EXHIBIT 99.1

Published on May 19, 2021

Exhibit 99.1

|

PRELIMINARY PROXY CARD – SUBJECT TO COMPLETION FOR THE SPECIAL MEETING OF STOCKHOLDERS OF LANDCADIA HOLDINGS III, INC. THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS The undersigned hereby appoints Richard H. Liem and Steven L. Scheinthal (the “Proxies”), and each of them independently, with full power of substitution, as proxies to vote all of the shares of Common Stock of Landcadia Holdings III, Inc. (the “Company” or “Landcadia”), a Delaware corporation, that the undersigned is entitled to vote (the “Shares”) at the special meeting meeting of stockholders of the Company to be held on [ ] at [ ] Eastern Time virtually, at https://www.cstproxy.com/landcadiaholdingsiii/sm2021 (the “special meeting”), and at any adjournments and/or postponements thereof. The undersigned acknowledges receipt of the enclosed proxy statement and revokes all prior proxies for said meeting. THE SHARES REPRESENTED BY THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER(S). IF NO SPECIFIC DIRECTION IS GIVEN AS TO THE PROPOSALS ON THE REVERSE SIDE, THIS PROXY WILL BE VOTED “FOR” PROPOSALS 1 THROUGH 8. PLEASE MARK, SIGN, DATE, AND RETURN THE PROXY CARD PROMPTLY. (Continued and to be marked, dated and signed on reverse side) P R O X Y Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to be held on [ ]. This notice of Special Meeting and the accompanying Proxy Statement are available at: https://www.cstproxy.com/landcadiaholdingsiii/sm2021 |

|

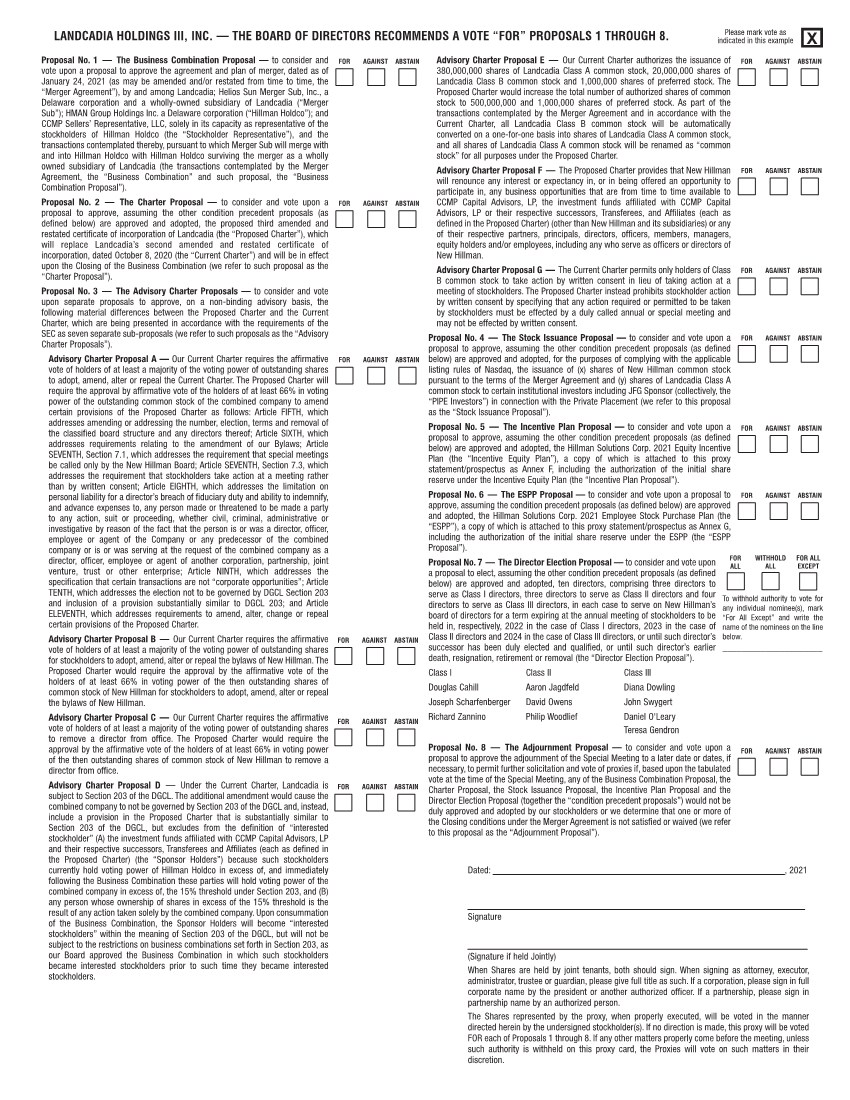

Please mark vote as indicated in this example X LANDCADIA HOLDINGS III, INC. — THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSALS 1 THROUGH 8. FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN Proposal No. 1 — The Business Combination Proposal — to consider and vote upon a proposal to approve the agreement and plan of merger, dated as of January 24, 2021 (as may be amended and/or restated from time to time, the “Merger Agreement”), by and among Landcadia; Helios Sun Merger Sub, Inc., a Delaware corporation and a wholly-owned subsidiary of Landcadia (“Merger Sub”); HMAN Group Holdings Inc. a Delaware corporation (“Hillman Holdco”); and CCMP Sellers’ Representative, LLC, solely in its capacity as representative of the stockholders of Hillman Holdco (the “Stockholder Representative”), and the transactions contemplated thereby, pursuant to which Merger Sub will merge with and into Hillman Holdco with Hillman Holdco surviving the merger as a wholly owned subsidiary of Landcadia (the transactions contemplated by the Merger Agreement, the “Business Combination” and such proposal, the “Business Combination Proposal”). Proposal No. 2 — The Charter Proposal — to consider and vote upon a proposal to approve, assuming the other condition precedent proposals (as defined below) are approved and adopted, the proposed third amended and restated certificate of incorporation of Landcadia (the “Proposed Charter”), which will replace Landcadia’s second amended and restated certificate of incorporation, dated October 8, 2020 (the “Current Charter”) and will be in effect upon the Closing of the Business Combination (we refer to such proposal as the “Charter Proposal”). Proposal No. 3 — The Advisory Charter Proposals — to consider and vote upon separate proposals to approve, on a non-binding advisory basis, the following material differences between the Proposed Charter and the Current Charter, which are being presented in accordance with the requirements of the SEC as seven separate sub-proposals (we refer to such proposals as the “Advisory Charter Proposals”). Advisory Charter Proposal A — Our Current Charter requires the affirmative vote of holders of at least a majority of the voting power of outstanding shares to adopt, amend, alter or repeal the Current Charter. The Proposed Charter will require the approval by affirmative vote of the holders of at least 66% in voting power of the outstanding common stock of the combined company to amend certain provisions of the Proposed Charter as follows: Article FIFTH, which addresses amending or addressing the number, election, terms and removal of the classified board structure and any directors thereof; Article SIXTH, which addresses requirements relating to the amendment of our Bylaws; Article SEVENTH, Section 7.1, which addresses the requirement that special meetings be called only by the New Hillman Board; Article SEVENTH, Section 7.3, which addresses the requirement that stockholders take action at a meeting rather than by written consent; Article EIGHTH, which addresses the limitation on personal liability for a director’s breach of fiduciary duty and ability to indemnify, and advance expenses to, any person made or threatened to be made a party to any action, suit or proceeding, whether civil, criminal, administrative or investigative by reason of the fact that the person is or was a director, officer, employee or agent of the Company or any predecessor of the combined company or is or was serving at the request of the combined company as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise; Article NINTH, which addresses the specification that certain transactions are not “corporate opportunities”; Article TENTH, which addresses the election not to be governed by DGCL Section 203 and inclusion of a provision substantially similar to DGCL 203; and Article ELEVENTH, which addresses requirements to amend, alter, change or repeal certain provisions of the Proposed Charter. Advisory Charter Proposal B — Our Current Charter requires the affirmative vote of holders of at least a majority of the voting power of outstanding shares for stockholders to adopt, amend, alter or repeal the bylaws of New Hillman. The Proposed Charter would require the approval by the affirmative vote of the holders of at least 66% in voting power of the then outstanding shares of common stock of New Hillman for stockholders to adopt, amend, alter or repeal the bylaws of New Hillman. Advisory Charter Proposal C — Our Current Charter requires the affirmative vote of holders of at least a majority of the voting power of outstanding shares to remove a director from office. The Proposed Charter would require the approval by the affirmative vote of the holders of at least 66% in voting power of the then outstanding shares of common stock of New Hillman to remove a director from office. Advisory Charter Proposal D — Under the Current Charter, Landcadia is subject to Section 203 of the DGCL. The additional amendment would cause the combined company to not be governed by Section 203 of the DGCL and, instead, include a provision in the Proposed Charter that is substantially similar to Section 203 of the DGCL, but excludes from the definition of “interested stockholder” (A) the investment funds affiliated with CCMP Capital Advisors, LP and their respective successors, Transferees and Affiliates (each as defined in the Proposed Charter) (the “Sponsor Holders”) because such stockholders currently hold voting power of Hillman Holdco in excess of, and immediately following the Business Combination these parties will hold voting power of the combined company in excess of, the 15% threshold under Section 203, and (B) any person whose ownership of shares in excess of the 15% threshold is the result of any action taken solely by the combined company. Upon consummation of the Business Combination, the Sponsor Holders will become “interested stockholders” within the meaning of Section 203 of the DGCL, but will not be subject to the restrictions on business combinations set forth in Section 203, as our Board approved the Business Combination in which such stockholders became interested stockholders prior to such time they became interested stockholders. Advisory Charter Proposal E — Our Current Charter authorizes the issuance of 380,000,000 shares of Landcadia Class A common stock, 20,000,000 shares of Landcadia Class B common stock and 1,000,000 shares of preferred stock. The Proposed Charter would increase the total number of authorized shares of common stock to 500,000,000 and 1,000,000 shares of preferred stock. As part of the transactions contemplated by the Merger Agreement and in accordance with the Current Charter, all Landcadia Class B common stock will be automatically converted on a one-for-one basis into shares of Landcadia Class A common stock, and all shares of Landcadia Class A common stock will be renamed as “common stock” for all purposes under the Proposed Charter. Advisory Charter Proposal F — The Proposed Charter provides that New Hillman will renounce any interest or expectancy in, or in being offered an opportunity to participate in, any business opportunities that are from time to time available to CCMP Capital Advisors, LP, the investment funds affiliated with CCMP Capital Advisors, LP or their respective successors, Transferees, and Affiliates (each as defined in the Proposed Charter) (other than New Hillman and its subsidiaries) or any of their respective partners, principals, directors, officers, members, managers, equity holders and/or employees, including any who serve as officers or directors of New Hillman. Advisory Charter Proposal G — The Current Charter permits only holders of Class B common stock to take action by written consent in lieu of taking action at a meeting of stockholders. The Proposed Charter instead prohibits stockholder action by written consent by specifying that any action required or permitted to be taken by stockholders must be effected by a duly called annual or special meeting and may not be effected by written consent. Proposal No. 4 — The Stock Issuance Proposal — to consider and vote upon a proposal to approve, assuming the other condition precedent proposals (as defined below) are approved and adopted, for the purposes of complying with the applicable listing rules of Nasdaq, the issuance of (x) shares of New Hillman common stock pursuant to the terms of the Merger Agreement and (y) shares of Landcadia Class A common stock to certain institutional investors including JFG Sponsor (collectively, the “PIPE Investors”) in connection with the Private Placement (we refer to this proposal as the “Stock Issuance Proposal”). Proposal No. 5 — The Incentive Plan Proposal — to consider and vote upon a proposal to approve, assuming the other condition precedent proposals (as defined below) are approved and adopted, the Hillman Solutions Corp. 2021 Equity Incentive Plan (the “Incentive Equity Plan”), a copy of which is attached to this proxy statement/prospectus as Annex F, including the authorization of the initial share reserve under the Incentive Equity Plan (the “Incentive Plan Proposal”). Proposal No. 6 — The ESPP Proposal — to consider and vote upon a proposal to approve, assuming the condition precedent proposals (as defined below) are approved and adopted, the Hillman Solutions Corp. 2021 Employee Stock Purchase Plan (the “ESPP”), a copy of which is attached to this proxy statement/prospectus as Annex G, including the authorization of the initial share reserve under the ESPP (the “ESPP Proposal”). Proposal No. 7 — The Director Election Proposal — to consider and vote upon a proposal to elect, assuming the other condition precedent proposals (as defined below) are approved and adopted, ten directors, comprising three directors to serve as Class I directors, three directors to serve as Class II directors and four directors to serve as Class III directors, in each case to serve on New Hillman’s board of directors for a term expiring at the annual meeting of stockholders to be held in, respectively, 2022 in the case of Class I directors, 2023 in the case of Class II directors and 2024 in the case of Class III directors, or until such director’s successor has been duly elected and qualified, or until such director’s earlier death, resignation, retirement or removal (the “Director Election Proposal”). Class I Class II Class III Douglas Cahill Aaron Jagdfeld Diana Dowling Joseph Scharfenberger David Owens John Swygert Richard Zannino Philip Woodlief Daniel O'Leary Teresa Gendron Proposal No. 8 — The Adjournment Proposal — to consider and vote upon a proposal to approve the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, any of the Business Combination Proposal, the Charter Proposal, the Stock Issuance Proposal, the Incentive Plan Proposal and the Director Election Proposal (together the “condition precedent proposals”) would not be duly approved and adopted by our stockholders or we determine that one or more of the Closing conditions under the Merger Agreement is not satisfied or waived (we refer to this proposal as the “Adjournment Proposal”). Dated: , 2021 Signature (Signature if held Jointly) When Shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by the president or another authorized officer. If a partnership, please sign in partnership name by an authorized person. The Shares represented by the proxy, when properly executed, will be voted in the manner directed herein by the undersigned stockholder(s). If no direction is made, this proxy will be voted FOR each of Proposals 1 through 8. If any other matters properly come before the meeting, unless such authority is withheld on this proxy card, the Proxies will vote on such matters in their discretion. FOR ALL WITHHOLD ALL FOR ALL EXCEPT FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN To withhold authority to vote for any individual nominee(s), mark “For All Except” and write the name of the nominees on the line below. _____________________ |