PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on April 4, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

___________________________________

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

___________________________________

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☒ | Preliminary Proxy Statement | ||||

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | ||||

| ☐ | Definitive Proxy Statement | ||||

| ☐ | Definitive Additional Materials | ||||

| ☐ | Soliciting Material Pursuant to §240.14a-12 | ||||

_________________________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

_________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||||||||||||

| ☐ | Fee paid previously with preliminary materials. | |||||||||||||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||||||||||||

|

|||||

|

NOTICE OF 2024

ANNUAL MEETING

To be held June 7, 2024

| |||||

|

FELLOW HILLMAN STOCKHOLDERS:

We are pleased to invite you to join us for Hillman’s 2024 Annual Meeting of Stockholders on June 7, 2024 at 10:30 a.m. Eastern Time. In order to make the meeting more accessible for investors, the 2024 Annual Meeting of Stockholders will be conducted via webcast only. You will be able to participate in the virtual meeting online, vote your shares electronically, examine our list of stockholders, and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/HLMN2024.

|

When | ||||||||||

June 7, 2024 at 10:30 a.m. Eastern Time.

|

|||||||||||

| ITEMS OF BUSINESS: | Where | ||||||||||

| 01 | Elect four directors, each for a term that expires in 2027. | ||||||||||

Online at: www.virtualshareholdermeeting.com/HLMN2024

|

|||||||||||

| 02 | Approve, by non-binding vote, the compensation of our named executive officers. | ||||||||||

| 03 | Amend our certificate of incorporation to declassify the Board by the 2027 Annual Meeting of Stockholders. | Who Can Vote | |||||||||

| 04 | Amend our certificate of incorporation to eliminate supermajority voting provisions. |

Holders of Hillman common stock at the close of business on the record date of April 12, 2024 are entitled to notice of and to vote

at the meeting.

|

|||||||||

| 05 | Amend our certificate of incorporation to provide for officer exculpation of liability. | ||||||||||

| 06 | Amend our certificate of incorporation to eliminate the sponsor corporate opportunity provision. |

||||||||||

| 07 | Amend our certificate of incorporation to eliminate the sponsor business combination provision. | ||||||||||

| 08 | Amend our bylaws to eliminate supermajority voting provisions. | ||||||||||

| 09 | Approve an increase in number of shares reserved under our 2021 Equity Incentive Plan. | ||||||||||

| 10 | Ratify the selection of Deloitte & Touche LLP as our independent auditor for fiscal year 2024. |

||||||||||

| 11 | Transact other business as may properly come before the meeting. |

||||||||||

|

ATTENDING THE MEETING

Stockholders holding shares at the close of business on the record date may attend the virtual meeting. You will be able to attend the Annual Meeting, vote, examine our list of stockholders, and submit your questions 15 minutes in advance of, and in real-time during, the meeting by a live audio webcast by visiting www.virtualshareholdermeeting.com/HLMN2024. To participate in the meeting, you must have your sixteen-digit control number that is shown on your Notice of Internet Availability of Proxy Materials or on your proxy card if you receive the proxy materials by mail. You will not be able to attend the Annual Meeting in person.

|

|||||||||||

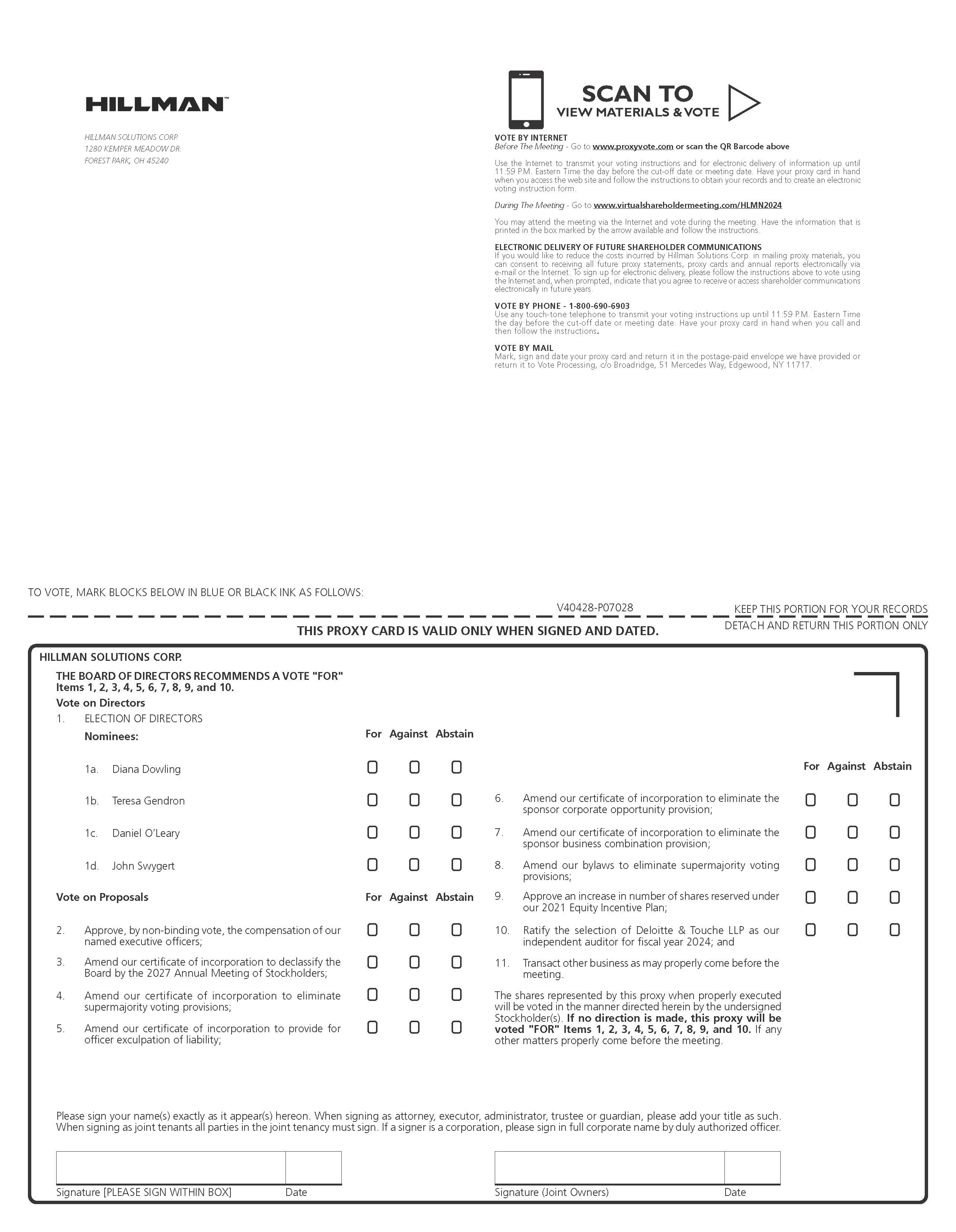

| Ways to Vote | ||

Your vote is important! Please vote your proxy in one of the following ways:

By internet

By visiting www.proxyvote.com.

|

By telephone

By calling the number on your proxy card or voting instruction form.

|

By mail

By marking, signing, dating, and mailing your proxy card if you requested printed materials, or your voting instruction form. No postage is required if mailed in the United States.

|

By mobile

By scanning

the QR code on your proxy card, notice of internet availability of proxy materials, or voting instruction form.

|

Real time

By voting electronically during the virtual Annual Meeting at www.virtualshareholdermeeting.com/HLMN2024.

|

||||||||||||||||||||||

We appreciate your continued confidence in Hillman and we look forward to your participation in our virtual meeting.

By Order of the Board of Directors,

Douglas J. Cahill

Chairman of the Board, President, and Chief Executive Officer

Hillman Solutions Corp.

April [●], 2024

Cincinnati, Ohio

|

TABLE OF CONTENTS

2024 PROXY STATEMENT

|

|||||

Board Diversity Matrix (as of April [●], 2024) |

|||||||||||

|

PROXY STATEMENT

FOR THE 2024 ANNUAL MEETING

|

|||||

FELLOW HILLMAN STOCKHOLDERS:

We are providing this notice, proxy statement, and annual report to the stockholders of Hillman Solutions Corp. (“Hillman”, “we”, “us”, “our”) in connection with the solicitation of proxies by the Board of Directors of Hillman (the “Board”) for use at the Annual Meeting of Stockholders to be held on June 7, 2024, at 10:30 a.m. Eastern Time (the “Annual Meeting”), and at any adjournments thereof. The Annual Meeting will be held virtually and can be accessed online at www.virtualshareholdermeeting.com/HLMN2024. There is no physical location for the Annual Meeting of Stockholders.

Our principal executive offices are located at 1280 Kemper Meadow Dr., Forest Park, Ohio 45240. Our telephone number is 513-851-4900. This notice, proxy statement, and annual report, and the accompanying proxy card were first furnished to stockholders on April [●], 2024.

QUESTIONS AND ANSWERS

| Why are you holding a virtual meeting? | ||

In order to make the meeting more accessible for our global investor base, our 2024 Annual Meeting is being held on a virtual-only basis with no physical location. Our goal for the Annual Meeting is to enable the broadest number of stockholders to participate in the meeting, while providing substantially the same access and exchange with the Board and Management as an in-person meeting. We believe that we are observing best practices for virtual stockholder meetings, including by providing a support line for technical assistance and addressing as many stockholder questions as time allows. | ||

| Who can vote? | ||

You can vote if, as of the close of business on April 12, 2024, you were a stockholder of record of Hillman common shares. | ||

| Who is asking for my vote, and who pays for this proxy solicitation? | ||

|

Your proxy is being solicited by Hillman’s Board. Hillman is paying the cost of solicitation. We also will reimburse banks, brokers, nominees, and other fiduciaries for postage and reasonable expenses incurred by them in forwarding the proxy material to beneficial owners of our common shares.

Proxies may be solicited personally, by telephone, electronically by Internet, or by mail.

| ||

|

2024 Proxy Statement | 1

|

|||||||

| How do I vote my proxy? | ||

|

You can vote your proxy in one of the following ways:

1.By internet, by visiting www.proxyvote.com.

2.By telephone, by calling the number on your proxy card, voting instruction form, or notice.

3.By mail, by marking, signing, dating, and mailing your proxy card if you requested printed materials, or your voting instruction form. No postage is required if mailed in the United States.

4.By mobile device, by scanning the QR code on your proxy card, notice of internet availability of proxy materials, or voting instruction form.

5.By voting electronically during the virtual Annual Meeting at www.virtualshareholdermeeting.com/HLMN2024.

| ||

| How can I participate and ask questions at the Annual Meeting? | ||

|

We are committed to ensuring that our stockholders have substantially the same opportunities to participate in the virtual Annual Meeting as they would at an in-person meeting. In order to submit a question at the Annual Meeting, you will need your 16-digit control number that is printed on the notice or proxy card that you received in the mail, or by email if you have elected to receive material electronically. You may log in 15 minutes before the start of the Annual Meeting and submit questions online. We encourage you to submit any question that is relevant to the business of the meeting. Questions asked during the Annual Meeting will be read and addressed during the meeting as time allows. Stockholders are encouraged to log into the webcast 15 minutes prior to the start of the meeting to test their Internet connectivity. | ||

| What documentation must I provide to be admitted to the virtual Annual Meeting and how do I attend? | ||

|

If your shares are registered in your name, you will need to provide your sixteen-digit control number included on your notice or your proxy card (if you receive a printed copy of the proxy materials) in order to be able to participate in the meeting. If your shares are not registered in your name (if, for instance, your shares are held in “street name” for you by your broker, bank, or other institution), you must follow the instructions printed on your Voting Instruction Form.

In order to participate in the Annual Meeting, please log on to www.virtualshareholdermeeting.com/HLMN2024 at least 15 minutes prior to the start of the Annual Meeting to provide time to register and download the required software, if needed. A replay of the webcast will be available at www.virtualshareholdermeeting.com/HLMN2024 until the 2025 Annual Meeting of Stockholders. If you access the meeting but do not enter your control number, you will be able to listen to the proceedings, but you will not be able to vote or otherwise participate.

| ||

What if I have technical or other “IT” problems logging into or participating in the Annual Meeting webcast? | ||

| We have provided a toll-free technical support “help line” on the virtual Annual Meeting login page that can be accessed by any stockholder who is having challenges logging into or participating in the virtual Annual Meeting. If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support line number that will be posted on the virtual Annual Meeting login page. | ||

2 | 2024 Proxy Statement

|

|

|||||||

| What documentation must I provide to vote online at the Annual Meeting? | ||

If you are a stockholder of record at the close of business on April 12, 2024 and provide your sixteen-digit control number when you access the meeting, you may vote all shares registered in your name during the Annual Meeting webcast. If you are not a stockholder of record as to any of your shares (i.e., instead of being registered in your name, all or a portion of your shares are registered in “street name” and held by your broker, bank, or other institution for your benefit), you must follow the instructions printed on your Voting Instruction Form. | ||

How do I submit a question at the Annual Meeting? | ||

If you would like to submit a question during the Annual Meeting, once you have logged into the webcast at www.virtualshareholdermeeting.com/HLMN2024, simply type your question in the “Ask a Question” box and click “submit”. You may submit questions beginning 15 minutes prior to the Annual Meeting start time. | ||

| When should I submit my question at the Annual Meeting? | ||

We anticipate having a question-and-answer session following the formal business portion of the meeting during which stockholders may submit questions. Stockholders can submit a question beginning 15 minutes prior to the start of the Annual Meeting and up until the time we indicate that the question-and-answer session is concluded. However, we encourage you to submit your questions before or during the formal business portion of the meeting and our prepared statements, in advance of the question-and-answer session, in order to ensure that there is adequate time to address questions in an orderly manner. | ||

Can I change or revoke my proxy? | ||

The shares of common stock represented by each proxy will be voted in the manner you specified unless your proxy is revoked before it is exercised. You may change or revoke your proxy by providing written notice to Hillman’s Secretary at 1280 Kemper Meadow Dr., Forest Park, Ohio 45240, by executing and sending us a subsequent proxy, or by voting your shares while logged in and participating in the 2024 Annual Meeting of Stockholders. | ||

| How many shares are outstanding? | ||

As of the close of business on the record date, April 12, 2024, our outstanding voting securities consisted of [●] shares of common stock. | ||

How many votes per share? | ||

Each share of common stock outstanding on the record date will be entitled to one vote on each of the four director nominees and one vote on each other proposal. Stockholders may not cumulate votes in the election of directors. | ||

| What voting instructions can I provide? | ||

You may instruct the proxies to vote “For” or “Against” each proposal, or you may instruct the proxies to “Abstain” from voting. | ||

|

2024 Proxy Statement | 3

|

|||||||

| What happens if proxy cards or voting instruction forms are returned without instructions? | ||

|

If you are a registered stockholder and you return your proxy card without instructions, the proxies will vote in accordance with the recommendations of the Board.

If you hold shares in street name and do not provide your broker with specific voting instructions on Proposals 1-9, which are considered non-routine matters, your broker does not have the authority to vote on those proposals. This is generally referred to as a “broker non-vote.” Proposal 10, ratification of auditors, is considered a routine matter and, therefore, your broker may vote your shares according to your broker’s discretion.

The vote required, including the effect of broker non-votes and abstentions for each of the matters presented for stockholder vote, is set forth below.

| ||

What are the voting requirements and voting recommendation for each of the proposals? | ||

| Proposals | Board Recommendation | Voting Approval Standard | Effect of Abstention |

Effect of Broker Non-vote |

|||||||||||||

| 01 | Election of Directors |

FOR

each Director Nominee

|

More votes “FOR” than “AGAINST” since an uncontested election | No Effect | No Effect | ||||||||||||

| 02 | Non-Binding Vote to approve Executive Compensation | FOR | Affirmative vote of the majority of shares participating in the vote | No Effect | No Effect | ||||||||||||

| 03 | Amend Charter to Declassify the Board | FOR | Affirmative vote of at least 66% of the outstanding shares | Same as “AGAINST” | Same as “AGAINST” | ||||||||||||

| 04 | Amend Charter to Eliminate Supermajority Voting | FOR | Affirmative vote of at least 66% of the outstanding shares | Same as “AGAINST” | Same as “AGAINST” | ||||||||||||

| 05 | Amend Charter to Provide Officer Exculpation | FOR | Affirmative vote of at least 66% of the outstanding shares | Same as “AGAINST” | Same as “AGAINST” | ||||||||||||

| 06 | Amend Charter to Eliminate Sponsor Corporate Opportunity Provision | FOR | Affirmative vote of at least 66% of the outstanding shares | Same as “AGAINST” | Same as “AGAINST” | ||||||||||||

| 07 | Amend Charter to Eliminate Sponsor Business Combination Provision | FOR | Affirmative vote of at least 66% of the outstanding shares | Same as “AGAINST” | Same as “AGAINST” | ||||||||||||

| 08 | Amend Bylaws to Eliminate Supermajority Voting | FOR | Affirmative vote of at least 66% of the outstanding shares | Same as “AGAINST” | Same as “AGAINST” | ||||||||||||

| 09 | Increase Shares Reserved under 2021 Equity Incentive Plan | FOR | Affirmative vote of the majority of shares participating in the vote | No Effect | No Effect | ||||||||||||

| 10 | Ratification of Independent Auditors | FOR | Affirmative vote of the majority of shares participating in the vote | No Effect | Not Applicable | ||||||||||||

4 | 2024 Proxy Statement

|

|

|||||||

|

ITEM NO. 1

ELECTION OF DIRECTORS

|

|||||

|

||||||||

|

The Board recommends that

you vote FOR the election

of all director nominees.

|

||||||||

| Nominees for Term to Expire in 2027 | ||

|

Diana

Dowling

Director

|

Teresa

Gendron

Director

|

Daniel

O’Leary

Director

|

John

Swygert

Director

|

|||||||||||||||||||||||||||||

YOU ARE BEING ASKED TO ELECT FOUR DIRECTOR NOMINEES FOR A TERM EXPIRING IN 2027.

As of the date of this proxy statement, the Board consists of nine members and is divided into one class of four members, one class of three members, and one class of two members. The members of the three classes are elected to serve for staggered terms of three years. However, Proposal 3, if approved by our stockholders at this Annual Meeting, would amend our certificate of incorporation to declassify the Board by the 2027 Annual Meeting of Stockholders, at which time all directors would be elected annually. See Proposal 3 for additional details.

Each of the nominees is a current director of the Company who has consented to stand for re-election to the Board with a term expiring at the Company’s 2027 Annual Meeting of Stockholders. In the event that any of the nominees becomes unavailable to serve as a director before the Annual Meeting, the Board may designate a new nominee, and the persons named as proxies will vote for that substitute nominee.

|

2024 Proxy Statement | 5

|

|||||||

Director Qualifications and Attributes | ||

The Nominating and ESG Committee is responsible for developing and recommending to the Board a set of director qualifications and attributes that are applicable to the Company’s business and strategic direction. The Nominating and ESG Committee evaluates each director candidate on the basis of the length, breadth and quality of the candidate’s business experience, the applicability of the candidate’s skills and expertise to the Company’s business and strategic direction, the perspectives that the candidate would bring to the entire Board, and the personality or “fit” of the candidate with our culture, existing members of the Board, and management.

The following are descriptions of the qualifications and attributes that the Board believes are important in effective oversight of the Company, listed in alphabetical order:

| Qualifications and Attributes | Relevance to Hillman | ||||||||||

| Diversity | We believe diversity strengthens our competitive advantage and reflects the consumers we serve. | ||||||||||

| Finance | Our business involves complex financial transactions and reporting requirements. | ||||||||||

| Governance | As a public company, we and our stockholders expect effective oversight and transparency. | ||||||||||

| Human Capital Management | Directors with experience in organizational management and talent development provide key insights into developing and investing in our employees. | ||||||||||

| Information Technology / Cybersecurity | We rely on technology to manage customer, employee and supplier data and deliver products and services to the market, and it is important to protect this data. | ||||||||||

| Marketing / Communications | Effective marketing and communications are critical to building customer loyalty, deepening customer engagement, and expanding market share. | ||||||||||

| Mergers & Acquisitions | Ability to assess M&A opportunities for a strategic fit, strong value creation potential, and clear execution capacity. | ||||||||||

| Product Development | Ideation, research and development, and commercialization of products and services are critical to our growth and customer retention. | ||||||||||

| Retail / Merchandising | Experience in the retail industry provides a relevant understanding of the business, strategy and marketplace dynamics of our customers and the markets we serve. | ||||||||||

| Senior Leadership | The significant leadership experience that comes from a senior leadership role can provide insight on business operations, driving growth, and building and strengthening corporate culture. | ||||||||||

| Strategic Management | Our Board regularly reviews and has input on our strategic plan, which guides our long-term business investments and objectives and our capital allocation. | ||||||||||

| Supply Chain | Upstream and downstream supply chain management, structure and design are critical to our strategic initiatives and sourcing. | ||||||||||

6 | 2024 Proxy Statement

|

|

|||||||

Directors and director nominees self-identified their qualifications, attributes, and expertise gained through their varied backgrounds and industries. The overall qualifications and attributes represented on the Board, as identified by the directors, is demonstrated through the following chart:

| Qualifications and Attributes | Cahill | Dowling | Gendron | Honda | Jagdfeld | O’Leary | Owens | Swygert | Woodlief | ||||||||||||||||||||

| Diversity | n | n | n | n | n | ||||||||||||||||||||||||

| Finance | n | n | n | n | n | n | n | n | |||||||||||||||||||||

| Governance | n | n | n | n | n | n | n | ||||||||||||||||||||||

| Human Capital Management | n | n | n | n | n | n | n | n | |||||||||||||||||||||

| Information Technology / Cybersecurity | n | n | |||||||||||||||||||||||||||

| Marketing / Communications | n | n | n | n | |||||||||||||||||||||||||

| Mergers & Acquisitions | n | n | n | n | n | n | n | ||||||||||||||||||||||

| Product Development | n | n | n | n | |||||||||||||||||||||||||

| Retail/ Merchandising | n | n | n | ||||||||||||||||||||||||||

| Senior Leadership | n | n | n | n | n | n | n | n | |||||||||||||||||||||

| Strategic Management | n | n | n | n | n | n | n | n | n | ||||||||||||||||||||

| Supply Chain | n | n | n | ||||||||||||||||||||||||||

|

2024 Proxy Statement | 7

|

|||||||

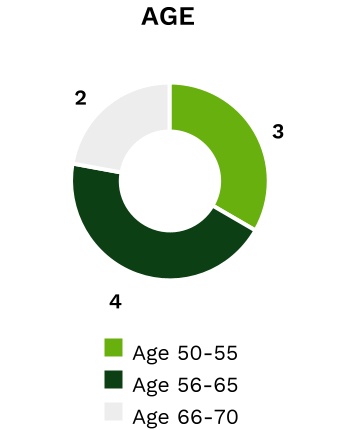

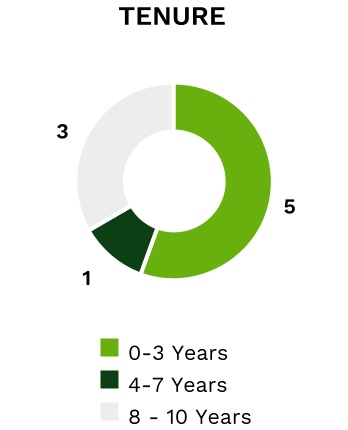

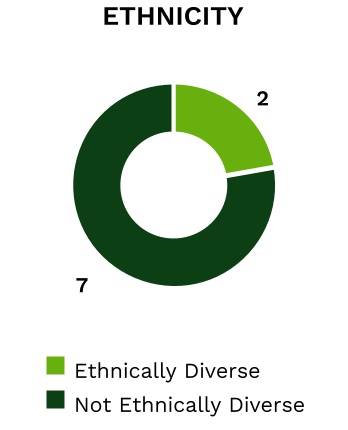

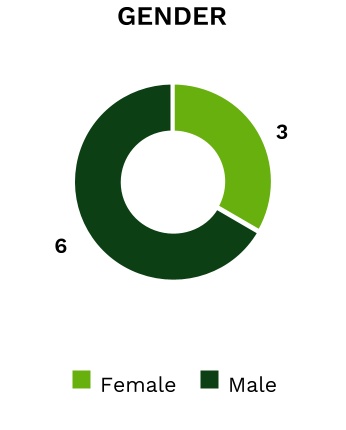

Board Diversity Matrix (as of April [●], 2024 ) | ||

The Board believes the Company benefits from the diversity of experience and perspectives of its members. The following Board Diversity Matrix in the format required under applicable Nasdaq rules:

| Total Number of Directors | 9 | |||||||||||||

| Female | Male | Nonbinary | Did Not Disclose Gender |

|||||||||||

| Part I: Gender Identity | ||||||||||||||

| Directors | 3 | 6 | - | - | ||||||||||

| Part II: Demographic Background | ||||||||||||||

| African American or Black | - | 1 | - | - | ||||||||||

| Alaskan Native or Native American | - | - | - | - | ||||||||||

| Asian | - | - | - | - | ||||||||||

| Hispanic or Latinx | - | 1 | - | - | ||||||||||

| Native Hawaiian or Pacific Islander | - | - | - | - | ||||||||||

| White | 3 | 5 | - | - | ||||||||||

| Two or More Races or Ethnicities | - | 1 | - | - | ||||||||||

| LGBTQ+ | - | |||||||||||||

| Did Not Disclose Demographic Background | - | |||||||||||||

Board Diversity | ||

8 | 2024 Proxy Statement

|

|

|||||||

| Director Nominees for a Term to Expire in 2027 | ||

The experience, qualifications, attributes, and skills that led the Nominating and ESG Committee and the Board to conclude that the following individuals should serve as directors are set forth below. The committee memberships stated below are those in effect as of the date of this proxy statement. References to director service to Hillman include service to our predecessor companies HMAN Group Holdings, Inc. and The Hillman Companies, Inc., as applicable.

|

|||||||||||||||||

|

Diana Dowling

Director | Age: 58 | Director Since: 2021

Committee: Compensation, Nominating and ESG

|

|||||||||||||||||

| Ms. Dowling has been an innovation and strategy consultant advising corporations on partnerships, M&A activity, and new product initiatives since 2017. Her recent clients include Epiq, where she focused on data privacy products and acquisitions, and Pitney Bowes, where she focused on mobile location data and ecommerce. While consulting at Pitney Bowes, Ms. Dowling led both the business strategy for the Newgistics acquisition, as well as the post-merger integration. She is also the CEO/Founder of Two Hudson Ventures, investing in start-ups and real estate. Earlier in her career, Ms. Dowling was a VP of Business Development at MaMaMedia, a digital media startup, and Director of Business Development at Hearst New Media. In addition, she worked as a market research analyst at Tontine Partners. Ms. Dowling began her career as an analyst and associate at Bankers Trust. She was Executive Director of Harvard Business School Alumni Angels NY, as well as Co-Chair of HBSCNY Entrepreneurship. Ms. Dowling was selected to serve on our board of directors due to her experience in digital marketing, e-commerce, data and analytics, innovation, new business development, and M&A. | |||||||||||||||||

|

2024 Proxy Statement | 9

|

|||||||

|

|||||||||||||||||

|

Teresa Gendron

Director | Age: 54 | Director Since: 2021

Committee: Audit

|

|||||||||||||||||

Ms. Gendron was Chief Financial Officer of Markel Corporation (NYSE: MKL) from March 2023 to December 2023. Previously, Ms. Gendron had been the Vice President and Chief Financial Officer of Jefferies from 2014 to 2023. From 2011 to 2014, Ms. Gendron was the Vice President and Controller of Gannett Co., Inc., a NYSE listed international media and marketing solutions company, and performed the duties of Chief Accounting Officer. Previously, Ms. Gendron was Vice President and Controller at NII Holdings, Inc., a mobile communication services company, which she joined as its Finance Director in 1998. Ms. Gendron was selected to serve on our board of directors due to her financial and business experience. |

|||||||||||||||||

|

|||||||||||||||||

|

Daniel O’Leary

Director | Age: 68 | Director Since: 2021

Lead Independent Director

Committee: Audit, Nominating and ESG

|

|||||||||||||||||

Mr. O’Leary is an independent consultant who served as President and CEO of Edgen Murray Corporation from 2003 to 2021. He was appointed Chairman of the board of Edgen Murray in 2006. He began at Edgen Murray, a distributor for energy infrastructure components, specialized oil and gas parts and equipment, and its predecessor companies in 2003, guiding a management buyout that grew the company through a series of acquisitions and growth initiatives. The company went public in May 2012 and was acquired in 2013 by Sumitomo Corporation. Mr. O'Leary has served on the board of Vitesse Energy, Inc. (NYSE: VTS), and has been designated as Lead Director, since 2023 and Custom Ecology, Inc. since 2021. Additionally, he served as an independent director on the board of Sprint Industrial from 2017 to 2019. Mr. O’Leary has a long career in leadership positions in manufacturing and distribution, principally in the oil and gas and energy infrastructure markets. Mr. O’Leary was selected to serve on our board of directors due to his extensive management, operational, investment, and business experience. |

|||||||||||||||||

10 | 2024 Proxy Statement

|

|

|||||||

|

|||||||||||||||||

|

John Swygert

Director | Age: 55 | Director Since: 2021

Committee: Audit

|

|||||||||||||||||

Mr. Swygert has been the President, Chief Executive Officer, and a Director of Ollie’s Bargain Outlet Holdings, Inc. (Nasdaq: OLLI) since December 2019. Prior to this appointment, Mr. Swygert was Ollie’s Executive Vice President and Chief Operating Officer since January 2018. Mr. Swygert joined Ollie’s in March 2004 as Chief Financial Officer and was later promoted to Executive Vice President and Chief Financial Officer in 2011. Mr. Swygert has worked in discount retail as a finance professional for over 30 years. Prior to joining Ollie’s, Mr. Swygert was Executive Vice President and Chief Financial Officer at Factory 2-U Stores, Inc. He held several positions while at Factory 2-U Stores from 1992, ranging from Staff Accountant, Assistant Controller, Controller, Director of Financial Planning and Analysis, Vice President of Finance and Planning, and Executive Vice President and Chief Financial Officer. Mr. Swygert also previously worked for PETCO Animal Supplies, Inc. in Business Development and Financial Analysis. Mr. Swygert previously served on the board of Truck Hero Holdings, Inc. from 2018 through January 2021. Mr. Swygert was selected to serve on our board of directors due to his extensive financial, operational and management experience in the retail field. |

|||||||||||||||||

|

2024 Proxy Statement | 11

|

|||||||

Continuing Directors – Term to Expire in 2025 | ||

|

|||||||||||||||||

|

Douglas J. Cahill

Chairman, President, and Chief Executive Officer

Age: 64 | Director Since: 2014

|

|||||||||||||||||

Mr. Cahill has been our Chairman since 2014 and Hillman’s President and Chief Executive Officer since 2019. Prior to joining Hillman, Mr. Cahill was a Managing Director of CCMP from July 2014 to July 2019 and was a member of CCMP’s Investment Committee and previously was an Executive Adviser of CCMP from March 2013. Mr. Cahill served as President and Chief Executive Officer of Oreck, the manufacturer of upright vacuums and cleaning products, from May 2010 until December 2012. Prior to joining Oreck, Mr. Cahill served for eight years as President and Chief Executive Officer of Doane Pet Care Company, a private label manufacturer of pet food and former CCMP portfolio company, through to its sale to MARS Inc. in 2006. From 2006 to 2009, Mr. Cahill served as president of Mars Petcare U.S. Prior to joining Doane in 1997, Mr. Cahill spent 13 years at Olin Corporation, a diversified manufacturer of metal and chemicals, where he served in a variety of managerial and executive roles. Mr. Cahill serves as a Board Member for Junior Achievement of Middle Tennessee and the Visitor Board at Vanderbilt University’s Owen Graduate School of Management. In January 2009, Mr. Cahill was appointed as an Adviser to Mars Incorporated. Mr. Cahill previously served as a director of Banfield Pet Hospital from 2006 to 2016, Ollie’s Bargain Outlet (Nasdaq: OLLI) from 2013 to 2016, Jamieson Laboratories from 2014 to 2017, Founder Sport Group from 2016 to 2019, and Shoes for Crews from 2015 to 2019. Mr. Cahill serves as the Chairman of our board of directors due to his financial, investment, and extensive management experience. |

|||||||||||||||||

12 | 2024 Proxy Statement

|

|

|||||||

|

|||||||||||||||||

|

Diane Honda

Director | Age: 59 | Director Since: 2023

Committee: Compensation

|

|||||||||||||||||

| Ms. Honda most recently served as the Chief Administrative Officer, General Counsel, & Secretary of Barracuda Networks, a cybersecurity and data protection company, through January 2024. During her 12 years at Barracuda, Ms. Honda built and led the Human Resources, Legal, Compliance, Information Security, and Real Estate functions. Prior to joining Barracuda in 2012, she held leading technical and business operations roles at Fortune 50 and mid-size public companies. She has years of transformational experience in leadership positions on both corporate and non-profit boards, and is currently on the Board of Directors and a member of the Audit Committee of Lucidworks, Inc., a privately held provider of next-generation AI-powered search applications. Ms. Honda was initially selected to serve on our board of directors due to her extensive cybersecurity, human capital, legal and corporate governance experience. | |||||||||||||||||

| Continuing Directors – Term to Expire in 2026 | ||

|

|||||||||||||||||

|

Aaron P. Jagdfeld

Director | Age: 52 | Director Since: 2014

Committee: Compensation (Chair)

|

|||||||||||||||||

| Mr. Jagdfeld has been the President and Chief Executive Officer of Generac Power Systems, Inc. since September 2008 and a director of Generac since November 2006 (NYSE: GNRC). Mr. Jagdfeld began his career at Generac in the finance department in 1994 and became Generac’s Chief Financial Officer in 2002. In 2007, he was appointed President and was responsible for sales, marketing, engineering, and product development. Prior to joining Generac, Mr. Jagdfeld worked in the audit practice of the Milwaukee, Wisconsin office of Deloitte & Touche from 1993 to 1994. Mr. Jagdfeld was selected to serve on our board of directors due to his extensive management and financial experience. | |||||||||||||||||

|

2024 Proxy Statement | 13

|

|||||||

|

|||||||||||||||||

|

David A. Owens

Director | Age: 61 | Director Since: 2018

Committee: Nominating and ESG (Chair)

|

|||||||||||||||||

| Dr. Owens has been the executive director of The Wond'ry, Vanderbilt University's center for creativity, innovation, design, and making since 2019. He is also Professor of the Practice of Innovation at the Vanderbilt Graduate School of Management where he has taught since 1998. Dr. Owens has significant industry experience, having served as an independent management consultant for numerous Fortune 100 companies since 1998 and having served as CEO of Griffin Technologies, a consumer products company, from 2017 to 2018. Dr. Owens was selected to serve on our board of directors due to his financial and business experience. | |||||||||||||||||

|

|||||||||||||||||

|

Philip K. Woodlief

Director | Age: 70 | Director Since: 2015

Committee: Audit (Chair)

|

|||||||||||||||||

| Mr. Woodlief has been an independent financial consultant since 2007 and was an Adjunct Professor of Management at Vanderbilt University’s Owen Graduate School of Business from 2010 to 2020. At Vanderbilt, Mr. Woodlief taught Financial Statement Research and Financial Statement Analysis. Mr. Woodlief also served as a Visiting Instructor of Accounting at Sewanee: The University of the South from 2017 to 2020. Prior to 2008, Mr. Woodlief was Vice President and Chief Financial Officer of Doane Pet Care, a global manufacturer of pet products. Prior to 1998, Mr. Woodlief was Vice President and Corporate Controller of Insilco Corporation, a diversified manufacturer of consumer and industrial products. Mr. Woodlief began his career in 1979 at KPMG Peat Marwick in Houston, Texas, progressing to the Senior Manager level in the firm’s Energy and Natural Resources practice. Mr. Woodlief was a certified public accountant. Mr. Woodlief currently serves as Chairman of the board of trustees of Sewanee St. Andrew’s School, and serves on the Masters of Accounting Advisory Board at Vanderbilt University’s Owen Graduate School of Business. Mr. Woodlief previously served on the board of Founder Sport Group from 2017 to 2020. Mr. Woodlief was selected to serve on our board of directors due to his financial and business experience. | |||||||||||||||||

14 | 2024 Proxy Statement

|

|

|||||||

Corporate Governance | ||

The Board has three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and ESG Committee. In addition, the Board has adopted Corporate Governance Principles and a Code of Business Conduct and Ethics. Each of these documents and the charters of the Board Committees are posted on the Company’s web site at https://ir.hillmangroup.com/corporate-governance/governance-documents.

DIRECTOR INDEPENDENCE

The Board and the Nominating and ESG Committee have reviewed and evaluated transactions and relationships with Board members and Board nominees to determine the independence of each of the members or nominees. The Board does not believe that any of its non-employee members or nominees have relationships with the Company that would interfere with the exercise of independent judgment in carrying out his or her responsibilities as a director. The Board has determined that each of Ms. Dowling, Ms. Gendron, Ms. Honda, Mr. Jagdfeld, Mr. O’Leary, Mr. Owens, Mr. Swygert, and Mr. Woodlief are “independent directors” as defined in Nasdaq rules and the applicable SEC rules. In making these determinations, the Board considered Ms. Gendron’s role as Chief Financial Officer of Jefferies through March 2023, which serves as a lender to the Company and has a current and long standing investment banking relationship with the Company.

BOARD ATTENDANCE

Each member of the Board is expected to make a reasonable effort to attend all meetings of the Board, all applicable committee meetings and each annual meeting of stockholders. There were 5 meetings of our Board during the fiscal year ended December 30, 2023. Each director attended at least 75% of the aggregate meetings of the Board and the committees on which he or she served in fiscal 2023. All of our directors attended our 2023 Annual Meeting of Stockholders.

BOARD LEADERSHIP STRUCTURE

Our Corporate Governance Principles provide our Board with flexibility to combine or separate the positions of Chairman of the Board and Chief Executive Officer in accordance with its determination that utilizing one or the other structure would be in the best interests of our Company. Currently, the roles are combined, with Mr. Cahill serving as Chairman of the Board and Chief Executive Officer. Our Board has determined that combining the roles of Chairman of the Board and Chief Executive Officer is in the best interests of our Company and its stockholders at this time because it promotes unified leadership by Mr. Cahill and allows for a single, clear focus for management to execute the Company’s strategy and business plans.

The Company revised its Corporate Governance Principles on November 2, 2023 to require a Lead Independent Director when the positions of Chairman of the Board and CEO are held by the same person. The independent directors of the Board appointed Daniel O’Leary as Lead Independent Director on November 2, 2023. The Lead Independent Director’s duties include:

•Work closely with the Chairman with regard to approving the information presented to the Board and setting and approving meeting agendas and meeting schedules;

•Chair meetings of the Board in the absence of the Chairman;

•Have authority to call and oversee meetings of the independent Directors, including executive sessions of the non-employee Directors;

•Serve as the principal liaison between the independent Directors and the Chairman; and

•Take a significant role in the Board evaluation process.

Due to the strong leadership of Mr. Cahill, coupled with the independent oversight provided by our independent committees and the position of Lead Independent Director, our Board has concluded that our current leadership structure is appropriate at this time. However, our Board will continue to periodically review our leadership structure and may make such changes in the future as it deems appropriate.

BOARD ROLE IN RISK OVERSIGHT

The Board executes its oversight responsibility for risk management with the assistance of its Audit Committee, Compensation Committee, and Nominating and ESG Committee. The Audit Committee oversees the Company’s risk management activities, generally, and is charged with reviewing and discussing with management the Company’s

|

2024 Proxy Statement | 15

|

|||||||

major risk exposures and emerging risks and the steps management has taken to monitor, control, and manage these exposures. The Audit Committee's meeting agendas include discussions of individual risk areas throughout the year, as well as an annual summary of the risk management process, including the Company’s risk assessment and risk management guidelines. The Compensation Committee oversees the Company’s compensation policies generally to determine whether they create risks that are reasonably likely to have a material adverse effect on the Company. The Nominating and ESG Committee monitors compliance with the Corporate Governance Principles and reviews the Company’s management of risks related to corporate social responsibility, including with respect to sustainability and the environment.

Although the Board and its committees oversee risk management for the Company, management is responsible for the day-to-day management and mitigation of the Company’s risks. We believe this division of responsibility reflects the appropriate roles of the Board and management in assessing and managing risks.

DIRECTOR NOMINEE SELECTION PROCESS

The Nominating and ESG Committee is responsible for recommending to the Board a slate of nominees for election at each annual meeting of stockholders. The Nominating and ESG Committee recruits candidates for Board membership through its own efforts and through recommendations from other directors, management, and stockholders. In addition, the Nominating and ESG Committee may retain an independent search firm to assist in identifying and recruiting director candidates who meet the criteria developed by the Nominating and ESG Committee.

The Nominating and ESG Committee also considers the specific experience and abilities of director candidates in light of our current business, strategy, structure, and the current or expected needs of the Board in its identification and recruitment of director candidates.

CANDIDATES NOMINATED BY STOCKHOLDERS

Stockholders who wish to recommend director candidates for consideration by the Nominating and ESG Committee may send a written notice to the Secretary at the Company’s principal executive offices. Stockholders should review the Company’s Bylaws and most recent proxy statement filed with the SEC to determine the applicable deadlines for the Company’s receipt of a stockholder’s nomination notice.

In general, the notice should indicate the name, age, and address of the person recommended, the person’s principal occupation or employment for the last five years, other public company boards on which the person serves, whether the person would qualify as independent as the term is defined under the applicable listing standards of Nasdaq, and the class and number of shares of Company securities owned by the person. The Nominating and ESG Committee may require additional information to determine the eligibility and qualifications of the person recommended. The notice should also state the name and address of, and the class and number of shares of Company securities owned by, the person or persons making the recommendation.

In addition, to comply with the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Securities Exchange Act of 1934 no later than April 8, 2025, which is the date 60 calendar days prior to the one year anniversary of the 2024 Annual Meeting.

The Board also approved updates to the Company’s bylaws, with effectiveness contingent upon approval of the other bylaw amendments pursuant to Proposal 8 at the 2024 Annual Meeting, to add provisions relating to new universal proxy rules and amend the advance notice provisions relating to director nominations by stockholders and stockholder proposals. These provisions will be implemented pursuant to the Amended and Restated Bylaws. The full text of the Amended and Restated Bylaws is attached to this proxy statement as Appendix C, in which we have shown the proposed amendments with deletions indicated by strikeouts and additions indicated by underlining. The Board may reconsider these updates to the Company’s bylaws at any time, even if Proposal 8 is not approved by stockholders.

BOARD DIVERSITY

In determining whether to recommend a director nominee, the Nominating and ESG Committee members consider and discuss diversity, among other factors, with a view toward the needs of the Board as a whole. The committee members generally conceptualize diversity expansively to include, without limitation, concepts such as race, gender, national origin, differences of viewpoint, professional background, education, skills and other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on the Board. The Board commits that highly qualified women and minority candidates will be included in each pool from which new non-

16 | 2024 Proxy Statement

|

|

|||||||

incumbent director nominees are chosen, as well as highly qualified candidates with otherwise diverse backgrounds, skills, and experiences.

PERIODIC EVALUATION OF THE BOARD

The Nominating and ESG Committee oversees a Board evaluation process for the Board and its committees each year. As part of the Board evaluation process, the Board considers, among other matters, whether its composition reflects the skills needed to appropriately oversee the Company’s long-term strategy and continued success. The Board also evaluates its processes and interactions with management to determine whether it is operating efficiently with respect to its oversight responsibilities.

CORPORATE GOVERNANCE PRINCIPLES

We operate under a set of Corporate Governance Principles designed to promote good corporate governance and align the interests of our Board and management with those of our stockholders. The Corporate Governance Principles relate to the role, composition, structure, and functions of the Board and the Company. The Nominating and ESG Committee is responsible for periodically reviewing these Corporate Governance Principles and recommending any changes to the Board.

MAJORITY VOTING POLICY IN UNCONTESTED ELECTIONS

Pursuant to our Corporate Governance Principles, in an uncontested election of directors (i.e., an election where the number of nominees does not exceed the number of directors to be elected), a nominee who receives more “Against” votes than “For” votes in such election is expected to promptly tender his or her resignation as a director. The Nominating and ESG Committee will consider each tendered director resignation and recommend to the Board whether to accept or reject it. After considering the recommendation of the Nominating and ESG Committee and any other information the Board deems appropriate, and within 90 days following the certification of the election results, the Board will act to accept or reject each tendered director resignation and promptly disclose its decision.

If a director’s resignation is rejected, the Board will disclose the reasons for its decision, and the director will continue to serve the remainder of his or her term until his or her successor is duly elected or until his or her earlier death, resignation, or removal. If a director’s resignation is accepted, the Board, in its sole discretion, may fill any resulting vacancy or decrease the size of the Board, in each case to the extent permitted by the Company's Bylaws.

Any director who tenders a resignation under this policy may not participate in the Nominating and ESG Committee recommendation or the action of the Board regarding whether to accept or reject such tender of resignation.

CODE OF CONDUCT AND ETHICS

We have adopted a code of business conduct that applies to all of our directors, officers, and employees, including our principal executive officer, principal financial officer, and principal accounting officer, which is available on our website at https://ir.hillmangroup.com/corporate-governance. Our code of business conduct is a “code of ethics”, as defined in Item 406(b) of Regulation S-K. Please note that our internet website address is provided as an inactive textual reference only. We will make any legally required disclosures regarding amendments to, or waivers of, provisions of our code of ethics on our internet website.

ESG EFFORTS

Our ESG efforts and reporting continue to evolve in a manner that is beneficial to the Company and our shareholders, and to align with upcoming reporting requirements of certain states and SEC requirements as they come to be effective. Hillman published its first annual ESG Fact Sheet in 2023 in respect of the 2022 fiscal year. Our most recent ESG Fact Sheet is posted on the Company’s web site at https://ir.hillmangroup.com/corporate-governance/governance-documents.

COMPENSATION RECOVERY POLICY (CLAWBACK)

We have adopted a Compensation Recovery Policy that provides for the recovery of certain executive compensation in the event of an accounting restatement resulting from material noncompliance with financial reporting requirements under the federal securities laws. A copy of our Compensation Recovery Policy was filed as Exhibit 97 to our Annual Report on Form 10-K.

INSIDER TRADING ARRANGEMENTS AND POLICIES

We are committed to promoting high standards of ethical business conduct and compliance with applicable laws, rules and regulations. As part of this commitment, we have adopted our Insider Trading Policy governing the purchase, sale, and/or other dispositions of our securities by our directors, officers, employees and certain

|

2024 Proxy Statement | 17

|

|||||||

contractors, that we believe is reasonably designed to promote compliance with insider trading laws, rules and regulations, and the exchange listing standards applicable to us. A copy of our Insider Trading Policy was filed as Exhibit 19.1 to our Annual Report on Form 10-K.

PROHIBITION ON HEDGING AND PLEDGING

Our Insider Trading Policy prohibits directors and executive officers from engaging, directly or indirectly, in the pledging of, hedging transactions in, or short sales of, Hillman securities.

EQUITY GRANT POLICY

Our Equity Grant Policy was approved by our Compensation Committee and specifies a procedure and timing for granting and pricing equity awards to protect against any appearance of spring loading or timing the grant of equity awards for the benefit of the grantee. The Equity Grant Policy designates quarterly predetermined grant dates for the granting of equity awards to employees, including our Executive Officers (a “Predetermined Quarterly Grant Date”), unless such date would fall during a blackout period. The Company selects Predetermined Quarterly Grant Dates because they will fall within the Company’s regular open trading window and should protect against any appearance of spring loading or timing the grant of equity awards for the benefit of the grantee.

Equity grants, including stock options, to our employees, including our executive officers, are generally approved annually at a meeting of the Committee that is held during the first quarter of each year. The grants are typically expressed and approved in fixed dollar terms, with the grant being effective as of, and the number of equity awards and exercise price calculated based on, the market value of the Company’s stock on the next Predetermined Quarterly Grant Date, which is during an open trading window (i.e. at least two full trading days following the release of earnings).

During our fiscal year ended December 30, 2023, we have not timed the disclosure of material nonpublic information for the purpose of affecting the value of executive compensation.

STOCKHOLDER COMMUNICATION WITH THE BOARD

Any of the directors may be contacted by writing to them at: Board of Directors, c/o Secretary’s Office, Hillman Solutions Corp., 1280 Kemper Meadow Dr., Forest Park, Ohio 45240. The directors have requested that the Secretary of the Company act as their agent in processing any communication received. All communications that relate to matters that are within the scope of responsibilities of the Board and its committees will be forwarded to the Board. Communications relating to matters within the responsibility of one of the committees of the Board will be forwarded to the Chairperson of the appropriate committee. Communications relating to ordinary business matters are not within the scope of the Board’s responsibility and will be forwarded to the appropriate officer at the Company. Solicitations, advertising materials, and frivolous or inappropriate communications will not be forwarded.

18 | 2024 Proxy Statement

|

|

|||||||

Committees of the Board | ||

To assist the Board in undertaking its responsibilities, and to allow deeper engagement in certain areas of Company oversight, the Board has established the following three standing committees: Audit Committee, Compensation Committee, and Nominating and ESG Committee.

All committees are composed exclusively of independent directors, as defined in Nasdaq rules and the applicable SEC rules. The current charter of each Board committee is available on our website at www.ir.hillmangroup.com under Corporate Governance – Governance Documents.

|

Audit Committee

Number of Meetings in 2023: 6

|

|||||||||||

| MEMBERS | Philip K. Woodlief (Chair), Teresa Gendron, Daniel O’Leary, John Swygert | ||||||||||

|

COMMITTEE FUNCTIONS

•Assist the Board in its oversight of:

◦Integrity of the consolidated financial statements of the Company;

◦The Company’s compliance with legal and regulatory requirements;

◦Independent auditor’s qualifications and independence;

◦Performance of the Company’s internal audit function and independent auditors; and

◦The Company’s internal control over financial reporting.

•Appoint, retain or terminate the Company’s independent auditors and pre-approve all audit, audit-related, tax, and other services, if any, to be provided by the independent auditors; and

•Prepare the Audit Committee Report.

|

|||||||||||

|

2024 Proxy Statement | 19

|

|||||||

|

Compensation Committee

Number of Meetings in 2023: 4

|

|||||||||||

| MEMBERS | Aaron P. Jagdfeld (Chair), Diana Dowling, Diane Honda | ||||||||||

|

COMMITTEE FUNCTIONS

•Review and approve the Company’s overall compensation strategy;

•Review and approve, or recommend to the Board for approval, the compensation of the CEO and executive officers of the Company;

•Administers the Company’s executive compensation policies and programs, including determining grants of equity awards under the plans;

•Prepare the Compensation Committee Report; and

•Has sole authority to retain and direct the committee’s compensation consultant.

|

|||||||||||

|

Nominating and ESG Committee

Number of Meetings in 2023: 5

|

|||||||||||

| MEMBERS | David A. Owens (Chair), Diana Dowling, Daniel O’Leary | ||||||||||

|

COMMITTEE FUNCTIONS

•Oversee the Company’s corporate governance policies and procedures;

•Identify individuals qualified to become new directors, consistent with criteria approved by the Board;

•Review the qualifications of incumbent directors to determine whether to recommend them for reelection;

•Recommend to the Board qualified individuals to serve as committee members on the various Board committees;

•Review the Board’s performance and director independence; and

•Review the Company’s ESG goals and initiatives and monitor the Company’s progress against the same.

|

|||||||||||

20 | 2024 Proxy Statement

|

|

|||||||

AUDIT COMMITTEE EXPERTISE

The Board has determined that Philip K. Woodlief qualifies as an “audit committee financial expert” as such term is defined in Item 407(d)(5) of Regulation S-K and possesses financial sophistication, as defined under the rules of the Nasdaq Stock Market. The Board has determined that Mr. Woodlief is an independent director as defined under applicable Nasdaq rules.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No member of the Compensation Committee was at any time during fiscal year 2023, or at any other time, one of our officers or employees. None of our executive officers has served as a director or member of a compensation committee (or other committee serving an equivalent function) of any entity during fiscal year 2023, one of whose executive officers served as a director of our Board or member of our Compensation Committee.

|

2024 Proxy Statement | 21

|

|||||||

Beneficial Ownership of Common Stock | ||

SECURITY OWNERSHIP OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the common shares beneficially owned as of April 1, 2024 by Hillman's directors, the NEOs, and the directors and executive officers as a group. The percentage of ownership is based on 203,062,145 of Hillman common shares outstanding on April 1, 2024, which includes the number of shares of common stock that could be acquired within 60 days following April 1, 2024 by the exercise of stock options and the vesting of time-based restricted stock units (“RSUs”) held by our directors and executive officers set forth in footnote 3 below.

| Shares Beneficially Owned | ||||||||||||||

Name(1)

|

Amount and Nature of Beneficial Ownership

(#)(2)(3)

|

Percent of Class (%) |

||||||||||||

| Douglas Cahill | 6,422,896 | 3.1 | % | |||||||||||

| Daniel O’Leary | 42,236 | * | ||||||||||||

| John Swygert | 25,029 | * | ||||||||||||

| Aaron Jagdfeld | 246,508 | * | ||||||||||||

| David Owens | 81,683 | * | ||||||||||||

| Philip Woodlief | 91,683 | * | ||||||||||||

| Diana Dowling | 32,236 | * | ||||||||||||

| Teresa Gendron | 32,236 | * | ||||||||||||

| Diane Honda | 14,699 | * | ||||||||||||

| Robert Kraft | 989,604 | * | ||||||||||||

| Jon Michael Adinolfi | 790,849 | * | ||||||||||||

| Scott Ride | 267,690 | * | ||||||||||||

| Randall Fagundo | 126,537 | * | ||||||||||||

| All directors and executive officers as a group (nineteen individuals) | 9,879,221 | 5.1 | % | |||||||||||

* Less than 1%

(1)Unless otherwise noted, the business address of each beneficial owner is c/o The Hillman Group, Inc., 1280 Kemper Meadow Dr., Cincinnati, Ohio 45240.

(2)This column consists of shares for which the directors and executives, directly or indirectly, have the power to vote or to dispose, or to direct the voting or disposition thereof, and also includes shares for which the person has the right to acquire beneficial ownership within 60 days following April 1, 2024. Except as otherwise noted, none of the named individuals shares with another person either voting or investment power as to the shares reported. None of the shares reported are pledged as security.

22 | 2024 Proxy Statement

|

|

|||||||

(3)Figures for the directors and executive officers include the number of shares of common stock that could have been acquired within 60 days following April 1, 2024 by the exercise of stock options or the vesting of time-based RSUs awarded under our equity plans as set forth below:

| Name | RSUs (#) |

Options (#) |

||||||

| Douglas Cahill | — | 6,110,811 | ||||||

| Aaron Jagdfeld | 14,699 | 49,447 | ||||||

| David Owens | 14,699 | 49,447 | ||||||

| Philip Woodlief | 14,699 | 49,447 | ||||||

| Robert Kraft | — | 794,691 | ||||||

| Jon Michael Adinolfi | — | 525,717 | ||||||

| Scott Ride | — | 267,690 | ||||||

| Randall Fagundo | — | 117,137 | ||||||

| Diana Dowling | 14,699 | — | ||||||

| Teresa Gendron | 14,699 | — | ||||||

| Diane Honda | 14,699 | — | ||||||

| Dan O'Leary | 14,699 | — | ||||||

| John Swygert | 14,699 | — | ||||||

| All directors and executive officers as a group (nineteen individuals) | 117,592 | 8,396,133 | ||||||

|

2024 Proxy Statement | 23

|

|||||||

Security Ownership of Certain Beneficial Owners | ||

The following table sets forth information regarding the beneficial owners of more than five percent of Hillman common shares as of the close of business on April 1, 2024, based on reports on Schedule 13G or Schedule 13D and other information filed with the SEC.

| Name and Address of Beneficial Owner | Amount and Nature of Ownership (#) |

Percentage of Class (%) |

|||||||||

|

The Vanguard Group(1)

100 Vanguard Blvd.

Malvern, PA 19355

|

19,267,632 | 9.9 | % | ||||||||

|

Kayne Anderson Rudnick Investment Management, LLC(2)

2000 Avenue of the Stars, Suite 1110

Los Angeles, CA 90067

|

14,977,324 | 7.7 | % | ||||||||

|

BlackRock, Inc.(3)

50 Hudson Yards

New York, NY 10001

|

14,257,243 | 7.3 | % | ||||||||

|

JPMorgan Chase & Co.(4)

383 Madison Avenue

New York, NY 10179

|

10,459,346 | 5.4 | % | ||||||||

|

Jefferies Financial Group Inc.(5)

520 Madison Ave.

New York, New York 10022

|

9,855,076 | 5.1 | % | ||||||||

(1)This information is based on a Schedule 13-G/A filed by The Vanguard Group on February 13, 2024. The Vanguard Group has sole voting power for none of the shares, shared voting power for 132,312 of the shares, sole dispositive power for 18,958,079 of the shares, and shared dispositive power for 309,553 of the shares.

(2)This information is based on a Schedule 13-G/A filed by Kayne Anderson Rudnick Investment Management, LLC on February 13, 2024. Kayne Anderson Rudnick Investment Management, LLC has sole voting power for 8,884,528 of the shares, shared voting power for 3,675,621 of the shares, sole dispositive power for 11,301,703 of the shares, and shared dispositive power for 3,675,621 of the shares.

(3)This information is based on a Schedule 13-G filed by BlackRock, Inc. on January 26, 2024. BlackRock, Inc. has sole voting power for 13,867,710 of the shares, shared voting power for none of the shares, sole dispositive power for 14,257,243 of the shares, and shared dispositive power for none of the shares.

(4)This information is based on a Schedule 13-G/A filed by JPMorgan Chase & Co. on January 23, 2024. JPMorgan Chase & Co. has sole voting power for 9,697,895 of the shares, shared voting power for none of the shares, sole dispositive power for 10,459,346 of the shares, and shared dispositive power for none of the shares.

(5)This information is based on a Schedule 13-G/A filed by Jefferies Financial Group Inc., on behalf of itself and its controlled subsidiaries, on February 14, 2024. Jefferies Financial Group Inc. has sole voting power for none of the shares, shared voting power for 9,855,076 of the shares, sole dispositive power for none of the shares, and shared dispositive power for 9,855,076 of the shares.

Delinquent Section 16(a) Reports | ||

Based solely on a review of the forms filed during, or with respect to, fiscal year 2023 and written representations from each reporting person, we believe that our directors, executive officers, controller, and beneficial owner(s) of more than 10% of our common stock filed all required reports on a timely basis, except for the late filing of a Form 4 related to the grant of restricted stock units to Anne McCalla on December 7, 2023, which was not reported timely due to an inadvertent administrative oversight.

Certain Relationships and Related Party Transactions | ||

24 | 2024 Proxy Statement

|

|

|||||||

REGISTRATION RIGHTS AGREEMENT - SECONDARY SALES

At the closing of the Business Combination, Hillman, Jefferies Financial Group Inc., TJF, LLC, certain CCMP investors and certain Oak Hill investors entered into the A&R Registration Rights Agreement, pursuant to which, among other things, the parties to the A&R Registration Rights Agreement agreed not to effect any sale or distribution of any equity securities of Hillman held by any of them for the periods stated therein from the Closing Date, and were granted certain registration rights with respect to their respective shares of Hillman common stock, in each case, on the terms and subject to the conditions therein. Rich Zannino and Joe Scharfenberger served on our Board through May 11, 2023 and are employed by CCMP. Another director, Teresa Gendron, was the CFO of Jefferies Financial Group until March 2023.

In February 2023, certain CCMP investors sold 28,750,000 shares in a secondary public offering for gross proceeds of $230.0 million. Hillman received no proceeds from the offering and, pursuant to its obligations under the A&R Registration Rights Agreement, incurred fees of approximately $0.6 million related to this offering

In May 2023, certain CCMP investors sold 22,455,000 shares in a secondary public offering for gross proceeds of $172.7 million. Hillman received no proceeds from the offering and, pursuant to its obligations under the A&R Registration Rights Agreement, incurred fees of approximately $0.4 million related to this offering.

SALES TO OLLIE’S BARGAIN OUTLET

In fiscal 2023, Hillman made sales of $1.6 million to Ollie's Bargain Outlet Holdings, Inc. ("Ollie's"). The sales consisted of several transactions for the sale of excess inventory. John Swygert, President and Chief Executive Officer of Ollie's, is a member of our Board of Directors.

RELATED PARTY TRANSACTION POLICY

The Board has adopted a written related party transaction policy that sets forth the following policies and procedures for the review and approval or ratification of related party transactions. This policy covers, with certain exceptions set forth in Item 404 of Regulation S-K under the Securities Act of 1933, as amended (the “Securities Act”), any transaction, arrangement, or relationship, or any series of similar transactions, arrangements, or relationships, in which we were or are to be a participant, where the amount involved exceeds $120,000 in any fiscal year and a related party had, has, or will have a direct or indirect material interest, including without limitation, purchases of goods or services by or from the related person or entities in which the related person has a material interest, indebtedness, guarantees of indebtedness, and employment by us of a related party.

In reviewing and approving any such transactions, our Audit Committee is tasked with considering all relevant facts and circumstances, including, but not limited to, whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related party’s interest in the transaction. All of the transactions described in this section were approved by our Audit Committee or Board, as applicable.

|

2024 Proxy Statement | 25

|

|||||||

Information about our Executive Officers | ||

The following persons serve as our executive officers:

| Name | Position | Age | ||||||||||||

| Douglas Cahill | Chairman, President, and Chief Executive Officer | 64 | ||||||||||||

| Robert O. Kraft | Chief Financial Officer and Treasurer | 53 | ||||||||||||

| Jon Michael Adinolfi | Chief Operating Officer | 48 | ||||||||||||

| Scott C. Ride | President, Hillman Canada | 53 | ||||||||||||

| Randall Fagundo | Divisional President, Robotics and Digital Solutions | 64 | ||||||||||||

| Aaron Parker | Vice President, Human Resources | 39 | ||||||||||||

| Gary L. Seeds | Executive Vice President, Sales and Field Service | 65 | ||||||||||||

| George S. Murphy | Divisional President, Hardware & Protective Solutions | 59 | ||||||||||||

| Amanda Kitzberger | Vice President, General Counsel and Secretary | 43 | ||||||||||||

| Scott K. Moore | Chief Technology Officer | 53 | ||||||||||||

The following is a brief biography of each of our executive officers. References to executive officer service to Hillman include service to our predecessor companies HMAN Group Holdings, Inc. and The Hillman Companies, Inc., as applicable.

DOUGLAS CAHILL

Douglas Cahill serves as Hillman's President and Chief Executive Officer since 2019 and Chairman of Hillman’s board of directors since 2014. Prior to joining Hillman, Mr. Cahill was a Managing Director of CCMP from July 2014 to July 2019 and was a member of CCMP’s Investment Committee and previously was an Executive Adviser of CCMP from March 2013. Mr. Cahill served as President and Chief Executive Officer of Oreck, the manufacturer of upright vacuums and cleaning products, from May 2010 until December 2012. Prior to joining Oreck, Mr. Cahill served for eight years as President and Chief Executive Officer of Doane Pet Care Company, a private label manufacturer of pet food and former CCMP portfolio company, through to its sale to MARS Inc. in 2006. From 2006 to 2009, Mr. Cahill served as president of Mars Petcare U.S. Prior to joining Doane in 1997, Mr. Cahill spent 13 years at Olin Corporation, a diversified manufacturer of metal and chemicals, where he served in a variety of managerial and executive roles. Mr. Cahill serves as a Board Member for Junior Achievement of Middle Tennessee and the Visitor Board at Vanderbilt University’s Owen Graduate School of Management. In January 2009, Mr. Cahill was appointed as an Adviser to Mars Incorporated. Mr. Cahill previously served as a director of Banfield Pet Hospital from 2006 to 2016, Ollie’s Bargain Outlet (Nasdaq: OLLI) from 2013 to 2016, Jamieson Laboratories from 2014 to 2017, Founder Sport Group from 2016 to 2019, and Shoes for Crews from 2015 to 2019. Mr. Cahill serves as the Chairman of our board of directors due to his financial, investment, and extensive management experience.

ROBERT O. KRAFT

Robert O. Kraft serves as Hillman’s Chief Financial Officer and Treasurer since November 2017. Prior to joining Hillman, Mr. Kraft served as the President of the Omnicare (Long Term Care) division, and an Executive Vice President, of CVS Health Corporation from August 2015 to September 2017. From November 2010 to August 2015, Mr. Kraft was Chief Financial Officer and Senior Vice President of Omnicare, Inc. Mr. Kraft began his career with

26 | 2024 Proxy Statement

|

|

|||||||

PriceWaterhouseCoopers LLP in 1992, was admitted as a Partner in 2004, and is a certified public accountant (inactive). Mr. Kraft currently serves on the board of Medpace Holdings, Inc (Nasdaq: MEDP).

JON MICHAEL ADINOLFI

Jon Michael Adinolfi serves as Hillman’s Chief Operating Officer since June 2023. From July 2019 to June 2023, Mr. Adinolfi served as Divisional President, Hillman US since July 2019. Prior to joining Hillman, Mr. Adinolfi served as President of US Retail for Stanley Black & Decker from November 2016 to July 2019. Prior to that, he served as President of Hand Tools for Stanley Black & Decker from October 2013 to December 2016. From June 2011 to September 2013, he served as the CFO — North America, CDIY for Stanley Black & Decker.

SCOTT C. RIDE

Scott C. Ride serves as President of The Hillman Group Canada ULC. Mr. Ride joined The Hillman Group Canada as the Chief Operating Officer in January 2015. Prior to joining Hillman, Mr. Ride served as the President of Husqvarna Canada from May 2011 through September 2014. From 2005 to 2011, Mr. Ride served in a variety of roles of increasing responsibility at Electrolux, including Senior Director of Marketing, Vice President and General Manager, and President.

RANDALL FAGUNDO

Randall Fagundo serves as Hillman’s Divisional President, Robotics and Digital Solutions since August 2018. Prior to joining Hillman, Mr. Fagundo served as the President, and Chief Executive Officer of MinuteKey from June 2010 to August 2018 when the company was acquired by Hillman.

AARON PARKER

Aaron Parker serves as Hillman’s Vice President, Human Resources since February 2023. From September 2020 to February 2023, Mr. Parker served as Director, then Senior Director, of Human Resources at Hillman. Prior to joining Hillman, Mr. Parker served in various positions in Human Resources at Fifth Third Bancorp from 2014 to 2020 and at Macy’s, Inc. from 2009 to 2014.

GARY L. SEEDS

Gary L. Seeds serves as Hillman’s Executive Vice President, Sales & Field Service since February 2020. From January 2014 to February 2020, Mr. Seeds served as Senior Vice President, Sales at Hillman. From January 2003 to January 2014, Mr. Seeds served as Senior Vice President, Regional and International Sales at Hillman. From January 1993 to January 2003, Mr. Seeds served as Vice President of Traditional Sales at Hillman. From July 1992 to January 1993, Mr. Seeds served as Regional Vice President of Sales at Hillman. From January 1989 to July 1992, Mr. Seeds served as West Coast Regional Manager. Mr. Seeds joined Hillman as a sales representative in February 1984.

GEORGE S. MURPHY

George Murphy serves as Hillman’s Divisional President, Hardware & Protective Solutions since February 2024. From September 2021 to February 2024, Mr. Murphy served as Divisional President, Protective Solutions & Sales at Hillman. From October 2019 to September 2021, Mr. Murphy served as Executive Vice President, Sales at Hillman. Mr. Murphy served as Executive Vice President of Sales of our Big Time Products division from January 2018 to October 2019 and the President of Home Depot Sales from March 2016 to January 2018. Prior to joining Big Time Products, Mr. Murphy served as Senior Director of Sales for Master Lock from June 2007 to March 2016.

AMANDA KITZBERGER

Amanda Kitzberger serves as Hillman’s Vice President, General Counsel, and Secretary since February 2023. From July 2021 to January 2023, Ms. Kitzberger served as Hillman’s Vice President Human Resources and Administration. Ms Kitzberger served as Assistant General Counsel at Hillman from 2019 to 2021. Prior to joining Hillman, Ms. Kitzberger was the Vice President and General Counsel at Clopay Plastic Products Co from 2014 to 2018 and served in in-house legal counsel roles at GOJO Industries, Inc. from 2008 to 2014.

SCOTT K. MOORE

Scott K. Moore serves as Hillman’s Chief Technology Officer since August 2022. From August 2018 to August 2022, Mr. Moore served as Senior Vice President, IT, of Hillman’s Robotics and Digital Solutions division, and in the same role at MinuteKey from 2011 to August 2018 when the company was acquired by Hillman. From 2006 to 2011, Mr. Moore served as Chief Information Officer of AP-Networks, an oil and gas consultancy using data analytics to improve performance.

|

2024 Proxy Statement | 27

|

|||||||

|

EXECUTIVE

COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

|

|||||

This Compensation Discussion and Analysis provides an overview and analysis of our compensation programs, the compensation decisions we have made under these programs, and the factors we considered in making these decisions with respect to the compensation earned by the following individuals, who as determined under the rules of the SEC are collectively referred to herein as our named executive officers (“NEOs”) for fiscal year 2023:

•Douglas J. Cahill, President and Chief Executive Officer

•Robert O. Kraft, Chief Financial Officer and Treasurer

•Jon Michael Adinolfi, Chief Operating Officer

•Scott C. Ride, President, Hillman Canada

•Randall J. Fagundo, Divisional President, Robotics and Digital Solutions

Overview of the Compensation Program | ||

COMPENSATION PHILOSOPHY

The objective of our corporate compensation and benefits program is to establish and maintain competitive total compensation programs that will attract, motivate, and retain the qualified and skilled workforce necessary for the continued success of our business. To help align compensation paid to executive officers with the achievement of corporate goals, we have designed our cash compensation program as a pay-for-performance based system that rewards NEOs for their individual performance and contribution in achieving corporate goals. In determining the components and levels of NEO compensation each year, the Compensation Committee of our Board considers Company performance, and each individual’s performance and potential to enhance long-term stockholder value. To remain competitive, our Compensation Committee also periodically reviews compensation survey information provided by our compensation consultant as another factor in setting NEO compensation. Our Compensation Committee relies on judgment and does not have any formal guidelines or formulas for allocating between long-term and currently paid compensation, cash and non-cash compensation, or among different forms of non-cash compensation for our NEOs.

28 | 2024 Proxy Statement

|

|

|||||||

COMPONENTS OF TOTAL COMPENSATION

Compensation packages in 2023 for the Company’s NEOs were comprised of the following elements:

| Short-Term Compensation Elements | ||||||||

| Element | Role and Purpose | |||||||