is well versed in identifying and realizing synergies through effective integration. Notable recent acquisitions include the Threaded Rod distribution business of SteelWorks in January 2006, the Quick-Tag acquisition in May 2010, the Serv-A-Lite acquisition in December 2010, the TagWorks acquisition in March 2011, the Ook acquisition in December 2011, and the Paulin Acquisition in February 2013. The SteelWorks acquisition strengthened our relationships with national retailers and provided us with another product category in which we now hold a leadership position. The Serv-A-Lite acquisition strengthened Hillmans position in specialty fasteners and electrical parts to hardware retailers. The TagWorks/KeyWorks collaboration is expected to provide an opportunity to develop a next generation consumer operated key duplicating system. The Ook brands excellence in the picture hanging specialty category strengthened our position of providing value-added products and services to home centers and hardware retailers. In the Paulin Acquisition, we acquired a leading Canadian distributor and manufacturer of fasteners, fluid system products, automotive parts, and retail hardware components.

10

Table of Contents

Recent Developments

On February 19, 2013, pursuant to the terms of the previously announced plan of arrangement dated as of December 17, 2012 (the Arrangement Agreement), Hillman acquired all of the issued and outstanding Class A common shares (the Shares) of Paulin and Paulin became an indirect wholly owned subsidiary of Hillman (the Paulin Acquisition). On March 31, 2013, Paulin was amalgamated with and into The Hillman Group Canada ULC.

Paulin is an Ontario, Canada-based distributor and manufacturer of fasteners, fluid system products, automotive parts, and screw machine components. Paulins manufacturing processes include Cold Heading, Nut Forming, Metal Stamping, Screw Machine, Adhesive Coating and Packaging. The industries served by Paulin include automotive, industrial, retail hardware, and agricultural. All manufacturing facilities are located in Ontario, Canada, while Paulins distribution facilities are located in Vancouver, Edmonton, Winnipeg, Toronto, Montreal, Moncton and Cleveland, Ohio. Paulin supplies over 75,000 different SKUs of standard fasteners and fittings.

In connection with the closing of the Paulin Acquisition, Hillman Group mandatorily exchanged all of its previously offered $65.0 million aggregate principal amount of temporary 10.875% Senior Notes issued under an indenture dated as of December 21, 2012 by issuing in exchange therefor a like aggregate amount of the initial notes. The initial notes so issued constituted an additional issuance of Hillman Groups 10.875% Senior Notes due 2018 pursuant to that certain indenture, dated as of May 28, 2010, as amended and supplemented on December 29, 2010, April 1, 2011, February 5, 2013 and February 19, 2013, between Hillman Group, the guarantors party thereto and the trustee, under which Hillman Group previously issued $200.0 million in aggregate principal amount of its existing notes.

On May 20, 2013, Hillman Group purchased an interest rate cap agreement (the 2013 Cap Agreement) with a two-year term for a notional amount of $225.0 million. The effective date of the 2013 Cap Agreement is May 28, 2013 and its termination date is May 28, 2015. The 2013 Cap Agreement provides for a cap strike price of 1.250% and a floating rate option of 3 months USD-LIBOR-BBA.

On May 23, 2013, Hillman announced that Executive Vice President and Chief Operating Officer James P. Waters will succeed Max W. Hillman as Chief Executive Officer, effective July 1, 2013. Mr. Waters, who had previously served as Chief Financial Officer of Hillman, joined Hillmans Board of Directors, effective May 23, 2013.

11

Table of Contents

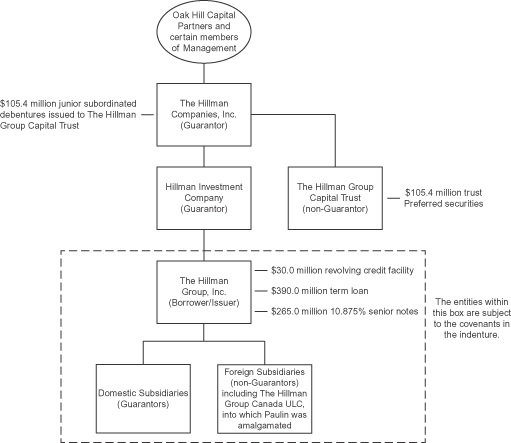

Corporate Structure

The following chart summarizes our legal entity structure as of March 31, 2013:

Equity Sponsor

On May 28, 2010, Hillman was acquired by an affiliate of Oak Hill Capital Partners III, L.P., Oak Hill Capital Management III, L.P (together, OHCP III), and certain members of Hillmans management and board of directors (the Merger). OHCP III is managed by Oak Hill Capital Management, LLC (OHCM, and together with the funds it manages, including OHCP III, Oak Hill Capital Partners). Oak Hill Capital Partners is a private equity firm managing funds with more than $8 billion of initial capital commitments from leading entrepreneurs, endowments, foundations, corporations, pension funds and global financial institutions. Over a period of more than 25 years, the professionals at Oak Hill Capital Partners and its predecessors have invested in more than 70 significant private equity transactions across broad segments of the U.S. and global economies. Oak Hill Capital Partners applies an industry-focused, theme-based approach and engages experienced operating consultants to work directly with management teams to implement strategic and operational initiatives. Oak Hill Capital Partners equity investment in Hillman was made from its current fund, OHCP III, which has $3.8 billion of initial capital commitments. Oak Hill Capital Partners is one of two independently managed firms (which may work together from time to time) that operate with the Oak Hill name and invest in various asset classes, including equity and debt securities.

12

Table of Contents

Additional Information

Each of Hillman and Hillman Investment is a holding company whose assets consist solely of the equity securities of its subsidiaries. Hillman Group is a direct subsidiary of Hillman Investment and an indirect subsidiary of Hillman, and is our principal operating subsidiary. Each of Hillman, Hillman Investment and Hillman Group is a Delaware corporation.

Our headquarters are located at 10590 Hamilton Avenue, Cincinnati, Ohio 45231-1764 and our telephone number is (513) 851-4900. We maintain a website at http://www.hillmangroup.com. Information contained or linked on our website is not incorporated by reference in this prospectus and should not be considered a part of this prospectus.

13

Table of Contents

Summary of the Exchange Offer

In this subsection, we, us and our refer only to The Hillman Group, Inc., as issuer of the notes, exclusive of The Hillman Companies, Inc., Hillman Investment Company and our subsidiaries.

| Exchange Offer |

We are offering to exchange $65,000,000 aggregate principal amount of our exchange notes for a like aggregate principal amount of our initial notes. In order to exchange your initial notes, you must properly tender them and we must accept your tender. We will exchange all outstanding initial notes that are properly tendered and not validly withdrawn. |

| The exchange notes constitute an additional issuance of 10.875% Senior Notes due 2018 pursuant to our indenture dated as of May 28, 2010, as amended and supplemented on December 29, 2010, April 1, 2011, February 5, 2013 and February 19, 2013, under which the existing notes were previously issued. Upon completion of this exchange offer, the exchange notes will trade with our existing notes. |

| Expiration Date |

This exchange offer will expire at 5:00 p.m., New York City time, on , 2013 unless we decide to extend it. |

| Conditions to the Exchange Offer |

We will complete this exchange offer only if: |

| | there is no change in the laws and regulations which would impair our ability to proceed with this exchange offer; |

| | there is no change in the current interpretation of the staff of the Securities and Exchange Commission (the SEC) permitting resales of the exchange notes; and |

| | there is no stop order issued by the SEC that would suspend the effectiveness of the registration statement which includes this prospectus or the qualification of the exchange notes under the Trust Indenture Act of 1939. |

| Please refer to the section in this prospectus entitled The Exchange OfferConditions to the Exchange Offer. |

| Procedures for Tendering Initial Notes |

To participate in this exchange offer, you must complete, sign and date the letter of transmittal or its facsimile and transmit it, together with your initial notes to be exchanged and all other documents required by the letter of transmittal, to Wells Fargo Bank, National Association, as exchange agent, at its address indicated under The Exchange OfferExchange Agent. In the alternative, you can tender your initial notes by book-entry delivery following the procedures described in this prospectus. For more information on tendering your notes, please refer to the section in this prospectus entitled The Exchange OfferProcedures for Tendering Initial Notes. |

14

Table of Contents

| Special Procedures for Beneficial Owners |

If you are a beneficial owner of initial notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender your initial notes in the exchange offer, you should contact the registered holder promptly and instruct that person to tender on your behalf. |

| Guaranteed Delivery Procedures |

If you wish to tender your initial notes and you cannot get the required documents to the exchange agent on time, you may tender your notes by using the guaranteed delivery procedures described under the section of this prospectus entitled The Exchange OfferProcedures for Tendering Initial NotesGuaranteed Delivery Procedure. |

| Withdrawal Rights |

You may withdraw the tender of your initial notes at any time before 5:00 p.m., New York City time, on the expiration date of the exchange offer. To withdraw, you must send a written or facsimile transmission notice of withdrawal to the exchange agent at its address indicated under The Exchange OfferExchange Agent before 5:00 p.m., New York City time, on the expiration date of the exchange offer. |

| Acceptance of Initial Notes and Delivery of Exchange Notes |

If all the conditions to the completion of this exchange offer are satisfied, we will accept any and all initial notes that are properly tendered in this exchange offer on or before 5:00 p.m., New York City time, on the expiration date. We will return any initial note that we do not accept for exchange to you without expense promptly after the expiration date. We will deliver the exchange notes to you promptly after the expiration date and acceptance of your initial notes for exchange. Please refer to the section in this prospectus entitled The Exchange OfferAcceptance of Initial Notes for Exchange; Delivery of Exchange Notes. |

| Federal Income Tax Considerations Relating to the Exchange Offer |

Exchanging your initial notes for exchange notes will not be a taxable event to you for United States federal income tax purposes. Please refer to the section of this prospectus entitled Certain United States Federal Income Tax Considerations. |

| Exchange Agent |

Wells Fargo Bank, National Association is serving as exchange agent in the exchange offer. |

| Fees and Expenses |

We will pay the expenses related to this exchange offer. Please refer to the section of this prospectus entitled The Exchange OfferFees and Expenses. |

| Use of Proceeds |

We will not receive any proceeds from the issuance of the exchange notes. We are making this exchange offer solely to satisfy certain of our obligations under our registration rights agreement entered into in connection with the initial notes. |

15

Table of Contents

| Consequences to Holders Who Do Not Participate in the Exchange Offer |

If you do not participate in this exchange offer: |

| | except as set forth in the next paragraph, you will not necessarily be able to require us to register your initial notes under the Securities Act; |

| | you will not be able to resell, offer to resell or otherwise transfer your initial notes unless they are registered under the Securities Act or unless you resell, offer to resell or otherwise transfer them under an exemption from the registration requirements of, or in a transaction not subject to, registration under the Securities Act; and |

| | the trading market for your initial notes will become more limited to the extent other holders of initial notes participate in the exchange offer. |

| | You will not be able to require us to register your initial notes under the Securities Act unless: |

| | the exchange offer is not permitted by applicable law or SEC policy; |

| | you are prohibited by applicable law or SEC policy from participating in the exchange offer; |

| | you may not resell the exchange notes you acquire in the exchange offer to the public without delivering a prospectus and that the prospectus contained in the exchange offer registration statement is not appropriate or available for such resales by you; or |

| | you are a broker-dealer and hold initial notes acquired directly from us or one of our affiliates. |

| In these cases, the registration rights agreement requires us to file a registration statement for a continuous offering in accordance with Rule 415 under the Securities Act for the benefit of the holders of the initial notes described in this paragraph. We do not currently anticipate that we will register under the Securities Act any notes that remain outstanding after completion of the exchange offer. |

| Please refer to the section of this prospectus entitled The Exchange OfferYour Failure to Participate in the Exchange Offer Will Have Adverse Consequences. |

| Resales |

It may be possible for you to resell the exchange notes issued in the exchange offer without compliance with the registration and prospectus delivery provisions of the Securities Act, subject to the conditions described under Obligations of Broker-Dealers below. |

16

Table of Contents

| To tender your initial notes in this exchange offer and resell the exchange notes without compliance with the registration and prospectus delivery requirements of the Securities Act, you must make the following representations: |

| | you are authorized to tender the initial notes and to acquire exchange notes, and that we will acquire good and unencumbered title thereto; |

| | the exchange notes acquired by you are being acquired in the ordinary course of business; |

| | you have no arrangement or understanding with any person to participate in a distribution of the exchange notes and are not participating in, and do not intend to participate in, the distribution of such exchange notes; |

| | you are not an affiliate, as defined in Rule 405 under the Securities Act, of ours, or you will comply with the registration and prospectus delivery requirements of the Securities Act to the extent applicable; and |

| | if you are a broker-dealer, initial notes to be exchanged were acquired by you as a result of market-making or other trading activities and you will deliver a prospectus in connection with any resale, offer to resell or other transfer of such exchange notes. |

| Please refer to the sections of this prospectus entitled The Exchange OfferProcedure for Tendering Initial NotesProper Execution and Delivery of Letters of Transmittal, Risk FactorsRisks Relating to the Exchange OfferSome persons who participate in the exchange offer must deliver a prospectus in connection with resales of the exchange notes and Plan of Distribution. |

| Obligations of Broker-Dealers |

If you are a broker-dealer (1) who receives exchange notes, you must acknowledge that you will deliver a prospectus in connection with any resales of the exchange notes, (2) who acquired the initial notes as a result of market making or other trading activities, you may use the exchange offer prospectus as supplemented or amended, in connection with resales of the exchange notes, or (3) who acquired the initial notes directly from the issuer in the initial offering and not as a result of market making and trading activities, you must, in the absence of an exemption, comply with the registration and prospectus delivery requirements of the Securities Act in connection with resales of the exchange notes. |

17

Table of Contents

Summary of Terms of the Exchange Offer

The summary below describes the principal terms of the exchange notes. Some of the terms and conditions described below are subject to important limitations and exceptions. The Description of Notes section of this prospectus contains a more detailed description of the terms and conditions of the notes.

| Issuer |

The Hillman Group, Inc. |

| Notes Offered |

$65,000,000 in aggregate principal amount of our 10.875% Senior Notes due 2018. The forms and terms of the exchange notes are the same as the form and terms of the initial notes except that the issuance of the exchange notes is registered under the Securities Act, the exchange notes will not bear legends restricting their transfer and the exchange notes will not be entitled to registration rights under our registration rights agreement. The exchange notes will evidence the same debt as the initial notes. The initial notes, the exchange notes and the existing notes will be governed by the indenture dated as of May 28, 2010, as amended and supplemented on December 29, 2010, April 1, 2011 February 5, 2013 and February 19, 2013. |

| Maturity Date |

June 1, 2018 |

| Interest |

10.875% per year (calculated using a 360-day year). |

| Interest Payment Dates |

Each June 1 and December 1, commencing December 1, 2013, in the case of the exchange notes. |

| Ranking |

The notes are our general unsecured, senior obligations. Accordingly, they rank: |

| | effectively subordinate to all of our existing and future secured indebtedness, including indebtedness under the new term loan and the revolving credit facility, to the extent of the value of the collateral securing such indebtedness; |

| | effectively subordinate to all existing and future indebtedness and other liabilities, including trade payables, of any non-guarantor subsidiaries (other than indebtedness and other liabilities owed to Hillman Group); |

| | equal in right of payment to all of our existing and future senior unsecured indebtedness; and |

| | senior in right of payment to all of our future subordinated indebtedness. |

| As of March 31, 2013, we had approximately $759.7 million of total indebtedness, of which: |

| | $105.4 million was indebtedness of Hillman, consisting of the 11.6% junior subordinated debentures due 2027 issued to the Hillman Trust (which represents the liquidation value of the Trust Preferred Securities); and |

18

Table of Contents

| | $654.3 million was indebtedness of Hillman Group, consisting of $388.4 million of senior secured debt under our term loan, $200.0 million of unsecured debt under the existing notes, $65.0 million of unsecured debt under the initial notes and $0.9 million of capital lease and other obligations; and |

| | $5.5 million committed for letters of credit and $24.5 million available for borrowings under our revolving credit facility. |

| In addition, as of March 31, 2013, there was outstanding a $105.4 million subordinated intercompany note due 2027 (the Intercompany Note) of Hillman Group held by Hillman Investment. The Intercompany Note was issued in connection with the issuance of the 11.6% junior subordinated debentures of Hillman and the trust preferred securities of Hillman Trust. |

| The indenture governing the notes restricts the ability of Hillman Group to refinance or otherwise pay principal or interest on the Intercompany Note. |

| Guarantees |

The notes are fully and unconditionally guaranteed, jointly and severally, on a senior unsecured basis by Hillman, Hillman Investment and each of Hillman Groups existing and future domestic subsidiaries. All of the guarantors have guaranteed Hillman Groups obligations under the term loan and the revolving credit facility on a senior secured basis. In the future, the guarantees may be released or terminated under certain circumstances. See Description of NotesNote Guarantees. |

| Each guarantee ranks: |

| | effectively subordinate to all existing and future secured indebtedness of the guarantor, including its guarantee of indebtedness under the new term loan and the revolving credit facility, to the extent of the value of the collateral securing such indebtedness; |

| | effectively subordinate to all existing and future indebtedness and other liabilities, including trade payables, of any non-guarantor subsidiaries; |

| | equal in right of payment to all existing and future senior unsecured indebtedness of the guarantor; and |

| | senior in right of payment to any future subordinated indebtedness of the guarantor. |

| Not all of our subsidiaries guarantee the notes. As of March 31, 2013: |

| | the notes were effectively subordinated to $17.5 million of indebtedness and other liabilities (including trade payables) of our non-guarantor subsidiaries; and |

| | our non-guarantor subsidiaries had assets representing approximately 25.2% of our consolidated assets as of March 31, |

19

Table of Contents

| 2013, and revenue representing approximately 6.3% of our consolidated revenues for the three months ended March 31, 2013. |

| Optional Redemption |

Prior to June 1, 2014, we may redeem the notes, in whole or in part, at a redemption price equal to 100% of the principal amount plus a make-whole premium and accrued and unpaid interest to the date of redemption. |

| On and after June 1, 2014, we may redeem the notes, in whole or in part, at the redemption prices set forth under Description of NotesOptional Redemption. |

| At any time prior to June 1, 2013, we may, from time to time, redeem up to 35% of the aggregate principal amount of the notes with the net cash proceeds of certain equity offerings at the redemption price set forth under Description of NotesOptional Redemption, if at least 65% of the aggregate principal amount of the notes issued under the indenture remain outstanding immediately after such redemption and the redemption occurs within 90 days of the closing date of such equity offering. |

| Change of Control |

If a change of control occurs, each holder of notes may require us to repurchase all or a portion of its notes for cash at a price equal to 101% of the aggregate principal amount of such notes, plus any accrued and unpaid interest to, but not including, the date of repurchase. |

| Certain Covenants |

The indenture governing the exchange notes is the same indenture that governs the initial notes and the existing notes. The indenture contains covenants that, among other things, limit the ability of Hillman Group and its direct and indirect restricted subsidiaries to: |

| | sell assets; |

| | pay dividends or make other distributions on capital stock or subordinated indebtedness; |

| | make investments; |

| | incur additional indebtedness or issue preferred stock; |

| | create certain liens; |

| | enter into agreements that restrict dividends or other payments from our restricted subsidiaries to us; |

| | consolidate, merge or transfer all or substantially all of the assets of our company; |

| | engage in transactions with affiliates; and |

| | create unrestricted subsidiaries. |

| These covenants are subject to important exceptions and qualifications, which are described under the heading Description of |

20

Table of Contents

| Notes in this prospectus. These covenants are generally not applicable to Hillman, Hillman Investment or any of their subsidiaries (other than the Hillman Group and its direct and indirect restricted subsidiaries). |

| Absence of a Public Market for the Exchange Notes |

The exchange notes are an addition to a relatively new issue of securities. The initial notes have traded separately from our existing notes. Upon completion of this exchange offer, the exchange notes will trade together with our existing notes. We cannot assure you that a market for the notes will develop or that this market will be liquid. Please refer to the section of this prospectus entitled Risk FactorsRisks Relating to the Notes and Our IndebtednessThere is no established trading market for the exchange notes, and you may not be able to sell them quickly or at the price that you paid. |

| Use of Proceeds |

We will not receive any proceeds from the issuance of the exchange notes in exchange for the outstanding initial notes. We are making this exchange solely to satisfy our obligations under the registration rights agreement entered into in connection with the initial notes. |

| Form and Denomination |

The exchange notes will be represented by one or more permanent global securities in registered form deposited on behalf of The Depository Trust Company (DTC) with Wells Fargo Bank, National Association, as custodian. You will not receive exchange notes in certificated form unless one of the events described in the section of this prospectus entitled Description of NotesBook Entry; Delivery and FormExchange of Book-Entry Notes for Certificated Notes occurs. Instead, beneficial interests in the exchange notes will be shown on, and transfers of these exchange notes will be effected only through, records maintained in book entry form by DTC with respect to its participants. |

| Risk Factors |

You should consider carefully the information set forth in the section entitled Risk Factors beginning on page 27 of this prospectus and all other information contained in this prospectus before deciding to invest in the exchange notes. |

21

Table of Contents

Summary Historical and Pro Forma Consolidated Financial Information

The following table sets forth our summary historical and pro forma consolidated financial information. The summary historical consolidated financial information set forth below for each of the years in the two year period ended December 31, 2012, the seven months ended December 31, 2010, the five months ended May 28, 2010 and as of December 31, 2012 and 2011 has been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary historical consolidated financial information for the three months ended March 31, 2013 and 2012 and as of March 31, 2013, has been derived from our unaudited consolidated financial statements included elsewhere in this prospectus.

The following table also presents certain pro forma financial information for the year ended December 31, 2012 and the three months ended March 31, 2013 that gives effect to the Paulin Acquisition as if it had occurred on January 1, 2012.

The summary historical consolidated financial information presented below is not necessarily indicative of results of future operations and should be read together with our consolidated financial statements and related notes and the information included elsewhere in this prospectus under the captions Managements Discussion and Analysis of Financial Condition and Results of Operations, Use of Proceeds, Capitalization, Where You Can Find More Information and Unaudited Pro Forma Financial Information.

Our summary historical consolidated financial information for the five months ended May 28, 2010 is referenced herein as the predecessor financial statements (the Predecessor or Predecessor Financial Statements). Our summary historical consolidated financial information for the seven months ended December 31, 2010 and periods thereafter is referenced herein as the successor financial statements (the Successor or Successor Financial Statements).

22

Table of Contents

Comprehensive Income Data:

| Predecessor | Successor | |||||||||||||||||||||||||

| Five Months Ended May 28, 2010 |

Seven Months Ended December 31, 2010 |

Year Ended December 31, |

Three Months Ended March 31, |

|||||||||||||||||||||||

| ($ in thousands) | 2011 | 2012 | 2012 | 2013 (1) | ||||||||||||||||||||||

| Net sales |

$ | 185,716 | $ | 276,680 | $ | 506,526 | $ | 555,465 | $ | 128,373 | $ | 143,919 | ||||||||||||||

| Cost of sales (2) |

89,773 | 136,554 | 252,491 | 275,016 | 63,589 | 73,646 | ||||||||||||||||||||

| Operating expenses: |

||||||||||||||||||||||||||

| Selling, general and administrative expenses |

82,850 | 90,760 | 169,766 | 188,330 | 44,920 | 48,369 | ||||||||||||||||||||

| Acquisition and Integration |

11,342 | 11,150 | 2,805 | 3,031 | 152 | 2,029 | ||||||||||||||||||||

| Depreciation |

7,283 | 11,007 | 21,333 | 22,009 | 5,889 | 5,542 | ||||||||||||||||||||

| Amortization |

2,678 | 10,669 | 20,717 | 21,752 | 5,471 | 5,446 | ||||||||||||||||||||

| Management and transaction fees to related party |

438 | | 110 | 155 | | | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total operating expenses |

104,591 | 123,586 | 214,731 | 235,277 | 56,432 | 61,386 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Other (income) expense, net |

(114 | ) | 145 | (851 | ) | 4,204 | (483 | ) | 1,103 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (Loss) income from operations |

(8,762 | ) | 16,685 | 38,453 | 40,968 | 8,835 | 7,784 | |||||||||||||||||||

| Interest expense, net |

8,327 | 20,712 | 40,679 | 41,138 | 10,102 | 11,953 | ||||||||||||||||||||

| Interest expense on mandatorily redeemable preferred stock and management purchased options |

5,488 | | | | | | ||||||||||||||||||||

| Interest expense on junior subordinated debentures |

5,254 | 7,356 | 12,610 | 12,610 | 3,152 | 3,152 | ||||||||||||||||||||

| Investment income on trust common securities |

(158 | ) | (220 | ) | (378 | ) | (378 | ) | (95 | ) | (94 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income (loss) before income taxes |

(27,673 | ) | (11,163 | ) | (14,458 | ) | (12,402 | ) | (4,324 | ) | (7,227 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Income tax provision (benefit) |

(2,465 | ) | (3,125 | ) | (4,679 | ) | (5,168 | ) | (1,737 | ) | (2,642 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net loss |