EXHIBIT 2.1

Published on November 14, 2017

Exhibit 2.1

Execution Version

ASSET PURCHASE AGREEMENT

by and among

HARGIS INDUSTRIES, LP,

THE SELLING PARTNERS,

THE SELLER REPRESENTATIVE,

AND

THE HILLMAN GROUP, INC.

November 8, 2017

{A17/10285/0001/W1528165.1 }

4846-4639-0869

Exhibit 2.1

Execution Version

ASSET PURCHASE AGREEMENT

THIS ASSET PURCHASE AGREEMENT (this “Agreement”), dated as of November 8, 2017 (the “Closing Date”), is entered into by and among (i) Hargis Industries, LP, a Texas limited partnership (“Seller”), (ii) Joe A Hargis, Hargis Industries #1, LLC, a Texas limited liability company, and Joedy S. Hargis, as successor trustee and on behalf of (a) the Joedy S. Hargis Irrevocable Trust and (b) the Jeffrey S. Hargis Irrevocable Trust (the “Hargis Trusts”) (each Person set forth in this subclause (ii) a “Selling Partner” and collectively, the “Selling Partners”), (iii) Hargis Industries #1, LLC, a Texas limited liability company (acting by and through its sole member, Joe A. Hargis) in the capacity as the Seller Representative (the “Seller Representative”), and (iv) The Hillman Group, Inc., a Delaware corporation (the “Buyer”).

RECITALS

A. WHEREAS, under the trade name of ST Fastening Systems, Seller is engaged in the business of designing, manufacturing, and distributing specialty fasteners, foam closure strips and other accessories to the steel-frame, post-frame, and residential building markets and related accessories (collectively, the “Business”); and

B. WHEREAS, the Seller desires to sell, transfer, and assign to the Buyer, and the Buyer desires to acquire and assume from the Seller, all of the Purchased Assets and all of the Assumed Liabilities, in each case subject to the terms and conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the foregoing and the respective representations, warranties, covenants, and agreements set forth in this Agreement and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties to this Agreement hereby agree as follows:

ARTICLE I

DEFINITIONS

DEFINITIONS

“Accounts Receivable” means, with respect to any Person, all accounts or notes receivable that are held by such Person, including any security, claim, remedy, or other right related to any of the foregoing, calculated in accordance with GAAP.

“Acquired Benefit Plans” has the meaning set forth in Section 2.01(n).

“Action” means any claim, action, cause of action, demand, lawsuit, arbitration, audit, notice of violation, proceeding, litigation, citation, summons, or subpoena of any nature, civil, criminal, administrative, regulatory, or otherwise, whether at law or in equity.

“Adjusted Sales Tax Exposure Amount” has the meaning set forth in Section 8.09(b).

“Affiliate” means, with respect to any Person, any other person that directly or indirectly, through one or more intermediaries, controls, is controlled by, or is under common control with such Person. The term “control” (including the terms “controlled by” and “under common control

-2-

4846-4639-0869

Exhibit 2.1

Execution Version

with”) means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract, or otherwise.

“Agreement” has the meaning set forth in the preamble.

“Asset Sale Purchase Price” has the meaning set forth in Section 2.06.

“Assignment and Assumption of Cincinnati Lease” means that certain assignment and assumption agreement, dated effective as of the Closing Date, by and between Seller, as assignor, and Buyer, as assignee, respecting the real estate lease for the facility located at 9950 Princeton-Glendale Road in Cincinnati, Ohio, executed and delivered by Seller and Buyer at Closing.

“Assumed Contracts” has the meaning set forth in Section 2.01(e).

“Assumed Liabilities” has the meaning set forth in Section 2.03(a).

“Assumption Agreement” means that certain assignment and assumption agreement, dated as of the Closing Date, by and among the Buyer and the Seller.

“Balance Sheet Date” has the meaning set forth in Section 5.05(a).

“Basket” has the meaning set forth in Section 8.04(a).

“Bill of Sale” means that certain bill of sale, dated as of the Closing Date, executed and delivered by the Seller and delivered to the Buyer.

“Business” has the meaning set forth in the recitals.

“Business Day” means any day except Saturday, Sunday, or any other day on which commercial banks located in New York, New York are authorized or required by Law to be closed for business.

“Buyer” has the meaning set forth in the preamble.

“Buyer Indemnitees” has the meaning set forth in Section 8.02(a).

“Cash” means cash, checks, money orders, marketable securities, short-term instruments and other cash equivalents, calculated in accordance with GAAP, excluding any security deposits, escrow accounts or collateral posted with vendors, landlords, or other parties. For the avoidance of doubt, “Cash” shall include, without limitation, Seller’s cash held by the TPA to fund any Excluded Liability of Seller arising under Section 2.03(b)(ii) (“restricted cash”), which restricted cash will be held for the benefit of Seller pursuant to Section 7.02, income tax prepayments/deposits, deposits in transit, but shall be net of any bank overdrafts and any outstanding checks, drafts and wire transfers.

-3-

4846-4639-0869

Exhibit 2.1

Execution Version

“CERCLA” means the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, as amended by the Superfund Amendments and Reauthorization Act of 1986, 42 U.S.C. §§ 9601 et seq.

“Closing” has the meaning set forth in Section 3.01.

“Closing Date” has the meaning set forth in the preamble.

“Closing Date Purchase Price” has the meaning set forth in Section 2.04(a).

“COBRA” means the Consolidated Omnibus Budget Reconciliation Act of 1985.

“Code” means the Internal Revenue Code of 1986, as amended.

“Confidential Information” means, with respect to any Person, all information, whatever its nature and form and whether obtained orally, by observation, from written materials, or otherwise, that relates to any research, technical, manufacturing, business, or commercial activities or plans of such Person with respect to the Business, including, without limitation, all the following that pertain to the Business: systems, servicing methods and business techniques, programs, formulas, processes, compilations of technical and non-technical information, inventions, discoveries, and improvements, designs, drawings, blueprints, Software, Software code, databases, product ideas, concepts, prototypes, features, procedures, training, promotional materials, training courses and other training and instructional materials, vendor and product information, sales intermediary lists and other sales intermediary information, and customer lists and other customer information, whether or not patented or patentable, and all other information that is not otherwise generally available to the public (including, without limitation, any terms or provisions of this Agreement) and that constitutes a trade secret of such Person with respect to the Business under the Uniform Trade Secrets Act. The term “Confidential Information” will exclude any information that is (or that becomes) generally available to the public through no action of the Person (including its Representatives) required to maintain the confidentiality of such information.

“Contracts” means all binding, written or oral, contracts, leases, deeds, mortgages, licenses, instruments, notes, commitments, undertakings, indentures, and joint ventures, all purchase orders, task orders, change orders, or other ancillary document in which the terms of any other Contract are supplemented or in any way modified and all other agreements, commitments, and legally binding arrangements.

“Copyrights” means all copyrights, whether in published or unpublished works, Documents, databases, data collections and rights therein, Software, web site content; rights to compilations, collective works, and derivative works of any of the foregoing and moral rights in any of the foregoing; registrations and applications for registration for any of the foregoing and any renewals or extensions thereof; and moral rights and economic rights of others in any of the foregoing.

“Crouch” means Alan “Bruce” Crouch.

“Crouch Employment Agreement” has the meaning set forth in Section 7.01.

-4-

4846-4639-0869

Exhibit 2.1

Execution Version

“Direct Claim” has the meaning set forth in Section 8.05(c).

“Documents” means all files, documents, instruments, papers, books, reports, business and employment records, tapes, microfilms, photographs, letters, budgets, forecasts, ledgers, journals, title policies, lists of past, present and/or prospective customers, supplier lists, regulatory filings, operating data and plans, drawings, technical documentation (design specifications, functional requirements, operating instructions, logic manuals, flow charts, etc.), user documentation (installation guides, user manuals, training materials, release notes, working papers, etc.), marketing documentation (sales brochures, flyers, pamphlets, web pages, etc.), and other similar materials related to the Business and the Purchased Assets, in each case whether or not in electronic form.

“Domain Names” means Internet electronic addresses, uniform resource locators, and alphanumeric designations associated therewith registered with or assigned by any domain name registrar, domain name registry or other domain name registration authority as part of an electronic address on the Internet, all applications for any of the foregoing and the goodwill of the Business associated with each of the foregoing.

“Employee Benefit Plan” means, with respect to any Person, each “employee benefit plan” (as defined in ERISA §3(3)) and each other material benefit plan, program, or arrangement maintained, sponsored, contributed to (or required to be contributed to) by such Person or any subsidiary or any ERISA Affiliate of such Person, or with respect to which such Person or any subsidiary or any ERISA Affiliate of such Person has any Liability.

“Employee Pension Benefit Plan” has the meaning set forth in Section 3(2) of ERISA.

“Employee Welfare Benefit Plan” has the meaning set forth in Section 3(1) of ERISA.

“Employees” means those Persons employed by the Seller in connection with the Business immediately prior to the Closing and set forth on Schedule 5.19(a).

“Encumbrance” means any charge, claim, community property interest, pledge, equitable interest, lien (statutory or other, but excluding inchoate liens), option, security interest, mortgage, or right of first refusal.

“Environmental Claim” means any Action, Order, lien, fine, penalty, or, as to each, any settlement or judgment arising therefrom, by or from any Person alleging liability of whatever kind or nature (including liability or responsibility for the costs of enforcement proceedings, investigations, cleanup, governmental response, removal or remediation, natural resources damages, property damages, personal injuries, penalties, contribution, indemnification and injunctive relief) arising out of, based on or resulting from (i) the presence, Release of, or exposure to, any Hazardous Materials prior to Closing, or (ii) any actual or alleged non-compliance with any Environmental Law or term or condition of any Environmental Permit prior to Closing.

“Environmental Condition” means any condition of the environment with respect to the Real Property, with respect to any property previously owned, leased, or operated by the Seller prior to Closing to the extent such condition of the Environment existed at the time of such ownership,

-5-

4846-4639-0869

Exhibit 2.1

Execution Version

lease, or operation, or with respect to any other real property at which any Hazardous Material generated by the operation of the business of the Seller prior to the Closing Date has been treated, stored, or disposed of, which violates any Environmental Law, or even though not violative of any Environmental Law, nevertheless results in any Release, or Threat of Release.

“Environmental Law” means any applicable Law, and any Order or binding agreement with any Governmental Authority (i) relating to pollution (or the cleanup thereof) or the protection of natural resources, endangered or threatened species, human health or safety, safety of employees or the public or the environment (including ambient air, soil vapor, soil, surface water or groundwater, or subsurface strata) or (ii) concerning the presence of, exposure to, or the management, manufacture, use, containment, storage, recycling, reclamation, reuse, treatment, generation, discharge, transportation, processing, production, disposal, or remediation of any Hazardous Materials, including the following (including their implementing regulations and any state analogs): CERCLA; the Solid Waste Disposal Act, as amended by the Resource Conservation and Recovery Act of 1976, as amended by the Hazardous and Solid Waste Amendments of 1984, 42 U.S.C. §§ 6901 et seq.; the Federal Water Pollution Control Act of 1972, as amended by the Clean Water Act of 1977, 33 U.S.C. §§ 1251 et seq.; the Toxic Substances Control Act of 1976, as amended, 15 U.S.C. §§ 2601 et seq.; the Emergency Planning and Community Right to Know Act of 1986, 42 U.S.C. §§ 11001 et seq.; the Clean Air Act of 1966, as amended by the Clean Air Act Amendments of 1990, 42 U.S.C. §§ 7401 et seq. and the Occupational Safety and Health Act of 1970, as amended, 29 U.S.C. §§ 651 et seq.

“Environmental Notice” means any written directive, notice of violation or infraction, or notice respecting any Environmental Claim relating to actual or alleged non-compliance with any Environmental Law or any term or condition of any Environmental Permit.

“Environmental Permit” means any Permit, letter, clearance, consent, waiver, closure, exemption, decision, or other action required under or issued, granted, given, authorized by, or made pursuant to Environmental Law.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended, and the regulations promulgated thereunder.

“ERISA Affiliate” means any organization that is a member of the controlled group of organizations of the Seller and any Subsidiaries (within the meaning of Sections 414(b), (c), or (e) of the Code).

“Escrow Agent” means Prosperity Bank.

“Escrow Agreement” means that certain escrow agreement, dated as of the Closing Date, by and among the Seller Representative, the Escrow Agent, and the Buyer, in substantially the form attached hereto as Exhibit A.

“Escrow Amount” means $4,800,000.00.

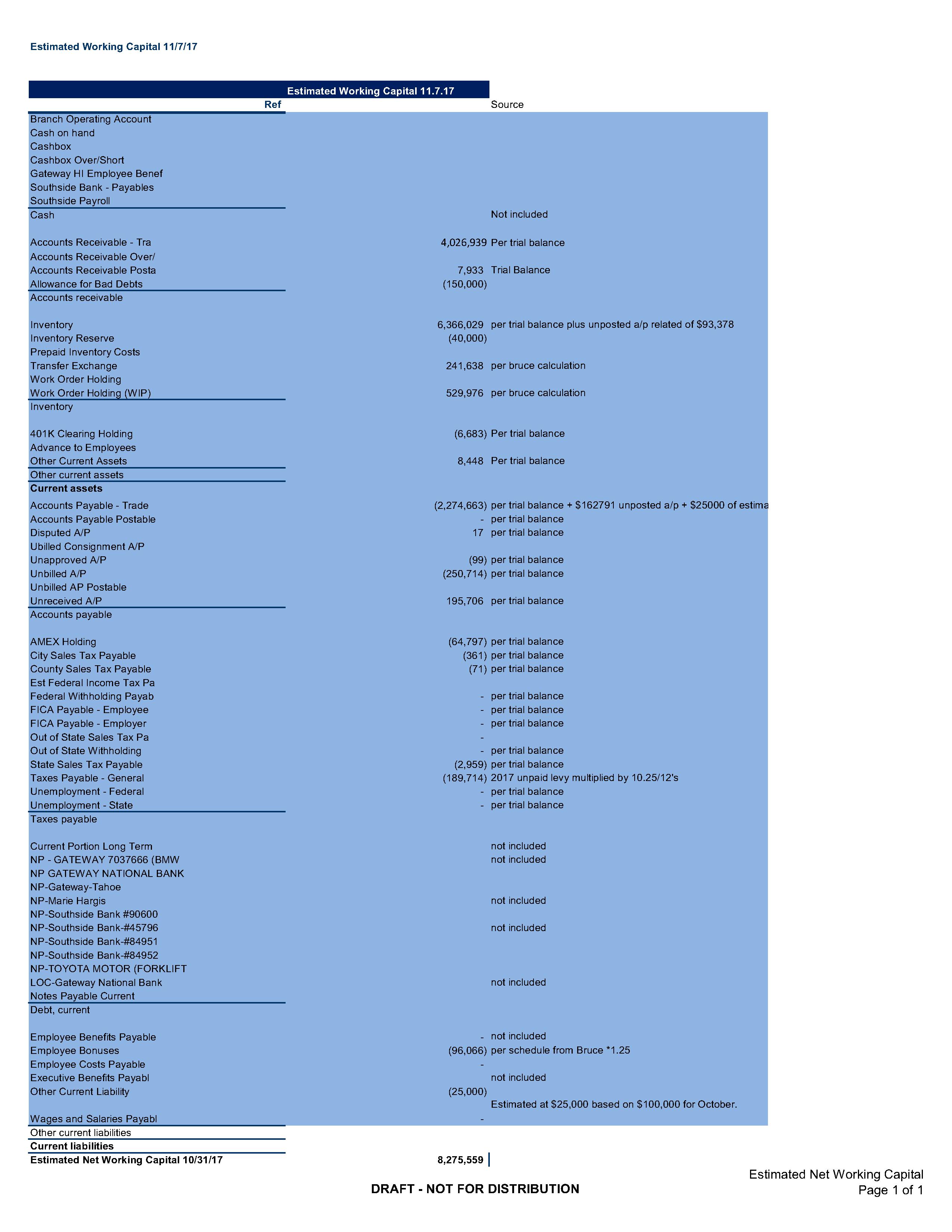

“Estimated Working Capital” has the meaning set forth in Section 2.05(a).

-6-

4846-4639-0869

Exhibit 2.1

Execution Version

“Excluded Assets” has the meaning set forth in Section 2.02.

“Excluded Benefit Plans” has the meaning set forth in Section 2.02(j).

“Excluded Employees” has the meaning set forth in Section 7.01.

“Excluded Liabilities” has the meaning set forth in Section 2.03(b).

“Excluded Representations” has the meaning set forth in Section 8.01.

“Extended Indemnity Period” has the meaning set forth in Section 8.09(b).

“Final Working Capital” has the meaning set forth in Section 2.05(b).

“Final Working Capital Statement” has the meaning set forth in Section 2.05(b).

“Financial Statements” has the meaning set forth in Section 5.05(a).

“GAAP” means United States generally accepted accounting principles in effect from time to time.

“Governmental Authority” means any federal, state, local, or foreign government or political subdivision thereof, or any agency or instrumentality of such government or political subdivision, or any arbitrator, court or tribunal of competent jurisdiction with respect to the Business, any particular Person and any matter.

“Guarantee” by any Person means any obligation, contingent or otherwise, of such Person directly or indirectly guaranteeing or otherwise supporting in whole or in part the payment of any Indebtedness or other obligation of any other Person and, without limiting the generality of the foregoing, any obligation, direct or indirect, contingent or otherwise, of such Person (a) to purchase or pay (or advance or supply funds for the purchase or payment of) such Indebtedness or other obligation of such other Person (whether arising by virtue of partnership arrangements, by agreement to keep-well, to purchase assets, goods, securities, or services, to take-or-pay, or to maintain financial statement conditions or otherwise) or (b) entered into for the purpose of assuring in any other manner the obligee of such Indebtedness or other obligations of the payment of such Indebtedness or to protect such obligee against loss in respect of such Indebtedness (in whole or in part). The term “Guarantee” used as a verb has a correlative meaning.

“Hargis Trusts” has the meaning set forth in the preamble.

“Hazardous Materials” means any (a) toxic, hazardous, extremely hazardous, infectious, explosive, corrosive, flammable, carcinogenic, mutagenic, sanitary, solid or radioactive waste, or otherwise hazardous substance, waste, or material, (b) petroleum and petroleum products, radioactive materials, asbestos-containing materials, mold, urea formaldehyde foam insulation, polychlorinated biphenyls, or radon gas, and (c) any other chemicals, materials, or substances defined as or included in the definition of “hazardous substances”, “extraordinarily hazardous substances”, “solid wastes”, “hazardous wastes”, “hazardous materials”, “extremely hazardous

-7-

4846-4639-0869

Exhibit 2.1

Execution Version

wastes”, “restricted hazardous wastes”, “toxic substances”, “toxic pollutants”, “contaminants”, or “pollutants”, or words of similar import, under any Environmental Law.

“Immediate Family Member” of a Person means any child, stepchild, grandchild, parent, stepparent, grandparent, sibling, spouse, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships, in each case, of such Person.

“Indebtedness” means any Liability (a) for borrowed money, (b) under any reimbursement obligation, including those related to letters of credit, banker’s acceptances, or note purchase facilities, (c) evidenced by a bond, note, debenture, or similar instrument (including a purchase money obligation), (d) for the payment of money relating to leases that are required to be classified as capitalized lease obligations in accordance with GAAP, (e) for the deferred purchase price of any property or services, (f) all obligations under any interest rate, currency, or other hedging agreement, (g) commitments to repay deposits or advances by or owing to third parties, (h) prepayment premiums of any change of control premiums, if any, “breakage” costs or similar payments associated with the repayments thereof and accrued interest, if any, on and fees and expenses and all other amounts owed in respect of any of the foregoing, (i) wealth accumulation plan, (j) self-insurance or health reimbursement arrangement liabilities for which Seller is responsible under Section 2.03(b)(ii), to the extent greater than the amount of “restricted cash” (as defined in the definition of Cash), and (k) any direct or indirect Guaranty of any other Person or a type described in the foregoing clauses (a) through (j); provided, however, for the avoidance of doubt, “Indebtedness” does not include the Assumed Liabilities, and the parties agree that the Toyota Lease will be classified as an operating lease obligation in accordance with GAAP for purposes of determining Indebtedness.

“Indemnified Party” means a party making a claim under ARTICLE VIII.

“Indemnifying Party” means a party against whom a claim is asserted under ARTICLE VIII.

“Indemnity Period” has the meaning set forth in Section 8.09.

“Independent Accountant” means Cassady Schiller & Associates Inc.

“Information Systems” has the meaning set forth in Section 5.11(g).

“Insurance Policy” or “Insurance Policies” has the meaning set forth in Section 5.14(a).

“Intellectual Property” means Copyrights, Domain Names, Patents, Software, Trademarks, and Trade Secrets.

“Intellectual Property Assets” means all of the Intellectual Property of the Seller that relates to, is used in, is necessary for the conduct of (as currently conducted), or is held for use in connection with, the Business, including all of the rights of the Seller to Intellectual Property under the Intellectual Property Licenses and the goodwill represented by all such Intellectual Property but excluding all Sealtite Intellectual Property.

-8-

4846-4639-0869

Exhibit 2.1

Execution Version

“Intellectual Property Licenses” means all licenses, sublicenses, and other agreements by or through which other Persons, including any Affiliate of the Seller, grant to the Seller exclusive or non-exclusive rights or interests in or to any Intellectual Property that is used in or is necessary for the conduct of the Business as currently conducted.

“Intellectual Property Registrations” means all Intellectual Property Assets that are subject to any issuance, registration, application, or other filing by, to, or with any Governmental Authority, including registered trademarks, domain names, and copyrights, issued and reissued patents, and pending applications for any of the foregoing.

“Inventory” means, with respect to the Seller, Seller’s finished goods, supplies, raw materials, work in progress, spare, replacement and components, or goods or products used, held for use or related to the Business, whether in Seller’s possession or located at any third-party locations, calculated in accordance with GAAP.

“Investment” means any equity interest (including any convertible debt, options, warrants, and similar instruments), of record or beneficially, directly, or indirectly, in any Person.

“IRS” means the United States Internal Revenue Service.

“Knowledge” means, with respect to the Seller, the actual knowledge of Crouch, Joe A. Hargis, Dave Quehl, VP of Marketing (only as to sales and customer matters) or Jim Carter, VP of Operations (only as to operations matters), with no duty to investigate.

“Law” means any applicable statute, law, ordinance, regulation, rule, code, order, constitution, treaty, common law, policy, guidance, judgment, decree, other requirement, or rule of law of any Governmental Authority.

“Lease Agreements” means the lease agreements pertaining to the Leased Real Property set forth on Schedule 1.1, substantially in the form attached hereto as Exhibit B.

“Leased Real Property” has the meaning set forth in Section 5.10(b).

“Liability” means a liability, obligation, or commitment of any nature whatsoever, asserted or unasserted, known or unknown, absolute or contingent, accrued or unaccrued, matured or unmatured, or otherwise.

“Loss” or “Losses” means loss, damage, Liability, deficiency, Actions, judgment, interest, award, penalty, fine, settlement, disbursement, cost, or expense of whatever kind, including reasonable attorneys’ fees and the cost of enforcing any right to indemnification hereunder and the cost of pursuing any insurance providers.

“Material Adverse Effect” means any event, occurrence, fact, condition, or change that is, or is reasonably be expected to become, individually or in the aggregate, materially adverse to (i) the business, results of operations, prospects, condition (financial or otherwise), or assets of the Seller or the Business (including the Purchased Assets) or (ii) the ability of the Seller or any of the Selling Partners, as the case may be, to consummate the transactions contemplated by this

-9-

4846-4639-0869

Exhibit 2.1

Execution Version

Agreement. Provided, however, “Material Adverse Effect” shall not include any event, occurrence, fact, condition or change, directly or indirectly, arising out of or attributable to: (i) general economic or political conditions; (ii) conditions generally affecting the industries in which the Business operates; (iii) any changes in financial, banking or securities markets in general, including any disruption thereof and any decline in the price of any security or any market index or any change in prevailing interest rates; (iv) acts of war (whether or not declared), armed hostilities or terrorism, or the escalation or worsening thereof; (v) any action required or permitted by this Agreement or any action taken (or omitted to be taken) with the written consent of or at the written request of Buyer; (vi) any changes in applicable Laws or accounting rules (including GAAP); (vii) the announcement, pendency or completion of the transactions contemplated by this Agreement, including losses or threatened losses of employees, customers, suppliers, distributors or others having relationships with the Seller and the Business; (viii) any natural or man-made disaster or acts of God; or (ix) any failure, in and of itself, by the Business to meet any internal or published projections, forecasts or future revenue or earnings predictions after the date hereof (but not excluding any of the reasons for such failure); provided, however, that any event, occurrence, fact, condition, or change referred to in clauses (i) through (ix) above, except clauses (v) and (vii), shall be taken into account in determining whether a Material Adverse Effect has occurred, or is reasonably expected to occur, to the extent that such event, occurrence, fact, condition, or change has a disproportionate adverse effect on the Business compared to other participants in the industries in which the Seller conducts the Business.

“Material Contract” has the meaning set forth in Section 5.07(a).

“Material Customer” has the meaning set forth in Section 5.13(a).

“Material Supplier” has the meaning set forth in Section 5.13(b).

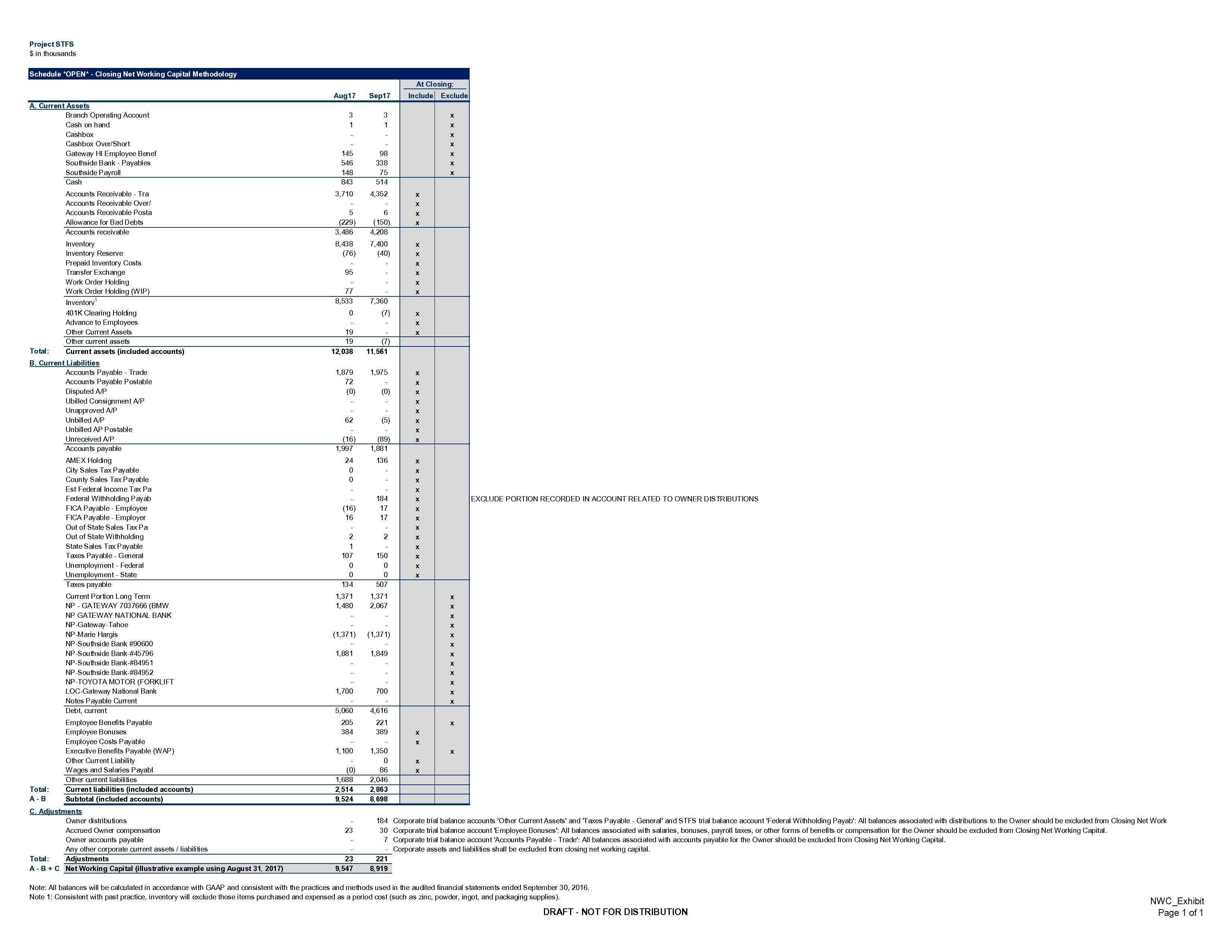

“Net Working Capital” means the amount by which (a) the Seller’s current assets (excluding Cash) exceed (b) the Seller’s current liabilities, each determined as of the applicable date and calculated in accordance with GAAP and in a manner consistent with Exhibit D.

“Non-Assignable Contract” has the meaning set forth in Section 7.12.

“Object Code” means Software that is substantially or entirely in binary form and that is intended to be directly executable by a computer after suitable processing and linking but without any intervening steps of compilation or assembly.

“Order” means any order, writ, judgment, injunction, decree, stipulation, determination, or award entered by or with any Governmental Authority.

“Ordinary Course of Business” means the ordinary and usual course of day-to-day operations of the Business consistent with past custom and practice (including with respect to quantity and frequency).

“Patents” means all patents, industrial and utility models, industrial designs, petty patents, patents of importation, patents of addition, certificates of invention, and any other indicia of

-10-

4846-4639-0869

Exhibit 2.1

Execution Version

invention ownership issued or granted by any Governmental Authority, including all provisional applications, priority and other applications, divisionals, continuations (in whole or in part), extensions, reissues, re-examinations, or equivalents or counterparts of any of the foregoing.

“Permit” means a permit, license, franchise, approval, authorization, registration, certificate, variance, or similar right obtained, or required to be obtained, from Governmental Authorities.

“Permitted Encumbrances” has the meaning set forth in Section 5.08.

“Person” means an individual, corporation, partnership, joint venture, limited liability company, Governmental Authority, unincorporated organization, trust, association, or other entity.

“Personal Property” means, with respect to Seller, all of Seller’s machinery, equipment, furniture, computer hardware, trade fixtures, motor vehicles, other miscellaneous supplies, tools, fixed assets, raw materials, supplies, works in process, finished goods, and other inventories and other tangible personal property owned or leased by Seller and related to or used or usable in connection with, the Business, including all artwork, desks, chairs, tables, hardware, copiers, telephone lines and numbers, telecopy machines and other telecommunication equipment, cubicles, and miscellaneous office furnishings and supplies, excluding Inventory.

“Post-Closing Portion” has the meaning set forth in Section 7.08(f).

“Post-Closing Tax Period” means any taxable period beginning after the Closing Date and, with respect to any Straddle Tax Period, the portion of such taxable period beginning after the Closing Date.

“Pre-Closing Portion” has the meaning set forth in Section 7.08(f).

“Pre-Closing Tax Period” means any taxable period ending on or before the Closing Date and, with respect to any Straddle Tax Period, the portion of such taxable period ending on and including the Closing Date.

“Purchase Price” has the meaning set forth in Section 2.04(a).

“Purchased Assets” has the meaning set forth in Section 2.01.

“Purchased Intellectual Property” means all Intellectual Property owned by Seller to the extent used, held for use, or related to the conduct of the Business by the Seller (in whole or in part), excluding the Sealtite Intellectual Property, together with all related income, royalties, damages, and payments due or payable to the Seller as of the Closing or thereafter and the rights to sue and collect damages for such infringements, misappropriations, or other violations, and any corresponding equivalent or counterpart rights, title, or interest that exist or may be secured hereafter anywhere in the world and all copies and tangible embodiments of the foregoing, including the Intellectual Property listed on Schedule 5.11(a).

“Real Property” means any and all real property and interests in real property of the Seller (together with all buildings, structures, fixtures, and improvements thereon), including the Leased

-11-

4846-4639-0869

Exhibit 2.1

Execution Version

Real Property, any real property leaseholds and subleaseholds, purchase options, easements, licenses, rights to access and rights of way, and any other real property otherwise owned, occupied, or used by the Seller.

“Real Property Leases” has the meaning set forth in Section 5.10(b).

“Related Party” means any current or former member, shareholder, manager, director, officer, employee, or Affiliate of the Seller or any Immediate Family Member or Affiliate of any Selling Partner.

“Release” means any actual or threatened release, spilling, leaking, pumping, pouring, emitting, emptying, discharging, injecting, escaping, leaching, dumping, abandonment, disposing, or allowing to escape or migrate into or through the environment (including ambient air (indoor or outdoor), surface water, groundwater, land surface or subsurface strata, or within any building, structure, facility, or fixture).

“Representative” means, with respect to any Person, any and all directors, officers, employees, consultants, financial advisors, counsel, accountants, and other agents of such Person.

“Residual Sealtite Use” has the meaning set forth in Section 8.02(a).

“Restricted Party” means, collectively and individually, each of the Seller, Joe A. Hargis, Hargis Industries #1, LLC and the Hargis Trusts.

“Restricted Period” has the meaning set forth in Section 7.03(a).

“Restricted Territory” means the United States and all of the specific customer accounts of the Buyer and the Seller as of the Closing Date, whether within or outside of the United States.

“Sale Bonus” means any stay bonus, change of control payment, or other amount paid as a result of the transactions contemplated by this Agreement.

“Sales Representative Agreements” has the meaning set forth in Section 3.02(a)(xvi).

“Sales Tax Customer” has the meaning set forth in Section 8.09(b).

“Sales Tax Customer Exposure Amount” has the meaning set forth in Section 8.09(c).

“Sales Tax Exposure Amount” has the meaning set forth in Section 8.09(b).

“Sales Tax Period” has the meaning set forth in Section 5.21(m).

“Sales Tax Spreadsheet” has the meaning set forth in Section 8.09(c).

“Sales Tax Statement of Objections” has the meaning set forth in Section 8.09(c).

“Sealtite Intellectual Property” means the name “Sealtite”, “Sealtite Building Fasteners”, or any related assumed names, domain names, trademarks, trade dress, registrations, or any

-12-

4846-4639-0869

Exhibit 2.1

Execution Version

variations thereof and all other Intellectual Property relating thereto, except for the Sealtite Construction Fasteners copyright registration, number Vatu001026270, as set forth in Schedule 5.11(a).

“Seller” has the meaning set forth in the preamble.

“Seller Indemnitees” has the meaning set forth in Section 8.03.

“Seller Representative” has the meaning set forth in the preamble.

“Seller Transaction Expenses” has the meaning set forth in Section 2.03(b)(vii).

“Selling Partner” or “Selling Partners” has the meaning set forth in the preamble.

“Software” means all computer software, programs, and code, including assemblers, applets, compilers, Source Code, Object Code, development tools, design tools, user interfaces, and data, in any form or format, however fixed.

“Source Code” means Software that may be displayed or printed in human-readable form, including all related programmer comments, annotations, flowcharts, diagrams, help text, data and data structures, instructions, procedural, object-oriented, or other human-readable code, and that is not intended to be executed directly by a computer without an intervening step of compilation or assembly.

“Statement of Objections” has the meaning set forth in Section 2.05(c).

“Straddle Tax Period” means any taxable period beginning on or before the Closing Date and ending after the Closing Date.

“Target Working Capital” means Nine Million One Hundred Thousand US Dollars ($9,100,000.00).

“Tax” or “Taxes” means any tax of any kind, including any federal, state, local, or foreign income, capital gains, gift or estate, gross receipts, commercial activity, sales, use, value-added, production, unclaimed property, escheat, ad valorem, transfer, documentary, franchise, net worth, capital, registration, profits, license, lease, service, service use, withholding, payroll, employment, unemployment, estimated, excise, severance, environmental, stamp, occupation, premium, property (real or personal), real property gains, intangibles, windfall profits, customs, duties, or other tax, fee, assessment, escheatment, or charge of any kind whatsoever, including tax for which a taxpayer is responsible by reason of Treasury Regulations Section 1.1502-6 (and any comparable provision of state, local, or foreign Tax law) or as a transferee or successor by reason of contract, indemnity, or otherwise, together with any interest, additions, fine, or penalty with respect thereto and any interest in respect of such interest, additions, fine, or penalties.

“Tax Contest” has the meaning set forth in Section 7.08(c).

-13-

4846-4639-0869

Exhibit 2.1

Execution Version

“Tax Return” means any return, declaration, report, claim for refund, information return or statement, or other document relating to Taxes, including any schedule or attachment thereto, and including any amendment thereof.

“Taxing Authority” means any Governmental Authority responsible for the imposition or the administration of any Tax.

“Taxes Due” has the meaning set forth in Section 8.09(c).

“Third Party Claim” has the meaning set forth in Section 8.05(a).

“Threat of Release” means a substantial likelihood of a Release that requires action to prevent or mitigate damage or injury to health, safety, or the Environment that might result from such Release.

“Toyota Lease” means the Master Lease Agreement by and between Seller and East Texas Lift Truck, Inc. dated March 26, 2015, as assigned to Toyota Motor Credit Corporation in accordance with the Notice of Assignment and Maintenance Collection Agreement for Equipment Schedule dated April 6, 2015 between Seller and Toyota Motor Credit Corporation, including all schedules to the said Master Lease Agreement.

“TPA” means Group Administrators, Ltd.

“Trade Secrets” means anything that would constitute a “trade secret” under applicable Law, and all other inventions (whether patentable or not), industrial designs, discoveries, improvements, ideas, designs, models, formulae, patterns, compilations, data collections, drawings, blueprints, mask works, devices, methods, techniques, processes, know-how, confidential information, proprietary information, customer lists, Software and technical information; and moral and economic rights of authors and inventors in any of the foregoing.

“Trademarks” means trademarks, service marks, fictional business names, trade names, commercial names, certification marks, collective marks, Internet domain names, and uniform resource locators and alphanumeric designations associated therewith and other proprietary rights to any words, names, slogans, symbols, logos, devices, or combinations thereof used to identify, distinguish, and indicate the source or origin of goods or services; registrations, renewals, applications for registration, equivalents, and counterparts of the foregoing; and the goodwill of the business associated with each of the foregoing.

“Transaction Document” means the Assumption Agreement, the Bill of Sale, the Escrow Agreement, the Crouch Employment Agreement, the Lease Agreements, the Assignment and Assumption of Cincinnati Lease, and each other agreement, document, instrument, or certificate contemplated by this Agreement or to be executed by the Buyer, the Seller, the Selling Partners, or the Seller Representative at Closing, as the case may be, in connection with the consummation of the transactions contemplated by this Agreement, in each case only as applicable to the relevant party or parties to such Transaction Documents, as indicated by the context in which such term is used.

-14-

4846-4639-0869

Exhibit 2.1

Execution Version

“Transfer Taxes” has the meaning set forth in Section 7.08(e).

“Transferred Employees” has the meaning set forth in Section 7.01.

“Treasury Regulations” means final and temporary regulations promulgated under the Code.

“WARN Act” means the federal Worker Adjustment and Retraining Notification Act of 1988, and similar state, local and foreign Laws related to plant closings, relocations, mass layoffs and employment losses.

“Working Capital Overage” has the meaning set forth in Section 2.05(a).

“Working Capital Underage” has the meaning set forth in Section 2.05(a).

ARTICLE II

PURCHASE AND SALE

PURCHASE AND SALE

2.01. Purchase and Sale of the Purchased Assets. Subject to the terms and conditions of this Agreement, at the Closing, the Seller will, and does hereby, sell, assign, transfer, and deliver to the Buyer, and the Buyer will, and does hereby, purchase and acquire from the Seller, all right, title, and interest of the Seller in and to all of the assets, properties, and rights of every kind and nature, whether real, personal, or mixed, tangible or intangible (including goodwill), wherever located and whether now existing or hereafter acquired, to the extent used, held for use, or related to the conduct of the Business by the Seller (such right, title, and interest of Seller in such assets, properties, and rights, being referred to as the “Purchased Assets”), in each case free and clear of all Encumbrances, including the following:

(a) all Inventory set forth on Schedule 2.01(a);

(b) all Personal Property set forth on Schedule 2.01(b);

(c) all Accounts Receivable, reimbursable costs and expenses, and other claims for money due to the Seller and arising out of the Business, and any security therefor, as of the Closing Date;

(d) all deferred expenses, inventory payments, and refundable deposits (including customer deposits and security for rent, electricity, telephone, or otherwise), in each case, of the Seller (excluding those pertaining to Excluded Assets);

(e) all rights and incidents of interest of, and benefits accruing to, the Seller under all Contracts of the Seller related to or used in connection with the Business and that are specifically set forth on Schedule 2.01(e) (the “Assumed Contracts”), including all claims or causes of action with respect to such Contracts;

(f) Seller’s leasehold estate in the Leased Real Property located at 9950 Princeton-Glendale Road in Cincinnati, Ohio;

-15-

4846-4639-0869

Exhibit 2.1

Execution Version

(g) the Purchased Intellectual Property;

(h) all Documents, whether or not in Seller’s possession or control;

(i) all Permits, including Environmental Permits, and all rights, and incidents of interest therein;

(j) all books of account, financial and accounting records, files (excluding any medical files relating to the Employees), invoices, and suppliers’ lists;

(k) all claims and causes of action of the Seller against third parties and all rights to proceeds therefrom relating to the Business;

(l) all rights of the Seller under non-disclosure or confidentiality, non-compete or non-solicitation agreements with former employees, Employees, consultants, and agents of the Seller or with third parties;

(m) the Business as a going concern and all goodwill, and other intangible assets of Seller (to the extent assignable) associated with the Business, including the goodwill of Seller associated with the Purchased Intellectual Property and the Business; and

(n) each Employee Benefit Plan of the Seller (including any Contracts related thereto) set forth on Schedule 2.01(n) (the “Acquired Benefit Plans”) and all assets held with respect to such Acquired Benefit Plans, subject to the claims and rights of the participants under such plans that are incurred post-Closing (and specifically subject to the rights and claims of plan participants to such assets that accrue prior to Closing or post-Closing).

2.02. Excluded Assets. Nothing contained in this Agreement is deemed to sell, transfer, assign, or convey the Excluded Assets to the Buyer, and the Seller will retain all right, title, and interest to, in, and under the Excluded Assets. “Excluded Assets” means each of the following assets:

(a) Cash, intercompany receivables, Investments, and all rights to any bank or deposit accounts, investment accounts and other deposits;

(b) the partnership agreement and other governing documents of the Seller, minute books, partnership interests ledgers and records, qualifications to conduct business, taxpayer and other identification numbers, Tax Returns, Tax information, Tax records related to the Seller or any of its Affiliates, corporate seals, and any other document relating to the organization, maintenance, and existence of the Seller, including duplicate copies of such records and Documents as are necessary to enable the Seller to file Tax Returns and reports, or otherwise required in order to comply with applicable Law;

(c) Documents, Permits, Environmental Permits, intangibles, causes of action, lawsuits, judgments, claims, counterclaims, offsets, defenses, and demands relating to any of the Excluded Liabilities or the Excluded Assets;

-16-

4846-4639-0869

Exhibit 2.1

Execution Version

(d) all express or implied guarantees, warranties, representations, covenants, indemnities, and similar rights relating to the Excluded Liabilities or the Excluded Assets, including third party warranties and guarantees and all related claims, defenses, rebates, refunds, security deposits, credits, rights of recovery, and set-off as to third parties which are held by or in favor of the Seller and related to the Excluded Liabilities or the Excluded Assets;

(e) the rights, claims, causes of action, receivables, offsets, defenses and counterclaims that accrue to the Seller or the Selling Partners under this Agreement and/or under the Transaction Documents to which the Seller and/or the Selling Partners are a party;

(f) all refunds and deposits of Taxes to the extent not included in the Final Working Capital calculation;

(g) rights of Seller under any Contracts that are not Assumed Contracts or that are not validly and effectively assigned to Buyer, including the Contracts specifically set forth on Schedule 2.02(g);

(h) Real Property (except for assignment of Seller’s leasehold estate in 9950 Princeton-Glendale Road in Cincinnati, Ohio);

(i) Insurance Policies, insurance proceeds, and the right to refund of any prepaid unearned premiums;

(j) all Employee Benefit Plans of the Seller (including any Contracts related thereto), except for the Acquired Benefit Plans (the “Excluded Benefit Plans”), and all assets held with respect to such Excluded Benefit Plans;

(k) all Sealtite Intellectual Property;

(l) credit cards, lines of credit, and other credit facilities, loan agreements, credit agreements and other similar agreements; and

(m) the assets set forth on Schedule 2.02(m).

2.03. Assumption of Liabilities.

(a) Subject to the terms and conditions of this Agreement, at the Closing, the Buyer will, and does hereby, assume, and promise to pay and perform when due, only the following Liabilities of the Seller (collectively, the “Assumed Liabilities”), in each case in accordance with their respective terms:

(i) all accounts payable and accrued expenses of the Seller and Business arising in the Ordinary Course of Business and to the extent reflected in the calculation of Final Working Capital;

(ii) the Liabilities of the Seller with respect to the Assumed Contracts to the extent relating to payment obligations arising in the Ordinary Course of Business, compliance

-17-

4846-4639-0869

Exhibit 2.1

Execution Version

and performance thereunder following the Closing Date; provided, however, that Buyer is not assuming any Liabilities of the Seller in respect of a breach of or default under, or any non-compliance with respect to, any of the foregoing that occurred on or before, or that relates to or commenced during any period, or accrued, prior to, the Closing Date; and

(iii) any Liability of the Seller under any Acquired Benefit Plan that is incurred after the Closing.

(b) The Assumed Liabilities will not include, and the Buyer will not assume or be liable for, any Excluded Liabilities. The Seller will timely perform, satisfy, and discharge in accordance with their respective terms all Excluded Liabilities. “Excluded Liabilities” means all Liabilities of the Seller, other than the Assumed Liabilities, including the following Excluded Liabilities:

(i) any Liabilities for (A) the Transferred Employees and other Employees, former employees, and other service providers, in each case, of the Seller for periods on or prior to the Closing Date and (B) the Excluded Employees, whether before, on, or after the Closing Date;

(ii) any Liability of the Seller under any Acquired Benefit Plan that is incurred prior to the Closing;

(iii) any product Liability tort claims with respect to the conduct of the Business that occurred on or prior to the Closing Date;

(iv) any Liability related to any actual or alleged violation or Liability arising under any Environmental Law or other applicable Law occurring on or prior to the Closing Date, regardless of whether such Liability related to any act or omission of the Seller;

(v) any Indebtedness of the Seller or any Encumbrances on the Purchased Assets;

(vi) any Liability of the Seller to the extent related to or arising in connection with the Excluded Assets;

(vii) any Liability of the Seller to any Selling Partner, Affiliate or Representative of the Seller;

(viii) any Liability of the Seller under this Agreement or the Transaction Documents to which the Seller is a party and any costs and expenses incurred by the Seller or the Selling Partners incident to the negotiation and preparation of this Agreement and the Seller’s performance and compliance with the agreements and conditions contained herein, including any sale or transaction bonuses payable to any former employee, Employee, independent contractor, advisor, or other Representative of the Seller (the “Seller Transaction Expenses”);

(ix) any Liability of the Seller to pay fees or commissions to any broker, finder, or agent of Seller with respect to the transactions contemplated by this Agreement;

-18-

4846-4639-0869

Exhibit 2.1

Execution Version

(x) any Liability of Seller for (a) Taxes of the Seller, any of the Seller’s Affiliates, or the Selling Partners or Taxes relating to the Business, the Purchased Assets or the Assumed Liabilities for all Pre-Closing Tax Periods (whether direct or as a result of successor liability, transferee liability, joint and several liability, contractual liability, under the common law doctrine of de facto merger or by operation of law), and (b) Taxes that arise out of the consummation of the transactions contemplated hereby or that are the responsibility of Seller and the Selling Partners pursuant to Section 7.08(e);

(xi) Liabilities of Seller with respect to warranties made by Seller to purchasers of goods manufactured and/or sold by Seller prior to Closing in the Ordinary Course of Business, including, without limitation, Seller’s “satisfaction guaranteed” policy of replacing goods if the customer is not satisfied, except for any such claims of which Seller has Knowledge and that were submitted in writing to Seller prior to the Closing Date and that are not reflected in the calculation of Final Working Capital;

(xii) Liabilities of Seller relating or arising from unfulfilled commitments, quotations, purchase orders, customer orders or work orders that (A) do not constitute part of the Purchased Assets, (B) did not arise in the Ordinary Course of Business, or (C) are not validly and effectively assigned to Buyer pursuant to this Agreement; and

(xiii) the matters identified on Schedule 2.03(b)(xiii).

2.04. Purchase Price.

(a) The aggregate purchase price to be paid by the Buyer for the Purchased Assets is an amount in cash equal to Forty Eight Million US Dollars $48,000,000.00, increased by any Working Capital Overage, or decreased by any Working Capital Underage (as adjusted, the “Closing Date Purchase Price”) and as further adjusted pursuant to Section 2.05 (the result of the foregoing calculation, plus Buyer’s assumption, payment and performance of the Assumed Liabilities is the “Purchase Price”).

(b) At the Closing, the Buyer will deliver, or cause to be delivered, by wire transfer of immediately available funds pursuant to the wire instructions set forth on Schedule 2.04(b), an amount equal to the Closing Date Purchase Price. The Closing Date Purchase Price will be delivered as follows:

(i) to the Escrow Agent, an amount equal to the Escrow Amount, to be held in accordance with the terms of the Escrow Agreement and Section 8.09;

(ii) to each applicable Person set forth on Schedule 2.04(b), an amount equal to the portion of Indebtedness or Seller Transaction Costs set forth opposite such Person’s name, which amounts of Indebtedness shall reflect the amounts set forth on the payoff letters delivered to the Buyer pursuant to Section 3.02(a)(xiii); and

(iii) to the Seller Representative, as set forth on Schedule 2.04(b), the balance of the Closing Date Purchase Price, minus an amount equal to Six Thousand Five Hundred

-19-

4846-4639-0869

Exhibit 2.1

Execution Version

Twenty Five US Dollars ($6,525.00), which amount shall be retained by the Buyer for satisfaction of 50% of the transfer fee assessed by Epicor Software Corporation under the terms of the Assignment and Assumption Agreement among the Buyer, the Seller, and Epicor Software Corporation,; provided, however, that in no event will the Buyer or the Buyer’s Affiliates have any responsibility or liability for the allocation or distribution of the Closing Date Purchase Price among the Selling Partners by the Seller Representative.

2.05. Purchase Price Adjustments.

(a) Estimated Working Capital. The Seller Representative has delivered to the Buyer, and the Buyer has reviewed and approved, the good faith estimate attached hereto as Exhibit C of the Net Working Capital as of the close of business on the day prior to the Closing Date (the “Estimated Working Capital”) prepared using the accounting methods, practices, principles, policies, and procedures employed in the preparation of Exhibit D. If the Estimated Working Capital is less than the Target Working Capital, the Closing Date Purchase Price shall be reduced by the amount of such shortfall (the “Working Capital Underage”), subject to further final adjustment as hereinafter provided in this Section 2.05. If the Estimated Working Capital is greater than the Target Working Capital, the Closing Date Purchase Price shall be increased by the amount of such excess (the “Working Capital Overage”), subject to further final adjustment as hereinafter provided in this Section 2.05.

(b) Final Working Capital Statement. Within ninety (90) days after the Closing Date, the Buyer will prepare and deliver, or cause to be prepared and delivered, to the Seller Representative a statement (the “Final Working Capital Statement”) setting forth the calculation of the Net Working Capital as of the Closing (the “Final Working Capital”) prepared using the accounting methods, practices, principles, policies, and procedures employed in the preparation of Exhibit D.

(c) Disputes. Within thirty (30) days following receipt by the Seller Representative of the Final Working Capital Statement, the Seller Representative will deliver written notice (a “Statement of Objections”) to the Buyer of any dispute the Seller Representative has with respect to the content or preparation of such Final Working Capital Statement. A Statement of Objections must describe in reasonable detail the items contained in the Final Working Capital Statement that the Seller Representative disputes and the basis for such disputes. Any items not disputed in the Statement of Objections will be deemed to have been accepted by the Seller Representative. If the Seller Representative does not deliver a Statement of Objections with respect to the Final Working Capital Statement within such thirty (30) day period, such Final Working Capital Statement will be final, conclusive, and binding on the parties hereto. If the Seller Representative delivers a timely Statement of Objections, the Buyer and the Seller Representative will negotiate in good faith to resolve such objections within the period of thirty (30) days immediately following the delivery of the Statement of Objections. If the Seller Representative and the Buyer, notwithstanding such good faith effort, fail to resolve such dispute within such thirty (30) day period, then the Seller Representative and the Buyer will jointly engage the Independent Accountant to resolve such dispute in accordance with the standards set forth in this Section 2.05(c), who, acting as an expert and not an arbitrator, will review only the disputed items identified in the

-20-

4846-4639-0869

Exhibit 2.1

Execution Version

Statement of Objections, and make a final determination of such disputed items and of the Final Working Capital as a result of such review, which determination will be conclusive, final, and binding upon the parties hereto. In resolving any disputed item, the Independent Accountant may not assign a value to any item greater than the greatest value claimed for such item by either party or less than the smallest value claimed for such item by either party. The fees, costs, and expenses of the Independent Accountant will be apportioned between the Seller, on the one hand, and the Buyer, on the other, based upon the relative difference between the Independent Accountant’s resolution of the disputed items and the respective positions of the Seller Representative and the Buyer in respect thereof. The Independent Accountant will make a written determination as soon as practicable, but in any event within thirty (30) days after its engagement pursuant to this Section 2.05(c).

(d) Compliance. For purposes of complying with the terms set forth in Section 2.05(c) and Section 8.09(c), each party will cooperate with and make available to the other party and its representatives, and to the Independent Accountant, all information, records, data, and working papers and will permit access to its facilities and personnel, as may be reasonably required in connection with the preparation and analysis of the (i) Final Working Capital Statement, (ii) Sales Tax Exposure calculation, or (iii) the content of the Sales Tax Spreadsheet and the resolution of any disputes under any such item.

(e) Downward Adjustment. If the Final Working Capital (as finally determined pursuant to Section 2.05(c)) is less than the Estimated Working Capital, then the Purchase Price will be adjusted by the amount of such shortfall and the Seller Representative, on behalf of the Seller and the Selling Partners, will pay, by wire transfer of immediately available funds to an account designated in writing by the Buyer, an amount in cash equal to such shortfall to the Buyer within three (3) Business Days after the date on which the Final Working Capital is finally determined pursuant to Section 2.05(c).

(f) Upward Adjustment. If the Final Working Capital (as finally determined pursuant to Section 2.05(c)) is greater than the Estimated Working Capital, then the Purchase Price will be adjusted by the amount of such excess and the Buyer will pay, or cause to be paid, to the Seller Representative, for the benefit of the Seller and the Selling Partners, by bank wire transfer of immediately available funds to an account designated in writing by the Seller Representative, an amount in cash equal to such excess within three (3) Business Days after the date on which the Final Working Capital is finally determined pursuant to Section 2.05(c).

2.06. Allocation of Purchase Price. Attached hereto as Schedule 2.06 is an allocation for Tax purposes of the Purchase Price and any other items, including Assumed Liabilities and other relevant items (collectively, the “Asset Sale Purchase Price”) among the Purchased Assets and the covenants set forth in Sections 7.03 and 7.04. To the extent the Asset Sale Purchase Price is adjusted, including an adjustment pursuant to Section 2.05, the Buyer and the Seller Representative will amend such allocation to reflect such adjustments. The Buyer and the Seller Representative will file, or cause to be filed, the applicable income Tax Returns (including IRS Forms 8594 and any similar forms required by applicable state, local and foreign Tax Law) on the basis of such allocation, as it may be amended pursuant to the preceding sentence, and no Party will thereafter take a position

-21-

4846-4639-0869

Exhibit 2.1

Execution Version

on a Tax Return or in an audit or other proceeding, or make any election, that is inconsistent with such allocation except upon a determination (as defined in Section 1313(a) of the Code or any similar provision of state, local or foreign Tax Law) by a Taxing Authority; provided that nothing contained herein shall prevent Buyer or Seller or their respective Affiliates from settling any proposed deficiency or adjustment by any Taxing Authority based upon or arising out of the allocation, and none of Buyer or Seller or their respective Affiliates shall be required to litigate before any Governmental Authority any proposed deficiency or adjustment by a Taxing Authority challenging such allocation. Buyer and Seller shall promptly notify each other in the event of an examination, audit or other proceeding regarding the allocation.

ARTICLE III

CLOSING

CLOSING

3.01. Closing. Subject to the terms and conditions of this Agreement, the consummation of the transactions contemplated by this Agreement (the “Closing”) will take place upon execution of this Agreement by the parties, via the exchange of documents and signatures on the Closing Date, and the Closing Date Purchase Price shall be paid via wire transfer(s) of immediately available funds initiated and received on the Closing Date pursuant to Section 2.04(b). All proceedings to be taken and all documents to be executed and delivered by all parties at the Closing will be deemed to have been taken and executed simultaneously and no proceedings will be deemed to have been taken nor documents executed or delivered until all have been taken, executed and delivered and the Closing Date Purchase Price has been paid and received pursuant to Section 2.04(b). The Closing shall be deemed to be effective as of 11:59 p.m. Eastern Daylight Time on the Closing Date.

3.02. Closing Deliverables.

(a) Deliveries of the Seller Representative. At or prior to the Closing, the Seller Representative will deliver, or cause to be delivered, to the Buyer each of the following:

(i) the Escrow Agreement, duly executed by the Seller Representative and the Escrow Agent;

(ii) a Bill of Sale, duly executed by the Seller, respecting the Purchased Assets;

(iii) the Assumption Agreement, duly executed by the Seller;

(iv) the Assignment and Assumption of Cincinnati Lease executed by Seller, as assignor, and by the landlord;

(v) the Lease Agreements, duly executed by the landlord party thereto;

(vi) a reasonably current certificate of good standing of the Seller, certified by the Secretary of State of the state in which the Seller is organized;

-22-

4846-4639-0869

Exhibit 2.1

Execution Version

(vii) resolutions of the general partner of the Seller approving this Agreement and the transactions contemplated hereby, in each case, certified by an officer of the general partner;

(viii) all documents and instruments, executed and delivered in form and substance reasonably acceptable to the Buyer, amending, terminating or assigning (as appropriate) any assumed name or d/b/a filings to eliminate the Seller’s (and each of the Seller’s Affiliates immediately prior to the Closing) right to use the name “ST Fastening Systems”;

(ix) certificates of title and applications to transfer title, if required, to any titled motor vehicles owned by the Seller and constituting Purchased Assets, duly endorsed or otherwise transferred to the Buyer (provided, notwithstanding anything herein to the contrary, Buyer shall promptly cause such titles to be reissued in Buyer’s name, and Buyer shall pay all related sales tax and transfer fees required to be paid in order to have new certificates of title issued in Buyer’s name pursuant to Section 7.08(e));

(x) copyright assignments, in a form reasonably acceptable to the Buyer, transferring to the Buyer all right, title, and interest of Seller in, to, and under all of the Copyrights included in the Purchased Assets, duly executed by the Seller;

(xi) patent assignments, in a form reasonably acceptable to the Buyer, transferring to the Buyer all right, title, and interest of Seller in, to, and under all of the Patents included in the Purchased Assets, duly executed by the Seller;

(xii) trademark assignments, in a form reasonably acceptable to the Buyer, transferring to the Buyer all right, title, and interest of Seller in, to, and under all of the Trademarks included in the Purchased Assets, duly executed by the Seller;

(xiii) payoff letters and appropriate termination statements under the Uniform Commercial Code and other instruments as may be reasonably requested by the Buyer to extinguish all Indebtedness secured by the Purchased Assets and all security interests related thereto, in each case, together with any other evidence of the full release of all Encumbrances reasonably requested by Buyer, relating to any of the Purchased Assets and in a form reasonably satisfactory to the Buyer;

(xiv) a statement from Seller, meeting the requirements of Section 1.1445-2(b)(2) of the Treasury Regulations certifying that Seller is not a “foreign person” within the meaning of Section 1445 of the Code and Treasury Regulations thereunder;

(xv) the Crouch Employment Agreement, duly executed by Crouch;

(xvi) a sales representative agreement, duly executed by each sales consultant set forth on Schedule 5.19(a) (collectively, the “Sales Representative Agreements”); and

(xvii) the consents from third parties set forth on Schedule 3.02(a)(xvii).

-23-

4846-4639-0869

Exhibit 2.1

Execution Version

(b) Deliveries of the Buyer. At or prior to the Closing, the Buyer will deliver, or cause to be delivered:

(i) to the Seller Representative, the following:

a.) |

the balance of the Closing Date Purchase Price, payable in accordance with Section 2.04(b)(iii);

|

b.) |

the Escrow Agreement, duly executed by the Buyer and the Escrow Agent; |

c.) |

the Assumption Agreement, duly executed by the Buyer; |

d.) |

the Assignment and Assumption of Cincinnati Lease, duly executed by Buyer as the assignee; |

e.) |

the Crouch Employment Agreement, duly executed by Buyer; |

f.) |

the Sales Representative Agreements, duly executed by Buyer; and |

g.) |

any other documents required under Section 3.02(a) that require Buyer’s signature.

|

(ii) to the Escrow Agent, an amount equal to the Escrow Amount; and

(iii) to each applicable Person set forth on Schedule 2.04(b), an amount equal to the portion of the Indebtedness or Seller Transaction Costs set forth opposite such Person’s name as provided in Section 2.04(b)(ii).

(c) Notwithstanding the foregoing, the Buyer or the Seller Representative, as the case may be, may waive the delivery of any closing deliverable set forth in Section 3.02(a) (in the case of the Buyer) or Section 3.02(b) (in the case of the Seller Representative), which waiver shall be evidenced by such party’s consummation of the Closing.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES RELATING TO THE SELLING PARTNERS

REPRESENTATIONS AND WARRANTIES RELATING TO THE SELLING PARTNERS

Each Selling Partner represents and warrants to the Buyer as follows:

4.01. Authority. Joedy S. Hargis is the successor trustee of the Hargis Trusts. Each Selling Partner has the capacity to execute, deliver, and perform such Selling Partner’s obligations under this Agreement and each Transaction Document to which such Selling Partner is a party. This Agreement and each of the Transaction Documents to which such Selling Partner is a party, as applicable, has been duly executed by such Selling Partner, and (assuming due authorization,

-24-

4846-4639-0869

Exhibit 2.1

Execution Version

execution, and delivery by the Buyer) constitutes a legal, valid, and binding obligation of such Selling Partner in accordance with their respective terms.

4.02. No Conflicts; Consents. Except as set forth on Schedule 4.02, neither the execution and delivery of this Agreement and the Transaction Documents, nor the performance by such Selling Partner of such Selling Partner’s obligations hereunder or thereunder will: (a) conflict with or result in a violation or other breach of any Law or Order applicable to such Selling Partner, (b) require the consent, notice, or other action by any Person under, conflict with, result in a violation or breach of, or constitute a default or an event that, with or without notice or lapse of time or both, would constitute a default under, result in the acceleration of, or create in any party the right to accelerate, terminate, modify, or cancel any Contract or Permit to which such Selling Partner is a party or by which such Selling Partner is bound, or (c) result in the creation or imposition of any Encumbrance on the Purchased Assets.

4.03. Legal Proceedings. There is no Order or Action pending or, to the actual knowledge of such Selling Partners, threatened against any Selling Partner that would give any Person the right to enjoin or rescind the transactions contemplated by this Agreement or otherwise prevent such Selling Partner from performing its obligations under this Agreement or under any Transaction Document to which such Selling Partner is a party or from otherwise complying with the terms of this Agreement.

ARTICLE V

REPRESENTATIONS AND WARRANTIES OF THE SELLER AND THE SELLING PARTNERS

REPRESENTATIONS AND WARRANTIES OF THE SELLER AND THE SELLING PARTNERS

The Seller and the Selling Partners, jointly and severally, represent and warrant to the Buyer as follows:

5.01. Existence and Good Standing. The Seller is duly organized, validly existing, and in good standing under the laws of Texas and the Seller is duly licensed or qualified to do business as a foreign limited partnership in each of the jurisdictions set forth on Schedule 5.01, which are the only jurisdictions in which the Seller is required to be so qualified. The Seller owns the Purchased Assets and operates the Business.

5.02. Indebtedness; Subsidiaries. Schedule 5.02 sets forth a true and complete list of the individual components (indicating the amount and the Person to whom such amount is owed) of all Indebtedness outstanding with respect to the Seller. The Seller has no subsidiaries.

5.03. Power; Validity and Enforceability. The Seller has the requisite, full power and authority (as applicable) necessary to (i) own, operate, and lease its properties and assets (including the Purchased Assets) as and where currently owned, operated, and leased in the operation of the Business, (ii) carry on the Business as currently conducted by the Seller, and (iii) execute and deliver this Agreement and the Transaction Documents to which the Seller is a party and to perform the Seller’s obligations hereunder and thereunder. The execution and delivery by the Seller of this Agreement and the Transaction Documents to which the Seller is a party, the performance by the

-25-

4846-4639-0869

Exhibit 2.1

Execution Version

Seller of its obligations hereunder and thereunder, and the consummation by the Seller of the transactions contemplated hereby and thereby have been duly authorized by all requisite action on the part of the Seller. This Agreement has been duly executed and delivered by the Seller and (assuming due authorization, execution, and delivery by the Buyer) this Agreement constitutes a legal, valid, and binding obligation of the Seller enforceable against the Seller in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar Laws affecting creditors' rights generally and by general principles of equity (regardless of whether enforcement is sought in a proceeding at law or in equity). When each Transaction Document to which the Seller is, or will be, a party has been duly executed and delivered by the Seller (assuming due authorization, execution, and delivery by the Buyer where applicable), each such Transaction Document will constitute a legal and binding obligation of the Seller enforceable against the Seller in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, moratorium or similar Laws affecting creditors' rights generally and by general principles of equity (regardless of whether enforcement is sought in a proceeding at law or in equity).

5.04. No Conflicts; Consents. The execution and delivery of this Agreement and the Transaction Documents to which it is a party, and the performance by the Seller of the Seller’s obligations hereunder or thereunder do not and will not: (a) conflict with or result in a violation or breach of any provision of the organizational documents of the Seller, (b) conflict with or result in a violation or other breach of any Law or Order applicable to the Seller, the Purchased Assets, or the Business, (c) except as set forth in Schedule 5.04, require the consent, notice, or other action by any Person under, conflict with, result in a violation or breach of, or constitute a default or an event that, with or without notice or lapse of time or both, would constitute a default under, result in the acceleration of, or create in any party the right to accelerate, terminate, modify, or cancel any Material Contract, or (d) result in the creation or imposition of any Encumbrances on any Purchased Assets; except in the cases of clauses (b) and (c), where the violation, breach, conflict, default, acceleration or failure to give notice would not have, individually or in the aggregate, a Material Adverse Effect. No consent, approval, Permit, Order, declaration or filing with, or notice to, any Governmental Authority is required by Seller or with respect to the Seller in connection with the execution and delivery of this Agreement or any of the Transaction Documents and the consummation of the transactions contemplated hereby and thereby, except for such filings as set forth on Schedule 5.04, and any other consents, approvals, Permits, Governmental Orders, declarations, filings or notices which, individually or in the aggregate, would not have a Material Adverse Effect.

5.05. Financial Statements; Undisclosed Liabilities.

(a) Schedule 5.05 includes true, complete, and correct copies of (i) the audited balance sheets of the Seller as of September 30, 2016, September 30, 2015, and September 30, 2014, and the related audited statement of income, partners’ equity, and cash flows for the fiscal years then ended, together with the notes thereto, and the other financial information included therewith, and (ii) the audited balance sheet of the Seller as of September 30, 2017 (the “Balance Sheet Date”) and the related audited statement of income, partners’ equity, and cash flows for the fiscal year then ended (collectively, the “Financial Statements”).

-26-

4846-4639-0869

Exhibit 2.1

Execution Version

(b) The Financial Statements (including, without limitation, Inventory and Accounts Receivable) present fairly, in all material respects, the financial position, results of operations, partners’ equity, and cash flows of the Seller at the dates and for the time periods indicated. The Financial Statements have been prepared in accordance with GAAP applied on a consistent basis throughout the period involved. The Financial Statements were derived from the books and records of the Seller. The books of account of the Seller and to which the Buyer and its Representatives have been provided access are true, accurate, and complete, have been maintained in accordance with good business practices and fairly reflect all of the properties, assets, Liabilities, and transactions of the Seller. The internal controls and procedures of the Seller are sufficient to ensure that the Financial Statements are true, correct, and complete in all material respects.

(c) The Inventory of the Seller is of a quality and quantity useable and saleable in the Ordinary Course of Business, subject to allowances reflected on the Financial Statements for obsolete, excess, slow-moving, and other irregular items. Such allowances have been calculated in accordance with GAAP and in a manner consistent with past practice. The quantities of each item of Inventory (whether raw materials, work-in-process, or finished goods) are reasonable in the present circumstances of the Seller. None of the Seller’s Inventory is held on consignment, or otherwise, by third parties.

5.06. Absence of Certain Changes, Events, and Conditions. Except as disclosed on Schedule 5.06, since the Balance Sheet Date, the Business has been conducted in the Ordinary Course of Business and there have not occurred any facts, events, developments, or circumstances that constitute, or are reasonably likely to result in, a Material Adverse Effect, and without limiting the generality of the foregoing, since the Balance Sheet Date, the Seller has not:

(a) amended any of the Seller’s organizational documents;

(b) changed any method of accounting or accounting practice, including any changes to Tax reporting or accounting principles;

(c) entered into, amended, or terminated any Material Contract, except as disclosed in the Schedules;

(d) incurred, assumed, or Guaranteed any Indebtedness, borrowed any amount, or become subject to any Liability other than (i) Liabilities incurred in the Ordinary Course of Business, (ii) Liabilities under Contracts entered into in the Ordinary Course of Business, and (iii) borrowings under lines of credit and other facilities;

(e) transferred, assigned, sold, or otherwise disposed of any of the assets or properties shown or reflected in the balance sheet included in the Financial Statements, other than in the Ordinary Course of Business;

(f) transferred, assigned, or granted any license or sublicense of any rights under or with respect to any Intellectual Property Assets;

(g) accelerated, terminated, modified, or cancelled any Permit;

-27-

4846-4639-0869

Exhibit 2.1

Execution Version

(h) incurred capital expenditures or commitments therefor except in the Ordinary Course of Business;

(i) sold, assigned, transferred (including, without limitation, transfers to any Employees, members, or Affiliates), licensed, or subjected to any Encumbrance any tangible or intangible assets or properties, other than sales of Inventory or other assets in the Ordinary Course of Business;